Since Mr. Mulvaney has been criticizing the numbers produced by the BLS [1], and scoring by CBO [2], I thought it of interest to see Mr. Mulvaney’s record on predictions. To make things easy on Mr. Mulvaney, I thought it would be more fair to evaluate his “nowcasting” abilities.

In July 2016, Mr. Mulvaney gave a speech to the John Birch Society in which he observed:

the Fed’s actions have “effectively devalued the dollar” and harmed economic growth.

It is difficult to assess the economic growth assessment without a counterfactual. However, we can easily observe what has happened to the dollar, as of July 2016, when Mr. Mulvaney provided his nowcast. First, the dollar in nominal terms (shown so “up” means a stronger dollar).

Figure 1: Log nominal EUR/USD exchange rate (blue), value of USD against basket of major currencies (red), and against broad basket of currencies (teal), all normalized to 2007M12=0 (up is stronger dollar). NBER defined recession dates shaded gray. Dashed line at time of Mulvaney’s statement on dollar devalued. Source: Federal Reserve Board via FRED, NBER, and author’s calculations.

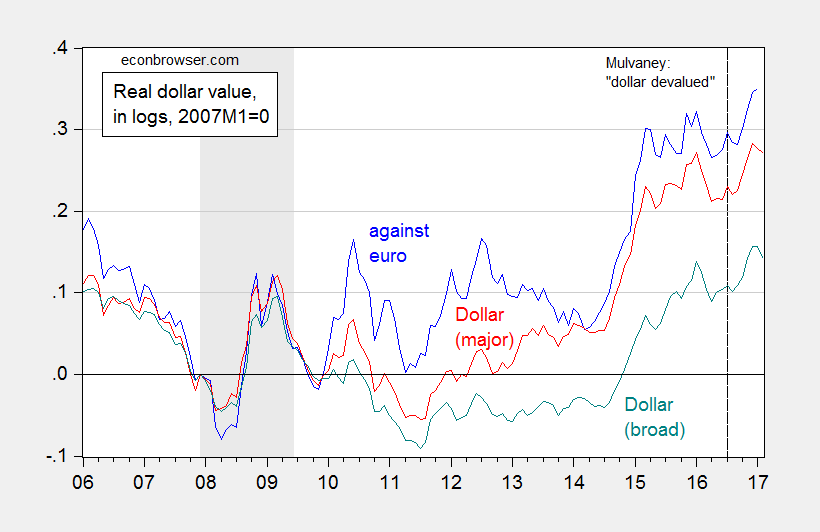

And here is the same picture in inflation adjusted (“real”) terms:

Figure 2: Log real EUR/USD exchange rate (blue), value of USD against basket of major currencies (red), and against broad basket of currencies (teal), all normalized to 2007M12=0 (up is stronger dollar). Adjustment using CPI’s. NBER defined recession dates shaded gray. Dashed line at time of Mulvaney’s statement on dollar devalued. Source: Federal Reserve Board via FRED, NBER, and author’s calculations.

Note that at the time of Mr. Mulvaney’s “dollar devalued” statement, the dollar was actually fairly strong, as compared against the previous decade. So, if Mr. Mulvaney is not even aware of how the dollar fares at a given instant, in a world of readily available data, how are we to take his assessments of data validity (e.g., from BLS), or scoring (from CBO)?

On a separate note, is this statement a Freudian slip of some sort on the part of Mr. Mulvaney?

“I don’t believe the facts are correct”

You can’t make up this stuff.

You are too hard on this guy. He was so right when he pointed out that the economy is fine so long as the job market is producing 250,000 dollars a month.

HAAA!! Love this reply.

And the bit about a lot of ways to calculate a percentage from a numerator and a denominator.

But Hillary’s E-mails????

If further reminder is needed that voting Republican is an immoral act, here is a run down on Trump’s budget. http://www.vox.com/policy-and-politics/2017/3/16/14943748/trump-budget-outline-moral

Allowing people to choose is not an immoral act.

Government picking winners and losers rather than the marketplace is why the economy is a mess.

You don’t know the definition of immorality.

