So spake Donald J. Trump, September 13, 2012. Here’s what actually happened.

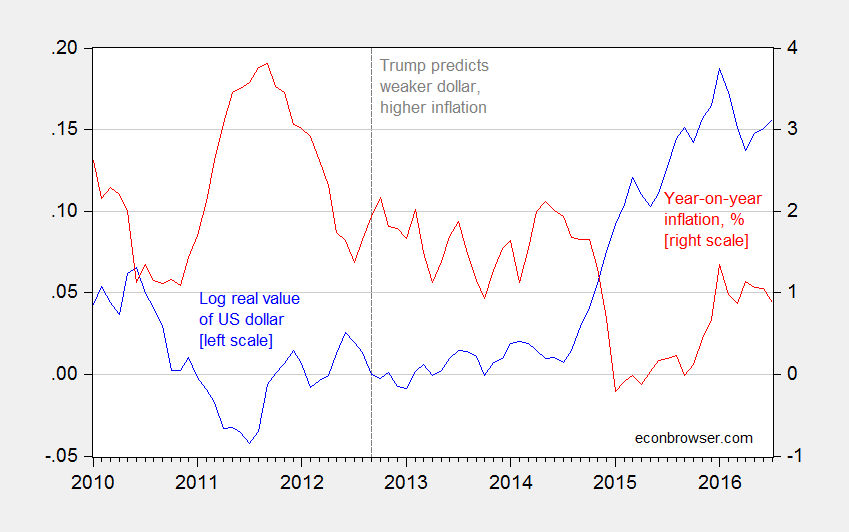

Figure 1: Log real value of US dollar against broad basket of currencies, 2012M09=0 (blue, left scale), and year on year CPI-all inflation, % (red, right scale). Source: Federal Reserve Board, BLS and author’s calculations.

If it’s not obvious, these predictions did not come to pass. Hence, Trump is in the company of Representative Ryan, John Boehner, and Ron Paul, among others.

Menzie,

The set of people who got an inflation call wrong is larger than the list you have above. Need I remind you that Paul Krugman and Lawrence Summers also made an incorrect inflation call. So what’s your point? Is it that Trump’s, Ryan’s, et al economic proposals shouldn’t be taken seriously? Then are you also suggesting that we should not take Summers or Krugman seriously in the same way?

Everyone was too optimistic. Who would’ve thought the Fed Funds Rate would still be near zero, or incredible monetary stimulus wouldn’t have caused accelerating inflation by now?

So 34 years ago Prof. Krugman made the wrong call on inflation. How has he been doing since the Financial Crisis and Great Recession? I know the answer: Nobody has done better, period. Many have done much worse, or have you forgotten the infamous open letter to Chairman Bernanke by numerous right wing “economists” and prognosticators? http://blogs.wsj.com/economics/2010/11/15/open-letter-to-ben-bernanke/

Paul Krugman, August 2002:

“To fight this recession the Fed needs more than a snapback; it needs soaring household spending to offset moribund business investment. And to do that, as Paul McCulley of Pimco put it, Alan Greenspan needs to create a housing bubble to replace the Nasdaq bubble.”

PeakTrader,

Yes, that was one of Krugman’s most egregious recommendations. Of course, he’s tried to weasel out of it but his statement is pretty clear.

peak,

http://cepr.net/blogs/beat-the-press/when-someone-says-paul-krugman-called-for-greenspan-to-create-a-housing-bubble-back-in-2002-they-are-trying-to-say-that-they-are-either-a-fool-or-a-liar

so which are you, the fool or the liar?

Baffling, so you’d rather believe someone’s interpretation of what Krugman said. And, if you don’t believe his interpretation, then you must be a fool or a liar.

Here’s Krugman’s article:

http://www.nytimes.com/2002/08/02/opinion/dubya-s-double-dip.html

peak, i have read the article. the interpretation was rather accurate. my guess is you actually have not taken the time to read and understand exactly what krugman was trying to convey. understandable, since you still don’t understand the origins of the financial crisis.

I read that column just now, and I think you are not reading it correctly. The quote is out of context. Krugman was arguing that the recession may double-dip. This guy from Pimco was saying that the only way it would not double-dip was if we have a housing bubble to replace the stock bubble. It was not a prescription. It was not a recommendation. It was a forecast that the recession would be worse than was thought at the time, unless something weird like a housing bubble happened. And, of course, that is what happened, but that does not mean he WANTED a housing bubble.

You read it wrong….

XO, how can you ignore Krugman wanted more household spending and recommended a housing bubble would do it!

I guess, the entire theme of his article didn’t matter to you and his dependent clause (between two commas in his quote I posted above) is more important to you than his independent sentence.

