Join me at 7 p.m. CT on UW Alumni Association’s TheUWNow livestream (via YouTube), where I’ll be joined by Conference Board Chief Economist Dana Peterson in discussing “The US Credit Rating and You” (moderated by Mike Knetter).

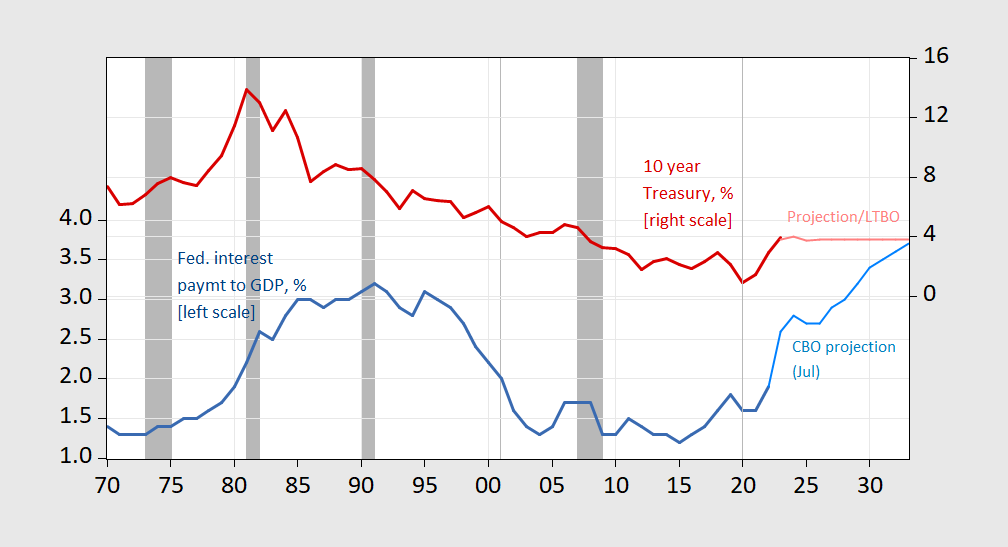

FIgure 1 below shows one graph, which better represents the burden of debt than debt-to-GDP, or deficits-to-GDP, alone.

Figure 1: Federal net interest payments as share of GDP (blue, left scale), CBO projection (light blue, left scale), in % and by fiscal year; ten year Treasury yield (red, right scale), and CBO projection and LTBO baseline (pink, right scale), both in %. NBER defined recession dates shaded gray. Source: Treasury via FRED, CBO (June, May, July 2023), and NBER.

My slide deck here.

AWESOME!!!!! So incredibly timely. Very cool.

“Federal net interest payments as share of GDP”

I’m assuming you are graphing nominal interest expenses. But the appropriate metric would be to use real interest expenses.

pgl: It’s normalized by GDP. If one uses the same deflator for net interest payments and GDP, then one would have the same picture.

Not saying nominal rate*Debt/P. More like (nominal rate – inflation rate) times debt.

Krugman opined on this at the NYTimes. OK I do not pay to get past their firewall so here is another link that has Krugman’s discussion:

https://inytimes.pressreader.com/article/281706914199025

Note in particular he is comparing the real interest rate, the real growth rate of income, and the primary surplus. All economists who get this issue does the same. Now your assumptions of long term real rate, real growth rate, and the primary surplus may differ.

Krugman argues rightly that the U.S. can always pay its obligations. It is a separate question whether the U.S. will always pay its obligations. Fitch cited a three-decade decline in governance in cutting the U.S. rating. Repeated threats to default, the Capitol insurgency, a conspiracy to overturn the 2020 presidential election, a former president absconding with thousands of classified documents, a Supreme Court packed with Justices who pledge to honor past Supreme Court rulings but eagerly overturns them, Justices who refuse to follow any sort of ethical code, a major political party which lies about science, about medicine, about everyday facts, which suppresses knowledge of history, which opposes the notion of governance – this seems to reflect a real decline in the governability and governance of the country. If rules don’t matter, contracts and obligations don’t matter.

I might not downgrade the U.S., but I understand Fitch’s position.

I was mildly surprised at Janet Yellen’s rebuff (for lack of a better term) of Fitch. I didn’t see all of her statement but the flavor of the headlines seemed to be that she kinda gave Fitch hell for the downgrade.

I think this falls under “Just doing my job”. There haven’t been enough U.S. downgrades to provide a pattern, but the first downgrade wasn’t well received by officialdom, either. Yellen had to say something – saying nothing would amount to saying something – and she has to sell trillions in debt, so she took her clients’ side. “Clients” being us, of course.

