I thought this had been determined half a century ago, but just to remind people in case they’d forgotten.

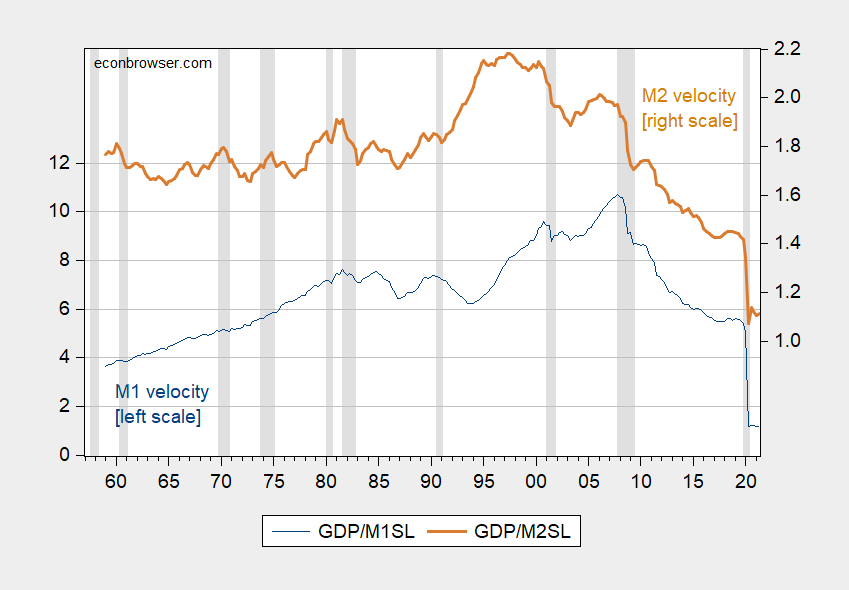

Figure 1: M1 velocity (nominal GDP divided by M1, end-of-quarter) (blue, left scale), and M2 velocity (brown, right scale). Source: BEA, Federal Reserve data via FRED, NBER, and author’s calculations.

If you want to use the Quantity Theory to predict future inflation, well, be my guest.

There are about a gazillion articles on what determines velocity, but interest rates are the most obvious, followed by financial innovation (just think about the money demand equation that is buried somewhere in some versions of the Quantity Theory).

https://fred.stlouisfed.org/graph/?g=BkzA

February 25, 2015

Velocity of M2 money stock, * 1960-2014

* http://krugman.blogs.nytimes.com/2015/02/25/monetarism-in-winter/

The velocity of M2 — the ratio of nominal Gross Domestic Product to a broadly defined version of the money supply — has turned out to be hugely variable.

Paul Krugman

https://krugman.blogs.nytimes.com/2015/02/25/monetarism-in-winter/

February 25, 2015

Monetarism in Winter

By Paul Krugman

Brad DeLong is writing about “cognitive closure” on the right, and focuses on the case of Allan Meltzer, * the long-time monetarist standard-bearer and co-founder of the Shadow Open Market Committee. ** Meltzer has been predicting inflation, just around the corner, for six years; the experience apparently has had no impact on his conviction that he understands the economy better than the Federal Reserve. And he considers it rude and unprofessional when some of us point out how wrong he has been for how long.

But there’s one thing that struck me in particular about the last entry *** in Brad’s bill of particulars, where Meltzer says this:

“The Fed’s third major error is its baffling inattention to the growth of monetary and credit aggregates. Central banks supply the raw material on which financial markets build the credit and money magnitudes. The reason given for neglecting these aggregates is usually a claim they are unstable. That is true only, if at all, of quarterly values. It is not true of medium- and longer-term values, as many researchers have shown.”

I’m not sure what Meltzer is saying here, exactly. Surely the claim is not so much that the aggregates are unstable as that the relationship between those aggregates and variables of interest — like inflation — is unstable. Now, where might the Fed have gotten that idea? Maybe from this:

https://static01.nyt.com/images/2015/02/25/opinion/022515krugman3/022515krugman3-blog480.png

The velocity of M2 — the ratio of nominal Gross Domestic Product to a broadly defined version of the money supply — has turned out to be hugely variable. Once upon a time Milton Friedman called for slow, steady growth in M2 as the key to a stable economy; surely you can’t think that makes sense given developments since the mid-1980s.

But here we have Meltzer insisting that the Fed is making a terrible mistake by not worrying about monetary aggregates, and complaining bitterly about those who question whether, given his track record, he has any authority to lecture the Fed. It’s really very sad.

