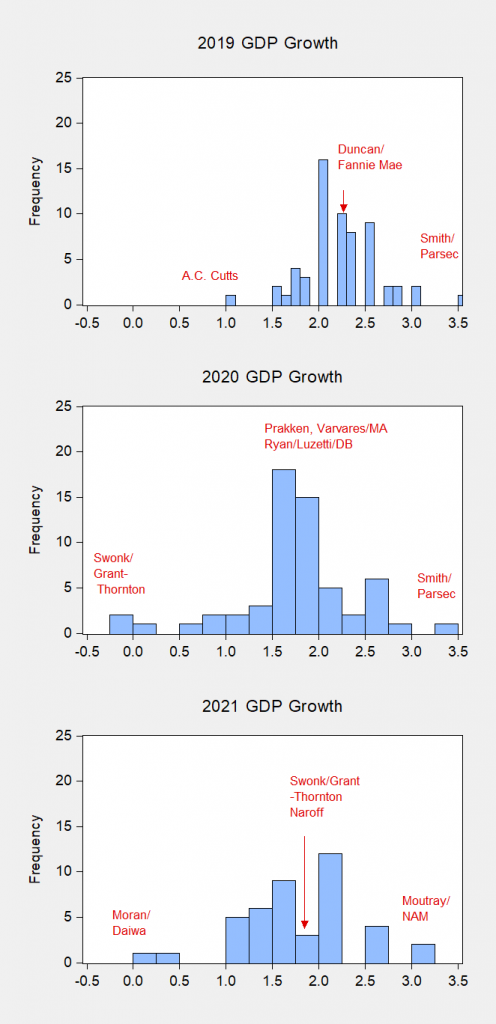

Recessions, once they are underway, happen fast — a lot faster than expansions. Who’s forecasting recessions, according to the WSJ February survey (the February Survey of Professional Forecasters has been postponed until March because of the data delays associated with the Trump government shutdown).

James F. Smith of Parsec Financial Management is relentlessly optimistic 2019-2020 (he even forecasts 3.5% growth for 2018 implying a 4.3% q/q SAAR growth rate for 2018Q4!).

While no one forecasts negative growth in 2019, Dianne Swonk of Grant Thornton and Stephen Gallager of Societe Generale do so for 2020 (-0.1% on y/y basis). Swonk forecasts negative growth in 2020Q1 (as does Lindsey Piegza of Stifel, Nicoulas and Co.

While forecasters are reluctant to predict negative growth, they clearly ascribe a higher likelihood of recession, with most estimates placing the recession in 2020.

If the recession ends up starting in 2019, well then everybody polled will have missed it (myself included).

Can we say we “predicted” it if we say it will happen between July 2019 and July 2020 (and it comes to fruition)?? Or does our economic scalpel have to cut a more minute piece in order for us to hold our nose high in the air?? Or, can we even be proud at all when more and more economists and even laymen (horrors!!!!) are jumping on the 2020 “bandwagon”?? That is in fact my “prediction” but the more and more people calling 2020 is when I start to think it might be 2021, ‘cuz I don’t like “group think”, I really kinda detest it.

But I am still predicting July 2019–July 2020, unless the stick-in-the-mud host of this blog insists I must “fine tune” my forecast, then I will run off crying in my diaper and try to fine-tune it.

Anyone have Stanley Fischer’s or Ben Bernanke’s unlisted phone number handy?? Or even Gita Gopinath’s private number?? In order to further mankind’s progress in economic forecasting I’m willing to sacrifice myself to talk with Gita. Anyone know if she prefers Riesling or Pinot Noir??

https://www.youtube.com/watch?v=jI34XzlRAyE

Let’s say that a couple of months before the Nov. 2020 election – all signs are signaling a recession. Guess who will write the first oped about the Goldilocks economy saying only a complete moron would think we are in a recession? Donald Luskin? Lawrence Kudlow? Stephen Moore?

I’m taking the bets right now. Payoff to the winner at the end of next year!

Kevin Hassett is going to feel slighted that you didn’t include him in your spinning wheel game.

Moses Herzog: He wasn’t in the survey…

@ Menzie

That was my little “haha” directed at pgl. Don’t worry, no one else gets my jokes either. At middle age I’m now confused if I don’t get blank stares after any of my jokes.

I thought about including Kevin but he is still getting over DOW 36000!

You know, just thinking “out loud” here or thinking “on the fly” (a dangerous recipe for me and usually how I get myself in trouble). Uuuuuhh, and I’m kind of playing devil’s advocate against myself—but 2020 is an election year—and I guess so was 2007–2008. But…. don’t politicians tend to find magical solutions to things when they start to smell “their own bacon” frying?? I mean….. I have to think this is part of Parsec’s thought process to come up with 3.5%, ‘cuz yeh know, outside of certain bodily orifices, I don’t know where the H___ else Parsec’s getting THAT number from. Some Legislative packages labeled “stimulus” that Pelosi hands Republicans on a silver platter to save Republicans so Pelosi can once again wrangle defeat out from the jaws of victory??

BTW, if I was being asked for an exact GDP number, I would foresee something like 1% by june-July 2020. And I have said before, I think anything below 1.5% GDP is when things “get hairy” for donald trump electorally. I am nothing if not consistent in my wrongness.

https://www.youtube.com/watch?v=eyU6iGjfK1c

I will wait for Bill McBride, Calculated Risk Blog, to make the call. He nailed the last one. He is not on recession watch yet.

It won’t take a recession to color people’s opinions about the economy. The expansion can go flat and it will seem like a recession to some sectors and some parts of the country. There was a localized slowdown in 2016, for example.

Whatever the GDP numbers are in 2020, I can guarantee they will be revised. What I believe will be more important are:

• New vehicle sales

• Housing starts

• Trend of unemployment

• Stock market

• Op-eds in The New York Times and The Washington Post blaming Trump for the failing economy (guaranteed this will happen about 3-4 months before the election)

It’s all about perception and perception is all about the news cycle. If people are told the economy is tanking, they will act as if it is and they will hold on to their money or act to get their money out of investments and exacerbate any problems in the economy. GDP? That a big meh. 95% of the people don’t know or care about GDP numbers.

So in that 3-4 month period , we should also have renewed calls for tax cuts which, as everyone knows, will pay for themselves AND reduce the deficit.

Maybe a middle class tax cut, one that will eliminate the estate tax and lower capital gains rates too. Milk and cookies for the true believers!

“Whatever the GDP numbers are in 2020, I can guarantee they will be revised.”

