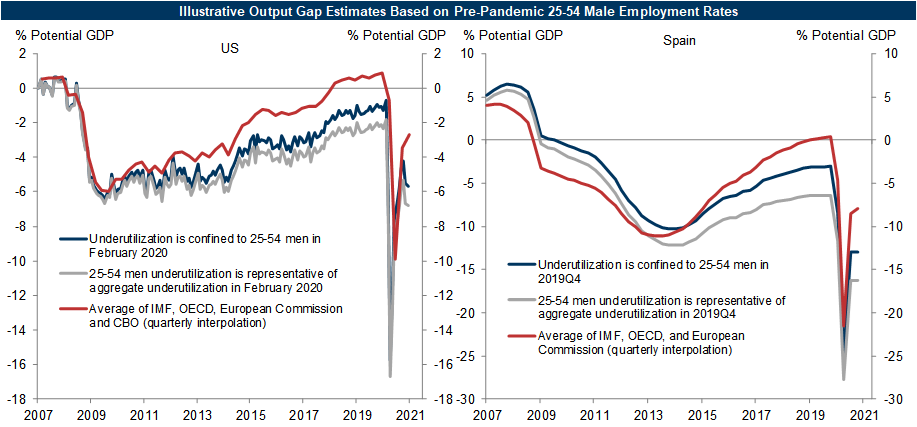

In this blog, we’ve recently covered production function/bean counting, inverted Phillips curve, and statistical techniques for estimating the level of potential GDP relative to actual GDP — that is the extent of economic slack. Struyven/Hatzius/Bhushan at Goldman Sachs estimate slack at several percentage points greater than that implied by the CBO measure.

Using the employment/population ratio for men aged 25-54 in late 2019/early 2020 relative to its level in 2005-2007, they find that the extent of slack is some 3-4 percentage points larger than the CBO output gap.

Source: Struyven, Hatzius, and Bhushan, “There Is More Slack Than They Think?” Goldman Sachs, February 16, 2021.

For December 2020, Goldman Sachs estimates US slack at 6% vs. 3% as average of CBO, IMF, OECD et al. estimates (My estimates approximating a plucking model a la Delong-Summers is 4%).

My objection to all the economists bickering about closing the output gap and NAIRU is how would they ever recognize it if they’ve never seen it?

For at least 40 years economists have been slamming on the brakes any time they foresee any hint of the horror of wage earners getting a fair share of the economy.

joseph: You do know that in economics, we try to measure unobservables all the time, because they are intrinsic to our models – but that doesn’t stop us from trying to measure the unobservables. Should we stop? Just say “have faith”?

I think “the rub” is in a correlation that is highly questionable to begin with (because so many variables and moving pieces) that rationalizes people not being able to feed their families. It also rationalizes an excess supply of labor.

Menzie,

Joseph has a good point regarding the matter of NAIRU. It seems that this deeply-embedded-in-the-textbooks idea of NAIRU looks to be not particularly functional. This reflects my long association with Post Keynesians, but I have long agreed with Jamie Galbraith who has long declared NAIRU to be vacuous. It initially came out of Milton Friedman’s famous 1968 AEA speech in which declared that long run expectations-fulfilled Phillips curves are vertical at the “natural rate of unemployment.” with this determined by some combo of the state of the labor force, institutions, and technology. Certainly if it was at a vertical PC, then it implied that any effort to get the unemployment below that rate would just generate inflation, although it was not clearly an implication that this would be an accelerating rate of inflation without end. In any case, presumably this rate is somehow also tied to this to “potential GDP,” although that idea has historically been more coming out of Keynesian sources, albeit often with a similar bottom line: that sustained efforts to produce more than it will lead to higher inflation.

Another idea Friedman put forward was that this natural rate was “natural” because it was what the economy would go to “naturally” if it was somehow left alone in a sort of de facto laissez-faire state of no active macro policy, which was what Friedman supported of course, with all this consistent with the monetarist view that all the Fed (or any other macro policy maker) can do in a systematic way is control inflation by keeping the money supply under control.

So ultimately all this became this textbook story that has also haunted policy makers ever since that somehow all these ideas are not only serious but coincide: this natural rate is what the economy “naturally” goes to, and it is also at or near potential output, and any effort to go beyond it to lower unemployment will simply lead to higher inflation and not just that but ever accelerating inflation, potentially leading to hyperinflation. This story has been widely believed. But the logic of why all these would coincide has never been laid out, and given the number of times we have now seen unemployment go below some widely identified supposed such natural rate without inflation accelerating, with this happening as far back as a quarter of a century ago., well, it is amazing anybody has continued to take this seriously (along with the collapse 35 years ago of the monetarist doctrine associated with it).

