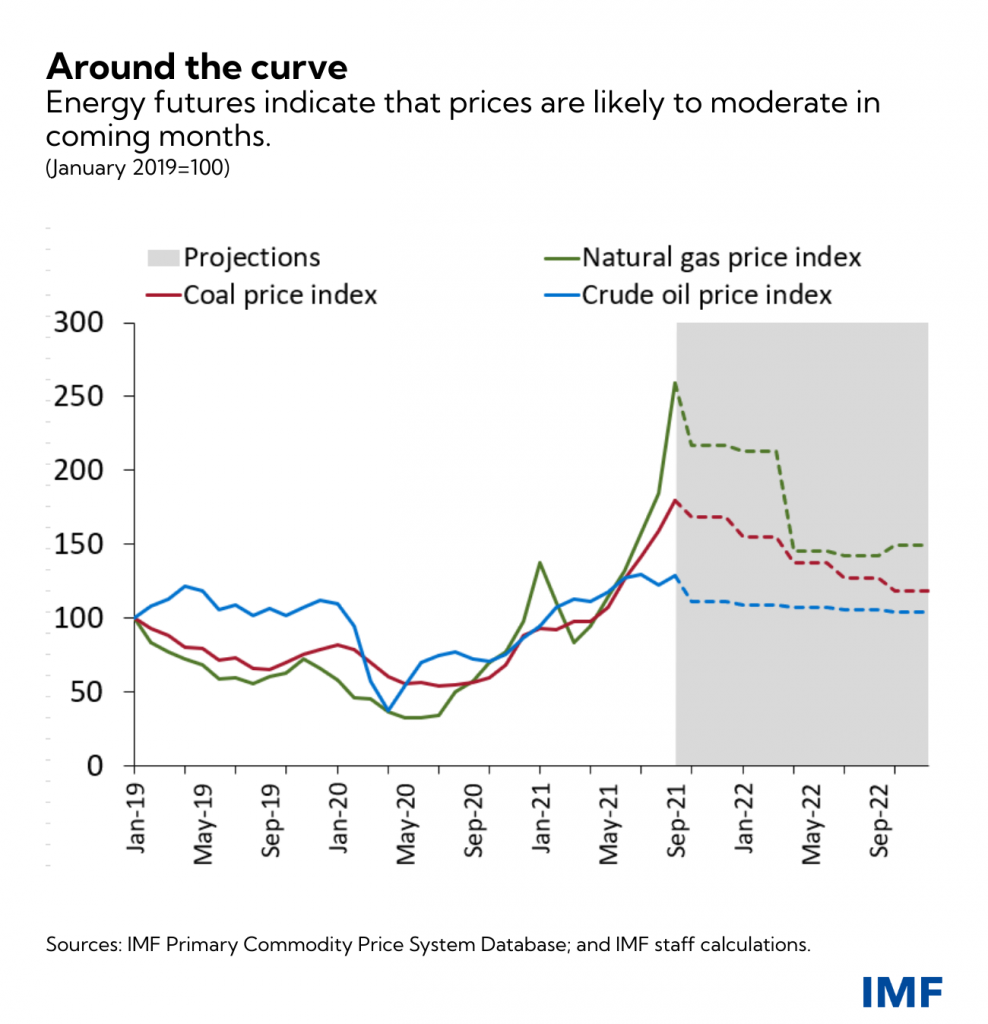

The IMF blog (Andrea Pescatori, Martin Stuermer, and Nico Valckx) predicts: “Surging Energy Prices May Not Ease Until Next Year”.

This assertion is based upon the following graph of futures:

Source: Pescatori, Steurmer, Valckx (2021).

Futures are pointing downward. How much faith should we put into these market indicators? Remember, only under the assumption of risk neutrality should the basis be an unbiased predictor of future spot rates. This characterization is certainly untrue for exchange rates, and precious metals. For energy, Chinn and Coibion (JFM, 2014) assess the data from 1990-2012.

