Before and after the November CPI release.

Several surveys and forecasts before the release, for one year ahead horizons.

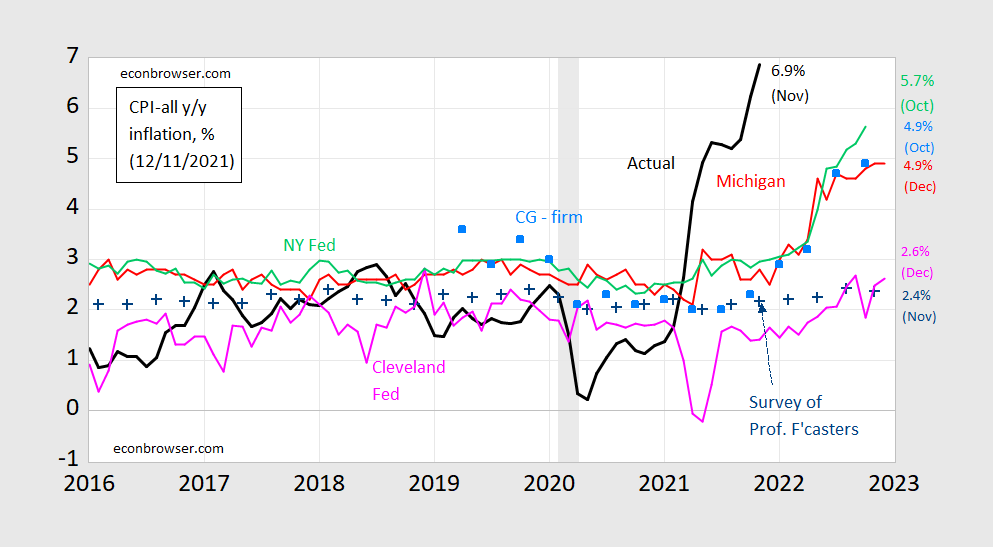

Figure 1: CPI inflation year-on-year (black), median expected from Survey of Professional Forecasters (blue +), median expected (preliminary) from Michigan Survey of Consumers (red), median from NY Fed Survey of Consumer Expectations (light green), forecast from Cleveland Fed (pink), mean from Coibion-Gorodnichenko firm expectations survey [light blue squares]. Source: BLS, University of Michigan via FRED and Investing.com, Reuters, Philadelphia Fed Survey of Professional Forecasters, NY Fed, Cleveland Fed and Coibion and Gorodnichenko.

And from the market, after the release on Friday:

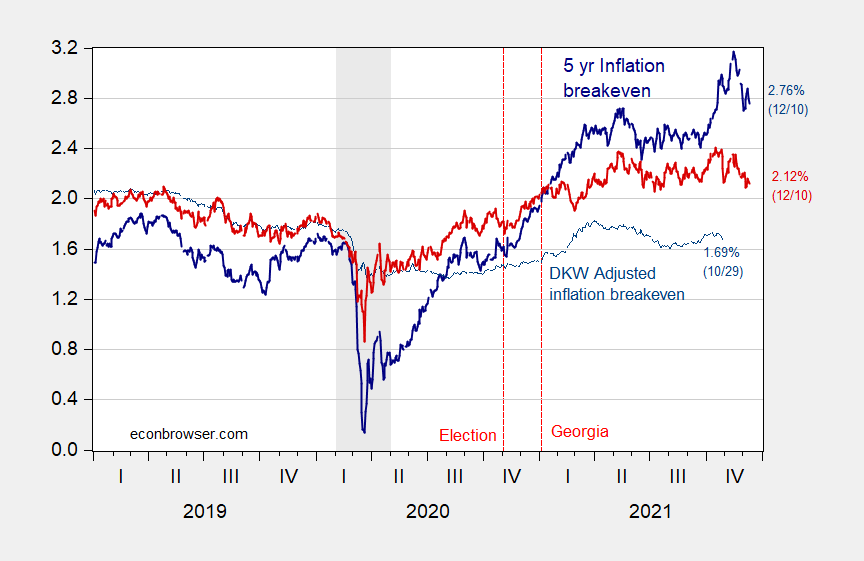

Figure 1: Five year inflation breakeven calculated as five year Treasury yield minus five year TIPS yield (dark blue line), five year breakeven adjusted by inflation risk premium and liquidity premium per DKW (light blue thin line), five year five year forward expected inflation calculated from Treasury and TIPS yields (red), all in %. Source: FRB via FRED, Treasury, Kim, Walsh and Wei (2019) following D’amico, Kim and Wei (DKW) accessed 11/5, NBER and author’s calculations.

The inflation breakeven (unadjusted) actually declined on Friday, as did the five year five year forward inflation breakeven (although the latter more modestly).

There have been several periods where actual inflation deviated from expected inflation. It is not like expectations massively changed as a result leading to a permanent rise in the inflation rate. But of course our dear press is too lazy to check the data over an extended period of time. If it bleeds, it leads!

Watching all these folks on the Island of Unwanted Toys…….. Yes, it’s true, I claim to be an adult. Next on the list in the next couple weeks, Die Hard, and Home Alone 1 and Home Alone 2. I’m gonna get sauced when I watch Die Hard though, I have a working theory that the enjoyment while watching Die Hard increases by at least multiple of 5 while drinking adult beverages, The dependent variable is my brain. The explanatory variable is amounts of dark Modelo (and other stronger such,) consumed in 12–16 hour period. It’s important I drink an amount so we have enough data to tabulate the correlation coefficient along with the elasticity of the sanity of my brain. Any theories on the latter, you are encouraged to keep to yourself. Some say my cognizance when drinking is very elastic, while I insist that it is inelastic. It doesn’t really matter, it just helps me get rid of “The Problem of Political Despair”, along with other musical drones.

Does anyone know what happened to that Christmas cartoon where the guy is fixing the inside of the large clock??I think Roddy McDowell was one of the voices. I can’t ever seem to find it on TV anymore.

Interesting the divergence between the forecasts of the New York and Cleveland Feds.

Barkley Rosser: NY Fed forecast is a survey of households, Cleveland is a data-based forecast.

