I was asked about my guess for the recession’s start. I said consensus was for 2nd or 3rd quarter this year, about 6 months from now. Then I wondered a bit. According to Miller (2019) (discussion here), the highest AUROC at 6 month horizon is the 5 year-Fed Funds rate spread. What does this spread indicate?

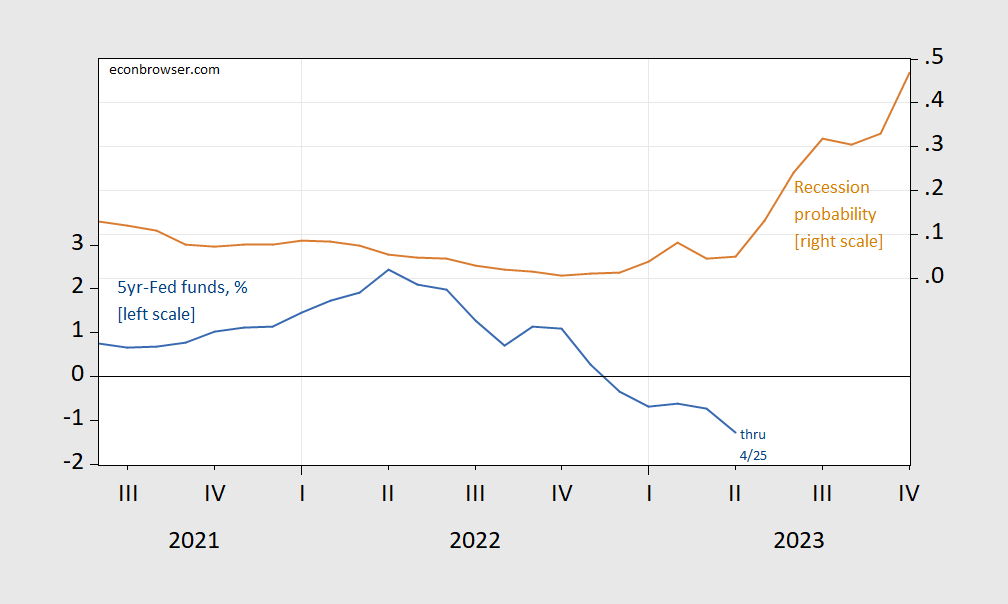

Figure 1: Five year Treasury-Fed funds spread, % (blue, left scale), and estimated probability of recession 6 months ahead (tan, right scale). Source: Federal Reserve via FRED, and author’s calculations.

So, for October 2023, the probability is about 60% using a probit model (pseudo-R2 = 0.16).

What about in the next few months, including Q1 and Q2? The Q1 advance will be out tomorrow; GDPNow for Q1 as of today is 1.1% q/q SAAR. S&P Global Market Insights (nee Macroeconomic Advisers) tracking as of today is at 1% and 0% for Q1 and Q2 respectively. Of course, as has been thoroughly discussed, NBER does not make a determination regarding business cycle dates on the basis of GDP alone (CEA (2022); Frankel (2022); discussion of CBO (2022); post).

