Today, we’re fortunate to have Giovanni Pellegrino (Aarhus University), Federico Ravenna (Danmarks Nationalbank, University of Copenhagen, HEC Montreal, CEPR) and Gabriel Zullig (Danmarks Nationalbank, University of Copenhagen) as guest contributors. The views expressed represent those of the authors, and do not necessarily represent those of Danmarks Nationalbank , or any other institutions the authors are affiliated with.

Policymakers at the time of COVID-19 face an extremely uncertain environment. This post argues that the benefit of reducing policy uncertainty at a time dominated by pessimistic expectations amounts to several points of Euro area GDP. The impact of uncertainty shocks in the Euro area is much larger during periods of negative outlook for the future of the economy. We estimate the impact on industrial production of the current COVID-19 induced uncertainty to peak at a year-over-year growth loss of -15.4% in September 2020, and to lead to a fall in CPI inflation between 1% and 1.5%. Policies providing state-contingent scenarios ready to be adopted if the worst-case outcomes materialize can reduce the impact of uncertainty.

As countries plan a gradual reopening of the economy after the COVID-19-induced lockdown, survey measures of confidence are still at their lowest, reflecting a pessimistic outlook for the future. Global and US indices of economic uncertainty reached an all-time high at the end of March 2020. By the end of May the value of the US option-implied stock-market uncertainty VIX index was still 200% of its value at the end of 2019. In this column we argue that the returns to enacting policies reducing the uncertainty in the economic outlook by providing to the public contingent scenarios are very high – and they are high exactly because the average outlook is so bleak.

The pandemic affects the views about the economic outlook of businesses and consumers through two separate channels. First, pessimistic expectations lower spending and demand for final, intermediate and investment goods and services. Second, a sharp rise in economic uncertainty – that is, an increase in the dispersion or the range of possible future economic outcomes – increases the risks in the outlook. Estimating a nonlinear VAR for the Euro area, we find that at times of low prospects for future economic activity, an increase in the dispersion of future outcomes has a much larger impact on the economy, relative to normal times. Many more consumers and firms, for example, may be closer to a worst-case scenario where they lose completely any income stream, and may optimally choose to change their behavior because of the increase in risk – even if there is a counter-balancing increase in the likelihood that the economy will rebound fast and demand growth will raise incomes.[i]

Uncertainty hurts the Euro Area – much more during pessimistic times

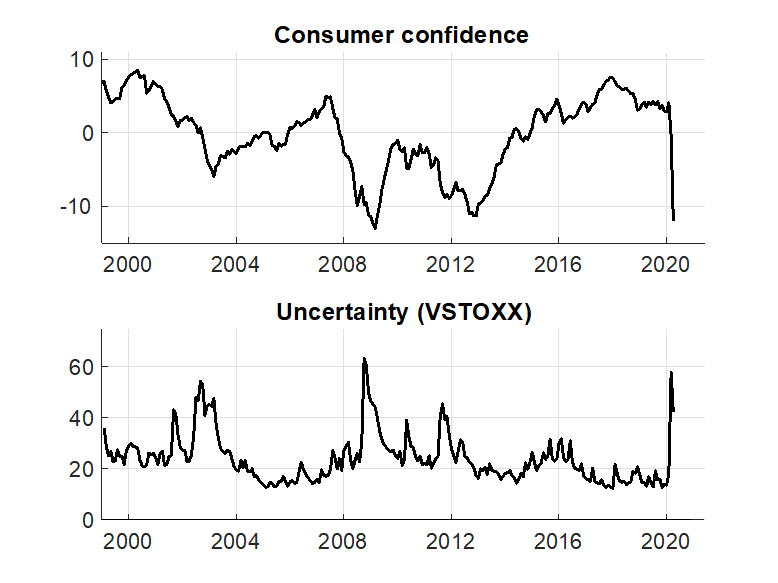

Figure 1 shows that the consumer confidence indicator released by the European Commission – a survey measure of the expected economic developments over the next 12 months for households – signaled in Q2 a confidence level approaching the number reached during the 2008-2009 financial crisis.