Maybe I’m “channeling my inner rsm and JohnH”. I mean maybe I am just refusing to admit I was wrong?? Honest to God in this case I don’t think so. I don’t think I’m THAT unwilling to admit when I’m wrong, I just, I can’t help it, part of me just strongly feels something is complete bullC— about these CPI numbers. “Conspiracy”?? “Collusion”?? I just, I’m sorry I think the official CPI numbers smell, they smell.

Thanks for the clarification, Menzie.

If anything has been confirmed this year, it is how bad inflation forecasts are. The SPF and TIPs break even are downright embarrassing.

And what do consumer expectations tell us? Consumers are price takers, not price setters.Does the survey represent anything more than a measure of how badly consumers expect to get screwed over? And aren’t those survey results a wonderful tool for businesses to use deciding how much to oblige consumers’ expectations?

To get a real handle on future inflation, it is business that should be surveyed. After all, it is business that sets the prices that consumers pay, particularly in an economy characterized as monopoly capitalism, Most businesses have fixed their 2022 budgets by now. Inflation assumptions are an important part of creating a budget, and those expectations are set. By now most large and medium sized businesses have carefully scrutinized where they can increase prices and by how much.

Businesses could be surveyed, but are apparently not…for curious and unknown reasons.

One hint about future inflation is that businesses expect to raise wages by 3.9% in 2022. You can rest assured that they will recapture those cost increases…and probably a lot more. And if there is a need to cast blame, we’ll, it’s readily available—supply chain issues can cover most anything. And if consumers expect higher prices, all the better for the price gouges.

Much as I hate to say it, Larry Summers is probably right this time: “ We’re having it confirmed that [inflation is] not transitory. And I think everybody recognizes now, with the statements from Chairman Powell, with the statements from Secretary Yellen, that this isn’t going to just go away of its own accord, that the Fed’s going to have to take substantial action to control inflation, unless there’s some kind of other adverse development, a crack in markets or something of that kind.”

https://www.breitbart.com/clips/2021/12/11/summers-without-changes-well-entrench-inflation-way-above-2-reconciliation-bill-will-increase-2022-and-2023-inflation/

But I don’t think that future inflation is just due to overheating. Rather, it’s monopoly capitalism exploiting an opportunity that’s just waiting on a silver platter to be seized. And inflation can become entrenched, it makes it easier for monopoly capitalists to keep raising prices faster than wages and satisfying investors’ need for ever higher margins.

You’ve severely disappointed me. I’ve defended you more than once on this blog and you use a Breitbart link in a straight fashion. Whatever your rock-bottom intentions are, I’ve taken up your defense here for the last time. Breitbart is a race-baiting outfit, with ties to QAnon, MAGA, Stephen Bannon, white supremacy, misinformation campaigns. You’ve lost whatever personal credibility you had here.

Moses—was the information in the article in any way wrong? Did Summers not say what was quoted? That should be the standard.

Personally I never read Breitbart, but when useful information comes up on an internet search, I use it. Too much good information gets blocked when you only use sources that pander to your preferred political views, leading to destructive polarization.

“Personally I never read Breitbart”

Well that is a good choice. But you also refuse to read actual economics.

@ JohnH

So by your “standard” when Joseph Goebbels puts out a press release telling you the sky is blue, and you look up and the sky is blue, you’re grateful to have had this extra source in a world short of sources. You know, I had a slight disagreement with Menzie once about something pgl had quoted here from horrendous sources. I wasn’t sold on this logic then, and I’m not sold on it now.

There’s no actual shortage of good news sources in this world. What there is a shortage of is people who will make the effort to decipher the differences and qualities that make a good source of information.

I will admit I sometimes link to lying right wing news cites but at least I try to point out where these clowns have gotten it all wrong. Even if they are hailing Saint Larry Summers! If I ever gave Breitbart BS a lick of credence, I so humbly apologize.

@ pgl

Most of your sourcing is quite good, that is why that one stuck out in my mind. I can hunt the permalinks down if you desire but it’s really neither here nor there at this point.

These things keep becoming huger and huger, and i think they will build up over time working towards 2024. In the past when the stories prove to be false, it takes all the air out of peoples’ balloons and the movements/cults die. But lately these movements (QAnon, MAGA, Breitbart, etc) are behaving very differently, even after having been proven drastically false, they just keep going on, as this FT author, Siddharth Venkataramakrishnan, states:

“…….. QAnon, as the movement came to be known, had for months been prophesying a huge win for Donald Trump in the November 2020 US election. When the opposite transpired, the posts just vanished. For some QAnon believers the loss proved a sharp snap back to reality — akin to a millenarian cult surviving its own end-of-the-world prediction.

For others, however, it would be the beginning of an entirely new era.”

https://www.ft.com/content/d4921e71-c841-433e-a4a9-f85ff7ca263c

The term used at the end of the article, “infodemic” reminds me of William Burroughs’ old “Cut-up Method”.

JohnH,

I looked at the link and it looks like Breitbart got it from Bloomberg pretty straight. Not sure why the google search did not go to Bloomberg first rather than Bloomberg. Primary sources are generally preferred whatever their biases.

I am personally less bothered by what sources are if the information is accurate. But there is no question that Breitbart is a pretty awful source. At least double checking on Bloomberg to see if it was right would have helped, and would have been better just to go to Bloomberg and use it.

“rather than Breitbart” not “rather than Bloomberg”

Why can’t the Fed sell inflation swaps, so businesses can hedge away inflation risk?

If inflation is just a power play, why can’t the Fed print faster than prices rise and distribute equally, so everyone’s real purchasing power is maintained no matter how fast or high nominal prices rise?

That is dumb even for you. The FED is not in the business of making speculative profits. OK, OK – you have no idea what the FED does which explains this idiotic advice.

So many words – so much gibberish. Now how are your forecasting model fared?

“Businesses could be surveyed, but are apparently not…for curious and unknown reasons.” You know you might try checking with this outfit known as the National Association of Business Economics. Not the brightest group of folks but I’m sure they know more about inflation they you ever will.