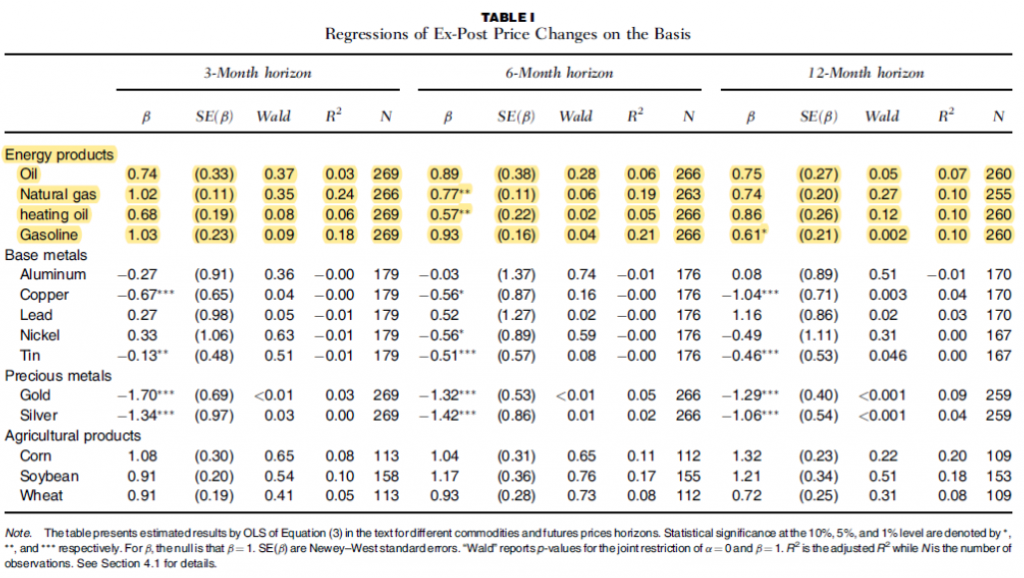

First, a regression of the change in spot rate on the basis. Table 1 shows the results for all commodities examined, with yellow highlights for energy commodities. In general, there are no rejections of the null hypothesis of β = 1 for petroleum, and only one for natural gas.

Source: Chinn and Coibion (2014).

Admittedly, R2‘s are pretty low for petroleum, less so for natural gas.

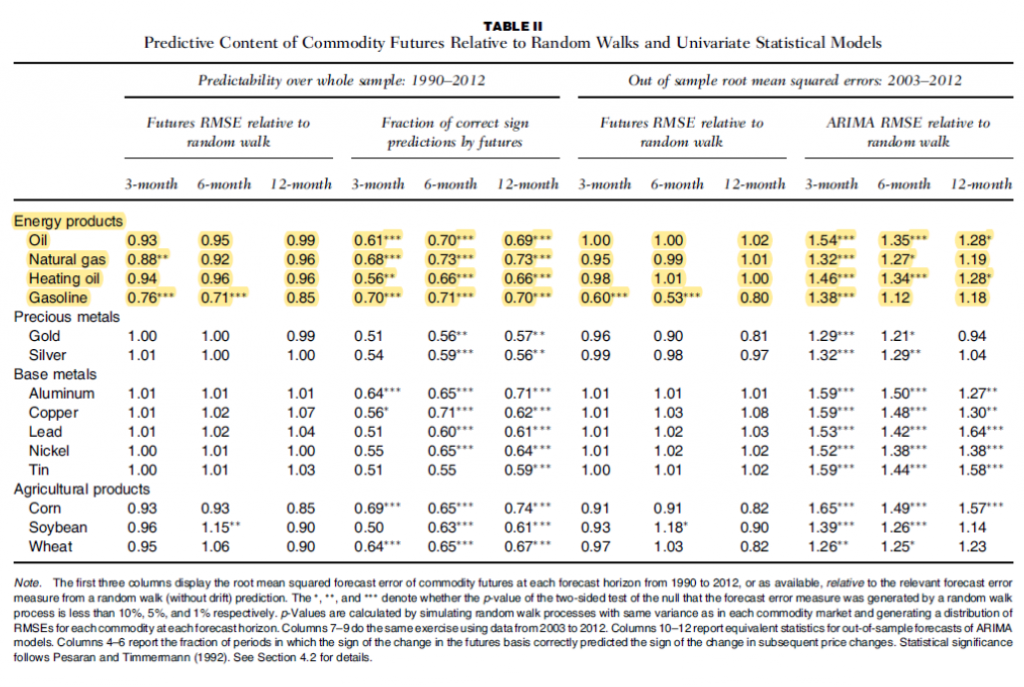

What about prediction? Table II addresses that issue. Once again, I highlight in yellow energy futures.

