PPI indicates they are down:

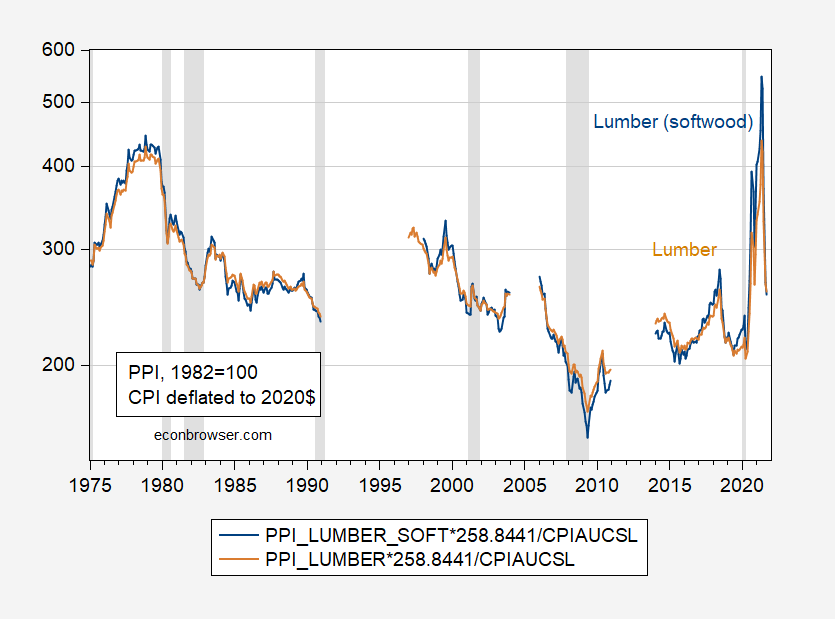

Figure 1: PPI for lumber, softwood (blue), and for lumber (brown), both 1982=100, deflated by CPI to 2020$, both on log scales. NBER defined recession dates shaded gray. Source: BLS, NBER, and author’s calculations.

The lumber real PPI is essentially back at the levels at the 2018M06 peak.

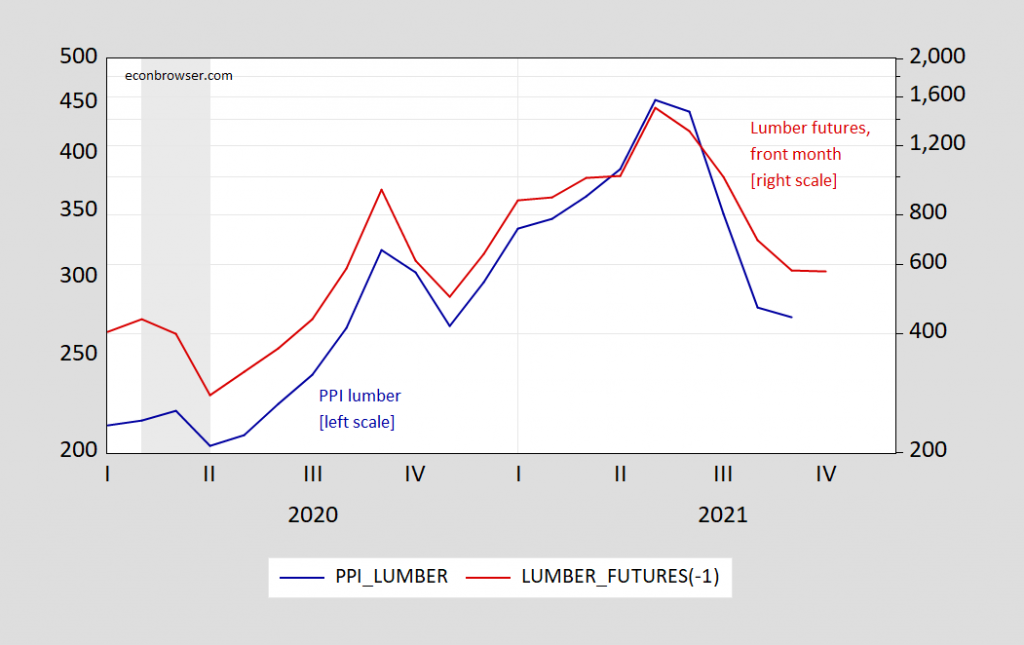

Front month futures through September suggest flat PPI come October’s data.

Figure 2: PPI for lumber (blue, left log scale), and front month futures, lagged one month (brown, right log scale). NBER recession dates shaded gray. Source: BLS via FRED, macrotrends.com, NBER and author’s calculations.

Addendum, 4pm Pacific:

Reader joseph asserts that plywood and other engineered products have not come down in price as much. I don’t see this in the PPI data.

Figure 3: PPI for lumber, softwood (blue), and for lumber, plywood (brown), both 1982=100, deflated by CPI to 2020$, both on log scales. NBER defined recession dates shaded gray. Source: BLS, NBER, and author’s calculations.

