Today we are fortunate to present a guest post written by Michal Rubaszek (SGH Warsaw School of Economics), Joscha Beckmann (FernUniversität Hagen and Kiel Institute for the World Economy) Michele Ca’ Zorzi (ECB), and Marek Kwas (SGH Warsaw School of Economics). The views expressed in this paper are those of the authors and not necessarily those of the institutions they are affiliated with.

We have released a new ECB Working Paper (No. 2731) entitled “Boosting carry with equilibrium exchange rate estimates”. The title suggests that it may be possible to boost the performance of FX trading strategies departing from the assumption that exchange rates move randomly.

It is a widely held view in economics that predicting future movements of exchange rates is almost impossible (Rossi, 2013). Two pieces of evidence are often put forward to support this thesis. The first comes from the (time series) FX literature on currency forecasting, arguing that it is preferable to assume that exchange rates follow a “random walk” and make a prediction of no change than forecasting exchange rates using a macro model. The second, which prevails in the FX literature on currency portfolios, points to the success of an investment strategy known as “carry trade”, consisting in borrowing in low-yield and investing in high-yield currencies (Lustig et al., 2011; Koijen et al., 2018). Profitability of carry trades contradicts the uncovered interest rate parity and implicitly assumes that exchange rates behave as random walks. For several decades there has been a parallel quest in these two strands of the FX literature, the first aiming at forecast accuracy and the second at portfolio profitability, to outperform the respective benchmarks, the random walk, and the carry trade strategy. In both cases the approach is the same in spirit, i.e. to set up a model that attempts to recover either theoretically or empirically a link between exchange rates and economic fundamentals (Menkhoff et al., 2017; Cheung et al., 2019; Colacito et al., 2020).

The assumption of random exchange rates is difficult to accept as it is at odds with economic theory. In Econbrowser blog “Exchange rate forecasting on a napkin” we argued that a gradual process of convergence of the exchange rate towards Purchasing Power Parity (PPP) tends to outperform the random walk in exchange rate forecasting. In the article “The reliability of equilibrium exchange rate models: A forecasting perspective” we generalized this result, showing that it also holds for equilibrium measures based on the Behavioral Equilibrium Exchange Rate (BEER) model (and not only PPP). Such predictive power contradicts the first piece of evidence in favor of the random walk hypothesis. In this blog we address instead the second piece of evidence in favor of such hypothesis, namely the success of carry trade strategies, and whether their strong past performance is evidence in favor of the random walk hypothesis.

To understand if one can exploit (time series) exchange rate predictability to design a competitive currency portfolio, we collected quarterly data for the G10 currencies from 1975 to 2020. We then calculated two sets of equilibrium exchange rate estimates using both the PPP and BEER models and verified our claim that there has been over this time horizon at least some time series predictability at the one-quarter horizon. We finally employed the tools and methods of the FX trading literature to show that investors could have built FX portfolios with competitive risk-return characteristics, exploiting evidence of exchange rate misalignments.