* http://www.bradford-delong.com/2015/02/five-years-ago-meltzer-on-inflation-econtalk-library-of-economics-and-liberty.html

** http://en.wikipedia.org/wiki/Shadow_Open_Market_Committee

*** http://www.economics21.org/commentary/allan-meltzer-fed-reserve-financial-crisis-2015-02-05

“There are about a gazillion articles on what determines velocity”.

Something tells me Princeton Steve has not bothered to ready any of these articles. In fact, it seems he has skipped reading all of your previous posts on this topic.

Well yeah. Central Banks don’t create money. Why markets liberals can’t see this is step 1 of their failure. So the Fed has a higher “balance sheet” worth of “bonds”. But deal. The government is pumping out so many bonds now, what the “Fed” buys isn’t enough to matter. Matter of fact, “QE” is nothing more than a gimmick the Fed uses when it decides to go to 0% rates on the one year note. To make it look like it matters.

Velocity is down because the impact of the industrial revolution really petered out in the 2000’s. The economy can’t grow much. 1.5% is a fair rate for stability. This kind of denial is a market liberal failure.

Good lord, what a lot of gibberish! If you want to be part of a conversation, you have to learn how to actually say something.

Of course, if all you want is to stand on a soap box and shout, you’re doing great.

Just for giggles, I figured I would check out this 2018 discussion from the American Institute for Economic Research, which is about as monetarist as it gets:

https://www.aier.org/article/what-is-money-velocity-and-why-does-it-matter/

It turns out this author is aware of the wide swings in velocity. Note he even covers GDP/M1 during the Great Depression where the Quantity Theory of Money fared very poorly. But something else Princeton Steve has not bothered to read!

Menzie,

You recently linked to analysis (such as it was) relying on M3. Here’s M3 velocity, for the curious:

https://fred.stlouisfed.org/graph/?g=

The story is, of course, the same as for other Ms.

Crud. Try again. Hope it works this time. It’s just nominal U.S. GDP over the OECD’s U.S. M3 series.

https://fred.stlouisfed.org/graph/?g=HNXH

https://cepr.net/the-high-paid-media-types-are-unhappy-workers-are-getting-higher-pay/

October 14, 2021

The High-Paid Media Types Are Unhappy Workers Are Getting Higher Pay

By DEAN BAKER

Many in the media are very upset that workers at the bottom end of the pay scale feel secure enough to demand higher pay and better working conditions. Yesterday, I had the pleasure of watching a television anchor, who earns $6 million a year, complain that 3 percent of the workforce quit their job in August. They seemed to find the idea of workers quitting unsatisfactory jobs appalling.

For those of us who think that all workers should be able to get decent pay, have decent working conditions, and be treated with respect on the job, the idea that large numbers of workers now feel they can quit jobs they don’t like is really great news. And, the increased labor market power for those at the bottom of the ladder is showing up in higher pay.

Here’s the story for production and non-supervisory workers in six of the lowest-paying industries. Note, these numbers are adjusted for inflation, so they take account of the extent to which higher prices have reduced purchasing power since the start of the pandemic.

https://cepr.net/wp-content/uploads/2021/10/Book3_30236_image001.png

The biggest gains were for workers in hotels and convenience stores who have seen their inflation-adjusted hourly wage increase by 9.0 percent and 8.6 percent, respectively, since the pandemic began. Workers in restaurants have seen their hourly pay rise by 5.6 percent, while workers in nursing homes have seen their pay rise by 4.6 percent. Child care and home health care workers have seen much more limited inflation-adjusted wage gains, getting increases of 1.9 percent and 1.4 percent, respectively.

It is important to remember that these gains are over just a one-and-a-half-year period. These workers have a long way to go before they have anything resembling a livable wage, but this is impressive progress in at least some of these low-paying industries.

There has been a sharp drop in employment in both home health care and child care since the start of the pandemic. These sectors will have a hard time getting back workers unless they can offer better pay and conditions. That will be difficult for them to do without more government support, pointing again to the importance of Biden’s Build Back Better agenda.

In any case, after decades of wage stagnation for those at the middle and the bottom of the wage ladder, it’s good to see some real progress for at least some low-paid workers. The folks who have rigged the economy in their favor so they can get big bucks may not like the fact that it’s harder to get good help, but them’s the breaks.

This brings back a lot of memories. I also thought the demand for money was not stable either

omg half a century agian i was a sr in college!

Me [expletive-deleted] too.

