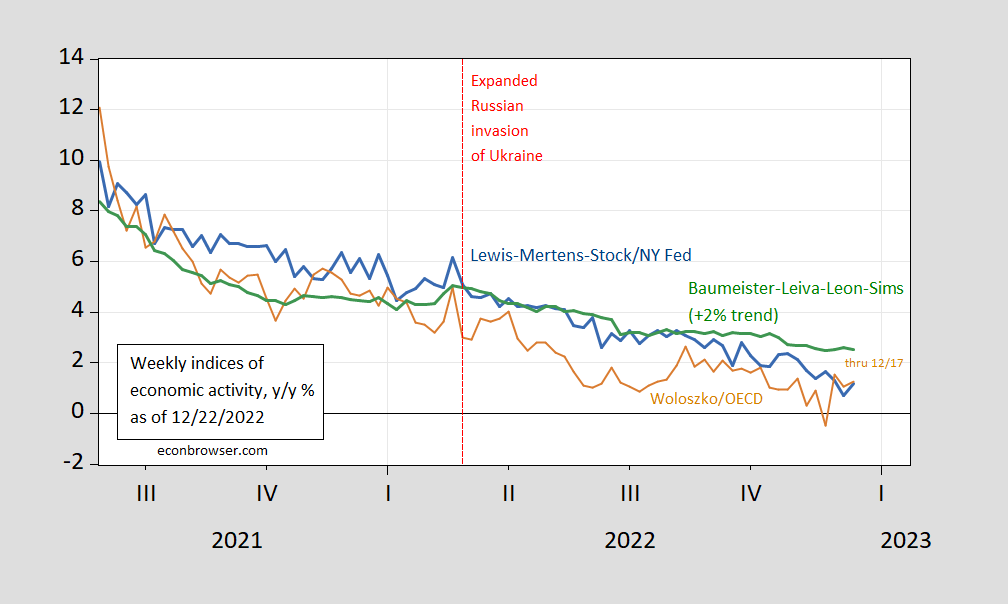

Weekly indicators from Lewis-Mertens-Stock (NY Fed) Weekly Economic Indicators, and Baumeister, Leiva-Leon and Sims WECI and Woloszko (OECD) Weekly Tracker through 12/17, released today.

Figure 1: Lewis-Mertens-Stock Weekly Economic Index (blue), OECD Weekly Tracker (tan), Baumeister-Leiva-Leon-Sims Weekly Economic Conditions Index for US plus 2% trend (green). Source: NY Fed via FRED, OECD, WECI, and author’s calculations.

The deceleration has been pretty consistent over time, and across indicators, with the exception of the Weekly Tracker, which dipped into negative for the week ending 11/26, before rebounding to match the WEI. The WEI reading for the week ending 12/17 of 1.2% is interpretable as a y/y quarter growth of 1.2% if the 1.2% reading were to persist for an entire quarter. The OECD Weekly Tracker reading of 1.3% is interpretable as a y/y growth rate of 1.3% for year ending 12/17. The Baumeister et al. reading of 0.5% is interpreted as a 0.5% growth rate in excess of long term trend growth rate. Average growth of US GDP over the 2000-19 period is about 2%, so this implies a 2.5% growth rate for the year ending 12/17.

Q4 GDPNow as of 12/20 was 2.7% q/q SAAR. There’ll be new release tomorrow.

Bruce Hall is still defending his recent claim that inflation is 13.3% (it’s not even close) while Kevin Drum is saying inflation is closer to zero:

https://jabberwocking.com/inflation-has-practically-disappeared/

Inflation has practically disappeared

Here is PCE inflation for November. It’s close to zero:

As usual, this is month-over-month inflation adjusted to an annual rate. The core rate, which the Fed considers the key inflation figure to follow, is down to 2%, which is their official target. The headline rate is even lower at 1.3%.

OK – I do not always agree with Kevin but unlike Brucie boy – Kevin at least tries to make an honest point.

Oooo, so you don’t actually read my comments. You just pick out two or three words and run with a snarky retort that makes no sense. Got it.

• https://econbrowser.com/archives/2022/12/do-foreign-yield-curves-predict-us-recessions-and-gdp-growth#comment-291074

• https://econbrowser.com/archives/2022/12/do-foreign-yield-curves-predict-us-recessions-and-gdp-growth#comment-291092

“Oh, and try reading everything in the context it was written.

For example, from January 2021 to June 2022, inflation as measure by the CPI rose almost 13.3%; since June 2022 there has been virtually no measured overall inflation.”

I never said the rate of inflation (you implied yr/yr during the whole 18-month period). What I said was, essentially, that it would take $1.13 in June, 2022 to buy what $1.00 would have purchased in January, 2021. I know that’s a difficult concept for you to grasp, but let me know if you need me to simplify it further.