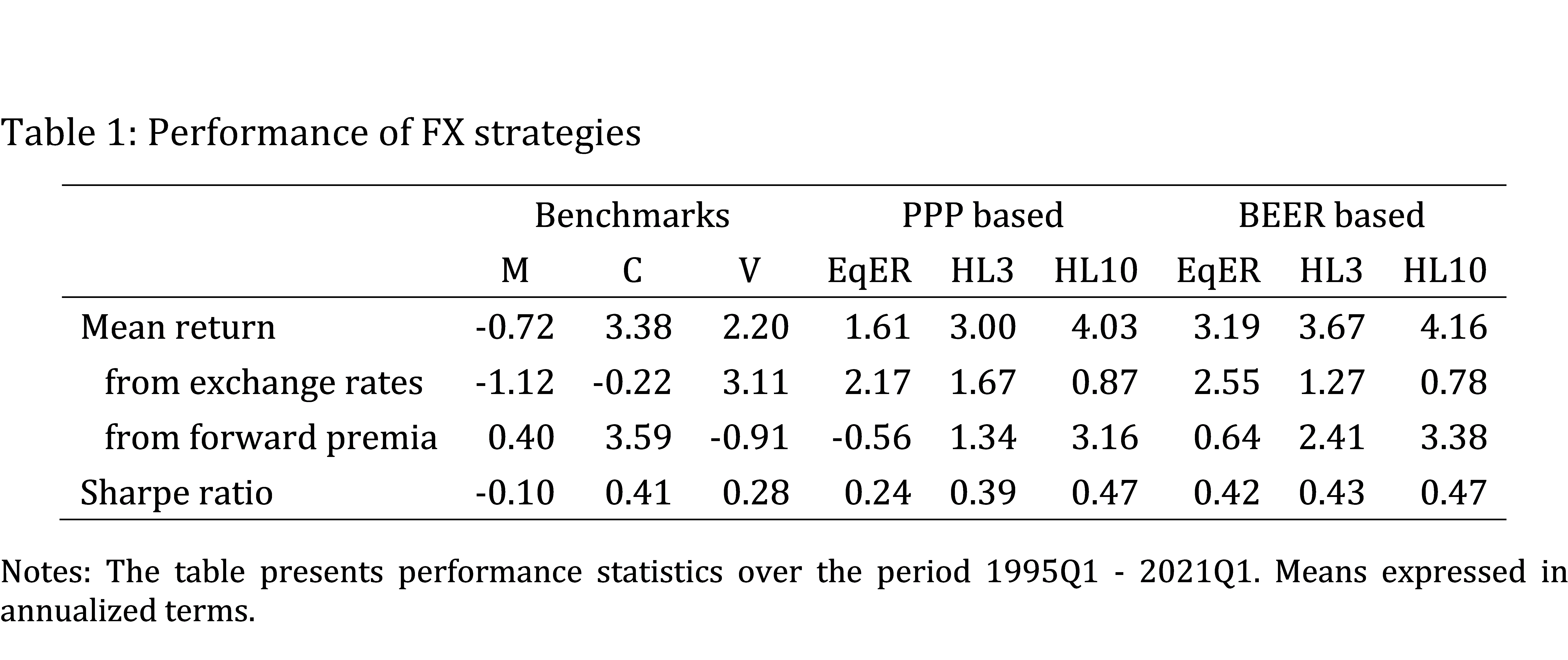

For that purpose, we evaluated:

- three benchmark strategies: momentum (M), value (V) and carry (C);

- strategies based on FX misalignments alone (EqER);

- strategies based on the assumption that exchange rates gradually return to their equilibria – postulating that half of the adjustment is completed in a fixed number of years, for example 3 (HL3) or ten (HL10).

The key performance statistics of the above strategies and their cumulative returns are shown respectively in Table 1 and Figure 1. The results suggests that strategies based on FX misalignments (EqER) over the horizon 1975 to 2020 would have been profitable as shown in terms of mean returns and Sharpe ratios (see rows 1 and 4 in Table 1). This is consistent with the insight that it is possible to exploit evidence of under or overvaluation given a large enough pool of currencies. However, their performance would have been inferior to that of a naïve carry trade strategy. We interpret this result as being consistent with the evidence that exchange rates initially adjust very slowly toward their equilibria – hence the component which is predictable is insufficient to outweigh the gains derived from knowing with certainty the prevailing configuration of interest rate differentials across countries.

The lesson one can draw is that it is preferable to rely on the alternative hypothesis that exchange rates adjust only gradually toward their equilibria. We show that indeed both HL strategies would have been very competitive compared to other benchmarks by exploiting simultaneously the time series predictability of exchange rates but also extracting forward premia (see rows 2 and 3 in Table 1). Among them, the HL10 strategy would have generated higher expected returns and Sharpe ratios than those of the naïve carry trade strategy, both in the case of PPP and BEER models. This result, which is robust for a wide range of half-lives, shows how departing from the random walk hypothesis can be instrumental for boosting a carry-based FX trading strategy. The key requirement is to assume a sufficiently slow adjustment process. Besides the issue of performance, HL strategies profoundly change the nature of expected returns since a significant component comes now from the modeler’s ability to extract the predictability of spot exchange rates (Table 1 and bottom panels of Figure 1).

Figure 1: FX portfolio returns

Notes: The upper panels present cumulated rate of returns for EqER-based and benchmark strategies. The bottom panels present excess return decomposition into spot rate predictability and forward premium.

The main message of this blog is not to dispute the evidence that carry trades performed well in recent decades. To the contrary, HL strategies are not dissimilar from carry trade strategies in practice. What we dispute is that the success of carry trade strategies automatically imply that exchange rates are random. The gradual adjustment of exchange rates to close existing misalignments seems instead a preferable assumption both from an economic theory and portfolio investors’ perspective.

References

Cheung, Y.-W., Chinn, M. D., Pascual, A. G., and Zhang, Y. (2019). Exchange rate prediction redux: New models, new data, new currencies. Journal of International Money and Finance, 95:332–336.

Colacito, R., Riddiough, S. J., and Sarno, L. (2020). Business cycles and currency returns. Journal of Financial Economics, 137(3):659–678.

