Donald Trump’s pronouncements can typically be taken as contra-indicators. In other words, what he says is invariably wrong. So, you gotta wonder on China…

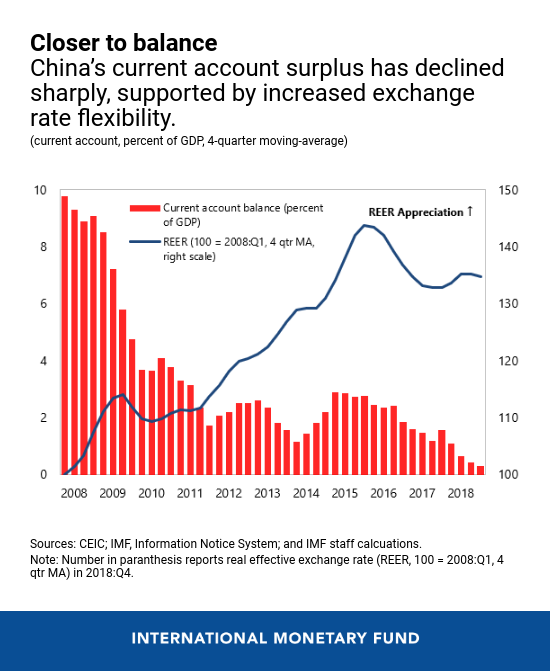

From the 2019 IMF External Sector Report (released last month), the evolution of the Chinese current account and real exchange rate.

Source: Gopinath, IMF Blog, July 2019.

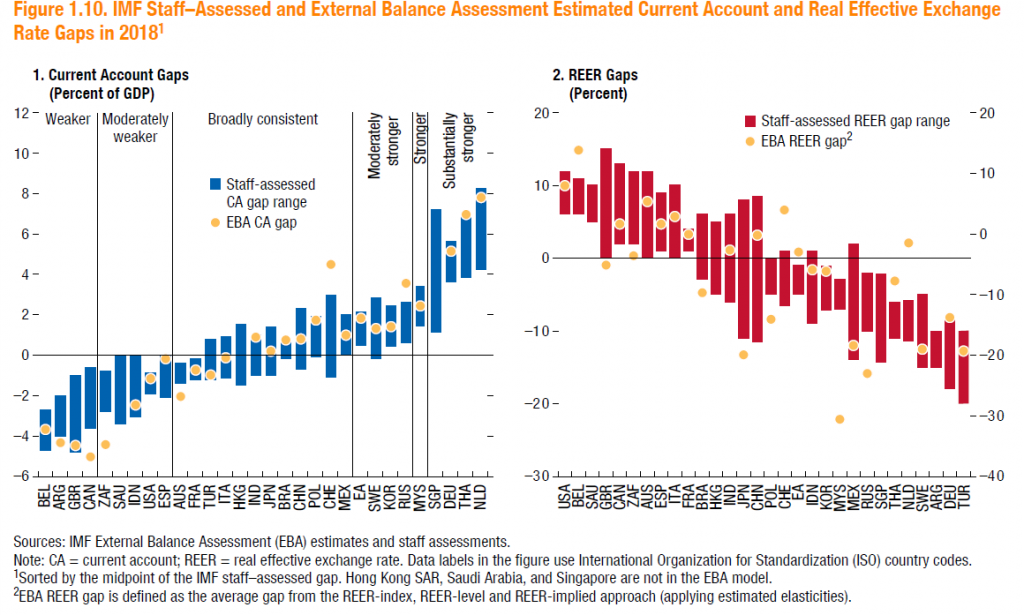

In contrast to what Mr. Trump has alleged, the IMF’s assessment is that the CA and the real effective exchange rate are close to their equilibrium values.

Source: IMF External Sector Report , July 2019.

Notice there are two estimates in each case; one is the “EBA” based upon a saving-investment balance approach, and the country desk assessment. For more on the former, see this post.

In words, the external balance approach (EBA) relies upon a saving-investment framework. This has a long history, both in and out of the IMF (my acquaintance starts with Chinn and Prasad (2000), published in JIE 2003, but for earlier, see Feldstein and Horioka (1979), published Economic Journal 1980 (over 4000 citations).

By the way, if you are wondering, just last May — a mere three months ago — the Mnuchin Treasury agreed that China did not fulfill the conditions (somewhat misguidedly over-focused on bilateral balances) set forth by the Treasury itself for defining “currency manipulation”.

“Donald Trump’s pronouncements can typically be taken as contra-indicators. In other words, what he says is invariably wrong.”

As you document, China’s trade surplus relative to GDP is quite modest today and its real exchange rate appears to be close to what we might deem to be equilibrium. Can someone ask Judy Shelton if she either: (a) agrees; or (b) has convincing evidence to the contrary?

I think Judy Shelton is narrating a commercial for gold “investments” on the Glenn Beck radio show right now.