Paper by me, Hiro Ito, and Robert McCauley. From the abstract.

Do central banks rebalance their currency shares? We explore this question by using different types of datasets from the global aggregated level, the country-level, and a panel context. At the disaggregate level, we find a mixed bag; some economies do rebalance while others do not. However, our casual analysis show that the US does not rebalance. Switzerland, a no-G3 advanced economy, does seem to rebalance FX reserves. Its currency composition is independent of the dollar exchange rate movements. We also explore the question of rebalancing with a panel data analysis and find that our sample economies on average do not rebalance. Emerging market economies (EMEs) do not rebalance and advanced economies do rebalance. Larger economies maintain stable currency composition while smaller economies have their reserves more vulnerable to exchange rate shocks.

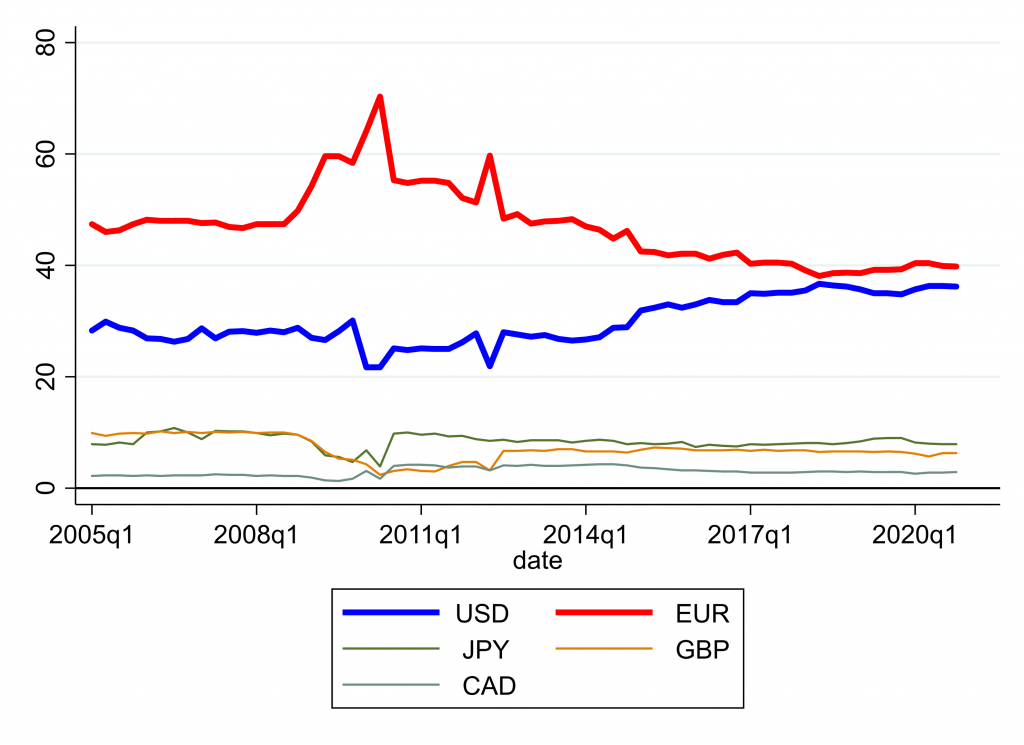

The analysis relies upon data at the central bank level. Here are reserves for the Swiss National Bank, for instance.

Figure 2 from Chinn, Ito, McCauley (2021).

Hiro Ito will discuss the dataset underlying this analysis, compiled by him and Robert McCauley, first used in this paper, in Thursday’s NBER session on data sources [live YouTube link]

2:30 pm [Eastern time]Introduction by Michael Klein

2:35 pm Historical International Macro-Finance Data Sources (An Overview)3:00 pm The Debt of Nations: Government Debt Composition Around the World 1900-20203:25 pm Currency Composition of Foreign Exchange Reserves (slides)4:15 pm Measuring Terms of Trade of Developing Countries

Looks like a good one, both the paper and the NBER presentation.

I just noticed I don’t have NBER on my YT subscriptions list. That is wild, I mean I follow like 1,000 different channels and I can’t believe I didn’t have that one. And it’s not like people might think it’s not that I just have music and movie links, I have a TON of academic and think thank like links, so that is so weird I didn’t have NBER subscribed too on YT. Well, got it now.

