Competitiveness is often appealed to in popular discourse, but seldom defined. In macroeconomics, competitiveness is usually interpreted as cost competitiveness. Chinn and Johnston (JPAM, 1994) discuss the topic at length. Here is the OECD’s measure of cost competitiveness since 1999, along with the Fed’s CPI deflated measure of the dollar against a broad basket of currencies.

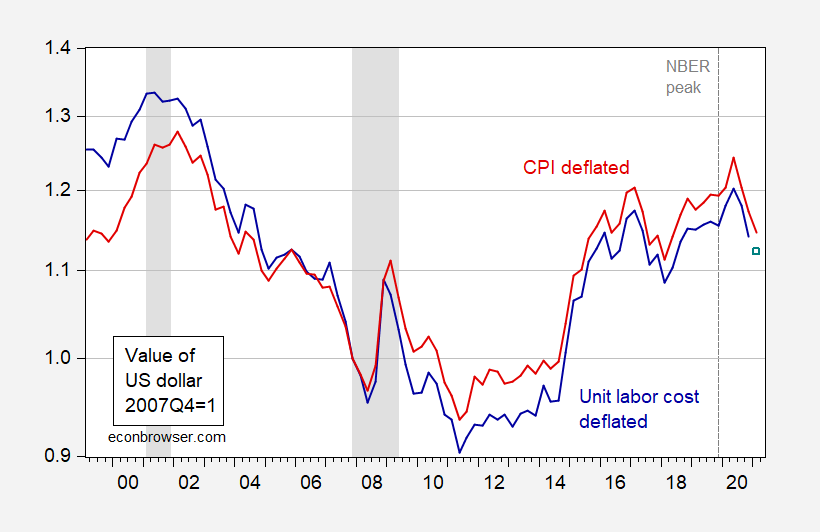

Figure 1: Unit labor cost (ULC) in manufacturing deflated value of US dollar (blue), estimated ULC deflated series for 2021Q1 (blue square), CPI deflated value of US dollar against broad basket of currencies (red), both in 2007Q4=1, on log scale. 2021Q1 observation is for January and February. Fed series is for goods and services 2006 onward; prior is goods, spliced to goods and services series. ULC deflated observation for 2021Q1 based on first differences specification using Fed series, 2019-20. NBER defined recession dates shaded gray. Source: OECD and Fed via FRED, NBER, and author’s calculations.

Given the differential growth rates in the US likely to arise with the implementation of the American Rescue Plan, a widening of the US trade deficit seems imminent. (The CBO projects a widening in 2021 relative to 2020Q4.) Increasing competitiveness, as measured by relative costs of tradables, can serve to offset the increase in the trade deficit.

Using the unit labor cost deflated real rate, the dollar’s value is down 5.2% in 2020Q4, and an estimated 6.8% in the first two months of 2021Q1.

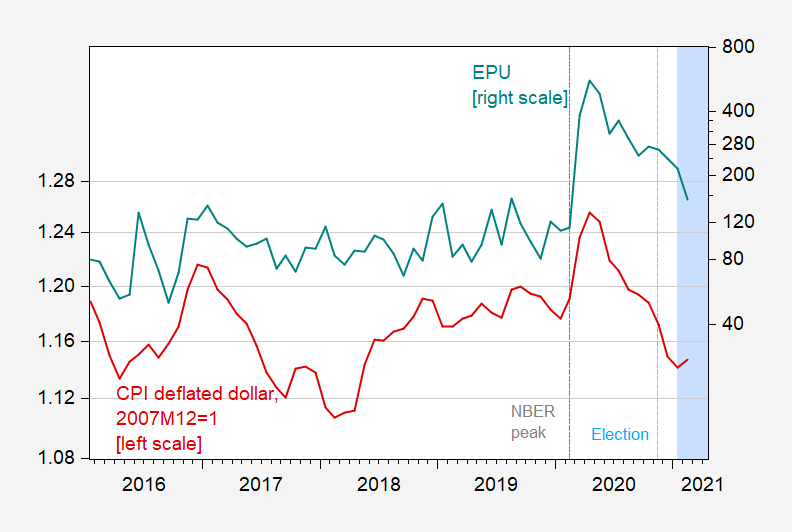

Most of the movement in competitiveness in recent years is driven by movements in the nominal rate, rather than in unit labor costs. And the dollar’s nominal value has been driven in large part over the past four years by policy uncertainty.

Figure 2: CPI deflated value of US dollar against broad basket of currencies for goods and services, 2007Q4=1 (red, left log scale), Economic Policy Uncertainty (news based) (teal, right log scale). Light blue shading denotes Biden administration. Source: Federal Reserve Board via FRED, policyuncertainty.com and author’s calculations.

The importance of elevated policy uncertainty in driving upward the dollar’s value is a useful fact to keep in mind — if we can restore some semblance of rational economic policy making (including trade policy), and foster cooperation with foreign policymakers, then we will achieve better cost competitiveness than otherwise.

Just show I get the diagram. It appears to be saying that real unit labor costs fell during Obama’s first term but the real value of our exchange rate fell by a similar amount so our competitiveness did not improve all that much.

After 2012, it appears that real unit labor costs rose but the dollar devalued in real terms as well, which allowed for higher real wages without that much of a loss in terms of competitiveness.

Forgive me if I got any of this backwards.

“Unit labor cost (ULC) in manufacturing deflated value of US dollar (blue)”

OK – I was overreading this. The two series are trying to convey similar things. Competitiveness improved during Obama’s first term (in part because of weak real wage growth) but unit labor cost relative to the value of the dollar soared during his 2nd term. Maybe I should go read your paper!

