In 2019, Fed economist David Miller undertook a comprehensive assessment of term spread predictive power for recessions (There is No Single Best Predictor of Recessions). For the 1984-2018 period, he found the following:

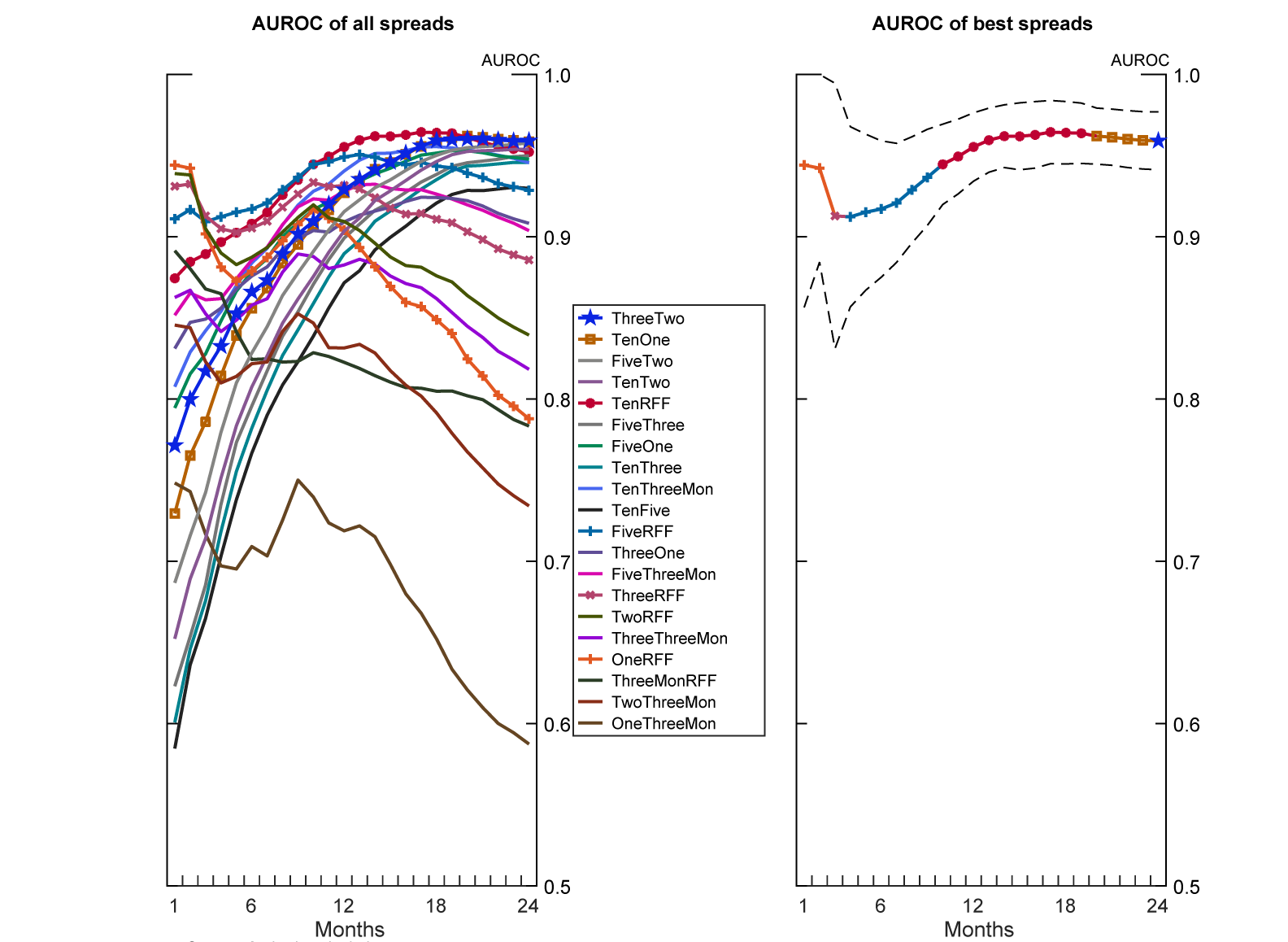

Figure 2: AUROC Sample 1984 – 2018 from Miller (2019).