Source: Chinn and Coibion (2014).

In terms of prediction, futures outperform a random walk, correctly predict direction-of-change more often than random chance, with statistical significance. Out of sample, futures don’t do any worse or better than a random walk. A random walk outperforms any time-series model that has coefficients to be estimated.

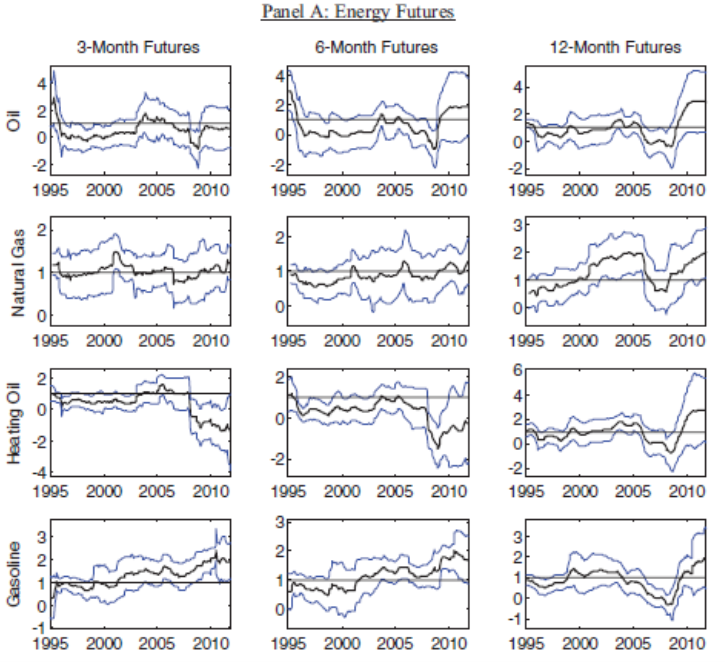

Table 1 reports full-sample estimates. The degree of bias exhibits time variation, as shown in Panel A of Figure 5.

Source: Chinn and Coibion (2014), Figure 5, Panel A. Note: Each figure plots estimates of the coefficient on the futures basis from Equation (3) in rolling five‐year regressions along with 95% confidence intervals (dashed lines) for each commodity and forecasting horizon.