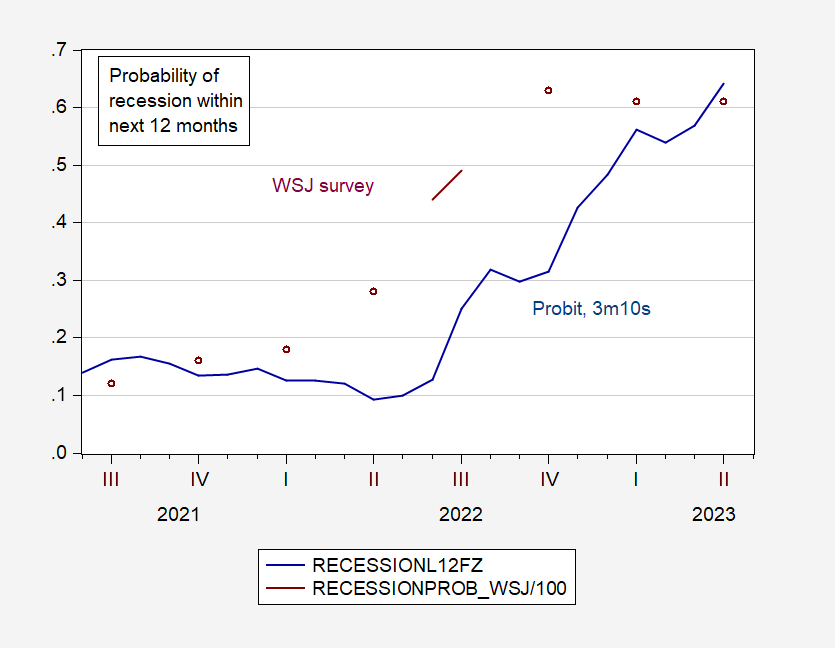

The recent (April) WSJ survey places the probability of a recession within the next 12 months at 61%, not far from what a plain vanilla probit on 3m10s term spread implies.

Figure 2: Estimated probability of recession within 12 months ahead based on 10yr-3mo spread (blue), and median from WSJ surveys. Source: WSJ surveys, author’s calculations.

Of course, the subjective probability from the WSJ survey has been at that level since October of 2022. So, perhaps Q4 is not a bad guess.

But you need to ask, why would a recession occur? Going by these spreads when the FOMC artificially raised rates beyond market desires leads to false positives like 1951, 1966. Even 1995 to a lesser extent.

Where is the over consumption via debt expansion???? Where is the over investment???? I see still a whole lot of catchup from the Covid mess. Which is what your missing.

Karen James/GREGORY BOTT: Please post under a single name/pseudonym.

I had suspected as much. Same style of writing. Same style of thought. Same style of error.

Mary Rosh has a twin sister.

so zanfino/econned has some competition for classless acts.

Give me a break. Same writing style??? It looks a lot like your bud. Your alter ego.

@ GregoryBott/ Karen James

You’re just not very intelligent are you?? The comments YOU made I would nearly bet my left arm came from the same IP address. The game is up dum-dum. You’re insulting your own writing. Wow, that’s a new one for the blog annals, even for Menzie I think.

You know most 9 year olds could explain IP addresses to you, yes?? You know that, right?? Go talk to a 4th grader about IP addresses. It’ll make your whole fraud game go much better.

so you were intentionally trying to comment as two separate individuals on the site? apparently this was no accident.

And to think I was extending more courtesy to this “Karen James” person as I thought they were one of the few female commenters here (I doubt one of the few regular readers). I suddenly feel extremely nauseated. Remember kids, no good deed goes unpunished.

Hi Menzie- because manufacturing is an important component of jobs in Wisconsin – I was wondering about the impact of Biden-Harris “Made in America” plan. https://www.whitehouse.gov/briefing-room/statements-releases/2022/03/04/fact-sheet-biden-harris-administration-delivers-on-made-in-america-commitments/ Looking at the FRED manufacturing jobs chart – it looks like Dems have added back all the manufacturing jobs lost by Trump admin and continue to add more. Also as compared to the GOP’s subsidizes for cronies/boondoggles – i.e. Foxconn here in WI; Carrier jobs in Indiana (anyone remember that Trump/Pence boondoggle) – the Dems are adding real middle class jobs.

Also – I am hopeful the WIGOP do-nothings will let Gov Evers actually spend the federal surplus in our state budget on roads. public transportation, and rural broadband as intended rather than giving more tax cuts for rich people. Unfortunately, the powerful Joint Finance Comm which makes all budget decisions is controlled 12 GOP to 4 Dem thanks to gerrymandering. https://www.whitehouse.gov/wp-content/uploads/2021/08/WISCONSIN_Infrastructure-Investment-and-Jobs-Act-State-Fact-Sheet.pdf

I am writing this before the Q2 GDP report is posted. I’ll wait for tomorrow’s real income, spending, and business sales reports to come out before saying more.