I think there is an argument to be made for political risk. Donald Trump with his never ending personal “solutions” to debt being to declare bankruptcy, and suggestions/hints that the US government could just not “pay China” for the debt they hold is actually a real contender for President.

Watched nearly the whole show. Super enjoyed it. I only missed about 2 minutes in the middle because I was eating KFC and had to wash the grease off my hands. You know it brought up a question in my mind that I hadn’t thought of in awhile. And I was trying to formulate the question clearly so it is asking what I mean it to ask. And I realize the question has become much more complicated since the Ukraine war started. One of the very very few things I kinda agreed with the orange abomination who lost the vote in 2020 was, why isn’t Europe paying more of its own self defense bill. That is, it is nearly always our own American ocean traveling warships and weapons carrying jets that come to the rescue in every European or MidEast kerfuffle. Do we get any remuneration for doing that from Europe?? Or maybe better worded, do they pay us at an appropriate level for that sense of security and lifted burden of their own military defenses?? And how much of our debts would lessen on the day they ever decided they wanted to remunerate America for the cost of defending them?? Would that just be a drop in the bucket?? or could it be meaningful added to other moves such as increasing tax revenues.

I like how the speakers Professor Chinn and Mrs Peterson, and the host, genuflected towards each other in the conversation and didn’t let egos invade the conversation. which does happen a lot, and more than should, when academics interact with one another in a public setting. So this air of non-egos brought a very refreshing and joyful tone to the show.

I hope Poland one day can be repaid by the international community for their kindness to Ukrainian “war refugees” (proper terminology??). Repaid monetarily or goodwill or something.

Regarding burden of the debt, keep in mind that “Federal Net Interest Payments” means net of inter-government transfers like trust fund interest. It does not include the net income that the Federal Reserve refunds to the Treasury. This is income on the assets that the Fed holds on its $8 trillion balance sheet. The Fed receives interest from the Treasury for the Treasury securities it holds and also from mortgage backed securities. The Fed subtracts its operating expenses from this interest income and refunds the balance back to the Treasury.

This annual refund of Treasury interest was around $100 billion a few years ago but decreased to about $60 billion in 2022 as they raised the Federal Funds Rate requiring the Fed to pay interest on bank reserves and repos.

So if you wanted to be more accurate, the burden of debt in the graph above should be adjusted for interest refunded to the Treasury by the Federal Reserve. This is a significant adjustment, typically ranging from about 0.2% to 0.6% of GDP.

the federal reserve bd h.4.1 is ‘Factors Affecting Reserve Balances – H.4.1’

open: https://www.federalreserve.gov/releases/h41/ click the date you want to see reported.

scroll to “2. Maturity Distribution of Securities, Loans, and Selected Other Assets and Liabilities,”

you will see the duration distribution of the holdings on the balance sheet.

note vast majority of mbs are > 10 year.

it also shows snapshot of reverse repo assets on balance sheet

Ability to repay.

Repayment / current revenues, over the business cycle.

What’s so hard to understand?

Explain it to wealthy individuals and corporations like donald trump who insist on paying zero income taxes over multiple years. Most of the rest of us get the concept.

Newly-unearthed memo lays out ‘controversial’ strategy for Trump to overturn 2020 election: report

https://nypost.com/2023/08/09/new-memo-lays-out-controversial-strategy-for-trump-to-overturn-election-report/

A previously unknown internal memo drafted by a lawyer allied with former President Donald Trump outlines a plan to overturn the 2020 election using fake slates of electors, according to a report. The lawyer Kenneth Chesebro, admitted that he was proposing “a bold, controversial strategy” that the US Supreme Court would “likely” reject, according to a copy of the Dec. 6, 2020, memo obtained by The New York Times. Still, he argued, it would focus attention on alleged voter fraud and buy the campaign time “to win litigation that would deprive Biden of electoral votes and/or add to Trump’s column,” the paper reported. Prosecutors say the missive — which was discovered during Trump’s third indictment last week – is a critical link to show how Trump and his allies’ plot morphed into a criminal conspiracy, the Times reported. It lays out Chesebro’s plan to have false Trump electors cast their electoral votes on Dec. 14.

Just a technical violation of the Constitution? First Amendment rights? Or maybe the Presidential Records Act. Trump can do whatever wants – grab them by the MEOW!

Speaking of debt, China carries a fairly heavy debt/GDP ratio and is flirting with deflation.