I was sort of hoping JohnH would take the time to show real lumber prices over time but of course he left that chore up to you. And golly gee – lumber prices are volatile but not certainly hitting the all time highs JohnH wanted us to believe.

Do the numbers in the graph include the 65% surge since late August?

In any case it’s scant consolation that they’re “back down” to the 2018 peak, which was more than double the prices for most of the last decade.

JohnH: The PPI data graphed extends through September.

Even Mr. Magoo can see that they do. Mr. Magoo can also see you are still cherry picking dates for a volatile series of commodity prices. CoRev taught you well.

Futures markets aren’t foreseeing a decline in lumber prices any time soon.

https://www.barchart.com/futures/quotes/LS*0/futures-prices

And Goldman is forecasting a 16% rise in housing prices through the end of the year.

https://www.businessinsider.com/housing-market-prices-forecast-goldman-sachs-rent-inflation-real-estate-2021-10?op=1

“ Lumber is a leading indicator, so structural changes to building materials prices always show up in wood products first. Last year there was just not enough lumber supply, because there were delays to production due to COVID. Manufacturers had to reduce, now they have made the necessary adjustments and production volumes are better. Right now the problem is showing up in everything else: there is a short supply of tiles, roofing, cabinets, countertop, toilets, etc. Builders can’t find that now, which is currently slowing down new home completions. The latest data shows housing starts were up, home sales were up, and new house prices were up. It is important to note that 78% of new U.S. homes sold in August had either not been completed or not been started. This rate is usually closer to 65%.”

https://www.lesprom.com/en/news/Last_year_builders_couldn_t_get_lumber_now_they_can_t_get_everything_else_100852/

Repeat: “Lumber is a leading indicator, so structural changes to building materials prices always show up in wood products first.”

But pgl just shrugs it all off as “just volatility!!!” Don’t worry, be happy.”

Now let the stream of insults flow…

‘But pgl just shrugs it all off as “just volatility!!!” Don’t worry, be happy.”’

You really do have serious emotional problems. Not only did I never say that but our host has another post just for you. Your grasp of the lumber market reminds us of Sammy and the soybean market.

Lumber prices is your only take away from that Business Insider discussion? What I read was that there has been an increase in the demand for housing which is driving up the price of new housing as well as what is required to build a new house. Now the lumber does not put itself up as that requires workers. And this discussion suggests that the market needs to increase wages for construction workers.

One would think a progressive would be focusing on this aspect. But not JohnH – who quite frankly is an embarrassment to most progressives.

Question regarding a tangential topic: what are the odds of a transportation work stoppage or slowdown?

Transport workers are in short supply. Around the clock operation at ports will put new strains on workers there, and it was apparently port operators’ reluctance to pay serious overtime which required White House intervention to expand hours. This could get messy.

Expanded port hours will move bottlenecks further into rail and truck transport. There is no pool of labor from which to draw new workers, so the transport sector needs to hire workers away from other jobs. Higher pay is required to do that, so might as well pay the guys already doing the job. They want more than higher pay, though.

I realize labor actions by transportation workers are limited under law, but there are plenty of ways to put a crimp in shipments short of a formal strike.

Maybe we should just pay more for drivers who have been underpaid for years.

#bares shelvesbiden

https://www.marinetraffic.com/en/ais/home/centerx:143.3/centery:35.4/zoom:7

compare flow around the world.

A neat little website but WTF does this have to do with Biden? Shipping is the game played by Wilbur Ross and of course McConnell’s father-in-law.

Prices for dimensional lumber have come down a lot, but prices for engineered wood products such as plywood, oriented strand board and laminated beams are still quite high. Engineered wood products are a higher percentage of house construction cost than dimensional lumber.

Dimensional lumber can be produced by lots of small, low-tech mills but engineered wood products are produced at fewer large high-tech mills. These big mills are slower to ramp up for some reason. Might be material shortages (resins and glues), labor shortages, or uncertainty about the market.

https://fred.stlouisfed.org/graph/?g=FT7o

January 15, 2018

Producer Price Index for plywood, 2007-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=HLd3

January 15, 2018

Real Producer Price Index for plywood, 2017-2021

(Indexed to 2017)

Correcting:

https://fred.stlouisfed.org/graph/?g=HLd3

January 15, 2018

Real Producer Price Index for plywood, 2007-2021

(Indexed to 2007)

joseph: I don’t see this. See the addendum.

You are looking a wholesale prices, but retail prices are still high. I’m not saying that things haven’t improved since August, but there are still rampant shortages and purchase limits depending on what part of the country you are in. Sorry, but that’s the real world.

