As of yesterday:

Figure 1: Five year inflation breakeven calculated as five year Treasury yield minus five year TIPS yield (dark blue line), five year breakeven adjusted by inflation risk premium and liquidity premium per DKW (light blue thin line), five year five year forward expected inflation calculated from Treasury and TIPS yields (red), all in %. Source: FRB via FRED, Treasury, Kim, Walsh and Wei (2019) following D’amico, Kim and Wei (DKW) accessed 1/6/2022, and author’s calculations.

There’s a wide gap between the 5 year inflation breakeven (2.87% as of yesterday) and the adjusted-for-premia estimate — 1.28 percentage points as of 12/31.

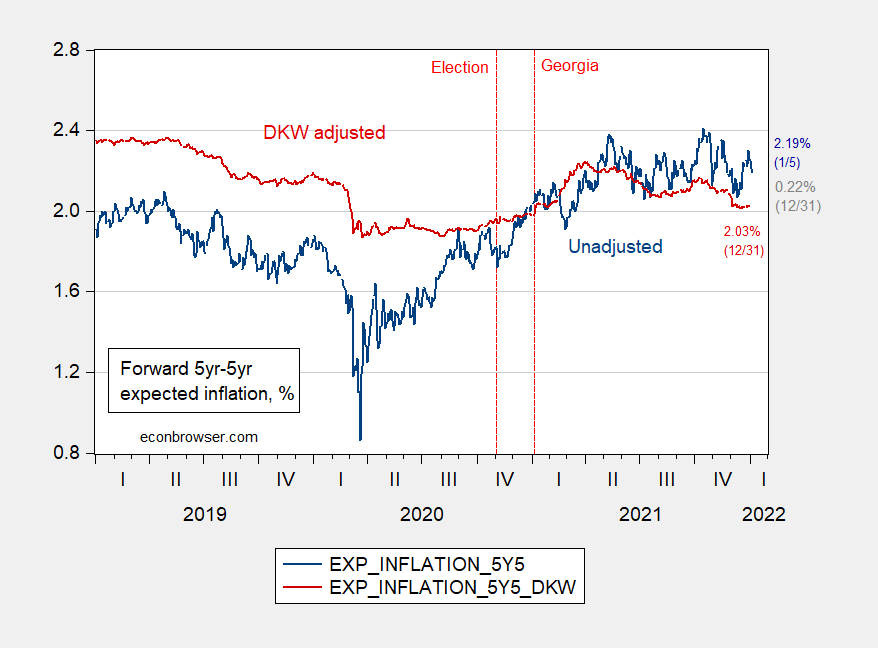

Figure 5: Five year five year forward expected inflation calculated from Treasury and TIPS yields (dark blue line), five year breakeven adjusted by inflation risk premium and liquidity premium per DKW (dark red line), all in %. Source: FRB via FRED, Treasury, Kim, Walsh and Wei (2019) following D’amico, Kim and Wei (DKW) accessed 1/6/2022, and author’s calculations.

The longer term expectations — 5 year average 5 years from now — are falling, and either unadjusted or adjusted are not far from 2% on CPI (not PCE).

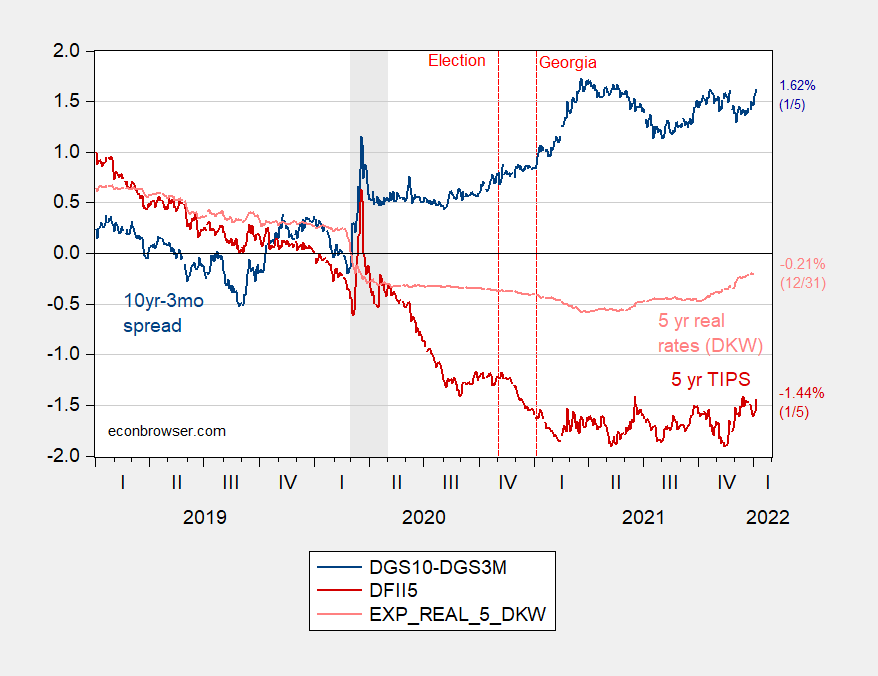

Figure 3: 10 year-3 month term spread (dark blue), five year TIPS yield (dark red)), five year average expected real rates fromDKW (pink), all in %. NBER defined recession dates 2/28-4/30/2020. Source: FRB via FRED, Treasury, Kim, Walsh and Wei (2019) following D’amico, Kim and Wei (DKW) accessed 1/6/2022, NBER, and author’s calculations.

