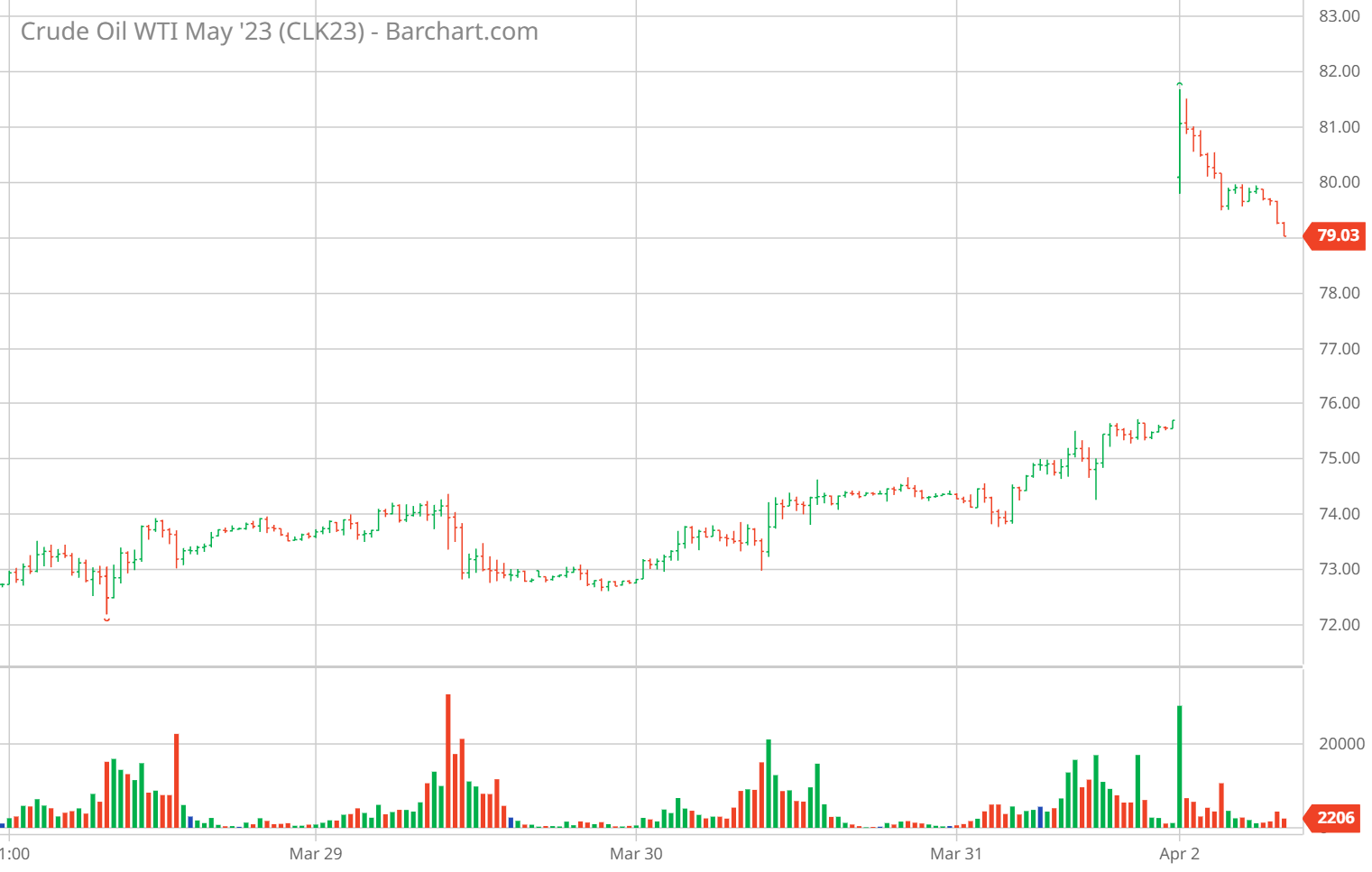

Source: BarChart.com.

