I was astounded not only by the outcome of the U.S. presidential election but also by the response of financial markets.

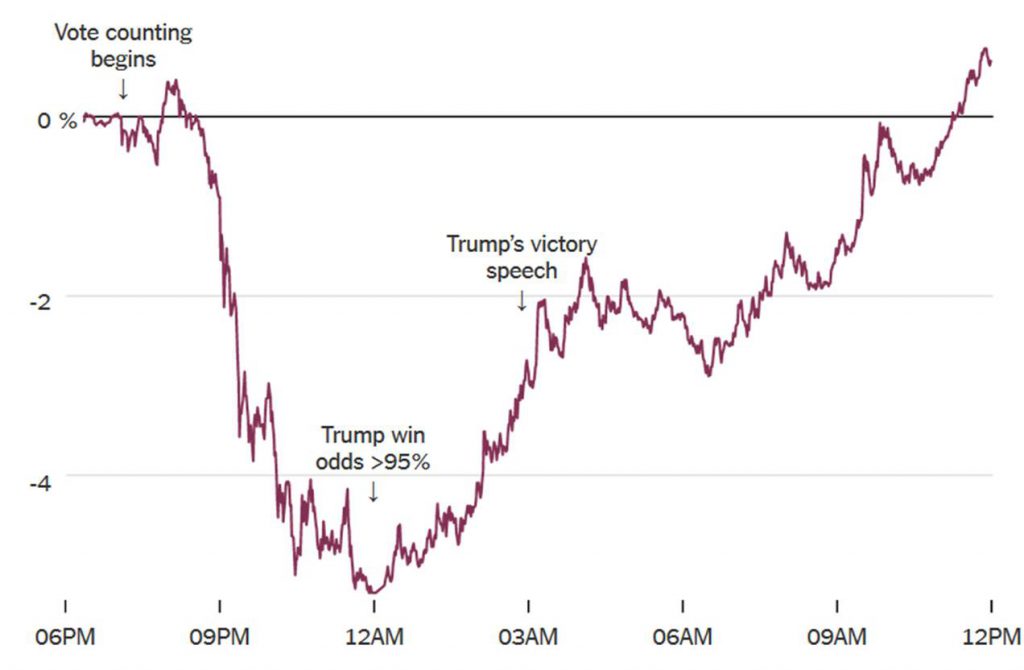

Of course I was not the only one who experienced shock on November 8. As polling results came in that night, S&P 500 futures prices plunged 5%. Paul Krugman offered this immediate assessment:

It really does now look like President Donald J. Trump, and markets are plunging. When might we expect them to recover?…. a first-pass answer is never.

But it turned out that the market recovered all of that loss the next morning. And stocks ended last week 2% higher than they had been before the election.

Change in S&P 500 futures index on Nov 8 and 9. Source: New York Times.