But for completeness’s sake, the Business Dynamics Statistics for Q3 2022 were posted earlier this week by the Census Bureau. This is not a survey, but a census of about 70% of all businesses in the QCEW, and unlike that metric, is seasonally adjusted. Here’s the lead paragraph:

“From June 2022 to September 2022, gross job gains from opening and expanding private-sector establishments were 8.8 million, an increase of 561,000 jobs from the previous quarter, the U.S. Bureau of Labor Statistics reported today. Over this period, gross job losses from closing and contracting private-sector establishments were 7.5 million, a decrease of 1.0 million jobs from the previous quarter. The difference between the number of gross job gains and the number of gross job losses yielded a net employment gain of 1.3 million jobs in the private sector during the third quarter of 2022.”

This tracks closely with nonfarm payrolls during Q3 of last year. But just as interesting, unlike the QCEW, there was no major revision to Q2. The BDS still shows that, on a seasonally adjusted basis, 287,000 jobs were lost in Q2 of last year.

I’m have been hoping we could avoid a recession, which is why I had hoped the FED would back off its high interest rate policies. Of course we know JohnH thinks anyone who would hope the FED would not put us in a recession must be in bed with Jamie Dimon. Yea Jonny has long advocated recessions as if they were good for workers. Go figure.

Of course Princeton Steve has been telling us for over a year that we have been in a recession for quite a while. I guess the people that publish BEA and BLS data have been lying to us – per little Stevie.

Useful. Tricky for the Biden administration heading into an election year.

Steven Kopits: Good you think interesting. You should also be interested in recession probability ascribed to 2022H1. Comments?

So it is all about politics with you after all. Come on Stevie – you miss being on Fox and Friends.

I found some educational material, related to illegal immigrants, that could be educational for our man who only likes to reside in blue states,

https://ondemand.npr.org/anon.npr-mp3/npr/wesun/2023/04/20230430_wesun_former_teen_farmworker.mp3?d=311&size=4983372&e=1172957412&t=progseg&seg=10&sc=siteplayer&aw_0_1st.playerid=siteplayer

Of course we already know Kopits is a proponent of mass scale illegal immigrants in America because he’s strongly against punishment of those who employ illegals.

I’d suggest considering what the word “probability” means. What is actually shown in the charts is the statistical occurrence of past events. It might imply probability – if all conditions are equal to what they were at the time of those events thereby allowing some causative process to occur.

At any rate, my guess is : no recession.

I have some reading here to catch up on but will definitely pay attention to the 5yr-FF spread going forward.

Opened up the WSJ this morning. The headline announced: “U.S. Economic Growth Slows to 1.1% Annual Rate’ but the accompanying chart shows Real GDP, quarterly change with the 1.1% for Q1 2023. I checked with the BEA and indeed the advanced annual real GDP growth rate is 1.1%.

The WSJ survey of economist point forecasts going forward are:

Q2 2023 — +0.15%

Q3 2023 — -0.32% (negative)

Q4 2023 — +0.12%

I am confused. Did the WSJ add monthly forecasts to annual measured read GDP growth in the chart?

Erik Poole: WSJ reports survey mean forecast for q/q at annual rates, as well as for q4/q4 growth rate.

1.1%. 3.4% ex-inventories.

I am not convinced in much “spill over”. Most of that was crypto and the banks involved are pretty small. Their depositer base was inflated and simply came down to meet the small nature of the bank.

Thanks Menzie. I downloaded the WSJ survey spreadsheet and see that those are indeed annualized quarterly growth rates.

Must be my priors. I expect a short, shallow recession but not the non-recessionary slow down that the average and median values seem to suggest.

The WSJ survey central measures suggest that the prices of commodities thought to be a longer-term structural supply deficit will remain relatively high: oil and copper.

I find it interesting that the absolute value of the median forecasts are always higher than the average forecasts.

Menzie Chinn,

Maybe I’m illiterate but what is your best guess? You tell us…

1) the consensus is 2nd or 3rd quarter this year, about 6 months from now

2) the probability based on other’s research suggests October 2023

3) WSJ survey places the probability of a recession within the next 12 months at 61%

4) a probit model of 10yr-3mo spread at ~64%

5) perhaps Q4 is not a bad guess

Your best guess seems no more than a vague commentary of other’s projections.

Econned: At long last, a substantive comment! Well, the 6 mos ahead probit model, and the w/in 1 yr ahead model I selected and estimated (not at random), so combining with nowcasts hardly seems just using my others commentary.

