Heretofore, I’ve approached in a piecemeal manner the assessment of the impact of massive tax cuts for the wealthy, building a really, really great wall, a final solution for the presence of undocumented immigrants, and the imposition a 45% tariff on Chinese imports. Moody’s Mark Zandi et al. have now done the hard work of trying to figure out what the macro impacts would be to implementing Mr. Trump’s agenda.

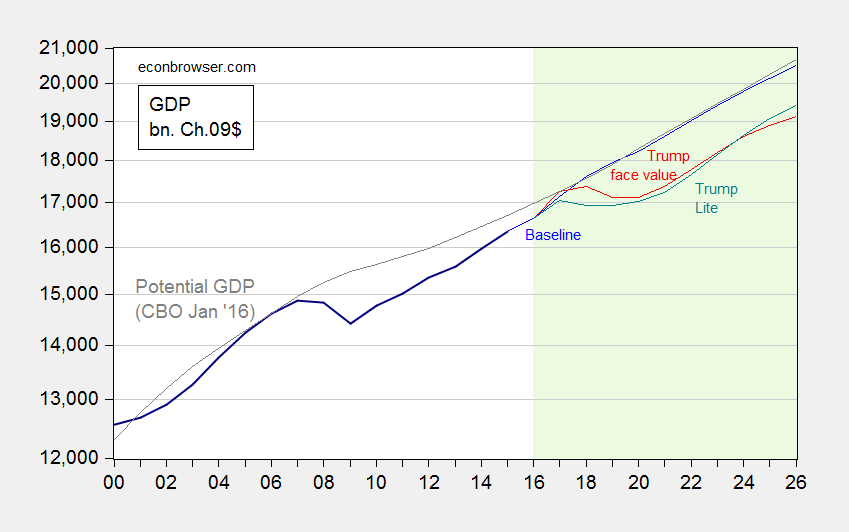

Figure 1 depicts realized real GDP (bn. Ch.2009$) through 2015, baseline (“current law”) GDP forecast through 2026, and GDP taking Trump at face value, and Trump lite (essentially, a smaller tax cut imposing only a revenue loss of 3.5 trillion dollars on a ten year basis).

Figure 1: Real GDP (dark blue), current law baseline (blue), under Trump agenda (red), under Trump-Lite scenario (teal), and potential GDP (gray). Light green shaded area denotes forecast period. Source: BEA, CBO (January 2016), and Zandi, et al. The Macroeconomic Consequences of Mr. Trump’s Economic Policies, June 17, 2016..

The cumulative loss relative to baseline GDP would be about 9.5 trillion Ch.2009$ in the Trump at face value scenario. Under Trump Lite, it’s 10.3 trillion Ch.2009$. (I don’t do the comparison relative to potential GDP, because almost surely, potential GDP would decline as the labor force shrank with the establishment of deportation processing centers, and eventual deportation of the undocumented.) For the sake of comparison, the cumulative GDP loss relative to potential GDP over the 2008-2015 period is 5.2 trillion Ch.2009$. In other words, the economic consequences of Mr. Trump would be larger — in terms of lost output — than the Great Recession.

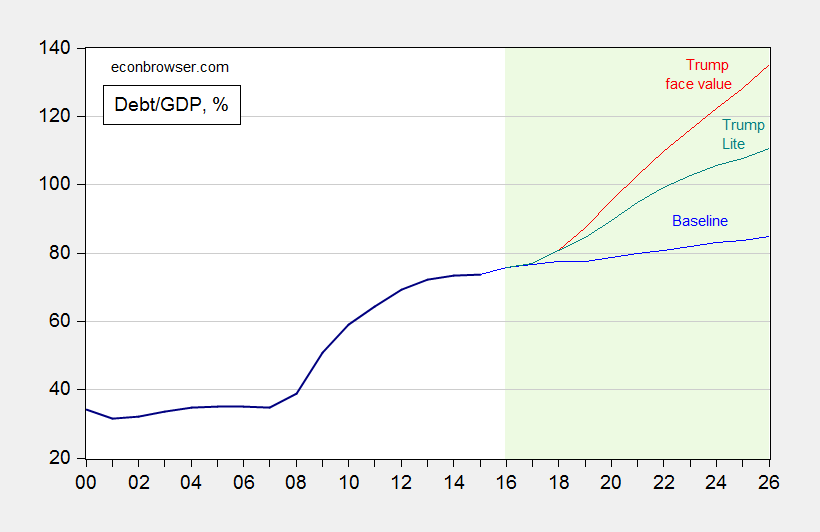

It is also of interest to see the implications for debt-to-GDP ratios.