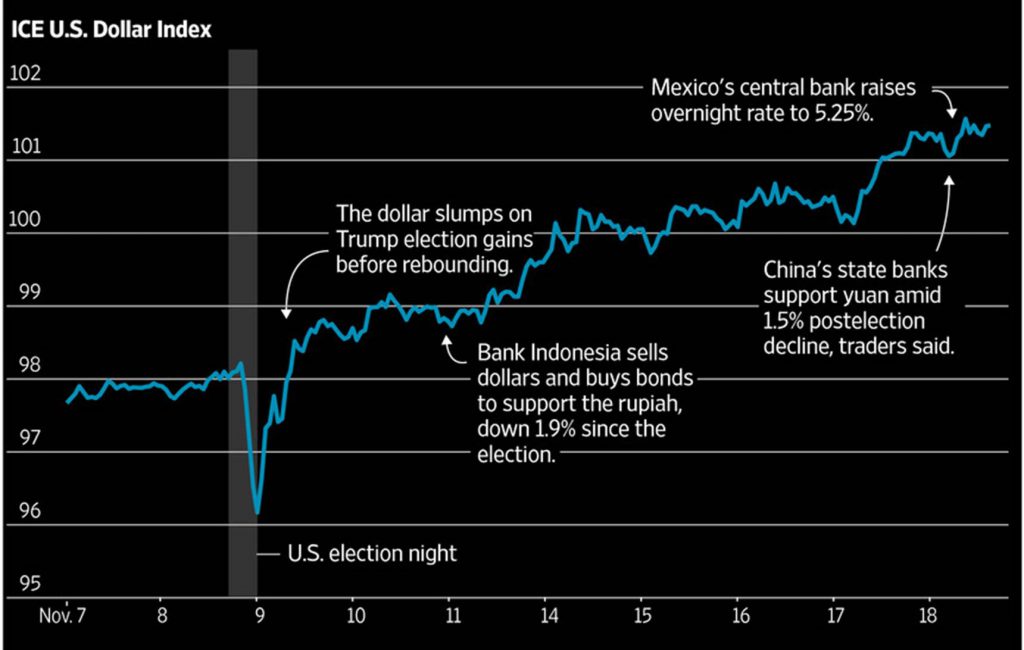

The same thing happened to exchange rates. The dollar fell 2% in overnight trading, only to make it all back the next day. Today the dollar is up 4% against the euro, 5.6% against the yen, and 10% against the Mexican peso, compared to before the election.

Source: Wall Street Journal.

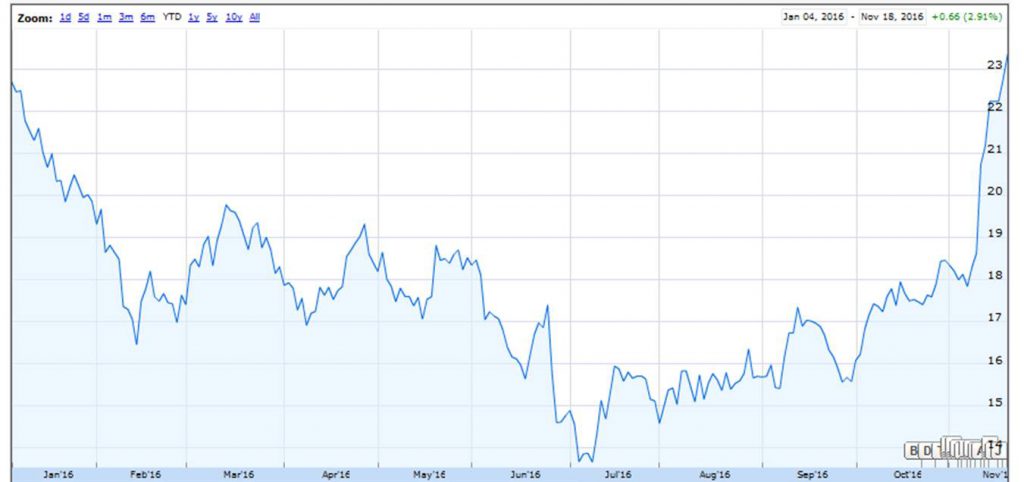

And long-term U.S. interest rates, which had been sinking all year on a growing consensus of dimmer prospects for long-term growth, are now up almost 50 basis points since the election.

Yield on 10-year U.S. Treasury security as reflected in the price of CBOE TNX contract. Divide by 10 to get interest rate in annual percentage points.

What does all this mean? Krugman offered this reassessment on the Friday after the election:

[Trump] will, in fact, be a disaster on every front… But it’s important not to expect this to happen right away. There’s a temptation to predict immediate economic or foreign-policy collapse; I gave in to that temptation Tuesday night, but quickly realized that I was making the same mistake as the opponents of Brexit (which I got right). So I am retracting that call, right now. It’s at least possible that bigger budget deficits will, if anything, strengthen the economy briefly.

Justin Wolfers was another observer surprised by the market turnaround, and offered this interpretation:

Call it a failure of imagination. Investors simply failed to imagine how they might feel when they woke up to President-elect Trump…. I know that my thoughts in the days after Mr. Trump’s win are different than those that dominated my election-eve conversations.