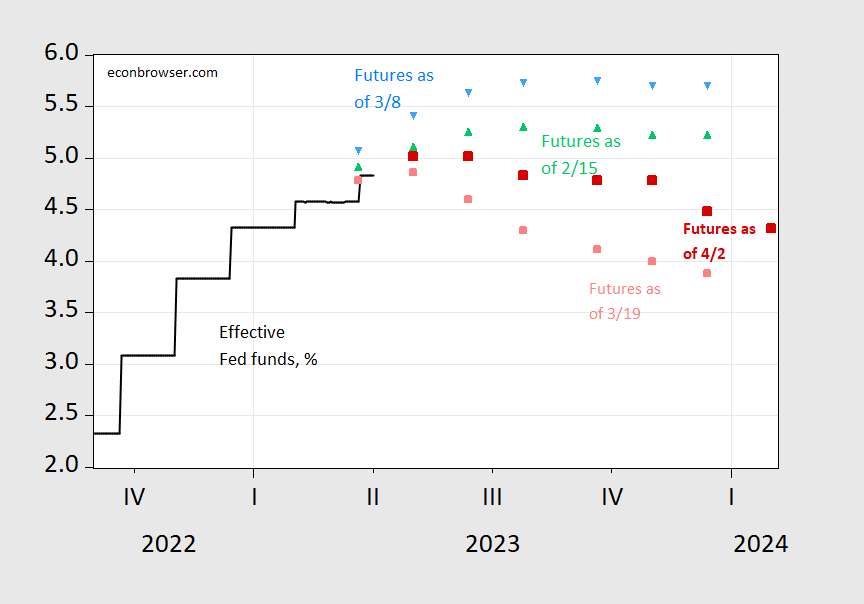

Figure 1: Effective Fed funds (black), implied Fed funds as of April 2 9:30PM CT (red square), March 19, 4:30 CT (pink square), March 8 (sky blue inverted triangle), and February 15 (green triangle). Source: Fed via FRED, CME Fedwatch and author’s calculations.

Well, that was worth p*ssyfooting around with Saudi Arabian madmen for the last few years, wasn’t it??

America keeps lifting up its skirt and then wondering why country XYZ hasn’t given them a call in the last week. I mean, at least see if the bum will pay your apartment rent for a month before the gonorrhea and the pee on the stick test.

Jonathan Stewart vs. Larry Summer…talking economics.

https://rwer.wordpress.com/2023/03/21/on-fighting-inflation/

I suspect Stewart kicked LARRY a lot here just after LARRY talked about drugs (he must have been on drugs) as LA#RRY’s justification for the FED raising interest rates. Wait – wait Jonny boy wants higher interest rates.

Please listen to when Stewart nailed LARRY on how higher interest rates will hurt workers. Something we have been trying to tell little Jonny boy for a long time. Of course little Jonny boy never seemed to get the message. So do listen very carefully to this interview as maybe finally reality will sink into your pea brain.

What I loved was when Stewart cited a study showing that Corporate America accounted for 30% of inflation. Summers simply could not juxtapose the words corporations and inflation, much less put them in the same sentence!

Larry Summer, an iconic. “liberal”public economist, was obviously covering for the miscreants, who had the means, motive, and opportunity to take advantage of ordinary people by raising prices faster than costs and wages. And, to add insult to injury, they took advantage of the opportunity to shift responsibility for inflation to their favorite targets–workers and government–using their stable of PR folks, media shills, politicians, and corporate coddling economists.

Of course pgl can’t stand it when the Feds raises interest costs but has no problem when Corporate America raises the cost of living.

I hope the clip goes viral. It confirms what everyone already knows about what’s driving inflation and how it gets covered up.

I guess someone stopped listening to LARRY. Then again – what he sensibly said was WAY over your little pea brain.

BTW I just realized you thought you had mansplained that firms had your precious hurdle rate higher than the 4% interest rate on corporate debt. DUH dude. I asked you if you even got Modigliani Miller and you clearly do not.

So let’s take this down to the preK level of finance since you clearly at the most clueless person ever. Like do you even get the Weighted Cost of Capital? Now we know you not but please Google this elementary concept and try the following SIMPLE exercise.

A firm is financed with 60% equity and 40% debt. The cost of equity = 11% and the cost of debt = 4%. What’s the cost of capital? We’ll wait while you take your shoes off. Report back next week as given your stupidity it will take you that long.

I completely understand weighed average cost of capital. They may have done that at one point, but over time most just set a hurdle and stuck with it–for large corporations it was 15%. pgl simply fails to understand how the investment process works in major corporations, be keeps blathering on trying to convince us that his cute theories actually determine corporate behavior.