Y’all know this: Deflation reduces nominal GDP, and all the individual nominal flows that make up GDP and fund debt payments. Unless debt is indexed to inflation, the math works out to increase debt/GDP and the interest payment/income ratio.

In the case that inflation is less than had been expected, the same mechanism works, but at a somewhat less damaging level.

What I don’t know is whether anything in the details of China’s financial arrangements makes the stress caused by deflation or less-than-expected inflation more or less pernicious than in the U.S. or Europe. Anybody?

Well, anybody who actually knows something?

“Speaking of debt, China carries a fairly heavy debt/GDP ratio”

Now Jonny boy find some statistic called External Debt which was low as percentage of GDP for China. Now it turns out that Jonny boy kept reminding us that he had no clue what this concept even means. But he acted like that was SO important for reasons that little Jonny boy never explained.

china is having issues with property developers once again. failure to pay off bonds, like in the past couple of years. country garden was the largest developer in china :

https://www.cnn.com/2023/08/09/economy/country-garden-china-property-default-intl-hnk/index.html

Macroduck

I guess one simple answer to your question, to which you might justifiably well reply “Well, duuuuuhh” is Chinese as individual consumers (at the household level) tend to be better savers than Americans are—and orthodox economics says inflation hurts savers more. Just a “we already knew that Biffy” thought from the simpleton dept here.

Of course, the effect of deflation on debt service is accompanied by the effect of less-than expected income on debt service. China’s growth is looking pretty slow.

I don’t know if pgl or someone else had already mentioned this on the blog, but it appears NYT is reporting Boris Epshteyn is Co-conpirator 6, which I guess was a mystery up to very recently.

I did not know that. Thanks for the update!

https://www.nytimes.com/2023/08/02/us/politics/boris-epshteyn-co-conspirator-6.html

Messages Point to Identity of Co-Conspirator 6 in Trump Indictment

His Wikipedia page spends several paragraphs on the role Boris Epshteyn played.

@ pgl

It makes me feel pretty stupid and out of touch that the story came out on the 2nd and I only found out on the 9th (no joke). You’re not placating me are you?? I can’t believe we both missed that reported fact for roughly 1 week?!?!?!?! I mean I know I am now the creepy uncle guy in the neighborhood, but am I that clueless now??? Someone say something comforting to what’s left of my ego, quick.

There is so much going on with respect to Trump indictments, we need a program to keep up with it all.

Heh, pgl you’ve made me kinda angry some of the comments you’ve made in the past, but you seemingly found the ONE way to say it, that doesn’t make me feel so ashamed. Thanks for that.

You can talk bad about me, you can attack me, argue with me, talk “shit” about me, I will never never never never give your real name away. YOU compared me to trump recently. “You talk bad about soccer player Rampole, it;s similar behavior to trump”. That’s a deep insult to me comparing to me to donald trump. Why do I mention this?? That is to SAY You can insult and argue with me and I won’t mention or put your real name on this blog. I very dearly want you to have the mental freedom to know this

Here is the least surprising financial headline I’ve seen in a very long time

“Alternatives Have Been ‘Kryptonite’ to Alpha — At Least for Public Pensions”

https://www.institutionalinvestor.com/article/2c0ergt9a0imgro0rt69s/portfolio/alternatives-have-been-kryptonite-to-alpha-at-least-for-public-pensions

Not the best headline, but it makes the point: alternative investment peddlers (hedge funds, private equity, real estate trusts) provide poor returns relative to risk.

It’s one of the behavioral oddities in finance that everybody knows alternative investment peddlers are losers, but pensions and family offices invest in them anyway. A bunch. If rationality were strong in investment decision-making, persistent negative alpha would be impossible – the whole “efficient markets” thingie. Persistent negative alpha exists aplenty among alternative investments.

“Ennis found that private equity didn’t help — or hurt — excess returns. But both real estate and hedge fund exposures detracted significantly from performance.”

And to think that Bush43 wanted to turn over the Social Security Trust Fund to these pirates.

The value of the Russian rouble has dropped to only one cent:

https://www.msn.com/en-us/money/markets/ruble-slumps-toward-100-per-dollar-weakest-in-16-months/ar-AA1f1eqg?ocid=msedgdhp&pc=U531&cvid=8a72429ad0884e85adab7a4e065f9a1e&ei=16

I wish more conservatives paid attention to Judge Michael Luttig:

https://www.msn.com/en-us/news/politics/former-federal-judge-trump-now-an-even-greater-danger-to-american-democracy/ar-AA1f1jOb?ocid=msedgdhp&pc=U531&cvid=962bbe370a9f4e2fbf016276355495c9&ei=7

Former federal judge Michael Luttig doubled down Wednesday on previous comments about former President Trump, who he says now poses an even greater danger to the U.S. than when Luttig testified to the House Jan. 6 committee last year. “More so today than he was last summer when I testified before the Congress,” Luttig said in a CNN interview.