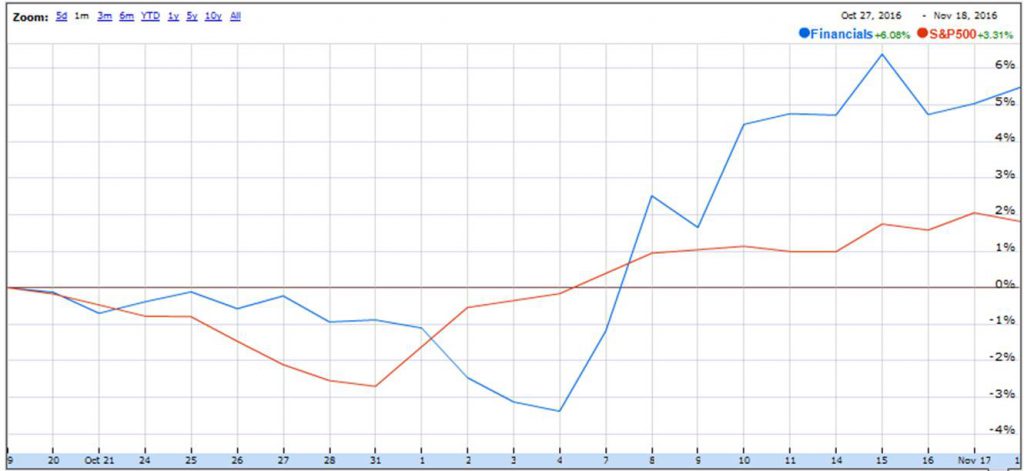

So what exactly should we see more clearly now? I think one thing we may reasonably expect is less regulation of banks, energy companies, and utilities, which could increase near-term profitability. Financials figured prominently in the recent stock-market gains.

Performance of financial stocks compared to S&P 500, Oct 18 to Nov 18. Source: Google Finance.

We also are likely to get some significant fiscal stimulus. Both Clinton and Trump had advocated new infrastructure spending as part of their campaign proposals. If Trump and the Republicans are able to find some common ground with Democrats on this issue, it could be an important step in trying to heal some of the deep wounds this election inflicted. There will surely also be some significant tax cuts as well. Calculated Risk notes this assessment from Goldman Sachs:

For most of the last eight years, policymakers have been solely focused on shoring up the recovery; today they also must consider the risk of overdoing it. Given above-trend growth, and with the prospect of fiscal stimulus, we see the US economy moving into modest disequilibrium over the next 1-2 years, with an unemployment rate falling below its long-run sustainable rate, and inflation rising above the Fed’s target.

The Federal Reserve may not have sufficiently powerful tools to get inflation back up to 2%. But the new Administration and Congress likely do. Though as interest rates and the deficit rise, we may once again soon be wondering what the plan is for keeping the debt-to-GDP ratio from growing unsustainably.

But for now, markets seem less worried about the prospect of President Trump than many of us would have imagined three weeks ago.

“The Federal Reserve may not have sufficiently powerful tools to get inflation back up to 2%. But the new Administration and Congress likely do. ”

I’m interested in this. Do you really feel the central bank couldn’t purchase assets to push inflation to x%?

Also, do you not put much credit in monetary offset? Or the thought by many that the ability of an administration / congress to impact inflation is constrained by what the central bank allows.

Way ahead of you.

https://econbrowser.com/archives/2016/11/thank-goodness-we-solved-that-problem-of-elevated-economic-policy-uncertainty#comment-198224

One of the reasons “the markets” may not be as worried as they were is because Trump seems to be reverting to type; that is, just another friend of the K-Street backslapping country club set. Initially some of Trump’s infrastructure spending proposals sounded sorta, kinda along the lines of things that Democrats could support. Not great big spending projects, but at least they were spending projects. Now it sounds like the infrastructure spending is really just a shell game to pump up monopoly rents. Of course, “the markets” would like that.

We also need to keep in mind that “markets” is plural. Some markets will do quite well under Trump; e.g., energy, big pharma, real estate, finance, etc. But other markets not so much; e.g., hospitals, various kinds of insurance, farmers, tourism & hospitality, green energy, non-profit higher education,etc.

But many of us aren’t primarily concerned with Trump’s economic plans, as bad as they are. My bigger worries are the consequences on climate change, an unintended military confrontation, privatization of Medicare and Social Security, and an accelerated slide towards the kind of right-wing authoritarian (or in some cases openly fascist & neo-Nazi) governments we’re seeing in other Western democratic countries. It’s the Benjamin Friedman hypothesis coming to haunt us. Trump plus another euro crisis might be one step too far. On the bright side, I suspect he’ll be a spent force and effectively a lame duck by 2018.

More American Jobs for Mexico!

The peso’s collapse is great news for Mexican workers, but not so good for all those Trump voters in the Rust Belt who thought he could get their jobs back. Mexican labor just became even more competitive thanks to Trump.

No need for that Great Wall. Plenty of work in Mexico now.