Koijen, R. S., Moskowitz, T. J., Pedersen, L. H., and Vrugt, E. B. (2018). Carry. Journal of Financial Economics, 127(2):197–225.

Lustig, H., Roussanov, N., and Verdelhan, A. (2011). Common risk factors in currency markets. Review of Financial Studies, 24(11):3731–3777.

Menkhoff, L., Sarno, L., Schmeling, M., and Schrimpf, A. (2017). Currency value. Review of Financial Studies, 30(2):416–441.

Rossi, B. (2013). Exchange rate predictability. Journal of Economic Literature, 51(4):1063–1119.

This post written Michal Rubaszek, Joscha Beckmann, Michele Ca’ Zorzi and Marek Kwas.

“Boosting carry with equilibrium exchange rate estimates”

The title suggests that it may be possible to boost the performance of FX trading strategies departing from the assumption that exchange rates move randomly.

[ Really nice, useful paper. ]

https://fred.stlouisfed.org/graph/?g=yeYT

January 15, 2018

Real Broad Effective Exchange Rate for China, United States, India, Japan and Germany, 1994-2022

(Indexed to 1994)

https://fred.stlouisfed.org/graph/?g=RRwA

January 15, 2018

Real Broad Effective Exchange Rate for China, Indonesia, Brazil, United Kingdom and France, 1994-2022

(Indexed to 1994)

https://mainlymacro.blogspot.com/2022/12/the-political-moral-and-intellectual.html

December 20, 2022

The political, moral and intellectual bankruptcy of the current Conservative party

The UK is currently suffering a level of strike action not seen for decades. There is a simple reason for most of that – it is government policy. Take the continuing strikes in the rail industry. According to the Financial Times two weeks ago: “Employers had planned to offer a 10 per cent pay rise over two years to the RMT union, but were blocked by the government, which controls the industry’s finances, according to three people familiar with the matter” by adding tough new conditions at the last minute.

Or take the unprecedented strike by many nurses. Nurses have seen a large cut in their pay relative to those in the private sector since 2010. The government’s current pay offer will see that continue. Quite simply, nurses are being forced to strike because the government insists on reducing their standard of living compared to private sector workers as well as making their working conditions more intolerable. Now if for every nursing vacancy there were hundreds of applications then you could make a case for lower pay, but the opposite is true, partly because many nurses are leaving the NHS. It is a similar picture across the public sector.

Of course the government tries to assert that none of this is true. Instead they like to pretend that they are on the side of poor suffering Joe Public, and also like to claim that somehow it is the Labour opposition’s fault that we are seeing all these strikes. Given the level of misinformation we have in this country many (although for nurses certainly not a majority) will believe them. The reality is that the government thinks these strikes will work to their political advantage in returning some core Conservative support they have lost in recent months. In other words, they are making these strikes happen, despite the inconvenience this will cause and the damage it will do to the country, because they believe it’s to their party’s political advantage.

Governing in a way that harms the country but boosts your flagging popularity is a good measure of political and moral bankruptcy….

— Simon Wren-Lewis

https://www.nytimes.com/2022/12/21/world/europe/uk-ambulance-workers-strike.html

December 21, 2022

U.K. Ambulance Workers Stage Their Largest Walkout in Decades

The industrial action, seeking higher pay and better working conditions, was driven by a cost-of-living crisis and coincides with strikes by rail workers, nurses and others.

By Isabella Kwai

https://fred.stlouisfed.org/graph/?g=M26o

January 30, 2018

Real private weekly earnings for United Kingdom, 2007-2022

(Indexed to 2007)

https://fred.stlouisfed.org/graph/?g=WKJS

January 30, 2018

Real Hourly Earnings in Manufacturing for United Kingdom, 2007-2022

(Indexed to 2007)

I like how you showed UK real wages over a longer period of time. We all have had enough of JohnH taking the low point for real wages and pretending that Cameron’s depressed economy magically raised real wages. No the series is volatile and taking the narrow time frame that JohnH wants to pretend is the right time frame is dishonesty in the extreme. But hey – what is one going to do when one is bought and paid for by a Tory Administration.

pgl just can’t let this go. But looking at a longer time frame, it’s easy to see that UK inflation was relatively high during the 2010s…and real wages dropped. Then when inflation went to zero in 2015, real wages rose. Meanwhile, Krugman et al. were fearmongering in 2015 about deflation and the harm about to be inflicted on the poor working man. But instead, real wages rose…until inflation overtook wage gains again a couple years later.

Of course, pgl believes that the inflation of the early 2010s was also caused by Cameron’s austerity.