DUH! Do you always write obvious and yet completely meaningless sentences. Oh yea – you do. Never mind!

pgl, I’m glad you can recognize the obvious; now if you could contribute something meaningful instead of 5th grade comebacks….

Since you didn’t criticize the rest of my comment, I can only guess there is one of two reasons:

• you agree that perspective based on the factors I listed is more important than GDP data to 95% of consumer/investor decision makers

• you can’t comprehend why those factors would be important to anyone, but haven’t figured out a cogent response

But here, let me help you out. The factors that I listed are part of the GDP or related to it. But they are more tangible and expressive of the economic reality to most people. When people hear that vehicle and home sales (and prices) are declining rapidly, they take notice. When they hear that unemployment rates are going up significantly, that might begin to worry. And when the stock market drops 5,000 points they get nervous. But when some economist with bottle lens glasses pronounces that the GDP is down 1% instead of up 2%, most people go “meh”, because they simply don’t relate to numbers that seem that small… it’s noise… even if revised by a few tenths of a percent.

Blah, blah, blah. Are you of the “adults” in those Charlie Brown episodes?

” The factors that I listed are part of the GDP or related to it.” Just wow – do you know how many goods an economy produces? Or how many prices exist? C’mon Bruce – list them ALL. You would then missing the forest for all the trees?

Next time I see one of your pointless comments, I’ll skip it as you get all whiny when someone calls you on your babbling.

Yet another nothingburger from pgl. Always a whiny comment without saying anything.

Perhaps Home Depot will have predicted it: https://www.cnbc.com/2019/02/26/home-depot-reports-fourth-quarter-2018-earnings.html

LOL! Bruce Hall fails to read his own link. Let’s see –

“Revenue for the quarter climbed nearly 11 percent from a year earlier, to $26.49 billion from $23.88 billion. That also came in short of analysts expectations for $26.57 billion. Chief Financial Officer Carol Tome said that the weather-driven demand negatively impacted sales by 0.85 percent.”

So Home Depot was doing really well but of late the weather dampened sales a wee bit. Of course it would be too much to expect Bruce Hall to look at Home Depot’s 10-K, which just happened to show sales topping $100 billion in 2017 with an operating margin = 14.5%. The 10-Q’s reported at http://www.sec.gov showed sales growth through 2019QIII. But Bruce Hall thinks Arthur Blank is suffering somehow and a recession is around the corner because they did not hit one singles earnings expectation due to weather. Lord – someone has no clue how to do real research. Heck – he cannot even read his own links!

OK wait for it. Brucie Boy is going to WHIIIIIIIIIIINE about this comment too. Like it my fault that he has ZERO research skills!

Bruce’s link which the research impaired little boy never finished reading noted HD’s stock price. Down for the day but up for the year as his own link noted. Given the fact that Bruce can neither read nor do independent research, maybe we should provide him this chart:

https://finance.yahoo.com/quote/HD/

Look Bruce – stop embarrassing your family with this incredibly DUMB comments.

pgl, and yet you’d look to lower GDP numbers to predict a recession, eh?

Come on, we’re talking about indicators and trends and you know that, so stop responding like a 5th grader.

This goes for the Home Depot link and other indicators as well, including slowing home sales and lower sales prices. Of course lower sales and profits doesn’t mean a recession, but in consumer spending sensitive industries it can be a forewarning. You can’t be that dense. On the one hand you want to be respected as some sort of “expert” and on the other hand you simply want to say “blah, blah, blah” (and I’m quoting you on that). To me that spells expert bullshitter.

“Bruce Hall

February 26, 2019 at 6:35 pm

pgl, and yet you’d look to lower GDP numbers to predict a recession, eh?

Come on, we’re talking about indicators and trends and you know that, so stop responding like a 5th grader.

This goes for the Home Depot link and other indicators as well, including slowing home sales and lower sales prices. ”

Oh my – you have a screw loose. Look – you failed to read your own damn link. And then like a 2 year old you call me a 5th grader. You did not provide any evidence on slower home sales here but I did see your comment in another thread how LA’s residential market is not booming. Fine but the topic YOU raised here pertains to the national economy not a region.

I would suggest you one day grow up but your own mother tells me that she has tried to no avail. I would suggest you learn to do basic research but again here you prove your complete inability.

Can’t wait for your next temper tantrum!

Perfect Recession Indicator?:

“Once the unemployment rate rises 50 basis points (or 0.50 percentage point) from its low, the economy was already in or heading for a recession, going back to 1948, according to Joseph Lavorgna, chief economist for the Americas at Natixis…The unemployment rate, at 4 percent, is currently 30 basis points from its recent low.”

https://www.cnbc.com/2019/02/20/a-recession-indicator-with-a-perfect-track-record-over-70-years-is-close-to-being-triggered.html

My comment: Given the weak expansion from the severe recession, along with conducive monetary policy, we may achieve a soft-landing or a mild recession.

We need to get Americans back to work, turning them into taxpayers, and reduce entitlement spending, which can be done simultaneously, to reduce the massive federal debt, which ballooned, since 2009.

Government needs to unleash free and competitive markets, and provide pro-growth policies for another economic boom in the 2020s, like 1995-00, when we had a pragmatic and moderate Democrat President and an active GOP Congress.

When a strong expansion is underway, we can raise taxes and afford regulations to slow the economy to a sustainable rate.

“Once the unemployment rate rises 50 basis points (or 0.50 percentage point) from its low, the economy was already in or heading for a recession, going back to 1948, according to Joseph LaVorgna, chief economist for the Americas at Natixis.”

Leave it to PeakDuncehead to come up with a duh obvious indicator. The weather man forecasted it would rain on my morning run but hey we all know about forecasts from the weather man. Now when my shoes were absolutely soaked, I thought to myself – that is a good forecast.

Any more really dumb comments from the Peanut Gallery?

Er, you mean raise taxes now, when there’s been historically low unemployment? Um, gosh. What did I miss. Or more important, what did you miss? We have had a long, slow recovery from a crash caused by 30 years of unbridled financial sector overgrowth. The private sector, baby! And then the usual suspects (Paul “Fraud” Ryan) preached austerity in the teeth of the worst recession since at least the Reagan years and maybe since Hoover. Then after a member of his political tribe took power, deficits didn’t matter and Paul “Fraud” Ryan was all about tax cuts for wealthy, powerful entities who would theoretically use that money to invest and then cause the remaining taxpayers to pay more and reduce the deficit. And now, how has that worked out? We have a wingnut with amnesia who wants to do the same thing again. Think about what policies lead to recession, and then think about what policies get us out. And then think about supply and demand – does supply care who causes the demand? That isn’t ideological.

