Answer: Yes, and (to a lesser extent) Yes.

Consider the current situation.

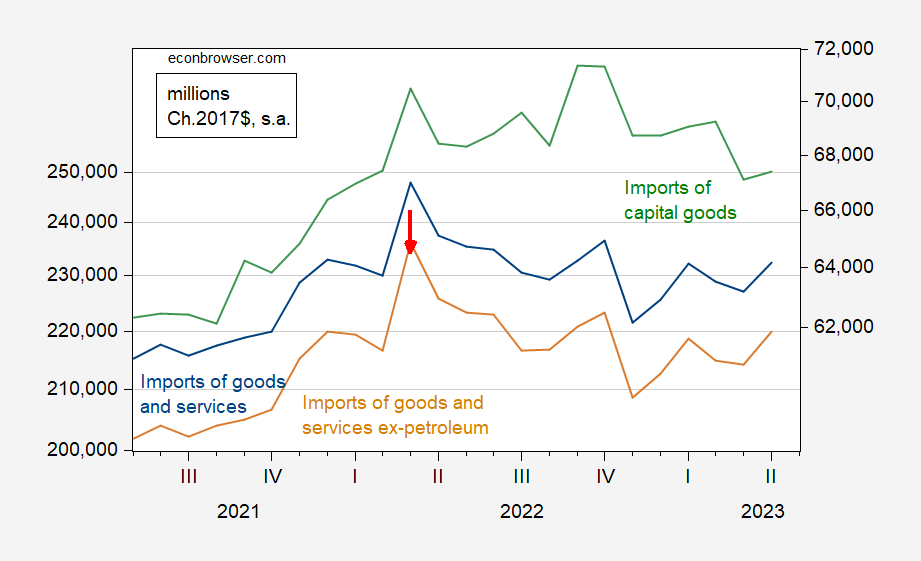

Figure 1: Imports of goods and services (blue), imports of goods and services ex-petroleum (tan), imports of capital goods (green, right scale), all in miilions of Ch.2017$. Source: BEA.

Real imports of goods and services excluding petroleum peaked in March of 2022. They, and total imports, remain below those levels. Capital goods imports — which should reflect more forward looking behavior — peaked in September of 2022.

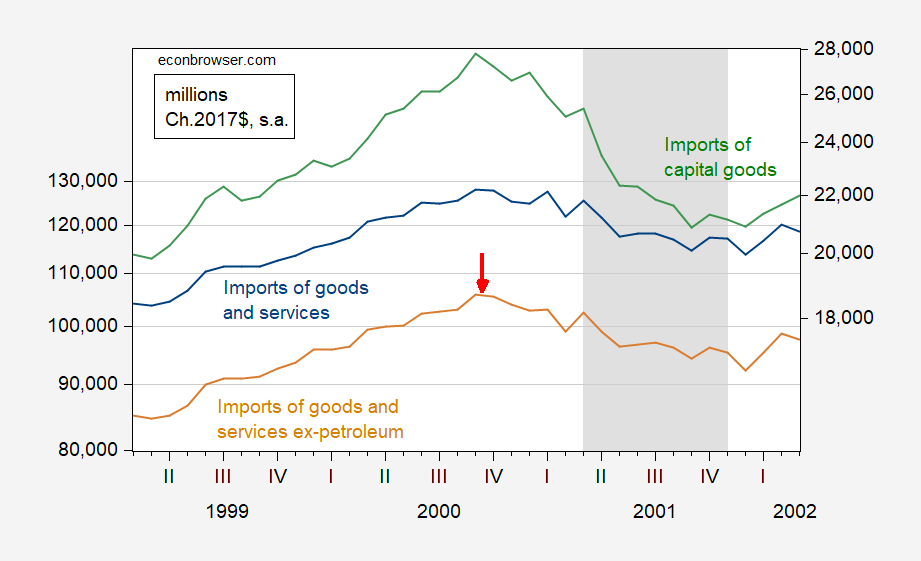

Real imports did peak before the recession of 2001.

Figure 2: Imports of goods and services (blue), imports of goods and services ex-petroleum (tan), imports of capital goods (green, right scale), all in miilions of Ch.2017$. NBER defined peak-to-trough recession dates shaded gray. Source: BEA, NBER.

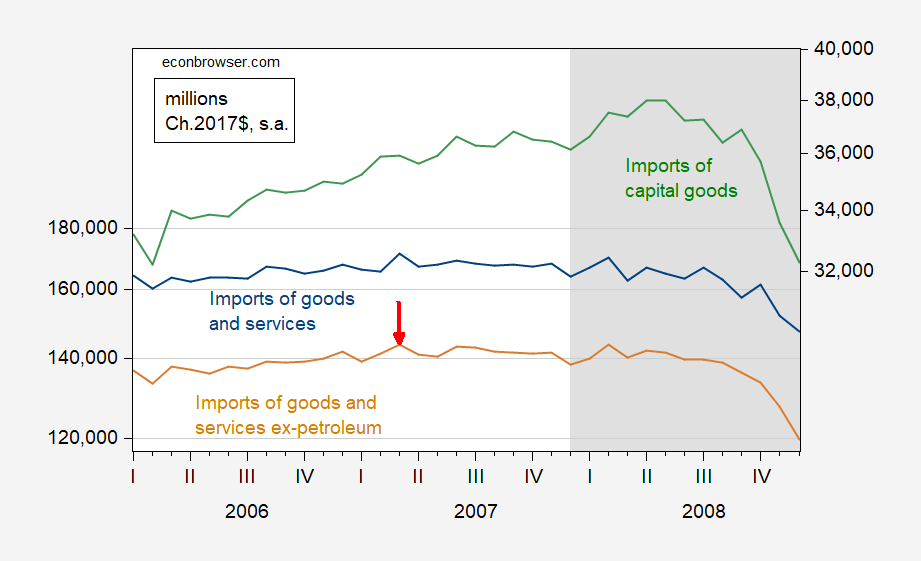

On the other hand, while imports ex-petroleum peaked in March 2007 (actually technically peaked slightly higher in February 2008), capital goods peaked in April of 2008, months into the recession as defined by NBER.

Figure 3: Imports of goods and services (blue), imports of goods and services ex-petroleum (tan), imports of capital goods (green, right scale), all in miilions of Ch.2017$. NBER defined peak-to-trough recession dates shaded gray. Source: BEA, NBER.