PeakTrader Perhaps you don’t know this, but Obamacare is all about giving people choices. Have you ever looked at the exchanges? They’re a menu of health insurance options…options that people wouldn’t have otherwise. Unless of course you believe telling low income folks that freedom means being free to buy policies with million dollar premiums.

You must have a warped moral conscience if you think the poor and sick have a meaningful choice in the health insurance market. In fact, Kenneth Arrow taught us long ago that there cannot be any such thing as a “market” when it comes to healthcare. Part of Obamacare’s problems stems from the fact that it is designed to cobble together a kind of ersatz market through exchanges with private insurers. It’s better than an uncobbled together ersatz market, but at the end of the day you’re still polishing a turd. Obamacare will always be a kluge as long as we have clueless Republicans pretending to be all about free market choices when what they really want are low taxes for the rich.

2slugbaits, Obamacare has mandates, rising prices, fewer choices, and health care inflation slowed, because people don’t use their health insurance due to the high deductibles. It’s a train wreck.

In a market economy, consumer choice and much fewer regulations will result in more choices, lower prices, along with lower premiums and deductibles, and more quantity and quality.

A market with minimum government intervention will generate massive efficiencies to free up resources. So, we can help the poor.

“Roughly one in five (21 percent) people will have just a single insurer offering health plans in their market, HHS says.

Many consumers have fewer choices in 2017 because several major insurers pulled out of many Affordable Care Act marketplaces. UnitedHealth Group, the nation’s largest insurer, is exiting Obamacare in 16 states. Other Obamacare dropouts include Aetna Inc., Humana, and Blue Cross Blue Shield plans in Tennessee and Nebraska.

Two of North Carolina’s three insurers have left the state’s Obamacare marketplace for 2017, displacing 284,000 people, according to published reports.

Rates for 2017, meanwhile, are all over the map. Minnesotans will see premium increases of 50 percent to 67 percent, on average. In Pennsylvania, the average increase is 32.5 percent. In Michigan, it’s 16.7 percent; in California, 13.2 percent.”

PeakTrader This is nuts. First, as Kenneth Arrow demonstrated half a century ago, competitive markets in healthcare are impossible. We’re not talking about hamburger or gasoline. All you’re demonstrating is that you don’t understand how health insurance markets work. You’ve got some ideological model in your head that you want to impose come hell or high water. Repeat, health insurance markets are not and cannot meet the requirements for a competitive market. There are asymmetries of information, and that fact alone rules out competitive markets.

You keep citing statistics about firms exiting the exchanges. True enough. But it’s not because of a lack of competition. The reason they are exiting the exchanges is because the subscriber pool is somewhat riskier than they had expected, along with the fact that they don’t know what will happen to the ACA. Most insurance companies would like to see the ACA stabilized, a larger subsidy and a stiffer penalty for the young and healthy who opt out. That would fix most of the problems with Obamacare.

You mentioned the one-time spike in rates. That’s because this is the first year in which the government cushion went away. The government covered some of the insurance companies’ losses during a temporary price discovery period. This price discovery period was necessary because the insurers had no idea what the risk pool would look like. That subsidy went away, so the rate hike represents a catching up.

What do you think will happen if Obamacare collapses? Do you honestly think prices will come down, more insurers will enter the market at lower rates, everyone will be able to afford health insurance with low deductibles, la, la, la. And don’t forget the unicorn. The reason we ended up with Obamacare was because the previous “market” approach was already in a death spiral.

Finally, insurance rates are high because medical costs in this country are high. Insurers cannot significantly lower rates unless the cost of healthcare comes down. And that means big cuts in doctors’ incomes, Big Pharma profits, medical engineering companies, labs, etc. Going to a single payer universal Medicare would be administratively more efficient, but costs would will still be increasing unless and until healthcare providers learn to live with less income. That’s just the hard reality.

2slugbaits, the free market can take care of the problem of asymmetric information. You can get a second opinion and consultation (which should also be part of the insurance plan) for a very low price, and therefore avoid potentially unnecessary services.