I also add that from early on, and even already recognized by Phelps who sort of co-authored this stuff in a parallel way with Friedman, was that the natural rate is endogenous to the actual past path of the unemployment rate, which pretty much upends the idea of how one must view this natural rate as this unbudgeable hard fact one must kowtow to. People like Summers and others pointed out the phenomenon of hysteresis, and Phelps noted the idea noted later also that a higher unemployment rate can lead to unemployed workers losing skills, while lower unemployment leads to workers gaining skills, with these effects presumably altering this natural rate. Really, it is amazing it had so much power and influence for so long.

And at the bottom line is Joseph’s quesion: if the natural rate or potential output really does not seem to have much connection with potential outbreaks of inflation, then what is the importance of getting an accurate measure of this potential output? How important is this output gap after all?

Greenspan (Blinder, Rivlin) engaged in a growth experiment. That is decidedly not “slamming on the brakes” in response to rising wage prospects. The funds rate target ran below conventional Taylor Rule targets for extended periods in the last expansion. That’s not slamming on the brakes. When Yellen chaired the Fed, she adopted a labor-market dashboard for assessing slack that shifted the Fed’s public assessment of the balance of risks toward less caution about wage-driven inflation.

Doesn’t look like joseph really knows much about Fed policy.

Now, if we want to look somewhere for wage suppression, perhaps your recent posts involving labor market monopsony and minimum wage effects would be a place (for joseph) to start.

@ macroduck

You’re being a little harsh on Joseph. People think Greenspan let rates get too low and that’s what added to “market exuberance”. I believe there was talk Blinder left because he wanted lower rates. But what if the Fed had taken its duties as a bank regulator more seriously, and taken up some of the “slack” (no pun intended) of Phil Gramm and his wife Wendy castrating the SEC and castrating the CFTC?? Nobody knows the answer to that question, because until Yellen finally (and rightfully) slapped Wells Fargo in the face for fabricating customer accounts that no one had actually opened (among other sins) the Fed has never taken its bank regulator mandate seriously.

We have to ask the true intentions of parties. Was Greenspan keeping rates low to facilitate the working man’s plight or was Greenspan lowering rates to keep his TBTF banker friends and DC cocktail party socialite friends happy?? Any person who thinks it is the former and has a college degree should head back to their university and relinquish something they do not deserve.

The point is you can’t cherry-pick and choose brackets of time when the Fed half-way did their jobs. People (specifically the working class) view the Fed in terns of what it has done for them (almost nothing) over a period of decades, not on a few moves here and there. If the Fed cares so much for the working man, why was the ONE time Yellen did her job as a regulator~~~was “coincidentally” when she hit the EXIT door?? What does that say about the “institution” of the Fed that the only time Yellen felt “safe” to do that was when she was standing in the door frame of the EXIT door?? Again, any person who doesn’t “read something into” that timing, should return their degree back to their alma mater.

Moses,

Oh dear, you are lying about Janet Yellen. This is not good. Are you gong to start accusing her of eating fancy ice cream nextt?

When Greenspan did his “growth experiment” in the mid-90s, the person who was most behind pushing him to do so and provided the arguments that justified it was not Rivlin nor Blinder. It was then Fed Governor Yellen, and she was not standing in the exit door, although she did become CEA Chair a few years later.

In 2005, when she was SF Fed prez, she was the first major figure at the Fed to identify that a serious housing bubble was goign on and that it was going to be a problem.

And her policies as Fed Vice Chair and then Chair largely look prett reasonable, and between those two positions she was in for 8 years, not just 4, and did not suddenly starte helping out “the working man” just as she was about to hit the esit door.

Given your completely off-the-wall comments on another thread, I have to ask” have you been hitting the cheap wine a bit too hard? I understand that you are having a bad time with the weather there in OK, and I even expressed sympathy for you, genuine sympathy, only to see you completely lose it. And this post is seriously full of bad nonsense. Whatever is going on with you, you usually do better than this, even when you bashing me relentlessly. At least some of the time you accurately list past mistakes I have made. But dumping inaccurately on Yellen as you do here is really bad news, a new low for you.

Blinder left, as I understand it, because his department said he had to teach or lose his spot. I was slack-jawed when I heard it, but that was the story at the time. I suspect he’d have stayed if the chairmanship was a serious likelihood, but it wasn’t.