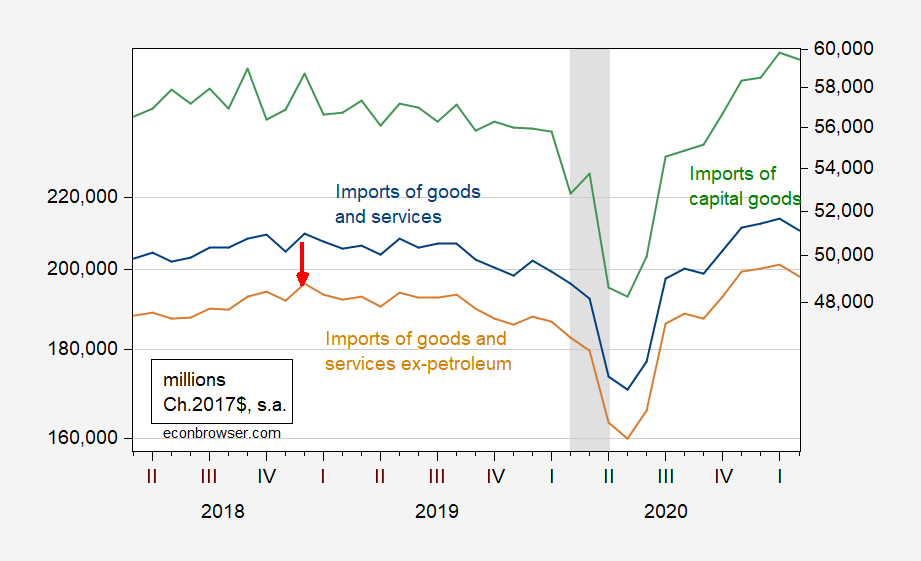

Finally, in the last recession, imports ex-petroleum peaked in December of 2018. And capital goods imports actually peaked in September of that year.

Figure 4: Imports of goods and services (blue), imports of goods and services ex-petroleum (tan), imports of capital goods (green, right scale), all in miilions of Ch.2017$. NBER defined peak-to-trough recession dates shaded gray. Source: BEA, NBER.

Hence, aggregate real imports are typically a relatively reliable precursor of recessions (subcategories like capital goods are not necessarily so), at least for the last three recessions. What about false positives — i.e., cases where imports fell but no recession occurred. One wants to consider cases where an extended period of flat or declining imports occurred, like half a year. On quick inspection, it looks like there’s only one such case — March 2015, when it took a subsequent 2.5 years to regain that level. No recession as defined by NBER occurred then, but as many have noted, there was a manufacturing slump starting in 2014M12, induced by dollar appreciation.

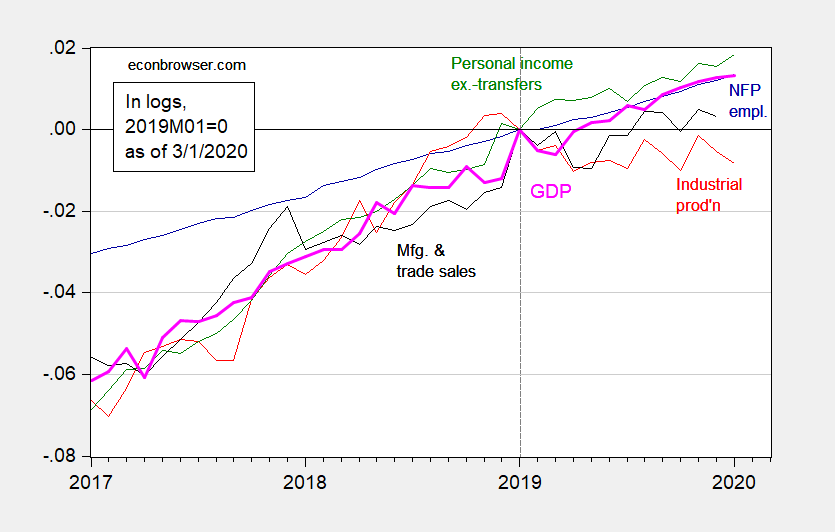

This set of finding suggests that, had no pandemic struck, the US might well have entered a recession nonetheless. Below is a picture of key NBER series, using real-time data (i.e., data as they were reported as of March 1, 2023) (from this post).

Figure 5: Nonfarm payroll employment (blue), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), and monthly GDP in Ch.2012$ (pink), all log normalized to 2019M01=0. Source: BLS, Federal Reserve, BEA, via FRED, Macroeconomic Advisers (2/28 release), and author’s calculations.

Notice industrial production and manufacturing and trade industry sales were trending sideways. The belief that a recession was imminent was consistent with my views laid out in a January 2019 post, noting the near inversion of the yield curve.

Off topic – Trump has been indicted in the Mar-el-Lago documents case. The indictment is sealed, but Trumps lawyers say some charges are based on the Espionage Act of 1917. Certainly not espionage per se, but under the act.

Talking Points Memo claims:

“And violating the statute carries an unusual penalty with it. If convicted, Trump would be disqualified from holding future office under the Act.”

https://talkingpointsmemo.com/live-blog/trump-says-hes-been-indicted-in-mar-a-lago-probe?entry=1460071

I think that’s wrong. The only part of the U.S. CFR I’ve been able to find in which Espionage Act violation disqualifies the perpetrator from anything is “1572.103 Disqualifying criminal offenses”. This address disqualification from receiving Transportation Security Administration credentials.

Anybody know otherwise?

One distinction between various Trump indictments may be worth keeping in mind. The documents case involves Trump’s behavior as a private citizen, much as he pretends otherwise. The rape case was also for non-president behavior, as was Stormy-Gate. Election tampering cases will cover his behavior while president. In a system in which all are equal, it shouldn’t matter, but it does. There is precedent; the Supreme Court ruled that Clinton could face charges while he was serving as president. I’m sure lawyers, especially Bill Barr type “unitary presidency” religionists, see more complexity in this question than I do.

Eugene Debbs was charged under the Espionage Act and ran for president while incarcerated. A third of the country wearing “Inmate 2947563 for President” hats ($75 each) seems to me another step toward the end of governability – which is part of Trump’s plan, adopted by much of the GOP, after a!!. Makes us too much like Italy and Israel for my taste.