He said Trump’s ongoing false claims about winning the 2020 election and being persecuted by the Justice Department have hurt the country, and that the Republicans who have backed the former president are also responsible. “For the two-and-a-half years since Jan. 6, these false claims have corrupted American democracy. They’ve corrupted American elections and they’ve corrupted the perception of the American people in America herself,” he said.

Luttig, a conservative, was a federal appeals court judge until 2006 and has repeatedly criticized Trump’s election fraud claims. Trump attorney John Eastman, one of the unindicted co-conspirators mentioned in the former president’s 2020 election fraud criminal case, was one of his clerks. He also served as an informal adviser to former Vice President Mike Pence. His testimony to the Jan. 6 committee included claiming that Trump “instigated” a “war over our democracy” so he could cling to power. “This must come to a conclusion and the trials of the former president now will become, together with the events of January 6, the singular infamous events in American history,” Luttig said Wednesday.

His interview was on CNN. I guess Faux News cannot have on a competent legal authority even if he is a true conservative.

I think you are confusing the interests of US with those of Europe. All Europe/NATO need to defend itself is a sufficient number of nukes to survive a first strike (including missile defense systems to protect those nukes). That is not even going to cost 1% of GDP. A conventional attack on the soil of a NATO member is not realistic, even as Russia clearly would not hesitate to conduct one against any European nation NOT a member of NATO. That is probably one of the main reasons for Putins attack, he knew that if Ukraine became a member of NATO he would forever have to forego that territory. A larger stockpile of conventional weapons to give to Ukraine would have been nice but that is both a US and European problem, that its due to misspending of funds not a lack of them.

What US is doing with its demand of much higher spending (on expensive US systems) is to fund its own global power and ambitions. Removing US bases and troops from Europe would hurt US more than Europe – they have served as invaluable assets in projecting US power. You might say that it is in Europes interest to defend middle eastern oil supply, but it actually is not. The more expensive oil gets, the quicker the transition away from that horrible energy source that enrich US oil companies at the expense of destroying the climate. That is why Saudi Arabia is trying to stop the Ukraine war – it has pushed Europe into racing away and US strolling away from hydrocarbon energy. In one or two decades hydrocarbons will be dirt cheep, because nobody will want them (and Saudi Arabia as well as Russia will be irrelevant)

Sounds like a huge wedge between reserves in the ground (cheap) and product (expensive) because the capital stock needed to get hydrocarbons out of the ground and turn them into products will wither.

The explanations I have seen for why public pension funds are getting into these idiotic “alternative” money losing “investments” is that the managers are dumb and/or corrupt. The only explanation I have seen that doesn’t put the blame on those managers is that the politicians are putting strong pressure on managers to at least project higher long term returns – so they don’t have to put as much money into the funds. Projections on alternative investments are a lot more complicated and easier to fudge.

I have seen someone compare China to Japan 40 years ago. An export driven economy with a huge real estate bubble. Everything slowly deflating while government takes on more debt to counter the worst of the effects. I am not sure how far the similarities go and whether the differences are big and significant enough to warrant expectations of different final outcomes 40 years from now.

China is not Japan minus 30 or 40 years.

Japan began industrializing 60-70 years before China.

Japan was integrated into the world economy 30 years before China, and also 85-100 years ago.

Japan had a fully functioning social security net 50-60 years before China.

Japan has had an easily convertible currency for over 50 years.

Japan has, and has had for 60-70 years, a functioning, respected judiciary.

ADD: Japan is an archipelago; China is a continent (the borders are all to isolated areas).

David, I think you are a very intelligent guy, Certainly, what I’ve made out, with your job, exceedingly better social skills than I have (my social skills are very bad). WHAT exactly are you saying here David?? That China started out from behind the 8 ball?? I’ve never hid I have love/hate feeling to China, after 7 years embedded in northeast China. You’re saying Japan had an “advantage” over China?? After or before Hiroshima/Nagasaki ??

Mr Herzog,

Thanks for the compliments; I return the respect.

What I am saying is “Stop comparing incomparable!”

What Japan accomplished, Japan accomplished.

What China accomplished, China accomplished.

The comparison is like, oh, Korea and India: why bother?