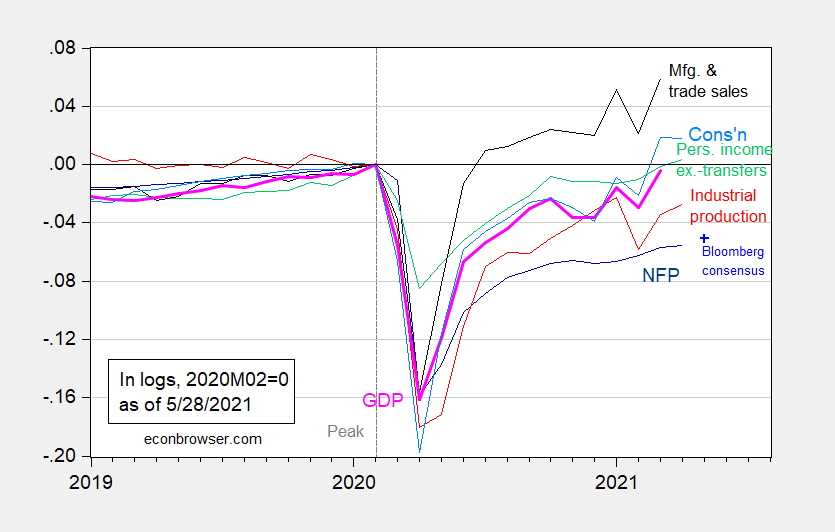

April personal income and consumption figures were released today, along with real manufacturing and trade industry sales. Here’s a depiction of these figures in the context of key macro indicators followed by the NBER Business Cycle Dating Committee:

Figure 1: Nonfarm payroll employment from April release (dark blue), Bloomberg consensus as of 5/28 for May nonfarm payroll employment (light blue +), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), consumption in Ch.20122$ (light blue), and monthly GDP in Ch.2012$ (pink), all log normalized to 2020M02=0. Source: BLS, Federal Reserve, BEA, via FRED, IHS Markit (nee Macroeconomic Advisers) (5/3/2021 release), NBER, and author’s calculations.

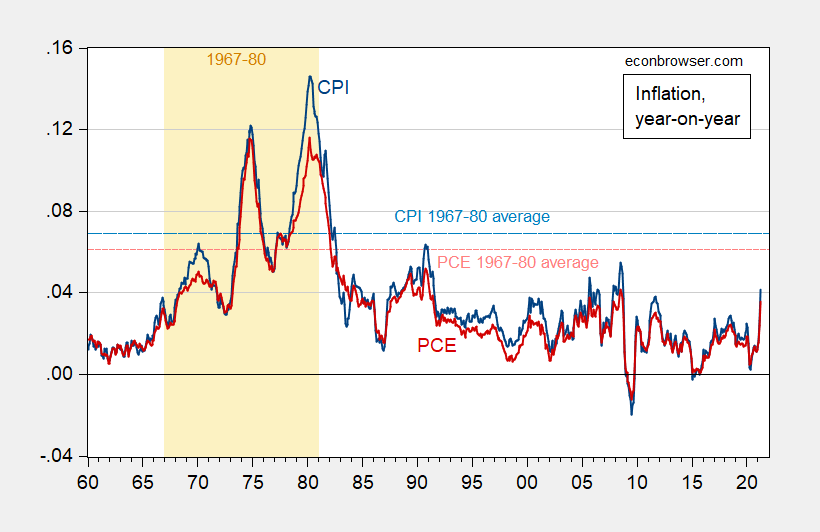

The personal consumption expenditure deflator figures were also released, providing another measure of inflation.

Figure 2: CPI inflation (blue), personal consumption expenditure (PCE) deflator inflation (red), both year-on-year. Dashed light blue (pink) line is average CPI (PCE) inflation 1967-1980, corresponding to orange shaded period. Source: BLS and BEA via FRED, and author’s calculations.

CEA twitter thread on income/consumption release.

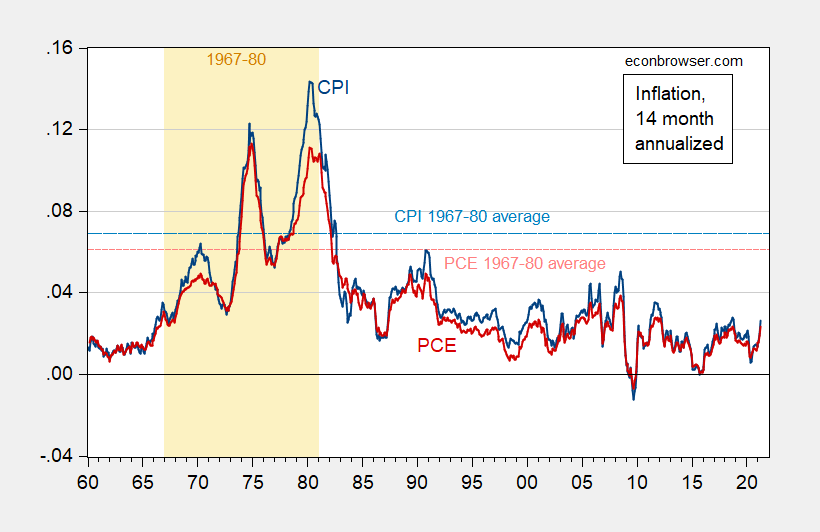

Addendum:

Here is Figure 2, displaying 14 month annualized inflation.

Figure 3: CPI inflation (blue), personal consumption expenditure (PCE) deflator inflation (red), both 14 month annualized. Dashed light blue (pink) line is average CPI (PCE) inflation 1967-1980, corresponding to orange shaded period. Source: BLS and BEA via FRED, and author’s calculations.

https://www.cbo.gov/system/files/2021-04/57025-Rx-RnD.pdf

Different topic but last month the CBO released its Research and Development in the Pharmaceutical Sector, which is packed with all sorts of information.

