We’ll see if it’s the cruelest month. For now, monthly GDP continues to grow in February, albeit slowly (0.2% m/m) while January growth was revised up.

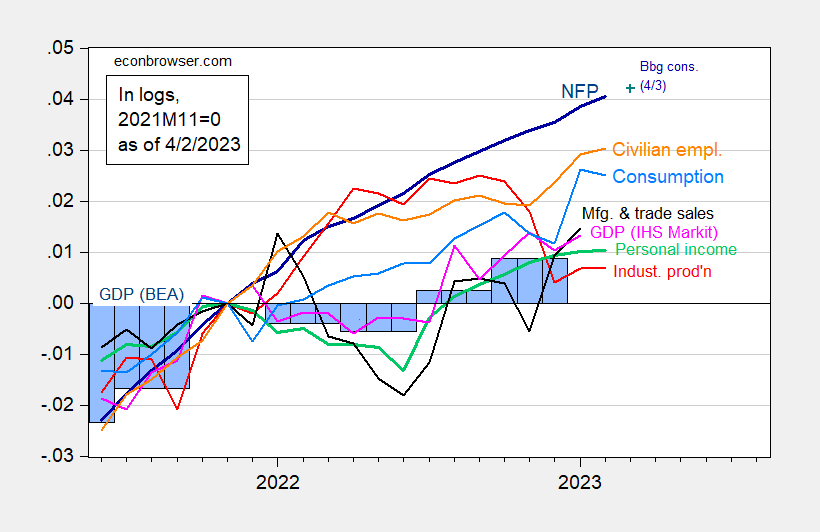

Figure 1: Nonfarm payroll employment, NFP (dark blue), Bloomberg consensus of 4/3 (blue +), civilian employment (orange), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), consumption in Ch.2012$ (light blue), and monthly GDP in Ch.2012$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Q3 Source: BLS, Federal Reserve, BEA 2022Q4 3rd release via FRED, S&P Global/IHS Markit (nee Macroeconomic Advisers) (4/3/2023 release), and author’s calculations.

The current estimate is due mostly to inventory accumulation; final sales were flat. S&P Market Intelligence notes that combined with their tracking forecast of quarterly GDP, implied monthly GDP in March is 0.2% m/m decline.

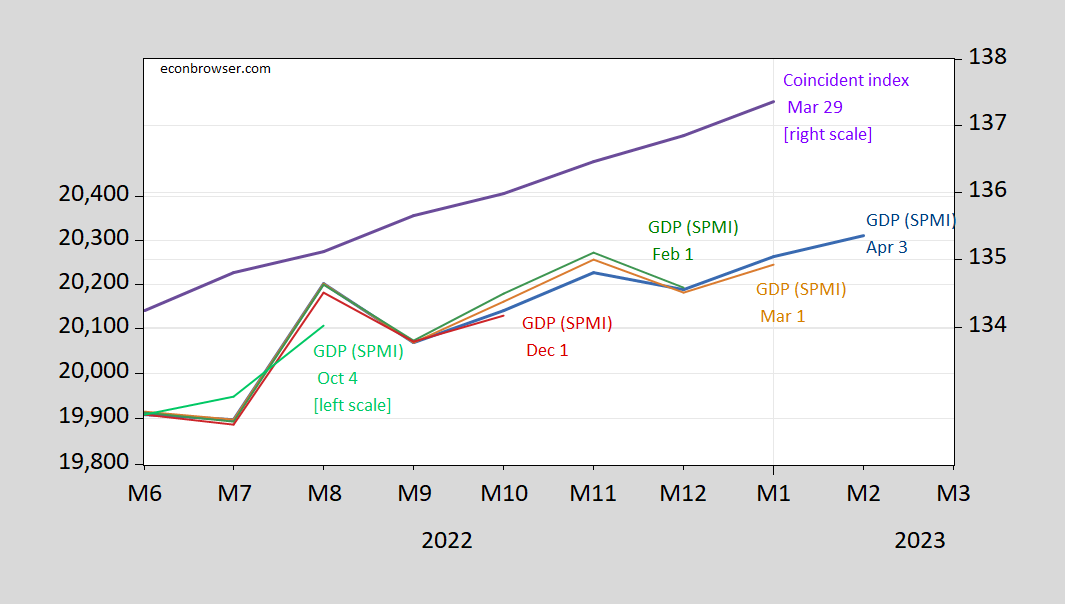

Monthly GDP will be revised next month, so one might wonder how much weight to put on this series. Figure 2 shows the evolution of monthly GDP over different vintages.