Figure 2: Debt to GDP (dark blue), current law baseline (blue), under Trump agenda (red), and under Trump-Lite scenario (teal). Light green shaded area denotes forecast period. Source: BEA, Fed via FRED, and Zandi, et al. The Macroeconomic Consequences of Mr. Trump’s Economic Policies, June 17, 2016..

Debt rises to 135% of GDP under Trump at face value, 111% under Trump lite, compared to 85% under current law. Notice that the plotted series is the debt held by the public, divided by GDP. Total Federal debt would be even higher.

On the plus side, under the Trump at face value scenario, the threat of deflation would be completely defeated — inflation in 2018 would surge to 5.4%.

Note: Not all provisions are scored. From the report:

Mr. Trump has brought up other potentially relevant economic policies that are not included here since either their macroeconomic impact is too small or they are at this point not sufficiently developed to quantify. These include, for example, his recent energy policy proposals, his seeming support for higher state-level minimum wages, and his ruminations on negotiating with investors in U.S. Treasury bonds and on bringing back the gold standard.

I’ve concluded that there are three principal (and not necessarily mutually exclusive) possibilities regarding The Donald:

(1) He is trying to destroy the Republican Party, either of his own volition or because he is on the payroll of the Clintons (note that The Donald has not released any tax returns);

(2) He is like a dog chasing a car who catches it; now what does he do? In other words, maybe he has decided that he does not want to be President after all;

(3) He is crazy.

Vanity Fair article on Trump’s tax returns (or rather the lack thereof):

http://www.vanityfair.com/news/2016/06/the-great-trump-tax-mysteries

Perhaps the oddest thing about this odd election year is that the GOP is on the verge of nominating someone who has so far refused to release his tax returns. If memory serves, even Romney released two years of tax return data, early in 2012.

Jobs

During Pres. Obama’s administration more than 10,000,000 private sector jobs have been created which is nearly 10 times the number created during the 12 years of last 2 GOP presidencies COMBINED. During Pres. Clinton’s administration, TWICE as many private sector jobs were created as during Obama’s administration.

The score is: last 2 Dem presidents – 31,000,000 private sector jobs;

last 2 GOP presidents – 1,000,000 private sector jobs.

https://fred.stlouisfed.org/series/USPRIV

Why do voters think Trump would be better for the economy and jobs than Clinton?

Because he is a “Business” man who, as he is the first to tell us, a Yuuge Success, and he will make things great for us all (at least if you are not Hispanic, Black, Asian, etc.). The so called media has been repeating this crap and misreporting business and economics for 16 years, so why change now.

What quackery! The most asinine post ever on Econbrowser.

A 3-year recession 2018-2020! Never since the Great Depression has there been such a thing. Fed funds goes from 0.6 in 2016 to 4.0% in 2017. Never except when oil prices quadrupled in 1973 has the funds rate ever been hiked as much in a year’s time! Then the next year the funds rate goes to 6%, when every leading indicator on the planet would be screaming recession. Insanity! In the first year of recession, the 10-year Treasury yield is 2.3 ppts above the funds rate. Not once in history in an initial recession year has this ever happened. Second and third years of recession (2019 and 2020), GDP falls but stock market rises. Both years! More insanity.

Using quarterly data from 1980, Zandi uses 5 variables to forecast the 10-year yield including the lagged 10-year. Of course, this comingles pre-crisis with post-crisis. Using those same variables with post 2009:Q2 recovery observations, the sign on three of the five coefficients flips! Zandi’s 10-year regression is pure nonsense. As is all the rest of this work.

Putrescent to high heaven. Propagandistic liberal modeling at its finest.

