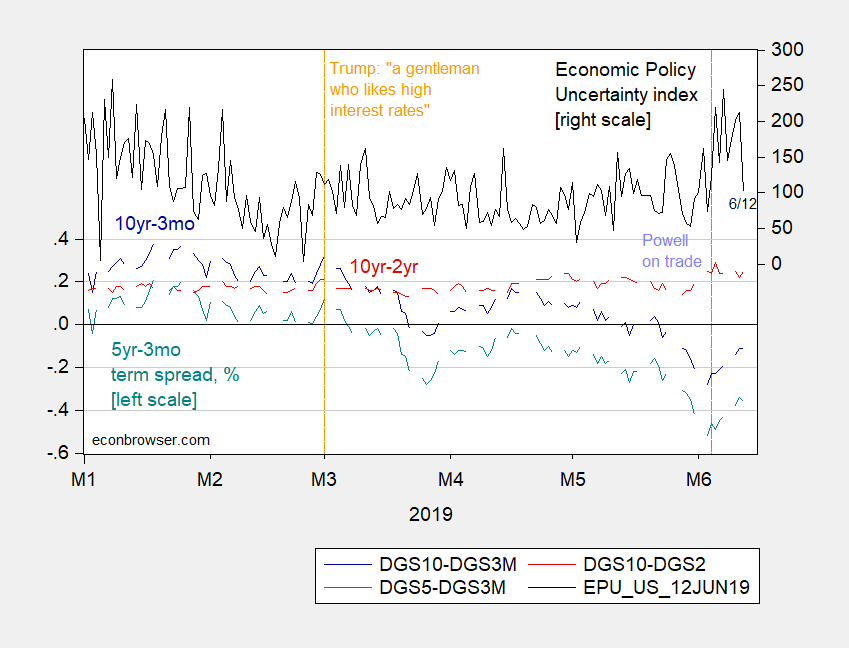

5yr-3mo spread continuously inverted since March 7th; let’s hope Cam Harvey‘s estimated probits are wrong this time around…(although I doubt they are).

Figure 1: Treasury 10yr-3mo spread (blue, left scale), 10yr-2yr (red, left scale), 5yr-3mo (teal, left scale), in % and Economic Policy Uncertainty index (black, right scale). Source: Fed via FRED, US Treasury, and policyuncertainty.com, accessed 6/12/2019.

On the other hand, economic policy uncertainty has dropped back into normal levels (for the Trump administration). How does policy uncertainty matter? Here’s what CEO’s say.

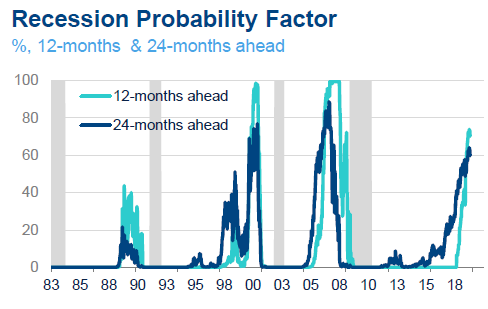

Interesting picture from BBVA today.

If I read it right, in technical terms, we are toast.

Great stuff (knowledge wise). Thanks for the links.

Honestly, and I may be incriminating myself on the shallowness of my own knowledge (which I feel is better than “the man on the street” knowledge base, but would have me humbled and shamed compared to a La Follette or UCSD grad student), but I find the BBVA link more interesting, especially as it covers two topics (shadow banking and business debt) that I feel are crucially important, but not so much discussed on this blog (directly anyway). As far as commercial debt, I guess Menzie and Jim feel like it’s a game of whack-a-mole and there’s only so much you can get around to. And “shadow banking”—well there’s a reason they call it “shadow banking” isn’t there, and economists rightly probably don’t want to “play around with” or model numbers they’re not too certain the reliability of.

I wish I could add a link here or add something constructive but nothing’s coming to me at the moment, other than a subjective non-economics view that I hope all this happens in donald trump’s watch, ‘cuz no one should be stuck cleaning trump’s mess like President Obama was stuck with Hank Paulson’s and the TBTF bankers’ mess.