For a discussion of AUROC (Area Under Receiver Operating Characteristics curve), see this post by Jim H.

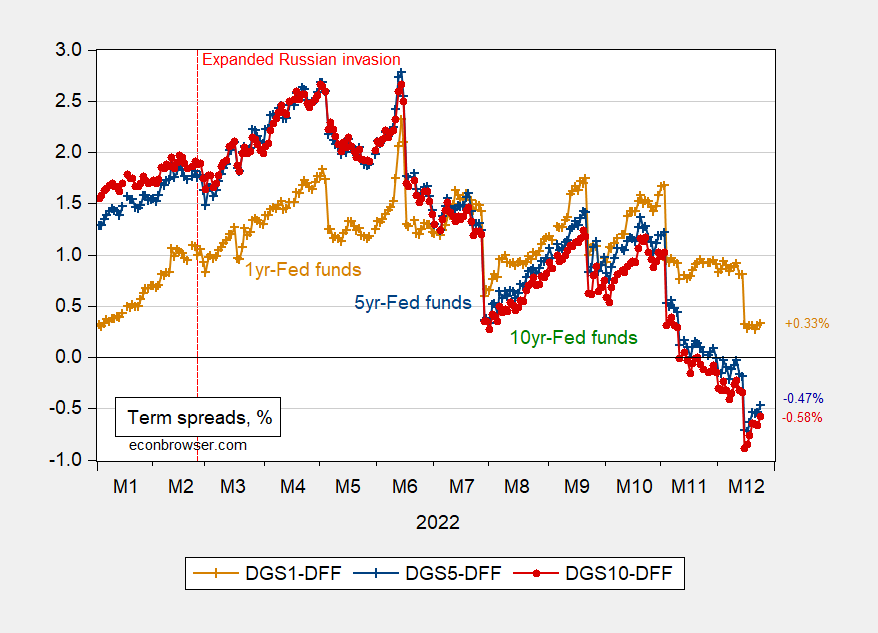

What do these spreads look like as of Friday (color coordinated to match the graph above?):

Figure 1: 1yr-Fed funds spread (chartreuse), 5yr-Fed funds (red), 10yr-Fed funds (bold teal), 10yr-1yr (sky blue), and 3yr-2yr (purple), all in %. Red dashed line at expanded Russian invasion of Ukraine. Source: Treasury via FRED, and author’s calculations.

The 1yr-Fed funds spread (1-2 month horizon) has not gone negative, although the 5yr-Fed funds spread (4-9 months) has since the last post on this subject a month ago. The 10yr-Fed funds spread (10-19 months) did end negative on November 10th, which would suggest that somewhere between September 2023 and August 2024 a recession would occur. The 10yr-1yr has also registered negative on July 12th, so between 20 and 23 months ahead (February to May 2024).

Note that these are maximum AUROCs for simple term spread models. They do not incorporate foreign term spreads (as suggested by Ahmed and Chinn, 2022), nor a factor based on disaggregated sectoral dividend yield ratios (as suggested by Chatelais, Stalla-Bourdillon, and Chinn, 2022).

Barr was a terrible Attorney General but that is why Trump hired him. Now Barr at the very end finally decided to do his job and for that Team Trump wanted to fire him:

https://www.msn.com/en-us/news/politics/trump-officials-wanted-to-release-statement-saying-bill-barr-should-be-fired-if-he-kept-refuting-voter-fraud-report/ar-AA15Ghpl

transcripts released by the House January 6 Select Committee show that the outgoing Trump administration considered releasing a statement attacking Attorney General William Barr for his ongoing refusal to endorse election fraud conspiracy theories — and threaten his termination if he didn’t fall in line. The statement didn’t explicitly mention Barr by name — but would have been timed specifically to make clear to whom it was referring.