From the Sharpe-Suarez paper: “Over the past 30 years, a handful of surveys focusing on firms’ capital budgeting practices have included questions asking respondents for their current investment hurdle rates—the expected rates of return they require for dedicating capital to new projects. On a couple of occasions, the Duke CFO Business Outlook Survey has itself included a question asking for firms’ hurdle rates, one instance being the survey in the second quarter of 2012, just prior to the survey studied in this paper. Using all 328 completed responses from that survey, we find that the average respondent reported a hurdle rate of 14.1%, while the median value was 13.4%. On the face of it, this seems quite high relative to the average BBB-rated corporate bond yield at

that time, which was close to 4%. To compare Global Business Outlook survey results with previous survey studies, we calculate and plot the results for the subsample of 150 respondents that are nonfinancial corporations with sales in excess of $100 million. In

this subsample, both the mean and median hurdle rates are even a bit higher, at 15% Just as interesting as the level of hurdle rates in 2012, and perhaps more relevant to the question at hand, is how little hurdle rates appear to have changed over time, even

long periods of time..”

Get it, pgly, or are you going to keep harassing me with your nonsense? How many times am I going to have to keep posting this quote every day until it finally sinks in?

John A Hofer? Oh yea just as BORING and unbelievably stupid as JohnH. I see you cannot even answer a very simple question.

“They may have done that at one point”

CFO’s today do not know how to do basic financial economics? Yea a survey of Mr. Hofer’s peer – morons.

For those who think that we can influence oil prices by “drill baby drill” please note the size of the cuts announced and those decided by Russia and Saudi Arabia last year. Not withstanding that the oil companies are refusing to drill the areas we already gave them – even the most vicious right wing approach to expanded drilling would produce mere drops relative to these cuts. The US is way too small to command the world oil prices by simply increasing its production of oil.

The Biden policies of combining increased US and Venezuela production with switch to alternative energy (in collaboration with EU) may have a chance of stabilizing prices at $60-80. Competence matters – thank you President Biden.

Big grain shipping companies have all announced they will cease or reduce shipments from Russia, apparently under pressure from Russia.

A couple of weeks ago, Ukraine, Turkey and Russia agreed to extend the Black Sea grain shipment deal, though there is disagreement on the duration of the extension. As a practical matter, it looks like 60 days.

Global stocks at the lowest level since 2012, output forecast up from last year.

Wheat futures are trading pretty steadily around $700, not much changed from before Russia’s re-invasion of Ukraine.

I guess Russia is trying to create panic around Wheat to make the prices go up – so they can lock in high prices on future deliveries. It doesn’t seem like the market is worried. It’s an obvious bluff since Russia desperately need the money. It is also possible that other producers have already increased the acres (and the markets know that). I think Biden really pushed for the US to increase production. Wheat is actually a market where US can push prices down (to the detriment of Russia). Russia may again overplay its hand and end up forced to sell really low on the spot market next fall.

What I found interesting was the day after I read about Cargill and Viterra exiting Russian grain trade (https://www.reuters.com/markets/deals/viterra-exits-russian-grain-trade-team-create-new-russian-exporter-2023-03-30/) – I read that Poland, Bulgaria are complaining about a grain glut: https://apnews.com/article/war-ukraine-grain-russia-poland-bulgaria-protest-906f712ccc01543a7a33d76c79882cc4 I guess Russia will now have to ship grain to China and India at a loss – like their oil.

“Poland’s agriculture minister promised financial support from the government and the European Union and easier rules for constructing grain storage as he met Wednesday with farmers angered by falling grain prices. Farmers in Poland blame the drop in prices on the market glut from the inflow of huge amounts of Ukrainian produce that was supposed to go to Africa and the Middle East. Bulgarian farmers also staged a border protest Wednesday over the issue. Poland and other countries in the region have offered to help transit Ukraine grain to third country markets after Russia blocked traditional routes when it invaded Ukraine 13 months ago. The European Union, which borders Ukraine, has waived customs duties and import quotas to facilitate the transport — also through Romania and Bulgaria — to markets that had counted on the deliveries. But farmers in transit countries say the promised out-channels are not working as planned. As a result, they argue, the grain stays, flooding their own markets and bringing prices down — to their great loss — while fertilizer and energy costs are sky-rocketing.”

Good news for Ukrainian farmers and I guess households in Eastern Europe are getting good deals but let’s hope more of this could be shipped to Africa.