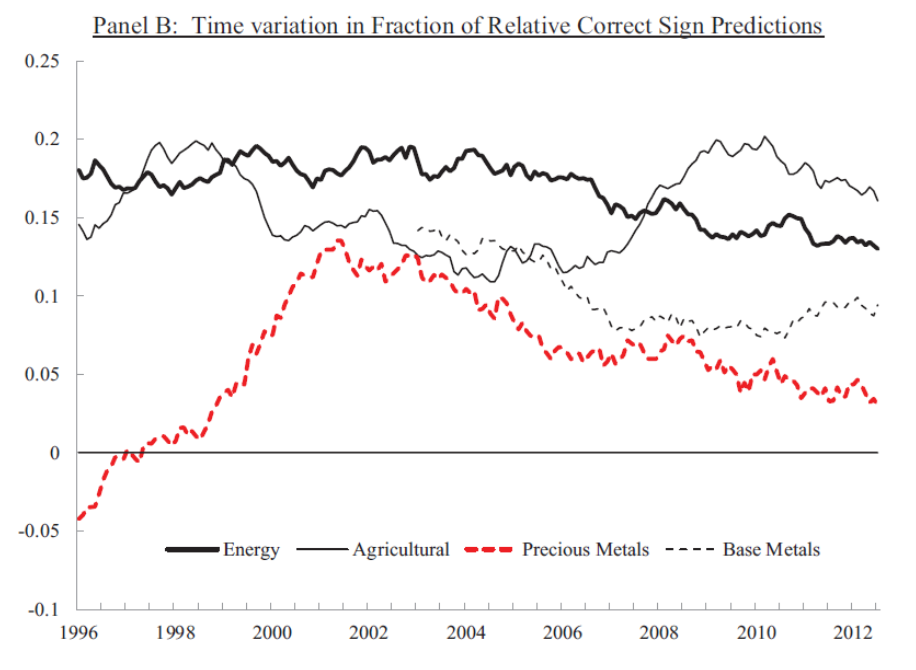

If one is more concerned about the direction of change, Panel B of Figure 7 is interesting. They show the fraction of correct sign predictions relative to 0.5 – so a value of 0.2 indicates energy futures correctly predict price changes more than random chance by 20 percentage points.

Source: Chinn and Coibion (2014), Figure 7, Panel B. Note: Panel B plots five‐year rolling fractions of correct sign predictions (using first‐differences of basis) minus their unconditional expectation, averaged across 3‐,6‐, and 12‐month horizons for all commodities within each commodity group.

Hence, energy futures have informational content, but declining over the sample period (ending 2012).

One caveat: the futures evaluated are mostly US (e.g., natural gas is for Henry Hub), so I’m not presenting empirical results for European natural gas.

In sum, the fact that energy futures are pointing downward is reassuring. However, one should not rely too much on the idea that future spot prices will go down as far as implied by futures, nor should one be surprised if actual prices turn out to be very high or very low relative to predicted (given the low proportion of variation explained by the typical regression).

This IMF blog post provided great insights into the market for oil, coal, and natural gas. I have been wondering of late why uranium prices have recently spiked and their discussion gives us a clue:

https://fred.stlouisfed.org/series/PURANUSDM

interesting tidbit: finland added themselves to the so far short list of eu countries proposing nuclear/fission as a renewable supplier….

if the us navy can run a sustained nuclear energy program for decades…..?

fission is one answer to ghg diinsihment.

the disposal of nuclear waste is a serious issue. i grew up in the shadows of a nuclear power plant. even had the opportunity to tour the facility. saw the old cores submerged in the “swimming pool” waiting for disposal. that was supposed to be a temporarily storage facility that has become permanent. this is a problem that needs to be solved if you are to consider any more nuclear plants. considering the half life of uranium, this problem will not simply fade away on its own through ignorance.

I find it disturbing that United States sanctions against Venezuela and Iran, making international use of their great energy reserves especially difficult, is scarcely questioned.

Also, I am wondering whether American energy reserves might be of use if the sense is that the the price rises are a reasonably short-term matter. Are regulatory authorities looking out for speculative market manipulations? What American diplomatic persuasion might be applied to Middle East energy suppliers to increase production?

Obviously, I do not have a sense what is driving American and European energy prices just now and have read no convincing account as yet.

Sanctions against iran are because iran is trying to build a nuclear weapon. That is what you should be viewing as disturbing.

Lol. Those sanctions aren’t doing anything. The faster they are removed, the faster you get to a nonnuclear Iran.

their effectiveness is up for a different debate. my point is that anybody who questions why the sanctions were implemented is being dishonest. maybe sanctions are not the best approach. but simply letting iran oil flow without addressing their nuclear ambitions is not a good policy, imo.

as for venezuela, the sanctions have been imposed on maduro and his cronies. why would you let such criminals enrich themselves with the people of venezuela’s resources? ltr, if you have a problem with the sanctions, then provide a solution to the maduro problem.

https://www.eia.gov/international/content/analysis/countries_long/Venezuela/venezuela_exe.pdf

EIA has an informative discussion of what has led to the steep drop in oil exports by Venezuela and your constant hammering of US sanctions is just bad analysis. First of all Venezuela can and does export oil to Europe. And a major reason for the decline in exports is that Venezuela has underinvested in its production capabilities.

