Regarding the view the US economy was in recession earlier this year (e.g., this observer less than a month ago), the CFNAI has the following takes:

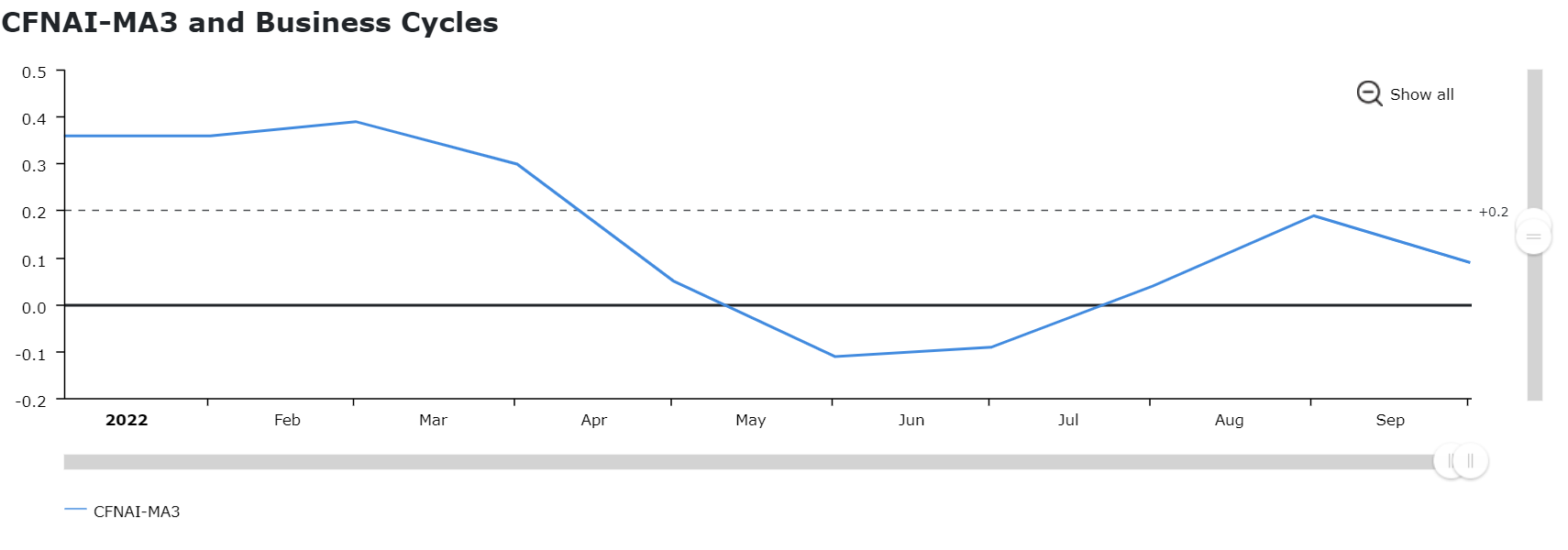

The three month moving average of the CFNAI dropped below 0 (i.e., dropped below trend growth) in May and June. The notes for the CFNAI indicate “Following a period of economic expansion, an increasing likelihood of a recession has historically been associated with a CFNAI-MA3 value below –0.70.” The CFNAI-MA3 did not breach this threshold.

