ADP released its December employment estimate of 807K vs Bloomberg consensus of 400K.

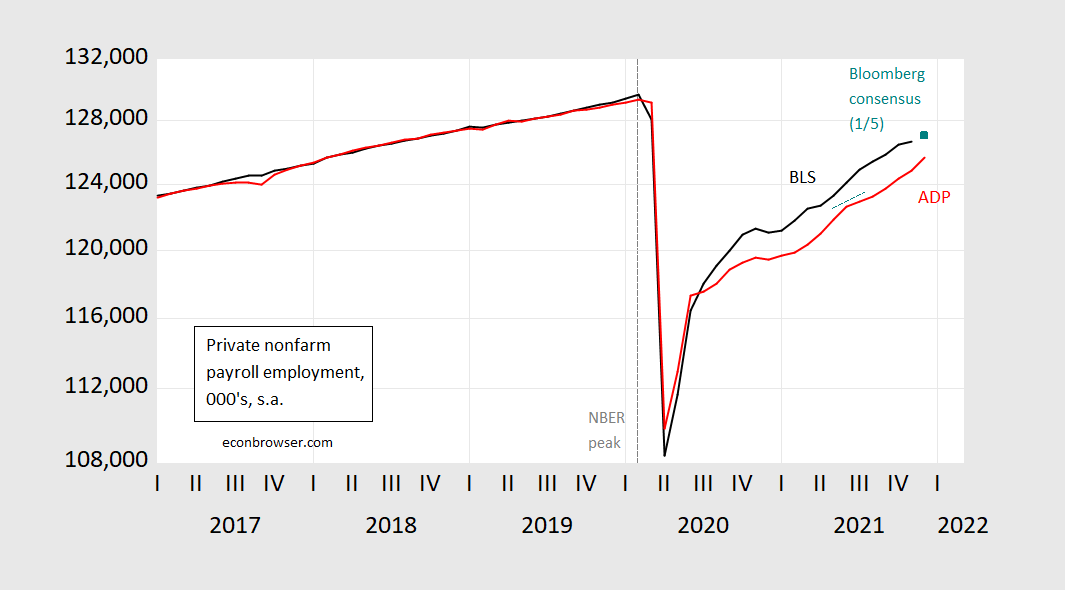

Figure 1: Private nonfarm payroll employment from BLS November release (black), Bloomberg consensus for November as of 1/5 (teal square), ADP November release (red), all on log scale. Source: BLS, ADP via FRED, Bloomberg, and author’s calculations.

In its note today, Goldman Sachs writes:

This morning’s ADP data was consistent with a strong pace of job growth in December, and it suggests that the Omicron wave may have arrived too late to significantly affect job growth in the month. We boosted our December nonfarm payroll forecast by 50k to +500k (mom sa) ahead of Friday’s report.