Eh, no. The value of repatriated earnings just increased. There is a larger incentive to enter the U.S. to work and send money back home.

if the peso drops relative to the dollar, then (besides increasing the value of repatriated earnings), the Mexican economy will be in a better competitive position relative countries manufacturing in dollars (the US), since their labor cost dropped to the same degree that the peso did.

If the (export) deal is already in place, and denominated in dollar, then the factory just got more profitable (which will be the case for e.g. Ford, GM, etc., owning factories in both countries). If it is an independent (Mexico only) factory, they will now be better able to compete with US based companies – so there *will* be more jobs in Mexico, and there *will* be less incentive to migrate to the US.

Ever since the recession, there has been a net out-migration to Mexico, from the US.

Wall Street and Corporate America were almost certain of a Hillary victory. The crony capitalists, who contributed to Hillary’s campaign, to protect themselves from the economic policies of liberals, gave almost nothing to Trump. He doesn’t owe them a thing. And, Trump not only ran against the powerful Democrat machine, he ran against the Republican establishment, and the broadcast and print media, who were brutally against him. Winning under those circumstances puts Trump in a very strong and independent position. He has waken enough Americans to the reality of elitism. It’s the beginning of the end of the long depression, the social destruction, and the foreign policy disasters. Trump will be a hard liner to right the ship.

Sure. Trump is the champion of the little guy. Hero of the downtrodden. The socialist worker hero on the front lines of the Paris Commune You betcha. Never mind that Trump is interviewing Cabinet candidates at his exclusive private golf course. Never mind that he thinks his family should act as a blind trust. Never mind that he wants to stack the NLRB that’s ruled against his business interests. Never mind that high risk, wheeler dealer stock prices jumped after Trump won. Never mind that his carried interest proposal turns out to have been a head fake. Forget reality. I’m just waiting for the day the White House gets covered with gold leaf from Ft Knox and the White House interior gets redecorated in a gaudy taste and style that only Vladimir Putin could love.

A billionaire living in a luxurious Manhatten penthouse did what the political elites couldn’t do: Connect with “middle class” Americans.

or, the uneducated:

https://4.bp.blogspot.com/-CVFtVGflIKw/WCdKKk1v3sI/AAAAAAAACLw/BTUtFRJdcUAFT7EPtzj4sVMeltSjJsVtwCLcB/s280/voting%2Bpatterns.PNG

Are you saying Trump winning white college graduates is because they’re uneducated?

And, are you saying Trump losing younger voters, blacks, and Hispanics is because they’re more educated?

Have you noticed as voters get older, more and more vote Republican? I wonder why?

Anyway, Trump has been a Democrat, Independent, and Republican, although he’s not a traditional Republican.

No. I’m reformulating your comment from:

“A billionaire living in a luxurious Manhatten penthouse did what the political elites couldn’t do: Connect with “middle class” Americans.”

to:

“A billionaire living in a luxurious Manhatten penthouse did what the political elites couldn’t do: Connect with “uneducated” Americans.”

“the crony capitalists”

and you thought clinton was guilty of this crime, peak? give trump 4 years and you will have a brand new understanding of what crony capitalism is all about. peak, trump is the very definition of wealthy elites getting what they want.

I came home from my elite college to vote for Hillary. Boy, was I shocked when I found out my pop was planning to vote for Trump. I argued with him. I explained the economic disaster that would follow. He wouldn’t listen. He said that most of the anti-Trump rhetoric was highly exaggerated. His blindness to the threat infuriated me but I knew it didn’t matter, since it was impossible for Trump to win anyway.

Then the unthinkable happened–11/9, the Trumpening.

Professor Krugman is right. Trumpageddon is coming. It should have happened immediately but, well, ugh, well…it’s just a matter of time. Meanwhile, I’ve found a place to go where I can ride out the coming disaster. I told my pop I’m moving there but he said “Don’t progressives already live there? That’s why they didn’t see Trump coming.”

I’m not sure what he meant by that.

https://s-media-cache-ak0.pinimg.com/564x/99/5d/62/995d621e9201e4c505508b900a0166ec.jpg

hey jr, listen to your father when he says it is ok to lie to get what you want. practice what he preaches for your own success and the benefit of society.

I think no one really knows what to expect. But there’s a feeling as though the country just woke up from a long sleep, as though the machinery is beginning to turn over again. We’ll see whether it lasts, and whether policy runs of the rails. But there is definitely a feeling that something has changed.