Holy cow! I’m only an outhouse economist, and I’m probably getting some things a little garbled. But there are things that a third grader should be able to figure out after reviewing a little history and un-filtered factual evidence.

Willie, obviously, you missed the weakest “recovery,” from a severe recession, in U.S. history.

Let me know when you finish “third grade.”

He will. Let us know when you finish preK!

And, why do you think we are having a weak recovery? It was a massive financial crash that was fueled by financial sector misbehavior. Like the Hoover crash. That recovery was pretty weak, too. It was aided by deficit spending and we finally pulled out of it once and for all when there was a war. Lots of government demand, which, shockingly enough, is demand that puts people to work.

Now, let’s fast forward to Paul “Fraud” Ryan in 2010. Deficits are awful and austerity will turn the economy around. Then, the orange guppy gets elected and Paul “Fraud” Ryan and the rest of the idiot right decide that Keynesian deficits are a great idea, so long as the major benefits are showered on wealthy, powerful people. And now we have a ballooning deficit caused by the very people who were happy to harm Americans for political gain less than ten years ago.

Learning how to observe and draw conclusions from actual facts was something I learned in kindergarten. Or maybe before. Peak’s mama didn’t teach him real good.

Willie, you blame it on everyone else, except government.

Government created the moral hazard for everyone to “misbehave.”

When you don’t know who’s the “idiot,” then it’s you.

Also, I may add, we did have a “long-boom” in 1982-07.

However, the subsequent weak growth isn’t fully attributed to financial excess. I’d expect slightly slower growth after the output gap closed by the end of 2011 (which, of course, didn’t).

The sudden, sharp, and sustained downshift in growth after the 2009 recession is a result of a restructured economy, including Obamacare, Dodd-Frank, small and slow net tax cuts, excessive regulations in too many industries, etc..

I’ve shown before, in the 10 year period 2008-17, employment growth was weak, along with Per Capita Real GDP growth. It wasn’t even a recovery!

“I may add, we did have a “long-boom” in 1982-07.”

So much rightwing intellectual garbage so little time. No 1990 recession? No 2001 recession? OK beyond that stupidity, let’s note WHY the output gap did not close faster after 2011. Republican led fiscal austerity. Your team Peaky. And of course your usual right wing BS about financial institutions.

PeakStupidity goes on and on with its insanity unabetted.

So, according to Peak Trader, the government is at fault. It’s the government’s fault that the financial sector decided to “innovate” by creating market friction they could profit from. Hmmm…. It’s the government’s fault that underwriters decided to stop paying attention. And then when the government responded to abuses in the financial sector that led to the crash, Peak Trader thinks it caused the slow recovery. ideology and idiot are kinda the same in Peak Trader’s case. Oh, and who was minding the store when the financial sector decided to misbehave? Why, the “small government” party. Let the fox guard the hen house. What could possibly go wrong.

Or maybe Peak Trader is actually a left wing operative sent to make “conservatives,” who are actually mindless parrots and reactionaries, look even dumber than they normally would. Who knows.

Oh, and Obamacare caused the economy to slow down, too. It wasn’t the GOP’s utter unwillingness, and Obama’s failure to push for sufficient stimulus in 2009 and 2010 that cause the slowdown. Nope. It was insufficient tax cuts (and deficit spending by the way). But mostly tax cuts. Because gosh, you should be able to profit mightily by living in the United States, but heaven forfend that you would ever consider that somebody needs to pay for it. And of course, the wealthy, who benefit the most, should be exempt because they are better than the rest of us. Did I miss anything here?

The right never fails to look even dumber when subject to logical analysis and a little bit of rational thought.

The last four years of Obama’s economy weren’t any better:

UCLA Anderson forecast – U.S. economy falls short of true recovery – June 2013

“U.S. real GDP is now 15.4 percent below the normal 3 percent trend. To get back to that 3 percent trend, we would need 4 percent growth for 15 years, 5 percent growth for eight years, or 6 percent growth for five years, not the disappointing twos and threes we have been racking up recently, which are moving us farther from trend, not closer to it. It’s not a recovery. It’s not even normal growth. It’s bad.”

Trump has reversed some of the damage. However, he inherited massive federal debt, along with a weakened military. It’ll take some time to get the economy back on track.

“The last four years of Obama’s economy weren’t any better: UCLA Anderson forecast – U.S. economy falls short of true recovery – June 2013

“U.S. real GDP is now 15.4 percent below the normal 3 percent trend..”

3% trend? Lord – you are a true moron. Did you note know we had 2.9% growth in 2015 and 2.5% growth in 2014. You end your latest fact free BS arguing Trump is doing better. Really? http://www.bea.gov shows 2017 growth at 2.2% which is less than growth was in either 2014 or 2015.

Look we know why you never cite reliable data. If you did – it would prove you are lying 24/7. Have you not embarrassed your mom enough already?

This is what I wrote last year:

If we’re near or at full employment, we wouldn’t still be creating so many jobs.

A conservative estimate is there remains substantial slack in the labor market. Over the 10 year period 2008-17, we added an average of 78,000 jobs per month.

However, we needed up to 159,000 jobs per month to keep up with population growth, subtracting retirements, and adding discouraged workers (or those expected to re-enter the workforce, if the “recovery” wasn’t so weak).

The conservative estimate, based on 100,000 jobs per month over the 10 year period, means we needed 2.6 million more jobs through 2017. So, at least, an additional 2.6 million jobs, above the 100,000 per month, is needed in 2018 and beyond to reach full employment.

The Fed estimates we need around 100,000 jobs per month at full employment.

(We added an average of 240,000 jobs per month in the last three months – late 2018 and early 2019 – and part-time jobs fell substantially)

It should be noted, much of the “financial excess” was caused by government, e.g. increased quotas of “affordable” home loans, more student loans, accumulated regulations in health care (driving-up prices), etc..

However, we also had a consumption boom, resulting in greater household debt, particularly in the 2000s (trade deficits reached $800 billion a year or 6% of GDP).

We needed a bigger and permanent middle class tax cut to allow the spending to go on. Instead, the government selfishly spent the money, along with restructuring the economy rather than promoting growth to close the output gap.

“It should be noted, much of the “financial excess” was caused by government”

The right wing spin machine is strong with this PeakyOne!

I guess you get paid by the word regardless of how utterly stupid each word really is.