“And a major reason for the decline in exports is that Venezuela has underinvested in its production capabilities.”

couple that with a very heavy crude that is difficult to process, and venezuela has fewer options to sell than other producers. the business of oil in that country is a joke right now, sanctions just compounded the already existing problems. venezuela should be wealthy and modern if not for the wasted decades of corruption in its leadership. i had a colleague who owned an office building in caracas. it is decaying because he cannot invest in the structure. seems to be an issue throughout the country. he is retired, and it is doubtful he will ever return to his homeland.

So: sell energy futures now if you produce it, buy if you are a consumer hedging?

do not underestimate the political power to release ’emergency’ stocks to lower futures prices… and take care of consumers?

opec+ recent production increase ~400k barrels a day takes in to account the pandemic may not wane this winter…… skeptical about outbreaks in larger nations.

while usa import of crude oil has risen largely by policy not pricing incentives….

finished product stock is usa has been slowly selling off.

winter 20-21 out side the failure of wind to perform in texas cold snap, was quite mild!

the unknown is how cold the coming winter.

“winter 20-21 out side the failure of wind to perform in texas cold snap, was quite mild!”

misinformation just like corev. it was natural gas that froze in the pipes and in the power plants that led to the failures in texas. not wind.

Natural gas freezes at -297F (-183C). Given those temperatures, I find it hard to believe that natural gas “froze in the pipes”.

Marc: More accurate to say the unweatherized equipment that moves the gas “froze”. (Comment from a transplanted west-coaster who now lives in a place that can go to 0 degrees F for a weeks on end…)

Fuel sources are proxies for production of electrical energy, which was only lightly covered but implied in the IMF article. The article almost completely ignored the ignored the impact of renewables on the energy markets. Policy, energy production policy, RENEWABLES POLICY affect prices. From the IMF article: “However, uncertainty remains high and small demand shocks could trigger fresh price spikes….”

and

“Governments should act to prevent power outages in the face of utilities curtailing generation if it becomes unprofitable.” (As in Texas last Winter)…

and

” However, uncertainty remains high and small demand shocks could trigger fresh price spikes.” ( Also as in Texas last winter and Europe this Summer and Fall)

These recent lessons learned on electricity pricing and AVAILABILITY from the Texas and European events involving the INTERMITTENCY of renewables has yet to be implemented. California is a leader in these policy failures. i failing to harden the alternative fuel sources for electricity generation.

These policy issues are so obvious it is amazing to so many to watch the wrong side of the politics/policy issue take precedence over logic.

“Fuel sources are proxies for production of electrical energy”.

Well this may be true for coal but I trust you know that oil is used as fuel for automobile and plane transportation as well. Of course the rest of your comment was your usual word salad babble. I hope you had a nice olive oil dressing for that salad.

solar and wind cannot be counted ‘one for one’ in grid base load determination…..

texas, cali and germany did and that is why costs exploded.

dependability of output, high down times and expensive easy to ignore routine maintenance…. essentially unsuitable to the task.

the $150b for “renewables” is the soft infrastructure bill is wastage..

biden’s presidency for some engineering!

“dependability of output, high down times and expensive easy to ignore routine maintenance…. essentially unsuitable to the task.”

good description of the natural gas failure in texas.

Baffled is still on his quest to justify INTERMITTENT sources as primary creators of electric power. His major problem is his inability to realize that some levels of intermittency, as in his natural gas example, can be corrected. BUT WHEN THE WIND STOPS, THE SUN FAILS TO SHINE, AND WATER DIMINISHES FOR HYDRO these intermittencies can not be fixed.