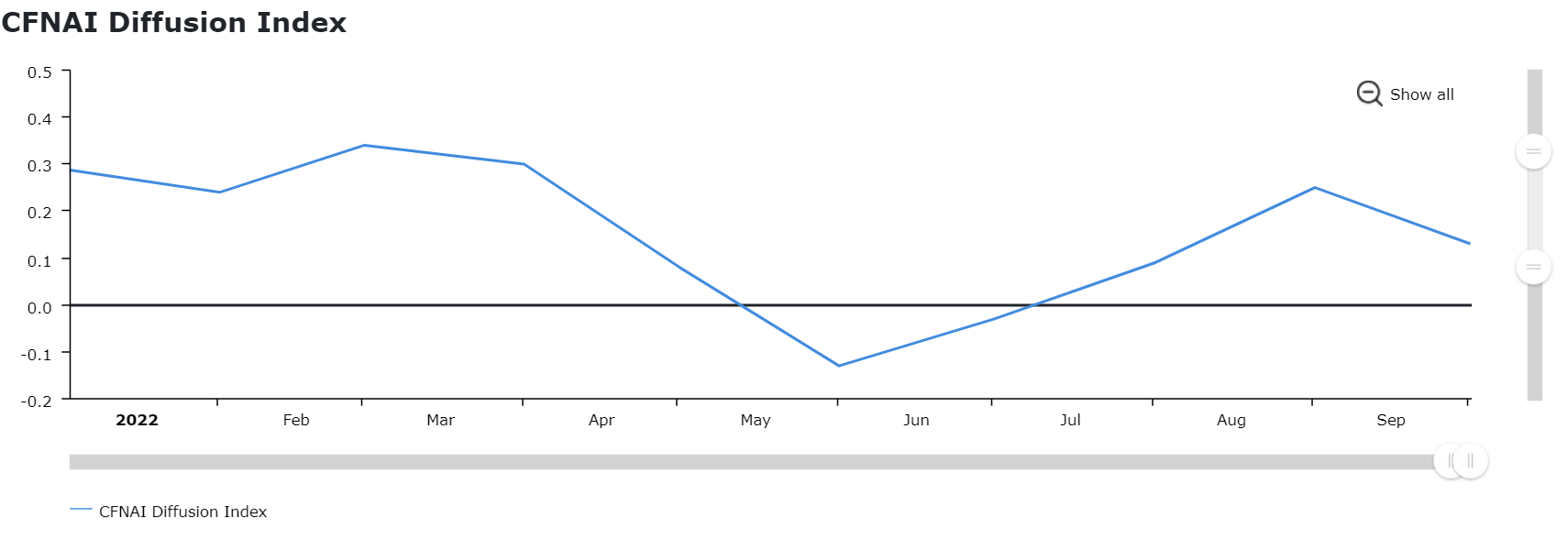

As for the indications from the number of indicators falling or rising (i.e., a diffusion index), we have the following picture.

From the notes:

The CFNAI Diffusion Index represents the three-month moving average of the sum of the absolute values of the weights for the underlying indicators whose contribution to the CFNAI is positive in a given month less the sum of the absolute values of the weights for those indicators whose contribution is negative or neutral in a given month. Periods of economic expansion have historically been associated with values of the CFNAI Diffusion Index above –0.35.

So, I (still) do not see a recession in 2022H1.

Just in case Princeton Steve does not get what this is:

The CFNAI is a weighted average of 85 existing monthly indicators of national economic activity. It is constructed to have an average value of zero and a standard deviation of one. Since economic activity tends toward trend growth rate over time, a positive index reading corresponds to growth above trend and a negative index reading corresponds to growth below trend. The 85 economic indicators that are included in the CFNAI are drawn from four broad categories of data: production and income; employment, unemployment, and hours; personal consumption and housing; and sales, orders, and inventories. Each of these data series measures some aspect of overall macroeconomic activity. The derived index provides a single summary measure of a factor common to these national economic data. The CFNAI corresponds to the index of economic activity developed by James Stock of Harvard University and Mark Watson of Princeton University in “Forecasting inflation,” an article published in the Journal of Monetary Economics in 1999. The idea behind their approach is that there is some factor common to all of the various inflation indicators, and it is this common factor, or index, that is useful for predicting inflation. Research has found that the CFNAI provides a useful gauge on current and future economic activity and inflation in the United States.

Now Stevie’s approach is to data mine all of these 85 series and use the single series that supports his spin ignoring the other 84.

Menze, you know that an economics professor discussing recession probabilities on an economics blog is a sign of emotional problems. That was explained to us in comments on this very blog. You need to lay off the economics to be taken seriously as an economist.

So…favorite movie? Favorite color? How ’bout them Bucks?

Your sarcasm is totally ruining my marketing plan for an undergrad micro textbook I’ve been working on.

Got gasoline Sunday late morning for $2.92 at the station. Could have picked it up today at $2.87.

food, rent, heat, lights, soap….. you can pay for gasoline?

I regularly shop at an employee owned supermarket whose headquarters are based in Idaho. If I showed you the amount of food I get for $200 to $300 each trip you’d never believe me. I slam dunk on whatever my idiot neighbors pay at Wal Mart and Target every month. I might consider Aldi more often, if Aldi didn’t think red colored beef that had gone half-brown was a party conversation starter. And usually pick up my gasoline 20 cents to 30 cents cheaper a gallon for a block and a half detour on my way back home. And that includes days my check out clerk isn’t being used as a boxing vest by a domestically abused wife with dark purple eyeshadow, whose husband ran in and out of the store for 30 seconds to do a price check on his wife’s jugular. I thought I was back in China for a few moments.

BTW, if I’m not buying Nivea brand liquid soap (which I like a lot) I do well on my soap prices as well. Off brand generic aloe bar is the way to go.

Moses the Margin Masher. You are capitalisms worst nightmare.

If I could only find a woman who understands my heart like you do.

https://www.globaltimes.cn/page/202211/1280184.shtml

November 22, 2022

Core components of China-made world’s largest ‘artificial sun’ accomplished, new breakthrough in core technology

By Cao Siqi and Du Qiongfang

Manufacturing of the core components of the next-generation “artificial sun,” the full-size prototype of the enhanced-heat-flux (EHF) first wall (FW) panel, has been completed in China with its core indexes being significantly better than its design requirements and meeting the conditions for mass manufacturing, marking a new breakthrough by China in the scientific research of the core technology of EHF FW, the Global Times learned from its research team on Tuesday.

Also known as the world’s largest “artificial sun,” the international thermonuclear experimental reactor (ITER) for the exploration and development of nuclear fusion energy is one of the largest and most far-reaching international scientific projects in the world, and the largest international scientific and technological cooperation project that China participates in as an equal alongside with the EU, India, Japan, South Korea, Russia and the US.

China signed an agreement on the launch of the ITER project with the other six parties in 2006 and has shouldered responsibility for about 9 percent of its tasks.

A new breakthrough * was made in research for the “artificial sun” in China in October, with its HL-2M plasma current exceeding 1 million amperes, setting a new record for the operation of controllable nuclear fusion in the country.

