I was interviewed for a Markeplace piece on some of the strange beliefs people have about how the government measures inflation.

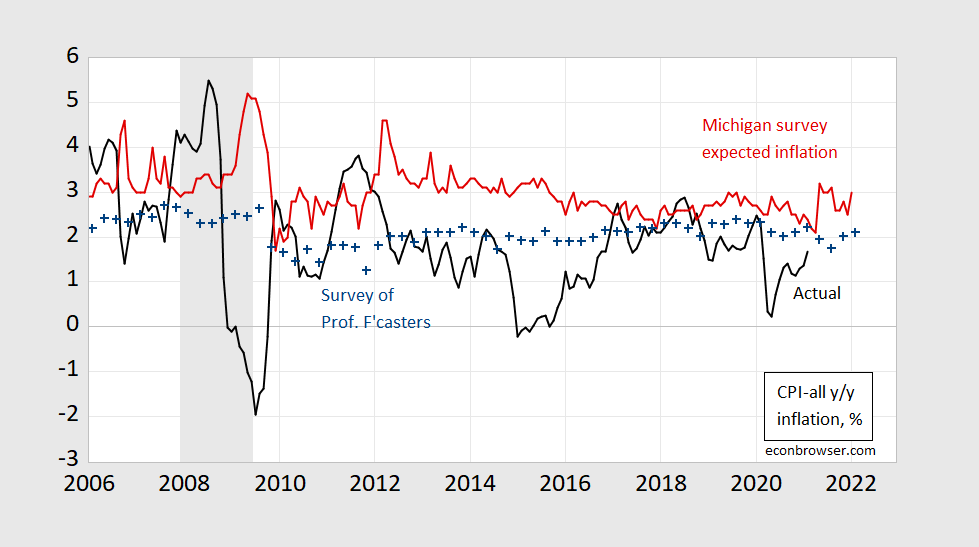

One of the tangental points I mentioned to the reporter (it didn’t make into the article) is household inflation expectations are consistently upwardly biased (by about a percentage point). This is shown in the below graph with ex post inflation (black) against forecasted from Survey of Professional Forecasters (blue) and Michigan (red).

Figure 1: CPI inflation year-on-year (black), median expected from Survey of Professional Forecasters (blue), median expected from Michigan Survey of Consumers (red). NBER defined recession dates shaded gray. Source: BLS, University of Michigan via FRED, Philadelphia Fed, NBER, and author’s calculations.

Coibion and Gorodnichenko (2015) discuss some of the implications of the bias in the household survey expectations; see also this post.

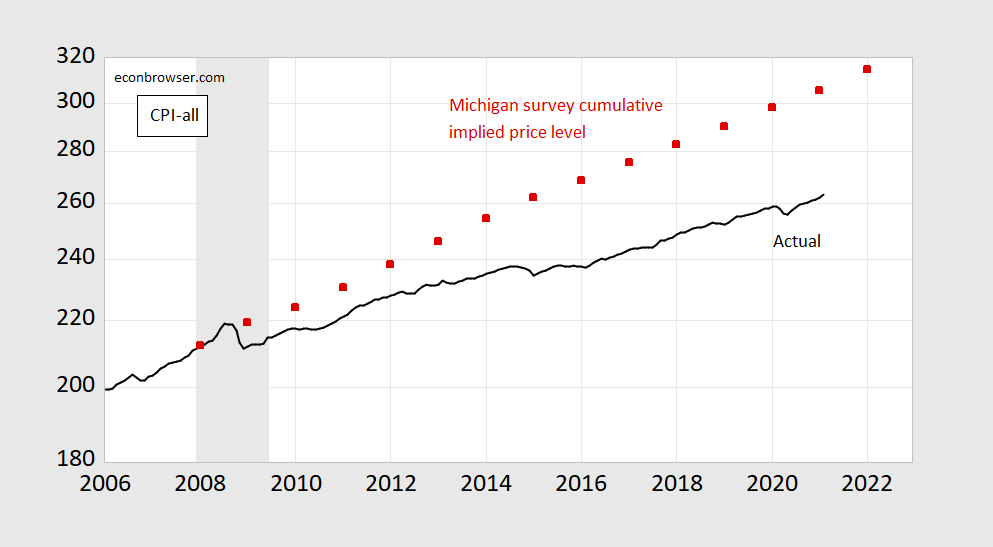

If households had continuously updated their estimate of the CPI level based on their expectations from January 2008 onward, the implied level would be the shown as the red squares in the below graph.