And your effort to dismiss the 13.3%? Okay, I used the seasonally adjusted data (and we know the end points are subject to further revision), and came up with 12.6% cumulative increase for the January, 2021 through June, 2022 period. Your effort to say that ” If a soybean farmer’s prices also rose by 12.6% and the cost of his fertilizer and other inputs rose by 12.6%, his real income does not change” was really a bad example because we know that didn’t happen. In fact, wage increases have trailed general inflation for the better part of the year. That’s disingenuous at best and totally divorced from reality. Quit trying to be an inflation apologist.

https://www.forbes.com/sites/qai/2022/10/01/us-wage-growth-fails-to-keep-up-with-rising-prices-for-17-consecutive-months/?sh=5dc5dfd4b007

I know, you think Forbes is a piece of crap. Get over yourself.

I read your comments – even if they are beyond dumb. For example:

‘I never said the rate of inflation’

This from the troll who does not know the different between inflation and the price level?

“I know that’s a difficult concept for you to grasp”.

Excuse me troll but the point is that when nominal income rises by the increase in the cost of living – real income does not fall. THAT is the simple point you have ducked every time. You were the one talking about overall income not just wages. Oh wait – you have become a socialist now who does not count capital income? Gee Brucie – that is not going to go well when you huddle up with your right wing buddies.

But of course you could have avoided all if this if you ever bothered to do two things: (1) cite reliable data; and (2) learn to write at a first grade level.

pgl, you gave me my morning laugh … again… trying really hard to walk that line between price increases and rate of inflation. Have you been listening to Joe Biden’s gal holding press conferences?

https://www.pbs.org/newshour/economy/commerce-department-inflation-gauge-shows-price-increases-slowing-to-5-5-percent

You still want to argue that real wages are keeping up with inflation. Let me help you out here.

Real average hourly earnings decreased 1.9 percent, seasonally adjusted, from November 2021 to

November 2022. The change in real average hourly earnings combined with a decrease of 1.1 percent in

the average workweek resulted in a 3.0-percent decrease in real average weekly earnings over this

period.

https://www.bls.gov/news.release/realer.nr0.htm

Of course, this doesn’t help the people who have fixed incomes.

As to “overall income”, I presume you want to include gains (well actually losses) in stock market assets.

https://www.slickcharts.com/dowjones/returns/ytd

Reliable enough for you? How are Nitpickers Anonymous these days?

But hey, Merry Christmas. It almost feels like a traditional Michigan Christmas here in Siesta Key this morning. Stay warm in NYC.

“trying really hard to walk that line between price increases and rate of inflation.”

No dumbass – it is you that continued to confuse the two. Yea – I read your garbage and it is beyond dumb. Then again – you only repeat the Alternative Facts from Kelly Anne so it is no wonder you do not realize that amount of utter stupidity you spew.

“Real average hourly earnings decreased 1.9 percent, seasonally adjusted, from November 2021 to

November 2022.”

Barkley was talking about recent changes – and the BLS reported on the m/m change. Leave it to the liar you are to pull out the year to year changed. Brucie – we have been over this before as well. START PAYING ATTENTION.

Gee Brucie lost money in the stock market. Dude – try looking at the chart showing overall real income since Biden took office. Very impressive growth. So someone is doing better.

Oh now if there is someone whose nominal income is fixed then OK. But WTF is that? You do know Social Security benefits are still indexed to inflation. Yea your right wing buddies want to change that but guess what troll. You have failed so far, which is a good thing.

‘you think Forbes is a piece of crap.”

Well Tim Worstall writes for this trash so hey. BTW – there have been a lot of comments as well as Dr. Chinn post on real wages over the past two years. As usual Brucie boy never understood that. Atta boy Brucie.

Ad hominem comments are the mark of an inability to debate. Are you arguing with the data and facts or simply trying to ignore those to say that the person reporting the data and facts is not worthy of your time? You need to loosen up a bit because your britches obviously are way too tight.

https://www.txst.edu/philosophy/resources/fallacy-definitions/Ad-Hominem.html

Just the facts, Jack.

Maybe you should check out where I discussed Worstall’s discussion of IKEA’s intercompany royalty play, which is over at Econbrowser. Timmy boy argued that the IKEA business model was the same as Starbucks. The only person who is dumber than that is someone named Bruce Hall.

“Are you arguing with the data and facts or simply trying to ignore those to say that the person reporting the data and facts is not worthy of your time?”

You – like JohnH – have had as long history of misrepresenting reality but citing newspaper articles rather than the original sources of data. Now you did recently link to BLS – good boy Brucie. But even then – you misrepresented what BLS said. Another JohnH trick.

Are you two writing an economics text book together. This should be the funniest thing ever!