Measures of future economic activity, such as the 10 year – 3 month term spread, indicate a slight improvement in optimism, but still not near levels of earlier in the year, like March 2021. Real 5 year rates have been edging upward – since middle of last year using the adjusted series.

https://www.cnbc.com/2022/01/05/nike-sues-lululemon-for-patent-infringement-over-at-home-mirror-gym-and-fitness-apps.html

Did you know Lululemon owns The Mirror? Lululemon is suing Peloton for patent infringement. And now Nike sues Lululemon for patent infringement? Gee it is like these oligopolists care more about draining your bank account than you getting in shape. What’s next – they will charge me for running in the nearby public park?

Timely comment. Bear steepener underway, unwinding an off-and-on flattening since April 1.

We’ll see whether the long-end sell-off lasts beyond profit-taking on flatteners.

Stocks are feeling it.

Entertaining. A large market selloff partially induced by rates moves will give the Larry Summers of the world what they want. Then Larry and pals can cry that although they had been screaming “inflation!!!” for the last year, what a horrendous mistake it was to raise rates. That’s the great thing about being an “expert” on American TV. The people watching Larry already forgot what gift they got for Christmas.

By the way, whatever the relative merits of Mexico’s plans to hang on to its oil, there may be a significant price impact in the near term through hedging:

https://www.bnnbloomberg.ca/world-s-biggest-oil-hedge-could-shrink-if-mexico-curbs-exports-1.1703645

Also some dark clouds for fracking, in Texas for now, more broadly if wisdom prevails;

https://oilprice.com/Energy/Energy-General/Strong-Earthquakes-Spell-Trouble-For-Americas-Oil-Heartland.html

“But last week, state oil firm Petroleos Mexicanos said it will cut exports by more than half in 2022 and stop them all together next year. Even if the plan for self-sufficient fuel production fails, a drive to reduce exports will likely mean a smaller hedge going forward. That in turn would shrink the volume of oil derivatives Mexico sells in the years ahead.”

PEMEX sells a lot of oil to US refineries. I read in another comment that PEMEX is trying to develop its own refinery business. The story seemed to suggest PEMEX is not exactly very adapt at refining.

The main thing to keep in mind about PEMEX is that for many decades its major function – in the eyes of Mexico City – has been first and foremost to be a revenue stream that would materially finance the Federal Governments’ budget.

To think of it as being politically autonomous, like say the TVA, (as it should be, for the sake of the patrimony as Latin Americans like to phrase it) is very wrong. PEMEX is simply the heavily exploited cash cow for the Mexican government, which it has been from the days of nationalization.

Sadly, this is typical throughout Latin America. State-owned oil companies are chronically underfunded for their internal expenses.

The metaphor would be not servicing your car regularly because you don’t want to spend the money for such things as new tires, oil changes, etc – heck the car is still running isn’t it? And you really, really need the money for those things that will make the family happy or at the least survive.

“The importance of January 6th as an historic event cannot be overstated. I was honored and proud to join my daughter on the House floor to recognize this anniversary, to commend the heroic actions of law enforcement that day, and to reaffirm our dedication to the Constitution. I am deeply disappointed at the failure of many members of my party to recognize the grave nature of the January 6 attacks and the ongoing threat to our nation.” Former Vice President Dick Cheney

Of course this Vice President outed a very valuable CIA agent to punish her husband for telling the truth as to how the Vice President lied to the American people to con us into going to war in Iraq some 18 years ago. But even Darth Vader is not as evil as Donald Trump.

He hasn’t shot anybody lately. Has he?

Cheney no but your boy Trump is responsible for the loss of lives on 1/6/2021.

The most important thing that happened today, and makes me feel pride as an American (which is a rare feeling in the last 5 years or so):

https://www.c-span.org/video/?c4994691/user-clip-biden-tells-truth

And, it’s crass deflection and distraction for the ongoing disasters.

Which “disasters”??

You prefer encouragement for Nazis and white supremacists I assume??

https://www.c-span.org/video/?c4811891/user-clip-trumps-very-fine-people-quote

It sounds like you actually support Trump’s domestic terrorists. Get a good defense lawyer as the Justice Department may be coming after you.

[Apologies if this is Groundhog Dayish, haven’t examined previous discussions.]

I don’t understand the red line. Surely the blue line indicates what betting markets are requiring, whether from “expectation” or “risk”. I mean it’s all a risk, right, when someone buys an investment? We don’t know what will occur. I thought the whole point of TIPS from when Clinton admin put them in was that it allows bond buyers to isolate themselves from risk (using the term broadly) of inflation.