Since the 1960s, government became more involved in health care creating unintended consequences, which required more government intervention. We need to allow the free market to work, which will reduce prices, and raise both the quantity and quality of health care. Government has a limited role, e.g. correcting market failures and providing a safety net. The free market will provide huge savings that can be used to help the poor.

“In a market economy, consumer choice and much fewer regulations will result in more choices, lower prices, along with lower premiums and deductibles, and more quantity and quality.”

peak, we tried this in the years prior to the ACA. the results were not impressive. you need to accept the results of that experiment.

Baffling, I don’t know what you’re talking about. U.S. health care was heavily regulated before Obamacare.

Since the 1960s, health care inflation rose twice as fast as the CPI and the supply of health care slowed, which is the opposite of the free market.

I agree, Obamacare made it worse.

We have a program of government picking winners and losers that the republicans have worked very hard to skew in the direction of supporting the industries that paid for their election.

It is called the US Tax Code.

Blame it all on Republicans, because Democrats would never skew the tax code.

Anyway, sounds like a case for small and very limited government.

PeakTrader You’re the king of hand waving. And your reply is pretty good evidence that you do not understand the relevance of the asymmetric information problem. The free market cannot handle the problem of asymmetric information. I know more about my health than any insurance company; that’s why the individual private insurance market will collapse if Obamacare goes down. It won’t just be those currently using the exchanges, it will be anyone who is getting their health insurance through individual markets. The issue isn’t about avoiding unnecessary services; the issue is that as long as insurance companies are prohibited from excluding people from buying insurance alongside the elimination of a penalty or mandate, then insurance companies have no way to determine who is a high risk and who isn’t. In other words, information is asymmetric. And that fact makes a free market approach impossible. Not just difficult, but literally impossible. That’s why you must have a mandate if you have non-excludability. Without a mandate insurance companies must assume that anyone who buys insurance is a high risk. That’s a death spiral for the individual market, and eventually a death spiral for employer provided insurance. You must have a government directed mandate to buy insurance in order to ensure healthy people subscribe to policies as well as the unhealthy. That’s just the iron logic of having universal access irrespective of pre-existing conditions. The only way to avoid this outcome is to abolish the idea of universal access irrespective of pre-existing conditions. And if that’s what you’re advocating, then you really do set the bar for advocating a deeply immoral policy.

The government got involved in the health insurance market long before the 1960s. Recall that employer provided health insurance was introduced as a way to offer non-taxable benefits that got around wage freezes during the Second World War. I find it hilarious how Republicans blather on about taking the government out of health insurance, but they wave the bloody shirt whenever academic economists talk about the “Cadillac tax” on high end insurance policies. Do they not know that those policies are heavily subsidized by the taxpayer and bear a lot of the responsibility for escalating healthcare costs?

A word of advice. If you want to be taken seriously here, let me suggest that you quit with the brain dead “free market” bromides and the hand waving “analysis.” Just claiming that cutting government regulations will achieve nirvana doesn’t cut it. If that’s what you believe, then you need to describe a coherent model that describes exactly how that is supposed to happen. In all your posts I have never seen anything that comes even close.

PeakTrader’s understanding of health insurance markets is so bad, it rivals that of the Speaker of the House. Ryan not only misunderstands the health insurance market — he doesn’t even understand insurance.

I don’t know if you have seen this map ( https://public.tableau.com/views/HIMap/2017Map?:embed=y&:display_count=yes&:showVizHome=no ), but it strongly suggests to me that it is state governments that make ACA work well, or not. ACA can work just fine in rural areas (see Maine, Idaho, Montana, New Mexico, North Dakota, etc.). ACA can work just fine in red states (see Arkansas, Nebraska, and some of the rural states mentioned earlier).

I don’t know if state efforts can overcome sabotage at the federal level, but we might find out this year. One of the Trump executive orders has already altered IRS handling of tax returns when the taxpayer provides no response on the Health Care: Individual Responsibility line. Previously, the IRS considered such returns to be incomplete, would not process them, and would inform the taxpayer of the need to provide further information. Now, the IRS is processing the returns and taxpayers will find it easier to stay out of the insurance market.

