Currency manipulation or not? The Treasury’s semiannual foreign exchange report, released yesterday, says no, contra Mr. Trump’s statement a few months ago.

Treasury has been engaging closely with China over developments in the Chinese renminbi (RMB). China has a long history of facilitating an undervalued currency through protracted, one-sided intervention in the foreign exchange market and other tools. Over the summer, China took concrete steps to devalue the RMB. Subsequently, Treasury determined under Section 3004 of the Omnibus Trade and Competitiveness Act of 1988 that China was a currency manipulator, given that the purpose of China’s devaluation was to gain unfair competitive advantage in international trade.

Intensive trade and currency negotiations between the United States and China over the last few months resulted in a Phase One agreement that requires structural reforms and other changes to China’s economic and trade regime in several key areas, including currency and foreign exchange issues. In this agreement, China has made enforceable commitments to refrain from competitive devaluation and not target its exchange rate for competitive purposes. China has also agreed to publish relevant information related to exchange rates and external balances. Meanwhile, after depreciating as far as 7.18 RMB per U.S. dollar in early September, the RMB subsequently appreciated in October and is currently trading at about 6.93 RMB per dollar.

In this context, Treasury has determined that China should no longer be designated as a

currency manipulator at this time.

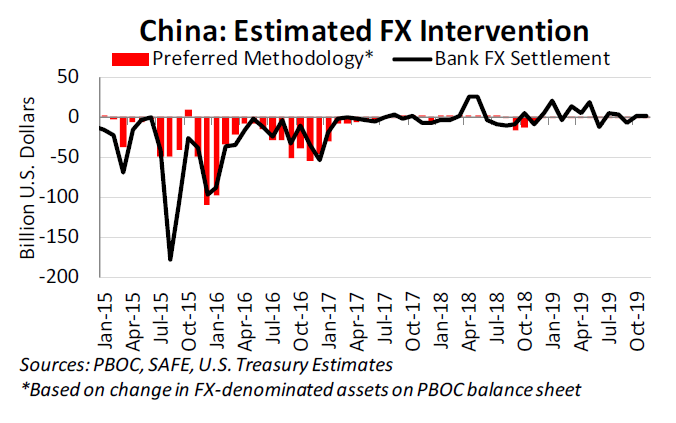

From a narrow balance of payments perspective, the currency manipulation issue should’ve been decided by this graph:

Source: Treasury (January 2020).

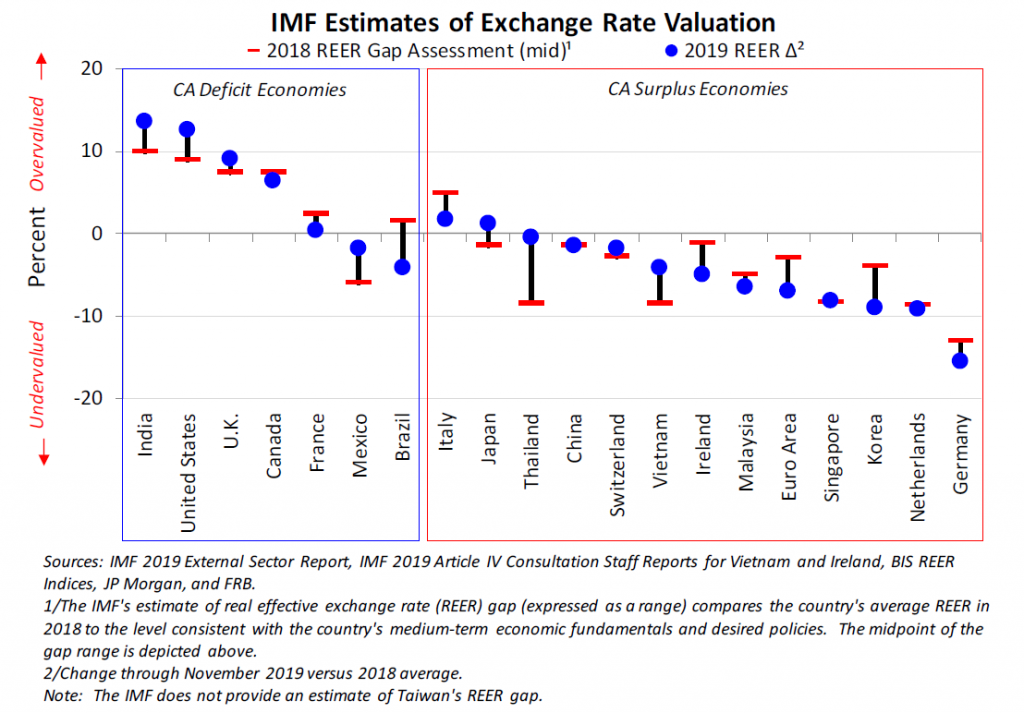

From my perspective on currency misalignment (see discussion here), the key graph is here:

Source: Treasury (January 2020).