Caveat: I don’t have a Ph.D. in econ. Don’t have a bachelor’s in econ. Never took a course at all. And all of my econ understanding is from 3 day corporate seminar, where the topic was 100% micro, 0% macro. The tiny (possibily misremembered) bit I know(?) about TIPS was stray remarks from the 8 days on corporate finance, where we developed discount rates, NPV, etc. for project economics. And that we spent 8 days on corpfin, 3 days on micro, and 0 on macro should tell you the skew.

P.s. Maybe interesting to see this red versus blue line a bit further back. Maybe back to when TIPS first put in? Just trying to get my head wrapped around what red means. When and why is it different from blue? So a longer time history might help. (Personal link request.)

You know what TIPS put me in the mind of?? Adjustable rate mortgages back in the late 1970s and the 80’s. Just how dumb did you have to be to buy into that?? Banks reel these folks in, and they have a “new instrument” for reaming these people sans lubrication every decade.

Re: The topic.

Pray for inflation.

Never underestimate Joe Biden’s capacity to ‘eff’ up everything. See Barack Hussein Obama quote.

i

@ T. Shaw

You see those beige colored bars?? Who was President then??

https://tradingeconomics.com/united-states/gdp-growth-annual

It almost reminds you of the numbers at the end of “W” Bush’s two terms. Oh wait, you can’t read anything on a higher plane than Roald Dahl. Never mind.

AP story on Bakken Fed lease sales. (These can be important for individual companies seeking to put together drilling programs, can derail particular units.) It does seem that current administration has walked back from the initial extremely anti-oil stance (much tougher than Obama). But I can understand industry and state concerns remaining. After all, why did they take the actions that required courts to intervene? And there are ways the Feds can still slow walk things. All that said, I’m hopeful that the off/on policy of DOE has moved to on.

—-

BISMARCK, N.D. (AP) — Oil and gas leasing on federal land is expected to resume early this year in North Dakota and Montana after the Biden administration halted the process nationwide last year.

The federal Bureau of Land Management is planning a lease sale for the first quarter of 2022 but has not finalized details. There are 6,850 federally owned mineral acres available in western North Dakota and eastern Montana, the Bismarck Tribune reported.

Oil and gas companies will bid to secure the leases and those that are successful will have a 10-year window to get a federal permit to drill.

President Joe Biden halted the leasing process after he took office last January when he issued an executive order announcing a review of the program “to restore balance on America’s public lands and waters to benefit current and future generations.”

Oil- and gas-producing states, including North Dakota and Montana, sued to try to force leasing to continue and were successful last June when a court order required the federal government to resume the sales.

North Dakota has filed a separate legal challenge with a hearing scheduled for Jan. 12 at the federal courthouse in Bismarck.

“We have every reason to believe they will continue to hold those lease sales as they’re directed to” by federal law, said Lynn Helms, director of the North Dakota Department of Mineral Resources. “But we’re going to continue with our court case to make sure that happens.”

There are no concerns to have. The “stance” was a fraud from the start. Then the administration could just shrug and look at supporters of it saying “eh, now you know”. The stance in the end is Obama part 2.

Yeah, I get that he needed to run left in the primaries and then “triangulate” back in the general. But the DOE statements and actions done immediately after entering office were not needed to help with a Democrat primary audience. After all both the primary and general were behind him. If anything, I get more the impression that that’s where the administration’s heart lies. Wind and solar and biofuels and EVs are all dreamy Silicon Valley stuff. Oil and gas are thuggish Texas stuff. But as with Obama, current administration recognizes the political impact of gasoline prices and “drill, baby, drill”.

[And maybe even belatedly the power of US drilling to impact a cartel-dominated commodity with high demand/supply elasticity. But I was really unhappy seeing Jenni G. laugh at the idea of US production affecting price. Was she asleep in NOV14? NOV18? 1986? I’m not sure she really gets microeconomic concepts. She’s very verbally poised, but I’m skeptical of a DOE sec with no background in science or math…both of which are really helpful grounding for econ also.]

At the end of the day, as someone who likes low gasoline prices and likes the US oil and gas industry, I don’t care why the stance changes, just that it persists. But industry is very skeptical of Jenni G. Obama’s E. Moniz was a lot better. Smarter overall (I mean really stunningly smart). And jumped on the shale revolution as it emerged. https://www.energy.gov/contributors/dr-ernest-moniz

So none of these indicators predicted the current inflation spike, but we’re supposed to trust them anyway?

Aren’t these instruments used in hedges and without knowing the associated trades and full positions (and why would private financial firms reveal that info?), you’re dealing with noise?

rsm,

These are forecasts for five years from now. So, no, they are not all that useful for short term forecasts. Just how dumb are you anyway?

Reading your comments is like listening to someone after the Vashta Nerada have gotten them. No brain left, just the same echo, over and over.

Gotta love Alex Kingston. “Spoilers.”

So one forecast error invalidates a model? You’re dumber than a rock.

In the name of forthrightness, I will semi-sheepishly confess to having originally found this in a ZH blog/Epoch Times article. I will say this, I find the idea very fascinating, at first glance very effective, and remind people, that desperate times call for desperate measures:

https://press.armywarcollege.edu/cgi/viewcontent.cgi?article=3089&context=parameters

“Beneath a broken nest, how can there be any whole eggs?”