Really nice paper.

https://fred.stlouisfed.org/graph/?g=mGFd

January 30, 2018

Total Reserves excluding Gold for China, United States, India, Japan and Germany, 2007-2021

https://fred.stlouisfed.org/graph/?g=mGFg

January 30, 2018

Total Reserves excluding Gold for China, United States, India, Japan and Germany, 2007-2021

(Indexed to 2007)

https://news.yahoo.com/top-us-general-said-trump-083501605.html

General Mark Milley speaks truth to power as he notes that Trump was indeed a wannabe Hitler. And of course Mitch McConnell and Kevin McCarthy remain loyal brown shirts.

‘Bout a half hour away aye?? I think I am actually going to be able to watch this live. NBER have a ton of stuff up (live) right now and I think I saw Darrell Duffie in one of the Zoom thingy-muh-boppers. Darrell Duffie, that’s pretty cool. I’ve always taken a strong interest in dudes in the asset pricing theory area. “He’s done the “dynamic” asset pricing which I thhnk deals a lot in time series, which as a lot of you may have guessed, largely shoots over my head in complexity.

Menzie, Have you ever met Darrell Duffie in person?? I bet a lot you have met Eugene Fama in person which I actually would probably be even more excited by. What a wild man Fama is, aye?? I mean sharp as hell (typical Jew) but his personal demeanor and outlook on life I think is drastically different than most of his peers in teaching and research.

I just listened to Senator Romney saying he is all for the infrastructure bill that a bipartisan group agreed to but he wants to talk about how to pay for it. Great but something tells me that the Senator believes in the tooth fairy.

First he said he is opposed to using deficit financing which would be cool if he wants to raise taxes. Oh wait – he said we should not raise taxes either. WTF? Money grows on trees in Romney World?

OK, OK, I get it. He wants to slash Social Security benefits and things like that. But of course he does not have the courage to say that. So money does grow on trees!

Damn, I was late, the presentation is in the one labeled “International Finance and Macroeconomics”. That may seem obvious to some people, but topics kind of crossover each other. That’s the one you want. NBER/ YT will probably upload the Zoom presentation later so you can watch in it’s entirety.

“You get what they give you”

“Well that’s kind of a deep thought about data”

Funny, some wry humor there I bet all researchers can relate to. I’m so sorry I missed the start. But will watch the entirety later and hang in here in case Menzie or Ito have questions to the other researchers. Looking casual suave cool in the shirt and glasses there Menzie, the video square is small but it looks like “blue lighting” (??) But you look good in case you were wondering.

There was a Korean presenter there, I think I remember his name right, but am afraid to give it for fear I will murder the spelling. He seemed like a gracious young gentleman, and it really kind of pained me to watch it, because I thought they were borderline vicious to him. I know part of the whole point is to find weaknesses in the papers to “fix” the papers and “sharpen the sword through fire”, but they really kinda tore him to pieces (the Korean Bank researcher took it well and is a much more mentally tough man than I am as I am not sure how I would take that). What almost made it worse, was Michael Klein was using some more wry humor (I think with good intentions) trying to lighten the mood, but I’m not sure if the dry humor translated to the Korean researcher well. Anyways, I am probably overreacting to the whole social exchange, it just kind of bothered me a little watching them all “take swings” at him in turn, when he seemed like such a courteous young man.

I presume most academic researchers would tell me “we have thick skin, it’s commonplace”, but it just kinda bothered me a little bit.

Well….. I guess it’s like country singer Willie Nelson once famously said “Mommas don’t let your babies grow up to be researchers”

Bada Han was the young gentleman’s name. I apologize for not remembering it earlier. I intend to read this Han paper (like so many I intend to read and seemingly never do). Including why the one guy made a production out of the title. I just thought it was a cheap shot, you tell him about the “error” in terminology (assuming it was indeed an error), You don’t rub a big wad of table salt in an open wound and go “Uhm, dude, your paper’s title is F’ed up”. I mean, that’s basically the tone it was said in.

Lots of great papers, including some on the Darrell Duffie panel, but so complex, wow,

Menzie,

I am wondering where the figure on Swiss central bank currency holdings came from, please? I did not see it in the paper. Was it presented for the NBER session?