They need backup, because even Baffled admits their failures are EXPECTED. Yet, he continues to blame the backups for WINDS failure in Texas. Continuing with this story is just craziness, and a willful failure to recognize the basic weakness. A weakness that has been pointed out for years and numerous times

“They need backup, because even Baffled admits their failures are EXPECTED.”

corev, you simply dont understand what it means to fail. when solar or wind are down, and that is predicted, it is not a failure. it can be accommodated. what is difficult to accommodate is when something goes down unexpected. that is a failure. when natural gas went down under conditions it was not supposed to go down, it becomes a failure. natural gas provides over 50% of power generation capacity. it is very problematic when natural gas fails. that is why we ended up with a blackout. your intermittency arguments are based on the state of affairs 20 years ago. they no longer apply in the modern world. i really don’t understand your hatred for renewables. it is not based on reality or logic. the world is moving towards renewables, and that is inevitable. why are you still in denial that

As I said: “…even Baffled admits their failures are EXPECTED.” His argument then revolves around what is a failure, but even the most obtuse understand that electric power providers must provide a STABLE supply not an INTERMITTENT supply. Baffled seems to think that intermittency is an on/off problem, but it is much more complex high/low than just on/off. Trimming and then replacing those high/low variations is what causes many grid problems.

Baffled is an example of how ideologues just don’t think. They just emote!

“Trimming and then replacing those high/low variations is what causes many grid problems.”

corev, please read up on the topic. an electric grid is easier to maintain with high low variations than dramatic shutdowns. when wind/solar gain and drop, the change occurs over tens of minutes or hours. the grid can handle these changes relatively well-especially a smart grid. when a nat gas plant shuts down or a nuclear plant trips, there is an instantaneous loss of large amounts of power. that is how a grid collapses.

it is kind of like a water hammer in your pipe system, caused by a sudden shutoff of water. but if you place an accumulator in the system, it dampens the pulse and is manageable. please educate yourself.

but let’s return to the texas grid failure in 2011. renewables were not an issue then. yet the grid failed. why?

ah corev, once again on a misinformation campaign. but i will remind you, again, that it was the natural gas facilities that failed during the texas winter storm. it would be appreciated if you would tell the truth rather than spread misinformation.

texas had widespread power outages from winter storms in 1989, in 2003, and in 2011. after each of those events, texas was told to winterize their power plants, but they did not. i will note texas power was not driven by renewables during those events. how did texas lose so much power when all those intermittent renewable power sources were not employed at the time. hmmmmmmmmm. fossil fuels apparently are not as reliable as corev would lead you to believe. otherwise those fossil fuel run plants would not have failed during previous winter storms. and right on cue, the natural gas power plants failed in spectacular fashion in 2021.

as a side note, ercot has contingency plans for winter weather during storms. wind turbines actually produced more power than was to be expected during the winter storm. they outperformed, and at one point during the storm outproduced natural gas as an electricity producer for the grid. if those wind turbines had not continued to operate, the grid would have collapsed and been out for weeks or months.

Baffled keeps repeating the same ignorance: it was fossil fuels that caused the intermittency of WIND. Because WIND is a already a known intermittent source ONLY the backups can be blamed for the outage(s). AND this is claimed on an economics blog?!?

Previously he has claimed the solution is adding more intermittent sources into a market drive pricing structure where renewables are growing largely due to government subsidies and incentives. If renewables base prices were actually compared to competitor base prices, then a comparative price driven market could exist for a DEPENDABLE and STABLE source of electric power.

On this politics and economics blog only one political side wants to ignore the policy impacts on energy pricing.

The average voter has noted the obvious NEGATIVE changes due to the POLICIES of the in power party and its chief. They voted mostly for personality change in 2020 and not policy change. They will vote for policy change in 2022.

My Lord – this is irresponsible babbling even for you. Please stop as this has to be the most dishonest trolling ever.

https://library.wmo.int/doc_num.php?explnum_id=10838

WMO has released its latest greenhouse emissions report. Let’s see if CoRev can report its findings honestly.

natural gas froze in pipelines in texas or louisiana.:

the electric grid failed the facilities moving natural gas. gas was not moving because electricity is needed to run gauges, valves, pumps etc…..

natural gas does not go liquid until minus 83 celsius (-117 fahrenheit) that is cryogenics.

https://www.statesman.com/story/news/politics/politifact/2021/03/05/texas-natural-gas-pipelines-dont-freeze-blame-power-outage/4596289001/

the grid was inadequate bc base load was not up to a climate event.

Paddy, and a large percentage of base load is from subsidized and incentivized INTERMITTENT WIND. Accordingly intermittent base load MUST be backed up, and that backup priced into the market-based competitors.