Let’s see how your monopoly capitalism hypothesis fits US data over the past 40 years. We enjoyed very modest inflation starting around the mid-1980’s. I guess that was due to the Reagan anti-trust revolution where the government cracked down on market power. Oh wait – the considerable economic research which you claim does not exist notes anti-trust enforcement has not been that great. So according to your BS hypothesis, we should have high inflation over the past 35 years. Huh – not such a great hypothesis. But do babble on!

What is the NABE forecast for inflation in 2022? Where is the link? And where is the survey of business expectations for their own price increases?

Nowhere, I suspect.

Oh, right! We are supposed to believe that corporations and their attitudes have no relevance to current events. But having worked for a Fortune 200 monopolist, I can assure you the price increases were part and parcel of the annual budget process whose goal was to report record revenues and record profits every year in perpetuity.

Summers talks about “the mood.” What hecould easily be talking about is business attitudes. pgl probably doesn’t know this, but attitudes change over time. And if monopolists did not aggressively increase prices in the past, when they were more likely to be noticed, that should , in no way lead anyone to conclude that they will not fully exploit the current situation. Consumers expect it. Excuses are abundant (supply chain issues, rising wages, etc.)

The Wall Street Journal (to be credited for its candor) explains what pgl, our resident, self-annointed genius, can’t fathom: “ Companies are paying higher wages, spending more for materials and absorbing record freight costs, pushing up economic inflation gauges. They are also reporting some of their best profitability in years.

Executives are seizing a once in a generation opportunity to raise prices to match and in some cases outpace their own higher expenses,”

https://www.wsj.com/articles/inflation-yellen-biden-price-increase-cost-shipping-supply-chain-labor-shortage-pandemic-11636934826

But let’s not talk about how American business contributes to inflation. It might discomfit the comfortable! Good capitalists talk only about rising wages not deliberate, inflationary price gouging.

In my very next comment, I provided one link to the NABE forecast but since you cannot read – here is the direct link:

https://www.nabe.com/NABE/Surveys/Outlook_Surveys/december-2021-Outlook-Survey-Summary.aspx

Learn to read – moron!

Wow! pgl calls this a forecast! “ 71%—anticipate that the Federal Reserve’s preferred gauge of inflation, the change in the core PCE price index, will not cool down to or below the Fed’s target of 2% year-over-year until the second half of 2023 or later.“

And I think Stef Curry will hit at least one three pointer in his next game. pgl would consider that a robust, well-considered forecast!!!

JohnH

December 12, 2021 at 5:45 pm

Read what I said idiot. I’m no fan of the NABE crowd. But you never answered my question. Give us your superior forecasting model. We will wait until you consult with Breitbart and Lenin.

“What is the NABE forecast for inflation in 2022? Where is the link? And where is the survey of business expectations for their own price increases? Nowhere, I suspect.”

OK – it is too easy to mock you since I did provide this link which you claim does not exist.

But let’s see – your new gurus are the WSJ and corporate America? Oh yea – you say you worked for a Fortune 200 company back in the day. But you will not give us their name? Why? Is it because your utter incompetence lead to their bankruptcy?!

“Mohamed El-Erian, chief economic adviser for Allianz, says the “characterization of inflation as transitory is probably the worst inflation call in the history of the Federal Reserve.””

https://youtu.be/g_DcRenJDow

Bruce Hall: The Fed has existed since 1913. I suspect maybe something around the Great Depression could’ve been worse (I think Friedman would agree), or the mid-1970’s, might be worse…

Not nearly as bad as Donald Luskin’s 9/14/2008 dismissal that the US was entering a recession!

BTW – didn’t one world leader recently argue that lowering interest rates was the correct approach for high inflation and a devaluing currency? Turkey’s I think.

I believe the comment was in reference to the Fed’s inaction, not that inflation is worse than the mid/late 1970s. However, the Fed’s record of interest rate changes hasn’t always been the greatest, so it’s legitimate to question that remark.

I believe the remark was in reference to the Fed’s present inaction, not that current inflation is worse than the mid/late 1970s. Of course, the Fed doesn’t necessarily have the greatest timing on its rate changes (as evidenced by 2006-08), so questioning El Erian’s remark is understandable.

Gee one of those NABE types which JohnH has resorted to ridiculing. Now I often call out JohnH but ridiculing NABE types is something I think he gets right!

Does this dude not remember how Nixon decided to abuse wage and price controls so he could induce the FED to pump the money supply in time for the 1972 elections. Which of course eventually led to Ford’s stupid WIN buttons, tight money, and the 1975 recession.

I guess your lack of knowledge of our economic history has led you not to know that these monetary mistakes is why Carter beat Ford in 1976.

there was a time i used to listen to el-erian. he provided some good insights in the first year or so post the financial crisis. but then he appeared to get a big head. he talks a good game, but i have found that his commentary has not been useful since that short period after the financial crisis. he has fallen into the trap of really believing his views are accurate, and contorting world events to try to support his view, even when wrong. he seems more interested in getting his media minutes than getting an accurate prediction of what the world is actually doing. most of his comments are along the lines of what the world should be doing, often in conflict to what is actually happening.

El-Erian is confusing a difference in definition with a difference in analysis. That’s not surprising- people argue over definitions all the time without knowing it or, worse, pretending to be arguing over substance when they are really just arguing foe a definition which serves their own view.

Economics is full of discussion of “one time” events which last for years. “Transitory” in that sense remains an entirely reasonable expectation for the pick-up In inflation. When Powell said the Fed would no longer use the term, he was clear that it had proven unuseful in communicating with the public. He didn’t say inflation isn’t transitory. It very likely will prove to be so.

El-Erian is becoming more Summers-like as he ages. The quote you posted is a clear demonstration of that.

“When Powell said the Fed would no longer use the term, he was clear that it had proven unuseful in communicating with the public. He didn’t say inflation isn’t transitory.”

this is true. unfortunately, this point has not been effectively understood by the media. Powell shot himself in the foot with this remark. rather than using greenspanspeak, he should have been more blunt and direct in his commentary.

https://www.entrepreneur.com/article/401048

Wow – the National Association of Business Economists (NABE) does issue a survey of its members expectation of inflation. I’m not saying anyone should rely on this crew’s forecast but JohnH assures of: (1) this survey does not exist; and (2) it did, it would be the most reliable forecasts. Huh!