“but there are still rampant shortages and purchase limits depending on what part of the country you are in. ”

then you probably should show some data or other evidence, joseph. based on the data that ltr and menzie produced, your comment is not accurate. if what you say is location dependent, it may not impact a very large percentage of the population. if that is the case, it would be unwise to make policy or prediction for the country as a whole based on those anecdotes. for example, if the location is on the gulf coast where recent hurricanes came ashore, that information is relevant to the locals but has no bearing on the rest of the country. the issues are isolated. same thing happens every hurricane season, especially severe ones.

baffling: “you probably should show some data or other evidence, joseph. based on the data that ltr and menzie produced, your comment is not accurate.”

No, I owe you nothing. Once again you have demonstrated how embarrassing it can be when academics stray out of their lane and pontificate on a subject they know nothing about.

The first embarrassment was last summer when they hastily googled lumber prices and posted a graph showing declining lumber prices declaring the spike over — but apparently had no idea that what they were looking at was not current prices but futures prices, several months ahead.

Then the second embarrassment was more recently looking at PPI prices and not realizing that these were wholesale prices on a railcar at the mill, not retail prices that consumers pay. There is still a wide gulf between the two due to shortages.

And then there was the failure to understand the structural market differences between dimensional lumber and the more important engineered wood products.

And in a brief digression in an attempt to prove prices were low, they cited a Home Depot price for sanded plywood, not realizing that sanded plywood is a very low volume specialty product that has much lower demand and little to do with home construction.

As I pointed out, the data Menzie and ltr cited were wholesale producer prices, not retail, so prove nothing.

The fact is that at the retail level, plywood that was $10 to $15 pre-pandemic is still $25 to $30. Oriented strand board that was $8 pre-pandemic is still $20 to $25. These prices are certainly better than the $60 to $80 prices in mid-summer but still quite high.

Last summer I argued against the so-called experts here that it was all over (based on their mistaken interpretation of futures) and I said that prices would not return to anything normal until the fourth quarter — and here we are, improved but still not back to normal.

After all these embarrassments you would think the keyboard commando “lumber experts” would at least back off. I assume an apology is too much to ask.

Again, is this data local to an area or applies across the country? And if it applies across the country, then it implies a market failure. Why should wholesalers not profit from the higher prices? I would imagine this occurs when regional impacts control prices, not national. So again, show me some data that applies to the country as a whole. Or are you providing retail pricing from spot checks at the local home depot?

I would assume wholesale prices are a better long term trend predictor than retail prices.

Why don’t you use your own lazy a** and check for yourself. Nothing I say will convince you. You spend 30 seconds googling a FRED chart and say “Pish tish, my work here is done.”

Baffling: “I would assume wholesale prices are a better long term trend predictor than retail prices.”

Which is exactly what I have been saying since last summer, with emphasis on “long term,” when you and everyone else were declaring the price spikes over and done based on a futures chart. The same for the PPI. Retail prices are still high but gradually coming down, but months after you were saying it was all over.

What is “high?” Well, everyone says that 10% increases in used car prices is high. A 25% increase in energy prices is high. But when it comes to lumber, prices that are still today 100% to 200% higher than pre-pandemic you say no big deal.

I’m not saying you are stupid. I’m saying you are obstinately ignorant. Because to do otherwise would be having to admit you were wrong and that is too much to bear.

Joseph, not sure where the anger is coming from. I was not one arguing with you about lumber prices in the past. I simply observed the data produced by prof chinn and ltr showed price drops. You said prices in retail did not, and theirs was wholesale. I was interested in that retail data, but not sure where you got it. Rather than being insulting, i thought you would provide your data source to an interested party. Guess i was wrong.

“Prices for dimensional lumber have come down a lot, but prices for engineered wood products such as plywood, oriented strand board and laminated beams are still quite high.”

Or “Prices for engineered wood products have come down a lot, but dimensional lumber is still quite high.”

Without quantifying, you can sweep all of kinds of stuff under the rug of innumeracy. Plywood prices are down 41% in September from July. Softwood lumber down 53%. Both strike me as “down a lot”. Both still high relative to the pre-pandemic period. Claiming that they are behaving very differently is a stretch.

https://www.nytimes.com/2021/10/14/business/energy-environment/oil-production-state-owned-companies.html

October 14, 2021

As Western Oil Giants Cut Production, State-Owned Companies Step Up

In the Middle East, Africa and Latin America, government-owned energy companies are increasing oil and natural gas production as U.S. and European companies pare supply because of climate concerns.

By Clifford Krauss

HOUSTON — After years of pumping more oil and gas, Western energy giants like BP, Royal Dutch Shell, Exxon Mobil and Chevron are slowing down production as they switch to renewable energy or cut costs after being bruised by the pandemic.

But that doesn’t mean that the world will have less oil. That’s because state-owned oil companies in the Middle East, North Africa and Latin America are taking advantage of the cutbacks by investor-owned oil companies by cranking up their production.

This massive shift could reverse a decade-long trend of rising domestic oil and gas production that turned the United States into a net exporter of oil, gasoline, natural gas and other petroleum products, and make America more dependent on the Organization of the Petroleum Exporting Countries, authoritarian leaders and politically unstable countries.

