Today we are pleased to present a guest contribution written by Michael Devereux at the University of British Columbia and Wei Dong and Ben Tomlin at the Bank of Canada. The views expressed below are those of the authors and do not represent those of the Bank of Canada. This post is based on a revised version of this paper.

The extent to which exchange rates changes affect domestic prices is an empirical question that has been the subject of a large research effort. Since at least the 1980’s, soon after the beginning of the modern period of floating exchange rates, it has been recognized that the “pass-through” of exchange rate changes to imported goods depends on a complicated mix of macro and micro factors. Almost all the empirical studies estimate coefficients of exchange rate pass-through less than unity, but different models offer a wide variety of explanations for limited pass-through. At the macro level, the degree of price stickiness, the stance of monetary policy, and the choice of invoicing currency have important implication for exchange rate pass-through. However, pass-through will also depend on microeconomic factors associated with price and markup determination and the degree of competition in traded goods industries.

While the literature has made major contributions to the understanding of how price adjustment depends on the behavior of exporting firms, one aspect that has received much less attention is the other side of the trading relationship, the role of importing firms. This perspective has become more important, however, since it has increasingly been acknowledged that a large fraction of international trade is “granular”, in the sense that the role of individual firms as buyers and sellers may be critical for the way in which prices and quantities are determined.

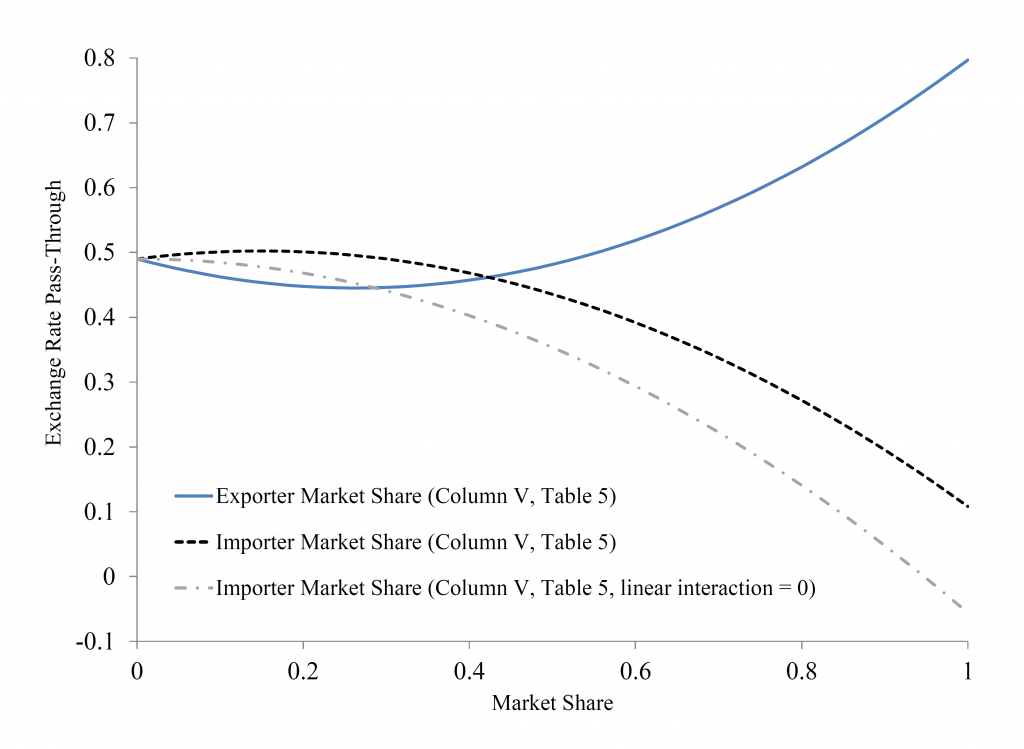

Using a unique micro data set that allows us to identify transactions and characteristics of all importers and exporters into Canada over a six year period, we investigate the structural determinants of exchange rate pass-through at a highly disaggregated level. In particular, we focus on the importance of the market share of firms on both sides of the market, the exporting and importing firms. Our results support a U-shaped relationship between exporter market share and exchange rate pass-through at a highly disaggregated level. Both small and very large exporting firms, relative to the market, tend to have higher pass-through than firms with intermediate market shares.

Our novel new finding is that the size of importing firms also plays a key role in exchange rate pass-through. Exchange rate pass-through is negatively related to the market share of importing firms (Figure 1). Given the opportunity to invest (at a cost) in more flexible technologies, high-productivity importers will have a higher elasticity of demand. The result is that exchange rate pass-through is lower for sales to importers with a higher market share. The higher the elasticity of demand of the importer, the more an exporter’s market share will vary if it allows price to respond to exchange rate shocks. Therefore, conditional on the market share of the exporter, pass-through will be lower for sales to importers with higher market share. This joint dependence on the market share on both sides of the trade transaction continues to hold when we allow for exchange rate pass-through to depend simultaneously on market share of exporters and importers.

Figure 1: Exchange Rate Pass-Through and Market Share

We further explore the interrelationship between firm size and the currency of invoicing for imported goods. We find that the probability of U.S. dollar invoicing (as opposed to destination-currency invoicing) is related to market share of exporting and importing firms in exactly the same pattern as is our estimate of exchange rate pass-through itself. That is, U.S. dollar invoicing is non-monotonically related to the market share of exporting firms, again in a U-shaped relationship, and negatively related to the market share of importing firms. Thus, we find that the structural determinants of exchange rate pass-through at the micro level are the same as the determinants of currency invoicing; the factors related to exporting or importing firm size that generates low pass-through tend towards domestic currency invoicing of imported goods in the same direction.

This post written by Michael Devereux, Wei Dong and Ben Tomlin.