Figure 1: European Commission Consumer Confidence Index (top panel) and monthly averages of VSTOXX implied volatility, a measure of risk as perceived by Euro-area stock market investors (bottom panel)

The current state of the world economy is characterized not only by a negative outlook, but by an unprecedented increase in uncertainty. Baker et al. (2020) document the recent increase in uncertainty as measured by several US indicators: the VIX index – the implied volatility on the S&P500 index from the Chicago Board of Options Exchange – measuring the perception of uncertainty of financial markets participants; the U.S. Economic Policy Uncertainty Index, measuring the frequency of newspaper articles on uncertainty about policy measures; survey-based measures reporting uncertainty about the outlook among firms.

The behavior of uncertainty measures for the Euro area is similar to its US and global counterparts. To measure uncertainty in the Euro Area, we adopt a measure of financial uncertainty that is well suited to provide high-frequency information: the VSTOXX index, measuring the implied volatility for the EURO STOXX 50 stock market index (Figure 1). We estimate an IVAR model, which allows impulse responses to an uncertainty shock to be conditioned on the level of an indicator of the state of forward-looking expectations in the economy, the Consumer Confidence Index computed by the European Commission.[ii] The monthly IVAR also includes as endogenous variables the Euro overnight interest rate (EONIA), the year-over-year growth of the manufacturing sector industrial production index, and the Euro-area CPI, over the sample 1999m1-2020m1.

The econometric exercise answers the following question: what is the impact of an unexpected increase in uncertainty, at times when consumer confidence is in the bottom 20% of its historical distribution? Armed with this model, it is possible to build scenarios for a path of innovations in uncertainty consistent with the COVID-19 induced shock.

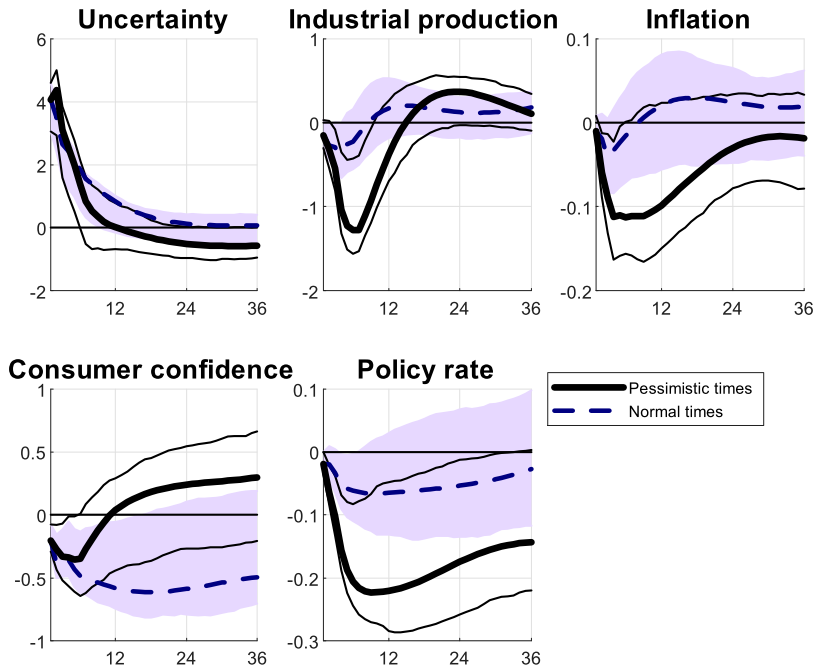

Our first result documents that historically uncertainty shocks in the Euro Area have had a significant impact on the economy only during pessimistic times. Figure 2 depicts the state-dependent response to a one standard deviation uncertainty shock along with 90% bootstrapped confidence bands. Real activity and inflation decrease in both states of the economy, but their decrease is more than three times larger, and more persistent, during pessimistic times. The peak response of real activity is -1.3% in pessimistic times and -0.4% in normal times. The shock is deflationary, but the impact on inflation is in any state moderate. From a statistical standpoint, the decrease in real activity and inflation is significant only for pessimistic times.

Figure 2: Pessimistic vs. normal times response of the Euro Area economy to a typical uncertainty shock. Mean response (solid line and dashed line) and 90% confidence bands.