“I think no one really knows what to expect.”

Wrong. It’s easy:

It’s going to be White House, Inc., LLC.

Steven,

Yes, something has changed but I do think we can make reasonable guesses as to what to expect. It will be an 80-20 presidency. 80% of the policies will be traditionally conservative while 20% will not.

One of the most important comments Trump made was in response to the charge that he’s not a conservative. He said “it’s called the Republican Party, not the Conservative Party.” Trump’s mission was to change the Republican Party from the Party of Reagan to a populist party of the working class. Trump proved to the Republican establishment that by adopting some populist policies coupled with traditional Republican policies, it would be possible to break the Blue Wall and win at the Presidential level.

The populist party represented by Trump and his followers agrees with 80% of the traditional Republican plank. So, in most respects, I think we’ll see a standard Republican Administration. However, “America First” is the guiding principle. On foreign policy, I think that means that policy will be guided with an eye as to whether it’s in America’s interest. NATO will still be there and they won’t do an Iranian-style deal. But they will not invade a country to democratize it. They see Russia as more of a natural ally than an enemy since America and Russia are both products of Western culture. But mostly, foreign policy will be very similar to traditional Republican foreign policy.

On the economy, they are not doctrinaire free marketers but they understand the benefits of capitalism. They will be pro-business. They will want to cut taxes and regulation. But capitalism is valuable not as an end in itself ( as libertarian conservatives tend to believe) but rather because it benefits the American worker. When it doesn’t benefit him, the “America First” principle means that they are ready and willing to intervene in the free market. On trade policy, for example, they are willing to adopt policies more favored by the Left. The Obama Administration’s trade policy was much more aggressive against China than was Bush’s. Obama slapped substantial tariffs on Chinese tires in 2009. The Administration brought 20 enforcement actions at the WTO, much of it aimed at China. These policies helped Obama win the blue collar voters in the rust belt in 2012 that Trump took from Hillary in 2016. I think Trump will continue and extend Obama’s trade policies, probably making them more aggressive to benefit specific industries they’ve targeted. I think Trump is serious about big infrastructure spending, which is more of a Democratic policy. Analogous to their views on the international goods market, I do think they will be less willing to import workers as well, in order to protect the American worker. Immigration policies will be stricter, probably across the board, and there will stronger policies against illegal immigration.

Basically, Trump’s populism is not very ideological. He favors most traditional Republican policies because he thinks they work for the American worker, but he can be persuaded to adopt policies from the Left too.

The big question is to what extent free market conservative Republicans in Congress will go along with Trump’s populist policies. I think they will try to cooperate, since Trump demonstrated that some ideological compromise gets them the power to do 80% of what they think is good, even if 20% isn’t. But there will be some battles and I can see Trump forming alliances with the Democrats in some cases.

You should not quote Krugman in the future anymore, may I suggest, he is a left-wing Clinton crony – which you know well.

I do not think that Trump is qualified for his job, but a lot will depend on the people he chooses.

Yes you are correct, there was a huge media smear campaign against Trump and Krugman’s fear mongering too, that the sky will fall in case of his election. It just shows how biased and untruthful Krugman really is.

Peak Trader Trump won white college educated voters by a mere 4 percentage points, which is 10 percentage points smaller than Romney’s margin in 2012. But why only look at white college educated? Among all college educated Clinton won by a 9 percentage points. Where Trump overperformed was with those with little or no college education…especially white voters with little or no education. His margin there was a whopping 39 percentage points. That’s the same demographic that bought into Trump University.

he’s not a traditional Republican Who knows what he really is? But it’s pretty clear that whatever his campaign persona was, he has quickly reverted to type. He’s just your standard issue corporate friendly Republican out to comfort the comfortable and afflict the afflicted. Big government for his cronies, lectures on self-reliance for everyone else. But here is where he is different. Most Republicans at least have some sense of aesthetic taste. I remember how trashy Taj Mahal used to be. I look at the gaudiness of Trump Tower. The tasteless and ostentatious display of wealth. Unlike most standard issue big business Republicans, Trump seems like a cultural Cretin.

the over 50 white voter with little/no college education was a grand supporter of trump. they will also be the ones most negatively impacted by the change of medicare into a voucher system. i think trump gifts to paul ryan his voucher overhaul. i can only imagine the howls, and how trump will spin it, when those voters realize they just elected the person who effectively remove them from affordable healthcare in retirement.