This Broken Nest idea strikes me as far superior to a stance that we would start World War III over Taiwan. I would argue that this is the current approach to deterring Putin from invading Ukraine. Yea we know Chicken Hawks like Ted Cruz want war over Ukraine. Something tells me that conceding we would not win the war over Taiwan will send Princeton Stevie boy in a mad frenzy. Of course Cape Cod has not been the front of any battle line since the 18th century.

No need for a broken eggs strategy in Ukraine. It’s already a basket case. Putin knows this and he knows that the US owns the problem…which is fine with him as long as US doesn’t put nuke-capable missiles on Russia’s doorstep.

The Taiwan strategy talks about the US threatening to raze semi conductor industry as a deterrent and possible response to Chinese invasion. It would be a credible threat since China depends on Taiwanese semiconductors. Only problem is that the US does too. Talk about threatening to shoot yourself in the foot!

Lord – you are working for Putin. And we thought Trump was a sell out.

No need for a broken eggs strategy in Ukraine. It’s already a basket case. Putin knows this and he knows that the US owns the problem…which is fine with him as long as US doesn’t put nuke-capable missiles on Russia’s doorstep.

The Taiwan strategy talks about the US threatening to raze semi conductor industry as a deterrent and possible response to Chinese invasion. It would be a credible threat since China depends on Taiwanese semiconductors. Only problem is that the US does too. Talk about threatening to shoot yourself in the foot!

Well TSMC has been the king of semiconductors for a long time but your comment ranks up there with the “expert analysis” we generally get from Bruce Hall. I guess you two have not noticed how much investment there has been in semiconductor factories right here in the USA.

I decided to check with http://www.census.gov for their international trade data on exports and imports of semiconductors. Fun fact – the US imported $58 billion of which over $7 billion were from Taiwan. I guess one might think we depend on imports of semiconductors from Taiwan. UNTIL one realized that we exported $55 billion of semiconductors. Two lessons learned:

(1) the semiconductor market is a global market; and

(2) whenever JohnH thinks he knows something please check the facts as it is 100% certain that JohnH never bothered to check the facts.

A typically Il-informed comment from pgl who obviously doesn’t realize that not all semiconductors are the same. Taiwan supplies high-end, leading edge semiconductors and holds a virtual monopoly in that market.

https://www.bloomberg.com/news/features/2021-01-25/the-world-is-dangerously-dependent-on-taiwan-for-semiconductors?sref=q0qR8k34

If the US were to raze TSMC to cripple China, it would really be shooting itself in the foot.

pgl really should refrain from commenting on geopolitics, about which he knows nothing.

JohnH

January 9, 2022 at 8:24 am

I can see you have never read TSMC’s 20-F (Annual Report). TSMC is a contract manufacturer. It does not design the chips – companies like Intel and Samsung Semiconductor do the designing and rely on TSMC for production. Now TSMC has developed process intangibles but not the product intangibles.

So your comment about “high end” is just another example that you understand nothing. But that is what one gets when one relies on some Bloomberg reporter as opposed to understanding the actual industry.

Now one might lament the loss of know how in terms of efficiently doing the contract manufacturing if China invades Taiwan. But the funny thing is that TSMC has a factory in the US and I’m sure its engineers would be welcomed here if they lost their home land.

Another lesson learned – JohnH thinks he is the industry expert even though he is too stupid to read even an Annual Report.

Federal Reserve vice-chair Richard Clarida failed to disclose transactions of $1 million to $5 million that he made during the market turmoil at the beginning of the pandemic in February 2020. He exchanged stocks into bonds on February 24 as the market started to take a dive as the pandemic became apparent. And then he exchanged millions back from bonds into stocks on the 27th the day before Powell announced his extraordinary measures to support businesses and the economy.

He had disclosed the February 27 exchange but had not disclosed the opposite exchange three days previous. He had described the February 27 transaction as just a pre-planned rebalancing transaction. But by failing to disclose the opposite move just three days before puts the lie to that cover story. He lied in failing to disclose both transactions and he lied about his cover story. The lying proves criminal intent.

Seriously, this guy needs to serve hard time in federal prison. Powell needs to address this hard.

@ joseph

The Economics Profession’s reply to your substantive outcry for accountability: https://soundsilk.com/wp-content/uploads/2019/09/soundsilk-cricket-chirp.mp3

https://www.nytimes.com/2022/01/06/business/economy/richard-clarida-fed-stock-fund.html

January 6, 2021

A Fed Official’s 2020 Trade Drew Outcry. It Went Further Than First Disclosed.

Corrected disclosures show that Vice Chair Richard H. Clarida sold a stock fund, then swiftly repurchased it before a big Fed announcement.

By Jeanna Smialek

Richard H. Clarida, the departing vice chair of the Federal Reserve, failed to initially disclose the extent of a financial transaction he made in early 2020 as the Fed was preparing to swoop in and rescue markets amid the unfolding pandemic.