Consumer confidence decreases for several months after the uncertainty shock hits, before starting to grow again after 6 months in pessimistic times and after roughly one year and a half in normal times. Importantly, the response of consumer confidence is only marginally statistically significant, supporting the conclusion that shocks to uncertainty contain additional information relative to consumer confidence, and do not simply proxy for the average outlook of the economy.

What is the impact of the COVID-19 uncertainty shock?

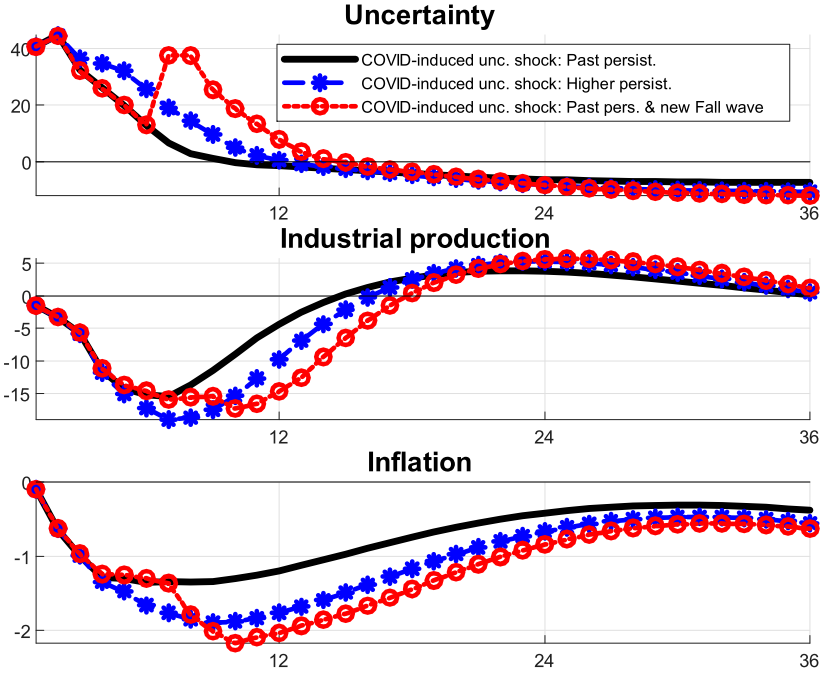

Our second set of results centers around predicting the possible effects of the COVID-19 shock via its uncertainty channel. According to our estimated IVAR, the unexpected rise in the level of the VSTOXX measure of uncertainty from February 2020 to March 2020 corresponds to a 10 standard deviations shock. We build three alternative scenarios. The black line in Figure 3 plots the effects of a one-time, 10 standard deviations uncertainty shock during the average pessimistic state according to our estimated IVAR.

Figure 3: The effects of the COVID-19-induced uncertainty shock under alternative scenarios

As Table 1 clarifies, industrial production experiences a year-over-year peak loss of 15.41% peaking after 7 months from the shock in September 2020, and subsequently it recovers with a rebound to pre-crisis levels predicted to happen in May 2021. Given that our measure of industrial production is 2.8 more volatile than the corresponding measure of GDP within the sample, a back-of-the-envelope calculation would translate the IVAR prediction for industrial production into a year-over-year fall in GDP of roughly 4.3% at peak, induced solely by the increase in uncertainty. The inflation year-over-year peak decrease is predicted to be -1.35% in August 2020.[iii] Our predicted fall on GDP driven by the epidemic-related increase in uncertainty (-4.3% in the Euro Area) is only slightly smaller than the one predicted for the US by Baker, Bloom, Davis and Terry (2020), amounting to a 5.5% year-over-year fall at the trough.

Table 1: Euro Area predicted response to the Covid-19-induced uncertainty shock.

Notes: ‘Time to trough’: number of months for the peak impact on industrial production to occur. ‘Time to rebound’: number of months for year-over-year growth in industrial production to go back to zero.

What if the COVID-19 uncertainty shock propagated in a way different from the past Euro Area experience? We first assume that uncertainty goes back to normal levels much more slowly in the current situation than in the past, given the persisting uncertainty in delivering a vaccine could span several months. Alternatively, a second spike in uncertainty may occur following a new wave of the pandemic in the 6 to 9 months following the initial shock.