Figure 2: CPI level (black), implied level using median expected from Michigan Survey of Consumers from January 2008 onward (red). NBER defined recession dates shaded gray. Source: BLS, University of Michigan via FRED, NBER, and author’s calculations.

Other interesting things about consumer prices: (1) the CPI is plutocratic. (2) you can’t know the “true” rate of inflation without knowing the underlying representative agent utility function.

Also, people should read about index number theory.

Professor Chinn,

You might find that this paper helps explain some of these differences https://www2.gwu.edu/~forcpgm/2020-002.pdf

This is an interesting post insofar as I do not find it very “strange” at all that “ household inflation expectations are consistently… biased”. To be sure, if one were assessing this ‘phenomena’ from the perspective of orthodox economics alone, this would seem to be a mighty puzzling finding. That households display various biases or that they may not act in a conventionally ‘rational’ fashion when assessing the prices that they pay isn’t at all “strange” to me. Given the field’s very tangible advancements as it relates to a much more honest approach towards empirical and theoretical analyses (particularly from a micro perspective) – this ‘puzzle’ seems as if it would fit nicely into the work of Thaler and others. (Or possibly if analyzed ‘outside’ of the field of economics altogether). I also say all of the above as someone who truly loves and has reverence for orthodox economics – but sometimes love is unrequited and the evidence often shows that orthodox economics doesn’t return the love (in the form of empirically supporting its claims) that it often receives.

From The Bank of Canada…

The behaviour of consumers—which is determined by psychology as well as knowledge—has been found to have a significant impact on inflation perceptions and expectations.

In terms of behaviour, our recent research shows that consumers’ perceived inflation rate tends to be influenced more by rising prices. The perception gap narrows when sharply declining prices are excluded (Chart 8).16

The reason behind this is simple: in forming their perceptions of inflation, consumers seem to put more weight on prices that go up rather than down. The loss of purchasing power from rising prices has been found to have an outsized psychological impact.

https://www.bankofcanada.ca/2020/08/perceived-inflation-reality-understanding-the-difference/

I like the academic papers and tuff, actually, I was just thinking a moment ago, I don’t even wanna hear about inflation now. Weird….. I think smart people should always re-think things and “revisit” things, I just don’t think inflation will be a near term problem.

When CPI inflation is low by modern standards, seems sensible to err toward the long-term mean.

“Err” in what way? By assuming mismeasure of current inflation or by favoring policies which lean toward higher inflation than otherwise?

Menzie,

Looking at this sent me to look at the US inflation numbers by month and year over this period. There has been so much talk about inflation remaining below the 2% target I had not realized (or maybe just forgot) by how much it fluctuated about a decade ago and just before. Annual rates were 3.8% in 2008 but -0.4% in 2009, with 1.6% in 2010 and back up to 3.2% in 2011, the year many were hyperventilating about possible hyperinflation. The latter certainly did not happen, but given the rise in the rare of inflation going on back then it was maybe not quite so ridiculous as many of us now declare to be at least somewhat concerned about it.

Of course some of those monthly variations were even greater, and your graph shows those, with it getting above 5% in mid-2008 (when crude oil prices peaked at over $130 per barrel), but then got down below -2% during 2009 briefly, a lot of variability, which got way reduced after 2011.

The other thing that sticks out, which you did not mention (maybe you did in your interview) is the clear backward looking aspect of the household expectations. So they jumped up the year after there were spikes in inflation in 2008 and 2011, which led to the most extreme forecast failure to be in 2009 when consumers were expecting inflation basically to be what it was the year before when it plunged into negative territory. The professional forecasters remained much steadier, but actually erring on the side of being too stable, at least back then, even for the annual averages.

Summers Sees Worst U.S. Macroeconomic Policy in 40 Years

(Bloomberg) — Former Treasury Secretary Lawrence Summers warned that the U.S. is suffering from the “least responsible” macroeconomic policy in four decades, pointing the finger at both Democrats and Republicans for creating “enormous” risks.

In his latest attack on the recent rush of stimulus, Summers told David Westin on Bloomberg Television’s “Wall Street Week” that “what was kindling, is now igniting” given the recovery from Covid will stoke demand pressure at the same time as fiscal policy has been aggressively eased and the Federal Reserve has “stuck to its guns” in committing to loose monetary policy.