Investors remain split on the effect of Mr. Trump’s policies on the financial sector. On one hand, he has appeared unwilling to saddle banks with more regulation. Market volatility could extend a good run for Wall Street trading desks, too.

Anyone who is surprised has been spending too much time in their little bubble. I tried to warn people that voters were not going to vote for an increase in the labor supply (aka immigration) when a) wages were stagnant and b) some of those immigrants are trying to kill us or bring drugs into the country. A higher labor supply and free trade is an easier sell when we are at full employment, wage gains are strong, and growth is much higher than it is now.

When wages are stagnant, it is totally rational to seek to curtail labor supply. Instead of taking those concerns seriously, Democrats tried to shame people by branding those concerns as xenophobic, or whatever. And by the way, that strategy has the opposite of the intended effect.

I personally never took these suggestions of a Trumpocalypse very seriously. When people compare you to Hitler a) they have lost the argument (Godwins law); b) it’s easy to beat expectations.

So now it dawns on people that we will get at least two years of less regulation of banks and energy companies, some tax reform (lower taxes), perhaps some fiscal stimulus I am not so sure that the fiscal stimulus will be as big as people think. I think that congress will adopt some version of the “penny plan” to eliminate the deficit over a number of years.

If a recession comes, it will be same as it ever was: Federal Reserve tightened too much. Not because we repealed Dodd-Frank.

In the last two weeks Trump has made my 401k great again. ok, it was pretty good, but now its definitely great.

My only real regret about the election is that I did not buy crow futures. So much crow is going to eaten, crow will become an endangered species.

And meanwhile, I’m buying railroad stock…

Uh, Warren Buffett, what did you do ?

He bought rail stocks a couple of years ago.

Or…these are just spasms (admittedly, large ones) to which we’re attaching explanations after the fact. (Peso and other EM currencies excepted.)

Interesting that the same crowd that saw none of this coming is now freely offering explanations.

I’m getting sick of winning already.

“So I am retracting that call, right now.”

How do you get to retract a call *after* the call has been proven wrong?

Before the last World Series, I predicted the Cleveland Indians would win. I am retracting that call, right now.

Vivian Darkbloom I think you misunderstood Krugman’s comment. He was not talking about retracting any previous call that the stock market would plunge. Krugman was retracting his earlier call that a Trump win would result in an immediate weakening of the economy and a global recession. Here’s the “temptation” quote, which makes it obvious that he was talking about the larger economy, not the stock market:

So we are very probably looking at a global recession, with no end in sight.

Krugman’s revised position is that Trump will be a disaster over the long run, just as Brexit will be a long run disaster for Britain. But over the short run the effects of a Trump presidency are more ambiguous and might even be positive, just as the short run effects of Brexit are ambiguous.

LOL. Your obfuscation is worse than Krugman’s. The reason he said the markets would never recover is that in the same breath he predicted an immediate weakening of the economy and recession. The two are part and parcel of the same call.

Perhaps you can point me to the place where he says “yeah, I blew that market call big time. Instead of never recovering, it is hitting all time highs. Who would’a known?” Nope. He’s trying to get away with a “retraction”.

Vivian Darkbloom Ah, I think I see the misunderstanding. This blog is read all over the world and perhaps American English is not your native tongue, so let me help you out. You see, Krugman’s comment: “Still, I guess people want an answer: If the question is when markets will recover, a first-pass answer is never.” was intended to be flippant. Call it Krugman snark. Apparently you took him literally, much as some unfamiliar with Krugman snark interpreted his comment about alien invasions literally. The phrase “first-pass answer” is the tell. It was a throwaway line. Krugman has never pretended to have any expertise in “the markets” and just made a flippant comment as a seque to his serious comment about the global economy going into a global recession very soon. A kind of “Yeah, whatever…” In his retraction he was saying that his prediction of an imminent global recession was likely wrong and that over the short-run Trump’s election could see a short bump in aggregate demand. When reading Krugman you have to separate the snark from the serious stuff.

Just say: Krugman messed it up and he is swimming around now.

A truly pathetic situation we have right now :

Nothing beats Trump lambasting the “elites” during his campaign then immediately proceeding to stack his administration with lobbyists and Wall Street men.

Funny guy- 70year old man with bleached hair. After the nomination of Ross, I expect the worst.