I don’t think so. But you be the judge:

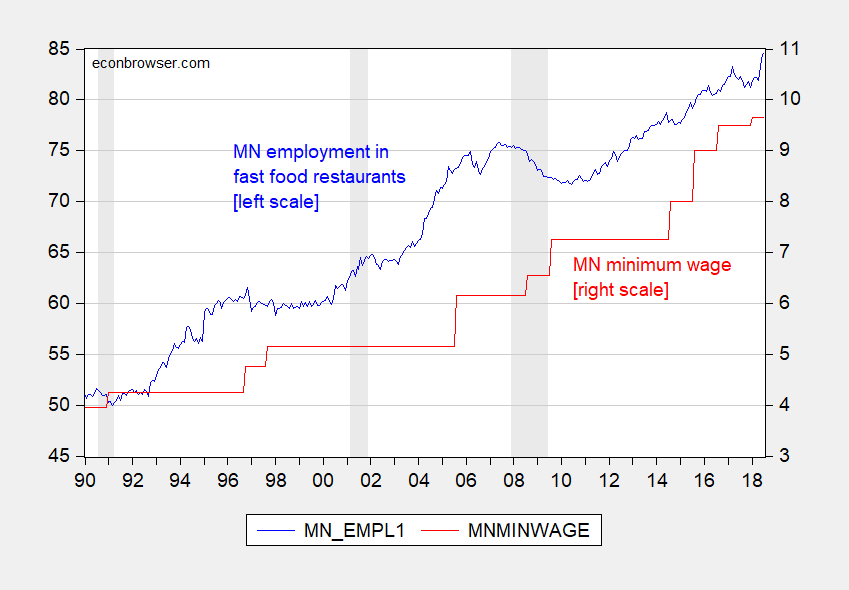

First, look at how the minimum wage and employment in limited-service restaurants have evolved over time.

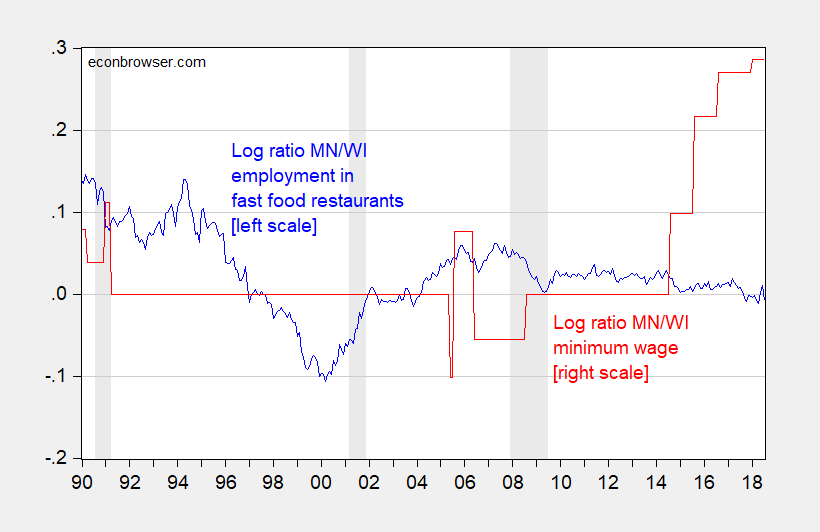

Figure 1 provides a cautionary note about trending variables. How about Minnesota versus Wisconsin (where there’s been no action on the minimum wage over the Walker years)? This comparison is shown in Figure 2.

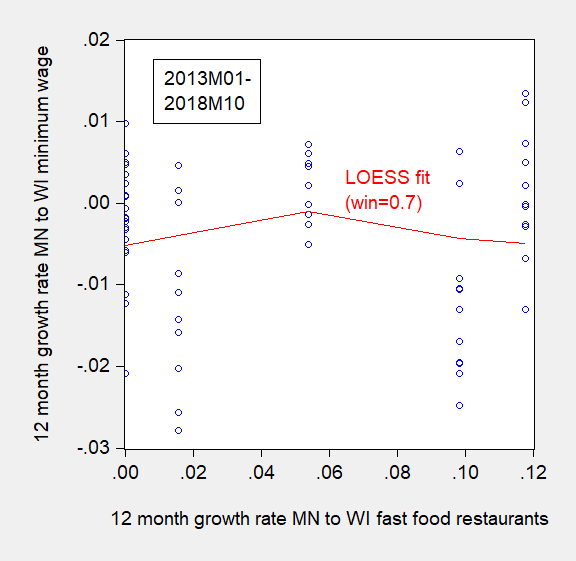

If you are tempted to say there’s no obvious relationship between relative minimum wages and relative employment levels in limited service restaurants, well, I think you’d be justified. Here’s a scatter plot of y/y growth rates, in Figure 3, along with a locally weighted regression fit.