Gotta disagree. Claiming that economists, which can only mean the Fed, have been “slamming on the brakes” for 40 years in response to tightening labor market slack is contrary to fact. It is certainly true that many people believe as joseph does, but those people are equally wrong in their belief.

The first argument for opportunistic disinflation at a Fed meeting was from President Boehne in late 1989, though the name wasn’t coined till some years later. Blinder spoke in favor of it at his confirmation hearing in 1994. The Fed is widely acknowledged to have pursued opportunistic disinflation starting in the 1990s. So for roughly 25 years, the Fed has declined to use rate policy to enforce below-trend growth forestall inflation. Yellen began arguing for rate hikes in May of 1996 because wages might rise and increase inflation expectations:

“We can’t dismiss the possibility that compensation growth will drift upward, raising core inflation and in turn inflationary expectations. This is a major risk. Obviously, we need to be vigilant in scrutinizing the data for signs of rising wages and salaries.”

So clearly, it was Yellen rather than anyone else who was behind Greenspan’s growth experiment. Right? The good news is that she had a change of heart as Fed Chair.

As to whether the growth experiment led to financial instability, fair enough, but that’s not the same as standing in the way of wage gains. Nor is any failure on the Fed’s part to to exercise adequate control over banks. If we are going to advocate for policy solutions, we need to have an accurate understanding of the policy environment. The Fed has not, for decades, activity opposed wage gains. Them’s the facts

@ Joseph

My understanding is that although some NAIRU adherents are still out there, NAIRU is not as “in fashion” as it once was. Either way, Ideologically I am 100% on your side on this topic Joseph. I think there is near zero connection. And I suspect, though do not know, Menzie would at least sympathize to a degree with your argument. Maybe not as strongly as you and I feel on it though.

The employment/population ratio for men aged 25-54 in late 2019/early 2020 relative to its level in 2005-2007 is how Brad DeLong has been proxy this for a number of years.

It it considered graceless to speak badly of the DEAD. I have no comment to make about this…….. man:

https://www.usatoday.com/story/entertainment/celebrities/2021/02/17/rush-limbaugh-conservative-radio-host-has-died-lung-cancer-70/5998621002/

In “other news”, it is said many Republicans disrespect and ignore science. Remember kids, in every dark cloud, there’s a silver lining:

https://www.mayoclinic.org/healthy-lifestyle/quit-smoking/expert-answers/cigar-smoking/faq-20057787

I have not listened to him since 1990. Chubby Tubby was still alive for the last 30 years?

@ pgl

I have a dark sector in my personality, you shouldn’t encourage me. I would have put my Vegas bet on atherosclerosis, even after he made the cancer declaration. Good thing I don’t live on the outskirts of Vegas. It’s fun looking at the still photo of Melania putting the medal around his neck. I think he super glued the inside of his shorts right at that moment when he closes his eyes.

https://images.app.goo.gl/AYH3DMEsQMpPrH8L6

Tell me I’m wrong….. I dare you.

“It it considered graceless to speak badly of the DEAD”

Then I will speak positively. After decades of bloviating about it, it’s about time that Limbaugh found a way to make a positive contribution to our democratic republic. Good on him for doing so.

Interesting that it is the practitioners outside the profession (with the exception of our hosts who are showing healthty respect for evidence by posting this estimate of the output gap) that seem most receptive to the idea of hysteresis or path dependence: Neil Irwin, Binyamin Applebaum, or Martin Sandbu (Financial Times), Jay Powell (inflation averaging). This version from Goldman Sachs might be generalized–there is probably a range of possible paths, depending on labor supply, endogeneity of technical change, etc. Breaching what appears to be potential output might then lead to inflation that temporarily exceeds the target rate it it has positive hysteresis effects. If negative shocks have hysteresis effects, overshooting the target inflation rate would be pretty much required in order to get back to the status quo ante. Actually, another exception is the Vines-Wills paper in Oxford Review of Econ Policy–they advocate multiple equilibrium.

We have come a long ways since Arthur Okun provided his estimate, which is still called Okun’s Law.

IIRC, Okun’s Law was discussed, sometimes for a half-hour or so, only in my undergrad macro classes. My grad classes made at most a passing reference to it. Of course, the way I was taught the neoclassical model, the short and medium runs were elided in favor of emphasizing a glorious long run efficient equilibrium, of course without the need for any pesky (and inefficient!) Keynesian stimuli.

Krugman’s latest notes that Goldman Sachs puts the gap at 6%, which he finds more credible that the CBO 3.5% estimate.