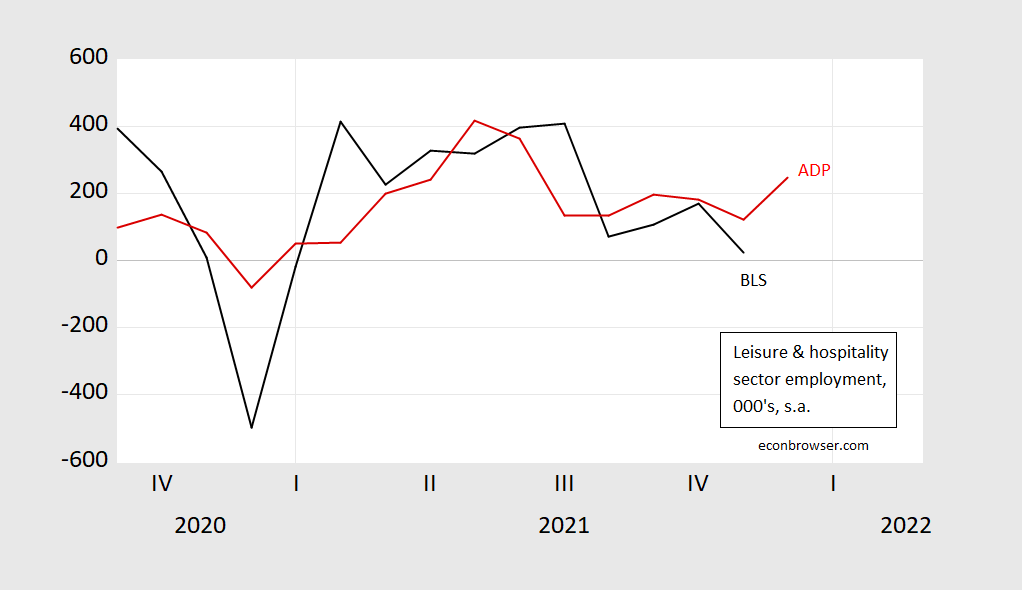

Interestingly, GS notes hospitality and leisure employment was strong at +246K. This is suggestive of a relatively small hit from omicron (especially as the BLS survey takes place in the early part of the month).

Figure 2: Change in leisure and hospitality services employment from BLS November release (black), and from ADP December release (red), both in 000’s, seasonally adjusted. Source: BLS via FRED, ADP, and author’s calculations.

One wouldn’t want to make too much of this increase in the ADP figure given that the correlation between the two series (in differences) has been low in 2021. A regression of the BLS changes on the ADP changes yields an adjusted R2 of 0.08, standard error of regression of 154K, so the BLS series could very well record a negative number.

It’s a nice number and reason for happiness. But it’s hard to put too much emotional stake in it when you know the omicron data really isn’t in there yet.

I’m hopeful (in a completely sentimental/saccharine kind of way, not a prediction in any sense) that the lesser severity of omicron will result in much better economic activity than the consensus expectation. But that is 100% wishful thinking on my part.

Just a casual observation about revising payroll job growth estimates in response to ADP data. It often doesn’t help. Those at the low end of the range of estimates can improve but even in years when ADP correlates more strongly with NFP, median and high-end estimates don’t seem to benefit from revison in response to ADP (again, based on casual observation).

If BLS data show similar strength (seasonal adjustment for December is tricky), then January is at risk of being not so great.

Just for fun, if readers will indulge me, I am showing a forecast for a monthly change in the FRED series, PAYEMS at 494K with a lower standard error forecast of 118K and an upper standard error forecast of 875K. Big spread.

Noise, amirite?

rsm,

I am not certain I understand your comment about “noise”, since I think there is a signal in the data. Although the monthly nonfarm forecasts may have a large spread when standard errors are considered and thus have a lot of uncertainty. Over the course of a year, it seems that the Bloomberg consensus forecast of nonfarm payroll was very accurate.

The sum of Bloomberg’s monthly consensus forecasted change in nonfarm payroll for 2021 was 6,727k and the reported actual change in nonfarm payroll is 6,448k. This is a difference of 279k or a 4% over forecast. Seems very good to me.

https://fred.stlouisfed.org/series/PAYEMS

https://www.bloomberg.com/markets/economic-calendar

What are your inputs?

Claims are through the floor, factory ISM index more positive in December, so the see how you get a strong rise in payroll employment. Is ADP part of the story?

AS is much better than I am with math and using the proper econometrics tools (which I am frankly jealous of), so I would never criticize AS on that score. But I am wondering if he used any kind of variable/coefficient etc, to account for what surely will be negative effects of Omicron. Even if AS has to make a guess, I hope he is including the Omicron factor somehow in his calculations.

Moses and Macroduck,

I used an intervention model with the intervention being Covid, especially the 2020m04 to account for the initial impact of the virus. I used data from 2008 to 2021M11. To account for the latest effect of the economy and Covid on employment I used new claims for unemployment, FRED series, ICSA. Correct me here, but I thought that the employment surveys are taken about mid-month, so perhaps the full effect of Omicron is not going to be seen for the December count.