“it’s easy to see that UK inflation was relatively high during the 2010s…and real wages dropped.”

I have been saying real wages declined for years. But no – you are the lying POS that claimed the Cameron fiscal austerity increased real wages. Yea a depressed economy lowered inflation but it did not raise real wages. This is the point you never got even though some 3 year olds understand that.

“pgl believes that the inflation of the early 2010s was also caused by Cameron’s austerity.”

No moron – you are the flaming idiot who fail to get basic cause and effect.

Keep it up Jonny boy – you repeatedly prove you never got basic economics.

pgl just can’t let this go…like a dog chewing on a bone.

Fact #1: UK inflation rose after 2010. Nominal wages couldn’t keep up. Real wages fell.

Fact #2: UK inflation fell to zero during 2015. Nominal ages grew. And real wages grew even faster, despite fearmongering by people like Krugman, who insisted that very low inflation rates would harm workers. The opposite happened. How wrong they were!

To ascertain the facts, all you have to do is to look at the attached chart provided courtesy of BBC using data from the UK’s own ONS:

https://ichef.bbci.co.uk/news/624/cpsprodpb/9AEB/production/_108295693_earnings.cpi-2019-aug-13-nc.png

What I just stated is my whole point–the disparity between the reality of what happened and the fearmongering that Krugman and other mainstream economists engaged in.

pgl OTOH wants to move the goalposts and shift the debate to Cameron. He wants you to believe that falling real wages was all due directly to Cameron’s austerity. Per pgl, the rise and fall of inflation was irrelevant, even if the bulk of the decline in real wages occurred during the period of highest inflation (2010-2013.)

So was it Cameron’s austerity that caused the high inflation.? That argument runs counter to dogma…but, hey, that’s what pgl has to believe if his argument is to make any sense.!

I really fail to understand why pgl is so insistent on shifting the debate to Cameron. I mean, Obama and his coterie of deficit hawks embraced austerity, too. And the UK and US economies’ growth tracked very closely for years. But pgl, always the partisan hack, embraces Obamausterity and decries Cameron austerity! Hypocrisy reigns supreme.

Perhaps pgl’s problem is that under Cameron, median household disposable income (not wages) ended up £1,000 higher than pre-downturn level. Worse, Median disposable income fell for the richest fifth of households by 3.7% under Cameron.

pgl must be shocked and outraged that median household income could rise while the wealthiest “suffered.” As usual the goal here is to comfit the comfortable and discomfit everyone else.

JohnH

December 22, 2022 at 2:47 pm

Gee – Jonny boy after years and years of babbling finally got the accounting correct. But this dude still gets an F minus in basic economics. Eh Jonny boy – this is an economist blog. But do keep reminding us that you are beyond incompetent. Please keep it up as your stupidity is incredibly funny.

ichef.bbci.co.uk? Jonny boy finds a chart from ichef.bbci.co.uk?

What is this cite Jonny boy? Do you even know? Likely some UK rightwing group that shills for the Tory Party. Oh wait – these are the guys that pay you to shill for the Tories. Got it!

“Of course the government tries to assert that none of this is true. Instead they like to pretend that they are on the side of poor suffering Joe Public, and also like to claim that somehow it is the Labour opposition’s fault that we are seeing all these strikes. Given the level of misinformation we have in this country many (although for nurses certainly not a majority) will believe them.”

These Tories have been spewing this BS dating back to the Cameron days if not longer. Simon Wren-Lewis is perhaps the UK best progressive economist. Of course back in the days when Cameron’s fiscal austerity was keeping the UK economy depressed, Simon Wren-Lewis would note very clearly how Cameron’s policies were leading to declines in UK real wages.

Back then and for some weird reason even now – JohnH has to deny all the wisdom Simon Wren-Lewis conveyed. I asked JohnH to actually read what Simon Wren-Lewis was saying but no – he could not do that as he had to parrot Cameron’s nonsense.

JohnH

December 22, 2022 at 10:40 am

If David Cameron was stupid enough to hire as his economic spokesperson a person dumb enough to write that comment, no wonder Simon Wren-Lewis kept tearing down his economic nonsenses. Even Lawrence Kudlow is not THAT dumb.

Try looking at the data I provided, pgl. Real wages rose in 205 when inflation fell to zero. And they fell when inflation was relatively high.

I saved the ONS chart provided courtesy of BBC…it looks like I’ll have to keep linking to it.

Real wages rose in 205? Got it – you have gone all the way back to the Roman Empire. Once again Jonny boy – this is not an accounting blog. If you even learn the economics of Keynes (some 1725 years later) let us know. In the meantime the kiddies at play school will continue to laugh at the dumbest troll God ever invented.