2slugbaits, health care insurance operates the same way as auto insurance. Insurance companies are not in business to lose money. They have some idea who’s high risk, and adjust premiums and deductibles to reflect costs.

The problem is when it costs $5,000 to fix something on your car when it should cost $500. So, of course, you’ll pay a lot more for insurance.

I agree, everyone should have health care insurance, because you’ll never know if you’ll need it and everyone should pay something. What isn’t paid for in the marketplace can be paid for by taxpayers. The free market will reduce prices and raise quantity to make health care affordable.

I find it amazing you blame Republicans, given the enormous damage Democrats caused in health care, since the 1960s, like the “War on Poverty.” And, I’ve explained a system to you more than once how to lower health care costs substantially, through less regulation and competition, which allows a stronger safety net.

Some people believe doctor’s incomes are too high. Here’s what an MD said:

“U.S. doctors earn more than in other countries because the vast majority of our pre-med and medical students don’t get funding from the government. The average medical school graduate has accumulated over $120,000 in debt. She will spend the next 3-7 years as a low-paid resident or fellow, but will have to pay the interest on the loans throughout this training. When a doctor finishes training and joins a practice, she has no patients yet and no revenue stream. She has to acquire patients, pay student loans, and often pay a buy-in fee to the group.”

My comment: And, what about the costs of malpractice insurance, administrative staff, workers compensation insurance, tools & equipment, advertising, etc.. Many MDs work long hours. Should the government limit every profession’s income?

“’ve explained a system to you more than once how to lower health care costs substantially, through less regulation and competition, which allows a stronger safety net.”

i think you have a misunderstanding of what is meant by a safety net.

So, you don’t believe needed medical care is a safety net. A safety net can be financed through savings or borrowing. Savings allow a stronger safety net. There’s a limit on borrowing.

PeakTrader: ““U.S. doctors earn more than in other countries because the vast majority of our pre-med and medical students don’t get funding from the government.”

Don’t get funding? Are you kidding?. Almost every medical resident receives $100,000 a year of U.S. taxpayer government money through Medicare to pay for their advanced training. They get to pocket half of that and the rest goes to pay for their training. Most residents will collect at least $300,000 and many as much as $700,000 of government money.

Name any other trade where the government will give you $100,000 a year for advanced training so that you can double or triple you income to $400,000 or $500,000 or $700,000 a year.

Joseph, please show your source for these $100K estimates. What I have found is significantly different for the Medicare IME/DGME program. 1st these funds go to the training hospital and NOT the resident. So the hospital takes its share before paying any resident. This example was provided from: http://www.uth.tmc.edu/med/administration/edu_programs/Assets/documents/gme/medicare_payments_gme.pdf

“Medicare Payments for Graduate Medical Education:

What Every Medical Student, Resident, and Advisor Needs to Know

Association of American Medical Colleges

Let’s look at a sample teaching hospital in 2012:

Sample hospital-specific PRA … $100,000

Medicare patient load … 30%

Medicare DGME payment for 1.0 FTE … $30,000

Potential annual loss for 0.5 FT ….. $15,000”

The stories of residents barely making poverty/livable level wages and still working very long hours for that wage holds true. Notice there are several factors which effect HOSPITAL,/b> reimbursement amounts.

Stop the biased exaggerations. Just citing the top number without explanation nor source is disingenuous.

So, you’re saying the government gives residents, after medical school, $100,000 and half goes to training. So, they earn only $50,000 a year the first few years?

“September 2009 – Career Resources Editor’s Note: Staggering educational debt is a reality for newly minted physicians. In addition to undergraduate indebtedness, a quarter of medical school graduates have debt exceeding $200,000.”

CoRev, the government resident program pays $100,000 for each resident. Roughly half goes to the training institution and the other half goes as salary to the resident. What’s complicated about that? Name any other trade or profession that will give you $100,000 a year of government money to pay tuition and living expenses so that you can double or triple your income to $500,000 or more.

PeakTrader, we are supposed to feel sorry for a doctor with $200,000 of school loans who earns $200,000 a year. It should be a breeze to pay off their debt in a couple years or so. That is, unless they splurge on the BMW and McMansion as soon as they start working. But in that case they take five years instead of two years to pay off their debt, all the while driving a BMW and living in a McMansion. Boo hoo.