Given the spread of the forecast using one standard error, it seemed reasonable to me that the employment change should be in the spread, although I am not certain about the mean forecast. Generally, when my mean forecast comes close to Bloomberg’s consensus, I do get some sense of optimism on my forecasts. So, we are at the point of hero or goat. If I am way-off, I accept the bricks being thrown.

When I modeled ten specific subsets of PAYEMS, such as FRED series USGOOD and USLAH the sum of the mean forecast was 238K, within the above forecast standard error.

Wow. You are serious!

Subsectors of PAYEMS in an intervention model is a solid step towards that light. The various sectors will have different responses to intervention, but is PAYEMS also reported by state or cities?

NYS Governor Hochul noted recently that the UE rate in NYC is twice the national average and is trying to address that. As NYC has many workers in hospitality ,which has its own demand problem given COVID and working from home, could your analysis offer insights?

Weekly petroleum inventories had a big build in products (I speculate: from low travel during the holidays, plus warm weather so less heating oil).

Big draw on crude.

https://www.eia.gov/petroleum/supply/weekly/

Brent sticking its nose over $80 (time of this post).

https://www.cmegroup.com/markets/energy/crude-oil/brent-crude-oil-last-day.quotes.html

Today, The WSJ Real Time Economics: I Quit, showed the latest for the Beveridge Curve.

https://newslettercollector.com/newsletter/real-time-economics-i-quit/

Interesting that according to ThoughtCo., the current curve shows increased market inefficiency compared to the recent past.

https://www.thoughtco.com/overview-of-the-beveridge-curve-1148116

ThoughtCo. has the formal view right, but nothing is said about the cause of reduced efficiency in the labor market, if that’s actually what we’re seeing. The cost to workers of working is higher now than before the pandemic. That’s not what is typically meant by inefficiency.

There is a sort of implicit assumption in the Beveridge curve that employers’ choices matter (openings reflect employers’s choices) while workers’ choices are a secondary matter (participation is reflected in the jobless rate).The shift in the Beveridge curve reflects a change in worker preferences, or costs, not more difficult search or declining labor mobility or whatever.

Most categories of employment rose very sharply in ADP’s December data. Factories are reported to have added 74,000. BLS has not reported a single-month gain in factory jobs that large since June 2020. Construction hiring at 62,000, strongest since March. (Weather, maybe?) Trade, transport and utilities up 138,000, off the charts for any period other than the rebound the immediately after the Covid recession.

All in a tight labor market? Seems fishy. Still, with GDP growth estimates running in the 5% to 7%+ range, some input must have risen strongly.

Interesting article from London/UK Covid. Not a hard core study. But lots of data/chtarts. In particular, the fourth chart (normalized versus last wave), showing lower vent/death versus cases is fascinating.

(forgotten link) https://www.ft.com/content/d07f4559-f4f5-4063-94e7-c322bdcf62ce

I’d expect January (and maybe Feb) to be an absolute disaster. But uncertainty is through the roof during this pandemic.

As mentioned, Dec survey was too early in the month to capture the hit and some projections are for a mid-Feb peak.

Also, it’s surprising that Menzie found these differenced series to be stationary – goes to show you never know until you do the work.

I know I’m more cavalier than the average, but I really get the impression (even in a left of center town) that people have general Covid fear fatigue.

Also, to start with, the initial indications were Omicron is mild. Understandably some people reacted with still having concern (not sure it would show same pattern in US as in SA, not sure longer time in the wave would show different results). But every week that goes by seems to support the mild argument more (much lower ventilation and death rates). Notably even the current Democrat administration has hesitated to implement harsh measures. If anything, they’ve been slightly easing response to previous Covid waves (lowered time for quarantine, mentioned states doing their own decisions).

There were some EU countries that implemented harsh travel restrictions and lockdowns preemptively with Omicron. But it doesn’t seem to have stopped spread there. Other countries that hesitated to implement tougher measures (to include the US, really) are probably even less likely to jump in now with tough measures. (Since as time goes on we get more and more support for the initial mildness hypothesis.)