BTW – the weather warmed up over night. It also rained a lot. Jonny boy would tell us the rain caused the higher temperatures. Yea – he is THAT STUPID.

“Nurses have seen a large cut in their pay relative to those in the private sector since 2010. The government’s current pay offer will see that continue. Quite simply, nurses are being forced to strike because the government insists on reducing their standard of living compared to private sector workers as well as making their working conditions more intolerable. Now if for every nursing vacancy there were hundreds of applications then you could make a case for lower pay, but the opposite is true, partly because many nurses are leaving the NHS. It is a similar picture across the public sector.”

JohnH likes to pretend he and he alone is the champion of the working person but he has not criticized the Tory government. Oh wait – JohnH is the spokesperson for the Tory Party. Which is why everything JohnH claims about the UK economy is contradicting from someone who really gets this economy – Simon Wren-Lewis!

So, bottom line seems to be that the strategy that does the best at beating random walk is the long-run equilibrium strategy, presumably assuming PPP as measuring that long run equilibrium, essentially a trade-based form of equilibrium that washes out financial markets. However, given that the adjustment to equilibrium is gradual, it looks that it does not do obviously dramatically better than random walk.

“Of course the government tries to assert that none of this is true. Instead they like to pretend that they are on the side of poor suffering Joe Public, and also like to claim that somehow it is the Labour opposition’s fault that we are seeing all these strikes. Given the level of misinformation we have in this country many (although for nurses certainly not a majority) will believe them.”

These Tories have been spewing this BS dating back to the Cameron days if not longer. Simon Wren-Lewis is perhaps the UK best progressive economist. Of course back in the days when Cameron’s fiscal austerity was keeping the UK economy depressed, Simon Wren-Lewis would note very clearly how Cameron’s policies were leading to declines in UK real wages.

Back then and for some weird reason even now – JohnH has to deny all the wisdom Simon Wren-Lewis conveyed. I asked JohnH to actually read what Simon Wren-Lewis was saying but no – he could not do that as he had to parrot Cameron’s nonsense.

Look at the data pgl. It’s a good, reliable antidote to your BS.

I have looked at the data. It is the same data that I looked at 8 years ago. It is the same data Simon Wren-Lewis has looked at. The difference is that Simon and I understand basic economics. You clearly do not. Then again – you never learned to tie your shoe laces.

For most of the period covered in the study, the yen and Swiss franc are funding currencies, dollar and sterling are target currencies:

https://fred.stlouisfed.org/graph/?g=XT3c

I may be wrong about this history, but I believe the SNB has kept rates low to fight currency appreciation through much of this period because of Swiss banks’ role in finance – lots of cash flowing in, risking damage to the real economy. Japan certainly engaged in currency manipulation in periods, but without the same root cause in banking. Japan has now been a naturally low-rate country for several decades.

Which leads me to a question. This study was conducted on a portfolio basis; do some carry trades dominate the result in some periods, so that most of the result is driven by a few pairs? The reliance of the 3-year half-life trade on both carry and FX movement for returns suggests this possibility. The 10-year half-life results indicate that carry dominates so that the movement of individual pairs matters little. That’s hardly a surprise – the cat ends up among the pigeons for every currency once in a while, messing up FX returns.

I’m also curious to know how the Eurozone intererest-rate convergence shows up in this study:

https://fred.stlouisfed.org/graph/?g=XT1O

Not only did interest-rate differentials disappear, but so did currencies. It’s obviously outside the scope of this study, but currency trade was dominated by rate convergence plays for a time, and then immediately lost trades within the Eurozone and had to pile into euro-against-other trades upon adoption of the euro. Fun times.

From the NY Fed’s quarterly Seven of Consumer Expectations labor market survey:

– Conditional on expecting an offer, the average expected annual salary of job offers in the next four months increased from $60,310 in July to $61,187 in November, reaching a new series high.

– The average reservation wage—the lowest wage respondents would be willing to accept for a new job—increased from $72,873 in July to $73,667 in November, the highest reading of the series. The increase was most pronounced for respondents below age 45.

https://www.newyorkfed.org/microeconomics/sce/labor#/

Isn’t “the highest reading of the series”, the highest nominal reading? Doing these figures in inflation adjusted terms would be a nice service.

Why ignore FX hedging in conjunction with carry trades?

Why have both covered and uncovered interest parity been violated for decades, and why doesn’t that result in negative derivative prices and persistent free lunches?