Funny how conservatives like to complain about the “irresponsibility” of the liberal arts major who graduates with $20,000 of school loans, but they ask us to feel sorry for the doctor who graduates with $200,000 of school loans but makes $200,000 or $500,000 a year in salary.

Joseph, I asked for your source while providing one myself which contradicted your first and even the 2nd of your biased personal opinions. Do you actually know any young doctors? Talking to them might enlighten you.

Here’s what a son of a doctor said:

My dad practiced orthopedics for 20 years. He had a PhD in ortho from U of Iowa, and served as a Navy surgeon in Viet Nam. He specialized in artificial knees and hips.

He and a couple colleagues invented the orthoscope, a gadget that radically improved the quality of care for his sports medicine patients and reduced surgical/hospital costs.

Dad worked 80 hours a week on average, including three weekends a month on call. Few breaks for holidays. We rarely saw him during the week. Divide $250k a year (just guessing – he wasn’t one to talk about money) into 4,000 hours a year and you get about 60 bucks an hour. Out of that salary:

– 25% or more went to taxes

– $70-80k a year for malpractice insurance to protect his family and practice from all the worthless patient lawsuits by crooked lawyers

– Salary for his administrative staff to process and follow up on reams of insurance and government paperwork.

– Costs of OSHA and other compliance overhead to run his clinic and x-ray machine.

I’m not saying we didn’t live comfortably. He took good care of us. Rather than credit his salary, I’d say God blessed him for all the pro-bono work he did for patients that couldn’t afford care but still took up his time. And trips to Africa on his own dime for medical missions. I heard once that our church was waiting on my dad for his tithe plan so it could figure out its annual budget.

I don’t know if these MD’s in other countries are as overlawyered and overregulated as US doctors are. Could be the reason why ours seem more expensive.

Final shot: Dad’s a humble guy. Often jokes that orthopedics was basically carpentry, and that he would have made more money and had less liability as a carpenter. But he couldn’t get into the union.

corev, joseph is correct regarding residency training. you can learn more here

https://economix.blogs.nytimes.com/2013/12/17/how-medicare-subsidizes-doctor-training/

you can learn about the caps in medical schools and residency programs here

http://www.nejm.org/doi/full/10.1056/NEJMp1306445?viewType=Print&viewClass=Print

be forewarned, some on this blog feel a scientific journal which promotes editorial views on its discipline is not a legitimate scientific journal, and more in line with aarp. however, i think it is fair to say the new england journal of medicine is a legitimate scientific journal, even with editorials.

regarding the debt trap, most physicians handle it fairly well. they go into the medical profession understanding the debt comes with payoff a few years down the line. medical residents making $50K per year is really not that bad. fellows make a little more, but earn quite a bit more after training. those that complain about the debt are probably not the best doctors anyway. at least that is my experience first hand with those in the medical profession.

CoRev, what are you disputing? What contradiction? The source you provided indicates that the government spends $15 billion a year supporting the residency training of doctors. The government provides on average $100,000 per resident per year to hospitals for each resident they train. The hospitals pay on average $50,000 per year of this amount to the resident as salary. The other $50,000 they keep for training expenses. The $100,000 is provided to the hospitals on a per resident basis called the Per Resident Amount or PRA. So what are you disputing? It’s says so right in your source. Did you read it?

Joseph, I made my point: “Stop the biased exaggerations. Just citing the top number without explanation nor source is disingenuous.”

PeakTrader: “Divide $250k a year (just guessing – he wasn’t one to talk about money) … “

Since you are just guessing, you might be surprised to know that the average salary for an orthopedic surgeon in the U.S. is $520,000 a year. Note that this is IRS reported net income after deductions for expenses, including malpractice insurance and office expenses.

Sort of casts your little anecdote in a different light — in other words, total BS.

Joseph, your conclusions are based on a lot of ignorance. The comment I saved from 2009 states the dad practiced orthopedics for 20 years, since the Vietnam war. So, the latest year he earned $250,000 was 1995 (and the son said that was a guess).