Or, maybe you read the wrong article.

Paul,

You believe that because Krugman loudly asserts he’s been right consistently, knowing that most of his followers won’t check. His record overall is not very good if you check. You should go through his old columns, particularly in the Bush years, and you’ll see many wrong predictions. I once did this in my comments at econbrowser, which you might be able to find by googling.

What about his record since the financial crisis? Yes, he said inflation would not accelerate and it hasn’t. But I wonder if you remember or are aware of the incident with Greg Mankiw in 2009? The Obama Administration put out a pretty rosy forecast of the effects of stimulus, a forecast that Mankiw questioned. Krugman responded by suggesting that the argument Mankiw was making was deliberately obtuse and somehow “evil.” Mankiw then invited Krugman to back up his defense of the Obama Administration’s forecast by putting his money where his mouth was. Krugman immediately went to ground, too afraid to respond. As the stranger in High Plains Drifter put it, “it’s what people know about themselves inside that makes ’em afraid.”

Scott Sumner kept track of the bet that Mankiw proposed and Mankiw would have won by a landslide. The nature of the recovery was perhaps they key question during the financial crisis and Krugman was massively wrong about it. Keep that in mind the next time you are tempted to say of Krugman that “Nobody has done better, period.”

Actually, the stimulus worked quite well with Real GDP going from -8.2% in 4Q08 to +3.9% in 4Q09. https://fred.stlouisfed.org/series/A191RL1Q225SBEA#0

When economists were surveyed by the University of Chicago, Booth School of Business in July, 2014, they agreed overwhelmingly:

Question: Because of the American Recovery and Reinvestment Act of 2009, was the U.S. unemployment rate lower at the end of 2010 than it would have been without the stimulus bill?

Response of 37 economists surveyed: 97.3% Affirmative

Source: U. of Chicago Initiative on Global Markets, Economic Experts Panel, 7/29/14.

Of course Mankiw and all the other con economists ignore job creation: 15 million new private sector jobs since the Great Republican (Mankiew) Recession hit bottom in Feb. 2010. https://fred.stlouisfed.org/series/USPRIV

Our slow recovery is due to the massive pivot away from stimulus that Obama made in April 2009, when he and Congress reduced the budget deficit by 75% (as a % of GDP) from FY 2009 through FY 2015 during the worst recession since WW2—something that was never done during any previous recession. Even Pres. Hoover increased the deficit during the Great Depression from FY1931 through FY1933.

Paul,

You are attempting to change the subject to whether the stimulus was effective or not. It was not effective. I have commented extensively on that in these comment pages.

However, if we do change the subject, let’s make sure before we do that the original point is crystal clear: Krugman was completely wrong about a major forecast on the extent of the recovery and Mankiw was right.

“You are attempting to change the subject to whether the stimulus was effective or not. It was not effective.”

most credible economists would disagree with your assessment. the stimulus was a positive effect. we could have used more.

Paul,

You should read the letter you linked to carefully. The signatories did not predict that inflation would occur. They said the QE policy carried that risk, which is very different. Lest you think that is some sort of off-the-wall view, I invite you to read Fed economist Daniel Thornton’s article in Economic Synopses, published by the St. Louis Fed. Thornton goes through the reasons that QE could present a risk of an acceleration of inflation.

“The planned asset purchases (QE) risk currency debasement and inflation, and we do not think they will achieve the Fed’s objective of promoting employment.”

They were wrong on all three counts and correct on none. IOW, they couldn’t have been more wrong if they tried. Three strikes and you’re out in the real world.

Paul,

Again, you are changing the subject. The point was that these economists did not make any forecasts in that letter.

Whether their concerns are right are wrong is the subject of much debate. On one of their points, the risk of inflation, I linked to a St. Louis Fed paper backing them up. I could do the same for their other point on the efficacy of unconventional monetary policy.

You, on the other hand, just asserted dogmatically that they are wrong, without any evidence at all, which is of course typical of the Left.

Mankiw, on his blog back at Harvard in 2006

WEDNESDAY, JUNE 14, 2006

Housing Bubble?

A student emails me to ask about the housing market:

Do you think there is a housing bubble in the US?

I have not myself studied current market valuations, but I did take note of this article on the housing market in the Financial Times a couple days ago:

Housing boom will not end in a crash, says Harvard

“Although housing prices are stretched, it is hard to see the catalyst for a crisis in the market,” says Nicolas Retsinas, director of the Joint Center for Housing Studies at Harvard. “The overvaluation looks pretty well balanced by longer term supports for house prices, so we may just see a few years with little action. Houses will revert to being something to live in rather than money makers.”

