Forecasted GDP rises yet again, with considerable dispersion.

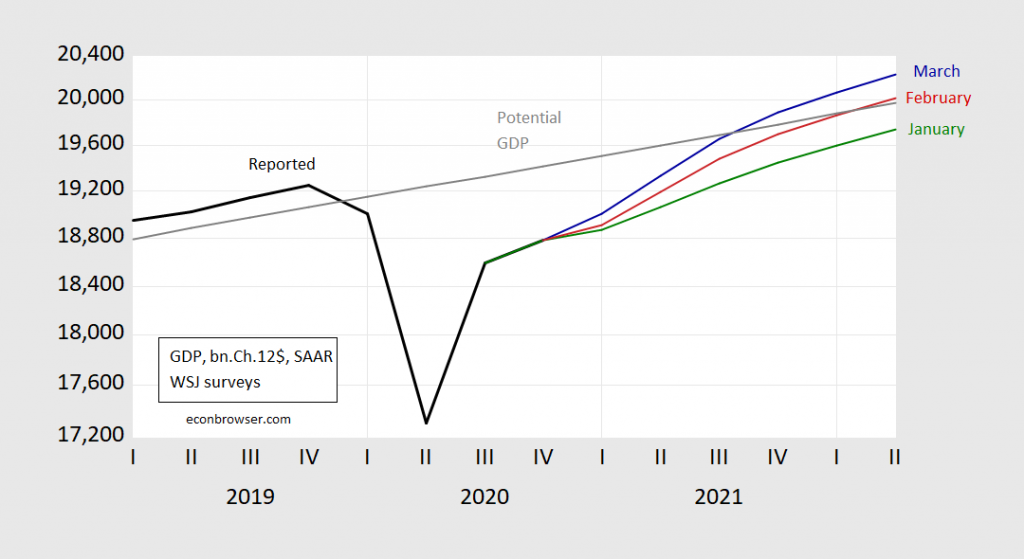

Figure 1: GDP actual (bold black), WSJ March survey mean (blue), February (red), January (green), CBO estimate of potential GDP (gray), all in billions Ch.2012$, on log scale. Forecasted levels calculated by cumulating growth rates to latest GDP level reported. Source: BEA (2020Q4 2nd release), WSJ surveys (various), CBO (February 2021), and author’s calculations.

The trajectory of GDP has risen considerably from the February survey, such that it now breaks CBO’s February 2021 estimate of potential GDP in the fourth quarter of 2021 (rather than the 2nd quarter of 2022, as in the February survey). Since the February survey, expectations of passage of the $1.9 trillion fiscal package have firmed up slightly, but I would expect that most of the upward shift in is due to the increasing confidence that the vaccination process is accelerating — and hence economic prospects improving — under a more competent administration.

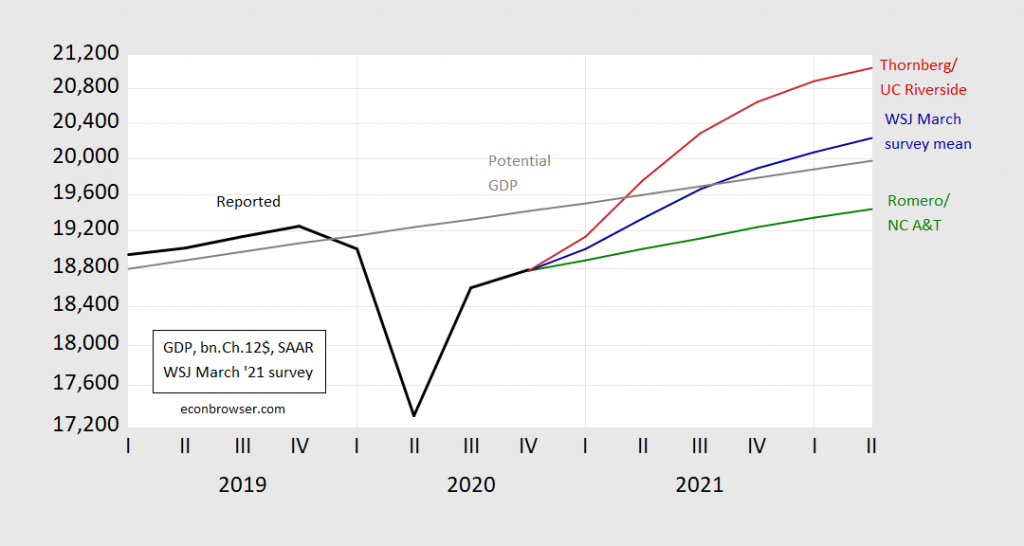

Figure 2 displays the mean March forecast, and the 2021 Q4/Q4 high (Christopher Thornberg/UC Riverside) (red), and low (Alfred Romero/NC A&T State U.) (green).

