Official Chinese statistics indicate 6.3% y/y growth in Q2. Maybe it’s less?

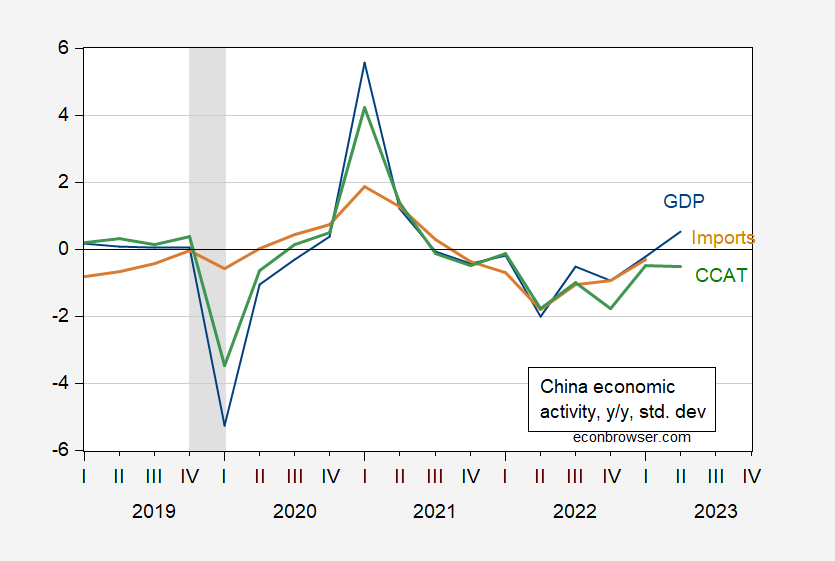

The FRBSF China Cyclical Activity Tracker (China CAT) of Fernald, Hsu and Spiegel (JIMF, 2020) indicates slower growth than reported by NBS:

Figure 1: Official Chinese GDP growth, standardized and detrended (blue), CCAT (green), and Imports (tan), in standard deviation units. ECRI defined peak-to-trough recession dates shaded gray. Source: China CAT (August 2023 version), ECRI.

Note that the Q2 observation for CCAT is different from usual because the consumption series was available only through April. Why the release of consumption data was delayed is a mystery (although periodic delays are not altogether unexpected).

The authors conclude:

Over the past four quarters ending in the second quarter of 2023, growth in cyclical Chinese economic activity was -0.51 standard deviations from trend.

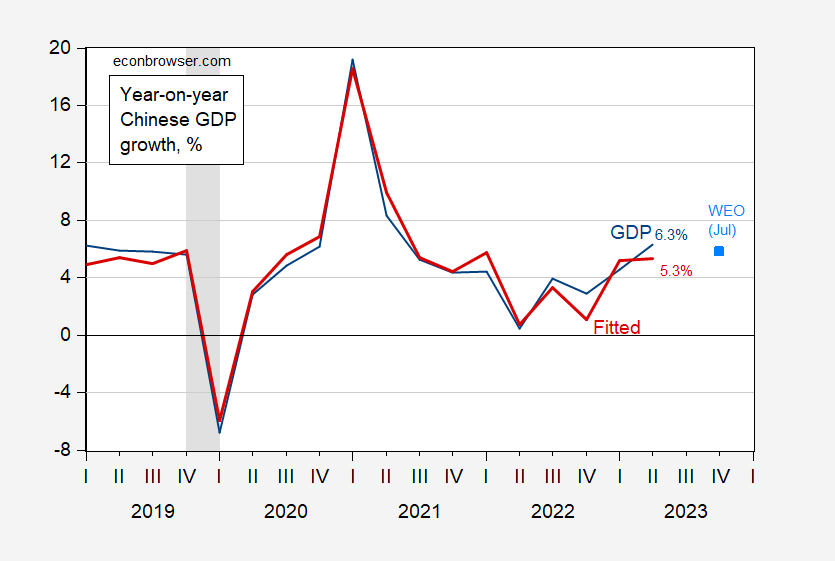

To translate this into GDP growth, I regress y/y GDP growth on CCAT, constant and a trend, 2019-2023. The regression adjR2 is 0.96. This yields the following figure.

Figure 2: Year-on-Year Chinese GDP growth (blue), and fitted using China CAT (red), IMF WEO July forecast (sky blue square). ECRI defined peak-to-trough recession dates shaded gray. Source: NBS, China CAT (August 2023), IMF WEO July update, ECRI and author’s calculations.

The GDP growth rate consistent with Q2 CCAT is 5.3% instead of 6.3%.