It notes how R&D has risen significantly over the past decade. One tone of it which progressives might find a bit offensive is that policy better not do anything to reduce the amount of future R&D but this report does contain some great information as well as analysis including a table on the COVID-19 vaccines.

One thing people might find odd is its claim that the cost of capital for this sector is only 7%. If they are following the procedure used by the Office of Technology Assessment back in 1993, however, they may actually overstating their estimate cost of capital.

https://www.pacificresearch.org/wp-content/uploads/2017/06/PhamaPricingF.pdf#:~:text=The%20paper%20estimates%20that%20the%20%EE%80%80capital%EE%80%81%20costs%20on,billion%20a%20year%20%E2%80%93%20a%20successful%20drug%20must

A presentation from an outfit called the Pacific Research Institute on pharma pricing with an estimate for the cost of capital in the pharmaceutical sector putting this at 9.9%. Of course using the return to the S&P 500 to measure the cost of capital for a sector is really dumb. Return to equity v. return to assets? Hello? Nominal v. real returns? Come on man. And why would anyone think the unlevered beta coefficient be one?

Did Princeton Steve learn finance form this joker???

Menzie, I just had relatively random thought when reading about people dropping off of the unemployment insurance, and although it’s off topic, I wish to query you about this, but also leave this comment as a “marker” as I am afraid I will forget about this topic and lose it “in the ether” over the next few months. Where are we in the Biden timeframe on U.S. federal government Agriculture subsidies??? Has Biden dropped some of these?? Are the government welfare payments to farmers going to naturally drop as China assumably goes back to buying soybeans etc?? When will we see a marked drop in Ag subsidies, and can you please give us a graph of these changes (assumably lowerings in government welfare for farmers) if and when they do occur??~~pretty PLEASE

i was quite surprised to find that even though real PCE fell by 0.1% in April, April’s real PCE was still up at a 8.96% rate from that of the first quarter…

in 2012 chained $s: (13,641.8 /13,352.2) ^ 4 = 1.08962

that suggests that even if real PCE does not appreciate during May and June from the April level, growth in real PCE would still add 5.87 percentage points to the growth rate of 2nd quarter GDP…

https://cepr.net/hey-kids-tax-increases-are-supposed-to-slow-growth/

May 28, 2021

Hey Kids, Tax Increases are Supposed to Slow Growth

By Dean Baker

Sometimes budget battles can get confusing, which is why it is important to keep your eye on the ball. That’s good advice for readers of the Washington Post’s article * on President Biden’s proposed budget for 2022. The short piece deals with various aspects of the budget and then gets to Biden’s proposed tax increases:

“Conservatives also warn that the administration’s tax plans could slow growth. The administration has proposed increasing the corporate tax rate from 21 percent to 28 percent, while also imposing dramatically higher taxes on multinational corporations operating abroad. The White House has denied those plans will slow the growth rate, though Biden has said he’s willing to negotiate with Republicans on other solutions.”

The reason that Biden is proposing tax increases is to offset additional spending. The spending adds to demand and boosts growth. This can lead to concerns about inflation, which are discussed in this piece. The tax increases pull money out of the economy, which means that people will have less money to spend, thereby slowing growth, so as to relieve inflationary pressures. Slower growth is not an unfortunate side effect of the tax increases, it is the point.

There is an issue that the proposed tax increases, which largely undo Trump’s 2017 tax cut, could lead to less investment. This could have the effect of reducing growth in the longer term, since less investment would mean slower productivity growth, and therefore slower GDP growth.

However, there is zero evidence that Trump’s tax cut led to any noticeable uptick in investment, and therefore no reason to believe that reversing the tax cut would slow investment. Furthermore, orders for new capital goods, the largest component of investment, have been very strong. This indicates the fear of higher taxes is not discouraging companies from investing in new equipment.

* https://www.washingtonpost.com/us-policy/2021/05/28/biden-budget-economy-2022/

https://fred.stlouisfed.org/graph/?g=tvXW

January 15, 2018

Manufacturers’ New Orders for Nondefense Capital Goods Excluding Aircraft, 2017-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=tvXT

January 15, 2018

Manufacturers’ New Orders for Durable Goods Excluding Transportation Industries, 2017-2021

https://fred.stlouisfed.org/graph/?g=twwl

January 15, 2018

Personal consumption expenditures price index and Personal consumption expenditures less food & energy price index, 2017-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=lLmk

January 15, 2018

Personal consumption expenditures price index and Personal consumption expenditures less food & energy price index, 2007-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=zcd8

January 15, 2018

Real Personal Consumption Expenditures, 2017-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=sjKz

January 15, 2018

Real Personal Consumption Expenditures, 2007-2021

(Percent change)

I’m seeing a number of newly erected cranes in Seattle. There are a couple potential building sites I’ll be especially interested in watching, if anything develops. There’s a huge hole in the ground across from City Hall that’s been there for more than a decade, as well as another site that’s got a parking garage on it about a block away. Both are downtown, and both are slated to have a mix of uses, including apartments. The economy seems to be picking up here reasonably well, with more life on downtown streets than there has been for a year. Life never left the neighborhoods, but it’s much more active now. Traffic is on its way back to being insufferable. There was one good thing about the pandemic and downturn.

Screw that. Any Sean Kemp sightings recently?? Please, no discussions of overhanging beer-belly, it ruins my personal image of him.

No Sean Kemp sightings that I know of. I believe he lives in a suburban area, which means it’s unlikely for me to ever see him even in the more unlikely event that I would recognize him from Adam these days. I pay more attention to baseball and football these days. For what should be fairly obvious reasons.