Earlier on, Moody’s Analytics took on the task of determining the likely impact of implementing the Trump economic pronouncements (tax cuts for the wealthy, massive deficit spending, increased defense spending, spending cuts on other discretionary components, and revocation of free trade agreements). Oxford Economics has taken up the task of evaluating the more recent incarnations of his pronouncements (to call it a “plan” is giving it too much credence).

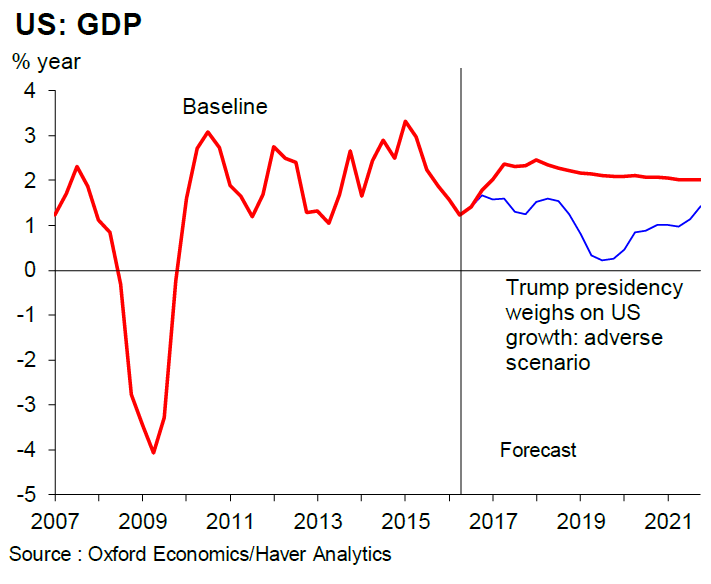

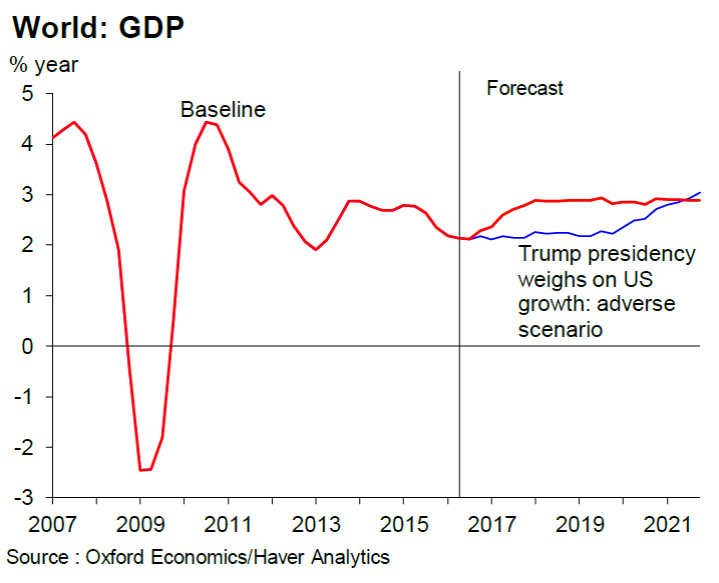

In its Q3 2016 Global Scenarios Service report, the following impacts on US and world output (assuming expansionary Fed monetary policy to offset the contractionary effects) our traced out in the “adverse” Trump scenario (there is a central scenario that entails smaller costs).