Mr. Clarida previously came under fire for buying shares on Feb. 27 in an investment fund that holds stocks — one day before the Fed chair, Jerome H. Powell, announced that the central bank stood ready to help the economy as the pandemic set in. The transaction drew an outcry from lawmakers and watchdog groups because it put Mr. Clarida in a position to benefit as the Fed restored market confidence.

Mr. Clarida’s recently amended financial disclosure showed that the vice chair sold that same stock fund on Feb. 24, at a moment when financial markets were plunging amid fears of the virus.

The Fed initially described the Feb. 27 transaction as a previously planned move by Mr. Clarida away from bonds and into stocks, the type of “rebalancing” investors often do when they want to take on more risk and earn higher returns over time. But the rapid move out of stocks and then back in makes it look less like a planned, long-term financial maneuver and more like a response to market conditions.

“It undermines the claim that this was portfolio rebalancing,” said Peter Conti-Brown, a Fed historian at the University of Pennsylvania. “This is deeply problematic.” …

As I have pointed out before, there is some very weird stuff in the DWK model. As Menzie Chinn points out, “there’s a wide gap between the 5 year inflation breakeven (2.87% as of yesterday) and the adjusted-for-premia estimate — 1.28 percentage points as of 12/31.”

But it isn’t just the magnitude of the gap, it’s the composition that is strange. Only a tiny bit of it, 0.1%, is unexpected inflation risk. Most of the gap is a negative 1.1% liquidity premium for TIPS. The DWK model is saying that TIPS, which represent a tiny percentage of Treasury bonds, are more liquid than nominal Treasuries which trade over $600 billion per day.

An overwhelming amount of research suggests that TIPS are less liquid than nominal Treasuries because of smaller trading volume, longer turnaround time and wider bid-ask spreads. This means the TIPS liquidity premium should be positive. Yet the DWK model is showing it to be negative — by a lot.

The DWK model is a complex mathematical model that I don’t pretend to understand, but as Krugman often says, you have to step back from your math on occasions to see if what your math is telling you makes sense.

This big negative TIPS premium in the model is weird.

Joseph,

Yep. When demand for TIPS is sufficiently strong, the model will necessarily reflect the strength of demand in one or more of its components.

Just a speculation on my part, but the relative illiquidity of TIPS could result in a negative liquid premium when buying is abnormally strong, or an exaggeratedly high liquidity premium when selling is strong.

It’s a bit perverse that a liquid premium could be distorted by illiquidity, but I think that’s what happens.

https://fred.stlouisfed.org/graph/?g=raZp

January 15, 2020

Interest Rates on 5-Year and 5-Year Inflation-Indexed Treasury Securities, 2020-2021

https://fred.stlouisfed.org/graph/?g=r5VO

January 15, 2020

TIPS 5-year spread, * 2020-2021

* Breakeven inflation rate (difference between rate on nominal Treasury Notes and on Treasury Inflation-Protected Securities)

Macroduck: “Just a speculation on my part, but the relative illiquidity of TIPS could result in a negative liquid premium when buying is abnormally strong,”

A negative TIPS liquidity premium would imply that the TIPS yield is depressed below the real interest rate due to strong demand for inflation protected securities. But when you apply a negative liquidity premium to the DWK formula, it lowers the expected interest rate, which is contrary to the assumption that strong demand for TIPS and fear of inflation is causing the negative liquidity.

Also note that a negative TIPS liquidity premium implies that the real interest rate is above the current TIPS yield, which is contrary to general expectations.

It’s all very peculiar.

My own intuition, for what it’s worth, is that the premium for unexpected inflation is going up, not that the TIPS liquidity premium is going down and negative. Both have the same result on expected inflation, but the first seems more logical to me. But that’s the opposite of what the DWK model shows.

Anyway, the only real world observations we can make are the actual TIPS and nominal Treasury rates. Expected inflation is somewhere in between and can only be inferred by models.

I was actually pulling for Nicholas Kristof. But this has to be deeply embarrassing for a man who considers himself to be pretty literate. The assumption is he read up on this before giving up his NYT job??

https://www.nytimes.com/2022/01/06/us/oregon-governor-kristof.html

You know another thought that just hit me right now?? (you guys know I’m slow sometimes right??). Kristof is no bozo. He had to have known what was going on with the Sulzbergers illegal intimidation of the NYT journalists’ labor union. Did he ever once write a column criticizing his then employer on that front?? Or for Nicholas Kristof was it “monkey hear no evil, monkey see no evil”??

That last question is a rhetorical one.

https://news.cgtn.com/news/2022-01-07/Chinese-mainland-records-174-confirmed-COVID-19-cases-16CxsYehkhW/index.html

January 7, 2022

Chinese mainland reports 174 new COVID-19 cases

The Chinese mainland recorded 174 confirmed COVID-19 cases on Thursday, with 116 linked to local transmissions and 58 from overseas, data from the National Health Commission showed on Friday.

A total of 45 new asymptomatic cases were also recorded, and 632 asymptomatic patients remain under medical observation.

