Over seven and a half years ago, Jim remarked about Bitcoin:

Hard to know where this is all going to lead. But one thing is clear– we have added a very interesting new chapter in the history of money.

In my course on the financial system, I’ve had to update the material to include cryptocurrencies and central bank digital currencies (CBDC). Here’s some pictures of cryptocurrencies.

Figure 1: Price of bitcoin (blue), ethereum (brown), litecoin (green), in USD, in logs, 2017M01=0. NBER defined recession dates shaded gray. Source: FRED, NBER.

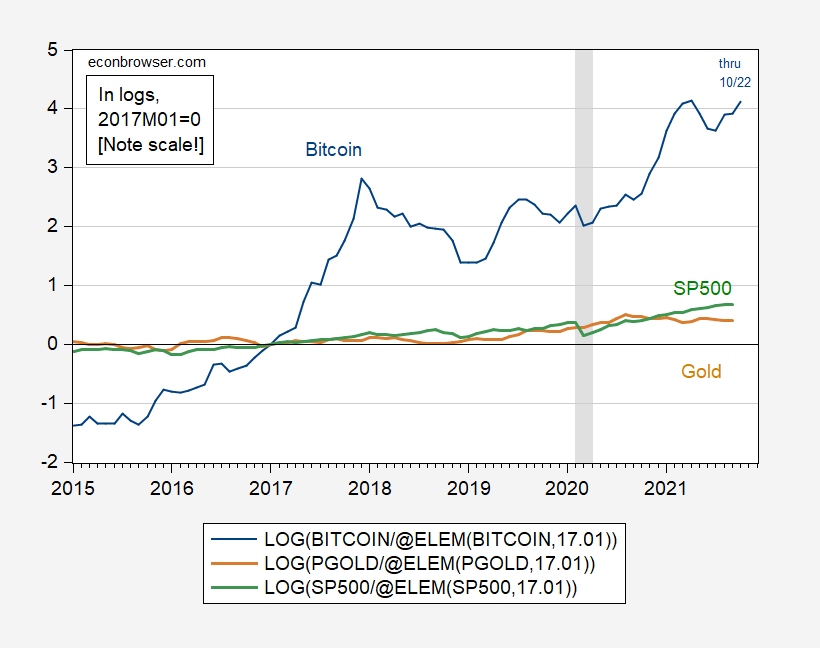

These three particular cryptocurrencies have experienced proportionately enormous appreciations. Taking bitcoin as an example, it’s clear cryptocurrency returns have been enormous compared to even the S&P 500.

Figure 2: Price of bitcoin in USD (blue), London 3pm price of gold in USD/oz. (brown), S&P 500 index (green), in logs, 2017M01=0. NBER defined recession dates shaded gray. Source: FRED, NBER.

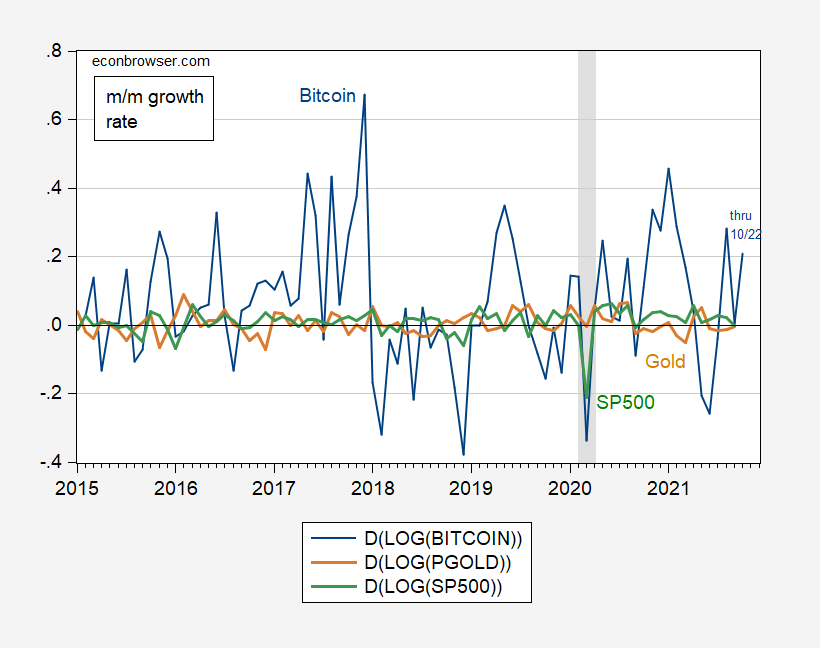

However, the month-on-month volatility of bitcoin is enormous, even dwarfing that of gold, as shown in Figure 3.

Figure 3: Month-on-month growth rate of the price of bitcoin in USD (blue), of London 3pm price of gold in USD/oz. (brown), of S&P 500 index (green), all calculated as log-differences. NBER defined recession dates shaded gray. Source: FRED, NBER.

The standard deviation of month-on-month (not annualized) changes was 2.8% and 3.9% for gold and S&P 500 respectively. For bitcoin, it’s 21.6% monthly. That means that bitcoin does not fulfill the third function of money, namely a store of value, very well.

Given this volatility, one has to wonder why one would want to hold bitcoin. In his post, Jim asks:

Why does the stuff have value in the first place? The answer is that it would be very helpful to many buyers and sellers of real goods and services if they were able to pay for transactions in this way. We can think of any form of money as an asset that provides liquidity services, which refers to the tangible benefit to its holder coming from the ability of the asset to facilitate certain transactions. The value of money, that is, the value of real stuff you’d be willing to give up to hold money, can be thought of as the present value of the stream of these future liquidity services.