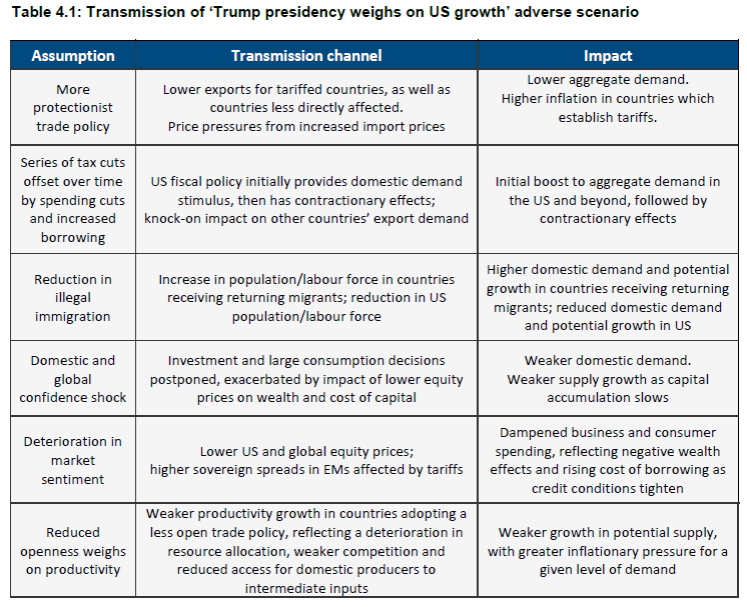

The effects are simulated based on these assumptions:

- Mr. Trump unexpectedly triumphs in the US presidential election. The Republicans retain control over both houses of Congress.

- The election result, combined with discordant rhetoric from the new president immediately following his election, dents business and consumer confidence both in the US and globally. We assume confidence effects roughly equal to 10% of the scale experienced during the global financial crisis, which gradually fade over the course of Mr. Trump’s presidency.

- Global financial markets show some modest safe-haven flight, with emerging market currencies weakening and the euro and yen strengthening against the dollar relative to the baseline, over the course of 2017.

- Deportation of illegal immigrants increases to 1.4 million a year, more than double the rate in the central Trump scenario. This would be consistent with aiming to achieve the stated 11.3 million figure over the course of two presidential terms (rather than over the promised two years).

- From Q3 2017, the US imposes 45% and 35% tariffs on Chinese and Mexican merchandise goods respectively – and then, as US consumers switch away from the higher priced Mexican and Chinese imports, the US raises tariffs on South Korea and India (the next two largest emerging market import

sources for the US).

- As a result of intense negotiations with Congress, the initial pledge of $10 trillion tax cuts is scaled back significantly to $1 trillion. These tax cuts, which are heavily tilted towards higher earners, are introduced in late 2017 and applied retrospectively from the start of that year.

- Government spending cuts are gradually phased in from 2017. Compared with our central Trump scenario, spending cuts are more substantive (all of the tax cuts are financed on a static basis by reductions to government spending, compared with 75% in the central case) and they are phased in less gradually.

The channels whereby which each policy affects the economy are traced out thusly.

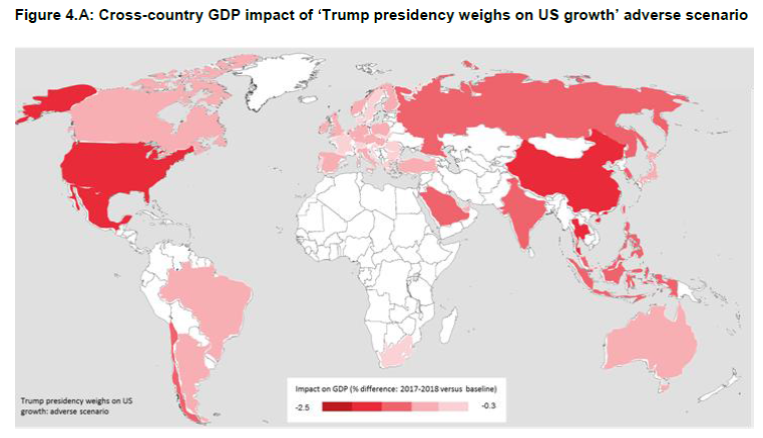

One interesting aspect of the results; China definitely suffers under the Trump (adverse) scenario. So all those people who have been heck bent on punishing China severely will get their truest deepest wish fulfilled. This is shown in the assessment of the geographic distribution of effects.

One unfortunate outcome: The US will suffer just about as much.