Why are the authors too afraid to put up a current trade that would test their little theory?

rsm,

The authors may well have made bets on this stuff, but they are not going to publicly discuss it for the benefit of clowns like you.

As it is, you are the prophet of how noisy all this stuff is, and it remains pretty noisy. So fully understand if risk averse authors are not running to make trades based on any of this.

I have made this point before here, which I think Dr. Chinn agrees with. Going back to the famous Meese-Rogoff study from decades ago, random walk beats most models most of the time. But a point they also made that has not gotten all that much publicity is that random walk itself really did not do all that well in forecasting FX markets.

As it is, since then, Dr. Chinn and some others have managed to occasionally find some models that do beat random walks. But, frankly, FX markets remain noisy to the point that even random walks do not do all that well.

George Santos has taken resume padding to a whole new level. He has lied about his employment and a lot of other things including being Jewish (he’s not). But isn’t he gay?

https://www.msn.com/en-us/news/politics/gop-rep-elect-george-santos-reportedly-divorced-a-woman-2-weeks-before-running-for-office-in-2019-despite-suggesting-he-s-been-openly-gay-for-a-decade/ar-AA15zrdk?ocid=msedgdhp&pc=U531&cvid=e58e4e1346114735b415f3e1d17f04c5

GOP Rep-elect George Santos may have lied about numerous aspects of his background.

He reportedly divorced a woman, Uadla Santos, in 2019 less than 2 weeks before launching his first campaign.

But he’s said that he’s “openly gay” and has “never had an issue with my sexual identity in the past decade.

As a New Yorker, you must have forgotten Santos’ days as an All American shortstop on Baruch”s nationally ranked D1 baseball team. Or that former Yankees GM, George Costanza, reportedly offered Santos a huge contract to sign with the Yankees. Santos said he had to turn it down while pursuing post grad work at NYU.

EPI just came out with a new report on wage inequality. It’s a perfect example of the perils of using averages…in this case average wages.

Their data shows that real average wages did indeed grow 2.4% from 2019-2021. However, all of the wage growth came from the top ten percent of wage earners. For the bottom 90% wages dropped 0.2% since 2019. At best this could be called wage stagnation.

https://www.epi.org/publication/inequality-2021-ssa-data/

In 2022, with the rate of inflation exceeding the rate of wage growth, average wages have dropped 1.8%. The brunt of this drop has almost certainly has fallen the bottom 90%, consistent with their declining share of wages since 1979. This suggests a wage recession. The fact that GDP is growing is scant consolation, since most of the gains go anywhere but to average Americans.

Robert Rich and Jospeh Tracy of the Dallas Fed confirm this: “Despite the stronger wage growth due to the tightness of the labor market, a majority of workers are finding their wages falling even further behind inflation. For workers who experienced a decline in their real wage in second quarter 2022, the median decline was 8.6 percent.

While the past 25 years have witnessed episodes that show either a greater incidence or larger magnitude of real wage declines, the current time period is unparalleled in terms of the challenge employed workers face.”

https://www.dallasfed.org/research/economics/2022/1004

Yet all too many mainstream economists either turn a blind eye to this situation or engage in denial, using aggregates and averages to mislead us into thinking all is well–“don’t worry, be happy.” Of course, this is totally consistent with what the top 1% want us believe.

“Yet all too many mainstream economists either turn a blind eye to this situation or engage in denial, using aggregates and averages to mislead us into thinking all is well–“don’t worry, be happy.”

EPI produces a lot of very excellent analysis. I suspect the good economists at EPI highly resent the pathetically insults you hurl at their profession. But you must feel compelled to misrepresent what others may think. Could this be that you have chosen to be spokesperson for right wing clowns like David Cameron and war criminals like Putin?

Yes, EPI does provide excellent analysis. You’ll note that I did not say “all economists” but rather “all too many economists turn a blind eye to this situation.”

I would not have referred to the EPI study if I thought their piece lacked merit.

Try reading what I write instead of constantly misrepresenting it.

I was citing “mainstream” economists who have done a lot more research on this issue than you could ever imagine. Of course you have no clue what mainstream even means. Heck – you have no clue what economics even means.

Five seconds on the Google and I found this from a “mainstream economist:”

https://equitablegrowth.org/income-inequality-affects-our-childrens-educational-opportunities/

One of the clearest manifestations of growing economic inequality in our nation today is the widening educational achievement gap between the children of the wealthiest and the children of everyone else. At first glance, this sounds like an obvious outcome. After all, wealthier families are able to afford expensive private schools, or homes in wealthy public school districts with more educational resources. But a closer look at this education achievement gap over the past 50 years or so shows that the gap only began to widen in the 1970s, right about the time that wealth and income inequality in our nation also began to grow. The past 30 years have seen a sustained rise in inequality in wages, incomes, and wealth, leading to more and more income and wealth accruing to those at the top of the economic ladder, pulling the rich further away from those on the other rungs.