I’m seeing commentary which casts the OPEC cut in highly political terms – Saudi Arabia sticking it to Biden. Or OPEC serving Russia’s needs, as demand from China and India is tapped out. But when I look at oil price charts, I see a simpler explanation:

https://fred.stlouisfed.org/graph/?g=128iT

Oil prices have been sliding. With global growth forecast to slow this year, there is a risk of further slide. This cut could simply be a precaution against further decline in oil prices.

From a monetary policy perspective, Greenspan’s rule-of-thumb seem relevant: Higher energy prices are inflationary when growth is above trend, contractionary when below trend. If OPEC aims to raise prices, that could actually lower revenues through a drop un demand. Simply preventing a further decline would make sense.

“ Exasperated at Biden, and flexing new market share muscle, OPEC announces surprise cuts of 1.66 million barrels per day.”

https://www.forbes.com/sites/christopherhelman/2023/04/03/opec-surprise-oil-cut-underscores-bidens-missed-opportunity-to-refill-strategic-reserves/?sh=54aa12016967

“Oil will rebound after recent banking turmoil as demand from top consumer China is set to soar, but worries around economic growth will keep both benchmarks hovering below $90 this year, a Reuters poll showed on Friday.”

https://www.reuters.com/business/energy/chinas-demand-comeback-help-oil-weather-banking-crisis-2023-03-31/

A showdown between the producer’s cartel and the consumers cartel capping prices. And we don’t even have to buy tickets from the Ticketmaster monopoly to watch!

Biden bashing followed by your incoherent babbling.

“A showdown between the producer’s cartel and the consumers cartel capping prices.”

Me thinks Jonny bot is nothing more than Chat GPT v 1.0.

Oil producers are fully aware of what will happen if price caps work against Russia–consumers will collude to put caps on other countries for whatever pretext. The Saudis are aware that if it can be done to Russia, it can be done to Saudi Arabia.

There’s only one problem–China doesn’t necessarily follow Biden’s “rules based order.” Oil producers now have options.

Ducky thinks that the Saudis are cooperating with China simply because they’re being commanded. Au contraire, mon cher Canard, Saudis are cooperating with China in part because China offers more opportunity and in part because they’re tired of Washington’s unreasonable demands. Heck, with China’s help, they were even able to reduce tensions with Iran, something anathema to Washington.

Yeah, I expected you to fall for the testosterone-soaked, tough-guy story.

David Ignatius, who is tight with US intelligence services: “ Saudi Arabia’s coldly pragmatic decision this past weekend to cut oil production and raise prices sent a simple message: The United States doesn’t call the shots in the Persian Gulf or the oil market anymore. For better or worse, the era of American hegemony in the Middle East is over.” https://www.washingtonpost.com/opinions/2023/04/04/saudi-arabia-opec-oil-production-cut/

But a high testosterone American chauvinist like Ducky can’t accept that American hegemony is over.

Agree. The OPEC cartel is doing what it is supposed to do. Trying to defend its prices at a level that it think it can. They have been known to not be that effective on that because their agreements usually are broken even before the ink is dry. We shall see what happens.

there’s an even simpler explanation: “global oil production exceeded demand by 620,000 barrels per day in February, despite OPEC production that was 927,000 barrels per day below their reduced quota”

it’s been that way, give or take a bit, every month for a year…rather than produce oil that no one wants, they’re just trying to rebalance supply & demand…

btw, the quote above is from my own synopsis of the OPEC March Oil Market Report, here: https://focusonfracking.blogspot.com/2023/03/oil-prices-at-15-month-low-after.html

scroll down til you hit the OPEC tables…

Two points here. WTI was down to pre-pandemic levels around $75 a barrel so it is not likely that this move with lead to Princeton Steven’s $180 a barrel.

Now if one was counting on Drill Baby Drill, CNBC had this dude saying forget about it:

https://www.msn.com/en-us/money/news/the-u-s-can-t-get-its-own-oil-producers-to-increase-production-in-any-material-way-economist-says/vi-AA19oBRf?ocid=msedgdhp&pc=U531&cvid=d633b049e82146be836f7336b8361be3&ei=11

I actually endured that 60 Minutes interview of Marjorie Taylore Greene last night but in case you spent your time more wisely, he is a recap:

https://www.msn.com/en-us/news/politics/marjorie-taylor-greene-gets-defensive-in-60-minutes-interview-people-never-focus-on-anything-good-about-me-video/ar-AA19ocFt?ocid=msedgdhp&pc=U531&cvid=36dba522b2484b6d96f079778f12a35d&ei=8

Yea – she is a really bad liar.