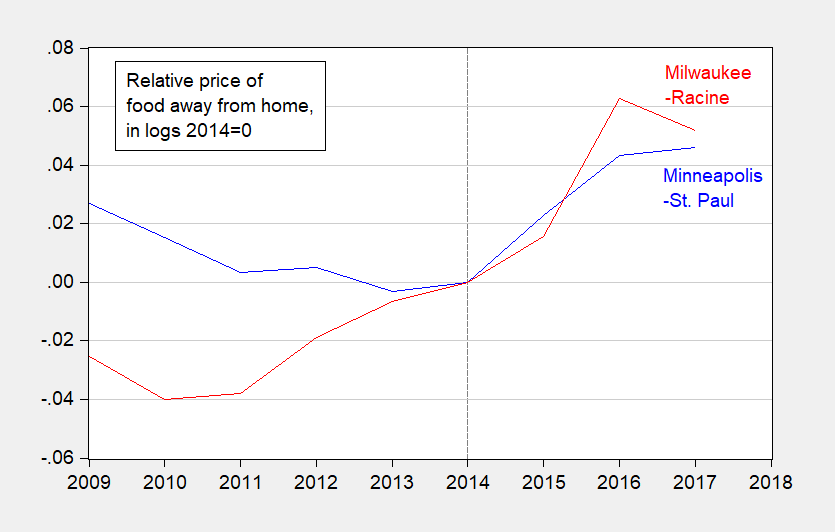

What about the fear that higher minimum wages would lead to higher prices? Inspecting Figure 4, I’d say it’s hard to see a profound effect here as well.

Unfortunately, the impact on fast food prices cannot be directly ascertained from the data. However, for all restaurants, it’s hard to see a big impact.

Given these points, arguments that minimum wage increases negatively impact employment growth and restaurant prices need to be viewed with some caution. Further statistical analysis is contained in this working paper.

I fall on the side of raising minimum wage—or that it benefits society more than it harms it. Although I guess, only using empirical means, as Menzie usually does, it’s not a “slam dunk” that that is indeed the case. Although I applaud papers that are done that strive to answer the question–as I believe “the white hats” will win.

@ Menzie You know I had been thinking some about an earlier comment I made. This one:

https://econbrowser.com/archives/2019/02/crazy-definitions-of-equilibrium-exchange-rates#comment-221517

……And, I was thinking that I probably got my little “mind reading” exercise wrong, in that, you are probably largely against a U.S policy of devaluation of the dollar. And as “mind reading” often is, it was kind of a dumb attempt on my part. But then I wondered…. is saying that “you” (general “you” here) are against China revaluing their currency upwards, the same as saying “you” (general you) are against U.S currency devaluation??? In other words, could someone be against the Chinese raising the value of their currency in dollar terms and at the same time, FOR the USA devaluing their currency in general (vs a basket of currencies)???

I’m tempted to try another mind reading game here, but don’t want to go 0-2 in “mind reading”. Anyways…. thanks for not “taking me out to the woodshed” in your posts CoRev and EdHanson style. : )

Moses, on a technicality, you cannot devalue a currency if it is floating only if it is fixed

“an issue that Noah Williams spoke about with University of Wisconsin’s College Republicans Tuesday evening.”

Never heard of Noah Williams. I did have one minor quibble. Could your charts be done using the inflation adjusted minimum wage?

I noted the other day (not on this site) that General Motors has shed 30,000 employees since 2010. 2010 was a pretty bad year for GM and 2018 not all that bad. So, in an era of increasing prosperity and low inflation and rising vehicle sales, why would GM shed employees? The simple answer is profits, but the more subtle answer is that GM has increasing alternatives to human employees: robotics and other technologies.