The push by governments to increase oil and gas production means it could take decades for global fossil fuel supplies to decline unless there is a sharp drop in demand for such fuels.

President Biden has effectively accepted the idea that the United States will rely more on foreign oil, at least for the next few years. His administration has been calling on OPEC and its allies to boost production to help bring down rising oil and gasoline prices, even as it seeks to limit the growth of oil and gas production on federal lands and waters.

The administration’s approach is a function of the two conflicting priorities: Mr. Biden wants to get the world to move away from fossil fuels while protecting Americans from a spike in energy prices. In the short run, it is hard to achieve both goals because most people cannot easily replace internal combustion engine cars, gas furnaces and other fossil fuel-based products with versions that run on electricity generated from wind turbines, solar panels and other renewable sources of energy.

Western oil companies are also under pressure from investors and environmental activists who are demanding a rapid transition to clean energy. Some U.S. producers have said they are reluctant to invest more because they fear oil prices will fall again or because banks and investors are less willing to finance their operations. As a result some are selling off parts of their fossil fuel empires or are simply spending less on new oil and gas fields….

the writer should spend some time with eia inventory sheets for usa!

what he has right is the biden regine is out to stop us crude and gas production. as well as make domestic transit of crude inefficient.

inputs to us refineries are running about avg, a lot more crude imported than last year.

perhaps, #baresshelvesbiden may not make a winter energy crisis……

hashtag: #freezeindarkbiden coming soon?

You have it in for Biden but please come up with something that makes at least a lick of sense.

#bareshelvebiden

biden is easy; i chuckle more at your jabs.

biden has not done anything to reduce production of us crude and gas today. paddy, you are simply fear mongering an agenda.

And, inflation is only an ‘issue’ among the wealthy!

Apparently, you are among the 36% of Americans that do not see how Empty=Shelves Biden’s puppeteers are pushing down the accelerator to a massive train wreck.

Lot’s of luck with that!

i do not predict the future, but someone should have worried the la/lgb ports in june!

i see what is being done and it is not a reliable supply chain operation.. unless dept of energy want to risk energy supplied.

1 Oct eia report 7 day average usa imports up >2million bbl/day (yoy), and stocks declined slightly.

8 Oct report that is down to .7mbbl/day more imports than yoy. stock down a bit but input to refineries moved positive wow!

the stock reduction may be okay, last year we had low demand and cheap per barrel oil and filled a lot of tankage.

imports from reducing domestic output exceeds opec+ increase by a lot.

to be fair inputs to refineries was better than 1 oct report but may not effect the lower distillate stocks reflected in the reports.

may be spring of 1974 won’t be repeated bc that is what got jimmy carter elected……

“This massive shift could reverse a decade-long trend of rising domestic oil and gas production that turned the United States into a net exporter of oil, gasoline, natural gas and other petroleum products, and make America more dependent on the Organization of the Petroleum Exporting Countries, authoritarian leaders and politically unstable countries.”

Wow – this is really dumb. OK, the Middle East oil reserves get depleted more quickly and the oil reserves elsewhere are depleted more slowly. So by 2040 – we will have the oil reserves and the Saudis will be out to lunch.

i would like a little more instruction on preserving us reserves for a rainy day in 2040….?

If we are relying on oil reserves in 2040, then we have a problem. I would hope all oil producers are in economic turmoil by then. In 20 years oil should be considered taboo. There is no way oil will be the cheaper and better energy producer after another 20 years of electric and hydrogen improvements.

https://fred.stlouisfed.org/graph/?g=ufab

January 15, 2018

Real Average Hourly Earnings in Transportation and Warehousing, * 1980-2021

* Production and nonsupervisory employees

(Indexed to 1980)

https://fred.stlouisfed.org/graph/?g=Gah1

January 15, 2018

Real Average Hourly Earnings in Transportation and Warehousing, * 2017-2021

* Production and nonsupervisory employees

(Indexed to 2017)

A chart proving what a few of us have been saying about the logistics crisis. These drivers have seen a 25% decline in their real pay since 1980. Time to give them hefty pay increases!

Larry Summers today on Bloomberg:

Summers castigated monetary policy makers in the U.S. and elsewhere for paying too much attention to social issues and not enough to the biggest risk to inflation since the 1970s!!!

“We have a generation of central bankers who are defining themselves by their wokeness. They are defining themselves by how socially concerned they are.”

Can we agree that Summers has gone full on sociopath loony tunes? Yes, Summers is saying that the Dual Mandate, written into law, is “wokeness.”

Economics can only advance when all of the economists alive in the 1970s are dead. As Planck said, science progresses one funeral at at time.

“Can we agree that Summers has gone full on sociopath loony tunes? Yes, Summers is saying that the Dual Mandate, written into law, is “wokeness.””