Figure 2: GDP actual (bold black), WSJ March survey mean (blue), Christopher Thornberg/UC Riverside Business School (red), Alfred Romero/NC A&T State University (green), CBO estimate of potential GDP (gray), all in billions Ch.2012$, on log scale. Forecasted levels calculated by cumulating growth rates to latest GDP level reported. Source: BEA (2020Q4 2nd release), WSJ surveys (various), CBO (February 2021), and author’s calculations.

Despite the improvement in the mean forecast, substantial heterogeneity in outlook remain. By 2022Q2, the forecasted mean output gap is 1.3% (log terms), but the high forecast (Thornberg/UC Riverside) is for a 5.2% gap and the low (Romero/NC A&T State) a -2.7% gap. Interestingly, for the first time in a very long time, James Smith is no longer at the top of the growth forecasts.

Of course, using alternative measures of potential GDP will give different measures of slack, as described here.

See the WSJ article as well.

Certainly plenty of dispersion there.

What strikes me, which is not news, is not all these forecasts but the claim that all through 2019 US was over “potential GDP” and yet we saw nary a hint of any outbreak of inflation. This just gets back to the old ongoing issue of why is this difficult-to-measure number so darned important if nothing seems to happen when an economy goes beyond it and stays beyond it for a considerable time.

After all, one of the more dramatic differences between some of these projections has to do with when and by how much they have GDP going above this supposedly magic number. But does this matter?

As it is, we are back to the matter that there may be a short term increase in inflation due to a bunch of supply-side problems arising due to the pandemic, from semi-conductor chips to shipping. But those problems are likely to ease hopefully by about the time even the most dramatically positive of these projections has GDP getting back up above this supposed potential like it was persistently back in 2019 when, well, nothing happened on the inflation front.

The pandemic may be contributing to the shortages. So, too, may a fire that shut down the NIttobo plant in Fukushima, Japan.

https://www.hardwaretimes.com/amd-chip-shortages-mainly-because-of-substrate-shortages-rather-than-tsmcs-foundry-capacity/

https://asia.nikkei.com/Business/Tech/Semiconductors/Chipmaker-Xilinx-says-car-supply-crunch-goes-beyond-semiconductors

Global supply chains can leave manufacturers vulnerable to critical component shortages when only a few sources are available worldwide. Automotive manufacturers recognized those risks along with the benefits of single sourcing awhile ago.

https://scm.ncsu.edu/scm-articles/article/benefits-and-risks-of-single-sourcing

Tesla appears to be embracing Henry Ford’s vision of manufacturing.

https://insideevs.com/features/450316/elon-musk-tesla-vertical-integration/

http://www.supplychain247.com/article/telsas_gigafactory_supply_chain_vertical_integration

“The pandemic may be contributing to the shortages.”

I read your links and they did not say this at all. I would accuse you of blatant lying but I know better. No – you generally do not read your own links preferring to cut and paste the daily crap from Kelly Anne Conway. Plus you would not even know what a semiconductor was even if some of them were in your breakfast cereal.

Another edition of Bruce Hall proving he is both dishonest and dumber than a rock.

There is an entire economic literature on whether to vertically integrate v. rely on third party suppliers. Bruce Hall seems to think vertical integration is the way to go but most people who get the semiconductor sector realize this is not the case. Yes Bruce “no relationship to Robert” Hall has once again proved he has not even read those earlier links where firms that used to rely on TSMC are turning to Samsung Semiconductor (pssst Bruce – these are Taiwanese and Korean giants since you did not know).

Now let’s relate this to how Biden is different from Trump. Trump never got the need for Federal coordination of the efforts to fight this virus which is one reason it turned out so badly (the other reason was dumbass advice from pathetic people like Bruce Hall on not socially distancing etc.). Biden is making sure all these efforts are coordinated which is why the vaccine campaign is gaining steam (of course Bruce Hall is still drinking bleach).

But let’s get back to the semiconductor sector. Trump did not do jack squat for boosting companies like Micron Technology but Biden is. Yes Biden gets the economics of this sector whereas MAGA hat types like Bruce Hall do not.

Good to see Menzie hasn’t lost his sense of humor:

“for the first time in a very long time, James Smith is no longer at the top of the growth forecasts.”

I was reading up what I could on this guy out of pure curiosity and a strong suspicion there had to be some kind of personal bias in his forecasts. It appears he is just one of those guys crying out for attention:

https://www.econforecaster.com

“You may or may not agree with him, but you’ll always learn a lot, know right where he stands, and be entertained if you’re seeing him in person.”

He must be Princeton Steve’s idol!

New Prediction: OB/GYN is going to be the place to be next year. This summer is going to be off the hook. Trying to win at birth control is going to be the new national team sport. There will probably be a baby boom.