Now comparing GM to fast food restaurants may seem absurd on the surface, but only if you want to ignore the economics of labor costs versus alternatives.

• https://emerj.com/ai-sector-overviews/fast-food-robots-kiosks-and-ai-use-cases/

• https://www.washingtonpost.com/technology/2019/02/22/this-fast-food-drive-through-person-taking-your-order-might-not-be-person-all/?noredirect=on&utm_term=.aea8c5151555

So, the question is: are higher minimum wages pushing fast food restaurants toward greater automation or is the opportunity to use greater automation pushing restaurants toward hiring fewer employees than they would have previously, but paying more for those who can manage an automated enterprise? Figure 2 may be indicative of the latter.

Bruce – you have written a lot of misleading BS in the past but this takes the cake. From 2010 to 2016, GM employment rose from 202 thousand to 225 thousand, which is pretty decent in a highly competitive global market. Now if you knew how to look at a 10-K – you would see its operating margin is quite modest. So much for the global automobile market. Now it is true that its employment has taken a hit over the past two years. Here is one story on this:

https://www.forbes.com/sites/davidkiley5/2018/11/26/gm-cuts-jobs-and-plants-to-deal-with-changing-tastes-and-trump-tariffs/

GM Cuts Jobs And Plants To Deal With Changing Tastes And Trump Tariffs

The headline captures the discussion offered here. None of your spin seems to be mentioned. Of course this is what we expect from the usual fact free Bruce Hall!

pgl, you are correct that General Motors did increase employment until 2016. However, the dramatic fall in employees was not related to relatively steady U.S. sales: http://gmauthority.com/blog/gm/general-motors-sales-numbers/. Furthermore, my point was that automation has reduced the need for as many assembly line workers: https://www.bloomberg.com/news/articles/2017-04-04/gm-hooking-30-000-robots-to-internet-to-keep-factories-humming.

Oh, the employment numbers were not related to sales in China either: http://gmauthority.com/blog/2018/01/general-motors-sales-numbers-figures-results-december-2017-china/.

With regard to profits, General Motors operating profit in 2017 was the highest since 2010 and that’s when the layoffs began. Yes, 2018 was lower, but about the same as the mid-2010s. https://www.stock-analysis-on.net/NYSE/Company/General-Motors-Co/Long-Term-Trends/Operating-Profit-Margin

pgl you should check data before spouting dogma.

Bruce Hall wants us to believe that GM’s financial fortunes were “not bad”. I guess Bruce has no clue about what happened to its stock price but it was done during 2018. Of course having operating profits fall from $8.66 billion in 2017 to less than $4.45 billion will due that. Yea I know over $4.4 billion sounds like a lot of profits until one realizes that GM sells almost $150 billion per year. Now if Bruce thinks a 3% operating margin is highly profitable – then he is dumber than I give him credit for!

Why did GM see lower profits in 2018? I would suggest that this guy at Forbes had a point regarding the Trump tariffs. Which may also be why GM laid of some of its workers. But then that’s a thought Bruce Hall never grasped so hey!

Where I live, with a coupon you can get 3 Whoppers and 3 cheeseburgers and 3 packs of fries for $13 even, before tax. Hypothetically that could feed a family of 4, and then you can still get a 2 liter of soda pop for 99cents waiting at home in the fridge. You have to just be smart still. Of course my state’s minimum wage laws are horrid (low). (It seems I am now arguing against myself).

According to ZH no one likes Ketchup or medium priced pantry/cupboard items anymore. Who knew?? #MAGA

https://www.zerohedge.com/news/2019-02-22/buffett-bruised-kraft-crashes-record-low-after-barrage-bad-news

Buffett’s shareholder letter will be released Saturday and I am sure will be available online.

I think Andrew Yang is probably having a hard time “getting traction”. I think he will continue to have a hard time getting attention. And my guess is he’ll be dead in the water by the time New Hampshire votes are cast. Fill in whatever you think the reason is. There are many legitimate reasons, and other more troublesome reasons why he’s probably just not going to get much wind under his wings. But I do think he deserves a hearing. Would he be my first choice at this stage of the game?? NO. But I do think if our country is really wanting to be a great country, that people like this guy should feel encouragement and attracted to running for the Presidency. I respect him for running, and I’m glad he’s running, and although he will get the shit kicked out him at the ballot box, I hope he holds out at least until the New Hampshire votes are cast, and doesn’t feel demoralized by the process when it’s all finished.

https://www.youtube.com/watch?v=8tuJ0phjFys

How many people thought a black man could win the Presidency when candidate Obama announced around 2006–2007?? Yang has the initiative, he has the intelligence, and a solid enough background to be considered.