We all swim in different patterns of discussion, so maybe there’s a different mood in academia. But I’m not getting the vibe of higher Covid fear where I work, play. There was a worry a month ago, sure. But fear seems to have lessened, not gone up, lately. Also, some business indicators (oil prices, economic activity) seem to indicate that initial concerns on Omicron have lessened, not increased, at least as markets view the risk. Unless the trend changes (for Omicron), I see further economic recovery, not another Covid setback.

I’m seeing it directly. Everyday. My employer had more than 2x increase in *incremental* – not total – positives last week relative to the week of Christmas. And I’m not talking about a company with 10 employees jumping from 2 to 4 positives… we were already in the hundreds of new positives. There are tons of people out of work due to COVID in the northeast. Many northeast hospitals are in worse shape today than at anytime during the pandemic. Every local new source has discussed recent MTA service disruptions because of staffing shortages resulting in closures of three subway lines. Hell, just look at basic hospitalization rates.

Different swimming patterns, indeed.

Also, it’s important to note that the following assertion

“If anything, they’ve been slightly easing response to previous Covid waves (lowered time for quarantine, mentioned states doing their own decisions).”

Is partially because we just can’t afford for everyone to be out of work all at the same time. So, as you mentioned, maybe Omicron isn’t as virulent but it spreads like wildfire. The data are clear that hospitalizations are going in NYC (https://coronavirus.health.ny.gov/daily-hospitalization-summary) and it often spreads from there – not to mention NYC has high vaxx’d rates than much of the country. But those who are out of work are a huge strain even if they aren’t occupying a hospital bed. USPS, Amazon, hospitals, grocers are already feeling that strain. As such, I wouldn’t be surprised if Jan and Feb are terrible for those reasons.

Mexico claims they will start improving their refining and keeping oil at home. I think most people in the industry doubt this,. Heard it before. Sort of like the endless press releases about Neutral Zone production restarting. Believe it when we see it.

https://rbnenergy.com/maya-mia-how-mexicos-plan-to-phase-out-crude-oil-exports-may-impact-us-refineries

Thanks for the interesting article. Even before I read it – the first thought that came to mind was how refineries have very modest margins even under the best of conditions. Mexico’s attempt to develop a refinery sector seems to be clownish at best given the discussion you linked to.

All industries over time, in a competitive market, should earn their cost of capital. With entrants and capacity expansions adjusting for increased demand (or exits of course).

There are definitely cultural differences though. E&P is more of a high beta (both the oil price sensitivity, as well as exploration risk). Think swaggering cowboys, making bets. Refining is more of a normal operating manufacturing business, where efficiency (throughput and cost control) are key to success.

Mexico has a lot of issues with graft, unions, lower technical capabilities. In general, these are easier to tolerate in E&P than in a manufacturing business, since E&Ps are really more like shell companies (lot of the work done by oilfield service companies) and since it’s really less technical to drill a well and sell the oil/gas than it is to run a refinery (super complicated integrated chemical plant, essentially).

Refineries are politically important to countries though, since they feel it affects their energy security and there are more steady jobs involved. Lots of countries without oil, still think its important to have refining. Also, it’s just more efficient, generally to ship crude than refined products (more stable, bigger ships, not market-differentiated (sulfur, octane, etc.) as much. So, it’s somewhat normal for a country to have some refining, even without oil/gas.

Of course Mexico has both up and downstream. But given the issues with their refineries (on top of everything else, not that complex [Nelson index]), makes more sense for them to buy our WTI (lighter, sweet) and sell us their Maya (heavier, sourer). But that’s a classic free trade argument and may not have as much sway with current Mexican administration.