@ Macroduck

Everything I’ve seen (even from left leaning lawyers) says he could be convicted and “in prison” and still serve as U.S. President. Where (the literal location) he would govern from (White House or a federal prison cell) I do not know. But they all seem to agree it would not preclude him from being an acting President.

This is what “conservatism” (or the special brand of American “conservatism”) gets us. A sitting U.S. President, guilty of multiple felonies and traitorous/mutinous behavior against the voters, possibly governing from a prison cell or being escorted out of a prison cell as he begins his term. Well that is certain to get us “respect from the world community” isn’t it?? CoRev’s wet dream come true. I wonder if right before CoRev “climaxes” if trump is wearing an orange jump suit in CoRev’s fantasy dream or an orange thong as CoRev digs his nails into trump’s cheeks??

Jack Smith unsealed the indictment. 50 pages of damning evidence. Jack Smith just spoke. Short and to the point.

Thirty-seven counts.

https://storage.courtlistener.com/recap/gov.uscourts.flsd.648653/gov.uscourts.flsd.648653.3.0.pdf

The indictment.

On topic –

The 2001 recession may be a special case for capital investment. Y2K caused a huge bunch of tech investment. The peak in capital imports did come after it was too late to do any good for Y2K disaster prevention, so maybe not a strong case, but worth looking into. I know 9/11 is the recognized cause of the 2001 recession, but core capital goods orders were plunging before the attack:

https://fred.stlouisfed.org/graph/?g=160aO

Looks Y2K-related to me.

There were a number of signs of economic trouble prior to the Covid pandemic, but the 2020 recession as declared by NBER is also arguably a special case.

So I can see reason to think any argument about regularities in capital imports based on the last three cycles isn’t good. Of course, you aren’t making an argument for capital imports, but rather for total imports. That’s likely a consumption-related issue:

https://fred.stlouisfed.org/series/A652RC1Q027SBEA

That seems to work.

Guess who just got indicted on 7 counts:

-Willful retention of national defense information (maximum penalty if convicted: 10 years)

-Conspiracy to obstruct justice (maximum penalty: 20 years)

-Withholding a document or record (maximum penalty: 20 years)

-Corruptly concealing a document or record (maximum penalty: 20 years)

-Concealing a document in a federal investigation (maximum penalty: 20 years)

-Scheme to conceal (maximum penalty: Five years)

-False statements and representations (maximum penalty: Five years)

I’m curious to see how many U.S. manufacturing jobs will be added by Biden admin/Democrats in the next two years. https://www.businessinsider.com/us-building-factories-census-data-chips-act-inflation-reduction-act-2023-6?op=1 Also – we can all agree – that the switch to EVs and solar is much needed now. The lesson learned here is that Democrats get things done https://www.nytimes.com/2023/06/06/opinion/biden-trump-ira-chips-manufacturing.html

Off-topic

I was very sad to hear that Wade Goodwyn had died. He was a terrific radio reporter.

https://www.npr.org/2023/06/08/1167837454/wade-goodwyn-npr-correspondent-dies

One of those guys who “kept his head down” doing his job, was one of the best at his job, and got very little recognition for it. Maybe they thought he was “privileged”?? Too bad Wade couldn’t find a handicap or minority status to cling to so he could be recognized more. Hollywood starlets with fading careers are at least creative enough to create a just now discovered mental disease or some “repressed memory” from childhood for those last 10 minutes of attention. Wade, tssk-tssk!!! Didn’t you know the rules of getting societal applause??

Here’s a picture of overall and manufacturing construction spending, along with two other construction types one might hope will benefit from recent legislation:

https://fred.stlouisfed.org/graph/?g=162BT

Factory construction is truly off to the races.

Here’s the source for data linked in the Business Insider article. It isn’t FREDable, but anyone who has Excel can play with the data:

https://www.census.gov/construction/c30/monthlysubnational.html

Not much evidence yet of factory hiring, or of construction hiring, due to the rise in factory construction. Could be a labor supply problem. Orders for factory machinery, however, are quite strong:

https://fred.stlouisfed.org/graph/?g=162EK

Speaking of factories, there’s this:

https://www.politico.com/news/magazine/2023/06/09/america-weapons-china-00100373

From the article – “But a swift response (to the dependence of the U.S. military on imported components) may not be possible, in large part because of how shrunken the U.S. manufacturing base has become since the Cold War. All of a sudden, Washington is reckoning with the fact that so many parts and pieces of munitions, planes, and ships it needs are being manufactured overseas, including in China.”

The U.S. depleted its stock of munitions in the second Iraq war. Clearly, if we ran out of munitions in a single-front war against a weak enemy, the 2 1/2 front doctrine was a sham. Something had to be done. Now, the U.S. is depleting munitions stocks on behalf of Ukraine – a single front in a grinding artillery war. Gaming out a war with China ends the same way, whether the U.S. wins in a scenario or loses; we run low on munitions quickly.

And it’s no just us. Russia has had to import shells from North Korea and drones from Iran. NATO countries are running low on just about everything they provide to Ukraine.

And when you think about what it would mean to fix this problem, it’s pretty bad. Diverting a larger share of national output to stockpiling stuff we hope not to use, for the sake of deterence, at the cost of having less of those things we should be happy to use, like housing and education.

I mention this because the likely result of China’s aggressive turn under Xi and Putin’s KGB view of the world is a prolonged arms race. We need to devote resources to reducing dependence on hydrocarbons. We need to devote resources to dealing with the consequences of climate change. Those needs are on top of long-standing societal needs that have gone unmet. All while enormous energy is devoted to distracting voters from real issues by whining about woke and guns.

https://fred.stlouisfed.org/graph/?g=NQNw

January 30, 2018

Consumer Price Indexes for food and energy in Euro Area, 2017-2023

(Percent change)

https://fred.stlouisfed.org/graph/?g=NT1G

January 30, 2018

Consumer Price Indexes for food and energy in Euro Area, 2017-2023

(Indexed to 2017)

[ That food prices are increasing so rapidly in the Euro Zone, reflects years of limited infrastructure investment as in water conservancy. The lack of investment was a refrain of European farmers for years, but to little avail. ]

west coast ports seem to be accumulating delays, for both imports and exports. any thought on how a slowdown in our ports will impact us?

Nothing surprising. Interruptions intermediate goods imports means interruption in domestic production. Interruption in finished goods imports means scarcity and rising prices.