Obviously, Summers needs to hire an economically literate editor. He’s become an attention hog; he seems put out that we all are not swanning at his every word, eager to hear his latest brain droppings. At this point, I think he’s ready for a regular gig on Faux News. He can join the other cranks & crackpots, as well as the goldbugs. He should feel right at home.

For myself, I intend to return to ignoring him as often as I can.

sumners is slowly going down the path of peter navarro. obviously peter was never as respected in the field. but both of them have steadily gone down the rabbit hole with age. sumners has a hard time accepting that he is neither relevant nor important anymore. he has been correct on some things. but he has been wrong far too many times to be taken seriously anymore.

Summers is saying just the opposite of what JohnH has been trying to say. For once in a blue moon, I tend to agree more with JohnH than the eminent Lawrence Summers!

Peter Diamond needs to die for there to be progress in economics? Janet Yellen? David Card?

Ignorance is bile, I guess.

I too am not convinced it’s Fed “wokeness.”

Other than that, Summers inflation concerns may be justified.

On top of $6 or $7 trillion [two-times what other nations did] COVID money pumped by the Government, The Fed contributes to inflation by continual, huge quantitative easing; massive growth in M1 and monetary base; too long [sound familiar?] keeping rates targets near zero.

Apparently, except the four boom years when Trump was writing mean tweets, the US’s tepid economy is dependent on eternal, massive QEs and near-zero rates [plus huge fiscal/deficit spending] . . . or it ‘curtains’ as it were.

“Apparently, except the four boom years when Trump was writing mean tweets,”

for the most part, the trump years were defined by economic growth on par with obama. the national debt rose nearly $8 trillion dollars under trump’s 4 years in office. trump nearly exceeded the increase in debt over the 8 years of obama’s 2 terms. tshaw, i think you misunderstand who/how money was spent over the past decade or so.

You’re correct.

I should have said the triumphant Trump first three years.

To prop up Obama’s tepid economic results, the Fed had to maintain rates at near zero and add $!.6 trillion in QE from 2011 through 2014; plus $9 trillion deficit spending.

Conversely, in 2017 and 2018 the apolitical Fed raised short rate targets to 2.25% to 2.50% I 9/2018, and no added QE.

If Trump had not successfully built up the economy, the last year’s (2020) [Covid – edited MDC] catastrophes/lockdowns would have been worse. As it was, it nearly destroyed everything, except equities markets, housing markets, US car sales, . . .

In Trump’s first three years the debt rose by $3+ trillion [$22.5 trillion in 9/2019 from $19.6 trillion 9/2016]. Sadly, similar to Obama’s $9 trillion over eight years [$19.6 trillion 9/2016 from $10.1 trillion 9/2008].

T.Shaw: I have edited for racist language. I will ban you if you persist in this behavior.

What does T. Shaw think about Ukrainians??

https://www.nytimes.com/2021/10/15/nyregion/adam-laxalt-lev-parnas.html

“Conversely, in 2017 and 2018 the apolitical Fed raised short rate targets to 2.25% to 2.50% I 9/2018, and no added QE.”

not sure what you are complaining about. this is exactly what trump said should be done during the election cycle, and even previous to the election.

“In Trump’s first three years the debt rose by $3+ trillion [$22.5 trillion in 9/2019 from $19.6 trillion 9/2016]. Sadly, similar to Obama’s $9 trillion over eight years [$19.6 trillion 9/2016 from $10.1 trillion 9/2008].”

implied in this statement is that obama should be blamed for the financial crisis, and trump has no responsibility for the covid crisis. you are a joke tshaw. it is the analysis of a partisan hack.

T. Shaw,

The pandemic year of 2020 was a “boom year”? Just how out of it are you?

You’re right!

I meant the three Trump triumphant years before the [Covid -edited MDC] was unleashed on the world.

Yea we read your Trumpian cheerleading already – none of it made any sense but I’m sure Kelly Anne Conway was turned on.

I know prof chinn is more tolerant, but your ethnic slander would be grounds for commenter banning in my book. This issue has been discussed extensively on this site.

My assessment aligns with that of Larry Summers. Where does that 32% rise in M2 go if the velocity of money returns to normal? Perhaps it will be withdrawn, with the housing and stock markets crashing as a result. Perhaps velocity does not recover. Perhaps the internationalization of the dollar will allow some of it to be soaked up overseas. Do I believe the Fed has the stomach to tank the markets? No. So that means they remain committed to a loose monetary policy, and that means most of the 32% — and whatever is to follow — manifests as inflation. So it seems to be inflation or recession.

so it goes…..

“Where does that 32% rise in M2 go if the velocity of money returns to normal?”

WTF? If you had been paying the least little attention to the posts from our host on this outdated junk science you would have not asked such an incredibly dumb question. Plot GDP/M2 or GDP/M1 over time (FRED has both series) and you will see why this may be the dumbest question in the history of time!

“So that means they remain committed to a loose monetary policy, and that means most of the 32% — and whatever is to follow — manifests as inflation.”

people were saying the same thing 15 years ago during the financial crisis. and inflation never materialized. steven, i would bet you were making similar arguments then as well. so tell me, how is it different today?