Velocity has nothing to do with the speed at which money travels.

http://www.philipji.com/mitem/2014-04-02/the-velocity-of-money-is-a-function-of-interest-rates

“Velocity has nothing to do with the speed at which money travels.”

Wow, that’s enlightening. Um,…who said it did? Money “travels” in wallets, armored cars and drug lords’ steamer trunks. It “turns over” in transactions. What does travelling have to do with the discussion? And Menzie already pointed out the connection to interest rates in his post, so what’s your point?

Tangentially, according to Fed data there is approximately $2 trillion in Federal Reserve Notes in circulation. That $2 trillion in currency compares in magnitude with $2+ trillion aggregate value of Bitcoin; $6.1 trillion Monetary Base;.$11 trillion aggregate value of gold in existence; $19.7 trillion M1; $40 or $50 [depending] trillion in US equities market value; and $!41.7 trillion is estimated US household net worth.

It seems to work.

You are comparing the world value of gold, Bitcoin, etc. to the US value of currency? Come dude – enough of your irrelevant babble.

Hope I made your day.

You are indeed the Klass Klown!

https://cepr.net/if-this-is-a-wage-price-spiral-why-are-profits-soaring/

October 16, 2021

If This is a Wage-Price Spiral, Why Are Profits Soaring?

By Dean Baker

That’s the question millions are asking, even if economic reporters are not. * The classic story of a wage price spiral is that workers demand higher pay, employers are then forced to pass on higher wages in higher prices, which then leads workers to demand higher pay, repeat.

We are seeing many stories telling us that this is the world we now face. A big problem with that story is the profit share of GDP has actually risen sharply in the last two quarters from already high levels.

https://cepr.net/wp-content/uploads/2021/10/fredgraph20-768×296.png

The 12.4 percent profit share we saw in the second quarter is above the 12.2 percent peak share we saw in the 00s, and far above the 10.4 percent peak share in the 1990s. In other words, it hardly seems as though businesses are being forced by costs to push up prices. It instead looks like they are taking advantage of presumably temporary shortages to increase their profit margins.

This doesn’t mean that some businesses are not in fact being squeezed. We are seeing rapidly rising wages for low-paid workers. ** That is putting a strain on many restaurants and other businesses that pay low wages.

That is unfortunate for them, but this is the way capitalism works. The reason we don’t still have half our population working on farms is that workers had the opportunity to work at higher paying jobs in manufacturing. If workers now have the option to work at better paying jobs, the restaurants that can adapt to higher pay will stay in business, but some obviously will not.

* https://www.washingtonpost.com/business/2021/10/15/us-economy-inflation-uncomfortable/

** https://cepr.net/the-high-paid-media-types-are-unhappy-workers-are-getting-higher-pay/

https://fred.stlouisfed.org/graph/?g=EqSq

January 30, 2018

Labor Share of Nonfarm Business Income and Real After-Tax Corporate Profits, 2017-2021

(Indexed to 2017)

Increase in labor share of income:

102.5 – 100 = 2.5%

Increase in real profits:

124.9 – 100 = 24.9%

Amazing how many capitalists don’t seem to understand that prices are always set to “as much as we can get”. That goes whether or not the cost of making products/services goes up or down. If there is an opportunity to raise prices (shortages) they will be raised, regardless – and profits increase. If production cost goes up there will be pressure to increase prices and free market forces will squeeze some producers out of the game (if they cannot swallow the cost or increase their prices enough). That adjustment on number of producers will allow prices to increase.

Not surprised that the big corporations have been able to increase profits; so many of them have been allowed to develop into oligopolies. Small service businesses are more likely to have a classic wage-price spiral for the next year. But the was long overdue since we have not raised the minimum wage with inflation for over 4 decades.

http://www.news.cn/english/2021-10/16/c_1310249804.htm

October 16, 2021

China embarks on longest-ever crewed mission for space station construction

JIUQUAN — Three Chinese astronauts aboard the Shenzhou-13 spaceship have entered China’s space station core module Tianhe, starting the country’s longest-ever crewed mission for space station construction.

The three astronauts are Zhai Zhigang, the commander and China’s first spacewalker, Wang Yaping, the first female on board China’s space station, and Ye Guangfu, a newcomer to space.

They will stay in orbit for six months, setting a new record for China’s crewed space mission duration. The current three-month record was kept by the Shenzhou-12 crew from June to September this year.

The Shenzhou-13 spaceship, atop a Long March-2F carrier rocket, was launched from the Jiuquan Satellite Launch Center in northwest China’s Gobi Desert at 12:23 a.m. (Beijing Time) on Saturday, according to the China Manned Space Agency (CMSA).

