That was a title of a conference last summer held by the Swiss National Bank, and noted in this post. Mark A. Wynne and Julieta Yung discuss the conference proceedings.

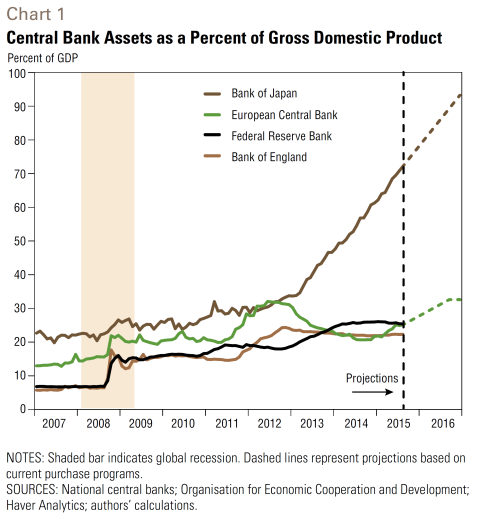

A key motivation for the conference is based on this graph.

Source: Wynne and Yung (2016).

They write:

Central banks around the world launched extraordinary monetary policy responses to the global financial crisis of 2007–09 and the European debt crises that began in 2010. Some were coordinated; all were directed at fulfilling domestic mandates for price and financial stability and supporting real economic activity.

Fears that the dramatic expansion of central bank balance sheets (Chart 1)—a concomitant of the unconventional part of the policy response—would lead to higher inflation at the consumer level have so far proven unfounded, whether due to still abundant slack in many countries or to wellanchored inflation expectations.

But it has been argued that an extended period of ultra-easy monetary policy is manifesting itself in excessive risk taking, bubbles in certain asset classes and price pressures in countries that are recipients of internationally mobile capital. This capital, in search of higher yields, could ultimately lead to higher inflation globally.

The experience of recent years has challenged our understanding of the transmission of monetary policy across national borders as well as the implications of financial interconnections and the global financial cycle for inflation spillovers and monetary control. Moreover, it has prompted us to reconsider the short- and long-run tradeoffs between structural reforms and monetary policy during international crises and the global implications of policy responses to the financial crisis.

Select papers are forthcoming in a Journal of International Money and Finance special issue.

International finance and local avarice will make every effort to expand bank credit in peripheral economies to the absurd levels found in the OECD. Obviously its easier to attract investment capital with an open financial regime… code for “I’ll gladly pay you Thursday for a Hamburger today”.

International commerce and finance has become a rigged pay-to-play game. Outsiders (your foreign trading partners) will probably not be able to do business with you unless your government plays ball with the OECD/BIS/US-Treasury banking system. Impediments range from the inability to secure letters of credit to outright governmental intimidation via criminal investigation and trade embargoes. Short of bartering, there is little room for any country to maintain an independent monetary policy.

Japan is in the “worst” situation by far according to the graph, but the interest rate on its 10 yr government bond is negative and its inflation rate is negative too. Japan’s inflation is projected to average 1% over the next 4 years.

http://www.statista.com/statistics/270095/inflation-rate-in-japan/

So “printing” money does not cause inflation after all, yet Milton Friedman lives on.

Treasuries are assets? Hardly. These are offset by future tax liabilities. The Fed does not buy assets, merely trading one form of bond (zero maturity money) for another. And the bonds they hold are not even theirs. Interest paid from the treasury to the fed is simply returned to the treasury at the end of the year. Buying bonds is simply one way (rather than more obvious thin air helicopter drop) to get money into the economy. Totally unnecessary. Another, my fave, would be to have the fed give social security recipients money each month. Simply credit recipients accounts. Skip the bond intermediation. Or instead of dollars have cards whose values grow. So its a $1 card, then next month its a $1.005 card, etc.. Money supply increases 6% automatically.

Paul: It seems to me that the entire history of Japan trying to stimulate inflation through monetary policy alone is an example of how futile such an attempt can be under certain macroeconomic and possibly demographic conditions. One could just wonder why they are not switching to fiscal inflation targeting instead.

As a solution to the infrastructure problem we have in this country, coupled with a congress unwilling to borrow at historically low rates to fund said infrastructure, perhaps the Fed should expand its asset purchase program. I can suggest a few bridges they can buy — with a contract for the Fed to purchase, upgrade, and maintain them.