Confirmed cases on the Chinese mainland now total 103,295, with the death toll remaining unchanged at 4,636 since January last year.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2022-01-07/Chinese-mainland-records-174-confirmed-COVID-19-cases-16CxsYehkhW/img/bd01ea6baa9a46668027b93e27446b11/bd01ea6baa9a46668027b93e27446b11.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2022-01-07/Chinese-mainland-records-174-confirmed-COVID-19-cases-16CxsYehkhW/img/0ed95ed061344aab9572cd5bcce7b8d2/0ed95ed061344aab9572cd5bcce7b8d2.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2022-01-07/Chinese-mainland-records-174-confirmed-COVID-19-cases-16CxsYehkhW/img/8c583cdeda6d453d8b420157ed085fb8/8c583cdeda6d453d8b420157ed085fb8.jpeg

http://www.xinhuanet.com/english/20220107/3024a2d8ab8d4633a5e7f6fac07af326/c.html

January 7, 2022

About 2.88 bln COVID-19 vaccine doses administered on Chinese mainland

BEIJING — About 2.88 billion COVID-19 vaccine doses had been administered on the Chinese mainland as of Thursday, data from the National Health Commission showed Friday.

[ Chinese coronavirus vaccine yearly production capacity is more than 7 billion doses. Along with about 2.88 billion doses of Chinese vaccines administered domestically, more than 2 billion doses have already been distributed to more than 120 countries internationally. Nineteen countries are now producing Chinese vaccines from delivered raw materials. ]

• https://nypost.com/2021/04/11/chinese-covid-19-has-low-effectivness-official/

• https://www.republicworld.com/world-news/china/chinas-sinovac-covid-19-vaccine-booster-ineffective-against-omicron-hong-kong-study.html

Government institutions may be “shirking responsibility” because Hungary had vaccinated people over 65 with the Sinopharm vaccine, contrary to the manufacturer’s instructions, Újhelyi said. [Whoa, Nelly! 80% or so of COVID-related deaths in the U.S. are in people 65-years and older. Is that unique to the U.S.? If not, the Chinese have developed a vaccine that is intended for people who normally recover from COVID.]

Source: dailynewshungary.com https://dailynewshungary.com/chinese-vaccine-ineffective-against-covid/

Regardless, we have to believe the statistics, right? China’s vaccination program is the best in the world.

Hey Brucie – do us all a favor. Take ltr out to dinner and iron out this issue on the effectiveness of this vaccine. We trust both of you to be fair and balanced Faux News style!

https://www.worldometers.info/coronavirus/

January 6, 2022

Coronavirus

United States

Cases ( 59,564,116)

Deaths ( 855,843)

Deaths per million ( 2,563)

China

Cases ( 103,121)

Deaths ( 4,636)

Deaths per million ( 3)

Oops. Payroll jobs up just 199,000.

Household job count, on the other hand, up 651,000, so ADP gets half a gold star.

Goldman gets a raspberry for allowing ADP to stampede it into revising an already high forecast higher. Not sure Goldman forecasts are worth special attention.

So our good man Mr. AS was 39k on the high side. That’s not too bad really. If my sourcing is correct AS was 162k closer to the actual reported number than the consensus. I think if you beat the consensus by 162k, you can “hang your hat” on that.

Take a small bow AS!!!!!

Not to mention kicking Goldie solidly in the pants.

Hahahaha, I didn’t even think about that, I should but I didn’t. Pretty good. Yup. I mean you know I would be on this blog bragging if I had done that, so……. I think AS should be proud of himself.

Well the employment to population ratio continues to climb but is still below 60%.

Have a look at the employment figures vis-a-vis the over 20s non-institutionalized population.

Have a look at the employment figures vis-a-vis the over 20s non-institutionalized population.

Demographics matter.

https://www.bls.gov/news.release/empsit.b.htm

The details from the employment survey. One thing I noticed is that government employment continues to decline each month. Which by itself is poorly timed fiscal austerity.

Princeton Steve had one of his usual stupid yet arrogant comments on this under the previous post. He may be the world’s worst consultant but he is always good for comic relief!

pgl,

Now now, I am the most arrogant person here. Moses has admitted he goes after me because of it, and he is not the first. I have had people trying to put me in my place for my arrogance since I was friends with the real Mike Smith back in Princeton over 60 years ago, old man that I am, :-).

Anyway, I am much more arrogant than Steven. He is just a second tier arroganter, not even in my league!

Covid is still running rough-shod over data collection efforts.

ADP reports a private job gain of 807,000 in December. BLS reports 211,000. Households report 651,000 new jobs in December. BLS reports 199,000. BLS reports 2,000 jobs lost in retail, purely an artifact of difficulty in seasonal adjustment. BLS reports revisions to prior months’ establishment job counts at +141,000.

ADP -29,000.

Quite a mess, and rubbing various data series together doesn’t help much. ADP and households both show remarkably strong hiring, so maybe the establishments number is wrong? But the job market is awfully tight to be cranking out either 650k or 807k new jobs in a single month. Establishments report a 3-month average pace of hiring at 365k. ADP at 626k. Households 723k. So again, ADP and households are in better agreement with each other, but at odds with evidence of a tight labor market.