The NABE forecast is a survey of business economists, most of whom have little or no access to line managers’ detailed plans for increasing prices.

What is needed is a a survey of business pricing expectations like the survey of expected wage increases. To get this information you need a survey of financial managers, not of economists who are mostly staff guys too isolated from much of the decision-making process to have much useful info about a corporation’s pricing plans.

But The information is there, but it appears that no one has the curiosity needed to get it. I mean, who really cares about the intentions of the people who set the prices measured eventually by the CPI? Much better to survey consumers, who are mostly clueless about future inflation!!!

So this crew gets paid for what? Mopping the floors? Excuse me for not consulting with your crew – the folks who bring subway sandwiches to the meetings!

Inflation is like the weather.

Everybody talks about it. Nobody does anything about it.

I disagree. Central banks do a lot to fight inflation (that isn’t caused by supply shocks). But I would agree inflation is like the weather in the sense that “experts” don’t seem to be all that good at forecasting either (sure, inflation forecasters do fine at forecasting 2% when that’s the FOMC target and inflation is roughly around 2%. But when things start to go awry… their models turn into pumpkins at midnight.)

You admit supply shocks sometimes increase CPI? I guess you may eventually concede “velocity” is neither a constant nor a micro-foundations behavioral equation. Progress comes slowly.

You’re still seeking my attention? Sure, I’ll bite…

You’re wrong again.

I never once suggested that velocity was a constant.

I never once commented on velocity wrt micro-foundations.

So how many times is that for you just the past few days? Your record is abysmal. Reading comprehension apparently comes slowly for PaGLiacci. HonkHonkHonk!!!

I think I did see you on my early morning run. Excuse me for calling the cops on your stalking!

I see you’ve been released from detainment following your self-incriminating discussion with the cops – that or you used your single phone call to recite this reply.

Seriously, we know you’re a clown but there’s no way you’re this big of a bozo. Anyone who can read is able to see you’re the one who constantly seeks my attention – you’re one of the biggest stalkers in the comment section.

Econned

December 13, 2021 at 11:00 am

Someone needs to get his meds refilled. Let’s start a Go Fund Me page for this sad little child!

here we have PaGLiacci resorting to childish comments because they know they look foolish. Again. Put away the clown nose, pgl. You’ve embarrassed yourself again.

serious question. do you think inflation can be accurately predicted during times volatile times? do you think this should be possible? or are there limits to possible predictions when things go awry? how deterministic do you believe the world is?

Serious answers…

Nope.

Possibly but unlikely.

Yes.

Very.

agree with your first three answers. puzzled by the last. if the world is deterministic, shouldn’t you be able to predict inflation in both good and bad times?

baffling,

Just because something is deterministic does not mean there is a full understanding of the process(es). I’m aligned with the Sam Harris and Robert Sapolsky’s of the world. I think Sapolsky said something along the line of “free will is just the biology we don’t understand yet.”

if something is deterministic, then in theory if you fully understand the problem, you can predict the outcome with full confidence. so this returns to my question about inflation. if the world is deterministic, then we will eventually obtain the ability to predict inflation in all situations. if not, then maybe the world is less deterministic that one believes. i have my doubts about our ability predict inflation in all cases.

A deterministic model is still a model and imperfect. They’re fun to talk about and play with but at the most practical matter they’re irrelevant. Determinism in the sense of philosophy is what matters for reality. I believe free will doesn’t exist and the world is determined by forces that precede one another. And we are so far away from modeling with such precision, that I don’t think it’s worth the time to even consider.

“I believe free will doesn’t exist and the world is determined by forces that precede one another.”

the universe we live in is probabilistic. that is no longer in dispute. it is backed up by the physics. the question is whether economics, as we know it, is impacted by this probabilistic characteristic. classical physics is deterministic, and works as long as you don’t push it beyond its limits. I don’t think economics is nearly as deterministic. two people under identical conditions can result in two different outcomes. that is not very deterministic, in my view. makes inflation predictions difficult.

I hope you found his replies deep and well articulated!

Yet another great comment by PaGLiacci the serial stalking clown. Insights abound.

“if the world is deterministic, shouldn’t you be able to predict inflation in both good and bad times?”

You are assuming Econned knows what deterministic means. He certainly has no clue what normative means.

JohnH wrote: “But I don’t think that future inflation is just due to overheating. Rather, it’s monopoly capitalism exploiting an opportunity that’s just waiting on a silver platter to be seized.”

Hi John, Do you consider yourself anti-data and anti-science? I ask because such an attitude seems rather popular these days.

There is no data to support your hypothesis. None. Either that or you need to come up with a story that explains why US inflation rates have remained so low for most of the 21st century despite massive monetary and fiscal stimulus. You need a story to explain why powerful oligopolists sometimes engage in profit-destroying price competition.

JohnH, Are you aware that nations that adopt policies shaped by your rhetoric tend to experience really awful economic outcomes? I thinking of the Neo-Marxist populist and usually authoritarian regimes of Black Africa and South America. They have definitely been the “Greatest” when it comes to destroying social economic wealth.

In the meantime, if you are willing to take the time and effort, an Expectations-Augmented Philips curve model would be a first albeit incomplete step to a better understanding of all of this. Clearly expectations and forecasts are often ex-post wrong — see the timely information provided by Menzie Chinn above — but that does not mean that they have no influence on outcomes and ultimately policy.

“There is no data to support your hypothesis. None.”

JohnH would explain this away by suggesting economists have never considered his hypothesis. Of course JohnH is lying when he says that as economists did study this. It was all the rage when I was in graduate school. And the data showed his hypothesis was utter BS. But in his total ignorance, JohnH can make up yuck all day long!

Poole—have you considered why there is no data? Could it possibly be that it is not being collected? Could it be that there is a strange lack of curiosity when it comes to economists looking at the role of corporate decisions as a contributor to inflation. (It’s certainly more acceptable to blame labor!)

Could the Wall Street Journal’s observation that profit margins are increasing along with inflation give you a clue?