One ironic outcome of full-fledged Drumpfonomics — the trade deficit would probably widen rather than shrink. That’s because an increase in the cyclically-adjusted budget balance typically increases the trade deficit.[1]

Sectoral and State Distribution of Effects of a Trade War

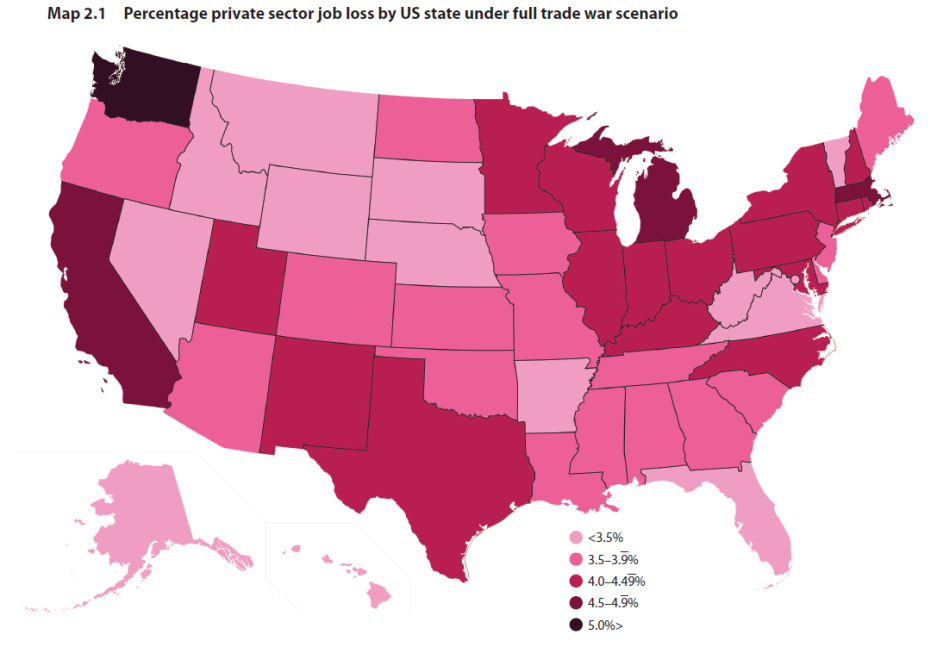

Suppose we ignore the imponderables of what a President Trump could get through Congress. Recent discussion has focused on what a president can do unilaterally with respect to trade policy. As Gary Hufbauer at PIIE has pointed out, the president can withdraw from trade agreements with relative ease — so (as Justin Wolfers has argued), a trade war (or just plain war) under a President Trump is not so far outside of the realm of the possible. Working off the Moody’s model augmented with a social accounting model, a full fledged trade war would result in the following geographic distribution of job losses:

Source: Marcus Noland, Gary Clyde Hufbauer, Sherman Robinson, and Tyler Moran, “Assessing Trade Agendas in the US Presidential Campaign,” PIIE Briefing 16-6 (September 2016).

In terms of sectoral distribution:

Together China and Mexico account for a quarter of US international trade in goods and services. In the full trade war scenario, employment in 2019, the trough of the recession, falls by nearly 4.8 million private sector jobs, more than 4 percent below baseline private sector employment. Sectors that produce capital goods are the most intensely affected, consistent with investment exhibiting the largest decline of any of the macro variables under this scenario (table 2.2). In percentage terms, high-speed drives and gear manufacturing (a multibillion dollar industry producing inputs used mainly in power transmission equipment) take the biggest hit, with a 10.2 percent employment decline. The damage is not limited to capital goods sectors. Iron and other metallic ore mining and aluminum production are also among the most intensely affected sectors.

In absolute terms, the largest job losses occur in nontrade service sectors, such as wholesale and retail distribution and sales, restaurants, and health care…

In other words, no one would be safe in a Drumpfonomics instigated trade war.