I love it when trolls capitalize the thing they wish to shout about as in CoRev’s INTERMITTENT WIND. You see we liberals have ruined America by insisting on a source of electricity that is not fossil fuels according to our supposed EXPERT (at least on Fox and Friends). Of course CoRev is too lazy or too dishonest to note intelligent and thoughtful discussions such as this one:

https://www.power-eng.com/coal/intermittent-wind-problems-and-a-possible-solution/

pgl, we have a lot of current research aimed at solving these problems-see arpa-e. in fact, i would bet the solution to wind and solar already exists. it simply needs refined. we could do so by funding more research in this area. we have great ideas for large scale batteries as well. if you notice, folks like corev will also try to block any of this research. why you ask? because he knows once these solution are refined, it is the end of the line for fossil fuels. so the idea is simply to delay and obstruct the new technology from maturing. if corev were so confident that fossil fuels were superior to renewables, he should have no problem with continued research in these technologies. because if he were right, they would never work. but i bet corev is against this continued research.

PGL strikes again with even another self goal. From his referenced article: “When needed for generation, the compressed air is released and mixed with natural gas in a fired reheat high pressure and low pressure expansion turbine to generate electricity. ”

It also makes this point: “Achieving those goals would go a long way toward smoothing the resource’s inherent lumpiness.” Lumpiness is another way of describing the on/off and high/low intermittency associated with wind and solar, the liberal unicorn-based policy for energy generation.

There’s even more in PGL’s reference that confirms the reality-based intermittency problems of wind and solar. Its title after all is: Intermittent Wind: Problems and a Possible Solution did he even read the article? If he says he did, then it’s another indication of ideologues can not interpret contrary commentary.

Its really hard to get PGL to think rather than just emote.

corev, you continue to harp on intermittency like it is a problem that only occurs with renewables. all energy sources have some level of intermittency. that is why you build redundancy into the system. you are foolish not to do so. engineers develop systems with belts and suspenders all the time, and have been doing so for a century.

“When needed for generation, the compressed air is released and mixed with natural gas in a fired reheat high pressure and low pressure expansion turbine to generate electricity. ”

what is your point of ridicule corev? would you rather embrace a method that uses MORE natural gas or LESS natural gas in the production of electricity? in the future, that nat gas fuel will be replaced with hydrogen fuel anyway. nobody is worried about a perfect process today. they just want a better process today until we achieve the perfect process tomorrow. your position on this is simply silly.

Quarantine-like restrictions and high fossil fuel prices are the best short-term methods for reducing greenhouse gas emissions. Since quarantine is not sustainable and not much fun, hgher energy prices are preferable. Gotta keep our priorities straight.

Kevin Drum is frustrated that these 9 major nations are doing all they can to increase the production of fossil fuels in spite of the lip service to addressing climate change:

https://jabberwocking.com/not-one-single-country-on-earth-is-willing-to-stop-extracting-fossil-fuels/

With all these pro fossil fuel policies, one would think we would see lower prices for coal and oil.

President Obama along with leaders of several nations negotiated a nuclear development treaty with Iran. The terms of the treaty meant international inspection of Iranian nuclear facilities every 6 months. Iran abided by the treaty, as affirmed by the inspections. However, President Trump abandoned the treaty soon after taking office. Iran abided by the nuclear treaty, Mr. Trump did not and indeed imposed severe economic sanctions on Iran.

Iranian energy reserves are evidently needed.

fear not, russia and china are “investing” in iraq and iran energy infrastructure…..

they are also moving to invest with and cooperate with saudi arabia, and the uae.

while usa makes noise of sanctions that are not , and fritters away…..

China is already producing and delivering a daily surplus of coal to energy consumer. The surplus is already ample and growing, while coal prices have fallen dramatically. China is steadily working on renewable energy production and consumption, but such work takes time and balance. What is also important to notice is just how quickly the Chinese energy shortage has been stemmed.

https://twitter.com/YuanTalks/status/1452619266415423490

YUAN TALKS @YuanTalks

#China’s daily #coal supply to power plants have been more than their coal consumption for 20 straight days, with surplus exceeding 1 mln tonnes since Oct 19 and hitting 2 mln tonnes on Oct 23, said state planner NDRC.