I’m at the very least “skimming” the paper with L.D. Johnston, and as pure usual I am at the very beginning of the paper (I tend to read slow but try to make sure I grasp what I can as I read, i.e. high comprehension outside of math equations). A random thought hits me, which may be very obvious but isn’t always articulated I don’t think. That when “we” (or economists specifically) discuss productivity and or competitiveness, how incredibly difficult it is to quantify quality as a part of productivity or competitiveness. How do we measure quality as a part of or segment of competitiveness or productivity?? It’s the old deal, you know it when you see it, but how to express in terms that can be gauged what quality is?? I think whatever economist ever figures this out, is going to have quite a “theory” on his hands, possibly worth a Nobel Prize. The Japanese gained market share in the automobile market in the early to mid ’80s and onward. A large part of the Japanese gaining market share over American auto makers was a near obsession with quality (that they got in part from W Edwards Deming). And quality may be a “subset” of “relative labor productivity” but I would argue a crucial part. How do you separate out or sift out, to isolate that part that is quality?? I think this is a very worthy question for a graduate student of Economics to ferret out, if it is indeed possible to “segregate” the quality portion.

https://fred.stlouisfed.org/graph/?g=lzla

January 30, 2018

Real Effective Exchange Rates based on Manufacturing Consumer Price Indexes for China, United States, India, Japan and Germany, 2000-2021

(Indexed to 2000)

https://fred.stlouisfed.org/graph/?g=lv0B

January 30, 2018

Real Effective Exchange Rates based on Manufacturing Consumer Price Indexes for China, United States, India, Japan and Germany, 2007-2021

(Indexed to 2007)

https://fred.stlouisfed.org/graph/?g=mrXo

January 30, 2018

Real Effective Exchange Rates based on Manufacturing Consumer Price Indexes for China, United States and Euro Area, 2000-2021

(Indexed to 2000)

https://fred.stlouisfed.org/graph/?g=mrXq

January 30, 2018

Real Effective Exchange Rates based on Manufacturing Consumer Price Indexes for China, United States and Euro Area, 2007-2021

(Indexed to 2007)

Back in 2015 Bernanke ran this blog noting how the German trade balance had become very large:

https://www.brookings.edu/blog/ben-bernanke/2015/04/03/germanys-trade-surplus-is-a-problem/

He noted that German workers needed a wage increase or perhaps its currency should be appreciated but the problem was that it was tied to the currency of everyone in the Euro area. There had been several blog posts noting how German unit labor costs had declined relative to the unit labor costs for other Euro area nations. One cure for this misalignment of competitiveness would be for the DM to devalue relative to the other currencies but that would mean an end to the Euro.

“There had been several blog posts noting how German unit labor costs had declined relative to the unit labor costs for other Euro area nations. ”

Yes, but most did ignore the fact that southern European countries had wage increases clearly above their productivity gains for years, quite a high share of the issue was home made, on top came the German reduction of wages at the same time.

“One cure for this misalignment of competitiveness would be for the DM to devalue..”

Really DEvalue? Not appriciate? And why not an internal devaluation in the southern European countries? Hint: The German contribution to the issue were internal devaluation around 1997-2000. You accept this in case of germany but do not see it as solution for the other countries. Strange.

Devalue the Franc – appreciate the DM. Thanks for the correction!

The German contribution to the issue was internal devaluation around 1997-2000. You accept this in the case of Germany but do not see it as solution for the other countries. Strange.

[ Paul Krugman has written about this several times, but critically and questioning the viability of the “European project.” German domestic policy from my perspective was meant to properly integrate East with West Germany, and was remarkably successful in doing so. From the beginning, wages in East Germany were equated to wages in the west, but then eastern labor needed to be fully utilized and this at a time when German women were increasingly working.

Economically, regional integration in Germany was a model of success and should be considered such in, say, an Italy. ]

https://fred.stlouisfed.org/graph/?g=m2Yj

January 30, 2018

Real Effective Exchange Rates based on Manufacturing Consumer Price Indexes for Germany and United States, 1994-2021

(Indexed to 1994)

And what would all the EU bureaucrats do without the Euro to create trade imbalances??? Where else will the EU bureaucrats be paid to do nothing?? Frightening……… or so I’ve been told. Britain is falling to pieces as we speak. Crumbling. Gosh.

“And what would all the EU bureaucrats do without the Euro to create trade imbalances?”

??????

” Britain is falling to pieces as we speak. ”

Nonsensical remark. The UK voted for becoming a third country and is only treated as one. That you as typical brexiter do not understand this is, however, no surprise.

A good academic discussione is found here: https://chrisgreybrexitblog.blogspot.com/

https://fred.stlouisfed.org/graph/?g=w7mi

January 30, 2018

Exports minus Imports of Goods and Services for Germany, 2000-2020

(Indexed to 2000)

https://fred.stlouisfed.org/graph/?g=Cbz6

January 30, 2018

Unit Labor Costs for Euro Area and Germany, 2000-2020

(Indexed to 2000)

https://fred.stlouisfed.org/graph/?g=orbU

January 30, 2018

Real Effective Exchange Rates based on Manufacturing Consumer Price Indexes for Germany and United States, 2000-2021

(Indexed to 2000)

https://fred.stlouisfed.org/graph/?g=CbGM

August 4, 2014

Real per capita Gross Domestic Product for Portugal, Spain, Italy, Greece and Germany, 2000-2019

(Percent change)

https://fred.stlouisfed.org/graph/?g=CbGS

August 4, 2014

Real per capita Gross Domestic Product for Portugal, Spain, Italy, Greece and Germany, 2000-2019

(Indexed to 2000)