There has been a shift toward Gulf and East Coast ports since the Covid jam-up on the West Coast. I don’t know how much the present strike will contribute to further shift, but I assume it won’t be nothing.

https://news.cgtn.com/news/2023-06-09/China-s-high-altitude-observatory-detects-brightest-gamma-ray-burst-1kuAFk5gwAU/index.html

June 9, 2023

China’s high-altitude observatory detects ‘brightest-of-all-time’ gamma-ray burst

By Sun Ye

The latest study by China’s Large High Altitude Air Shower Observatory (LHAASO), has given the world its first understanding on multiple perspectives into the afterglow of what’s been described as “the brightest-of-all-time gamma-ray burst.”

The study * was published in the academic journal Science on Friday.

Cao Zhen, chief scientist at LHAASO, elaborated on the significance of the study in an interview with CGTN.

“This was the first time that LHAASO precisely measured the entire light curve of high-energy photons from the afterglow of a gamma-ray burst, and the first time the rapid enhancement process of high-energy photon flux from a gamma-ray burst was measured,” said Cao. “We also observed its rapid decay process, which explains why this gamma-ray burst is ‘the brightest of all time’.”

“The gamma-ray burst was a very surprising event, so rare, so special, so surprising and delightful that it was like fireworks,” he added.

Cao said that while the world has studied gamma-ray bursts for over 60 years, in previously-measured explosions, events as bright as this one were very rare, occurring only once every 10,000 years.

“Then this beam of light happened to land right in the middle of LHAASO’s field of view. You can imagine how this is even rarer than an event that occurs once every 10,000 years,” He added.

Situated over 4,400 meters above sea level in Daocheng County, southwest China’s Sichuan Province, LHAASO started running less than two years ago in July 2021.

It’s the only facility in the world able to capture rare sighting events, and did so on October 19, 2022….

* https://www.science.org/doi/10.1126/science.adg9328

https://english.news.cn/20230607/da2f26f977a7475fb44e64bd5758c73a/c.html

June 7, 2023

China’s telescope makes new finding on super massive first generation star

BEIJING — An international research team have discovered the oldest known star in the Galactic halo. Their findings indicate that it was born in the gas cloud left by a first generation star with a mass up to 260 times that of our Sun. This discovery has improved mankind’s understanding of the first stars and the evolution of the Milky Way and the universe.

The new study * led by Chinese astronomers at the National Astronomical Observatories of China (NAOC) under the Chinese Academy of Sciences (CAS) was published online in Nature on Wednesday.

Zhao Gang, leader of the research project, said that the first stars illuminated the universe during the cosmic dawn and put an end to the cosmic “dark ages” that followed the Big Bang. However, the distribution of their mass is one of the great unsolved mysteries of the cosmos.

Numerical simulations of the formation of the first stars estimate that the mass of the first stars could reach up to several hundred solar masses. Among them, the first stars with masses between 140 and 260 solar masses ended up as a special type of supernovae, called pair-instability supernovae (PISN), which would imprint a unique chemical signature in the atmosphere of the next generation of stars, said Zhao.

However, no direct evidence of such type of supernovae had been previously found.

Based on the survey by the Large Sky Area Multi-Object Fiber Spectroscopic Telescope (LAMOST) in China and the follow up observation by the Subaru telescope in Japan, scientists identified a chemically peculiar star, named LAMOST J1010+2358. Its special chemical characteristics are consistent with the theory of PISN. Scientists confirmed that this star was formed in the gas cloud dominated by the yields of a PISN with 260 solar masses.

“Our discovery is the first clear direct evidence of the existence of a PISN from a very massive first generation star in the early universe,” said Xing Qianfan, a key member of the study from NAOC.

“This paper presents what is, to my knowledge, the first definitive association of a Galactic halo star with an abundance pattern originating from a PISN,” said Timothy Beers, a professor with University of Notre Dame in the United States.

Wang Xiaofeng, a professor with Tsinghua University, said that the next generation stars carry the elemental imprints formed by the evolution and death of the previous generation stars. “It’s like we can trace the characteristics of a child’s father by examining the child’s DNA.”

This discovery proves that the mass of the first generation stars can reach up to several hundred solar masses, and will have a profound impact on the research of the origin of elements, star formation in the early universe, and the chemical evolution of galaxies, said Zhao.

“Understanding the properties of the first generation stars is crucial for us to understand the formation of stars, galaxies and large-scale structure of the universe,” said Han Zhanwen, an academician of CAS….

* https://www.nature.com/articles/s41586-023-06028-1

About 50 years ago the usa put a man on the moon and created a space station. Just sayin…

On Hubble, Compton, Chandra and Spitzer. On Mariner, Voyager, Deep Space and James Web. On Mercury, Gemini, Apollo and Shuttle…

There are some I’ve missed, I’m sure. These are the ones that came to mind. Apologies to Clement Moore.

it is not clear to me why ltr seems to think it is important to post ad nauseam Chinese propaganda that were accomplished by the USA decades ago. for instance, its wonderful that china finally sent to orbit a space station. other nations accomplished this feat 50 years ago. so to trumpet that success 5 decades later is simply propaganda, not news worthy to post on an economics blog. and yet ltr does that … over and over and over again. ltr, does the ccp pay you by the post rather than quality of content?

Even Trump toadie Jonathan Turley was impressed by the unsealed indictment:

https://www.msn.com/en-us/news/politics/extremely-damning-fox-s-jonathan-turley-calls-unsealed-trump-indictment-overwhelming/ar-AA1clrqR?ocid=msedgdhp&pc=U531&cvid=1db1346efa064d3e8497732d3ef13858&ei=9

It is an extremely damning indictment. You know, there are indictments that are sometimes called narrative or speaking indictments. These are indictments that are really meant to make a point as to the depth of the evidence. There are some indictments that are just bare bones — this is not. The special counsel knew that there would be a lot of people who were going to allege that the Department of Justice was acting in a biased or politically motivated way. This is clearly an indictment that was drafted to answer those questions. It’s overwhelming in details. And, you know, the Trump team should not fool itself, these are hits below the waterline. These are witnesses who apparently testified under oath, gave statements to federal investigators, both of which can be criminally charged if they’re false. Those witnesses are directly quoting the president in encouraging others not to look for documents or allegedly to conceal them. It’s damaging. And the key here to keep in mind that every case I’ve ever been involved with, the indictment was a heart stopper. You know, these are written by lawyers who are trying to client every indictment I’ve ever dealt with has falling apart to some degree. Once we look more carefully at what the evidence may be, but this is is not an indictment that you can dismiss. There are a lot of people who are testifying under oath and they’re saying highly incriminating things with regard to these charges.

