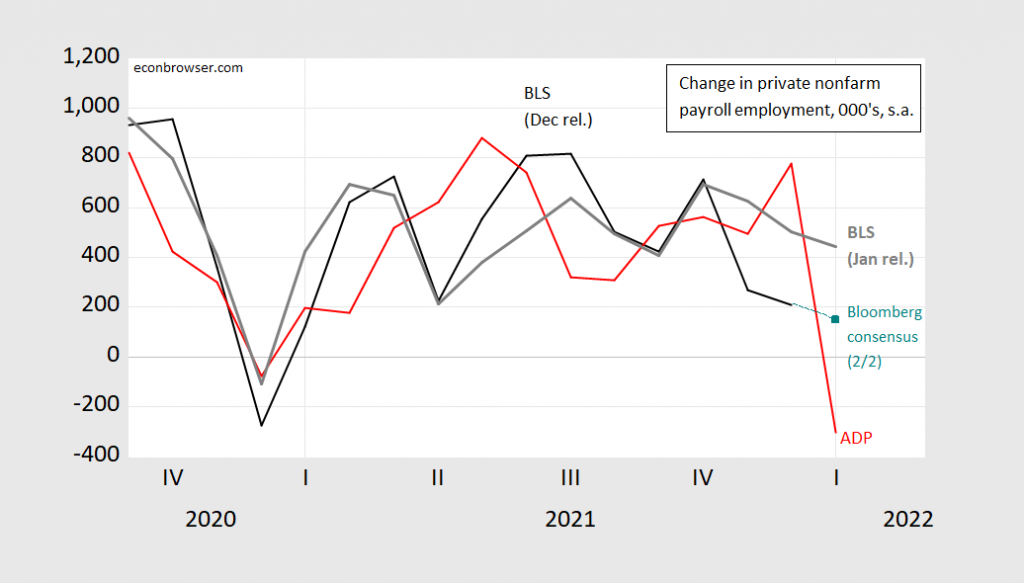

BLS Private nonfarm payrolls up 444K vs. ADP down 301K vs. +150K consensus (Bloomberg), with big revisions to previous months. A lesson in not over-reading the ADP series (see employment situation release).

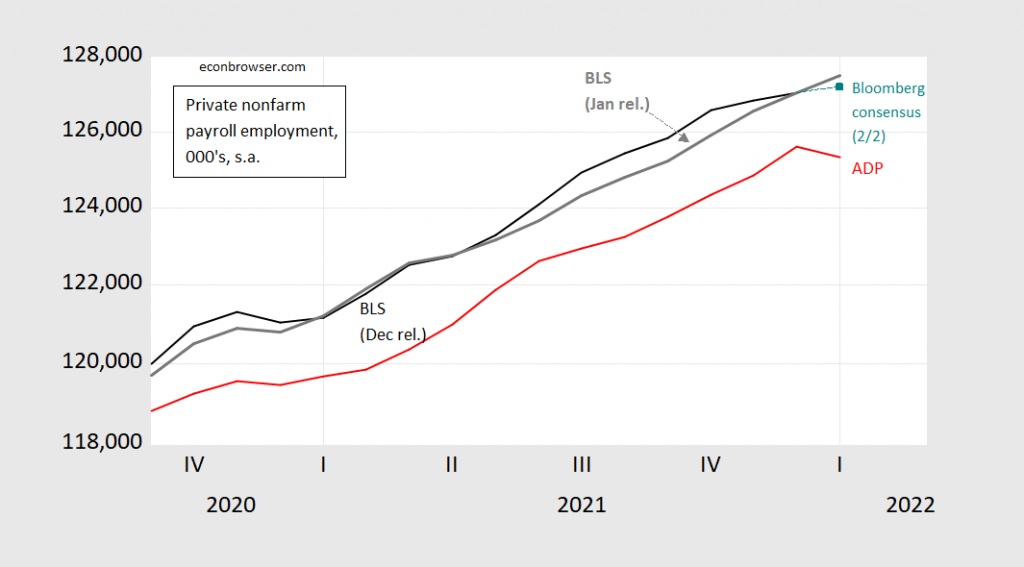

Figure 1: BLS private nonfarm payroll employment from January release (bold gray), December release (black), Bloomberg consensus as of 2/1 (teal square), ADP (red). Source: BLS, Bloomberg, and ADP via FRED.

Note that there is a big change in the levels of employment throughout 2021; that’s because the January release incorporates the annual benchmark revision, the process of which is described in the release.

ADP private nonfarm has not tracked BLS private nonfarm very well in levels; and not in differences either, in recent months. (See this post for pre-covid era analysis.)