Curiously, given the emphasis on the situation of the Chinese rmb, it was not one of the currencies the Swiss central bank holds. The five listed in order seem to be the euro, USD, British pound, Japanese yen, and then the “CAD,” not the RMB. I am assuming that CAD is the Canadian dollar. It is ahead of the RMB?

Barkley Rosser: Check the notes to the paper. I can admit I didn’t do the hard work of compiling the data set. CAD is Canadian dollar. In aggregate statistics on reserve holdings (COFER), CAD and RMB are neck and neck as I recall.

I couldn’t find anything on COFER which individualizes it by central banks (Maybe one of the reasons the 3 of you did the paper and created the database??~~because it isn’t specified individually by many banks?? This is why the stress in the paper on USA Central bank and the Swiss bank??~~because they are so good about reporting their own numbers?? I found this on the Swiss website. I am assuming because these numbers are so difficult to tabulate is why March 1 is the most recent data.

https://www.snb.ch/en/iabout/assets/id/assets_reserves

For the most recent “shares” of reserves it looks like China is “ahead” for the most recent Quarter. China 2.45% vs Canada’s 2.11 %

One could argue Japan’s is the most impressive relative to the size of the country, at 5.89% of world reserves. Happy to be corrected if I am reading this wrong and/or quoting it wrong.

It is my understanding CAD and RMB are neck and neck in aggregate shares of central bank shares globally, both around 2 percent. This particular figure is for the shares in the Swiss central bank, where it looks like CAD is ahead of RMB.

Those two numbers I got are from COFER. As far as I know the only place you can get the individual SNB numbers are the bank site itself and Menzie, Ito’s, and Bob’s database. I believe the “individualization” of the numbers was a large point of doing the paper, which there were already other NBER researchers expressing their gratitude on those individualized central bank numbers being fruitful and beneficial for them in their own work and research escapades.

Moses,

I opened the link you provided from the Swiss central bank. Showed numbers for end of Q1 2021. I did not see rmb listed. CAD was fifth at 3%. “Other” was at 8%. Otherwise the numbers at that link look pretty much consistent with the figure Menzie provided in his main post above.

It’s the SNB site, obviously. What is your obsession with that?? Of course they are the same, the graph was made with numbers from the site. I can’t tell if you are working overtime at annoying me, have the greatest talent in all of the world for stating the obvious, or BOTH. I’m going with the last choice.

You are utterly sick and screwed up, Moses. This was not remotely about you, but you think somehow that everything on this site has to do with you. But you are an incompetent zero nobody takes seriously, aside from one or two very foolish people. Of course you and others started out here off-topic as so often, blathering about this and that.

So I was simply dealing with the post itself, the core of which is the figure and the text. So I was struck by a disjuncture between the two and pointed it out to Menzie, with you not remotely involved, carrying on in your usually worthless and distracting way about other matters. I noted that while the post was supposedly about the role of the rmb in central bank reserves, and then the figure showed those over time of the Swiss central bank. Those showed five currencies, none of them being the rmb, which I found odd and noted. I did not make some big deal about it, although I was the only person here actually commenting on the post itself.

You then came charging in, providing a link that did not show what you claimed it showed, a supposed lead of the rmb over the cad in reserves of the Swiss central bank. That I have now pointed this out, you are having a fit, but this fit just makes you look even more ridiculous and out of it than you already do.

Time for you to get it together, Moses. You seem to be just completely losing it.

Really, I find it a pain the A. to deal with these stupid and baseless personal attacks from you right now. I happen to be very busy. I am chairing a major international conference of a multi-disciplinary society of which I am president a week from now, which , as Menzie and maybe one or two others here know, involves a lot of escalating work as that approaches. So, leave me alone, please. I am very busy, and am totally sick and disgusted with dealing with lying garbage from a demented creep like you. Just get it together, Moses. I am perfectly prepared to have serious discussions with you about issues, but I am totally sick of you worthless stupid illness.

Barkley Junior says: ” I noted that while the post was supposedly about the role of the rmb in central bank reserves”

Hey stupid~~~did you read the title of the post or the research paper?? It’s about reserve currencies in general and the amount held in individual central banks. Can your “mind” even differentiate what blog thread you are in??