This is not an effort to chum the water for rsm. And it is certainly true that the numbers look good, no matter which version one chooses to (sort of) believe. Just a hard time to draw conclusions from monthly data.

Maybe Census and BLS should have a chat before the nexr jobs report.

New business applications

https://www.census.gov/econ/bfs/index.html

BLS business birth/death model

https://www.bls.gov/web/empsit/cesbd.htm

It’s like wondering why your moped is running rough and then finding a rat living in the carburetor.

To the extent that new businesses account for some of the discrepancy between establishment hiring data on one hand, household and BLS on the other, that does not mean the labor market isn’t tight. People starting their own businesses (however defined) are less available for employment in establshed firms. In the JOLTS data, they would show up as quits or dismissals, but not as hires unless BLS discovered them.

The magnitude of the gap between housholds/ADP and establishments is mighty big to be accounted for entirely by self-employment. It would mean in lot of months, people are hiring themselves faster than established firms are hiring.

This is not necessarily a blossoming of entrepreneurship in a virtuous sense, other then making a virtue of necessity. These start-ups will often be single-person operations, with employment benefits coming straight out of household income, which will often be erratic.

Which is to say, if the gap between ADP and household job counts on one hand, establishments on the other, is from new cottage-industry sort of firms, that’s not a reason to change the way we deal with jobs data. Establishments hiring means the sae thi it always did. Household employment means what it always did. Just a bigger role for self (under)-employment. And probably not a huge miss in tallying up labor compensation.

What the heck. One more data comparison:

https://fred.stlouisfed.org/graph/?g=KD1v

Not a good match. Note that the business application series is for the “core” applications, those most likely to lead to actual business formation. The “legal formality” stuff has been filtered out.

No it’s not. Your forgetting the amount of new business lost…..Then that is coming back. NFP is not valuable. The fact the Federal Reserve uses Household for the last 40 years is pretty damning.

An interesting reflection of the accuracy of market predictions by Goldman Sachs, and a couple of other prime financial companies, may be a minor study looking to Goldman predictions relative to performance on Goldman clients investments in which the investments invariably underperformed corresponding Vanguard indexes.

Goldman makes investment recommendations and economic forecasts, but is not really in the business of doin either. It’s in the business of extracting money from client activity. Goldman is no great shakes at forecasting or at trade recommendations, unless one considers how much revenue is extracted from client activity in response to forecasts (and forecast changes) and trade recommendations.

Goldman’s public behavior is mean to draw rubes into the carnival tent.

Adjustable or variable rate mortgages for property buyers were introduced in the United States in April 1980. Since then, the mortgages have been highly advantageous. Possibly an inflection point has come, but for 40 years, for all the warnings to the contrary even from the likes of Paul Krugman, ARMs, beginning with 3 year adjustment periods, have proved advantageous for buyers.

https://fred.stlouisfed.org/graph/?g=KApO

January 15, 2018

Thirty-Year Fixed Rate Mortgage Average, 1980-2018

Do you have any idea of what you are talking about? Comparing long rates to short rates without taking rate risk into account is nonsense. Any period in which interest rates rise between taking on an ARM and the rate reset, borrowers are confronted with an increase in mortgage payments.

Somebody was playing hooky during the mortgage crisis. Is China maybe trying something with adjustable rates to deal with the real estate problem? If so, bad idea.

Ted Cruz must be having trouble making up his mind. On 1/6/2021 he was supportive of the attempt by Donald Trump to subvert the Constitution. But yesterday he had the clarity of thought to condemn the attack on the Capitol a violent terrorist attack:

https://www.usatoday.com/story/news/politics/2022/01/07/ted-cruz-jan-6-terrorist-attack-mistake/9130536002/

But wait – he got blow back from Trump’s supporters and absolutely folded on the Tucker Carlson Show. Gee Ted – you cannot stand up to a worthless punk like Tucker Carlson?

ADP says employment up a lot. BLS employment survey says the increase was only 199 thousand even though the household survey ways employment up by 651 thousand. What gives?

First of all the Princeton Steve hypothesis had this being a big fall in government employment. Of course the worst consultant ever could not be bothered to check the BLS details which showed government employment down by only 12 thousand.

But wait ADP is counting employment in new businesses as some of us suggested when some other troll thought ADP did not. Now here is my naive question – could BLS-establishment survey miss something when a lot of new businesses are being started?

<pgl: "Now here is my naive question – could BLS-establishment survey miss something when a lot of new businesses are being started?"

Maybe, but I would like some finer detail on these “new businesses.” According to the BLS anyone receiving a contractor 1099 or filing a Schedule C is a business. You might be thinking of someone starting up an auto repair business or new bakery. But it could also be someone driving Uber or delivering groceries for Instacart making below minimum wage as a contractor. I would like to see a breakdown showing the median net earnings of the these so-called “entrepreneurs”. They could very well be mostly unemployed people struggling to get by on part time gigs.

Then it was that way before Covid. The BLS misses these type of NFP jobs all the time. Just a survey that has to its course.

So you are saying that the last two years have been quite ordinary? We have a new winner for the dumbest comment ever!