So Jonathan – are you saying that Jack Smith is very good at marinading?

Gobs of Chinese auto imports on the horizon: Greg Ip, WSJ writes “China’s EV Juggernaut Is a Warning for the West.” Leading indicator of future US economic stagnation or just of lots more protectionism, most likely promoted most vociferously by erstwhile free trade fundamentalists?

“China rocked the auto world twice this year. First, its electric vehicles stunned Western rivals at the Shanghai auto show with their quality, features and price. Then came reports that in the first quarter of 2023 it dethroned Japan as the world’s largest auto exporter.

When Western auto executives flew in for April’s Shanghai auto show, “they saw a sea of green plates, a sea of Chinese brands,” said Le, referring to the green license plates assigned to clean-energy vehicles in China. “They hear the sounds of the door closing, sit inside and look at the quality of the materials, the fabric or the plastic on the console, that’s the other holy s— moment—they’ve caught up to us.”

Manufacturers of gasoline cars are product-oriented, whereas EV manufacturers, like tech companies, are user-oriented, Le said. Chinese EVs feature at least two, often three, display screens, one suitable for watching movies from the back seat, multiple lidars (laser-based sensors) for driver assistance, and even a microphone for karaoke (quickly copied by Tesla). Meanwhile, Chinese suppliers such as CATL have gone from laggard to leader.

The threat to Western auto market share posed by Chinese EVs is one for which Western policy makers have no obvious answer. “You can shut off your own market and to a certain extent that will shield production for your domestic needs,” said Sebastian. “The question really is, what are you going to do for the global south, countries that are still very happily trading with China?”

https://www.wsj.com/articles/chinas-ev-juggernaut-is-a-warning-for-the-west-1389f718

Meanwhile, what’s the US auto industry doing? Branko Marcetic: “For Proof That Corporate Greed Is Driving the Inflation Crisis, Look to the Car Industry…Maybe no product has embodied today’s inflationary pressures quite like cars have, as shortages of parts coupled with continuing strong demand for vehicles has sent their prices soaring. While we’ve been told that firms are simply passing along higher production costs to consumers, car dealers have also been making record profits, with Federal Reserve Bank of Richmond president Tom Barkin telling the New York Times that carmakers and dealers had “discovered that a low-volume, higher-price model was actually a very profitable model.” A Bureau of Labor Statistics (BLS) study from this past April determined that dealer markups contributed majorly to inflation in the price of new cars.

This is backed up by the words of the executives of the country’s largest dealerships themselves, who on earnings calls have explicitly talked about selling cars at inflated prices and making a tidy profit. It points to the need for robust government action to provide relief for consumers against such private sector greed.”

https://jacobin.com/2023/06/inflation-prices-profits-car-dealerships-controls

It looks like another round of protectionism and government bailouts is on the horizon for a pathetic, greedy domestic industry that politicians just won’t allow to put itself out of its misery.

“It looks like another round of protectionism and government bailouts is on the horizon for a pathetic, greedy domestic industry that politicians just won’t allow to put itself out of its misery.”

First you bemoan the Chinese coming up with a more affordable EV followed by Jonny boy criticizing trade protection. Yea we need a program keeping up with how many times Jonny boy flip flops.

“ake CarMax, the largest used car dealer in the United States. On an earnings call this past April, CEO Bill Nash explained how the firm’s “extensive price elasticity tests,” which look at what happens to the level of demand when prices are raised or lowered, convinced the company it could safely get away with the very low-volume, higher-price model Barkin spoke about. The company had “determined that we could have sold a few more cars, but we actually would have made less money,” Nash explained. On an earlier earnings call from December 2022, Nash responded to questions about other competitors lowering their prices to move cars off their lots and how that would impact CarMax’s strategy. Nash again cited the firm’s determination that they would have made less money, concluding that “what I’ve always said is . . . what we’re going after is profitable long-term market share gains.” He mentioned that the firm had price-tested both up and down, which “gives us confidence that we made the right decision from a profitability standpoint.”

CarMax???? Never mind the fact that this RETAILER made less in operating profits in 2022 than it did the year before (yes I went to sec.gov to check their financials – something Jonny boy has never done).

But this is a retailer who sells all sorts of cars from all sorts of place. Jonny boy wanted to say something about who is producing EV and he quotes the CFO of a retailer?

Come on Jonny boy – do try to understand WTF you are babbling about,

The usual, lame attempt by pgl to refute a point by citing a single company and hilariously alleging that it is representative of a whole industry! It happens all the time…

“The usual, lame attempt by pgl to refute a point by citing a single company and hilariously alleging that it is representative of a whole industry!”

What a retarded statement even for you. YOUR link focused on CarMax not me. Or did little Jonny once again forget to read his own damn link?

AutoNation chief financial officer Joe Lower likewise told investors in February 2023 that “more than half of our vehicles were sold at or above MSRP”

OK Jonny boy’s link referred two – count them two – dealerships. Now to repeat myself that Jonny boy ducked? How many of the cars sold be Autonation were EVs? Oh Jonny does not know as Jonny cannot bother to read a damn 10K filing (www.sec.gov).

Macroduck’s C- minus grade is the worst grade inflation I have ever seen as Jonny boy is too dumb to graduate from kindergarten.

The real story on Lithia Motors than the always lame as it gets JohnH missed:

https://www.cnbc.com/2021/08/05/lithia-motors-is-taking-on-autonation-to-become-top-dealer-in-us.html

Morningstar notes this is acquisition gone wild but then excuses it as achieving efficient minimum scale. I think it is time for the anti-trust crew to explore whether this is just sheer monopolization.

This would be a lot more convincing if we were all C- students in junior high. Try, try to make an adult argument. Just once.

Ducky makes his usual attempt at character assassination as cover for his inability to refute either the article on the booming Chinese industry article or the article on US auto industry greed’s role in driving inflation.

Can Ducky juxtapose the words corporate and inflation or does his allegiance to his moneyed bosses forbid that?