Hence, I have to conclude that you are not illiterate (not that I called you that), but reading comprehension-challenged.

Menzie Chinn,

Perhaps it’s you who is reading comprehension-challenged of your own writing. Perhaps you’re a poor writer. Perhaps you’re simply hedging to minimize further hematomas of the ego. Perhaps you could’ve actually provide your guess instead of writing so poorly and concluding “perhaps Q4 is not a bad guess.” Perhaps?

@ Econned

I’ll tell you one thing I’ve learned as I start to get up in years here, and certainly in my time overseas as what I demurely refer to as a “pretend teacher”. Respect is a two way street. You could learn boatloads from that Econned. You can’t do “drive-by attacks” on a blog, insult 2-3 other commenters, insult the blog host, then disappear when they answer your cheap-shots. When you do that it becomes blatantly obvious to everyone you’re just here to push people’s buttons and play with the bull horns. Guess what happens when you play with the bull horns??

It’s been my experience Menzie shows a lot of restraint and tolerance, on a blog he uses to educate people not paying a dime of tuition (other than internet provider fees) and taking his own time (pretty valuable for a upper tier D-1 school professor teaching a complex topic, and more than one category of sub-genre economics). Frankly I think anyone who attacks Menzie really has never had a job where personal time came at a premium.

Econned simply continues to display his professional jealousy of prof. chinn. The fool wants the ability to denigrate others, but then cries foul if somebody is harsh towards him. Similar to how ltr feels she has the right to post any propaganda on this site, but others are mean and racist if they push back in the garbage presented.

Does Monetary Policy Matter? The Narrative Approach after 35 Years

Christina D. Romer and David H. Romer

NBER Working Paper No. 31170

April 2023

The narrative approach to macroeconomic identification uses qualitative sources, such as newspapers or government records, to provide information that can help establish causal relationships. This paper discusses the requirements for rigorous narrative analysis using fresh research on the impact of monetary policy as the focal application. We read the historical minutes and transcripts of Federal Reserve policymaking meetings to identify significant contractionary and

expansionary changes in monetary policy not taken in response to current or prospective developments in real activity for the period 1946 to 2016. We find that such monetary shocks have large and significant effects on unemployment, output, and inflation in the expected directions. Analysis of available policy records suggests that a contractionary monetary shock likely occurred in 2022. Based on the empirical estimates of the effect of previous shocks, one would expect substantial negative impacts on real GDP and inflation in 2023 and 2024.

https://www.nber.org/system/files/working_papers/w31170/w31170.pdf

Interesting research but I bet JohnH refuses to read it as Jonny boy has already declared that the recent tight monetary policy is good for everyone as monetary restraint cannot cause a recession. The Romers suggest otherwise but hey what do they know?

No, pgl, tight monetary policy is bad for some folks…like the Wall Street investors that you seem to care most about, under the guise of helping workers.

Tight monetary policy is also supposed to be good for hundreds of millions of Americans who care about maintaining their purchasing power and trying save for their first house, their kids college education, or for their retirement.

So please explain to me why we should make savers’ real yield on their savings even more negative.

More evidence that inflation is low:

https://www.bea.gov/news/2023/personal-income-and-outlays-march-2023

‘The PCE price index increased 0.1 percent.’

Of course our resident Know It All (JohnH) insists expected inflation must be at least 6%!

First Republic Bank situation looking pretty dire. Didn’t we have a semi-regular commenter here who made an investment in that?? Hope he ditched it in time. It’s a slaughter and looks like FDIC will be taking over soon.

Did anyone see Rob Reiner on Ari Melber’s show Friday?? Funniest TV segment I have seen in awhile. Go watch it on YT, you won’t regret it. Reiner’s spot on facial impression of Tucker Carlson is worth it alone, and then the ethnic joke about him playing DiCaprio’s Dad is a laugh riot. This guy needs to get back to writing comedy films.

Reiner had a decent version of the Tucker stare. I should make a Tik Tok of me doing the Tucker stare. Trust me on this one – it would crack you up. Plus I do a pretty good version of Tucker’s faux look of amazement.

Thanks for having us watch the interview as it was a delight.