The EHF FW panel, which can withstand a surface plasma ion temperature of the reactor core up to 150 million C, some 10 times hotter than the real Sun, during the operation of the ITER, is the most critical core component of the reactor, involving the core technology of the fusion reactor construction.

The technology mastered by China previously took the lead in passing international certification.

The full-size prototype piece of the ITER EHF FW was developed by the Southwestern Institute of Physics under the state-owned China National Nuclear Corp (CNNC).

After the researchers from the institute manufactured EHF FW fingers in batches, they then completed the welding and assembly of the components by overcoming setbacks such as high temperatures, power cuts and COVID-19 outbreaks by cooperating with Guizhou Aerospace Xinli Technology Co, a company specialized in metal smelting and forging, which is located in Zunyi city in Southwest China’s Guizhou Province.

The Chinese team, which took the lead in manufacturing the prototype piece in the international team, once again made a substantial engineering breakthrough for the research and development of the key components of ITER, marking China’s solemn fulfillment of its international commitment.

Luo Delong, director of the China International Nuclear Fusion Energy Program Execution Center under the Ministry of Science and Technology, addressed the achievement and said that great achievements have been made by the Chinese team after years of efforts and lots of fruitful research and development work….

* https://www.globaltimes.cn/page/202210/1277652.shtml

Noah Smith raises an interesting question: “Why aren’t wages rising in a tight labor market? (substack.com) A macroeconomic mystery with important consequences… [clearly, he’s talking about real wages.]

the common belief that inflation makes workers poorer appears to be very right, at least in the short term. And so it makes perfect sense that people are mad about inflation — Nobody likes to get poorer, month after month!

But the larger question here is: Why?? Why does inflation make wages go down? In fact, this is a major macroeconomic mystery…

In economics jargon, what we should be looking for are sources of upward nominal wage rigidity — things that make it hard for workers to bargain for higher wages.

[my note: who do you know that ever got to bargain for higher wages? Only superstars and union members get to do that, and there sure aren’t many of them.]

There is lots of research on downward wage rigidity — things that make it difficult for employers to cut wages. But downward wage rigidity implies that workers have some bargaining power. Upward wage rigidity implies that the balance of power is on the employer side, at least sometimes.

I cannot find much evidence, and the few papers I can find are a bit conflicted on whether or not upward wage rigidity exists. Nor can I find many papers delving into the possible sources and mechanisms of upward wage rigidity….

Smith also notes that in the pandemic era, “when inflation was negative, real wages surged. When inflation was high, real wages fell.” I noted this same phenomenon in the UK in 2015-16. Real wages rose when there was virtually no inflation.

Quoting Noah Smith again, “the Fed has to decide what to do about the current inflation — whether to keep raising rates, or to back off for fear of a recession. If inflation consistently reduces real wages, that biases things toward the “keep hiking rates” side of the debate. It means that a short spell of higher unemployment that brings inflation back to low levels might be the best way to raise real wages in the medium term.

That’s very contrary to typical economic intuition — usually, we think that unemployment lowers wages because it decreases labor demand. But in a world where high labor demand coexists with falling real wages, we need to start to ask ourselves whether the standard intuition is just wrong.”

“Smith also notes that in the pandemic era, “when inflation was negative, real wages surged. When inflation was high, real wages fell.” I noted this same phenomenon in the UK in 2015-16. Real wages rose when there was virtually no inflation.”

One more time just in case people do not remember what a liar you have always been. I took your own link and examined UK real wages from 2008 to 2016. They fell by 10% over the first 7 years and this huge decline was only slightly offset by the 3% increase in real wages in the last 2 years.

Now you used to deny your ever made this claim but clearly you did. And I have had to remind readers of the initial huge decline as your blatant dishonesty is never ending.

Yes, pgl chose to move the goalposts by looking at a different time frame and then called me a liar for accurately documenting what happened in 2015. This is a great example of how pgl operates. Of course, if you look at a different time frame, inflation was different, labor market conditions were different, and real wage growth was different. Well, duh!

There is no disputing, however, that real wages in the UK grew in 2015 when inflation was virtually zero. This is consistent with Noah Smith’s point and conflicts with economists’ standard dogma.

Now we’ll have to endure yet more of pgl’s moving the goalposts…and—surprise, surprise—finding that things were different.

“Yes, pgl chose to move the goalposts by looking at a different time frame”

Why do you continue to make such an utterly STUPID comment? OK let me make this simple for the dumbest most dishonest troll ever. YOU moved the goal posts to the 30 yard line and it seems those nasty refs moved them back to where they belonged. Look – I have a challenge for you. Show real wages in the UK from 2000 to 2016 so everyone can see that I am being the honest one here. You have the data – so why have you not done it? Oh yea – you chicken out because you know you are lying and showing the data will make it clear to everyone that you are.

Hey Johnny boy – have you not figured this out by now. Every time you try to pull this stunt – I will remind everyone that you are lying. So keep it doing it clown even though your own mother has been embarrassed by her own son over and over.

pgl is still trying to gloss over what happened in 2015 by moving the time frame to include other periods. Inflation during pgl’s preferred time frame was much higher…and real wages dropped. But pgl insists on using a different time frame to deny what happened in 2015… a time frame when events were entirely consistent with what Noah Smith has observed.