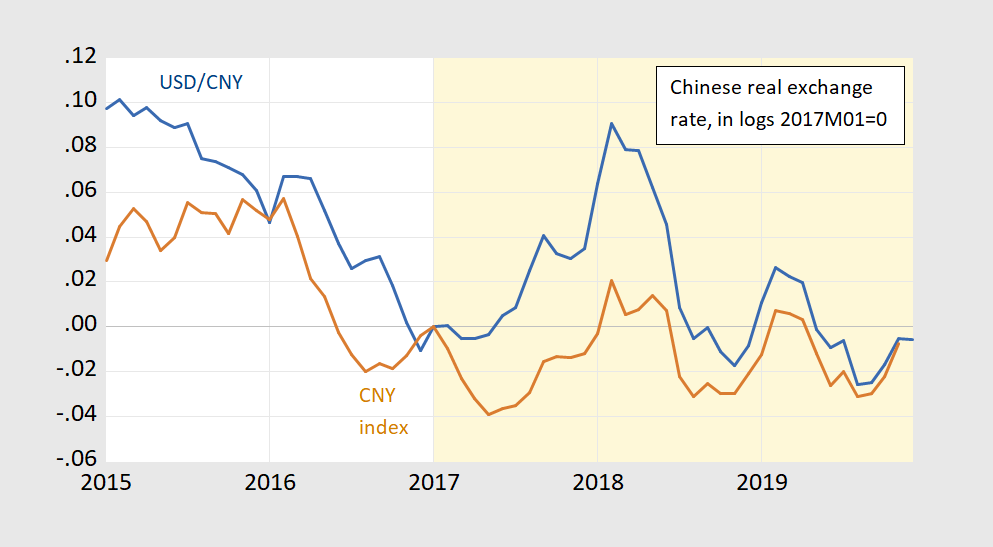

The Treasury report presents time series graphs of nominal Chinese exchange rates, but not real. Here are two real, bilateral and trade weighted (BIS):

s Real bilateral US-China exchange rate (blue), real broad trade weighted Chinese value of currency (brown), both in logs 2017M01=0. Real calculated using CPIs. Orange shading denotes Trump administration. Source: Fed, BLS, OECD via FRED, BIS, author’s calculations.

As of November, the trade weighted CNY is about the same as when Mr. Trump took office.

What of the main issue that the Administration went to trade war over, the assassination of Archduke Ferdinand the extensive use of industrial subsidies? From the report:

The pervasive use of explicit and implicit subsidies as well as non-tariff barriers and other unfair practices are increasingly distorting China’s economic relationships with its trading partners. This Administration has made it clear that the United States will confront China’s unfair practices — including forced technology transfer, weak intellectual property rights protection, and industrial subsidies — and will strive for a fairer and more balanced economic relationship.

Well, here the Administration has punted (apparently). This language will probably be mirrored in the “deal” that will be signed tomorrow.

A couple of comments using data from:

Table 3. Major Foreign Trading Partners – Expanded Trade Data

The discussion claims “China has the largest trade surplus with the United States by far, after which the sizes of the bilateral trade surpluses decline notably”.

Well yea – China’s $401 billion is larger than Mexico’s $93 billion in absolute terms. But notice the next column. China’s bilateral trade surplus is a mere 3.9% of its GDP whereas Mexico’s bilateral trade surplus is 10% of its GDP.

Also note Hong Kong has a bilateral trade deficit with the U.S. Given the fact that a lot of China’s processed trade flows through Hong Kong affiliates, should the Hong Kong deficit be counted against the Mainland’s surplus?

Noting that bilateral trade balances are misleading, let’s contrast the following from this report:

“China’s current account surplus declined to 0.4 percent of GDP ($49 billion) in 2018, but has widened again in the first half of 2019 to 1.2 percent of GDP ($88 billion over the first two quarters) … Germany’s current account surplus as a share of GDP stood at 7.3 percent over the four quarters through June 2019 and remains the largest in the world in nominal terms at $283 billion.”

Germany’s current account surplus is much larger than China’s even as China’s GDP is considerably higher than Germany’s. So why the fuss over China and not Germany?

Because Trump’s next wife might come from Germany, but surely won’t come from China. Or maybe just mistress. Something like that.

So, by how much will PRC increase its purchases of US-produced soybeans by as a result of this deal? Is that still up in the air?

Today’s WaPo makes it clear what nearly nothing burger this deal is. Something like two thirds of the tariffs between US and China that were not there before this trade war started will still be on. Some have been reduced, but a long list of industries ranging from chemicals to car parts are seeing no improvements from this. Yes, there is a promise by China to buy $200 billion more worth of energy and agricultural products over the next several years (maybe soybeans will be doing better), but such promises have been made before and not kept. I am not holding my breath.

This looks like a matter of banging one’s head against the wall every 30 seconds and then announcing that one will only do it every 45 seconds. Wow! That feels so much better! Or at least one can announce that we shall be feeling better soon, maybe, a little bit.

As it is, WaPo reports that few businesses see much decline in longer term uncertainty related to all this as a result of this deal. Nobody has any confidence in any expectation about what trade relations between the US and China will look like say, oh, a year from now. so forget stimulating any investment out of this.