“Poole—have you considered why there is no data? Could it possibly be that it is not being collected? Could it be that there is a strange lack of curiosity when it comes to economists looking at the role of corporate decisions as a contributor to inflation.”

I could call this another one of your blatant lies. But given you are too damn stupid to actually read the economic literature, let’s blame this one on your incredible ignorance.

“Could the Wall Street Journal’s observation that profit margins are increasing along with inflation give you a clue?”

Back in the 1970’s when inflation was roaring, the great Franco Modigliani presented an incredible insightful paper which documented that even though inflation was supposed to be neutral under rational expectations and all that jazz, corporate valuations were tanking when inflation rose. So you little one period observation does not exactly stand the test of times.

Of course you rely on the idiots who write for the WSJ as you never bothered to read analyzes from smart economists. So typical!

1970s…before the great wave of corporate mergers and massive industry concentration? Surely pgl is more of a fool than I thought if he thinks that monopoly capitalism back then was remotely close to what we’re experiencing now.

Back in the 1970s, the government even enforced anti-trust laws!

You just made my point idiot! Yes when we stopped enforcing anti-trust, inflation went down. Ever wonder why you cannot publish in the AER or the JPE? This contradictory BS of yours does not appeal to their editors!

BTW – JohnH only thinks he invented the term ‘monopoly capitalism’. I hate to break this to our know nothing but Lenin beat him to it over 100 years ago. Lenin was accusing the governments of the west of promoting market power.

Now I bet some of the push for things like anti-trust policy and ending other restraints to free entry into competitive markets was to take the sting of this criticism that came from Communist Russia aka the Soviet Union. Now know nothings might think that modern Russia is better than the old Soviet Union but of course we people in the real world realize that Putin has established much of the old regime including state run monopolies like Gazprom. Oh wait – JohnH has become Gazprom’s spokesperson!

Monopoly capitalism is the the term Krugman used in an op-Ed in the Irish Times. Interesting that he never chose to publish the article in America!

Personally I prefer the term “savage capitalism” though “monopoly capitalism” is certainly apt in the current situation.

So Krugman took the term from Lenin. Gee – your knowledge of economic history sucks too!

Monopoly capitalism is the the term Krugman used in an op-Ed in the Irish Times. Interesting that he never chose to publish the article in America!

Personally I prefer the term “savage capitalism” though “monopoly capitalism” is certainly apt in the current situation.

I have an idea, which is almost as good as the movie and beverage choices that Moses has planned.

U.S. auto manufactures should start a lobbying blitz with the Biden administration and Congress to get some hard-core tariffs slapped on imported cars and trucks so that they can lock in high profit margins for the next decade. Mercantilism is the most patriotic and bi-partisan effort that our politicians can work together on.

The wage gains are clearly a one-off, so with some Fed tightening next year we can drive up the unemployment rate and businesses can lock in cheap labor until Trump takes power in ’24.

This will be a Christmas Miracle!

Love it! It is interesting that when Bush43’s Justice Department made the mistake of letting Whirlpool acquire Maytag back in 2006 the research shows the impact on washing machine prices was at first muted. Of course foreign competition does that. Nut then we got those Trump tariffs and boom, the Whirlpool market power set in and prices increases.

Of course JohnH applauded tariffs totally unaware of the implicit irony in your delightful comment. Tariffs promote the abuse of market power. Economists have known this for two centuries but this realism is way over the head of JohnH!

If economists have known this for two centuries, why was it note brought to light by Krugman and others in the discussion of washing machine tariff related price increases. Why did the public discussion focus on the tariffs and overlook the oligopolistic structure of that market?

Half truths…

JohnH: For economists who have to teach *introductory* trade policy (like I do, even if I’m not a trade specialist), we all know that some tariffs and particularly quotas will induce greater price increases if the domestic market is not perfectly competitive. I’m sure with a couple of minutes of googling, you’ll find economists mentioning this.

I am sorry, but I am forced to ask if you have ever taken an economics course.

We have provided JohnH the research papers on this very topic. I guess he once again refused to read these papers preferring to claim they cannot exist. It is alas a pattern with him.

Menzie,

JohnH has previously claimed to have taken some undergrad econ courses at UW-Madison no less, apparently before I was there, maybe early 60s or even further back, certainly not after the mid-60s. Am curious who he had and how much he may have forgotten since then.

Actually, Menzie, my memory is that JohnH claimed to actually have been an econ major at UW back whenever sometime before I was, not just having taken some courses. I asked then who he had, but no answer. He did claim to be proud of the fact that the Institute for Research on Poverty is at UW-Madison (back then it was just “UW”).

Of course, I may not be remembering things right. After all, more than one person here has declared me to be unequivocally senile, with my colleagues needing to learn this from them so that the Taxpayers Of Virginia can be saved from having me draining them of their hard-earned tax dollars. And we know these wise commentators are leading experts in such matters. So, my memory on anything having to do with any of this must be viewed as highly questionable.

Maybe it was sociology that JohnH majored in, and it was UW-M, aka University of Wisconsin-Milwaukee, and he just happened to stop by the department in Madison one time when he was visiting the Rath and the Union Terrace, or maybe he took a summer school course in econ at The Real UW, :-).

Donald Luskin claims he took Econ 101 at Yale. Well, he managed to take the first couple of weeks of classes but then he dropped out.

@ Barkley Rosser

I am about to give you what is meant as a compliment but what you will probably receive as a “backhanded compliment”. Are you ready??? I think ego is your major problem, not “Senility”. As far as JohnH, I don’t think he would intentionally lie. ALthough his quoting Breitbart has me re-evaluating everything as it relates to JohnH.

Moses,

Well, I shall agree that I have a swollen ego and am arrogant and pompous often. I like to think that in person I am a nice and friendly guy. But my rather formidable wife informs me that I am deluded, and that I am regularly overbearing in person and intimidate people even to the point of many of them being frightened of me. I actually try not to do that, but apparently I am not doing all that good of a job of it.

LOL – now Krugman is your new hero? After all of your dishonest bashing of the man. BTW – I have provided you links to research on this topic – which was not co-authored by Krugman. Of course you were too damn lazy to READ it.