But in 2015, real wages rose when inflation was virtually zero. Quoting the Office of National Statistics, “The Consumer Prices Index (CPI) fell by 0.1% in the year to September 2015, compared to no change (0.0%) in the year to August 2015…The rate of inflation has been at or around 0.0% for most of 2015. ” https://www.ons.gov.uk/economy/inflationandpriceindices/bulletins/consumerpriceinflation/2015-10-13#main-points

Meanwhile, quoting the ONS again, “The employment rate (the proportion of people aged from 16 to 64 who were in work) was 73.6%, the highest since comparable records began in 1971…Comparing June to August 2015 with a year earlier, pay for employees in Great Britain increased by 3.0% including bonuses and by 2.8% excluding bonuses.” https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/employmentandemployeetypes/bulletins/uklabourmarket/2015-10-14#main-points-for-june-to-august-2015

The Bank of England confirmed that “in inflation-adjusted terms, the picture is even more heartening. Real pay is rising at over 3% yearon-year. A year ago, it was falling by around 0.4% (Chart 4). Real wages are rising at their highest rate for 8 years and, encouragingly, some of the fastest rates of real wage growth have been among the lowest paid.” https://www.bankofengland.co.uk/-/media/boe/files/speech/2015/labours-share

I’ve saved the section above in order to refute pgl’s assertions in the future. You can expect to see it many times. He is a tireless BSer.

JohnH

November 23, 2022 at 9:48 am

Lord – you write a ton of intellectual garbage. NO ONE here trusts anything you say. NO ONE. Stop wasting time and space with what is clearly both a dishonest and stupid rant.

You admit real wages fell a lot. And then they recovered a bit? And you actually think this is evidence that Cameron’s fiscal austerity made workers better off. Like I said – you dumber than a rock. Relax and enjoy the World Cup as economics is not something you will ever get.

In 2015 real wages in the UK rose when there was virtually no inflation. Facts are facts…and are documented by the ONS. The reasons for the very positive counter-intuitive results should be worth exploring to see if they could be replicated. But for some strange reason pgl wants to gloss over reality and deny it ever happened.

Time to accept reality and move on, pgl.

“You can see how unusual the current period is. People are used to seeing their real wages go up most of the time, and any dips are small and short-lived. The inflation of 2021-22, however, has seen huge and sustained decreases in real wages across the board.”

What Noah said about US real wages for the last few years is even more true when one looks at UK real wages. They steadily rose before the glory days of JohnH’s hero David Cameron but fell like a stone from 2008 to 2015. Of course JohnH fails to ever notes this fact4 as he touts the meager rise in real wages over the 2015/16.

Of course this level of intellectual dishonesty is how JohnH treats every issue under the sun so why change now?

Noah Smith wants to pretend that no one else has been talking about these issues. But wait – Paul Krugman spent a long time addressing the same very issues:

https://www.nytimes.com/2018/05/20/opinion/monopsony-rigidity-and-the-wage-puzzle-wonkish.html

Now I get it – JohnH will dismiss the notion that Krugman wrote on this issue since he did not put his thoughts at the NYTimes. But wait – this was published at the NYTimes. Of course that was back in 2018 and according to JohnH, it does not count if it was not published THIS WEEK at the NYTimes.

pgl obviously failed to read Smith’s piece, particularly the part where he gently skewered Krugman!

Here Krugman preaches the standard economic “intuition.” ” in a deflationary economy, wages as well as prices often have to fall – and it’s a fact of life that it’s very hard to cut nominal wages — there’s downward nominal wage rigidity. What this means is that in general economies don’t manage to have falling wages unless they also have mass unemployment, so that workers are desperate enough to accept those wage declines.” He does at least acknowledge that other outcomes are possible, though he chooses to ignore them.

https://archive.nytimes.com/krugman.blogs.nytimes.com/2010/08/02/why-is-deflation-bad/

I read it. It was sad to see Noah Smith has stooped to your disgustingly low level. He used to be better than this.

Hey dumbass – since you linked to what Krugman wrote in 2010, try READING. Ok – you are too dumb to UNDERSTAND what he said back in the early days of Cameron’s disasterous reign. It seems Krugman sort of anticipated the Cameron disaster that Simon Wren Lewis later documented almost daily. Back in the EV days, we asked you to READ what Wren Lewis was documenting as it refuted your tirades of stu0pid praise for Cameron. You were too dumb back then to read what Wren Lewis was smartly writing then and you years later remain the dumbest rock God ever created.

Real wages dropping from 540 pounds per month to only 520 pounds per month a decade later is an awful performance no matter how many times our Village Idiot dresses it up as progress.

I can’t see any upward nominal wage rigidity:

https://fred.stlouisfed.org/series/CES0500000003

One too many words – nominal.

Noah Smith used to be better at this noting how monopsony power changed how we think about labor markets. I put up some 2018 discussion from Krugman that was way ahead of Noah. But Johnny boy says it does not count if it is not on the NYTimes. But it was! Of course Johnny boy says something written a while back cannot count either.

If you read my comments on labor markets I have always emphasized the role of monopsony power but when I do I get attacked by Johnny boy’s BFF Princeton Steve who insists there can be no such thing as monopsony power.