“so tell me, how is it different today?”

He can’t based on the facts. Again – let’s plot GDP/M2 or GDP/M1 and see how stupid the idea that velocity is some sort of constant really is.

Steven,

Velocity of money has not been “noirmal” or at least stable since the mid-1980s.

https://fred.stlouisfed.org/series/M2V

Monetarists used to tell us GDP/M2 hovered around 1.8. They stopped making this claim some 13 years ago. Someone should ask Stevie boy if he thinks “velocity” is about to jump from around 1.1 to 1.8 any time soon.

BTW – we have a new post on this topic to check out!!!

“My assessment aligns with that of Larry Summers.”

Wasted sentence if ever there was one. Your assessment orthogonal to reality and your language gaasy as a well-fes heifer.

https://www.nytimes.com/2021/10/14/opinion/workers-quitting-wages.html

October 14, 2021

The Revolt of the American Worker

By Paul Krugman

All happy economies are alike; each unhappy economy is unhappy in its own way.

In the aftermath of the 2008 financial crisis, the economy’s problems were all about inadequate demand. The housing boom had gone bust; consumers weren’t spending enough to fill the gap; the Obama stimulus, designed to boost demand, was too small and short-lived.

In 2021, by contrast, many of our problems seem to be about inadequate supply. Goods can’t reach consumers because ports are clogged; a shortage of semiconductor chips has crimped auto production; many employers report that they’re having a hard time finding workers.

Much of this is probably transitory, although supply-chain disruptions will clearly last for a while. But something more fundamental and lasting may be happening in the labor market. Long-suffering American workers, who have been underpaid and overworked for years, may have hit their breaking point.

About those supply-chain issues: It’s important to realize that more goods are reaching Americans than ever before. The problem is that despite increased deliveries, the system isn’t managing to keep up with extraordinary demand.

Earlier in the pandemic, people compensated for the loss of many services by buying stuff instead. People who couldn’t eat out remodeled their kitchens. People who couldn’t go to gyms bought home exercise equipment.

The result was an astonishing surge in purchases of everything from household appliances to consumer electronics. Early this year real spending on durable goods was more than 30 percent above prepandemic levels, and it’s still very high.

But things will improve. As Covid-19 subsides and life gradually returns to normal, consumers will buy more services and less stuff, reducing the pressure on ports, trucking and railroads.

The labor situation, by contrast, looks like a genuine reduction in supply. Total employment is still five million below its prepandemic peak. Employment in the leisure and hospitality sector is still down more than 9 percent. Yet everything we see suggests a very tight labor market.

On one side, workers are quitting their jobs at unprecedented rates, a sign that they’re confident about finding new jobs. On the other side, employers aren’t just whining about labor shortages, they’re trying to attract workers with pay increases. Over the past six months wages of leisure and hospitality workers have risen at an annual rate of 18 percent, and they are now well above their prepandemic trend.

The sellers’ market in labor has also emboldened union members, who have been much more willing than usual to go on strike after receiving contract offers they consider inadequate.

But why are we experiencing what many are calling the Great Resignation, with so many workers either quitting or demanding higher pay and better working conditions to stay? …

https://fred.stlouisfed.org/graph/?g=yWG2

January 4, 2018

United States Labor Force Participation Rates for men and women, * 2017-2021

* Employment age 25-54

we are seeing small restaurants closing at odd times or going out of business for lack of workers…. i don’t think the services bottleneck will be any easier to solve than the longshoreman’s union bottlenecks.

some restaurants are closing on sunday and monday, and nightly by 9pm. years ago, when i was a child, no restaurant was open during those times either. this is not necessarily a problem.

“going out of business for lack of workers”

actually they are not going out of business for lack of workers. they are going out of business because they are a poorly run business. there are too many restaurants that are THRIVING right now to blame lack of workers. it is poorly run businesses who go under. well run businesses are doing very well. the restaurant business is tough to begin with. it does not take much to go under. blaming workers is garbage.

baffling,

Here’s a recent bit of research reaching the same conclusion:

https://voxeu.org/article/reallocation-effects-minimum-wage

Done in Germany, where structural differences may cause different outcomes, but maybe not.

The troubling part is that inefficient firms, in the authors’ view, were smaller firms. A rising minimum wage (so I assume rising wages in general) helps workers, but hurts small firms. More concentration is not necessarily good. Otherwise, bring on the wage increases!

I think that is a valid point that larger firms can be more efficient. That said, small firms can be more nimble and make up ground. The emergence of fintech can help small firms tremendously. I am always impressed with how square has improved the checkout experience at the local cafes. Years ago, my lawn guy used quicken online and payments were easy. Today i need to leave a check under the front mat for the lawn guy. He has plenty of room to improve if he wants to grow his business. Otherwise somebody will come along that is cheaper and more profitable.

i am reading the local social nedia….

can’t drive up for a cup of coffee at 4 PM…

Gee – bars in my neighborhood may close at 1AM rather than 4AM. Like I care because I’m in bed well before then.