I don’t think there’s a lot to be gained with unconditional forecasts. That’s mostly a fool’s game. I’d be much more interested in “what if” scenario conditional forecasts. For example, it seems reasonable to assume that the odds of a 2020 recession increase if Trump follows through with maximum tariffs against our major trading partners and if those trading partners respond in kind. Similarly, a hard landing Brexit or Italian banking collapse would make a US recession more likely. An unconditional forecast is effectively a ceteris paribus forecast, and if there’s one thing we’ve learned while living in Trump World, it’s that we don’t live in ceteris paribus land.

2Slugs,

I appreciate you thoughts. How would one modify an unconditional forecast to explicitly account for continued tariffs or a Brexit hard landing?

@ 2slugbaits

I think “what if” games can be fun, and even useful. But do you really like the pre-game football predictor who says “If the Raiders don’t fumble they will win this game” “If the Vikings get over 400 yards, the game is theirs easily” “If the Sooners #1 tailback rushes for 150 yards, the Sooners will be victorious”. Yeah, it’s a nice way to cover your ass (semi-truck drivers call it “CYA”) when you really have NO IDEA what is going to happen. But when you’re making equities wagers, wagers on rates and bonds, places to make hedges to create win/win scenarios, or even wagers on your household/family income decisions, conditional forecasts are really not worth rat droppings.

You can call making straight out predictions a “fool’s game”, some of the rest of us call it living in reality.

Moses Herzog There are two ways to look at macroeconomics. One way is to take the view that the macroeconomy is inherently unstable, explosive and always moving away from equilibrium. In this view the task of policymakers is to try hold things together without making the economy even more unstable. The best policy recommendation is to pray to your favorite economic saint and ask for his or her intervention. My sense is that this is very much of a minority and heterodox view within the profession. It might be right, but it’s not how most mainstream economists view things. The other view is that the economy moves toward an equilibrium position, but can be buffeted by exogenous shocks. There might be transient dampening cycles as the economy moves towards equilibrium, but all of the math we use to describe the macroeconomy assumes a long run steady state equilibrium. Put another way, it’s pretty hard to build a coherent equilibrium model that includes endogenous recessions. Recessions happen, but they have to come from outside the basic model. And here I’m distinguishing between a recession and a transient dampened cycle along an equilibrium path. I’m neither an academic economist nor smart enough to work through my own heterodox, nonlinear and nonstationary macroeconomic model, so I rely upon mainstream approaches. So with all that, I don’t know how you can predict when a recession is supposed to happen within an endogenous macroeconomic model that assumes the economy is always moving towards equilibrium. In other words, the unconditional forecast is always some incremental movement towards the steady state growth rate. When you predict a recession, you are really trying to predict the conditional impact of some exogenous shock.

Your sports analogy isn’t really quite right. For one thing, sports is about game theory in which humans act and react strategically. Of course, economics has been trying to incorporate game theory, but even there most of the successful applications have been in microeconomics and less so in macroeconomics. And the motivation for incorporating game theory is to better describe an economy’s path towards equilibrium. At the end of the day we still assume some kind of stationary path and strong deviations away from that path are assumed to be exogenous events such as wars, natural disasters, and “animal spirits” (i.e., the economist’s catch-all term for “who knows???”).

“Recessions, once they are underway, happen fast — a lot faster than expansions.” -MC

True. Can anyone recommend a recent paper that explains that asymmetry between expansion and contraction rates?

Erik Poole: I think it’s implicit in any regime switching model a la James Hamilton where the autoregressive parameters and constant differ between the regimes. James Stock wrote papers on time deformation in the mid 1990’s (in JBES, JPE).

Erik Poole, a paper isn’t needed to understand a fire in a crowded theater will cause people to exit faster than they entered.

I asked for more dumb comments from the Peanut Gallery and peanut brain delivers!

Go easy on him. He’ just recently learned that Sonny Bono died twenty one years ago. News does not travel fast in Peakworld.

Noneconomist, your fake news are as predictable as Pgl’s dumb comments.

PeakDunceHead just called this fake news:

https://www.history.com/this-day-in-history/sonny-bono-killed-in-skiing-accident

FYI Peaky – he died in 1998 from a skiing accident. Of course your brain died 25 years ago so you likely missed this.

Just because Peak didn’t know Sonny’s term as mayor of Palm Springs ended in 1992, doesn’t mean Peak doesn’t know everything worth knowing about California. Just ask him.

@ pgl

It’s humorous, because I thought that comment to be one of PeakIgnorance’s more intelligent comments on this blog. It’s very fascinating to me. And it’s interesting that different minds will take in different statements and information in very different ways.

I have thought for many years, that some of our greatest minds in this world are of the Jewish persuasion. And I know this is apt to get filtered by Menzie, but on the proviso he doesn’t think the comment will get him into trouble, I hope Menzie will make the exception here. I think there’s not much denying that some of our greatest minds are Jewish, if you look at the fact they account for (roughly) 0.2% of the world population in total, and yet have a “disproportionate” share (in relation to their % of the world population) of Nobel Prize winners, and also, if people look at the list of names involved in the Manhattan Project in Los Alamos, you might see certain common threads. I just don’t see how you can argue it when you look at those two points of reference of a group only composing 0.2% (roughly) of world population. In my book that’s a “slam dunk”. Be that as it may…. Richard Feynman is one of those fine individuals, and this is what he had to say on the topic of how different people perceive and disentangle information in their head/mind:

https://youtu.be/P1ww1IXRfTA?t=3403

It’s something to be greatly admired, not to get “worked up” or “angry” about.

The CNBC link was not that bad but then PeakDishonesty had to treat us to a Trump rally with this BS:

“We need to get Americans back to work, turning them into taxpayers, and reduce entitlement spending, which can be done simultaneously, to reduce the massive federal debt, which ballooned, since 2009.

Government needs to unleash free and competitive markets, and provide pro-growth policies for another economic boom in the 2020s, like 1995-00, when we had a pragmatic and moderate Democrat President and an active GOP Congress.

When a strong expansion is underway, we can raise taxes and afford regulations to slow the economy to a sustainable rate.”

Arrrghh! I repeated this intellectual garbage. Now I need to take a shower to wash the stinch off.

Which I guess means that if Nancy Pelosi were Jewish rather than Italian you might stop makking ridiculous comments alleging that she is stupid, when she is about the smartest and most capable person in the Congress. Heck, she is probably smarter than both Dianne Fienstein and Barbara Boxer, both of whom are Jewish, and also very smart, if not a smart as Pelosi.

Moses, My daughter thinks that marriage between the folks of Chinese and Jewish cultures should be prohibited. They will bring up a super race to rule us all.