About 582 seconds after the launch, Shenzhou-13 separated from the rocket and entered its designated orbit. The crew members are in good shape and the launch is a complete success, the CMSA declared.

It is the 21st flight mission since the country’s manned space program was approved and initiated, and the second crewed mission for China’s space station project.

At 6:56 a.m., the spaceship completed the orbital status setting after entering the orbit and conducted a fast automated rendezvous and docking with the radial port of the Tianhe core module, forming a complex together with the cargo crafts Tianzhou-2 and Tianzhou-3.

The whole process took approximately 6.5 hours.

After a series of preparations, Zhai Zhigang opened the hatch of Tianhe. At 9:58 a.m., Zhai Zhigang, Wang Yaping and Ye Guangfu entered the core module one by one.

TASKS IN ORBIT

The mission will test key technologies for assembly and construction of China’s space station, such as module transfer supported by the robotic arm and manual remote operation, according to Lin Xiqiang, deputy director of the CMSA, earlier at a press conference held at the Jiuquan Satellite Launch Center.

The astronauts will perform two or three extravehicular activities (EVAs) during the mission to install the dual-arm connector, the device to link the big and small mechanical arms, as well as the suspension device, Lin said.

Wang Yaping will be the first Chinese female astronaut to participate in the EVAs.

The mission will further verify the health, living and working support technologies for astronauts’ six-month stay in orbit, he said.

The astronauts will also carry out sci-tech experiments and applications in fields such as space medicine and micro-gravity physics, as well as diversified public science education activities, he said.

The mission will achieve a comprehensive assessment of the functional performance of various project systems for carrying out space station tasks and the compatibility between systems, he added.

Wang Yaping is renowned as China’s first space teacher as she delivered a televised science lecture to an audience of over 60 million schoolchildren during her first space mission aboard the Shenzhou-10 spaceship in 2013.

She will give a new lecture during the Shenzhou-13 mission, encouraging Chinese students to bring up what they want to know about space….

Unfortunately, Congress voted in 2011 to prevent China from participating with NASA in space exploration programs. China then developed a range of independent space exploration programs that now include a manned space station that will shortly be open to scientists and astronauts from other nations. The point being that the Chinese are pragmatic and technically adept, and the space exploration programs being developed have been and will be internationally meaningful.

Menzie

Wouldn’t one way (that no one ever seems to mention) to decrease inflation be to have the govt increase taxes on rich people? The money is not being spent on anything useful and it would take money out of circulation. https://www.bloomberg.com/news/articles/2021-10-17/-2-7-trillion-in-crisis-savings-stay-hoarded-by-wary-consumers

Also it would decrease the deficit and make the GOP happy.

Thank you

James: Yes, that would be one way. I think that’s part of the reconciliation bill to withdraw aggregate demand through higher taxes weighing heavily on higher income groups, those are the offsets. But I think the Republicans are only happy with “conditional” deficit reduction – reduction when the opposing party is in power (really, the objective is to cut spending on — in their view — undesirables and undeserving). Whilst in power, they are perfectly happy with busting the budget through tax cuts for the wealthy.

I admit that this is not my area, so I may have missed something. However, it seems to me that there is this focus on money (M1 – M4) as cash/deposits. But lots of things called assets could influence the economy and inflation in just as effective a way as M1-M4 money supply.

Think about corporate stocks/bonds, they are as easy to convert into consumption as money deposits in a bank (may take a split second longer). Even real estate, art, jewelry, can be converted to consumption money (although it may take a few months). Why this obsession with M1-M4? Should we not also have an M5, that include the value of all stocks – and an M6 that include the value of all assets?

The reason we worry about high M1-M4 driving up inflation is that it supposedly represents claims on future products and services (so if people were to take such claims on products and services, that could drive generalized shortages – driving up prices). The reason that “serious people” were so wrong about inflation from Fed expanding money during the great recession – was that this money (predictably) was not able to expand consumption of products and services (it barely compensated for the recessionary loss of consumption).

If the total value of the US stock market goes from $20 trillion to $25 trillion doesn’t that represent an expansion of $5 trillion in claims on future products and services? How is that any different than if the Fed “prints” another $5 trillion? (maybe 5 of those platinum coins with Krugman’s smiling face on one side and my bare ass on the other). If one represents a dangerous potentially inflationary expansion of claims on future products and services, why wouldn’t the other?