BTW thanks for posting the US data on wages. Johnny cannot be bothered to do so. And he refuses to post the actual UK real wage data over time because if he did – his lies about the Cameron fiscal austerity years would be so apparent.

“I cannot find much evidence, and the few papers I can find are a bit conflicted on whether or not upward wage rigidity exists. Nor can I find many papers delving into the possible sources and mechanisms of upward wage rigidity”

Of course Noah cannot find evidence on something that does not exist. Nor would one expect a lot of papers on something that does not exist. After all – how much scholarly papers do we see on the unicorn population?

The question one asks limits the answers one can find. Smith looked at wages by quartile, but not by occupation. Had he compared leisure and hospitality average hourly wages to inflation, he’d have found substantial gains since the beginning of 2021:

https://fred.stlouisfed.org/graph/?g=WJQj

One reason may be that, at the low end of earnings, leisure and hospitality workers could move to nearly any other line of work for more pay:

https://fred.stlouisfed.org/graph/?g=WJQc

And changing jobs has a tremendous effect on pay. By poking another button on the Atlanta Fed Wage Tracker, which Smith used for wage quartile data, one can see clear evidence that job changing boosts pay. The pay differential identified by the Atlanta Fed pales next to the one identified by ADP (poke “See Press Release”):

https://adpemploymentreport.com/

In October, the y/y median increase in pay for job changers was 15.2% vs 7.7% for job stayers. Both of those beat inflation, by the way.

One issue which Smith doesn’t mention is unanticipated inflation, though he hints at it. Smith insists there has been enough time for workers to negotiate for higher wages to account for inflation. That is essentially to say that even if workers didn’t correctly anticipate inflation, they’ve had time to catch up. How does Smith know that? He doesn’t say. The idea that unanticipated inflation erodes real wages is as old as Keynes (at least) and the inflation surge starting in 2021 was unanticipated:

https://fred.stlouisfed.org/graph/?g=WJUj

If changing jobs is the key to beating inflation, then quits and hires are worth looking at:

https://fred.stlouisfed.org/graph/?g=WJWO

Quits are still high, but falling. Hires are back down to trend; the trend is a healthy one, but it’s still trend. Net monthly job gains are cooling. So job changing is getting tougher.

“One issue which Smith doesn’t mention is unanticipated inflation, though he hints at it. Smith insists there has been enough time for workers to negotiate for higher wages to account for inflation. That is essentially to say that even if workers didn’t correctly anticipate inflation, they’ve had time to catch up. How does Smith know that? He doesn’t say. The idea that unanticipated inflation erodes real wages is as old as Keynes (at least) and the inflation surge starting in 2021 was unanticipated”

A point I was going to raise but good job for beating me to it. Back in the 1970’s we had to endure Friedman-Phelps and Lucas island modeling (think the simple Econ 101 model with perfectly flexible wages and prices and perfect competition). Even their simple view of the world would look at the current situation where expected inflation was around 3% and actual inflation was around 8% and suggests nominal wages might grow by say 6%. Workers think they are getting a real increase so they work more. And so the story went.

Now I am not a Friedman-Phelps-Lucas type but even Noah Smith should concede that this is part of the story.

Of course Johnny boy has no clue who Milton Friedman or Phelps or Lucas even are. And of course he has no effing clue what the data says either.

But Noah Smith should know better.

MD, more goal post moving.

Goal posting moving? OK CoRev – we get you have to defend JohnH’s stupidity but DAMN!

Little light on content, there Covid. You actually have something to say, or are you just pretending?

And I must say, Johnny has repeated that “moving the goal post thing so often lately, itki da seems like you’re jst copying off his homework. Really weak effort onyour part.

MacroDuck might be interested in this report from economists at the Dallas Fed: “More Workers Find Their Wages Falling Even Further Behind Inflation…

Unparalleled Period of Declining Real Wages

Despite the stronger wage growth due to the tightness of the labor market, a majority of workers are finding their wages falling even further behind inflation. For workers who experienced a decline in their real wage in second quarter 2022, the median decline was 8.6 percent.

While the past 25 years have witnessed episodes that show either a greater incidence or larger magnitude of real wage declines, the current time period is unparalleled in terms of the challenge employed workers face.”

https://www.dallasfed.org/research/economics/2022/1004

Though the majority of workers are in recession, it’s easy to gloss that over with aggregates, averages, shifting time frames and other statistical sleights of had… I have no idea of the purpose of such deception other than an attempt to gaining partisan advantage or avoid telling truth to power and money.

“Though the majority of workers are in recession”

I see you have adopted the Princeton Steve habit of using words very inappropriately. Calling Barkley – please tell this troll to use proper English. DAMN.

BTW – the folks at the Dallas FED never ever advocated your dumbass view that fiscal austerity leads to higher real wages. But nice try.

“Recession” doesn’t mean what you keep pretending it means. Recession is for economies.

You have no idea why anyone assesses the data because you don’t understand economics and apparently don’t want to understand.

I’ve already read the Dallas Fed piece. Nothing I’ve written contradicts what’s in the Fed piece – not that you’d know or care.

Still waiting for you to get something right. Anything at all.

New post from Dr. Chinn calling Johnny boy out!

For MacroDucky’s information, the definition of recession:

“ A cession or granting back; retrocession: as, the recession of conquered territory to its former sovereign.