“These are the least responsible fiscal macroeconomic policy we’ve have had for the last 40 years,” Summers said. “It’s fundamentally driven by intransigence on the Democratic left and intransigence and the completely irresponsible behavior in the whole of the Republican Party.”

Summers, a top official in the past two Democratic administrations, has emerged as one of the leading critics among Democrat-leaning economists of President Joe Biden’s $1.9 trillion pandemic plan. Summers warned in the interview the U.S. was facing a “pretty dramatic fiscal-monetary collision.”

He said there is a one-in-three chance that inflation will accelerate in the coming years and the U.S. could face stagflation. He also saw the same chance of no inflation because the Fed would hit the brakes hard and push the economy toward recession. The final possibility is that the Fed and Treasury will get rapid growth without inflation.

“But there are more risks at this moment that macroeconomic policy will cause grave risks than I can remember,” said Summers, who is a paid contributor to Bloomberg.

Administration officials have pushed back against the critique, saying the Biden bill aims to provide relief to those in need and won’t overheat an economy still suffering from high unemployment. Fed officials have broadly echoed that view — flagging the risk of delivering too little fiscal support, and signaling they have no intention of tightening monetary policy anytime soon.

Also speaking on “Wall Street Week,” Nobel Laureate Paul Krugman rejected the theory that the U.S. will witness a 1970s-style inflation surge because of the stimulus.

“It took really more than a decade of screwing things up — year after year — to get to that pass, and I don’t think we’re going to do that again,” Krugman said, adding the Fed has the tools to tackle price pressures if needed.

The worst-case scenario out of the fiscal stimulus package would be a transitory spike in consumer prices as was seen early in the Korean War, he said. The relief bill is “definitely significant stimulus but not wildly inflationary stimulus,” he said.

https://finance.yahoo.com/news/summers-says-u-facing-worst-114227209.html

I agree with Summers.

You agree do you? There is a lot in this discussion such as the FED’s ability to avoid inflation by raising interest rates. Of course we could raise taxes as Biden proposes to do. Do you agree with that? Oh wait – if you actually stand a real stand, your next appearance on OANN might get canceled and your buddies on Fox and Friends will not invite you ever again. So yea – don’t say another word.

Larry is a wimp.

“He said there is a one-in-three chance that inflation will accelerate in the coming years.”

Wow, a 33% chance of accelerating inflation!!! And when exactly are those “coming years”?

Larry’s crystal ball seems very hazy.

Remember back in early 2009 when Christina Romer advocated a very strong fiscal stimulus to reverse the Great Recession? Well Larry got his way and toned this down – which meant the damage from this recession lasted longer than necessary. Skip what Larry says as I’m more interested in what Dr. Romer and Sec. Yellen have to say.

Joe should bring back Christina. She was the best Obama had, but he went with Geithner and Summers and the rest is history.

My cloudy plastic ball is at reliable. Maybe I could apply for his job.

Steven Kopits Given Summers’ notoriously fragile ego I suspect that he would have a very different view if he had been invited to join the Biden Administration. Sometimes he reminds me of the pouty kid who didn’t get be the leadoff hitter so he took his bat and ball home. But setting that aside, Summers assumes without evidence that inflation and stagflation are synonymous. They’re not. Stagflation is a product of weak productivity growth. He also assumes without evidence that the Fed is incapable of taming inflation without driving the economy into a severe recession. Finally, his 33% risk isn’t a frequentist risk, it’s a personal credence. Presumably he’ll be updating his priors as the economy chugs along and we still don’t see any inflation.

“But there are more risks at this moment that macroeconomic policy will cause grave risks than I can remember.”

This is almost a truism; very large fiscal stimulus as a share of GDP and persistent very stimulative monetary policy amount to a bunch of stimulus, so arguably a bunch of policy risk. That doesn’t mean the policy is wrong or irresponsible.

It does mean Summers has carved out a spot for himself as a critic of the first Democratic presidential administration in decades in which he does not play a leading role.

Summers knows how to think in economic terms better than most. Yes, lots of Treasury money and lots of Fed money adds up to a sizable risk. Yes, emerging economies can “sell” environmental quality to developed economies. But as I recall, the last time Summers had a position of influence, he foisted a sizable policy error onto Obama. Labelling things by their proper economic name is not the same thing as getting policy right.

One might also suspect that Summers has a different set of policy objectives than Biden does.