Of course none if this should surprise anyone as Trump was nothing more than a mob boss.

https://twitter.com/RonFilipkowski/status/1606015566770077696

Is Lauren Boebert afraid that her 4 sons are gay or what? Voting for the Omnibus bill “sexualizes our children”. How much pot is she smoking?

Fascinating stuff. I think the caption under Figure 1 is not quite right? I only see three series plotted.

Doug: Yes, you are right! Leftover from another caption. Now fixed. Thanks!

Why did Putin help Trump in 2016?

The Mariupol Plan: Six Years Later

https://davidwarsh.substack.com/p/the-mariupol-plan-six-years-later

In the summer of 2016, somebody, perhaps Vladimir Putin himself, sketched a peace plan for Ukraine. The provenance of the proposal remains deliberately vague. Had the suggestion been accepted, it would have avoided Russia’s war on its neighbor five years later. The so-called “Mariupol plan,” named for eastern Ukraine’s largest industrial city, would have split off four prosperous Donbass counties to form an autonomous republic, to be led by Viktor Yanukovych, the deposed president of Ukraine who had fled Kyiv for Russia two years before. In effect: East and West Ukraine

The trouble is, the proposal was conveyed, via intermediaries, amid elaborate secrecy, to just one man, US presidential candidate Donald Trump. Rival candidate Hillary Rodham certainly would reject the plan were she to be elected. So the loosely-worded proffer was said to be enhanced by a sweetener: Russia would take a hand in the American election, denigrating Clinton through a massive hacking campaign.

Putin owned the White House for 4 years. And had his puppet managed to secure a 2nd term – Putin would own Ukraine.

Apple Japan’s operations have been hit with a massive consumption tax hit because of certain creative way of evading this tax:

https://asia.nikkei.com/Business/Retail/Apple-Japan-hit-with-98m-in-back-taxes-for-missing-duty-free-abuses

Apple Japan is being charged 13 billion yen ($98 million) in additional taxes by Tokyo authorities, apparently for bulk sales of iPhones and other devices to foreign tourists that were incorrectly exempted from the consumption tax, Nikkei learned on Monday. Bulk purchases of iPhones by foreign shoppers were discovered at some Apple stores, a source said. At least one transaction involved an individual buying hundreds of handsets at once, suggesting that the store missed taxing a possible reseller.

Japan’s tax-free shopping allows visitors staying for less than six months to buy items such as souvenirs or everyday goods without paying the 10% consumption tax, but this exemption does not apply to purchases for resale purposes. Apple Japan is believed to have filed an amended tax return. The company also voluntarily stopped offering tax-free shopping in June. “We do not offer tax-free shopping at our stores,” the company told Nikkei. “We apologize for the inconvenience.” Apple’s sales in Japan totaled $26 billion in fiscal 2022, according to the company’s latest annual report. The unusually large back tax charge underscores a glaring loophole in Japan’s unique tax-free shopping rules.

If there is a recession, it won’t be a deep one. It will probably have domestic political consequences, depending on where it hits and how hard it hits there, but overall, I don’t expect much of a downturn. There is too much hiring still going on and there are still too many open positions with not enough people to fill them. Inflation is abating a bit. Ironically, the Russian invasion of Ukraine will create a big stimulus when the cash for the latest defense bill starts trickling through the system. It is another Putin misstep, since it boosts the party that doesn’t have prominent pro-Russian members.

The inverted curves are a concern, as is the discussion of recession in the press. If my usual rule of thumb is correct, we are already in as much of a recession as we are going to have because there is so much denial that we are in a recession. What with flat growth, maybe somebody will say we are in one, and that will mean it’s over. The cloudy plastic crystal ball says so.