The quit rate certainly reflects increased ease of finding better work. It probably also reflects a higher cost of working. A labor shortage manifested as reduced availability of child care leads to a further reduction in labor supply. Draconian demands on workers because of unfilled positions leads to a further reduction in labor supply. Positive feedback in action.

If ease of finding a better job is all that has boosted quits, some future equilibrium will look like our earlier equilibrium. If a higher cost of working is a big driver of quits, the future equilibrium will look quite different from our past equilibrium.

https://www.nytimes.com/2021/10/15/business/economy/rent-inflation.html

October 15, 2021

Rising Rents Are Fueling Inflation, Posing Trouble for the Fed

Economic policymakers have said inflation will prove temporary, but rising rents may challenge that view and pressure Washington to react.

By Jeanna Smialek

Terrell McCallum, a private wealth adviser in Dallas, spends a lot of time thinking about markets and interest rates. He knows that the Federal Reserve targets 2 percent annual price increases on average, so it was a shock when he learned that his rent would increase a whopping 10 percent this year.

“I can afford it, but it gets to the brink of financial burden,” said Mr. McCallum, 33. He and his wife have been saving up for their first home, but now that they are paying $1,830 for their apartment and fees, that will become more difficult. He tried to push back on the increase, but the company he rents from wouldn’t budge.

“They said: ‘This is what the market is doing.’”

Mr. McCallum’s experience is echoing across America, as rents shoot higher after a brief pandemic slump, burdening households and fueling overall inflation. That is bad news for the Federal Reserve, because it could make today’s uncomfortably rapid price gains last longer. It’s also problematic for the White House because it hits households right in their pocketbooks, diminishing well-being and fueling unhappiness among voters.

The jump in rents stemmed from a frenzy in the market for owned homes. People tried to buy as the pandemic took hold in the United States, often searching for extra space, but found that houses were in short supply after years of under-building following the housing crisis. That dearth of properties has been exacerbated by work stoppages, supply shortages and labor constraints during the coronavirus era, all of which have kept developers from ramping up production to meet demand….

https://fred.stlouisfed.org/graph/?g=CgJo

January 15, 2020

Sticky Consumer Price Index and Sticky Consumer Price Index less Shelter, 2020-2021

(Percent change)

“The jump in rents stemmed from a frenzy in the market for owned homes.”

Cause and effect? Could it be that the price of houses (an asset) are high because rents (a flow) have increased? BTW in rational markets, values of assets reflect expected cash flows over an extended period of time so maybe we will have to get used to high rents.

Now maybe markets are not that efficient. After all Princeton Steve’s hair is on fire over some alleged housing bubble.

I remember building our home in 2010 and finding out that lumber prices had skyrocketed. Odd that the chart doesn’t reflect that.

https://futures.tradingcharts.com/historical/LU/2010/0/continuous.html

“I remember building our home in 2010 and finding out that lumber prices had skyrocketed. Odd that the chart doesn’t reflect that.”

Gee Bruce – Menzie’s charts show lumber prices in real terms were very low in 2010. So you did not need to provide another chart.

Now maybe you were buying lumber at JohnH’s local store. I have a little suggestion for the two of you. Google “Home Depot” to find the closest one of their stores to where you live.

Bruce Hall: Your comment highlights the need for perspective. I suspect you were noticing the spike up from the very low prices at the end of the Great Recession (mid-2009). By March 2010, lumber prices had risen 37%.

Same with oil prices which were very high in early 2008 but plummeted the rest of the year. And so Republicans took the oil prices at the end of the year as some sort of norm and bashed Obama over some alleged record oil price increase. Volatility is sort of a license for political liars!

oil is priced in dollars, oil contracts are effected by dollar inflation as well as demand and supply.

what the loyal opposition to obama was saying ‘better management of supply and lower inflation could effect price at pump….’

or less kind: obama was out to make gas and stove oil expensive for the green ‘movement’s’ agenda.

“I remember building our home in 2010 and finding out that lumber prices had skyrocketed. Odd that the chart doesn’t reflect that.”

Can you say ‘base effects’?

I’m a little late with this historical chart of the capital gains tax rate v. the top rate on ordinary income. We had a few great suggestions about how to simplify the tax code and to properly tax capital income when Sammy chimed in with his usual rightwing knownothingism claiming we need preferential capital gains tax rates to induce more investment. There were lots of rebuttals followed by Sammy doing one of his really dumb demonstrations claimed lower rates raise expected returns EVEN AFTER I asked this know nothing to note they also raised after-tax risks.