Maybe Summers wants to return to the days when Feldstein recruited him to work for St. Reagan and clean up the mess created in 1981. As I recall – they did pass that 1986 tax reform that lowered taxes rate on capital paid for by sticking it to the middle class.

A bit off topic but a warning about Republicans screaming election fraud. I have to wonder why some MSNBC show though Chuck DeVore would be an interesting guest as his own stick was alleged voting fraud in Texas. He refused to actually answer any real questions just going on and on with Trumpian garbage. Curious who this clown was but Google turned up one of his opeds on Faux News:

https://www.foxnews.com/opinion/chuck-devore-will-illegal-voting-tip-texas-blue-in-2020

You see if you get to mail your vote and if your vote is for a Democrat, that is per se fraud according to this lying piece of garbage.

A “BIT” off topic?

https://fred.stlouisfed.org/graph/?g=t8ci

January 15, 2018

Inflation Expectation and Inflation, 2000-2021

https://fred.stlouisfed.org/graph/?g=t7Y7

January 15, 2018

Inflation Expectation and Inflation, 1992-2021

I am reminded that the experience of inflation differs for people in differing circumstances. People who were older had inflation experience that was heavily influenced by drug price increases. There was or is even a consumer price index for older men and women. People who were lower in income, had different inflation experiences than people with high incomes. So, I can easily understand inflation expectations among consumers tending to be higher than recorded inflation.

ltr: But you can see the inflation bias shows up in the post-2008 period in the graph.

In addition, in the link to the plutocratic CPI post, the differences in y/y inflation are not that different for different quintiles.

Since the Great Recession, consumers have been badly informed about inflation by the news media and social media. There’s no reason to think they will return to the real world anytime soon, so we are in for a lot more crying wolf about inflation.

For some rime after the Great Recession, Bloomberg’s economic reporting shop maintained a strong bias toward declaring that inflation was a big risk. It was a rare story on monthly inflation, Fed policy, commodity prices and such which didn’t carrry a warning about inflation just around the corner.

Our people regularly received calls from BBG reporters for economic commentary. When we couldn’t be pressured into saying something scary about inflation, they stopped asking about inflation. GDP? Sure. Treasury issuance. Yes? Rate policy? Only to the point of the rate decision and technical aspects of policy – never about appropriateness of policy. Inflation outlook? No.

That’s journalism, I guess.

Is it possible that widespread MSM reporting supports a misimpression?

My analogy is that during Dem administrations there is incessant harping on deficits; during Rep administrations not so much. It is a common perception that Rep administrations are fiscally “responsible” and Dem administration’s are not. At least since Reagan, this misimpression seems to have had been widespread, even if refuted by experience.

My personal experience is that reporting of increases in “inflation” indices is more faithfully reported prominently than reporting steady prices. And again, I would have low expectations for a member of my public acquaintance explain to me the difference between 2% and 3% inflation in their lives, while 10% price increases they “get.”

http://www.xinhuanet.com/english/2021-03/20/c_139822561.htm

March 20, 2021

The United States is not qualified to talk to China in a condescending manner, and the Chinese people will not accept that.

Yang Jiechi

I am sorry. This post was entirely accidental, not at all intended for this thread.

Menzie Chinn:

But you can see the inflation bias shows up in the post-2008 period in the graph.

In addition, in the link to the plutocratic CPI post, the differences in y/y inflation are not that different for different quintiles.

[ Yes, I agree completely, my comment was foolish. The bias is not there between 1978 and 2008.

Thank you for the necessary correction. ]

https://fred.stlouisfed.org/graph/?g=t7QR

January 15, 2018

Inflation Expectation and Inflation, 1978-2021

It probably is wise to keep in mind what the Fed seems to be forecasting, which looks pretty sharp to me, even if in the end it turns out to be wrong in one direction of the other, and keeping in mind that so far despite lots of headlines and shouting actual CPI inflation remains mired below the target 2% rate.

Anyway, the official Fed position, which seems to follow earlier forecasts by St. Louis Fed president, Jim Bullard, is that inflation will rise later this year to somewhere noticeably above 2% due to the combination of rising demand and a series of pandemic-induced supply bottlenecks, with these exacerbated by the pandmic-generated “chaos” in global shipping. However, this inflation surge is expected to pull back as the pandemic eases and the shipping situation improves, along with some other issues. As it is, the economy is currently a hodge podge of some sectors way below capacity while others are already experiencing supply shortages.