The UK Office of National Statistics released revised figures for GDP and investment today. What can we glean from these numbers?

In the wake of the Brexit vote last June, tremendous relief was expressed over the fact that the economy held up fairly well, as measured by aggregates like GDP. Of course, monetary policy eased in the wake of the Brexit surprise, so this was not a ceteris paribus experiment. On the other hand, one would expect the main effect of policy uncertainty to be manifested in decisions regarding investment, rather than nondurables and services consumption (which has thus far held up pretty well).

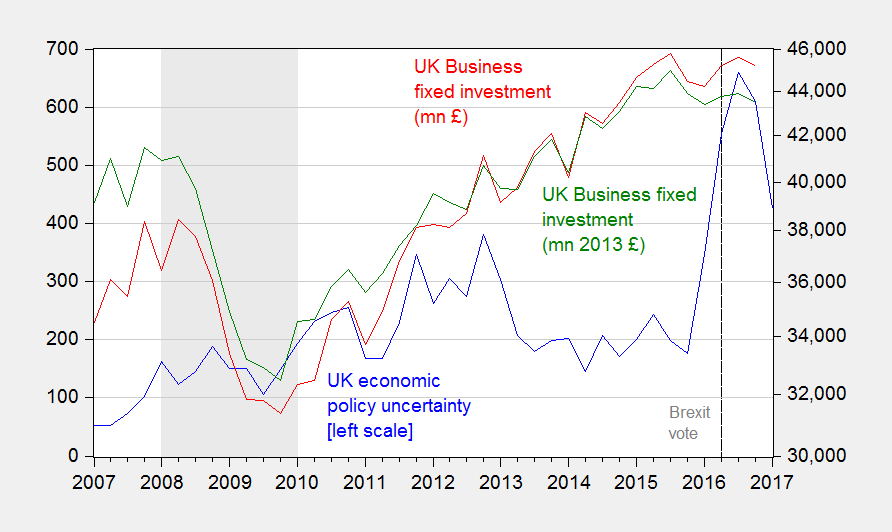

First, business fixed investment declined in the 4th quarter; in real terms, it is 0.6% lower than in 2016Q2.

Figure 1: Economic Policy Uncertainty index for UK, quarterly average of monthly data (blue, left scale), and nominal business fixed investment, in mn pounds (red, right log scale), and volume of business fixed investment, in mn chained 2013 pounds (green, right log scale). ECRI defined recessions dates shaded gray. March 2017 EPU average of daily figures, accessed 3/31. Source: policyuncertainty.com, UK Office of National Statistics (accessed 3/31), ECRI and author’s calculations.

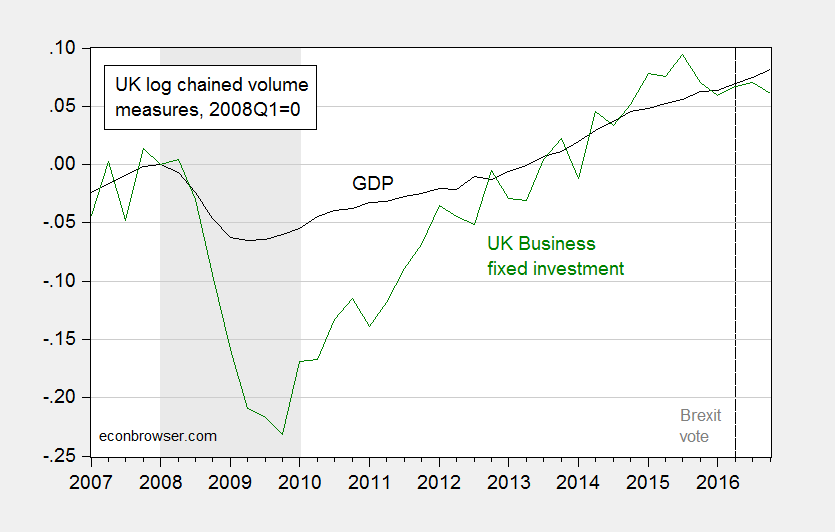

Obviously, there are a number of factors at play, and investment fluctuates substantially over time. However, it is interesting to compare the trends in business fixed investment against those in overall GDP. I plot these two series in Figure 2, both normalized to 2008Q1=0 (ECRI defined peak).

Figure 2: Real UK GDP (black), and real UK business fixed investment, (green), both in logs normalized to 2008Q1=0. ECRI defined recessions dates shaded gray. Source: UK Office of National Statistics (accessed 3/31), ECRI and author’s calculations.

In other words, the (admittedly) loose relationship between GDP and business fixed investment has changed over the period when economic policy uncertainty has been elevated (a period that starts in February 2016, according to the Baker, Bloom and Davis index). In the absence of an econometric model of investment for the UK incorporating uncertainty, it’s difficult to be more definitive. In an analysis of investment over the 1996-2014 period in 22 advanced economies, Matthieu Bussiere, Laurent Ferrara, and Juliana Yael Milovich find uncertainty, measured in a variety of ways, is an empirically important determinant of the slowdown in investment, accounting for approximately 17% of the slowdown (see slide 7).

Here’s some investment sector commentary on the issue:

When it comes to business investment, British companies are slow-playing their hands. Instead of spending on R&D or equipment, they seem to be focused on contingent location strategies to prepare for changes in relations with the EU.

What are the prospects looking forward in the wake of invoking Article 50? From IHS-Markit today (Howard Archer; not online):

Businesses will likely become more cautious over investment and employment as the economy shows increasing signs of slowing and uncertainties over the outlook are magnified by Brexit negotiations coming to the forefront now that the government has triggered Article 50.

The IHS-Markit newsletter continues, viewing the declining purchasing power of households arising from elevated inflation and slow wage growth, as implying slowing consumption growth moving forward. For those of us who believe in the accelerator model — output growth determines in large part investment — there will be further headwinds to business fixed investment.