“(Attacking the person): This fallacy occurs when, instead of addressing someone’s argument or position, you irrelevantly attack the person or some aspect of the person who is making the argument. The fallacious attack can also be direct to membership in a group or institution.”

Brucie boy loves to attack Joe Biden with all sorts of stupid claims that the President is too old. Of course Brucie thinks he is addressing Biden’s economic policies which is a real laugh since Bruce has no idea what those policies are. Brucie thinks he is being so cool here but I guess he is so full of himself to have noticed all the other preK kiddies are laughing at him.

Brucie boy thinks he is up to date relying on some Forbes article that is 3 months old? Brucie – FRED is a great source that is more up to date and comprehensive. We’ve been over this before but hey:

https://fred.stlouisfed.org/series/LES1252881600Q

Note real wages rose in the last quarter – something Barkley has had to remind JohnH of many times. But did Brucie notice? Of course not. And of course Brucie is either too dumb or dishonest to note the spike in real wages right after the pandemic started even though Dr. Chinn has noted this many, many times.

Yea Brucie is really, really SLOW.

“In 2021, annual wages rose fastest for the top 1% of earners (up 9.4%) and top 0.1% (up 18.5%), while those in the bottom 90% saw their real earnings fall 0.2% between 2020 and 2021. Workers in the 90th–99th percentile of the earnings distribution also experienced real losses in 2021.”

https://www.epi.org/publication/inequality-2021-ssa-data/

In 2022 average wages dropped 1.7%, which means that average workers are most likely finding out found that their wages have dropped even more after the usual suspects have finished skimming off the cream.

https://fredblog.stlouisfed.org/2018/02/are-wages-increasing-or-decreasing/

The EPI study shows that there was no “spike” in real wages in 2020…except for the top 10%. That was enough to make the overall average rise. (Using the overall average wage is certainly a great way to paint a deceptively rosy picture of the prosperity of the overall labor force!)

Other measures show that workers earnings are back to where they were in 2019…or even 2017.

https://fredblog.stlouisfed.org/2018/02/are-wages-increasing-or-decreasing/

But yes, now that inflation has come down, real wages did rise in the last quarter…and we can finally expect that they will rise further as inflation continues to abate.

Already responded to this. The last three months do not make up for the last two years. Keep trying.

Okay, off to a nice big family gathering for Christmas Eve. Then off to Orlando for some more family visits and golf.

Keep warm… it will help your attitude.

No you did not. You are talking about average wages. Jonny boy decided to change the topic to the distribution of wages, which is fine I guess. But damn Brucie boy – you do not know the difference? Damn – you are really SLOW.

Hey Brucie – since you have been talking about the average real wage, you need to carefully and SLOWLY read the EPI data on the pandemic labor market. The AVERAGE (which you were referring to) ROSE by 2.4%.

Come on Brucie – pointing out you serial lying is getting way too easy. Dude – you need to learn to READ before you embarrass your family again.

Of course Forbes was reporting on real average hourly earnings. Let’s check with BLS:

https://www.bls.gov/news.release/archives/realer_12132022.htm

Real average hourly earnings for all employees increased 0.5 percent from October to November, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. This result stems from an increase of 0.6 percent in average hourly earnings combined with an increase of 0.1 percent in the Consumer Price Index for All Urban Consumers (CPI-U).

What? what? CPI is not rising by more than 1% per month as Brucie tried to tell us. And real wages last month rose? Hey Brucie boy – you are getting more and more like the Village Moron JohnH each day. Relying on some stupid news account rather than checking the readily available source data? Dude – that was my original point – something else that went over Brucie’s little brain.

if last month were the good old days…….?

‘sprain why bruce hall should shift to the one month view of rising pce index.

You got some sprainin’ to do too. You still have a designated driver,right?

your handle is the best you have!

You should remember: honesty is the best policy. Just sprainin’.

Macroduck recently explained this but you were too drunk to have noticed.

And core CPI ex-housing is *negative* for 2 straight month-over-month prints… OER keeping headline above water but it’s laggy and both home prices and actual rents declining. My read is that inflation over the past 2 years was mostly not structural and was mostly over by summer when everyone was celebrating the Fed’s successful soft landing. But energy crunch in early fall from Russia shutting down NS1 and OPEC cutting production spooked everyone and Fed over-reacted to more transient inflation. I bet they are cutting by spring.

Why is my economic activity completely unrelated to these made-up indices with error bars a mile wide?

rsm: Possibly because you are detached from reality, so are unable to properly ascertain what your level of activity – brainwave or otherwise – is.

rsm,

Maybe you were fired for incompletence, from whatever job you might have had, so your economic activity has declined somewhat as a result of your personally declining income. Of course, you may be having trouble estimating by how much your income is declining because you keep trying to put massively wide error bars around it.