JBH I don’t think Zandi said the Trump recession would last 3 years. He said it would include three calendar years, and that happens all the time. The Dec 2007-Jun 2009 recession spanned 3 different calendar years. He seems to be thinking in terms of something along the lines of a 27 month recession, which would not be beyond the realm of the plausible given the radical nature of Trump’s budget plan.

I am inclined to agree with you that it’s unlikely we would see BOTH high inflation and high interest rates during a Trump recession. The Trump budget would create strong inflationary pressures, but the Fed would likely try and choke off that inflation with higher interest rates. We’d probably see one or the other, but not both. I can easily imagine the Fed increasing interest rates even during a recession. A President Trump would be in a position to appoint Janet Yellen’s replacement with some goldbug. And we could surely count of crazy Tea Party nut jobs in Congress warning us about “debasing” the currency. Given that kind of toxic political environment I don’t think it’s at all unrealistic to worry about the Fed doing the wrong thing during a recession.

The problem with all of these analyses of Trump’s budget is that his plans are so far “out there” that we don’t have any good precedents to guide us. We would be in uncharted waters. Trying to analyze the effects of Trump’s budget is a lot like trying to estimate the costs of a 6 degree (Celsius) increase in global temperatures due to manmade global warming. We probably have a decent idea of what a 2 degree increase would do, but 6 degrees is anybody’s guess. Same with Trump’s budget. All we know is that it would be a disaster; we just don’t know the scale of the disaster.

JBH: Just for the record, BEA data indicates 4 continuous years of year-on-year declines in GDP, 1930-1933.

Also, just for the record, according to this document on the House plan – a little smaller than the eventual plan passed — forecast real GDP (re-expressed in 2000$) was 11575.0, 12074.5, and 12722.1 for 2010-2012. Actual GDP expressed in 2000$ was 12106, 12300, and 12573.

I’ve got no reason to doubt the analysis although the detail are “lite”. It would be interesting to show Figure 2 in log scale as was done in Figure 1. I believe it would indicate a continuation of the rate of increase from the Obama administration. “Baseline”, I’m presuming, assumes no recession ahead.

Bruce Hall: Depiction of variables in levels on a log scale is conventional. Depiction of ratios of variables in levels — such as debt to GDP — is quite atypical, as it’s already in “percent” terms.

Of course, thanks. Brain fart.

Regardless of who is the next president, would dropping the corporate income tax rate stimulate the economy due to increased corporate investment, increased hiring and repatriation of overseas cash? This is just an economic question, not a political question on my part. It seems that monetary policy has perhaps reached a point of diminishing returns and my understanding is that we need fiscal policies that spur investment, hiring and consumption.

Unless aggregate demand is increased, there will be no increased investment or hiring. The economy is demand deficient and that is the reason for the slow growth.

AS It’s not clear why cutting the corporate income tax would stimulate aggregate demand. Generally people appeal to supply side effects when they want to argue for a cut in the corporate tax rate. I’m skeptical as to the supply side effects, but at least it’s a somewhat coherent argument. If the cut in the corporate tax rate is revenue neutral, then the lost revenue will have to be made up somewhere else, which is likely to defeat any stimulus effect it might have had. If the tax cut is financed by borrowing, then I suppose there might be some small stimulus to aggregate demand under the right conditions; viz., no crowding out, “animal spirits” spurring businessmen to invest, etc. But lowering the corporate tax rate also diminishes the effectiveness of other traditional demand stimulus policies, such as investment tax credits. Lowering the corporate tax rates reduces the value of investment tax credits. I suppose there might be some small wealth effect, but I suspect it would be a third or fourth order effect. In any event, direct government spending financed with helicopter money while at the ZLB is a much more effective way to stimulate private sector investment and aggregate demand.

2slugs,

I had hoped that you would respond. I respect your knowledge and opinion. I thought that if productivity is one of today’s problems, that dropping the corporate income tax rate could influence bringing back overseas cash that may be used for corporate investment in equipment that may help productivity and hopefully hiring. If there is a better way, let’s get at it.