Figure 2: Monthly GDP of April 3 release (blue), of March 1 release (tan), of February 1 (green), of December 1 (red), of October 4 (light green), in billions Ch.2012$ SAAR (left log scale), and coincident index (blue, right log scale). Source: S&P Market Intelligence (various issues), and Philadelphia Fed.

This suggests to me no recession through February. No guarantees going forward.

Some 15 years ago Ben Bernanke and other economists were wondering why investment demand was not stronger. It seems Nobel Prize winning economist John A. Hofer know. Yes little Jonny boy reads one odd paper that surveyed CFOs and it appears complete incompetents have managed to have this position at major corporations.

After all 60 years of work on how to estimate the cost of capital are being ignored by CFOs according to Mr. Hofer (assuming this is Jonny boy’s real name). No – these stupid CFOs have a hurdle rate = 15% even when the properly calculated cost of capital is 10% or less.

Now if this is correct, shareholders should be suing upper management because their company’s are being run by people dumber than even Mr. John A. Hofer.

It’s not just one odd paper: “Over the past three decades, the U.S. economy seems to have become less responsive to monetary policy. Slow recoveries followed recessions in 1990-91, 2001, and 2007-09, a contrast to the much more rapid recoveries that followed pre-1990 recessions. These slow recoveries occurred despite sizeable monetary accommodation from the Federal Reserve, primarily through reductions in short-term interest rates. This article investigates shifts in the economy’s interest sensitivity by examining how total employment responds to changes in monetary policy. The Federal Open Market Committee (FOMC) has emphasized the important link between monetary policy and employment. For example, in September 2012, the FOMC announced its intention to provide additional monetary policy accommodation on an open-ended basis that would continue as long as “the outlook for the labor market does not improve substantially.” While this implies a direct transmission channel between monetary policy and employment, the empirical analysis in this article suggests aggregate employment has become less responsive to monetary policy in recent decades…

While the interest rate channel is easy to describe, its recent effectiveness is hard to confirm. Monetary policy accommodation following the three most recent recessions did not produce the robust economic recoveries of the 1970s and 1980s. Furthermore, when the

FOMC tightened monetary policy in 2004, the interest rate transmission channel appeared broken. In a speech in February 2005, the

Federal Reserve’s then-Chairman Alan Greenspan called the decline in long-term interest rates in the face of steady increases in the federal

funds rate a “conundrum.”

Evidence suggests the interest sensitivity of the U.S. economy has declined over the past 50 years.”

https://www.kansascityfed.org/documents/604/2015-Has%20the%20U.S.%20Economy%20Become%20Less%20Interest%20Rate%20Sensitive%3F.pdf

Of course, these studies are anathema to economists who pander to Wall Street interests…without the narrative of helping workers by lowering interest rates, they no longer have a rationale for a policy that boosts the value of their patrons’ portfolios.

Little Jonny boy has trouble reading economics so let us have him focus on three simple words:

‘declining interest sensitivity’

Declining does not mean zero, which is the stupid claim you keep making. Throughout this paper, the authors note their empirical work suggests that investment is less interest sensitive but never do they claim there is zero effect.

Nice try Jonny but could you do everyone a favor? Learn to read at the 1st grade level before tackling economics.

“FOMC tightened monetary policy in 2004, the interest rate transmission channel appeared broken. In a speech in February 2005, the Federal Reserve’s then-Chairman Alan Greenspan called the decline in long-term interest rates in the face of steady increases in the federal funds rate a “conundrum.”

Poor little Jonny does not get what Greenspan meant by a conundrum even if this paper clearly noted what was going on. The FED back then was raising short-term interest rates on the concern that the increase in government spending from the Iraq War might overstimulate the economy. But anyone who knows anything (which excludes of course Jonny boy) knows long-term interest rates did not rise.

So investment demand did not fall because interest rate did not fall. And little Jonny boy thinks this shows investment demand does not respond to interest rates. Yea – Jonny boy is THAT STUPID.

I’m reading the references in this paper and the authors note research on this issue that dates back for over 30 years. Wait – Jonny boy finds one paper? Jonny boy keeps telling us economists do not investigate this issue very much.