An orthopedic surgeon is the highest paid specialty. Salaries are also dependent on geography and how much pro bono work they do. It seems, he ran a private clinic. Do you have proof the $520,000 is based on net income, after expenses, rather than gross income? An average salary of $520,000 may be appropriate, particularly given regulations and lawsuits. Maybe, you think an orthopedic surgeon is overpaid and Oprah is underpaid making $300 million a year.

“The comment I saved from 2009 states the dad practiced orthopedics for 20 years, since the Vietnam war. So, the latest year he earned $250,000 was 1995 (and the son said that was a guess).”

peak, you did not state that in your original comment. your comment implies these are modern numbers. this was done intentionally, to further your argument. and you hoped nobody like joseph called you on it. this was an extremely dishonest attempt to support your point.

Baffling, it’s not my problem you can’t add.

peak, what you said was

“My dad practiced orthopedics for 20 years. He had a PhD in ortho from U of Iowa, and served as a Navy surgeon in Viet Nam.”

it has nothing to do with adding. he served in vietnam. you are not clear at all when he began and ended his practice. he could have remained with the military after the war. and then you throw out numbers from 1995, in year 2017, with no clarification on their vintage. knowing your past history, this was done intentionally. or your communication skills are lousy.

Baffling, I can only respond to the actual comment.

You creating a false narrative and making negative implications shows you’re just being creative.

peak, your original comment did not state “SINCE the vietnam war”. you added that LATER. this is not a false narrative. this is you rewriting history to improve your position. so again, either this was done intentionally, or you are a lousy communicator.

Baffling, I did not write the original comment. So, I don’t know what you’re talking about. Obviously, you didn’t understand what I wrote and are just making things up.

It’s amazing how you make things up and then attack me for the nonsense you create. I don’t know if you’re playing games, cannot comprehend English, or you just like making everything as complicated as possible, like Obamacare.

also, if he invented the orthoscope, he was obviously an above average surgeon. and would have derived royalties for his invention. his income was most likely much higher than peak indicated. or he was a very poor businessman.

PeakTrader: “So, the latest year he earned $250,000 was 1995”

“And paid $70,000 to $80,000 a year for malpractice insurance.”

PeakTrader, stop before you make even a greater fool of yourself. The average malpractice insurance for an orthopedic surgeon is $20,000 — in 2016.

Nothing in your story makes even the least bit of sense. It is completely made up nonsense. It’s a mystery why conservatives are so susceptible to fantastical, obviously made up stuff on the internet, but they will believe just about anything if it confirms their conservative gospel.

Joseph, you’re the one making nonsense and a fool out of yourself. The comment may be true or not. I stated it was a comment. Yet, you’re sure it’s a lie with absolutely no proof.

Some states, like Texas and California, put a $250,000 cap recently on non-economic damages to reduce malpractice insurance premiums substantially. However, in some states, like New York, some surgeons pay over $300,000 for malpractice insurance. It seems possible an orthopedic surgeon paid $80,000 for malpractice insurance in the ’90s.

PeakTrader: “The comment may be true or not.”

And there you have it, folks. Exactly what Dr. H.G Frankfurt wrote about in his book titled “On Bullshit”. He distinguishes between an outright liar and a bullshitter. “The liar cares about the truth and attempts to hide it; the bullshitter doesn’t care if what they say is true or false, but rather only cares whether or not their listener is persuaded.” Truth or falsehood is completely irrelevant to his purpose.

And that, my friends, is PeakTrader — a bullshitter. Don’t blame PeakTrader, blame some anonymous commenter.

As with Donald Trump, he doesn’t care about the truth. If Trump repeats something outrageous and false from Fox News, don’t blame Trump, blame Fox News.

Another ignorant comment by Joseph.

And, it seems, too many liberals feel they need to politicize everything, including the weather.

and too many conservatives feel it is ok to use innuendo, lies, deceit and alternative facts rather than simply acknowledging what is true. this includes trump and peaktrader.

You’ve simply proved, again, you’re a political hack.

And, if Trump is a conservative, it’s because of people like you.