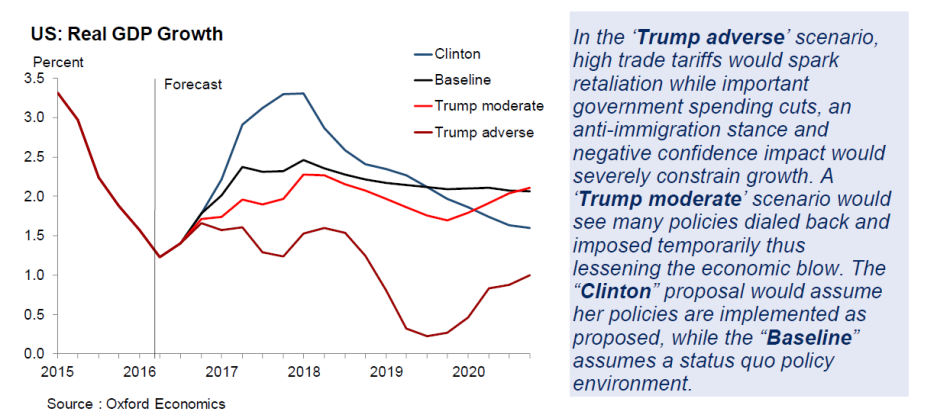

Update, 9/26, 6pm Pacific: Here is a graph comparing Trump adverse, Trump moderate and Clinton growth outcomes, as assessed by Oxford Economics.

Source: Gregory Daco, “Trump vs Clinton: Polarization & uncertainty,” Oxford Economics Research Briefing (September 19, 2016).

“Drumpfarmegeddon”

“Drumpfonomics”

“to call it a “plan” is giving it too much credence”

Further examples of why you’re such a hack.

Well, we must believe analysts’ data and models.

https://www.theguardian.com/business/2016/sep/21/post-referendum-gloom-fears-confounded-economic-evidence

Although, countries benefit from trade, e.g. through the law of comparative advantage, there should be minimum universal standards on taxes, regulations, and wages.

Consequently, there would be less exploitation by some of our trading partners and the U.S. would be more competitive. Trade imbalances will narrow by reducing negative externalities.

Peak Trader I don’t disagree with the thrust of you sentiments here, but we need to keep in mind that strictly speaking countries don’t benefit from trade for the simple reason that countries are abstractions, not concrete human beings. In the aggregate trade usually benefits the winners more than it hurts the losers. We don’t directly control the taxes, regulations and wages of foreign countries, so I wouldn’t want to rely too much on those countries raising their standards. But the American electorate can control how the gains from trade are distributed. The winner take all approach that we see too much of today is not sustainable. At some point the losers will resent their status and vote for snake oil salesmen like Trump; and they’ll vote for the snake oil salesman even if it’s against their own long run interests. Brexit has shown us that voters are perfectly capable of cutting off their noses to spite their faces. So instead of counting on other (and usually poorer) countries doing all of the heavy lifting needed to help out downscale American workers, how about asking the 1% to give back some of their unearned windfalls?

2slugbaits, rich people have always found ways to minimize or avoid taxes. So, the burden falls on the middle class, including through producing less value for society.

Trade agreements that include minimum standards for a safety net, the environment, and labor may increase a poorer country’s gains from trade, although the poorer country works less and the richer country works more.

“[M]assive deficit spending” is exactly what we need.

Please do NOT demonize deficit spending or the debt. Anyone who does this is playing right into the hands of the “small government” budget balancers who are to blame for our anemic recovery.

Obviously it is fine to demonize austerity, inflation hawks, “trickle down” policies and tax cuts for the 1%, but demonizing the debt and deficit spending is the proximate cause of our infrastructure ruination and completely anti-Keynesian. Demonizing the debt has become a hallmark of the Democrats since Pres. Obama said this in April, 2009:

“But we can’t settle for a future of rising deficits and debt that our children can’t pay. All across America, families are tightening their belts and making hard choices. Now, Washington must show that same sense of responsibility.” President’s Weekly Address, 4/25/09.

The result of invoking the Family Finances Fallacy of government budgeting was the PAYGO Act which the Democratic-controlled Congress passed shortly thereafter and which has hamstrung fiscal policy ever since. The Fed can’t do it all, as Keynes presciently said 80 years ago. Economists who have led us into this anti-Keynesian swamp have a lot of ‘splainin’ to do.