One of her long time friends, an American of Chinese ancestry married a fellow from the Jewish culture.

Her girl friends from high school through college were of Korean, Chinese, Japanese and Jewish cultures.

@dilbert dogbert

I know your daughter was joking, (as you are well aware as well), and I appreciate this style of humor very much. And what makes it humorous?? Because in all good humor there is that strain or large thread of truth in that. And I think there are people such as your daughter, you, and me , who can chuckle at this joke and greatly admire that “stereotype”, and others who get upset about it.

There is, how to say, some intra-discussion amongst Jewish culture, and this has kind of become a “phenomena”, where Jewish males are marrying Asian girls. I’m not Jewish myself but am kind of a “judeo-phile” for lack of a better term. And I am also sensitive to this topic because of my extended time in China and some experiences I had there (better thought of when there’s a large bottle of bourbon handy). I think there is actually a mixture (no pun intended) of reasons for this. The main one being it’s exceedingly more difficult for males outside of the Jewish culture to convert to Judaism than it is females (although certainly it is not “cheesecake” for females to convert either). So, it makes that process much easier.

I think the other big reason is, both cultures are very literate and both cultures tend to be more obsessed with educational attainment—which makes for a natural “cohesiveness” between the cultures. This is coming from a person (me) that has neither Asian or Jewish blood, it’s just my subjective observations.

There are other things which make it natural young people could feel connection and relate to each other, such as both cultures can sometimes have “domineering” parents, the Asian “tiger mom”, the “overbearing” Jewish mother sometimes using “guilt trips” in a weaponized way. Things better saved for a sociology blog probably before I get this comment filtered here.

If your index goes from 100 to 50 that is a 50% drop.

But if it goes from 50 to 100 that is a 100% rise.

The best forecasting rule of thump for a recovery is that the time to go from the bottom to the previous peak is the same

as the time from the previous peak to the bottom.

So you can easily see why recoveries have higher growth rates even though the scale of the rebound == down 50 and up 50 — is the same as the decline.

Erik Poole: You will look in vain for any paper whatsoever that explains this asymmetry as this asymmetry does not exist. The economy merely slides into recession. And then if anything, rockets out into expansion for reasons that ought to be obvious.

Take the 1st quarter of recession as underway and the second quarter of recession as then happens fast. Similarly take the 1st quarter of recovery as expansion and the second as more expansion. Starting with the 1970 recession thru the last, the average % ch in real GDP in the initial underway quarter of recession was -2.3%. Growth the next recessionary quarter averaged 1.2%. No abyss here. Then first quarter of expansion averaged 5.1%. Ditto for the next quarter of expansion.

“The economy merely slides into recession. And then if anything, rockets out into expansion for reasons that ought to be obvious.”

So you are saying our host lied? You have no clue what you are babbling about as usual.

You might want to redo your fake stats by noting how long it takes to get back to full employment. Krugman uses the term PLOG – check it out. Prolonged Large Output Gap. Or do you think you know more than Dr. Krugman? Snicker!

Dead wrong, JBH. The data and the literature overwhelmingly support asymmetry of business cycles. There are lots of papers by top economists in leading journals supporting this conclusion.

Jim Morley has a good paper in 2012 in Review of Economics and Statistics on the asymmetry of business cycles. Also, Daron Acemoglu has fairly recently writeen about it. The data certainly fits it, and although some here questioned it, it seems to be the pattern for most business cycles pretty clearly.

Barkley Rosser: Yes, this paper is what I was mentioning to my macro students. The Morley-Piger is the latest comprehensive approach to modeling the various types of nonlinearities.

Brad DeLong is being mean to Lawrence Kudlow for reminding us of what Kudlow wrote back in early April 2008:

https://www.cnbc.com/id/23995123

“The Therapeutic Power of Recessions

Recessions are part of capitalism. They happen every so often. We’ve had two in the last super-prosperous 25 years. And it looks like we’re entering a third one after Friday’s jobs-loss report.”

At least he was not a recession denier – his buddy Luskin certainly continued to deny the recession. But wait!

“Lest we get too gloomy, there were some positive spots in the employment report. For example, the median duration of unemployment actually fell to a fifteen-month low of 8.1 weeks in March, the lowest level since December 2006. This indicates that about half of the unemployed are finding jobs in about two months. (Hat tip to Prof. Mark Perry of the Carpe Diem blogsite.) Additionally, aggregate hours worked in March actually rose, as did the private and manufacturing work weeks. So while there is an economic correction at work, it could prove relatively mild. Let’s remember, the U.S. has experienced ten recessions since 1947, averaging ten months in length. But in the more recent high-tech quarter century, in which tax rates and inflation have been historically low, the two recessions of 1990-91 and 2000-01 lasted only eight months.”

Ah yes – the recession that occurred a decade ago was going to be a mild one. Right Larry! Kudlow omits that the Bush41 recession and the one that started as of March 2001 (not 2000 LARRY) left employment weak for years. There’s more!

“And let’s also remember that recessions are therapeutic. They’re even necessary to create the foundations for the next recovery. Economic excesses always occur in free-market capitalist economies, and from time to time they must be cleansed. Just think about the excessive risk-speculation, leverage, and housing prices of the current episode. If anything, recessions make for clean starts.”

If we have a 2020 recession I’ll bet the ranch is that he will write this rubbish again. But we are not done!

“And think of this: Despite housing woes, credit problems, and the sub-prime virus, banks are still lending to businesses. In other words, we don’t have a genuine, across-the-board credit crunch. This is very good news, and more evidence that an economic contraction will not be drawn out.”

We did not have a credit crunch? Lord – the man is an idiot!

pgl,

Kudolw indeed is notoroius for his awful forecasting record. The list of his serious blunders is long, much longer than Kevin Hassstt’s which is pretty bad. But there was a reason why many applauded when Hassett was appointed to CEA Chair, looking downright reasonable compared to the likes of Kudlow, not to mention such lunatics as Peter Navarro, who, unlike Kudlow, actually has some serious economics credentials fromhis past (Harvard PhD in econ), which he has managed to dishonor with his more recent ravings.

However, I must note that on at least one matter Kudlow actually looks more honest that a bunch of professional economists, with Paul Krugman of all people pointing this out. This has to do with the group that back in 2011 (or was it 2010?) that forecast that the US would have a hyperinflation as a result of Obama’s fiscal policies. Many promient economists signed this statement. Needless to say, they were all wrong, but, as Krugman has noted, basically none of them has ever really admitted to having been so, with most of them simply saying nothing about it or continuing to maintain that maybe we might still have one. Of all those who were in on that, the only one who actuallly did publicly admit that he was wrong was Kudlow. The irony, and Krugman noted this, is that it may have been easier for him precisrly because hs is not actually a professional economist, even though he has as it were played one on ?TV for a long time. So it was less of a big deal for him professionally to admit and move on.