Your fig 1 is (re)tweeting…

thanks for this!

Breitbart high fiving something Larry Summers said on THE Bloomberg’s Wall Street Week???

On Friday’s broadcast of Bloomberg TV’s “Wall Street Week,” economist Larry Summers stated that “we’re going to entrench inflation way above 2%, perhaps in the 4% or even higher range, unless something happens to break the current mood,” and the Build Back Better reconciliation bill will increase inflation over the next two years, but it could be offset by the Federal Reserve’s monetary policy.

Huh – is this the same Larry Summers who co-authored a piece with Brad DeLong that advocated the FED targeting a 5% expected inflation rate? That paper was an interesting suggestion. After all – a very young Summers was brought by Martin Feldstein back in 1982 to navigate the disaster Volcker wrought on the US economy to Whip Inflation Now. The current Larry Summers seems to be losing his memory. I guess old age tends to do that.

I would still like somebody to tell me why 4% inflation is so gawdawful? Why does the world end at 4%? People are ridiculous.

It does not end. In fact, Summers himself has co-authored papers advocating the FED to raise its inflation target from 2% to 5%.

The Germans love this 2% target but then there have become the problem for creating a lack of aggregate demand in other nations tied to the Euro. Some economists – including conservative Milton Friedman – advocated getting rid of the Euro precisely because of the German aversion to higher inflation.

Summers used to know all of this but I guess old age is setting in.

“NY Fed forecast is a survey of households, Cleveland is a data-based forecast.”

Makes you wonder why households expect inflation more than twice as high as the data-based forecast.

Do you think it has anything to do with the New York Times, for example, running bogus stories about mythical $1.99 a gallon milk in the good ole days pre-ARP? The press, in their endless pursuit of fabricated drama, is doing their best to misinform the public.

joseph: There’s a large literature on why this occurs, consistently, over the years. Please see my previous posts on Michigan survey and NY survey, vs. SPF.

I spent years trying to convince my dad that the days of a 5 cents bottle of Coca Cola were long gone. Then again my kids fall on the floor laughing at how I do not know how to use a smart phone to its true capabilities.

Not that long ago (we’re talking weeks here) I could get a 2 liter of off-brand soda for 68cents. The true miser raised by a Depression baby father never gives up hope.

The U.S. Coast Guard is giving a live concert on Youtube right now. I imagine they will upload it when it’s finished. Just do a key word search with “holiday concert”, the year, and “United States Coast Guard Band” in the YT search and most likely it will pop up for you. Highly recommended, I found some of the music emotionally moving (and I’m not even drinking right now, so, anything get a lump in my throat when I’m not drinking is pretty good). They’ll give another concert January 16th.

I watched the Army-Navy game yesterday. Navy stuffed Army’s run after the 1st TD but Army’s QB got off a few good passes. Why Army went to the ground game for the rest of the game is beyond me. Oh well – those damn Cowboys did well which means Steven A. Smith will have to eat crow tomorrow.

Our good man down in San Diego, Professor Hamilton, I venture to say is a Navy fan. So hope he got to watch it and enjoy.

As I get older it seems I’m slowly getting less and less into football. I have to find personalities I can attach myself to and I just don’t feel much connection to the current ones. I like Mike Leach at Mississippi State and Lincoln Riley. Trying to think of pro guys I like. Not very many. I still like listening to Al Michaels a lot, but it has to be a good game or I will even skip him. Justin Herbert is fun to watch just to watch his arm throwing mechanics, the motion of his arm, but as a person I don’t know anything about him. For me it just seems like all the “colorful characters” are gone. Can you imagine in 2022 a coach like Mike Ditka putting gum on a TV camera. A coach like Sid Gillman inviting players over to his house for spaghetti?? A Sam Wyche type, telling off the fans at Cleveland and saying women reporters don’t belong in a place where men are changing their clothes???? Those days are gone. And Ditka has sold his soul to the devil for infomercial dollars. Best not to think about it.

I have to admit I watch hoping certain QBs get rocked hard – as in Tom Brady and

Aaron Rodgers. Ever noticed how QBs refer to the rest of the players as MY TEAM. Which is why a lot of those players truly hate their arrogant “leader” who does none of the dirty work.

@ pgl

mIxed feelings, but I sure do appreciate the honesty and forthrightness on your thoughts on some modern QBs. I really kinda hate Rogers guts, but I suppose some would say I’m “being political” about football. I remember “back in the day” before a Packers vs. Bears Monday NIght game, Jim McMahon and Brett Favre in the pregame laying back on the field staring at the stars and comparing notes like old Roman warriors. That’s probably me romanticising the past more than anything. Still, I can’t stop myself from feeling that way. Now all the frauds with the cameras rolling post game to patronizingly fake pat each other on the back. Nauseating.

in overtime #12 tom brady hit #13 perriman for a 58 yd td on a 3rd and 3….

whoooadunk, on 3rd and short, the old man would hit a guy with no one between him and the end zone????

otherwise tampa bay should have put buffalo away in the third qtr….

i always pull for army!

The Bills did put a few hard shots on Brady. Tom looked like he was about to cry.

they panned to brady’s motivational speech to the o line before their last possession in the 4th….. the ‘motivation’ should be recorded.

Tom, you survived the sacred Pats rematch, emotional hailstorm. Suck it up dude.

Peter Navarro today says that he is still taking orders from a private citizen in Florida who told him to refuse a Congressional subpoena related to the administration’s pandemic response..

Navarro has become like Colonel Kurtz, only minus a love of the truth,

Omicron continuing to present as a milder but more transmissive strain of Covid. Somewhat cold-like.

Unless you decide to live in a cave for next couple months, high likelihood of being exposed to it in next couple months.

https://www.youtube.com/watch?v=m2vI4XczqZ8

I wonder if we get more variants after this, that are more dangerous, like the earlier Covid. Or if Covid sort of just becomes mixed in with the general cold/flu danger that is around us always.

All this inflation stuff has policy consequences, which have market consequences. After the November Fed meeting, markets were pricing in something like 9 months to the first Fed rate hike. Lately, it’s more like six months. In one sense, rate hikes are needed to correct an easing in monetary policy – real rates have fallen with the rise in inflation (expectations).