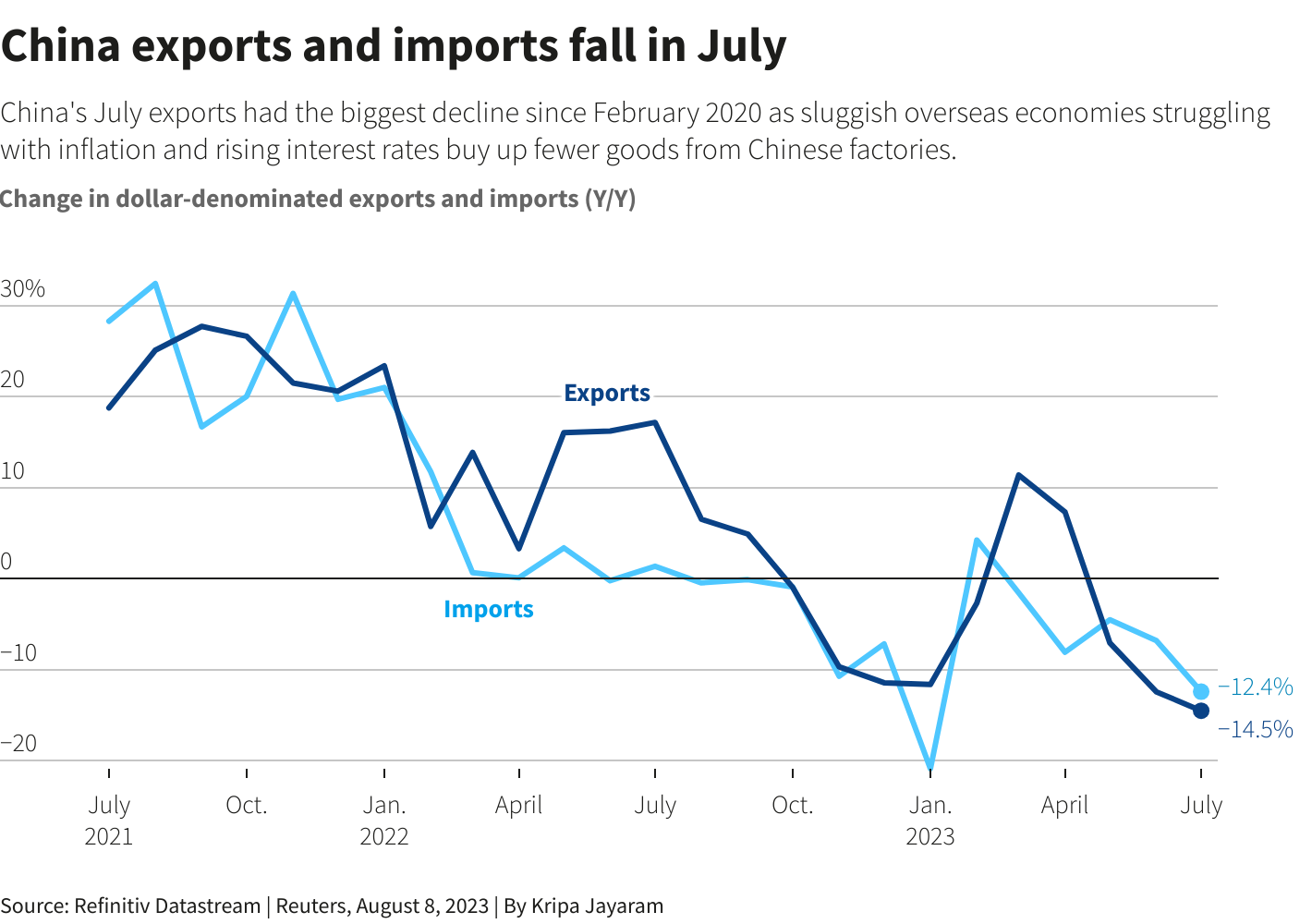

Concerns about growth prospects were heightened by the release of July trade figures. Both exports and imports (in nominal USD terms) fell further than expected (respectively 14.5% vs 12.% Bloomberg consensus; and 12.4% vs 5.0% consensus).

Source: Reuters.

From Cash/Reuters:

The grim trade numbers reinforce expectations that economic activity could slow further in the third quarter, with construction, manufacturing and services activity, foreign direct investment and industrial profits all weakening.

Discussion of constraints on reporting on Chinese statistics and economic analysis, here.

Addendum, 8/9/2023:

See additional discussion, Huang and Lovely (2023); Posen (Foreign Affairs, 2023); Bloomberg via WaPo today.

‘

Reuters did make a big deal about the fall in exports but wait – imports also fell a lot. So the change in net exports was not that large. Reuters wanted to make this a reason why China might be in a recession but isn’t the aggregate demand issue the change in net exports?

pgl: You can interpet in an accounting sense — conditional on other components of GDP, a small decline in net exports doesn’t mean much to current quarter GDP. On the other hand, a big decline in exports means externally sourced aggregate demand is down, while a big drop in imports means — given lots of imports are used in exports — a big drop in anticipated production. The latter is using some thinking about the nature of the Chinese economy and the nature of value chains — which might or might not be correct(!).