They even included my favorite bullshit term. “Job creators”.

https://www.youtube.com/watch?v=1f3ssfxddlA

Looks like it started hurting at $9 / hour.

One would need to know the spread of wages before commenting on whether the raised minimum wage is a binding constraint.

Not a lot of people work at Fed min wage. A lot of people work at $10 / hour.

Raising the min wage hurt employment at $9 but helped once it got above $10? Lord – of all the stupid comments from Princeton Steven, this one tops them all.

Of course the movement in employment you saw had more to do with the business cycle. I would ask you to walk over to Princeton’s economics department so they might explain it to you but knowing you – you’d get lost on the trip.

You have to love all these rumors. One thing we already know, the March 1 penalties have already gone out the window. Which Chinese will probably interpret as donald trump’s personal weakness. China’s government only understands one thing—-real punitive penalties and/or violence. Once Chinese officials see they can stall on trade moves, they’ll know trump is weak, and then the Chinese go back to their favorite game—platitudes and stalling, then more platitudes and stalling, then more platitudes and stalling, and then guess what?? Another round of platitudes, slogans, and stalling. America’s farmers can enjoy bankruptcies and crappy prices for their crops while donald trump goes on TV and tells everyone what a “tough” and “powerful” man he is.

https://www.youtube.com/watch?v=dplX537R3Oc

My advice to America’s farmers going bankrupt and getting low prices on your crops— enjoy it, YOU voted for the orange colored bastard—so you enjoy the fruits of YOUR ballot vote

I seem to remember a certain “so and so” on this blog expressing interest in Rod Rosenstein’s continued employment at USDJ. It appears that “so and so” had concerns for very good reason:

https://www.politico.com/magazine/story/2019/02/21/jeffrey-rosen-rod-rosensteins-replacement-isnt-ready-for-the-job-225194

@pgl who wrote: “Could your charts be done using the inflation adjusted minimum wage?”

Agreed, certainly for figure 1. Would probably not change the overall message and would likely portray minimum wage hikes since the early 1990s as far more tepid than the nominal numbers suggest.

I applaud the push to evidence-based policy. Note that Minnesota is a northern state that is never singled out for having large pools of unproductive labour that are apparently found in some of the southern states. I am basing my impressions on remarks by trade economists and auto sector executives and analysts over the years.

So if somebody could kindly point to evidence that minimum wage hikes have no discernible effect on employment in places like Georgia, Louisiana and Mississippi, I would be obliged.

My work is building budgeting and forecasting systems. That includes workforce planning and capital planning. Whenever I hear somebody say “increasing the minimum wage will hurt employment” I realize these folks have never done any workforce planning.

First thing to keep in mind is that the required workforce is based on production. Production is based on sales. So if Joe owns a burger joint and he figures he’s going to sell as many hamburgers this year as last year, he knows exactly what his workforce will be. Wages don’t enter into it. At all. Ever. Second thing to keep in mind is, generally, regardless of the line of business, people are the most expensive input. So if you want to reduce your people cost, you have to reduce the number of people. This drives automation regardless of the wage. At Joe’s burger joint, people are the highest cost input. At Fred’s bank, people are the highest cost input. Note that if the prevailing wage goes up (i.e. minimum wage increase) that doesn’t change: people are still the most expensive input. They were most expensive before any prevailing wage increase. Whether Joe or Fred can automate depends, has always depended, on the cost of automation not the cost of labor. Reducing Joe’s taxes or raising the minimum wage won’t affect the number of people Joe has to employ. Same for Fred. Wage levels don’t change the number of people Joe or Fred hire, just the cost.

Now, I’ve only been doing this for 20 years, and I’ve only done it for manufacturing, finance, entertainment, transportation, government, and various service industries. So I’m sure somebody will be able to point out an exception to all this.

Side note: Tax reductions don’t affect workforce planning either. Never have, never will. Decreasing Joe’s or Fred’s taxes won’t change how many people they employ because employment is based on production. Period.