Off-topic

I just thought this was worth sharing. There’s at least 2 videos here one could label as “shocking” depending on what angle or aspect you are looking at them.

https://www.youtube.com/watch?v=nYRWUXtiLy0

1) Lindsey Graham getting more applause in Europe than a man currently inhabiting the title of US “president”

2) An entire room applauding the leader of Germany loudly while braindead Ivanka sits there tone-deaf after taking inauguration kickbacks for her bastard father’s D.C. hotel.

3) Word that Dan Coats (a very capable and intelligent man) will soon be fired by Orange Excrement.

https://www.politico.com/story/2019/02/20/trump-firing-coats-intelligence-1176457

Federal budget deficits-to-GDP ratios are projected to be will above their average for the past 40 years. https://www.cbo.gov/publication/54918

Thus there is fuel for the continued expansion and if the Trump trade wars end this year, we should avoid a recession. The Black Swan is nowhere in sight.

I have a theory that the consensus can not forecast a recession.

Recession occur when the business community makes a mistake and overestimates growth and end up with large unwanted inventories.

Since for the most part the business community uses the consensus for planning purposes, to actually forecast a recession the

consensus has to forecast that the consensus is wrong — over optimistic.

But this never happens so the consensus never forecast a recession.

Now, if I can just come up with a reason why the consensus always forecast a weak recovery.

The best answer I have is that no one believes anyone who forecast a strong or normal recovery.

https://youtu.be/1B3PGe-PRWo?t=768

https://www.youtube.com/watch?v=1p-tuKqPnSI

https://newrepublic.com/article/143586/trumps-russian-laundromat-trump-tower-luxury-high-rises-dirty-money-international-crime-syndicate

https://www.propublica.org/article/trump-inc-new-evidence-emerges-of-possible-wrongdoing-by-trump-inaugural-committee

https://www.buzzfeednews.com/article/jasonleopold/trump-russia-cohen-moscow-tower-mueller-investigation

https://www.nytimes.com/2019/02/19/us/politics/trump-investigations.html

https://www.politico.com/story/2019/02/22/trump-north-korea-nuclear-summit-hanoi-strategy-1179753

#MAGA !!!!!!!!

Uh-oh, pgl’s BFF is stirring up trouble again:

Just as many former Clinton supporters and staffers continue to hold a grudge against the Vermont senator, many Sanders supporters still nurse grievances about the way the senator and his campaign were treated by the Clinton campaign and the party establishment, including the Democratic National Committee.

Michael Briggs, Sanders’ 2016 campaign spokesman who often traveled with Sanders on the private flights, said Clinton and her staff were “total ingrates” in light of the efforts the Vermont senator put in to try to help elect her in the general election.

“You can see why she’s one of the most disliked politicians in America. She’s not nice. Her people are not nice,” he said. “[Sanders] busted his tail to fly all over the country to talk about why it made sense to elect Hillary Clinton and the thanks that [we] get is this kind of petty stupid sniping a couple years after the fact.”

“It doesn’t make me feel good to feel this way but they’re some of the biggest a**holes [edited MDC] in American politics,” he added.

Private jet travel on the campaign trail is not uncommon — either for candidates like Clinton or a top surrogate tasked with stumping for them. Often it is the most efficient mode of transportation, particularly when events are in locations where commercial air travel options are limited.

One veteran Democratic operative who oversaw surrogates for past presidential campaigns said providing private planes is standard practice for the most important surrogate of a presidential campaign in the general election.

https://www.politico.com/story/2019/02/25/bernie-sanders-hillary-clinton-private-jet-flights-1182793

Pooooooooor Candidate Hillary…….. Pooooooooor candidate Hillary……

https://www.youtube.com/watch?v=TW8Vq6xM-fw

One might get the impression Hillary thinks jet travel on her dime is more important than 4 dead Americans. Eh, what difference does it make?? Two plus years later, and she has all her bitter little minions out there, pinching their nose up like bitter old widows in the church pews that saw a young girl wearing a skirt to Sunday service, and Hillary is “not having it!!!”

These two has beens are still fighting over 2016? Time to move on.

I read stuff like this and it reminds me of traveling in the car with children: Child one: Daddy!!!! He touched me!!! Make him stop!! Child two: I did not touch her!!! She touched me first!!!

Politics at the highest levels is a blood sport. If your fee fees get hurt easy stay out. Christ On A Crutch!!!

The rethuglican party nailed their political thesis to the doors of the White House decades ago.

Moses,

“4 dead Americans”???

Hillary was a bad candidate and has long been a moneygrubber, but are you buying old Fox News hysteria about Benghazi? I note, the GOP had 8 different committees spend millions of dollars investigating that. in the end they got nothing on Hillary. of course the hard fact they kept running up against was that it was the GOP in Congress who cut the budget for State Dept security that led to Marines being removed from the Benghazi compouns, which which was a low priority facility, not being either an embassy or a consulate, although when he spent the night there unfortunately, Amb. Stevens was campaigning to upgrade it to a consulate. But maybe this is another of your anti-woman schticks. like how Warren is horrible for her Native goofs and Pelosi is a senile incompetent, now Hilary is really guilty over the four dead Americans in Benghazi even after the GOP has given up on it and shut the eff up about it. They are into her emails still, not Benghzi anymore.

I will have predicted it. Am on record. All the way back in October. Recession starting in 2019, not 2020. Current metrics place the central tendency date this November, with 95% confidence interval August to next February.

JBH: I am curious. What’s the model?

@ Menzie

May I lay down one of my “brilliant” Cliff Clavin style predictions for you?? You’re never going to see an answer to that question.