As Menzie has regularly pointed out, the yield curve is the most reliable recession predictor we know of. If the Fed were to hike rate now, the curve would be the flattest it has ever been at the onset of rate hikes – easy to invert: https://fred.stlouisfed.org/graph/?g=JNDn

I (and others) have suggested that Fed asset purchases may have eroded the yield curve’s predictive power, so tha inversion may no longer be as reliable a predictor, but that doesn’t mean I’m right.

Now, it may be the case that tapering asset purchases will steepen the curve, making inversion less likely (and policy-induced curve distortion less pronounced), but if not, Fed rate hikes could quickly induce inversion. If memory serves, the Fed only managed 225 bps past time it hike rates, then got spooked by financial market jitters af backed down a bit. The yield curve, all by itself, makes me doubt the Fed will raise rates anything like 225 bps this time, despite above-target inflation. Tough spot for policy makers.

@ macroduck

Found this from Claire Jones over on FT. Would love to read your thoughts on it after you read it. From the agile and adroit mind of Wizard Hyun Song Shin:

https://www.bis.org/speeches/sp211209.pdf

Quick note while I read. The author observes that factory inventories of autos are very high. Others have made the same point. That inventory category includes unfinished vehicles and parts. The surge in factory auto inventories reflects parts shortages, not business decisions, as some commentary suggests.

You probably knew that, but I want to get it out there. High factory inventories represent a problem, not a solution to a problem.

The author’s mention of the “bullwhip effect” is tantalizing, as it agrees with my own views. That probably means I’m not a reliable critic on this issue. But it seems to me that full garages and closets will quell goods demand as services supply returns to a new normal. That will cure bottle-necks.

I like the structure of the piece, moving from the short-term problem of inflation to structural sources of the problem. The author recites well-known structural differences between various regional labor markets, then goes right to the problem of the so-called flexibility of the U.S. (and UK) labor market(s). Shabby treatment of workers leads to limited attachments to employers; We reap what we sow.

Wisely and humbly, the author does not claim to know what the future holds (take note, ego-driven commenters), but rather points out the conditions which will drive outcomes.

As an example of writing from a crusty multinational organization, this is quite good.

Bruce Hall thought he was adding to the discussion by featuring a youtube of some NABE clown. I did listen to his Face the Nation interview as it seems Mr. NABE never heard of this bullwhip effect.

@ macroduck

Appreciate it. Yeah I skimmed the first few pages and i liked what he had to say, and some of it i really hadn’t thought about too much prior. Same as your thoughts highlighting things, I knew you’d see some things I didn’t see which was why I asked you. i think I have read other things of his in the past and been quite impressed so when Jones gave the link to the paper it got my attention. The part about bottle necks being resolved quicker than the consensus (right or wrong) also got my attention. I admit to some bias on the transitory inflation, I been singing that tune so strongly the last few months, but I also like to think I”m willing to fold my cards on a losing hand. and i just don’t think this has been “resolved” yet.

Macroduck provided this excellent discussion on Menzie’s new post highlighting Dean Baker’s forecast of inflation for the next 12 months (spoiler alert -0.5%). Thanks for this link as it really adds to that discussion.

I’m surprised this deranged letter from the Putin government to Ukraine’s government has not received more attention in the discussion of how the US should address Putin’s threat to Ukraine:

https://val-de-moder.org/putins-brutal-letter-to-ukraine-under-medvedevs-signature/

After all – it is like the Russian government asked their favorite American puppet (Trump). Insults, threats, bizarre analogies to goats hanging out with wolves.

Yea I know some commenters here think we should let Putin have his way as we have to let the EU buy natural gas from Putin’s cronies at modest prices. If Ukrainians die in the process, so be it.

pgl,

As I think you know (or should), I have put up a fairly lengthy post on Econospeak about the Russian/Ukrainian situation, too long to summarize here, http://www.econospeak.blogspot.com/2021/12/a-looming-anniversary.html .

The term Monopoly capitalism misrepresents what actually happens. It should be Oligopoly capitalism in the interests of accuracy.

Nevertheless, it hints at the notion that economies of scale and scope give firms an advantage and ultimately this leads to more concentrated market power.

It is absolutely crucial to point out that economies and scale and scope are important determinants of productivity and material standards of living. The kind of stuff that ultimately benefits the poor and low-income workers.

The next thing that one should notice is that economies of scale and scope are becoming increasingly important for numerous economic sectors and that regulation often encourages greater scale not less. In the past, industrial production favoured scale and more recently information technology has clearly favoured scale.

The emerging importance of ESG is a big factor. Environmental, Social and Governance. Sure there might be lots of gratuitous virtue signalling under the banner of ESG but for several sectors, this is important if not absolutely vital and expensive. Companies hire teams of people to handle ESG. In particular, resource companies. Numerous town hall meetings and dozens upon hundreds of community consultations cost. Being able to spread these costs out over larger and/or many operations is critical to keeping units costs down.

This is historic. Willy, nilly, and righteously imposing negative externalities on other parties is no longer viewed as acceptable or for that matter as a good way of conducting business. The once popular zero-sum game approach to doing business is fading away. This new found respect coupled with longer-term decision horizons will cost private companies and will favour scale. The collective benefits are clear. None of this should be controversial if you believe that social contracts and social cooperation are key determinants of economic outcomes.

Industrial organization aka market structure economists have discussed the trade-offs between the benefits of economics of scale v. the need to limit market power. The kind of economic analysis that the DOJ and FTC have been doing on mergers etc. since the Reagan anti-trust revolution finds these kind of issues very central. Alas as recent research has suggested, this Reagan anti-trust revolution has allowed for too many anti-competitive mergers. As recently noted here – the merger of Whirlpool and Maytag was a mistake. One question – where are the economies of scale in producing things like washing machines?

JohnH wrote: “Poole—have you considered why there is no data? Could it possibly be that it is not being collected? ”

Is there a review study that carefully documents the destruction of social wealth in the Neo-Marxist guided populist and authoritarian regimes of Black Africa and Latin America? Not that I am aware of.