I believe I was discussing a healthy degree of cynicism as it relates to organized religion with some blogger recently. Maybe born out of things such as this:

https://ftalphaville.ft.com/2019/06/11/1560249168000/The-Rick-Santorum-backed-coin-for-Catholics/

https://talkingpointsmemo.com/muckraker/cathio-santorum-schlapp-alleged-fraud

Say it ain’t so Joe (soon to be retitled “Say It ain’t so Rick”)

https://www.youtube.com/watch?v=1PH5HNiZduY

When you ask evangelicals or Catholics how they can cast their lot in with an immoral alley cat like donald trump they say “because he’s fighting for the unborn child”, “because he’s going to install conservative judges”. What does the scam of bitcoin have to do with “saving the unborn child”?? Why would Rick Santorum do business with a man who forges clients’ signatures?? Why would Rick Santorum do business with a man whose co-directors in a company were accused of fraud by the FBI and was removed from the company?? What is the REAL reason guys like Rick Santorum like donald trump?? I believe Brother Rick has “shown us the light”. “Preach on” how to screw over American white trash Reverend Rick. Show us “the path to redemption” Reverend Rick.

What will be the “happy ending” for Cathio coin?? Shall we “clairvoyantly” write the headlines now and save “TPM” the trouble of piggybacking Financial Times stories 3–5 years from now?? Wait, I’m getting a vision now…….. “Cathio Investors Left Holding the Bag, Santorum Claims He Doesn’t Know Where Cathio Funds Went”

Menzie,

I don’t have an economics background, so please correct me if I’m not understanding this right. On your previous article on Cam Harvey, you had this:

Pr(recession=1) = –0.023 – 0.90x(gs5-tb3ms)

How does that result in a probability >0.4 when gs5-tb3ms is almost zero?

RB: Those are the coefficients in a probit regression. Put in the RHS variable value, you’ll get a number, the predicted z score.Then consult a table of the (Gaussian) Normal distribution, and find the corresponding number. This will give you the probability.

Menzie,

Thanks – I was able to replicate your result.

On the matter of various indicators turning downwards, let me warn against overinterpreting one that Menzie has not made much of, the unexpectedly low growth of jobs in May. We shall have to wait and see, but as many of us noted that a part of the surprising high first quarter GDP growth was an unexpected surge of inventories, many of us noted this would probably be followed by a decline in inventories in second quarter, which would drag down GDP growth, with this possibly a factor in the slow job growth in May.

The warning is that while we may end up with a slow growth second quarter, to the extent that ends up being partly due to a decline in inventories, that factor will probably disappear in following quarters ans presumably that decline will reverse towards zero, or an increase, or at least a smaller decline. Inventories will not further contribute to a declining GDP growth rate, although there is plenty out there suggesting declining growth rate coming from various fronts.

Professor Rosser,

Have you formulated a model to forecast PAYEMS or MANEMP using the change in inventories as one of the independent variables? If so, would you share the model?

Thanks.

Sorry, but no, AS. However, inventory changes are a widely looked at leading indicator. A major change occurred in the 1980s-90s in that prior to then we regularly had noticeable macro fluctuations tied to inventory fluctuations or cycles, with this reflecting an old theory of the Kitchin cycle, 2-3 years long supposedly, driven indeed by inventory cycles. But in the 80s and 90s computerized inventory management systems originated in Japan spread throughout most of the high income nations, and since then these shorter term macro fluctuations driven by inventory cycles seem to have pretty much disappeared.

It is rarely commented on, but I would suggest that this is a factor in why 1991-2001 was the longest period we saw without a recession until the current period. We just are not seeing those inventory fluctuations be large enough to put the whole economy into and out of small recessions. Got to wait for ones driven by financial crashed like the dot.com bubble in 2000-01 and the housing bubble in 2006-08.

AS:

Inventory investment creates jobs. But only a trivial number relative to demand in the rest of the economy. Since 2011, inventory investment averaged 4 tenths of a % of real GDP. Assume jobs are roughly uniform across GDP. This percentage converts into only a couple thousand new workers per quarter. Which is not even on the radar screen monthly. Inventory investment is too small (and too choppy) a variable to explain changes in payroll employment. Especially in a tight labor market, employers won’t fire hard-to-find skilled workers because of a modest buildup in inventories. Equilibrium inventory investment is around $70 billion. At $126 billion last quarter (6.6 tenths of a percent of GDP), inventory investment is indeed above equilibrium. But few workers will be let go for reasons stated here.