Whatever the correct method is to stimulate private sector investment, productivity and demand, it seems that now is the time to do it. We seem to be looking at an unending malaise that monetary policy is not curing.

MMMMM? Question? What if the countries we would deport to said: You broke’em, you keep’em? Pottery Barn.

I am sure Mexico could find good jobs for 8 to 10 million new workers. The wall Drump would build would make it easy for Mexico to shut its border to the US. Would we fly them into Mexican airspace and parachute them down? Babies and children too? The World Wonders.

The “Wall” is just a fiction.

“And when they’ve given you their all

Some stagger and fall, after all it’s not easy

Banging your heart against some mad bugger’s wall.”

— Pink Floyd

Zandi’s predictions in 2009 of the impact Obama’s stimulus package would have the economy by 2012 vs. actual outcome:

Zandi prediction for total growth in real gdp, 2010 – 2012: 11.25%.

Actual total growth in real gdp, 2010 – 2012: 6.3%

Zandi prediction for increase in payroll employment, 2010 – 2012: 14 million.

Actual increase in payroll employment: 2.8 million

Zandi prediction for unemployment rate in 2012: 5.85%.

Actual unemployment rate in 2012 = 8.1%

Hard work indeed! Why would anyone put stock in this guys predictions?

MegloDon ‘s ceaseless antics do little to encourage his own party. Yet the Trumpnado continues sweeping the floor with the Tea Party broom. Why aren’t mainstream conservatives buying into his shtick? Where are the big, up-ticket donors? Karl, Karl, anyone?.

On the surface, the big-money political engine appears to have lost its mojo. Will the dems even need to spend money if the GOP can’t or won’t? Could it be that the diminishing returns on the political capital undermined the foundations of crony capitalism? Oh NO!!! Citizens Unite! Coalesce! Dominate! Maybe a GOP VP emeritus will declare the tea party insurgency is “in the last throes.”

How blithely ridiculous does that sound now?

The competition for future history has taken an unprecedented turn. Chaos, disruption and an evanescent funding supply are now the agents of change. It is as if the concentration of political angst has closed in upon itself, creating a political black hole for those unable to escape the tidal disruption of the party-wide re-evaluation. Why not mix metaphors — let’s just call it [Conservative] Dissociative Identity Disorder

“Dissociative identity disorder is characterized by the presence of two or more distinct or split identities or personality states that continually have power over the person’s behavior. With dissociative identity disorder, there’s also an inability to recall key personal information that is too far-reaching to be explained as mere forgetfulness. With dissociative identity disorder, there are also highly distinct memory variations, which fluctuate with the person’s split personality.”

The GOP’s long-worshiped former charismatic leaders, their belief system regarded as superior, have failed to deliver a pluralistic notion of participation and democracy. The GOP primary rendered the Cult of Reagan bankrupt.

Should one party’s pathology disturb the population at large? Hey, it almost seems cathartic!

For comparison of Figure 2

US Grosss government debt is 105% according to the IMF and 123 % in the OECD counting

https://data.oecd.org/gga/general-government-debt.htm#indicator-chart

Genauer: Thanks. My understanding is most European countries don’t have much intra-governmental (at country level) debt, so for US and Japan, debt-held-by-public is best for cross-country comparisons.

That depends on whether you can scrap the pensions

http://oecdinsights.org/wp-content/uploads/2016/01/Figure1-Gross-and-net-government-debt.fw_.png

Dean Baker makes a good point about this Zandi report.

“First, much of the Zandi horror story is premised on the idea that the economy is at full employment and that any further stimulus from larger budget deficits would lead to higher interest rates and/or inflation. If folks believe this then they must also believe that stimulus from infrastructure spending would lead to higher interest rates and or/or inflation.”

http://cepr.net/blogs/beat-the-press/the-trump-economic-disaster

If the economy is below full employment not running at capacity then tax cuts could stimulate the economy. Even tax cuts for the rich.

efc: If the AS curve is nonlinear, then Dean Baker’s assessment makes a lot of sense. If it’s linear, then stimulus pushes up interest rates and prices the same amount if under or over potential.

The Zandi scenario would most likely lead to one-time price level changes but is unlikely to spur inflation.