Menzie: My workhorse model has recession beginning within 9 months at 51% probability. As new data come out that probability will change. I explained the workings of this model to you before. My above comment refers to a completely different model. My workhorse model uses magnitude. This second model uses time – months from the peak of a leading indicator to initial month of recession. Based on past history going three recessions back. Given that an indicator has already peaked this cycle, it’s straightforward to take the month of that peak and add the historic average months-to-recession to get a prediction of the initial month of this coming recession for that indicator. Then sum across all indicators. Besides conceptualizing the model this way, the art comes in selecting quality indicators that fulfill obvious criteria. One of these indicators is the private sector credit impulse. Unfortunately credit data lag severely. Hence I must at this early stage make an assumption for the rare couple of indicators like credit that have not yet shown their hand. My assumption for the credit impulse is that it did indeed peak in Q3. If it turns out that it did not peak in Q3, the entire constellation of the model including central tendency month and the confidence interval that surrounds it gets pushed incrementally into the future by a fraction of a month. Some indicators peaked far back and are so far down that their pattern this cycle peak is already etched in granite. Yield curve inversion is a slippery one. I use the 2-10 in the second model. It has yet to invert though as of today it is within 16 bp. My working assumption is it will in March. This is already built into my initial comment. If the 2-10 does not invert in March, the slippage will push the constellation incrementally. But the main constellation with far more indicators than just the yield curve is firmly enough in place that its current confidence interval extending out ‘til February next year ought to comfortably enough contain any incremental pushes. Most of what is about to happen is already writ in granite. The two diciest are unemployment claims and the stock market. If the market does go to a new monthly high and claims do fall to a new monthly low this will cause a bigger reset. This should answer your question and give you the flavor of what I meant by metric in my initial comment.

JBH Didn’t you also predict 60,000 sealed indictments would be revealed in Feb 2019? I guess you still have a few days, so maybe I’m jumping the gun.

I second Menzie’s request. Let’s see the model and all of the gory math and econometrics. I’m especially interested in your understanding of a 95% confidence interval.

Wrong. I believe the number was 182,413 to be more precise. And that’s just for starters.

@ 2slugbaits

You remember in high school math the first time you saw a Venn diagram?? You know, a relatively simple concept but something fascinating about seeing 3 categories laid out on top of each other, and maybe when you have 3 categories fitting one individual that overlapping area is often quite small.

I keep wondering what does the Venn diagram look like of people who watch this stuff like I will put in the link just below and people who regularly visit Menzie’s blog?? I like to think of myself as just slightly above average intelligence compared to the general population—and I have to confess, that one has left me completely baffled, if not for months, then for years.

https://www.youtube.com/watch?v=UkX_Uc_DPPA

This is a Q-Anon thing?? But how do these nutjobs wander upon Menzie’s blog?? I dare not think of it too long or my head will explode.

Do we know there are less than 60,000 sealed indictments? Mueller of late has had one of those shit eating grins on his face!

JBH’s source, Lady Grazilla, , a psychic who also studied economics at Trump University, has pegged the number of indictments at 191, 506. Or more. Or less. Or maybe the same. Sometime in the future. Maybe the near future. Or maybe not.

It was the best of times. It was the worst of times…..

“Erik Poole, a paper isn’t needed to understand a fire in a crowded theater will cause people to exit faster than they entered.”

@Peaktrade: That is a poor analogy as people rarely return to theater that has experienced a fire.

—————————————————

“You will look in vain for any paper whatsoever that explains this asymmetry as this asymmetry does not exist. The economy merely slides into recession. And then if anything, rockets out into expansion for reasons that ought to be obvious.”

@JBH: De Long and Summers in a 1984 working paper argue that the asymmetry does not exist for GNP or industrial production but does exist for unemployment.

Menzie Now I have a question for you. Why have you not posted 3 perhaps 4 or more of my recent comments stretching all the way back to September? You allow the many lightweights that populate this site to say virtually anything. Ad hominem attacks on the president and attacks on other commenters here who are not on the Regressive side of the aisle are off the charts relative to what they were years ago. Yet the crude and indeed scatological language and outright nastiness that is the stock in trade of many of the new crop of Nancy boys who comment here is far beyond anything that I said in comments back to one or two of them, including to 2slugs with whom I go back many years.

The 2 year to 10 year yield curve is not inverted right now, but the 1 year to 7 year one is.

“Nancy boys”??? Does this mean that you are joining Moses Herzog in denouncing Nancy Pelosi for allegedly being a senile incompetent?

JBH: Because the comments were either hateful and irrelevant, or obscene. But I will reproduce for your benefit so everybody can see the two (2) items that were relegated to Trash:

“[name deleted]: Rubbish! Purblind Alinsky rubbish from a liberal ignoramus whose right eye is so glued shut that no known solvent on earth will ever open it. You possess the quintessential trait of a liberal — small l liberal — you are bossy. Manifest by shoving your one-dimensional Flatlander view down the throat of anyone who shows even a modicum of creativity in expressing anything in the sphere of economics and the sphere beyond in a way that threatens you. Fear-driven Alinsky rubbish.”

and

“What a circle j*** of a joke this once decent site has turned into, Menzie! Gresham’s law at work.”

I reserve the right to delete any comment that equates anybody to Stalin, Hitler or Alinsky, and/or makes reference to obscene behavior.

Oh, and 2 < 3 or 4…

Thanks for letting us know that comparing anybody here to Saul Alinsky is out. Yes, he was certainly responsible for many more people dying than either Stalin or Hitler, :-).

Barkley Rosser: The prohibition on Alinsky references is because it’s such an intellectually lazy (and usually incorrect) comparison that I feel it has no place in respectable dialog…you are right on death counts. I’m adding to the prohibition Mao.

I wanna say for the record (like it matters what I think, it just makes me feel better saying it), my thoughts on “SDA” (can I say “SDA” like we now say “AOC”??).

The base reason for filtering “SDA’s” name should not be that he was a bad person or had bad ideas, but that the reference is innumerably misused.

Ironically (or not??) the same could be said about “AOC” now.

I wanted to make a personal remark here directly at another commenter, (Not the blog host, to be clear) but I will make it indirectly. Anyone who thinks “SDA” did more damage than good, really, if you are over 60 and lived through “SDA’s” time and think that—rather than teaching a university class you should probably enroll yourself into some programs at Marbridge.org PLEASE, the sooner the better. Treatment is available.

JBH, the site’s prime conspiracy theorist,–whose guru on all subjects American is apparently a Pakistani physicist– is hurt by his lack of recognition by the site’s host ? And by host’s adamant refusal to allow him to call out the varied liberals/socialists/communists/fascists/whigs/greenbackers and other known no-gooders who frequent said site.

Awww!

This sad state of affairs though JBH has insisted that he’s kind of certain–ok, don’t hold him to any time table– that 213, 876 sealed indictments will shake our the political foundations. Indictments that will shock–shock, he says!–the citizenry beyond belief.

Worse, the site’s host gives free rein to the nefarious Nancy boys (uncertain who they are, but–given his mysterious ties to the unknown–I’m going with followers of Nancy Drew) who must resort to scatology to refute his irrefutable brilliance.