Okay, so the housing market has “reached what looks like a permanently high plateau.” Now that’s reassuring.

Yeah, that was definitely reassuring. Does the good doctor have any other “reassuring” advice for us?

Paul,

You’ve completely misunderstood Mankiw’s comment. Mankiw is saying the opposite of what you think he’s saying.

Obviously, you did not recognize the phrase “reached what looks like a permanently high plateau” but the fact that Mankiw put it in quotes should have alerted you that he was quoting someone else. Also, the fact that the quote is a hyperlink should have a been a clue. Mankiw included the link because he knew many of his readers would not be familiar with the quote.

That hyperlink refers to the wikipedia article on Irving Fisher. That quote is the infamous statement from Irving Fisher, who said the stock market has reached a permanently high plateau 3 days before the stock market crash of 1929. At the time, Fisher was a widely respected economist and his statement reassured people that all was well. But that statement ultimately ruined Fisher, costing him his wealth and his reputation.

Mankiw was saying that he hasn’t looked specifically at the real estate market but that when well-respected experts such as Retsinas from the Joint Center For Housing Studies say something about housing reminiscent of what Fisher said about the stock market, we should be worried. Mankiw was being sarcastic, and was really saying that we should not be reassured.

Mankiw turned out to be right of course.

Perhaps, Menzie, you should grant them the same infinite grace period as you grant yourself for your predicting the success of Abenomics. Perhaps you’re both “just early”.

Menzie: Entertaining and informative as is often the case. 🙂

Perhaps “we economists” should exercise some humility? These guys and reefer ships full of other pundits and talking heads have been making the same kind of inflation forecast errors for most if not all of this century.

Are these errors simply not due to the way North American economists teach macroeconomics? Do not undergraduate teachers of economics still focus on money aggregates as the principal driver of inflation?

Are not very few teachers of economics at the undergraduate level discussing in any kind of depth the structural factors that allow inflation rates to go up and maintain momentum? Are not discussions of market structure and trade union power for the most part non-existent?

This is not yet another example of “market failure” but rather an example of “professional economist failure”.

Baffles and xo, Peak’s plain reading of Krugman’s plain meaning is correct.

Pinning down Krugman is often hard, since he writes with a studied imprecision that gives him and his faithful defenders deniability. In this case, however, Krugman uncharacteristically repeated and clarified his 2002 claim about 4 years later, in an answer to a reader’s question. Here is the exchange from the NYT, Oct 30, 2006:

“Neeraj Mehra, Amritsar, India: Mr. Greenspan has done a disservice to the nation by creating the housing boom. As a layman-observer, that’s the lingering thought I’ve had. Your article reaffirms it.

The question I have is this: Did he do the right thing — acting morally by engineering a housing boom, more as a bridge loan, until something else showed up at the horizon to shore up the economy — because he didn’t have a choice, or did he undertake a path of mere political expediency? And, that’s a question that’s nagging me for a while.

Would appreciate it if you could shed some light.

Paul Krugman: As Paul McCulley of PIMCO remarked when the tech boom crashed, Greenspan needed to create a housing bubble to replace the technology bubble. So within limits he may have done the right thing. But by late 2004 he should have seen the danger signs and warned against what was happening; such a warning could have taken the place of rising interest rates. He didn’t, and he left a terrible mess for Ben Bernanke.”

I’ve bolded Krugman’s clarifying sentence. So, yes, he did mean what he said in 2002 that Greenspan needed to create a housing bubble. And yes, he thought that was a good idea, as long as it was done within “limits.”

Limits. It’s good to see that important policy qualification from Professor Krugman. Listen up kids. If you are running the Fed, it’s just fine to use monetary policy to blow up a housing bubble. But just make sure you keep it under control!

Seriously, my liberal friends, what does it say about Krugman’s judgment that he’d suggest that it’s ok to use monetary policy to induce a housing bubble, as long as you clairvoyantly raise rates at just the right moment to prevent catastrophe? (Something Greenspan failed to do, in Krugman’s mind)

I agree completely with your point, but what the heck is the “real value of the US dollar against … other currencies”? Is that some kind of PPP-related measure? Why not just use DXY here, rather than inviting people to doubt a chart of some unexplained over-complicated series they can’t easily confirm?

Tom Warner: The real (broad) value of the currency is reported by the Federal Reserve Board, and is easily accessible from FRED. There’s plenty of documentation on the weights, etc., of this variable. It is used a lot by academics, and referred to a lot by policymakers. DXY is on the other hand obscure (unless I want to go try to look up the darn thing — I have not idea what the weights are, and whether it’s Divisia or average or geometric…)