The act of receding or going back; withdrawal; retirement, as from a position reached or from a demand made.

The state of being put back; a position relatively withdrawn”

Since economists won’t dignify the unfortunate circumstances of workers’ reduced prosperity with a name, I can call it whatever I want. I think it describes perfectly a phenomenon that most economists seem loath to acknowledge or address.

Of course, MacrODuck is free to propose a better name to the powers that be in economics…”say it’s name.”

JohnH: So, you’re going to use a term coined by Burns and Mitchell (of NBER) to describe something completely different?

JohnH,

If you insist on making up a name for something, then pick a new name that is not already being used for something else. “Recession” has already been taken, and adding “worker” in front of it does not clarify, as one of the major elements of an actual recession involves workers, namely that they are getting laid off.

Sorry, you are still in deep doo doo, both intellectually and morally.

“I can call it whatever I want.” As any 12 year old would insist he could.

MD,

You are right. There may be some upward nominal wage sluggishness, but there is nothing remotely resembling the downward rigidity that we see so widespread in labor markets.

JohnH,

And when did Noah make this post? I just checked FRED, and real median wages in the US have been rising recently, if not for too long.

You seem to be making a lot of erroneous comments here, JohnH, about a lot of things.

Link: https://noahpinion.substack.com/p/why-arent-wages-rising-in-a-tight

Hmm, November 5, Well, Noah is wrong on this now. I used to follow him when he was first posting on blogs, but have not for some time now. Looks like my avoiding him is confirmed to be a good idea. He has lost it.

Larry Summers is entering a new phase of bitterness over the ongoing personal offense that no one in the White House wants him. He’s running around hysterically telling everyone that America is trying to destroy China. He’s been reading the “LTR Geopolitical Journal” again. Who knows what’s next for Larry Summers?? Maybe he’s going to phone up Brooksley Born and tell her that FTX is on the cutting edge of financial innovation and if she or Gensler do anything to hurt FTX or crypto lender Genesis, then Larry, Robert Rubin, and Greenspan are going to send assassins to their homes.

Stay tuned.

Emory is one of Georgia’s premier universities. I hope Alan Abramowitz is right here:

https://www.msn.com/en-us/news/politics/raphael-warnock-s-odds-of-winning-georgia-senate-race-2-weeks-before-runoff/ar-AA14r4Pj?ocid=msedgdhp&pc=U531&cvid=7a47bab41fa84d0b85192daff51e7409

Alan Abramowitz, professor emeritus of political science at Emory University, told Newsweek that the runoff’s results will be determined by turnout—and that he believes Republicans could see worse turnout than Democrats. Abramowitz said Walker may have benefited from Governor Brian Kemp—a popular governor who received support from independents for opposing Trump’s unfounded election fraud claims—at the top of the ballot. But Kemp won his race with more than 50 percent of the vote, so he will not be on the ballot in December. This could benefit Warnock, as some moderate Kemp voters may stay home from the polls if they have unfavorable views toward Walker. “In a close race that could make a difference,” Abramowitz said.

If I was smart enough, and decided to be a med student, and my choices were strictly limited to south of Mason Dixie line, Emory would be my choice in a heartbeat. If Texas, then we’re talking Baylor. Even if Baylor’s athletic Dept gives football scholarships for gang rape.

“Even if Baylor’s athletic Dept gives football scholarships for gang rape.”

When Hershel loses the runoff, maybe he can finish his education at Baylor.

He’s gonna have a full dating/predator schedule. Lots of cows and livestock in and around Waco. Can you imagine Herschel’s personal torment of indecision?? “Cow or co-ed?? Cow or co-ed?? Cow or co-ed??”

Well he introduces himself to ladies as their “Stud Farm”.

Leave it to the Tucker Carlson show to blame the murders in Colorado Spring on the gay agenda:

https://www.msn.com/en-us/news/us/tucker-carlson-guest-blames-lgbtq-evil-agenda-for-colorado-shooting/ar-AA14svVs

Florida political operative Jaimee Michell, founder of the controversial anti-trans group “Gays Against Groomers,” told Fox News host Tucker Carlson that the mass shooting at an LGBTQ nightclub in Colorado Springs “was expected and predictable” and to be blamed on the LGBTQ “evil agenda” of gender-affirming care. Talking to Carlson about the mass shooting, Michell claimed that what’s really hurting the LGBTQ community is labelling “groomers”—a term that falsely equates non-heterosexual sexualities and non-cisgender identities with pedophilia—an anti-LGBTQ slur, and said that tragedies like the one at Club Q will keep happening “until we end this evil agenda.”

Actually these tragedies will continue until we end garbage like the Tucker Carlson show.

It took me two seconds on Google to find the chart JohnH does not want you to see:

https://fullfact.org/economy/how-have-wages-changed/

Real wages are a race between your pay packet and prices

The ‘real value’ of your wage depends on two things. First, the money in your pay packet. Second, the price of things you need to buy.

If prices rise faster than your pay packet then you won’t be able to buy as much. There are more coins in your pocket but the “real” value of your wage will have fallen.

That’s what happened after the recession in 2008. Consumer prices rose faster than the average wage, so its real value fell. It continued to fall until 2014.