Copmala Harris, currently polling at 32%. I believe there were people on this blog who told me Harris was going to help “carry” Biden with Black voters when she couldn’t even win with Blacks residing in her home state (which struck me as an odd argument to make at the time). She’s only 8% below Biden and I guess she’s hiding out in the same broom closet Mitch McConnell hid in during the government shutdown. But really, who knows where Copmala Harris is right now?? If Copmala can’t remember if she ever visited the southern border, then she might be disoriented now after visiting a friend in Chevy Chase Maryland and somehow getting it muddled in her head she was in Laredo.

https://www.dailymail.co.uk/news/article-10367939/Biden-starts-year-dire-40-approval-rating-Kamala-just-32.html

https://www.cnn.com/2022/01/05/politics/peter-velz-vincent-evans-kamala-harris/index.html

People. please don’t blame Copmala Harris for terminating all of her staff because they can’t “fix” the media gaffes Harris makes every 10 minutes. Remember now, she was “that little girl on the school bus”.

https://news.cgtn.com/news/2022-01-06/Chinese-mainland-records-189-confirmed-COVID-19-cases-16AZHPwrsPK/index.html

January 6, 2022

Chinese mainland reports 189 new COVID-19 cases

The Chinese mainland recorded 189 confirmed COVID-19 cases on Wednesday, with 132 linked to local transmissions and 57 from overseas, data from the National Health Commission showed on Thursday.

A total of 45 new asymptomatic cases were also recorded, and 629 asymptomatic patients remain under medical observation.

Confirmed cases on the Chinese mainland now total 103,121, with the death toll remaining unchanged at 4,636 since January last year.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2022-01-06/Chinese-mainland-records-189-confirmed-COVID-19-cases-16AZHPwrsPK/img/f24ab0cec31749459c644e405da4ecee/f24ab0cec31749459c644e405da4ecee.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2022-01-06/Chinese-mainland-records-189-confirmed-COVID-19-cases-16AZHPwrsPK/img/1bc1efebec8f47f395a4e2ead7f613bc/1bc1efebec8f47f395a4e2ead7f613bc.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2022-01-06/Chinese-mainland-records-189-confirmed-COVID-19-cases-16AZHPwrsPK/img/18977cd9112c406bb2ca87dc4e5670ad/18977cd9112c406bb2ca87dc4e5670ad.jpeg

http://www.xinhuanet.com/english/20220106/c0729848c58a4a3095ce95cf25b720ce/c.html

January 6, 2022

Over 2.87 bln COVID-19 vaccine doses administered on Chinese mainland

BEIJING — Over 2.87 billion COVID-19 vaccine doses had been administered on the Chinese mainland as of Wednesday, data from the National Health Commission showed Thursday.

[ Chinese coronavirus vaccine yearly production capacity is more than 7 billion doses. Along with nearly 2.87 billion doses of Chinese vaccines administered domestically, more than 2 billion doses have already been distributed to more than 120 countries internationally. Nineteen countries are now producing Chinese vaccines from delivered raw materials. ]

https://www.worldometers.info/coronavirus/

January 5, 2022

Coronavirus

United States

Cases ( 58,805,186)

Deaths ( 853,612)

Deaths per million ( 2,556)

China

Cases ( 102,932)

Deaths ( 4,636)

Deaths per million ( 3)

New business creation makes these index’s worthless. The hedonics can’t capture them and have not been able to for 18 months now.

I did not see their efforts at being a metric that captures every possible economic indicator. Rather it is an index of the cost of logistics. To call their efforts worthless is overly harsh.

Sorry – I was still focused on the prior post. Are you saying new businesses do not report to ADP? I suspect such a claim is not correct.

Wrong, as always. Here’s why:

https://fred.stlouisfed.org/graph/?g=Kzsc

Not sure what you had in mind with hedonics, but pretty sure you had the wrong thing in mind. Are you talking about estimating employment with a price model, or about how much fun employment is?

Make sure Gregory reads: (1) the FRED reference which is Automatic Data Processing; and (2) Menzie’s follow-up comment. Me thinks Gregory has no clue what ADP does.

GREGORY BOTT: This statement makes absolutely no sense. ADP is getting its primary data from the payroll services it provides to new and old businesses.

WTI touching $80 (Brent few bucks higher) right now.

As per usual dynamics, the prompt has varied more than the strip. So FEB22 (prompt) is up about $3 from couple days ago. And the DEC22 contract (which is in backwardation) only went up about $1.50. So difference increased to ~$7 from ~$5.50.