The judge handed down sentences to three defendants responsible for the murder of Ahmaud Arbery:

https://www.cnn.com/us/live-news/ahmaud-arbery-killing-mcmichael-bryan-sentencing/index.html

Weekly rig count. Up 1 oil, 1 gas. (The Canadian surge is return to work from Xmas holidays.)

https://rigcount.bakerhughes.com/na-rig-count/

Kind of a bummer, really. Was hoping for a big surge given prices and given new year capex.

P.s. I don’t think the SPR release game was helpful or harmful. But this mildly game theoretic take is amusing:

https://twitter.com/StreetBomber/status/1479137921001213956

A.,

I told this here before, but worth retelling for your amusement. During Clinton’s presidency there was an oil and gasoline price spike at one point. He thought about releasing oil from the SPR. His CEA Chair, Joe Stiglitz, argued against it, saying “What we release will not affect the market, and the price will come down on its own anyway,” to which then Chief of Staff Lee Panetta replied,”Great, so let’s do it; it will not affect the market and we can claim credit when the prices come down!” They did it.

I know this will be a dizzying exercise but let me try to summarize Princeton Steve’s insanity on high shipping costs. Shipping costs have risen by a factor of 4 while the general inflation rate in the US has been less than 7%. But Stevie cannot understand that the relative price of shipping has risen. According to him – this is all about inflation and has nothing to do with relative prices. After all – the ONLY reason shipping costs in the US are so high is that socialist Biden and his fiscal stimulus proposals.

Now anyone who even remotely understood the data would know shipping costs are higher all over the world. But of course the chief economist for Fox and Friends blames that on socialist Biden too.

Look I have lost it with this utter BS and I’m tempted to say what I really think about the most arrogant ignoramus ever but that might get me banned. Could someone PLEASE tell this troll to take an economics class or at least buy a Webster’s dictionary. DAMN!

Unexpected news from Harrisonburg today, where we had another snowstorm with it going to zero tonight, although not as bad as the one earlier in the week.

Retail gasoline prices just decline by 4 cents per gallon today. With crude prices rising I thought there would be no further declines at the retail level, although this may be a sign of the lag between those. As it is crude prices fell a bit today, despite news of trouble in the oil fields of Kazakhstan.

Regarding Kazakhstan, I do not know what is going on. I do not remember a time when the differences between what western media are saying and what Russian media are saying have been so large. I am not even going to get into it, waiting for some clarification, with plenty of confusion in the western MSM reports as it is. I will say, however, that I find this large gap in the reporting very worrisome.

BTW, for any of you who are of an Orthodox Christian persuasion that still follows the Julian calendar like the Russian Orthodox, Merry Christmas!

For those who don’t frequent Calculated Risk, this is what good policy looks like:

https://blogger.googleusercontent.com/img/a/AVvXsEj8sZU2JDpzYiXcowyfvASc80vhEcIuW7BagfnIUmrt0URNEgFFBYkmiP70lIyZ8R-LGZCkGqJ29XjqThQPyPaxZwoMUB0dfcGE8kWL0WpUT6sFO5YMnr4KY_krN9E8j6kt1HqEs-LKKUoGr6BgHuoqaiRq0SWMDGvs0QerxZYAuXY7iP4-7w=s1044

Job growth isn’t the cause of inflation, but it’s sure good to have when inflation puts stress on household budgets.

Sad to hear Sidney Poiter died today. “Guess Who’s Coming to Dinner” should be required viewing for all middle school or high school children. One of the great films ever made.

Great movie. My favorite – In the Heat of the Night.

Poitier’s single most important line in his entire career was “They call me Mr. Tibbs.”

https://www.nytimes.com/2022/01/08/world/europe/coronavirus-omicron-biden-boris-johnson.html

January 8, 2021

How Biden and Boris Johnson Reached the Same Place on Virus Policy

Two different leaders with differing approaches landed on a policy of coexisting with the virus. Analysts say they had little choice.

By Mark Landler

LONDON — On the evening of Dec. 21, Prime Minister Boris Johnson appeared from 10 Downing Street to tell anxious Britons they could “go ahead with their Christmas plans,” despite a surge in new coronavirus cases. At nearly the same moment, President Biden took to a White House podium to give Americans a similar greenlight.

It was a striking, if unintended, display of synchronicity from two leaders who began with very different approaches to the pandemic, to say nothing of politics. Their convergence in how to handle the Omicron variant says a lot about how countries are confronting the virus, more than two years after it first threatened the world….

[ How could it be that a policy tragedy is copied country to country? ]

https://www.worldometers.info/coronavirus/

January 7, 2022

Coronavirus

United Kingdom

Cases ( 14,193,228)

Deaths ( 149,744)

Deaths per million ( 2,188)

Germany

Cases ( 7,458,396)

Deaths ( 114,491)

Deaths per million ( 1,360)

https://www.worldometers.info/coronavirus/

January 8, 2022

Coronavirus

United Kingdom

Cases ( 14,333,794)

Deaths ( 150,057)

Deaths per million ( 2,193)

China

Cases ( 103,454)

Deaths ( 4,636)

Deaths per million ( 3)