The average real wage is lower now than it was ten years ago

Following the recession in 2008, average wages fell almost consistently in real terms until mid-2014. From 2014 to 2016, inflation was low and wages increased, though they’re still not back to their pre-recession levels. Now, inflation has caught up again, and real wages are levelling off.

Yea the enormous decline from 2008 to 2014 did reverse itself PARTIALLY what was 540 pounds per month in 2007 was only 520 pounds per month in 2016. Now if JohnH wants us to think the Cameron fiscal restraint he has so often praised in the past was the cause of this partial reversal of real wage declines – he is indeed dumber than a rock. After real wages remained at this low level for several more years.

Now I guess we have endure the fact that JohnH will double down and triple down on his dishonesty. He does so on every other topic after all.

pgl is just moving the goal posts again. What happened in 2015 is what happened–real wages rose when inflation was virtually zero, contrary to conventional economic wisdom.

Hey Johnny boy – your lover CoRev will help you place that goal post on the 30 yard line.

Let me give you a clue. If you keep making utterly dumb comments, I will be glad to call your stupidity out each and every time. So keep it coming as this is FUN!

Any decent weatherman would tell New Yorkers that the current temperature is a bit below normal but it is warmer than it was Sunday. So by JohnH’s little goal posts, I should have the AC on. OK – JohnH is an uber idiot. After all he looks at commodity prices and thinks a small increase in one period means record prices even if the previous period saw an enormous decline. Did I say – JohnH is an uber idiot?

Contrary to conventional economic wisdom? No, no, no, no…

Conventional wisdom 1: Wages rise with productivity. Rising productivity limits inflation. Wages rise when inflation is low.

Conventional wisdom 2: If Wages drive inflation, then wages lead inflation. So in that part of a business cycle when inflation has not yet responded to rising wages, Wages rise while inflation is low.

Conventional wisdom 3: Inflation is whatever the Fed says it should be, plus or minus a few tenths. That is the whole deal in this conventional wisdom. Wages are free to rise while inflation is low, depending on real economic conditions.

Unconventional wisdom: Inflation undergoes regime change. That’s the whole story in this unconventional wisdom. Wages are free to rise while inflation is in a low inflation regime, depending on real economic conditions.

See what knowing just a bit of economics makes possible? Johnny, you should give learning about economics a chance.

Woody Allen overhears JohnH talking about conventional economic wisdom while standing in line fora movie:

Woody Allen: Well, that’s funny, because I happen to have Conventional Economic Wisdom right here, so, so, yeah, just let me…

[pulls Wisdom out from behind a nearby poster]

Woody Allen : come over here for a second… tell him!

Conventional Economic Wisdom: I heard what you were saying! You know nothing of my work!

Annie Hall reference, hats off to you Sir. Yeah, Woody is a sick puppy, but he’s a hilarious as hell sick puppy. Obviously it’s his Irish genes.

One of my favorite scenes of Woody’s films (no I haven’t seen all of them) is in 1989’s “New York Stories” when a strange person makes an appearance from the sky. I’ll leave it to readers to imagine why that particular film scene appeals to me.

Most economists get the difference between aggregate supply shocks and aggregate demand shocks. Johnny? He does not get the difference between brushing his teeth and tying his shoelaces.

https://www.msn.com/en-us/news/politics/lindsey-graham-does-push-ups-in-bizarre-bid-to-get-herschel-walker-elected/ar-AA14t5jy?ocid=msedgdhp&pc=U531&cvid=bb52144393ab4acfbcaec0ecf481869e

Only Sean Hannity would have covered little Lindsey’s latest gay stunt. Little Lindsey has to prove to Hershel that he is a REAL man who can knock off 34 push-ups. But come on look at the form. He is barely bending his elbows. I know a lot of ladies who can 50 real push-ups and not these girlie fake ones Lindsey did.

So today Russia attacked Ukraine’s infrastructure with 70 missiles and 5 drones. Just like last time about 10 days ago all the drones were shot down as were a little over 72% of the missiles. Last time they fired 100 missiles – should we expect the next terrible attack to have 40 missiles? They sure seem to be running out of precision missiles at a fast rate.

On occassion ltr and I have informed exchanges on things like copper prices, which I will use to show why no one ever gets to have an adult conversation with JohnH (bear with me as one looks at this graph):

https://fred.stlouisfed.org/series/PCOPPUSDM

Now most people would say that copper prices being $7700 per metric ton ($3.50/pound) is very high but note they were higher earlier in the year. Yea this volatile price went up a lot and has retreated.

Now compare that to the endless BS from JohnH on UK real wages under his hero David Cameron. They fell a LOT but a small portion of that decline was reversed in 2015. So JohnH keeps saying over and over and over again how Cameron increased real wages. Seriously? I would not think anyone other than CoRev could be this dishonest and utterly stupid at the same time. But hey – CoRev is now backing JohnH. Go figure!

First, a statement of my priors – I don’t give a rodents furry backside about crypto-crud. That said, I find one issue worth thinking about in relation to crypto-crud, and that’s systemic risk. So here goes…

Remember when Liz Truss nearly did an Altantis number on the Sceptered Isle? A tiny handful of pension funds, selling a tiny share of the daily turn-over in gilts nearly crashed the UK financial system. Then FTX came along, blowing vastly more nominal value in the first round of losses, but with little evident systemic damage. That’s a lesson in liquidity – no matter how much you about financial flows, you don’t know enough to predict liquidity shocks.