From an opportunity cost perspective, my impression is that Neo-Marxist populist/authoritarian regimes have sacrificed and foregone far more social wealth than the original authoritarian socialist models found in the Soviet Union, the Warsaw Pact and the early days of Red China. I am not aware of a rigorous study that explores that claim.

But rather than waiting for a larger-than-life authority figure to tell you what and how to think, there is much you JohnH can do. You can figure out how economists measure economic performance and wealth. You can read elite media that often summarizes headline economic data. And you can examine the numbers and time series of numbers such as real per capita GDP that are collected by the CIA, the UN, the IMF, the World Bank, the OECD. You can look at and compare time series of socio-economic outcome indices.

California watches how the anti-choice zealots in Texas snowed the Constitution only to have the Supreme Court go silent for the moment and thought to themselves – how can we use this to ban guns in our state:

https://jabberwocking.com/california-takes-on-the-supreme-court/

Do it! Yes – the gun lobby will scream Second Amendment but this will make justices like Alito, Thomas, the Trump’s three stooges get all wrapped up in their own panties!

Santa read this comment.

This year, he’s bringing you a copy of the US Constitution.

Copper prices of late are booming with the price per pound at times passing $4.50:

https://www.macrotrends.net/1476/copper-prices-historical-chart-data

It was back in 2006 when copper prices sky rocketed to $3.50 a pound that certain conservative economists including Greg Mankiw got up on their high horses trying us to get rid of the penny. I’m wondering why they are not back on their high horses once again. Or maybe they have decided to join Stephen Moore putting us on some sort of copper standard for monetary policy.

Paul Krugman on “monopoly capitalism:

Paul Krugman on “monopoly capitalism:

http://web.mit.edu/krugman/www/eman.html

May 24, 1999

The Ascent of E-Man

By Paul Krugman

The retreat of business bureaucracy in the face of the market was brought home to me recently when I joined the advisory board at Enron–a company formed in the ’80s by the merger of two pipeline operators….

It’s not that government has vanished from the marketplace. It’s still a good guess that in a completely unregulated phone market, long-distance companies would buy up local-access companies and deny their customers the right to connect to rivals, and that the evil empire–or at least monopoly capitalism–would rise again. However, what we have instead in a growing number of markets–phones, gas, electricity today, probably computer operating systems and high-speed Net access tomorrow–is a combination of deregulation that lets new competitors enter and “common carrier” regulation that prevents middlemen from playing favorites, making freewheeling markets possible….

https://www.nytimes.com/2016/04/18/opinion/robber-baron-recessions.html

April 17, 2016

Robber Baron Recessions

By Paul Krugman

When Verizon workers went on strike last week, they were mainly protesting efforts to outsource work to low-wage, non-union contractors. But they were also angry about the company’s unwillingness to invest in its own business. In particular, Verizon has shown a remarkable lack of interest in expanding its Fios high-speed Internet network, despite strong demand….

https://www.irishtimes.com/business/economy/paul-krugman-monopoly-capitalism-is-killing-us-economy-1.2615956

April 19, 2016

Monopoly Capitalism is Killing US Economy *

We aren’t just living in a second Gilded Age, we’re also living in a second robber baron era.

By Paul Krugman

* https://www.nytimes.com/2016/04/18/opinion/robber-baron-recessions.html

https://www.cepr.net/secular-stagnation-and-the-trade-deficit/

April 18, 2016

Secular Stagnation and the Trade Deficit

Paul Krugman had a good column * this morning pointing to a lack of competition as an explanation for relatively weak investment in spite of low interest rates and high corporate profits. His immediate target is Verizon, where workers are now striking, which shows little interest in expanding its Fios high-speed Internet network in spite of soaring profits. Krugman points out that with little competition, Verizon sees little need to invest more to improve the quality of its service. He then argues that this weak investment is a major cause of secular stagnation, the ongoing weakness of demand that prevents the economy from reaching full employment.

I’d agree with virtually everything in the piece (Krugman may be a bit overly optimistic about the interest in the Obama administration in pursuing a serious competition policy), but there is an aspect to the argument that bothers me. While we should perhaps expect investment to be booming in a context of high profits and very low interest rates, investment actually is not low measured as a share of GDP….

— Dean Baker

https://www.nytimes.com/2021/12/13/business/workers-pay-europe-inflation.html

December 13, 2021

Workers in Europe Are Demanding Higher Pay as Inflation Soars

Prices are rising at the fastest rate on record, and unions want to keep up. Policymakers worry that might make inflation worse.

By Liz Alderman

PARIS — The European Central Bank’s top task is to keep inflation at bay. But as the cost of everything from gas to food has soared to record highs, the bank’s employees are joining workers across Europe in demanding something rarely seen in recent years: a hefty wage increase.

“It seems like a paradox, but the E.C.B. isn’t protecting its own staff against inflation,” said Carlos Bowles, an economist at the central bank and vice president of IPSO, an employee trade union. Workers are pressing for a raise of at least 5 percent to keep up with a historic inflationary surge set off by the end of pandemic lockdowns. The bank says it won’t budge from a planned 1.3 percent increase.

That simply won’t offset inflation’s pain, said Mr. Bowles, whose union represents 20 percent of the bank’s employees. “Workers shouldn’t have to take a hit when prices rise so much,” he said.

Inflation, relatively quiet for nearly a decade in Europe, has suddenly flared in labor contract talks as a run-up in prices that started in spring courses through the economy and everyday life.

From Spain to Sweden, workers and organized labor are increasingly demanding wages that keep up with inflation, which last month reached 4.90 percent, a record high for the eurozone….

New York Times, for example, running bogus stories about mythical $1.99 a gallon milk….

[ There has apparently been no such story in the New York Times:

https://fred.stlouisfed.org/graph/?g=JPmb

January 30, 2018

Average Price per Gallon for Fresh, Whole, Fortified Milk, 2017-2021 ]

“There has apparently been no such story in the New York Times”

Sorry, that particular story was CNN. But that’s not to say that the NYT hasn’t had their own share of inflation fearmongering stories.