8:53 AM · Oct 25, 2021

“coal prices have fallen dramatically”. Seriously on what planet have coal prices fallen dramatically? FRED is reporting a rather dramatic increase in the global price of coal:

https://fred.stlouisfed.org/series/PCOALAUUSDM

I noticed you provided no source for what appears to be an incredibly false claim.

https://www.cnbc.com/2021/10/20/major-coal-miners-in-china-vow-to-boost-output-and-cap-prices.html

If I’m reading this story correctly, China saw a rather dramatic increase in coal prices well above global prices. But then China encouraged more domestic production to partially reverse these incredibly high prices.

Anne (excuse me ltr) has alas adopted the habits of CoRev and JohnH in the gross misrepresentation of economic reality.

https://www.msn.com/en-us/money/markets/china-needs-more-coal-to-avert-a-power-crisis-e2-80-94-but-its-not-likely-to-turn-to-australia-for-supply/ar-AAPWX5D?ocid=uxbndlbing

The true story on China’s coal market is getting better and better. Chinese coal production has been on the decline which threatens a shortage in China – which is why domestic coal prices shot up. Now Australia has traditionally exported a lot of coal to China and stands ready to send the coal China needs. Only problem is that the Chinese government is angry at Australia for other reasons and has decided not to import Australian coal.

Of course ltr as head cheerleader for this government decides not to tell us the real story. Go figure!

As for Venezuelan oil, before the economic sanctions imposed by President Trump, I remember public service ads that were repeatedly run a few years ago by the Kennedy family thanking Venezuela for supplying heating oil for needy families through New England winters. I also remember Venezuela supplying oil to a number of Latin American countries, and a national chain of gasoline stations in the United States that was owned by Venezuela and used refined Venezuelan oil.

So, I would suspect the sanctions have had an effect and might be considered in analysis.

Also, just in the last few weeks an overwhelming number of countries voted in the UN General Assembly that all countries have a fundamental right to develop economically. I would think then the repeated use of economic sanctions by the US, such as sanctions against energy producers, might be subject to further consideration.

then you would not be in support of chinese economic sanctions against taiwan? or tibet?

Ignoring all reality again? I posted that report from EIA. Read it if you want to maintain the slice of credibility you may have left.

There is, of course, no question but that imposing economic sanctions and taking the great energy reserves of Iran and Venezuela from energy markets lessens supplies and increases consumer costs. New England low income homes have had no subsidized heating oil from Venezuela or any other compensating country since the Trump years, but heating oil must still be bought. I surely think the matter of economic sanctions might be carefully considered. Trump imposed more than 1,000 sanctions yearly.

Yes, poor families struggling with heating oil bills in New England are real as real can be to me.

https://www.eia.gov/international/content/analysis/countries_long/Venezuela/venezuela_exe.pdf

November 30, 2020

Although one of the original five large oil-producing countries that created the Organization of Petroleum Exporting Countries (OPEC) in 1960, Venezuela fell to the fourth-smallest producer among OPEC’s 13 members in 2019, ranked higher than only Congo-Brazzaville, Gabon, and Equatorial Guinea.

Reduced capital expenditures by state-owned oil and natural gas company Petróleos de Venezuela, S.A. (PdVSA), along with increased U.S. sanctions, have resulted in foreign partners continuing to cut activities in the oil sector, making crude oil production losses increasingly widespread.

Venezuela’s revenue from oil exports is severely constricted because few of the exports generate cash revenues. The remaining crude oil exports are sold domestically at a loss or sent as loan repayments to China, Russia, and European companies Repsol and ENI.

In January 2019, the United States imposed further sanctions, making it increasingly difficult for foreign companies to conduct business in Venezuela. Further U.S. sanctions in February 2020, May 2020, and June 2020 have placed further restrictions on foreign companies.

[ Sanctions of course have an important impact, which is why they have been imposed. ]