I guess Jonny boy does not realize that this issue has been a hot topic ever since Hicks interpreted Keynes General Theory was back in 1937.

Jonny come lately wants us to present little Jonny boy is the expert on this issue because he just read ONE paper = a paper he clearly does not understand.

Obviously pgl wants to cherry pick the papers so that he can peddle the guise that lowering interest rates will help workers via more capital investment, when in fact what happens is that lower rates actually goose stock market prices…and maybe down the road help employment some…like what happened in the 2010s.

When mainstream economists claim they care about wages and workers, who they prefer to ignore, it’s time to look for a pig behind the lipstick.

Cherry pick? Everything this paper noted confirmed that investment responds to interest rates. Jonny boy – you love to write stupid stuff like this which is cool as we all know you are one dumb liar. Keep it up clown as I am having fun.

As promised: “If the connection between prevailing interest rates and the hurdle rates firms use to determine investment choices is critical to interpreting our results, then it would be instructive to examine the available survey evidence on hurdle rates and how they have changed over time. Over the past 30 years, a handful of surveys focusing on firms’ capital budgeting practices have included questions asking respondents for their current investment hurdle rates—the expected rates of return they require for dedicating capital to new projects. On a couple of occasions, the Duke CFO Business Outlook Survey has itself included a question asking for firms’ hurdle rates, one instance being the survey in the second quarter of 2012, just prior to the survey studied in this paper.

Using all 328 completed responses from that survey, we find that the average respondent reported a hurdle rate of 14.1%, while the median value was 13.4%. On the face of it, this seems quite high relative to the average BBB-rated corporate bond yield at that time, which was close to 4%. To compare Global Business Outlook survey results with previous survey studies, we calculate and plot the results for the subsample of 150 respondents that are nonfinancial corporations with sales in excess of $100 million. In this subsample, both the mean and median hurdle rates are even a bit higher, at 15%.

https://www.federalreserve.gov/pubs/feds/2014/201402/201402pap.pdf

Of course pgl has produced no evidence supporting his contention that corporations making capital investment decisions do not use a stable, predetermined hurdle rate, which makes their decisions fairly insensitive to interest rates. In fact, they have deliberately separated the investment decision from the financing decision.

All pgl can do is throw out ad hominem attacks and whine that corporations do not use hurdle rates the way that he thinks is they should…the view from in his ivory tower or from his sinecure promoting low interest rates to boost stock prices.

You have produced no such evidence either. Now maybe you have evidence that some CFOs are almost as stupid as you are. Keep reminding us of this as maybe there is still one person on the planet who has yet to figure out that you are the dumbest troll ever.

Gotta love this one! Per pgl Corporate Financial Officers are all stupid.

Actually they have very good reasons for establishing and maintaining a stable hurdle rate and not changing it every time interest rates change. But pgl, who could barely understand the concept of a stable hurdle rate, definitely wouldn’t understand why they use it.

The real question is, why doesn’t pgl just stop embarrassing himself?

Anyone who does not know basic finance is stupid. And who said CFOs do not estimate the cost of capital for their own firm. YOU DID. Damn – I should go talk to that dead tree outside as that would be more productive than dealing with your stupidity.

I like when you throw in literary references Menzie. BTW, many of which in my limited education (my fault, not others) you had introduced me to. Thank you for that.

https://www.hplovecraft.com/writings/texts/poetry/p228.aspx

Today is supposed to be “high fire danger” in my state/region. We had some about 3 days ago near to the house. Don’t worry, I’ll be sober then and I can do the man’s job when necessary, But I’d appreciate anyone reading this to say a prayer for my home and others in my city. THANKS!!!!

There’s a non-trivial possibility that the NBER will ultimately date a cycle peak to January, despite nonfarm payrolls continuing to increase. That’s what happened with the 1970, 1974, and 1980 recessions. Obviously, it depends on what the other indicators have done since then, and revisions to all of them.

But here’s the situation: Industrial production is down more than 1% since October. Personal income less government transfers growth has slowed down consistently since then, and was up only 0.03% in February, which rounds to unchanged. Only real manufacturing sales increased through its last update for January. The real retail sales component of real manufacturing and trade sales declined .8% in February.