Booming China car sector? Gee Jonny boy – wouldn’t that compete with your greedy US retailers? Funny you never told us what the profit margins for CarMax and AutoNation were. Oh wait – you do know.

I just checked the 20-F for Toyota. BTW dumbass – that is a Japanese based car multinational that sells a lot to CarMax and AutoNation. You would know that if you took the time to read their 10Ks. Toyota’s profits margin for 3/31/2022 jumped to 12.75%. But Jonny boy can’t blame Toyota as Jonny boy has no clue what they are making on production and wholesale distribution.

And since I challenged you to tell us how many EVs Carmax and Autonation sold, one would think you would have figured that out by now. Oh wait – you do not know how to do that either.

Your Branko clown writes these words “carmakers and dealers had “discovered that a low-volume, higher-price model was actually a very profitable model” in the same lame discussion that talks about Lithia Motors? I guess little Jonny boy does not know this company has more than doubled its revenue from 2020 to 2022.

Oh wait – little Jonny boy did not read its 10K filing which explains how Lithia Motors did this. Try acquiring smaller competitors like crazy. Now wouldn’t this be an important little fact to discuss when talking about the alleged use of market power? Was didn’t little Jonny boy or his new car guru tell us that?

Simple – Jonny boy is a know nothing who relies on the writings of other know nothings.

“It’s a similar case with Lithia Motors, as of last year the largest dealership group in the country. Asked in a February 2022 earnings call if he was “seeing any hesitation at all among consumers to the elevated prices,” executive vice president Chris Holzshu replied, “Absolutely not.” “Demand is very high right now, and we’re taking advantage as much as possible in both new and used in that capacity,” he said.”

Jonny boy is relying on some earnings call from Feb. 2022? I bet Jonny boy did not bother to check the 10K filing for Lithia Motors. I did. Yea its profit margin for 2021 (which this call discussed) was 7.3%. Guess what the profit margin was for 2022? A whopping 6.8%!

I wonder if little Jonny boy thinks 6.8 exceeds 7.3?

Economic Effects of State Bans on Direct Manufacturer Sales to Car Buyers by Gerald R. Bodisch, May 2009

https://www.justice.gov/atr/economic-effects-state-bans-direct-manufacturer-sales-car-buyers

Now if Jonny boy wanted to tie the EV market to CarMax or whatever, he might have noted Tesla wanted to skip that 3rd party retail mess and use direct manufacturing sales. Which was a hot topic during the recovery from the Great Recession. Yea – this paper is 14 years old but it is real economics rather than the usual Jonny boy babble.

https://www.nytimes.com/2023/06/09/business/william-spriggs-dead.html

June 9, 2023

William E. Spriggs, Economist Who Pushed for Racial Justice

An educator who served in the Obama administration, he championed workers, especially Black workers, and challenged his profession’s racial assumptions.

By Ben Casselman

William E. Spriggs, who in a four-decade career in economics sought to root out racial injustice in society and in his own profession, died on Tuesday in Reston, Va. He was 68.

The A.F.L.-C.I.O., for which Dr. Spriggs had been chief economist for more than a decade, announced his death. His wife of 38 years, Jennifer Spriggs, said the cause was a stroke.

One of the most prominent Black economists of his generation, Dr. Spriggs served as an assistant secretary of labor in the Obama administration and held other public-sector roles earlier in his career. But he was best known for his work outside of government as an outspoken and frequently quoted advocate for workers, especially Black workers.

In addition to his role at the A.F.L.-C.I.O., based in Washington, he was a professor at Howard University, where he mentored a generation of Black economists while pushing for change within a field dominated by white men.

“Bill was somebody who was deeply committed to the idea that we do economics because we have a social purpose,” William A. Darity Jr., a Duke University economist and longtime friend, said in a phone interview. “That this is not a discipline that should be deployed just for playing parlor games, and that we should use the ideas that we develop from economics for the design of social policy that will make the lives of most people far better.”

Dr. Spriggs worked on varied issues, including trade, education, the minimum wage and Social Security. But the topic he came back to most frequently, and spoke most passionately about, was that of racial disparities in the labor market. Black Americans, he pointed out time and again, consistently experienced unemployment at double the rate of white people — a troubling fact that he argued got too little attention among economists.

“Economists have tried to rationalize this disparity by saying it merely reflects differences in skill levels,” Dr. Spriggs wrote in an opinion article in The New York Times in 2021, before going on to dismiss that claim with a striking statistic: The unemployment rate for white high school dropouts is almost always below that of overall Black unemployment.

During the nationwide racial reckoning after the death of George Floyd in 2020, Dr. Spriggs wrote an open letter to his fellow economists that was sharply critical of the field’s approach to race — not just in its failure to recruit and retain Black economists, which had been widely documented, but also in economic research.

“Modern economics has a deep and painful set of roots that too few economists acknowledge,” Dr. Spriggs wrote. “In the hands of far too many economists, it remains with the assumption that African Americans are inferior until proven otherwise.”

Biden administration officials said they had discussed appointing Dr. Spriggs to senior economic policy roles as recently as this year. In the end, he remained on the outside, nudging the administration in public and private not to back off its commitment to ensuring a strong economic recovery. In recent months he was a vocal critic of the Federal Reserve’s aggressive efforts to tame inflation, which Dr. Spriggs warned would disproportionately hurt Black workers.

“Bill was a towering figure in his field, a trailblazer who challenged the field’s basic assumptions about racial discrimination in labor markets, pay equity and worker empowerment,” President Biden said in a statement on Wednesday.

William Edward Spriggs was born on April 8, 1955, in Washington to Thurman and Julienne (Henderson) Spriggs. He was reared there and in Virginia. His father had served during World War II as a fighter pilot with the Tuskegee Airmen and went on to become a physics professor at Norfolk State University in Virginia and at Howard, in Washington, both historically Black institutions.

His mother was also a veteran and became a public-school teacher in Norfolk after earning her college degree while her son was in elementary school.

“I remember studying history together,” Dr. Spriggs later recalled of his mother in a White House blog post written while he was at the Labor Department. “She would check out children’s books covering the topics she was learning about.”