Ah, but are we quite done with the crypto-crud meltdown? Perhaps not:

https://www.bloomberg.com/news/articles/2022-11-21/crypto-firm-genesis-warns-of-possible-bankruptcy-without-funding

Genesis is not a crypo miner any more than FTX was. Genesis is a lender, FTX an exchange. Genesis was having trouble getting paid well before FTX collapsed:

https://www.wsj.com/articles/genesis-lent-2-4-billion-to-hedge-fund-three-arrows-capital-11658170583

Contagion is to payment problems like Indiana Jones to snakes – Why did it have to be payment problems?

So anyhow, Genesis has now halted withdrawals in response to FTX’s troubles. See? Somebody doesn’t pay me, I don’t pay somebody else, and the whole daisy chain falls apart. Question is, how important is this daisy chain?

So, with the infrastructure of the crypto-crud market under pressure right along with the miners, do we have a wider systemic problem? Let’s look:

https://fred.stlouisfed.org/graph/?g=WKec

Not there. BBB corporate spreads peaked during the UK problem and have fallen ever since. But maybe here:

http://www.worldgovernmentbonds.com/cds-historical-data/united-states/5-years/

Uh, Oh! Five-year U.S. CDS rates jumped in late October and are still climbing. However, that late October date doesn’t match up with any crypto-crud news or major price declines. (Did anybody in the Republican caucus mention the debt ceiling around October 24?)

https://en.macromicro.me/collections/384/spreads/3775/ted-spread

TED is normal.

So we got an asset class in freefall, a lender and an exchange disintegrating, and no clear sign of wider systemic shock. Not saying it couldn’t happen, ’cause no matter how much you about financial flows, you don’t know enough to predict liquidity shocks. But when gilts couldn’t get a bid, that was a knuckle-biter. Some markets matter a lot. Some markets are stupid…sorry…some markets are less systemically important.

Wait – you cover credit spreads? Of course you have quite ably. But JohnH told me that neither one of us knew how to calculate credit spread. Yea I insist on going this with maturity matching – you know, the right way. But not Johnny – he likes to mix and match credit spreads and term structures. Sort of advanced bloviating I guess.

tulips

One…count ’em…one single difference. You can eat tulips.

Anonymous is a Russian bot. Russian bots eat copper for breakfast.

MD,

Yeah, debt ceiling. In today’s WaPo Catherine Rampell writes again about how the lame duck Congressional Dems need to either raise the darned thing using reconciliation while they can or just get rid of it. But she reports that somehow the Dems there do not seem to be bothering with this, including the new incoming leaders such as Jeffries, who thinks “we can deal with this next year.” Really? What is the matter with these people?

I haven’t analyzed this particular situation to say with any certainty, but my first guess would be Jeffries is in a purple district.

OK, this is Hakeem Jeffries?? Our guy running for speaker. So I got that guess wrong. He won by 72%. Maybe they feel that with a Republican majority, and with Republicans blinking on this in the past, they’re better off voting at a time when they don’t have to take all the blame for the budget later?? Even with a slim majority, if Republicans balk at a budget, they have to face the blame later. So Dems maybe betting that it leaves them less open to attack either way by putting onus on Republicans. I certainly don’t think this is the nightmare (politically) you’re painting it as.

BTW this was one of Pelosi’s problems. Always creating a problem where there was none. Jeffries may do well to wait and say behind closed doors “You have the majority, you don’t want the government workers salaries feeding the economy while Biden is telling America he’ll sign a budget?? GO FOR IT”. If he sits around trying to figure out how to appear righteous everyday instead of quietly playing hard ball on issues it makes sense to quietly play hardball on~~~he will fail the same way Pelosi has failed for the last 3 decades.

Moses,,

This is the entire Dem political leadership involved in this massive stupidity. Yeah, Pelosi is still Speaker and so the person who should be pushing this through the House, and she is not, with her near certain successor, Jeffries, also somehow not on board. But this seems to include the key people in the SEnate, Schumer, Bernie Sanders, and Manchin, and then apparently Biden himself, although it seems that Janet Yellen would like something to be done..

Somehow these Dem politicians (well, technically Bernie is not a Dem) all have it in their minds somehow that voters are going to view them as “irresponsible” if they raise the ceiling now (they may not be able to get rid of it entirely using reconciliation, which is what must be used here, given no GOP support). But I seriously doubt that would happen, and it is clearly irresponsible as all get out to leave it the mercy of the lunatics who will be running the House next year.

Happy Thanksgiving you all.

Remember when Newt became Speaker? He started playing this debt limit card and President Clinton basically told him “make my day”. Kevin McCarthy would do the Dems a big favor if he pulled this stunt as it would take only a few moderates to switch parties and BAM Speaker Hakeem Jeffries.

pgl,

Problem is if they really trigger a major global recession that goes into 2024, blame may end up on Biden’s desk, quite aside from all the damage it would do to many people around the world. What Newt got in trouble for was temporary government shutdowns, which did not lead to major recessions. The latter can end up on the doorstop of the White House. We have seen pleny of political situations where one side caused something bad that then the other side got blamed for.