Once again Jonny boy proves he has no effing clue what the economics profession does. There is a ton of research on this topic but just because Jonny boy is too stupid or lazy to read it gives him the right to insult economists? Seriously?

Yes, Equitable Growth is one of the few other sites that does serious work about inequality. That in no way exonerates the vast majority who would rather forget about the economic wellbeing of average Americans and rarely mention them…with the exception of times when it serves the interests of Corporate America and its wealthy investors to hype the harm or benefit to ordinary people.

Cases in point: average people’s real earnings are harmed by inflation, but that is rarely mentioned. Instead, a narrative to blame labor for inflation gets put in place. when, reality, inflation has been partially caused by Corporate America. Corporate American’s responsibility gets overlooked or denied outright. With the scapegoat labor narrative established, Corporate America is then freed to profit mightily by raising prices faster than costs and wages and blame it all on labor.

Of course, the other ploy is to emphasize the harm done to ordinary Americans when the Fed raises interest rates to combat the inflation that is also hurting average Americans. It is easy to see why this is done. Nobody would be sympathetic to wealthy folks’ portfolios being dinged a bit by higher interest rates causing asset prices to drop. Obviously they have to find a more sympathetic group that is being harm. As a result they hype the extent to which ordinary people will be hurt and gloss over the fact that it is in the interest of Corporate America and Wall Street investors to reduce interest rates and increase the value of their assets.

Did I mention that pgl has always been a BIG fan of low interest rates all the while denying the benefit derived by Corporate America and wealthy investors?

You have to be the most boring troll I have ever made. Dude your soap box is rotting away – be careful you do not fall and hurt yourself.

Now your little tirade about interest rates is going look dumber than your usual rants when the latest tight monetary policy leads to a recession. But one can only hope the US output gap is not as massive as the UK output gap under Cameron. Oh wait – you celebrated Cameron’s fiscal austerity which did maintain this gap for too long. Yes – JohnH has always been a gold bug.

JohnH,

Gosh, yes, changes in real wages are a contest between which are going up more rapidly, nominal wages or prices. The list of things that lie behind what is driving each of those is very long and has long been studied by many economists of all sorts. WE know you have your own pet story on this you think we should all repeat endlessly everywhere, but, sorry, it is only one of a long list of things going on.

You complain repeatedly about how not enough economists write about this stuff. Well, I have news for you. There are only so many outlets for papers on this topic or any other specific topic as well. If all economists spent all their time writing about this, well, a bunch of them would become unemployed because they would not be able to publish.

As it is, you may think that not enough economists are spouting your fave lines, but are there any who are pushing the opposite? Are there any economists out there either denying that we are seeing increasing inequality of wages, income, and wealth or, ebtter yet, got any who admit inequality is increasing, but are claiming this is a desirable good thing? Oh, I did not think so on either count. It is pretty much universally known among pretty much all economists that inequality is generally increasing and that this is generally not a Good Thing.

As for me, arguably not a “mainstream economist,” I have published a moderate amount on income distribution. One of the ideas that I am credited with having first proposed (along with Ehsan Ahmed and Marina V. Rosser just over two decades ago), is that there appears to be a positive relationship between income inequality and the size of the underground economy in most nations around the world, this observation having first been made for the transition economies, with indeed the idea first being inspired by the case of Russia, after my wife and her mother ducked down in her mother’s apartment in Moscow because gangsters were shooting up a bank across the street, with income inequality having massively increased in Russia. The original paper on this, there have been several followups, has had several hundred google scholar citations.

Has any of this massive research ever proved the proposition that maintaining a depressed economy for many years is actually good for real wages? Yea I get this would be an absurd proposition but if Jonny boy actually grasped the BS he is spewing, this is exactly what he is saying. Now if one could find evidence that this bizarro model were valid, then that would be worth publishing in the American Economic Review.

We have invited Jonny boy to write this up and submit it for publication. I’m sure the editor would get a good laugh at Jonny’s little paper.

More from these mainstream economists:

https://equitablegrowth.org/a-college-degree-is-not-the-solution-to-u-s-wage-inequality/

Relatively stagnant or declining wages for the vast majority of U.S. workers became a feature of the U.S. economy after the 1970s, along with a shift to “lousy” and low-wage jobs and rising wage and income inequality despite increasing productivity.