Dr. Spriggs earned a bachelor’s degree in economics and political science from Williams College in Massachusetts and attended graduate school at the University of Wisconsin, where he earned a master’s degree in 1979 and a doctorate in 1984, both in economics….

https://fred.stlouisfed.org/graph/?g=162BO

January 4, 2018

Unemployment rate difference for Whites and Blacks, * 1972-2023

* Employment age 16 and over

https://fred.stlouisfed.org/graph/?g=rdPk

January 4, 2018

Unemployment rates for Whites and Blacks, * 2000-2023

* Employment age 16 and over

A point about Chinese technology accomplishments, beyond the advancements as such, is that the United States has been working to stop Chinese technology development or really to stop Chinese economic development which is what the campaign against Chinese technology amounts to. This makes Chinese technology advances all the more significant. After all, trying to stop the development of a country of 1.4 billion that has grown dramatically for more than 40 years, lifting tens and tens of millions of people from severe poverty in those years, should be taken seriously indeed.

Remember, Congress passed the Wolf Amendment in 2011, preventing China from working with NASA on space exploration, while now China has a permanent manned international space station and is advanced in space exploration in myriad ways.

https://news.cgtn.com/news/2023-06-04/China-produces-early-stage-blood-cells-in-space-for-the-1st-time-1kmAFuLK6kg/index.html

June 4, 2023

China produces early-stage blood cells in space for the 1st time

By Gong Zhe

Space science researchers successfully created early-stage blood cells at the China Space Station, a step closer toward finding a way to treat diseases by producing any kind of human cells.

The experiment was conducted after the Tianzhou-6 cargo craft docked with the space station. The cells have been brought back to Earth by the Shenzhou-15 spacecraft on Sunday, along with three taikonauts, or Chinese astronauts.

During the experiment, pluripotent stem cells – a special kind of stem cells that have the potential to grow into all major human cells – were brought into the Wentian lab module on the space station, where some of them successfully grew into hematopoietic stem cells – another kind of stem cells that produce blood cells.

In this way, scientists managed to produce for the first time blood cells in space.

“Actually we have achieved the first goal of our project,” said Lei Xiaohua, a researcher at the Institute of Biomedicine and Biotechnology, Shenzhen Institute of Advanced Technology. “And we have a lot to do next.”

Lei told China Media Group (CMG) that his team will compare the cells produced in space with cells on Earth, trying to locate the exact genes that control the growing process.

“We will do more studies around stem cells with the Tianzhou-7 and 8 missions,” Lei said.

Stem cells are key to the scientific field of “regenerative medicine,” which is focused on regenerating human organs, tissues and other parts to heal original parts damaged by aging, disease or accident….

I was curious about China’s EV market so I decided to search for something more informative than the usual stupid babble we get from JohnH:

https://www.technologyreview.com/2023/02/21/1068880/how-did-china-dominate-electric-cars-policy/

MIT TECHNOLOGY REVIEW EXPLAINS

How did China come to dominate the world of electric cars? From generous government subsidies to support for lithium batteries, here are the keys to understanding how China managed to build a world-leading industry in electric vehicles.

By Zeyi Yangarchive, February 21, 2023

A very informative discussion. Three quick takeaways one would not get reading the stupidity of Jonny boy:

(1) The government has been heavily subsidizing its EV market for a generation

(2) Tesla is very involved in the development of China’s production

(3) China domestic demand for EVs is so high that it might just consume all domestic production

So Elon Musk has little to worry about in terms of China exporting EVs to the West. Yea – Jonny boy missed all of this as his research skills are a joke.

“China domestic demand for EVs is so high that it might just consume all domestic production…”

China has passed the United States and Germany and Japan, and is now easily the leading exporter of electric vehicles and of all vehicles.

$8.3 billion of exports leads the world? Not even in the top 15. I get you are paid to spread PRC spin but come on – at least try to get your facts right.

https://www.worldstopexports.com/car-exports-country/#:~:text=Car%20Exports%20by%20Country%201%20Germany%3A%20US%24139.1%20billion,8%20United%20Kingdom%3A%20%2430.2%20billion%20%284.2%25%29%20More%20items

Car Exports by Country

Below are the 15 countries that exported the highest dollar value worth of cars in 2021.

Germany: US$139.1 billion (19.6% of total exported cars)

Japan: $85.6 billion (12%)

United States: $54.7 billion (7.7%)

South Korea: $44.3 billion (6.2%)

Mexico: $39.9 billion (5.6%)

Spain: $33.9 billion (4.8%)

Belgium: $31.8 billion (4.5%)

United Kingdom: $30.2 billion (4.2%)

Canada: $29.2 billion (4.1%)

Slovakia: $26.8 billion (3.8%)

Czech Republic: $23.4 billion (3.3%)

China: $22.4 billion (3.2%)

France: $20.6 billion (2.9%)

Italy: $16.2 billion (2.3%)

Sweden: $12.6 billion (1.8%)

By value, the listed 15 countries shipped 86% of global cars exports in 2021.

Among the top exporters, the fastest-growing cars exporters since 2020 were: mainland China (up 125.3%), South Korea (up 24.4%), United States of America (up 19%) and the United Kingdom (up 13.7%).

“ltr” is like a lot of advertisers on American TV and American radio. He tells boldface lies and counts on the fact very few people will crosscheck what he says.

China imported $48 billion of cars? Like I said – China consumes more than it produces:

https://www.worldstopexports.com/cars-imports-by-country/

Cars Imports by Country

Below are the 15 countries that imported the highest dollar value worth of cars during 2021.

United States: US$148.1 billion (20.7% of imported cars)

Germany: $66.8 billion (9.3%)

China: $48.8 billion (6.8%)

France: $40.2 billion (5.6%)

United Kingdom: $35.8 billion (5%)

Belgium: $31.9 billion (4.5%)

Canada: $27.8 billion (3.9%)

Italy: $25 billion (3.5%)

Australia: $17.6 billion (2.5%)

Spain: $15.3 billion (2.1%)

South Korea: $12.9 billion (1.8%)

Saudi Arabia: $11.9 billion (1.7%)

Netherlands: $11.7 billion (1.6%)

Japan: $11.6 billion (1.6%)

Switzerland: $10.4 billion (1.5%)

This shows how pragmatic the Chinese people are. As much as the Chinese absolutely hate and detest conceding foreign nations build higher quality products, they will buy foreign cars in droves (including Japanese cars) both because they know Chinese quality is terribly poor, and to steal the techniques and “know how” of foreign manufacturers. “Fortunately” for America we also build crap cars. So America should pray daily China doesn’t copy Japanese manufacturing processes too well or China will begin to make better cars than America. It wouldn’t be terribly hard either, if Chinese leaders ever wanted to make the actual effort involved.