Figure 3 and Table 1 report the results of these two exercises. Both scenarios would delay the recovery by less than a quarter, yielding a larger total loss in industrial production. In the case of a new fall wave, our simulations predict the trough to happen in December 2020 and the rebound in August 2021.

Will policy reduce uncertainty?

The impact of the COVID-19 shock via its uncertainty channel, which will be only part of the pandemic’s overall impact. Our results suggest that the return to normality will be slow and painful. The uncertainty-channel alone will contribute for a substantial share to the overall cost of the COVID-19 disaster shock. While governments are pouring massive resources to support incomes and prevent bankruptcies, they would create the conditions for a faster recovery by providing clarity about the future. Reducing uncertainty does not require being overly optimistic and boosting confidence in an average outlook tolerable to household and firms. Rather, policymakers able to reduce the uncertainty in the outlook need to provide to the public contingent scenarios and policies ready to be adopted if the worst-case epidemic outcomes materialize, and clarifying how they will limit the downside risk.

References

Baker, S., Bloom, N., Davis, S. and Terry, S., (2020) ‘COVID-induced economic uncertainty and its consequences’, Voxeu.org, 13 April.

Cacciatore, M. and Ravenna, F., (2020), ‘Uncertainty, Wages and the Business Cycle’, mimeo, HEC Montreal https://bit.ly/3fayH18

Fajgelbaum, P. D., E. Schaal, and M. Taschereau-Dumouchel (2017), ‘Uncertainty Traps,’ The Quarterly Journal of Economics, 132(4), 1641-1692.

Leduc, S. and Liu, Z., (2020), ‘The Uncertainty Channel of the Coronavirus’, Federal Reserve Bank of San Francisco Economic Letter 2020-07.

Pellegrino, G., F. Ravenna, and G Züllig (2020): ‘The Effects of COVID-19-Induced Uncertainty in the Euro Area: The Role of Pessimism’, CEPR Covid Economics, 18:2020 https://bit.ly/3dUHYcP .

[i] Fajgelbaum, Schaal, and Taschereau-Dumouchel (2017), Cacciatore and Ravenna (2020), have suggested models able to explain the time-varying impact of uncertainty shocks.

[ii] Pellegrino, Ravenna and Züllig, (2020) https://bit.ly/3dUHYcP , provides modeling details and results under a variety of alternative specifications. Our analysis relates to studies of the impact of COVID-19 uncertainty by Baker, Bloom, Davis and Terry (2020) – estimating a peak impact on year-over-year US GDP growth of about 5.5% – and Leduc and Liu (2020), estimating an impact on US unemployment peaking at one percentage points after 12 months.

[iii] Note that this is a conservative estimate, since the actual drop in confidence in April 2020 is larger than the average drop in the ‘pessimistic’ state over the sample.

This post written by Giovanni Pellegrino Federico Ravenna (Danmarks Nationalbank, University of Copenhagen, HEC Montreal, CEPR) and Gabriel Zullig

Medical expert Dr. Lawrence Kudlow assures us there is no 2nd spike for COVID-19:

https://talkingpointsmemo.com/news/no-second-wave-covid-19-kudlow-wrong

Yea he was on Fox & Friends but watch it anyway as it is hoot. He kept saying “I’m not health expert”. Copy that LARRY – you are not an economist either. But he said he talked to health experts not naming them. Oh yea, Larry, Curly, and Mo. Didn’t Kudlow the Klown assure us back in February that the virus was contained?

The authors state that the pandemic affects the economic outlook through two channels – pessimism about the future and uncertainty. That seems to leave out at least a couple of channels. One is a drop in potential. The other is a shock through the credit channel, not all of which can be put down to pessimism and uncertainty. There has pretty clearly been a decline in the value of real productive assets, which lowers access to credit.

Not sure that changes the conclusion regarding policy, though I do think that conclusion is self-evident.

https://www.forbes.com/sites/carlieporterfield/2020/06/10/twitter-begins-asking-users-to-actually-read-articles-before-sharing-them/#5c048db766a34

“Twitter announced Wednesday that it will test a new feature that will prompt users to open up a link to an article before sharing it, which appears to be a move to further combat the spread of misinformation on the platform.”

This will cramp Bruce Hall’s style.