But hey – Sammy never learned to read actual economics. There was one claim we had strong investment in the pre Saint Reagan days even though we had high capital gains tax rates. Well – not so fast. We have always had preferential capital gains tax treatment with the one exception being the short aftermath of the 1986 tax reform, which was the byproduct of the excellent advice from Martin Feldstein. Not that Feldstein’s boss (St. Reagan) or Sammy ever understood what Feldstein tried to get across.

http://www.forbestadvice.com/Money/Taxes/Federal-Tax-Rates/Historical_Federal_Capital_Gains_Tax_Rates_History.html

I was trying to make sense out of some Action Aid accusation that a British multinational has been abusing transfer pricing to rip off South Africa when I decided I needed to understand the various reporting of sugar prices (No. 11 v. No. 16). No. is a global price of raw sugar (no processing and none of those pesky American tariffs) and OMG, this price has double from $0.10 a pound in April 2020 to nearly $0.20 a pound now. Time of JohnH to jump up and down with his hair on fire. Oh wait, this price recently was $0.30 a pound:

https://fred.stlouisfed.org/series/PSUGAISAUSDM

Never mind! But don’t ask me as I have not bought sugar in the last 15 years.

https://www.nytimes.com/2021/10/15/opinion/us-economy-inflation.html

October 15, 2021

Wonking Out: The power of “nobody knows”

By Paul Krugman

What’s happening to inflation? We know, of course, what the current numbers say: Inflation is high right now, although not 1970s high. But is this a blip or the beginning of a longer-term problem? Economists are deeply divided. I’m basically for the former, on what has come to be known as Team Transitory, but I might be wrong — and the data are sufficiently ambiguous that both sides can claim that the evidence supports their take.

Yet policymakers can’t just shrug their shoulders; they have to, um, make policy. So what should they do in the face of uncertainty? The answer, I’d argue, is to make decisions that won’t do too much damage if their preferred take on inflation is wrong.

In the current context this means that the Federal Reserve should ignore calls for a quick tightening of monetary policy.

Why is it so hard to make a call on inflation right now? Because the current economy, still very much shaped by the pandemic, is, to use the technical term, weird. In particular, the standard measures economists use to distinguish between temporary price blips and underlying inflation are telling different stories.

The traditional measure of underlying inflation is the rate of change in the “core” price index, which excludes volatile food and energy prices. But there are alternative measures, like the median (as opposed to average) change in prices, which excludes drastic price moves in any sector.

During the last economic crisis it didn’t matter much which measure you used. All of them had the same message: Don’t panic. For example, when headline inflation was running hot in the winter of 2010-11, leading Republicans berated Ben Bernanke, the Fed chair, for loosening credit, warning that easy money might “debase” the dollar. But measures of underlying inflation were low and stable:

https://static01.nyt.com/images/2021/10/15/opinion/krugman151021_1/krugman151021_1-articleLarge.png

When core inflation gave the right advice.

So the Fed stayed the course, and it was right.

These days, however, the different measures are telling very different stories:

https://static01.nyt.com/images/2021/10/15/opinion/krugman151021_2/krugman151021_2-articleLarge.png

We live in confusing times.

A few months ago core inflation was looking high, driven by things like used-car prices — which clearly don’t represent underlying inflation, but are still part of the standard measure — while median inflation was subdued. More recently, core has subsided, but median inflation — mainly reflecting shelter prices — has surged.

So how serious is the inflation problem? We can argue about that, but maybe the crucial point is that nobody is going to win that argument in time to give helpful guidance to policymakers. Sorry, but ranting on cable TV and tweeting in CAPITAL LETTERS isn’t going to settle this.

So what should guide policy? I’d suggest that we heed the advice of Oliver Cromwell: “I beseech you, in the bowels of Christ, think it possible you may be mistaken.” (OK, you can maybe skip the gastroenterology.)

Consider, as an example of what not to do, the fate of the Obama stimulus package that was enacted in 2009.

It’s now clear that while stimulus was necessary, the actual plan was much too small and short-lived (as some of us warned at the time). Why the undershoot?

Part of the answer is that the administration’s economic forecast was excessively optimistic, envisioning the kind of quick recovery that rarely happens in the aftermath of financial crises. But the larger problem was a failure to think through what would happen if the forecast was wrong.

If the stimulus had turned out to be too big, that wouldn’t have been a big problem: The Fed could have raised interest rates a bit to head off overheating. But if the stimulus proved too small, the Fed couldn’t cut rates because they were already zero. So then what? …

https://fred.stlouisfed.org/graph/?g=HNkW

January 15, 2018

Median Consumer Price Index, * Consumer Price Index less food & energy and Consumer Price Index, ** 2007-2021

( * Percent change and ** Compounded change)

https://fred.stlouisfed.org/graph/?g=HNl3

January 15, 2020

Median Consumer Price Index, * Consumer Price Index less food & energy and Consumer Price Index, ** 2020-2021

( * Percent change and ** Compounded change)

https://fred.stlouisfed.org/graph/?g=HNvT

January 30, 2018

Global Price for Sugar, 2000-2021

(Percent change)