BTW, I have used my Ryobi lithium mower 3 times now and it performed well all 3 times. Happy so far. It charges pretty quickly. Still need to assemble my Ryobi weed wacker. Just being lazy again.

Nice to hear. Just saw an 80volt lawnmower at Costco. Pretty expensive though. I like a smaller battery with an ecosystem of uses. The 18v and 40v accomplish that well.

@ Baffling

If a person had a large yard it might make it worth it (for extended mowing time of one charge up). I think mine is 48 minutes, so basically I can do the entire lawn in two sessions of 48 minutes (Not counting weed wacker time). I got a Toyota car from 2007, a $27 Casio watch with supposedly a 10 year battery. I hold the things I purchase up to a high standard, and the Japanese are still pretty good at making things. Let’s hope the Japanese don’t get lazy and become a half-ass culture like America is now. I’m thinking of getting a new car in next two years or so. I got 3-4 cars on my list, and I might buy them used to save a few thousand. Here’s my working list:

Toyota Corolla

Toyota Camry

Honda Civic

Subaru Impreza (the Glue gaskets are a problem, but I think if you do low mileage, maybe you can put real gaskets on around 100k miles?? Not sure yet)

Subaru Crosstrek

Cars I would NOT get if they paid me. ANY Hybrid car. ANY Nissan. ANY Kia. ANY Hyundai. ANY Ford. ANY Chevy, ANY GM car. Any turbo or “turbo charged” car. Any Jeep (electronics nightmares from hell). 95% of SUVs I wouldn’t touch~~overpriced sticker and gasoline hogs.

I’d mention some others I wouldn’t purchase such as BMW, but I can’t buy that one ANYWAY because I can’t afford it. But unless you are a driving fanatic who loves driving just for the sake of driving, and you don’t mind a vacuum air funnel going directly from your wallet to a flushing toilet, I wouldn’t buy a BMW either. Garbage plastic under the hood and a blackhole for your money. People buy these cars and it never registers how much they are giving to the nearby mechanics’ children’s college fund. I gotta a guy lives nearby me.. Nice guy. Divorced, (I suspect the wifey left him because one of the children has a mental disability, screams all the time and curses, a good kid underneath it all) has 5-6 children. Great person. Terrific human being. He’d give me the shirt off his back, now my lawn when I go on vacation, drive to to the hospital at the gesture of my hand. “Salt of the Earth”. I buy fruit at the supermarket for him and his kids. ” Man’s man” has children’s mouths to feed. He’s got a mini-Cooper, beautiful shiny red with a black line running down the middle~~been sitting on the street in front of his house for the last 18+ months. Just sitting there. I don’t even wanna know what the battery charge on that car is now. But everyone must think it’s a nice looking car. It IS a nice looking car. It just doesn’t move and he can’t pay for the repairs.

Buy cars with good quality engines and transmissions. Otherwise……. Run. Run away as fast you you can. Like the 40-yard dash. Run away like the hellhound chasing you is going to eat your groin.

https://www.globaltimes.cn/page/202306/1291963.shtml

June 5, 2023

China’s vehicle exports in April surge 150% to reach 425,000, maintaining strong growth momentum

China’s vehicle exports in April reached 425,000 units, recording a year-on-year increase of 150 percent, maintaining its strong growth momentum, data from China’s Association of Automobile Manufacturers (CAAM) showed on Monday.

Total vehicle exports value stood at $8.31 billion, up 200 percent, CAAM said. It also reported that China’s total exports of vehicles reached 1.49 million representing a year-on-year increase of 76.3 percent over the first four months of 2023, with the total export value recording a 100 percent increase over 2022 to reach $29.68 billion.

New-energy vehicles (NEVs) become a major component of vehicle exports, according to the CAAM.

The sales of NEVs in China accounted for 60 percent of the world’s total in the first four months of 2023, Cui Dongshu, secretary general of the China Passenger Car Association (CPCA) said on his WeChat account recently, attributing the achievement to China’s strong supply chain with the domestic market sales and exports both ticking upwards.

Cui noted that total NEV sales worldwide from January to April in 2023 reached 3.54 million, a year-on-year increase of 38 percent. China’s NEV sales in the same period topped 2.11 million, surpassing both Europe and North America….

‘China’s vehicle exports in April surge 150% to reach 425,000, maintaining strong growth momentum’

Nice headline but I guess ltr does not know that world production of vehicles exceeds 85 million. Yes China makes a lot of cars including EVs. My point however was simple – China consumes more cars than it produces. Maybe it exports a few EVs but its imports of cars far exceeds its exports of cars. ltr’s own link talks about how much Chinese consumers purchase the EVs the nation produces.

This is an economic blog which makes it a shame that a few people cannot even grasp the most basic things. Then again any one who decides to defend the insanity from JohnH has already gone down the rabbit hole.

Before ltr goes further down the rabbit hole JohnH dug for her, maybe this will help the thoroughly confused:

https://www.statista.com/topics/1013/car-imports-and-exports-in-china/#editorsPicks

Automotive industry in China: imports and exports – statistics & facts

China has remained the world’s largest light vehicle manufacturer for more than a decade. In 2019, China accounted for nearly 30 percent of global vehicle production. However, only around three percent of passenger cars produced in China were exported. In 2018, China generated approximately 15.7 billion U.S dollars from its car exports, accounting for 0.6 percent of the total export value that year. The number of exported vehicles fluctuated widely in the past ten years but haven’t seen a breakthrough. The major obstacles Chinese enterprises encountered were the saturated market and shifting foreign trade policies.

Published by Yihan Ma , Jan 3, 2022

After all net exports = production minus consumption.

If a nation consumes more of a good than it produces, it is a net importer.

ethan siegel is an excellent science writer, on a number of sites, including medium.

https://bigthink.com/starts-with-a-bang/scientific-experts-non-experts/

I would recommend that covid read this article, before he continues to promote his false theories on the climate, economics, viruses, etc. the major point is that if you are a layman (covid), the odds that you have found something wrong with the scientific consensus is miniscule. we saw this with the spectacularly erroneous analysis of dick striker, where a non expert (dick) promoted r0 analysis that has been seen to be erroneous with respect to what the world experienced. dick was not a public health professional, and his analysis showed that during the covid pandemic.