Of course markets have huge uncertainty and lots more wiggles to reveal. But if you take them as Bayesian indicators, it means we would expect a more significant drop in gasoline prices a year from now (before midterms). But to a higher level. [Then a few days ago Bayesian prediction.]

Biden v. Trump on what occurred a year ago at the Capitol:

https://www.msn.com/en-us/news/politics/jan-6-live-updates-biden-slams-trump-for-web-of-lies-about-jan-6-election-loss/ar-AASuQAR

Lindsey Graham slams Biden’s speech:

https://www.msn.com/en-us/news/politics/lindsey-graham-biden-speech-brazen-politicization-of-jan-6/ar-AASvvgi

Look – I would argue Graham lost it a quarter of a century ago. If you have any continuing doubts that the man is a complete clown, please explain his rant today.

Elon Musk watch out. Sony has moved on from Playstations to designing and making electric vehicles!

https://www.theverge.com/2022/1/4/22867818/sony-mobility-cars-vision-prototype-ces-2022

I’ve always been a fan of Sony in general (as my Father was). I hope they clean Elon’s clock. Especially after his sloughing off the cultural genocide in Xinjiang. Rot in hell Elon.

Back in 1995, I was working with a bright economist from Japan on some Sega transfer pricing project where he told the idiot lawyers representing Sega that their approach to Japanese/US transfer pricing was likely dumb unless Sega somehow fended off the competition from Sony. The idiot lawyers of course ignored us as they were the usual know it alls. Then came the new Playstation and Sony of course cleaned Sega’s clock.

Personally, I think this is “much ado about nothing”. People looking for something there, that isn’t there.

https://www.washingtonpost.com/lifestyle/media/audie-cornish-npr-all-things-considered/2022/01/05/48e2d306-6d86-11ec-aaa8-35d1865a6977_story.html

People thinking if they join in on the siren call they get free SJW flight miles. People leave for higher paying jobs, and that means “NPR is racist”. Oh…… horrors, when will the pain of other just as capable people at running their mouths into a microphone end?? These are the same people who have yawned in between gulps of Starbucks coffee while labor unions are destroyed and then want to provide “both sides” of a semi-truck driver “shortage”, think that talking warm air into a mic after reading NYT and that morning’s WaPo makes them into a nuclear physicist. Who the F**k is NPR kidding anymore?? In-between 20 minutes solid of corporate adverts on “public radio”, believe me, they are totally on the working man’s side. I know because the NPR hosts keep phonily telling me so as big tech hides underneath NPR’s skirt in every other news story while Amazon etc ad nauseam crap on their workers.

But it is topical and it is debatable. You can cry for Black hosts who just voluntarily left their jobs for a pay raise. You can cry all day if it makes you feel self-righteous. I’m certainly not going to stop you. Again, the free SJW airline mileage migh come in handy someday, you never know. It helped Oprah and Hillary when all of those pictures of them with Harvey Weinstein got rehashed, so maybe it can help you, I don’t know.

Some shops are great springboard. Some shops steal from the best. Neither one has reason ro apologize.

Some shops are springboard which also steal from the best. Exciting places to work.

I’m not exactly a Candace Owens fan. But it reminded me of a Congressional panel that discussed racism. They had Candace Owens on one side and three upper class white people on the other side, who gave you the feeling they had never been in a room with over two Black people in it (or certainly hadn’t walked the sidewalk in lower class Black neighborhoods), lecturing Candace Owens on what racism was. And after Owens sat there listening to what the 3-4 upper-class white panelists had read from books on what racism was, she said something to the effect of (paraphrasing very much here) “You guys say white supremacy extremists are Blacks biggest problem, but if you look at the long-term record Blacks’ biggest albatross has been absentee fathers, education levels, and illiteracy”. And I thought to myself “Hmmmm, I don’t even like her…… but I don’t know if what she said is wrong”.