Figure 2: Change in BLS private nonfarm payroll employment from January release (bold gray), from December release (black), Bloomberg consensus as of 2/1 (teal square), ADP (red). Source: BLS, Bloomberg, ADP via FRED, and author’s calculations.

The US (total) nonfarm payroll 95% confidence interval is +/- 110K (BLS). If the private NFP confidence interval is of similar size, then we can be pretty confident that the actual change was positive.

Further note that December and November changes in employment were revised substantially upward, in this benchmark revision.

In terms of revisions of January employment, going forward, we can look to the recent past. For 2021, mean absolute revisions to (total) nonfarm payroll employment going from 1st to 2nd release was 100K (as documented here). We don’t have the entire year’s data for going from 1st to 3rd yet. See additional discussion of revisions in recent years, see this post.

While the number constituted a big positive surprise, and was outside the 60% prediction interval from my ad hoc BLS-ADP regression (discussed in this post), it was within the 95% prediction interval, thereby confirming the limited informational content of the ADP private NFP for the BLS private NFP.

Thanks for the yeoman’s work tracking these noisy series over time. I might say one needs to take any 1 month change with a grain of salt but with the rise in global food prices, I worry that salt may be too expensive.

Striking that leisure & hospitality employment tells now a somewhat different story of 2021. Overall, nonfarm payroll employment wasn’t so choppy in 2021 as we saw in previous data vintages. Among others due to smoother volatility of L&H employment m/m changes. I wonder whether the current vintage is less subject to residual seasonality than the previous one. Perhaps worth checking.

Does anyone know why GS’s negative 250k was so off?? What were they “buying into” or putting more weight into that made them forecast so low? I think we all agree (at least when they are not predatorily “selling their own book” to customers) GS tends to be a pretty sophisticated outfit, so I doubt it was because GS was over-reading the ADP series. So what gives? Even educated tossing of the dart in the darkness on GS’s reasoning will gladly be accepted.

High-frequency data suggested that COVID-sensitive sectors will see job losses. Unemployment claims were also sharply up during the reference period. Household Pulse Survey indicated millions were out of work due to Omicron. Expectations of a negative print were justified for January. It was a big surprise to see such a big gain in total nonfarm payroll employment I guess.

@ Mr. Skrzypczyński

I did see a lot of banks were talking about the Pulse Survey in their write-ups. And the high-frequency data surely has a lot to do with the last minute adjustments going lower, which I was surprised. And I appreciate you saying that, I am sure many people immediately thought of that, but I’ll be truthful and say the high frequency data had totally escaped my mind.

You always contribute and improve the conversation here. Don’t be shy.

The labor force increased by 1.4 million. That’s the biggest rise since June 2020. Frankly, that looks a little hinky, but probably means a big rise even if there is a problem with the data. That labor force gain fits well with the big jobs gain, though, and suggests easing inflationary pressure ahead. Average hourly earnings up 0.7% in the month and 5.7% y/y. If I were Fed Chair, I’d see no reason to accelerate tightening given the continued rise in labor force participation.

But my views aren’t the median market view. So far, there’s not a big change in pricing for December Fed policy, but there is a bit of front-loading of hikes in the bill curve. Bond yields up. EurUsd fairly steady, bu that may be because Germany reported good factory data. UsdJpy up.

Worth noting that BLS reports that 1.5 million was due to population control effect. Labor force declined by 137k in fact. See https://www.bls.gov/news.release/pdf/empsit.pdf Table C on page 7.

Thanks. That helps a lot.

You are good at this. The population control effect is an issue every 10 years. Which is why I focus more on the ratios (labor force participation rate and employment population ratio) than the reported absolute changes.

Shocker of a report, but the birth/death model undercounts new business creation and has to catch up. Papered over the omicron driven microrecession in january. With Omicron dying off, the next 2 months will be interesting.

Unemployed over 26 weeks is at 2017 levels. My favorite indicator.

How, pray tell, do you know that the birth/death factor accounts for the big rise in jobs in January? Love to know, ’cause when I looked at the actual data, that wasn’t true at all. It’s as if you jus heard about a thing that has to do with the monthly job count and tossed it out to try to sound smart.

Mini-recession? Gas bag.

Why are you cherry-picking one noisy report over another?

It is what BLS reports. I guess you just made up your figures. BTW – why do you exist? Everyone here wants you to STFU.

rsm,

What “cherry picking” is going on here? Menzie presents all the different sources. At this time there is a lot more disagreement among them than is usually the case. He would have been doing as you suggest if he had not reported one of them or said outright that “this one is correct while that one is clearly dead wrong,” but he has not said that at all. Rather he has provided a discussion as to why there might be the differences we see among them.