One of the explanations for this job-quality crisis is that not enough workers have the skills required for an increasingly digital and technologically advanced jobs market, leading to a widening gap between the rising wages of the highest-paid workers and everyone else. The concept of a skills gap was likewise blamed for high unemployment after the Great Recession ended in July 2009 and is now cited as the key challenge facing low-wage workers amid the current coronavirus recession. The proposed solutions to closing this apparent gap center around education and training for low-wage workers, often with a focus on getting more workers to obtain college degrees, so they can fill these high-wage, high-demand jobs.

A college degree is not the solution to U.S. wage inequality

Download

Yet this focus on individual workers misses the structural conditions that constrain workers’ options and ability to share in economic growth. This issue brief examines recent data-driven research that demonstrates the skills gap is only a small and relatively unimportant explanation for the college wage premium because it fails to account for declining worker power and the role of monopsony in the labor market. These more important explanations for the college wage premium—and its recent decline—underscore why policymakers need to improve the underlying labor market conditions for all workers, instead of shifting responsibility to those already struggling in an uneven playing field.

The college wage premium can’t explain the ongoing rise in wage inequality

A recent National Bureau of Economics Research working paper by economists David Autor at the Massachusetts Institute of Technology (and a member of Equitable Growth’s Research Advisory Board) and Claudia Goldin and Lawrence F. Katz (also an Advisory Board member) of Harvard University demonstrates how the college wage premium changed over time in response to labor market changes and policy shifts affecting worker power. While the paper itself is based in a skills-focused framework, its findings show that even this framing falls short when attempting to explain the rise in wage inequality since 2000. The paper is part of a series of research that assumes employers’ demand for skilled labor is driven by “skill-biased technological change.”

There’s a lot more here. Of course Jonny boy will not read what these mainstream economists are writing as our Economic Know Nothing is on his sand box hurling pointless insults.

Something tells me that Perry Greene must feel relieved:

https://www.msn.com/en-us/news/politics/republican-rep-marjorie-taylor-greene-is-officially-divorced-from-her-husband/ar-AA15ziiq

Republican Rep. Marjorie Taylor Greene of Georgia has finalized her divorce with her now ex-husband, Perry Greene….Perry Greene first filed for divorce in September, stating that the couples’ marriage had been “irretrievably broken.” The couple moved to finalized their divorce settlement earlier this month. It was the couples’ second time filing for divorce: as The Atlantic reported in December, Taylor Greene previously filed for divorce in July 2012 after alleged affairs she had with two men who worked at the Crossfit gym where she trained. The couple later reconciled.

“Marriage is a wonderful thing and I’m a firm believer in it,” the congresswoman said in a statement after the September filing. “Our society is formed by a husband and wife creating a family to nurture and protect. Together, Perry and I formed our family and raised three great kids. He gave me the best job title you can ever earn: Mom. I’ll always be grateful for how great of a dad he is to our children.”

I’m sure Perry is a good dad but this notion that your marriage is a wonderful thing is an odd one since you CHEATED on hubbie with a couple of ugly hick body builders. Oh well – Marjorie herself is quite ugly and one of the most disgusting pieces of vile ever to enter the Capitol Building. Hey Perry – good luck on finding a woman worth your time.

Did Marjorie Taylor Greene (R-Ga.) and Lauren Boebert (R-Colo.) vote to protect the rights of actual “groomers”?

https://news.yahoo.com/28-republicans-call-gay-people-174500075.html

For the past year, we’ve been subjected to an endless, escalating right-wing fearmongering campaign presenting LGBTQ adults as innate child sexual predators, or “groomers,” and any children in their vicinity as victims. People are literally throwing molotov cocktails into establishments that host drag events, under the guise of protecting children. The now-feuding Reps. Marjorie Taylor Greene (R-Ga.) and Lauren Boebert (R-Colo.) have been the most front-facing proponents of this rhetoric (even though Boebert’s husband was jailed for exposing himself to teens in a bowling alley a few years ago).

Yet, on Wednesday, Greene and Boebart joined 26 other House Republicans to vote against the bipartisan Respect for Child Survivors Act, which overwhelmingly passed out of the House anyway and will address how the FBI has historically mishandled child sexual abuse cases. The bill will create specific teams within the FBI to support child victims and investigate child sexual abuse, trafficking, and child abuse content. Neither Greene nor Boebert have publicly offered explanations for their votes, and frankly, they don’t have to—the gross hypocrisy of constantly lying that LGBTQ people pose a threat to children, all while declining to protect children from actual sexual predation, speaks for itself.