Further, as of their last report the YoY trends in the above three coincident indicators are also consistent with an imminent or already ongoing recession. Industrial production has increased +0.32% YoY, real manufacturing and trade sales +1.0%, and real personal income less government transfers +1.55%. Over the past 60 years, when *all three* together have been at those current values or worse, it has always been after a recession had already started, or in three cases within 2-6 months of the start of the next recession (November 1979, January 1990, and December 2019).

There is also a 75 year history that, with the exceptions of 1951 and 1967, whenever the 3 month average of real retail sales have turned negative YoY – as they did in Q4, where they were down -0.4% YoY – a recession has followed shortly or already begun.

Turning to GDP and GDI, in the 12 recessions since the end of 1945, in the last full quarter before the recession began, real GDP averaged +1.7%, and the median was 2.3%, with a low of -2.9% and a high of +9.3%. Q4’s revised real GDP is certainly in this ballpark. Even in the first quarter of the 12 recessions themselves since 1945, real GDP was more often than not still positive in real terms, with an average of +0.4% and a median of +0.5% (and a low of -4.6% and high of +4.9%).

When we take out inventories, and focus on real final sales and real final sales to domestic purchasers, which were +0.3% and less than +0.1% in Q4, respectively, in the past 60 years when both of those quarterly increases or worse occurred together, with the exceptions of 1979 and 1987, a recession was 2 quarters or less away.

Also, real GDI was -1.1% in Q4, again typically in the past a number that either occurred during a recession, or within two quarters of its start, (with the exceptions of 1993, 2012, and 2016).

The bottom line is that, when we look at the 5 series highlighted by the NBER and several components or close correlates of those series, together as of their last reports they are in a configuration that in the past has either been during a recession or in close proximity thereto. Just a nowcast, not a forecast, but again, it’s non-trivially possible that a recession has already begun and we just don’t know it yet because of reporting delays, noise, and revisions.

Industrial production isn’t down. It is at a new high.

Gregory Bott: So you’re saying the Fed’s index is completely wrong?

https://fred.stlouisfed.org/series/INDPRO/

Industrial Production: Total Index

Dude – learn to check the facts before your next stupid lie.

Stormy Daniels gets medieval on Marjorie Taylor Greene:

https://www.msn.com/en-us/news/politics/scotus-justices-thought-trump-was-setting-them-up-at-white-house-ceremony-report/ar-AA19pWwK?ocid=msedgdhp&pc=U531&cvid=c45778b23c854794908f752beb8c5cc3&ei=12

Speculating on whether Trump and Greene end up having an affair – ewww!

Penn’s Jeremy Siegel says the recent rise in oil prices will not lead to more inflation as natural gas prices are dropping:

https://fred.stlouisfed.org/series/mhhngsp

Henry Hub Natural Gas Spot Price

Oil prices up and natural gas prices. Who knew there as a series that calculated the oil price to gas price ratio but yea it is really low:

https://www.msn.com/en-us/money/markets/u-s-natural-gas-slides-again-oil-to-gas-price-ratio-highest-in-nearly-11-years/ar-AA19qURy?ocid=msedgdhp&pc=U531&cvid=ec8079a58597413b94cd800035ad9d5a&ei=17

Alvin Bragg has been a good DA for Manhattan but lying MAGA hatters would to tell you otherwise:

https://www.msn.com/en-us/news/crime/fact-focus-manhattan-da-s-record-distorted-amid-trump-case/ar-AA19qZtz?bncnt=BroadcastNews_TopStories&ocid=UCPNC2&FORM=BNC001&pc=U531&cvid=ab44450f1b254234b10406b7d5404bed&ei=22

Oh gee – is Trump getting indicted today? It turns out Trump attacked Bragg’s wife but then again she is black so are you surprised?

New Deal, government inflation numbers are not trustworthy. They can overestimate them and badly at times. The early-mid 90’s income slump simply should have meant a persistent recession, but it didn’t happen. NBER does not care much about supposed “real income”. Why??? Because its untrustworthy. Its why they use nominal income period. I fwiw, reject 2020-22 inflation figures fwiw. IMO, they are too high. I think real inflation in 2020 was negative and only around 2-3% in 2021. 5-6% in 2022. You can see how that adds up. Errors compound errors. 91-96 says high. The same problem, yet the economy grew and employment recovered if too slowly for some.

Gregory Bott: Actually, if you look at the NBER BCDCs documentation, they use *real* income ex. current transfer receipts.