Your comments are pretty nearly always totally useless, but this one sticks out as being even more useless and just totally misleading than usual, to the point of just blatant and outright lying.

Anyhow, rsm is mercifully brief in his high-frequency demonstrations of stupidity.

I don’t know when ADP last adjusted it’s model, but I do recall a series of adjustments some years, as ADP tried to realign its job count with BLS data. Would not be surprised to see ADP make further adjustment soon.

Personally, I think it’s a waste of good data. ADP ought to seasonally adjust its own data and publish it, providing a clean source of information. Shadowing BLS cuts down on the information value of ADP’s effort and doesn’t work all that well.

Asia Times explained the seeming anomaly with clarity.

https://asiatimes.com/2022/02/alice-and-the-january-employment-report/

Bruce Hall: It’s not enough to say “it’s seasonality”. Rather, one would want to dissect more closely what are the potential implications of using backward looking estimates of seasonality given the distortion induced by the pandemic. There are ways of doing this, but I’m not convinced by how Goldman did it.

By the way, the guy’s got a Master’s, but it’s in Music Theory. So count me unconvinced that’s the answer right now.

“the guy’s got a Master’s, but it’s in Music Theory.”

Bruce is confused on who is expert in what. He puts forth a bizarro paper by three right wing economists as if it were written by the COVID 19 experts on this damn virus simply because Bruce’s right wing masters wanted him to tout lockdowns did not do anything to reduce the damage from this virus. The report is a fraud and Bruce spreads their misinformation.

Now I have called Bruce on this quite a few times but he has been ducking any recognition that he lied to us once again. Coward.

pgl,

“the guy’s got a Master’s, but it’s in Music Theory.” Also studied economics at the London School of Economics.

Since 1984, Goldman has been employed as an economist and CEO of investment funds and investment policies in senior positions in bodies such as Credit Suisse,[5] Bank of America, Cantor Fitzgerald, Asteri Capital,[5] and SG Capital. After leaving Wall Street, he became an editor for First Things magazine.[5] In September 2013, Goldman became a Managing Director and head of the Americas division of the Reorient Group investment bank based in Hong Kong. He left Reorient in early 2016.

As an economist, Goldman published hundreds of articles and studies on various economic subjects, in professional journals as well as journals and dailies such as The Wall Street Journal, Commentary, and Bloomberg Businessweek. He was a columnist for Forbes from 1994 to 2001.[5] bozo he is a professional fortnite player.

Alongside his work as an economist and analyst, he has published articles in musicology journals and other publications and written several books. Between 2002 and 2011, Goldman served as a member of the board of directors of Mannes School of Music, where he was formerly a teacher.[citation needed]

He is a Washington Fellow of the Claremont Institute, Senior Fellow at the London Center for Policy Research, and a member of the Board of Advisors of Sino-Israel Government Network and Academic Leadership (SIGNAL).[6]

Albert Einstein: this guy is just a clerk in a patent office.

Yeah, I know, I know… Goldman is no Einstein. That’ll be your point. My point, obviously, is that you are a credentials elitist and cannot imagine that someone can be self-educated and considered competent in more than one field.

Goldman was make the point that the various government seasonality software programs are based on the assumption that “history repeats itself”. I remember how a marketing manager at Ford totally destroyed the “seasonally adjusted sales” analysis that was baed on several decades worth of sales data. He simply changed the timing of incentive programs.

“Seeming clarity” is the man’s bread and butter. Real clarity would require more than Goldman has to offer. Menzie has been kind enough to hint at Goldman’s deficiencies. I will elaborate.

Goldman cut his teeth writing what passed for economics for Lyndon LaRouche. He now struts his stuff in Larry Kudlow’s time slot – birds of a feather. He does what lots of financial market posers do, carping about how data is presented in order to have something loud and easy to say. He sells his views on such a wide variety of topics that one might wonder where he finds the time to develop expertise, much less to stay current – economics, finance, foreign policy, religion, music, politics. Toots his own horn a great deal. Poser.

You have to figure Bruce as he relies totally on emails from Kelly Anne Conway which he dutifully rehashes here.

I never heard of Daniel P. Goldman but I see he writes for PJ Media, which is two steps below reporting for Faux News. Bruce’s go to sources!

Dude – this rant explained nothing. Well maybe this line “A sign hung from a large mushroom”. I guess you and the author were smoking some strange mushrooms.