How many times have NRA apologists told us that teachers should carry guns?

https://www.msn.com/en-us/news/crime/several-staff-members-at-the-covenant-school-in-nashville-carried-guns-to-provide-security-according-to-a-police-call-report/ar-AA19o9Iu?ocid=msedgdhp&pc=U531&cvid=a9c914ff78484f1abb9bf4db48d23fc2&ei=16

A woman who was at the Nashville, Tennessee, school during the mass shooting on March 27 told police that a few staff members typically carry a gun on campus, according to a police call obtained by The Tennessean.

Well they were packing. But I guess letting the murderer have two military assault weapons overwhelmed a couple of teachers with pistols. I bet CoRev would have the 9 year olds carry guns to class.

The teachers have to first and foremost lock and barricade their classrooms to protect the children. They actually did that perfectly well in Nashville. The shooter didn’t make it into any classroom during that 14 min before police shot her. All the victims were people who were not in the class rooms and were locked out because of the lockdown.

Teachers having a gun will not make any difference in any likely scenario. Guns have to be locked down in a drawer (for obvious reasons). The first thing a teacher has to do if they get alarmed (even if they have a gun), is to lock and barricade the door to their classroom. After that is done the gun is useless (unless the intruder has superpowers to get through a barricaded door). Alternatively, if the intruder gets into the classroom before the door is locked, it is also too late to get the gun out of that locked drawer. The whole concept that we can protect kids by having teachers armed is a bunch of Rambo fantasy stupidities.

I am reminded of that Country singer who performed at the Las Vegas massacre site. He said that he had plenty of guns but never imagined there would be no way of using them to protect himself.

While oil prices have fallen to pre-pandemic levels, gasoline prices have not. Does anyone know how refinery margins compare now v. late 2019?

That is because diesel got the first push rebuilding supply, little surprise. With the late March draw down, that will likely go into gasoline. hurting RBOB futures as stockpiles build up.

All that babbling but not anything related to the question I asked. How stupid are you? Never mind as you are a total waste of time.

Whine whine. Total oil production isn’t running fast enough since covid too have lower prices. Got it yet. Its why these opec cuts are useless. You can’t cut what you aren’t producing. They have to pump enough at a minimum to keep their economies growing. Its why the announcement isn’t going to do a thing. The price is down to gas ratio because of Russia’s war and its dislocation of oil supplies. US exports to China have crashed and indeed its being stored more at home, boosting supplies. The same with the North Sea and Europe. But not enough to lower RBOB.

Off topic, presidential politics –

The secretive No Labels party is working to get candidates registered in some swing states. Looks like the aim is to strip away votes from the 2024 Democratic candidate:

https://nymag.com/intelligencer/2023/04/the-terrifying-threat-that-no-labels-will-re-elect-trump.html

There was talk of Trump running a third-party race back when DeSantis was doing better in the polls. Plenty of time for Trump to lose ground, in which case we might have a four-way race. What fun.

Come on Macro. Everybody smells a fraud. Take away votes from Democrats???? It will just add to them. Take away votes from Republicans. Yup.

Dude – we get you on competing with JohnH for Stupidest Troll Alive but dude – Jonny boy is kicking your butt. More trolling please.

You really are full of yourself, aren’t you, boy?

I have yet to see you offer evidence for a single claim you’ve made. Just “Bott knows stuff.” No reason to believe you do.

What’s the problem? Democrats could always stand more attractive candidates, offer a more people oriented vision, have a coherent economic agenda, go after banksters and oligopolies, invest in America rather the pointless and futile foreign misadventures…

Gaaack…Democrats can’t do that…the 1% and Corporate America wouldn’t approve!

What da matter Jonny boy – are you scared G. Bott is taking over for you in the race to be the dumbest troll alive?

Professor Chinn,

Still trying to make sure I am reading the proper data on CME Fed Tool website. I used the “probability” tab.

I see the following rates as of this morning April 3, 2023, that look similar to your data, but the data extend to the meeting date 9/24/2024.

05/03/2023***5.02

06/14/2023***4.88

07/26/2023***4.84

09/20/2023***4.73

11/01/2023***4.59

12/13/2023***4.41

01/31/2024***4.21

03/20/2024***4.00

05/01/2021***3.73

06/19/2024***3.62

07/31/2024***3.40

09/25/2024***2.95

Is the implication that market participants don’t think the FOMC will ignore this supply shock? Here’s hoping the market is wrong on this one.