Not to worry. He’ll have the last laugh when those 222, 639 indictments are delivered–maybe soon, maybe not– and the guilty are removed from the Congress by presidential decree. Only then, will we once again be able to cleanse America of those who want to destroy it.

And once again, it was the best of times, it was the worst of times….

And back to fearless predictions. I watch building permit applications among other things to track the economy. My income was tied to construction for decades, which meant doing fairly well in a good economy and then going down the tubes when the economy fell off again. I don’t have a mathematical model, just observations. I don’t expect a recession in 2019, barring some kind of craziness like a big, shiny, new trade war. What I do expect is a slowing in the overall growth rate. We may have isolated areas that are not growing, just as happened in 2016. I expect a slowdown in demand for automobiles, which will make some parts of the country fall into localized recessions. I also expect construction to slow. It won’t stop for another year. Once the train is in motion, it takes a while to stop. As the cranes come down, there won’t be as many replacing them. Recent college graduates are so heavily burdened with student loan debt that the housing industry isn’t going to have the kind of demand necessary to get back to historic levels of production. It hasn’t since the crash, and I don’t think it will for quite a bit longer. The apartment construction boom around here isn’t slowing, but it will because there are vacant apartments and rents are finally falling.

So fearless prediction – no recession in 2019. Slowing toward the end of the year. Some parts of the country may fall into localized recessions. We may have a recession in 2020, but it will be mild by comparison to 2009. The business cycle hasn’t been repealed, and tax cuts for corporations won’t result in any kind of long-term stimulus that can stave off a recession in 2020 if we get one. The real irony, to me, is the timing of the GOP tax cuts. They cranked up stimulus when it wasn’t all that urgent, which means there will be nothing but more borrowing and spending for Keynesian purposes when the economy does falter again. And it will sooner or later.

Menzie: (1) Nearly always my comments are uniformly on track with the post. This has been the case for years.

(2) The complexion of comments on this site has changed since the election of Donald Trump. Often comments now go off subject immediately. Obviously there is a certain serendipity in such. But what rankles is the frequency with which commenters here put down our president with deprecating remarks like Orange Orangutan and the like. This is straight out of Alinsky’s playbook, and you know it. I thus finally addressed this issue with the two comments you trashed. You also trashed a comment to one of Frankel’s pieces last Fall.

(3) My on-track comments are meant to either add to the discussion additional grounded-in-the-data insight that I possess, or point out what I perceive to be noteworthy flaws. My comments do not stoop to ad hominem and sarcastic putdown. Ad hominem being a logical fallacy and sarcasm being the lowest form of humor in the English language.

(4) Take my first comment on this thread on Feb 25 10:31. Your leadoff sentence struck me as: Well this is not how I see it. So I’ll take the time and go to the data and see if I’ve missed something all these years. That search confirmed what I thought I knew and so I composed and posted my comment to inform others that the economy does indeed slide into recession rather than fall off a cliff. I had no intention of putting you down. My intention was to set the record straight. Yet immediately I was accused of calling you a liar. This is what I mean by Alinsky tactics.

(4) My next comment was on Feb 26 at 8:20 AM. It was directly to the point of your post in that I know of no other professional forecaster calling for recession this calendar year. But it so happens that I am. With the usual caveat that one can hardly know the exact initial month of recession at such an early date, and that the data show the likelihood also flows over into the early months of 2020.

(5) When you followed up with what I thought was an excellent question, I took some time and composed a condensed version of a matrix I’d recently created to come to the forecast I’d laid out. On target, no innuendo, informative to anyone interested in getting a better handle on the peak of the business cycle, and specifically on what is currently coming. The work of Zarnowitz, Geoffery Moore, and other business cycle greats packed into my own model which extends their work.

(6) Were there any thoughtful responses? Nary a one other than your question. But others sure are curious about Qanon. Backhandedly call me out for not knowing what a confidence interval is. Call me a nutjob. And take a double dig by bringing in Trump University. You have not banned Alinsky if you permit this kind of scurrilousness.

(7) And then we see wildly bloated numbers tossed about for the well-documented growing number of sealed cases in federal courts, accompanied by the standard mainstream putdown of conspiracy theorist. Along with denigration, by someone who surely hasn’t cracked its cover, of Kamran’s brilliant book so well documented that it would take months to work through all the source material.

(8) Good honest journeyman economics from which everyone including lurkers can learn has been displaced by all too much opinion puffery. I’ll leave it at this.

JBH: OK. Thanks (not) for bringing my attention to the term “circle j***”. I was blithely ignorant until you introduced it to this blog.

JBH Alinsky’s greatest admirer was probably Newt Gingrich. Alinsky was literally required reading for young up-and-coming GOP candidates who went through Gingrich’s GOPAC training curriculum. So I always found it amusing when folks on the wingnut right trash talk Alinsky. I guess imitation is the greatest form of flattery.

Your “model” looks like nothing more than hand waving. No one made substantive comments because you didn’t offer a substantive and replicable description. Just some fuzzy talk about finding various averages of peak-to-trough times, blah, blah, blah. Did you spell out which indicators you look at? No. Did you tell us how many years of history you use? No. Did you tell us how to weight those indicators? No. You didn’t even identify what the dependent variable is supposed to be in your “model”?

As to those “wildly bloated” numbers of unsealed indictments, apparently you don’t understand sarcasm and mockery. This is truly QAnon craziness. Some versions have it at 4,000 sealed indictments. Other versions have it at 40,000 sealed indictments just from the Utah AG alone. I can only conclude that your willingness to believe this kind of crackpot nonsense comes from the same kind of psychological need to believe that you’re in touch with some secret knowledge…a QAnon version of the Masons. Here’s a reality check. You’re not in touch with secret powers. You’re just gullible.

Well documented growing number of sealed cases in federal court. And you know this how? “How much” is the number growing? Do YOU know? How do you know?

Are you an economist, a federal prosecutor, a shoe salesman? What is your actual expertise in predicting recessions AND the coming upheaval in American civilization?

Personally, I look forward to the 40,000, 60,000, 80,000, indictments whatever, that you once said are sure to arrive “soon”. That is, until YOU reversed yourself and waffled and then waffled some more.

But, yes, do lecture more on puffery. But please. Look in the mirror when doing so.

jbh, based on YOUR quotes noted by menzie above, you no longer have any credibility when creating a long list of “gripes” against this blog. you cannot conduct the same acts that you condemn. that behavior is rick strykeresque-he can lie but condemns anybody else doing the same.