Interesting point. Thanks. And I agree – we need to look past the accounting.

A conventional understanding of the social contract in China is that citizens surrender personal freedom in return for good governance and steady growth. Here’s a partial list of evidence against the government holding up its end of the bargain:

Mal-investment

Non-performing loans

High youth unemployment

Public health theater in place of real public health during the Covid lockdowns

The betrayal and suppression of Hong Kong Chinese

Bed sharing in an economy with excess residential real estate

Anti-corruption campaigns

Poor growth

Shipping 300,000 recent grads and entrepreneurs to rural areas

Feel free to suggest other evidence.

What does the government do when it fails to live up to its side of the bargain? Hide the evidence, of course.

One commenter here has claimed to know that China’s communist regime will fall by a certain date not far in the future. That’s silly – too know-it-all specific. However, when government fails to deliver on the social contract, it is to be assumed that the public will too, eventually.

In the near and medium terms, that would be bad for:

The Chinese

Taiwanese

Tibetans

Uyghurs

Indians

North Korea’s rulers

The global system of production

Risky assets

Ducky sure loves to trumpet his schadenfreude over China’s potential problems! Could this be much ado about nothing? I doubt Ducky has any area expertise about China or how its economy works. But like any good propagandist, he seizes on any negative news about countries the foreign policy establishment deems to be its bogeyman du jour and reviles anyone who might dare express skepticism.

A couple days ago, there was “bad news” about Chinese deflation. Horrors! Deflation!! Banks will suffer! People’s real purchasing power will rise. What awful fate could possibly be conjured up as worse than that for someone with a Wall Street mindset? And what could be better for those who dislike China?

The big problem with the “bad news” is that it provided no context. It turns out that the main culprit was “food prices [which] fell by 1.7 per cent from a year earlier in July, compared with a rise of 2.3 per cent growth in June, while non-food prices remained unchanged last month, year on year, up from a fall of 0.6 per cent growth in June.

Analysts at Nomura pointed to the high base from last year as the main driver for the negative CPI reading.” [Declining food prices…unconscionable…better to have a 5.7% rise like the US!]

https://www.scmp.com/economy/economic-indicators/article/3230530/china-inflation-4-takeaways-deflation-worries-grew-july-worst-over

Another factor was the fall in the producer price index (PPI), which fell by 4.4 per cent in July, year on year, mostly due to lower commodity prices. [Apparently Chinese manufacturers pass lower costs along to wholesalers. What a concept!]

Let’s remember what all those doomsayers were saying a year and a half ago about how bad it was going to get for the Russian economy, apparently based on little more than a desire to be in synch with a whole lot of wishful thinking by the foreign policy establishment and little knowledge of how the Russia economy works or what Russia’s options were. The same could be true of all those China doomsayers and all their irrational exuberance about what lies in store for China.

“? I doubt Ducky has any area expertise about China or how its economy works. But like any good propagandist,”

Funny Johnny! One thing Johnny obviously can’t know is my level of expertise regarding China’s economy. Johnny doesn’t have the knowledge necessary to judge. Instead Johnny “doubts”, as if Johnny’s doubt counts for anything. Note also that Johnny didn’t bother to respond to the point I made. He just piled word on top of word, hoping to distract from my point.

Johnny, the endless font of propaganda, tries to call me a propagandist. Tee hee!

China is big. We need to know what’s happening there. China doesn’t want us to know the bad news. Neither does Johnny. Not my problem. I’m going to keep watching China. Johnny will undoubtedly keep trying to distract from the reality in China.

Oh, one more thing. Y’all realize, though Johnny doesn’t seem to, that my comment about Xi failure to uphold the Social Contract isn’t economics? It’s de Groot, Hobbes, Rousseau, Kant and those guys, not Smith or Ricardo.

Johnny was so eager to distract that he didn’t bother to adress anything I actually said.

Me thinks Jonny does not understand what you wrote. Jonny boy is really slow after all.

So many weasel words – so much worthless babble. Dude – we get you have serious emotional issues so please seek professional help.

“People’s real purchasing power will rise.”

You make this mistake a lot. Real income growth represents the difference between nominal income growth minus inflation. Let’s say inflation = 0 but nominal income fell. Sort of like the nominal wages of UK workers during the Cameron regime. Anyone with an IQ above the teens would see this scenario where real income fell.

But not Jonny the Utter Moron. Yea – this troll kept telling us how real wages rose. Seriously dude – maybe you need to learn to tie your own shoelaces.

To quote pgl, “So many weasel words – so much worthless babble. Ducky – we get you have serious emotional issues so please seek professional help.”

And most important of all, Ducky refused to claim any area expertise or special economic knowledge about China…but he’s certainly eager to bloviate about how bad it’s going to get for China.