Bitcoin has two potential advantages over credit cards for providing such liquidity services. First, the supporting network only needs to verify that the private code is valid, which is less costly than verifying that you are indeed the rightful owner of a credit card and are ultimately going to deliver good funds. …

Second, Bitcoins are relatively more anonymous than credit cards. In this respect, they enjoy some of the same advantages as cash….

One can formalize this argument by referring to the equation for pricing assets:

D stands for dividends when P refers to a stock price. In our context, D is the liquidity services provided by bitcoin (which can be small for those who don’t need to evade restrictions), P the price of bitcoin. If one can rule out bubbles, then a bitcoin price is equal to the present discounted value of liquidity services. However, there’s no reason to impose this assumption.

Then the price of bitcoin is moved primarily by new information that changes the information set used for forecasting the future price — in other words, the speculative motive is central.

The expected future price is in this interpretation driven by new information about the liquidity services provided by bitcoin. New regulatory measures — either tightening or loosening — should be associated with bitcoin price movements. Figure 4 highlights the role of such regulatory events, as well as the discount rate.

Figure 4: Price of bitcoin in USD (blue, left log scale), TIPS 5 year yield, in % (brown, right scale). NBER defined recession dates shaded gray. Source: FRED, NBER.

Chinese measures to rein in the use of bitcoin negatively impacted prices. On the other hand increasing acceptance of the use of bitcoin — as in the establishment of a bitcoin futures ETF — enhanced the liquidity services provided by bitcoin.

What does the future herald for the price of bitcoin? It depends on the balance between increasing regulations that limit the desirability of bitcoin as a pseudonymous means of transactions and the increasing usefulness of bitcoin as an asset class. The establishment of central bank digital currencies (CBDCs) will also certainly alter the relative desirability of cryptocurrencies.

For more, see Charles Engel’s paper on the subject. Eswar Prasad devotes considerable discussion of cryptocurrencies in his new, comprehensive assessment of the digital revolution in finance, The Future of Money.

No reply: interesting.

I have nothing to add.

Interesting. No reply.

I have nothing to add.

What happens when Mastercard facilitates transactions in bitcoin? Does it lose the anonymity? As for verifying only the accuracy of the code and not the owner does that not shift the safeguard burden to all crypto owners who are at theoretical risk of fraudulent transfers and at more risk of theft as cash dollars only exist in reality and blockchain exists in code accessible on any device (yes I get the immutable code angle except this immutability is a human invention.)

in the crypto world, i see a divergence between something like bitcoin versus ethereum. bitcoin may serve as a store of value, but it really is a difficult crypto to integrate into purchases. other coins like ether seem to be more realistically approaching the use case of purchasing, although they do not have the same hard cap on coin production as bitcoin has. bitcoin is probably not a real good proxy for the crypto world in general, going forward. ether seems to have more common characteristics to the other cryptos being developed. at any rate, i appreciate the post on cryptos. as i have said before, i have more made some small investments (very small) in the space, as an incentive to learn more about them. and there is much to learn, i have found.

prof. chinn, i am intrigued by figure 3. i anticipated large changes in growth rates for bitcoin, but this is the first time i have seen it quantified. quite a difference from the general market-more than i expected.. do you know if ether has a similar large change in growth rates, as compared to bitcoin? since it historically has not been as supply constrained as bitcoin, i wondered if it still acted the same.

baffling: By general market, do you mean cryptocurrency market? For the other two cryptocurrencies I have data on, the volatility in percent terms is comparable.

sorry prof chinn, by general market i meant the sp500, which you provided. i was interested to see if ether is just as volatile as bitcoin, and you answered that question. they have fundamentally different use cases (ether and bitcoin), so i am curious to see if they continue with similar volatility into the future. they currently ride on a common momentum trade, but at some point that will probably dissipate. apparently not yet.

The use cases for all crypto is the same. The anonymity of bitcoin provides thieves, hustlers and charlatans with the ability to steal, extort and ransom in an electronic way that couldn’t previously. It’s much harder for a Nigerian prince to get you to provide your bank information than it is to have you send non-refundable, non-traceable electronic currency.

Now, all sorts of criminal organizations are able to utilize ransomware and get paid without being traced or tracked.

Bitcoin is a futures contract on criminal activity.

“The use cases for all crypto is the same.”

obviously you have not read up on crypto, else you would not make such a statement. anonymity is not the main reason most people are interested in crypto. and the most valuable use case is in the area of smart contracts. it begins to eliminate the need and cost of a middleman. this is why all the big financial institutions are working on blockchain technology. if they cannot monetize it, they will be out of business in the future. the digital transaction part is not the big driver. it is decentralized finance and smart contracts that hold the value prop. recent ransomware hacking has shown crypto is not anonymous. only a fool would believe otherwise.

Right, the case for blockchain and smart contracts is a different argument. You can utilize those things without mining cryptocurrency or using crypto as a store of value.

Want to use blockchain to replace title insurance? Go for it.

Want to use crypto as an asset class? Know that it is a futures contract on criminal activity

As for the “DeFi” concept – all your doing is replacing one middle man (banks) for another (tech).

“As for the “DeFi” concept – all your doing is replacing one middle man (banks) for another (tech).”

i would say this is a rather naive description. at any rate, the point of the replacement is to get something that is faster, more accurate and cheaper. if that is what the new middle man provides, why is that a problem?

“Want to use blockchain to replace title insurance? Go for it.”

what you are saying is that you do not trust digital. interesting. i file my taxes completely digitally. all of my finances are online. at any rate, i would like you to elaborate on your issue with title insurance. please explain the problem?

i would find it hard to talk about bitcoin without addressing the massive externalities involved in mining….

& i would argue that it’s not money as long as its value is quoted in dollars…ie, if it were money, we’d see the value of the dollar quoted in bitcoins…