It is not working. It won’t work. One, the Russians are flooding Chindia with Oil priced at 55$. This is where the disconnection is coming in. US exports have collapsed in turn and indeed, it boosting US’s stock nationally with defacto nationalization. Secondly, Europeans nationalized(essentially) and are pumping oil out of there North Sea reserves at a rate similar to the 1980’s/90’s. I would have gone with the alternative and pumped oil as fast as possible challenging Russia’s control over east Asia…………looking at you Saud’s. Not only are these cuts bogus and not real in any sense, their partners will ignore them and send oil out at their leisure………you know, to make money. Just like they did with the October “cuts”. Maybe the Saudi’s should stop pumping oil completely. Lay off everybody. Watch how that flies.

In the end, that modest price shot was a short squeeze, already falling back. By May, long in history’s view of failed “attempts”.

looks to me that opec+ is out to prevent oil price to hit $65 bc jim cramer needs to keep high % wrong.

usa net crude imports running lower y on y

usa net all petrol exports very up y on y

usa total petrol inv down, mostly lower safety level in strat petrol reserve

more Econ than politics on opec+

Yep. “Simplest explanation is best” says you’re right, but folks have to have a story.

@ Macroduck

America keeps getting “takin’ for a ride” as naive people often do. You know I love you brother. But I think we disagree on this one. We give Saudi leaders tons of “legitimacy” while they act like out of control madmen. And when we need them on inflation and the war on Ukraine, they take a lunch break. Will what they have in national savings and assets they couldn’t “come through” for us this one time ?!?!?!? “Economics not politics”?? REALLY?!?!?! You’re being sarcastic?? I hope.

BTW, I like the Japanese pianist you rcommended.

L. S. may be interested to know – Ryuichi Sakamoto has died. The solo albums are a wonder.

Higher Fed rates and higher oil prices both have the same general effect on the economy, it seems to me. They raise the cost of doing business and therefore have a chilling effect.

In fact, oil prices may be the better tool because they affect consumers more quickly than do Fed rates.

It has been a classic thing that I have seen (even myself in small markets) that the best way to fracture a cartel is to bring in outside supply. We have seen this in 1986. And (despite a HUGE amount of egg onhis face) Mr. “hundred dollars here to stay” “Peak Oil in America” oil “expert” (not really) James Hamilton, we saw it again in 2014! BOOM BABY! Oh…and the sainted Obama said we couldn’t drill our way to lower price, but we sure as hell did in 2014.

Now, can we do it forever? Maybe not? Or maybe one more time. But I sure as hell would like to take the gloves off and just see. Drill ANWR. Drill the VACAPES. Get rid of Jennie G. If it doesn’t work, so be it. But let us try. Get rid of the monkeywrench gang stopping permits and pipelines and etc.

Oh…and if we don’t, I hope the Republicans tattoo the gas prices on the Democrats (figuratively) in advertising. I know for a fact there are left wingers here who have commented that high gas prices are feature to move people to tree hugging. So, good. Enjoy the political results.

No, eco fascists will call Republicans fossil fuel globalists and anti-Americans. Green Nationalism means destruction of capitalism, think Solidus in metal gear solid. Your oil drilling won’t work. Tar oil has only so many benefits bud. Drill all you want, price is set by finance in many respects.

One of the better oil commenters (lot of experience with demand centers in Asia):

https://www.youtube.com/watch?v=Ht9P3omHtcQ

He sees demand growth as strong. Then on top of that, OPEC cuts driving price increases. Some interesting comments on disposal of Russian oil and high transport costs (rents if you are a shipper).

I don’t really buy any TV chit chat about predicting the price of oil. We can see from fixed price future options that uncertainty is strong. The EIA’s STEO funnel chart (which is not their opinion, is just the Bayesian odds) shows prices between $30 and $165 (90% CI). This is very normal, actually.

https://www.eia.gov/outlooks/steo/images/Fig1.png

Also, despite it being popular to predict higher oil prices (happens every time we have a run up, the momentum fallacy comes out of the cracks), the mean expectation is actually reversion to lower prices. [Moderately lower, of course. Because there is time/storage arbitrage, it is hard for the mean future expectation to be too drastically different.]

https://www.cmegroup.com/markets/energy/crude-oil/light-sweet-crude.quotes.html