OK, pgl. Contrary to what you claim, inflation was not zero in China… it was negative. So if inflation is negative and real wages remain constant, what happens to purchasing power?

[Actually, what happened in the UK in 2015 was that inflation dropped to virtually zero while real wages rose, even though prominent economists like Krugman were pontificating about how deflation was going to hurt workers! LOL!]

pgl thinks that if he can repeat the same lie enough, people will think that real wages didn’t rise in theUK in 2015!

Like you said, don’t believe anything the government says. Unless, of course, it’s the Russian or Chinese government. Their information you can take to the bank.

JohnH: Are you ignoring this entire post devoted to your ridiculous argument?

https://econbrowser.com/archives/2022/11/how-to-end-and-endless-debate

It seems your BS has attracted the attention of our host. You must have failed to read his last post on this so Dr. Chinn links to it below. Try READING it this time. Damn!

I forgot to mention our most obvious bit of local evidence of the Xi regime’s failure to uphold the social contract – ltr’s ridiculous behavior here. If China had any real justification bragging, we wouldn’t be treated to the buffoonery ltr delivers.

Among the many federal budget issues under discussion in DC, the farm bill is not getting all that much attention, but that could change. Politico sees signs of worry that House Republicans might blow up negotiations:

http://www.politico.com/news/2023/08/09/house-gop-farm-bill-00110350

Note the dollar figure mentioned – $1 trillion. That’s a multi-year figure, but still…

So I wonder what’s happening with crop subsidies.

Soybeans are not eligible for crop subsidies, but an effort is afoot to add soybeans to the crop subsidy list. I don’t know how much of the trillion-dollar Ag budget would be devoted to expanding crop subsidies to include beans. In 2021, total crop subsidies amounted to $28.5 billion, about 20% of the Ag budget and about $11,000 per farm worker.

Crop subsidies are not based on some recent evaluation of social need. Formulas for crop subsidies are based on decisions made in the 1930s, when the Dust Bowl and the Great Depression were not yet merely chapters in history books. Rice and cotton are the most heavily subsidized crops relative to value. Many crops are not heavily subsidized, at all; some 60% of U.S. farm output receives less than 3% of subsidies.

“Other senior Republicans are trying to convince their colleagues, and even some GOP leaders, that the hardline, partisan approaches Speaker Kevin McCarthy deployed in the debt limit and government spending fights won’t fly for the farm bill”

McCarthy – like most of the other “Freedom” Caucus are from farm county districts. Of course we are not going to see reductions in farm subsidies from this crew. Even if that would be good policy.

The political dynamics are interesting. The Hard core house MAGA nuts are more interested in making the point that they are hard core, than in getting policy and legislation through. In their MAGA cult districts it is actually a positive to come back and say I fought the democrats and the GOP establishment and lost – rather than talk about actual changes accomplished through compromise with either. So in order to pass things in the house McCarthy has to compromise with the Dems and they are demanding a heavy price (even before it goes to conference with the Senate democrats). The final outcome is that actual passed legislation is a lot more moderated by democrats priorities than if the GOP could get it together. Good news is that the MAGA nuts have a strong incentive to continue their all-or-nothing approach and the democrats know exactly how to capitalize on that.

Here is the thing that kills me as I try to work through this in my mind. By “kills me” I mean the exasperation and infuriation. What exactly is the point/logic in these GDP economic lies that certainly those external to China know are a joke, and I guess are largely a joke to the better educated, better read (more apt to be urban) Chinese?? Does the Chinese government think that the high percentage of young people (recent college grads) will read I high GDP number and think to themselves “Oh, yeah, high GDP for the nation. So it’s not systemic problem!!!! I really am a loser and a failure.” Is that the “gain”/”benefit” the CCP thinks they get with these lies??

Although this is a few months old, the World Bank published an analysis of China’s economic activity and issues that remain relevant.

https://www.worldbank.org/en/country/china/overview

Net exports are expected to weigh on growth, due to softer external demand coupled with a modest acceleration in import growth driven by the increase in domestic demand.

Given the dustups between the Biden Administration and China and the overt slow breakaway from economic entanglement with the CCP, it would seem that China will face an uphill battle to increase exports unless it aggressively courts new markets. Given that the US and Europe represent about 30% of China’s export trade, any slowdown in those regions could significantly inhibit China’s economic growth.

http://english.customs.gov.cn/Statics/355e61a4-772e-43c2-a109-bcb5ae102037.html

https://www.bloomberg.com/news/articles/2023-08-08/china-says-europe-s-soaring-trade-deficit-is-its-own-fault#xj4y7vzkg

Retail sales will (?) be out Aug 15, and after a 26% drop in pork prices should show a headline-grabbing drop … nominally.

Thus far, retail has been OK-ish, which is a perfectly valid degree of exactness in the case of China.