Here is actually the clip, so that I don’t misrepresent what had been said in my sloppy paraphrase:

https://www.c-span.org/video/?c4818085/kathleen-belew-candace-owens-clash-hearing-white-supremacy

This is exactly the same thing I’m talking about with NPR. They are a fraud.

https://www.bloomberg.com/news/articles/2022-01-05/new-york-times-illegally-restricted-labor-activism-u-s-alleges

NYT claim to be “Democrat” or “liberal” then have a bunch of weasel bean counters running around trying to kill the union. And make no doubt, this intimidation of journalist’s livelihoods is coming from the Sulzberger family, and them alone, they can do the Ellen Degeneres sh*t show tapdance “Oh, I have layers of management, I didn’t know”. Anyone of intelligence knows she’s a sack of sh*t and the Sulzbergers put themselves in the same class by bullying union members.

What they have now done, is lost at least one reader (me) who picked up a hardcopy NYT once a week at the convenience store. $3 times 52, you do the math. I’m done wasting $156 a year on a bunch of bottom-feeders trying to kill the labor unions. You know how derogatory stereotypes start about a certain group of people?? The type of behavior described in the above Bloomberg link

Bloomberg probably took great glee at this jab at a competitor. Now maybe someone at the NY Times should do a story on how THE Bloomberg treats its workers.

Not against it, as long as it’s accurate. I used to subscribe to the magazine before they got a female editor just for the sake of having a female editor, who they fired shortly later after subscription numbers dropped, me being one of them. Used to be able to get the hardcopy for less a buck an issue. That ends my bad cover-tune of Springsteen’s “Glory Days”.

BLS in at +199,000 for December, so very far off the ADP number. It is interesting to note that the big gap between ADP and BLS opened up in Q2 2020, perhaps due to the various stimulus programs, or perhaps due to more fundamental factors related to the pandemic. In any event, it would not seem unreasonable to expect the gap to close as stimulus winds down and the economy moves past covid. This would suggest that, for a period of time, ADP numbers will regularly, and probably materially, outperform the BLS survey to the upside.

“BLS in at +199,000 for December, so very far off the ADP number. It is interesting to note that the big gap between ADP and BLS opened up in Q2 2020, perhaps due to the various stimulus programs”

Are you too incompetent to read past the headline figures. The employment survey indicated a 199 thousand increase but check out the household survey as they report a 651 thousand increase. Now it is true to the overall establishment survey includes government jobs whereas ADP is private only. But if you had bothered to check – the establishment survey indicate a decrease in government employment of only 12 thousand.

Come on dude – you have to be the most incompetent consultant ever. Try admitting that to your stupid clients.

Now, now, pgl. Figure 2 (above) certainly appears to be this series: https://www.bls.gov/ces/ and only for Leisure and Hospitality of 53,000 with a range of -3,800 to +109,800. The total discussed on this page is the 199,000 that Steven was referencing. You are correct that there is another survey, but the data in Figure 2 are not reflecting that other survey.

If the problem you have with Steven is the 199,000 number which includes government, then the “corrected” private number is 211,000 (105,400 to 316,600). Still a far cry from the ADP number or the 651,000 number you are referencing (which has a different basis):

The BLS-CPS (Monthly sample survey of approximately 60,000 eligible households):

Includes the unincorporated self-employed, unpaid family workers in family businesses, agriculture and related workers, workers in private households, and workers on unpaid leave. Excludes workers on furlough for the entire reference week, even if they receive pay for the furlough period (they are considered unemployed, on temporary layoff).

Approximate size of over-the-month change in employment required for statistical significance at the 90-percent confidence level: ±500,000

The BLS-CES (Monthly sample survey of approximately 144,000 businesses and government agencies, representing about 697,000 individual worksites):

Excludes all of the groups listed at left, except for the logging component of agriculture and related industries. Includes furloughed workers if they receive pay for any portion of the pay period that includes the furlough.

Approximate size of over-the-month change in employment required for statistical significance at the 90-percent confidence level: ±110,000

The point is, pgl, it’s not necessary to be snarky with every comment you write.

Wow – a new record for the most words while remaining totally irrelevant to the discussion at hand. You have this down to an art form!