In a project with Laurent Ferrara, we have been examining the properties of financial indicators as predictors of (NBER defined) recessions. In addition to the term spread, we have considered Financial Conditions Indices (Arrigoni-Bobasu-Venditti, Goldman Sachs), the foreign term spread (a la Ahmed-Chinn) and the BIS debt service ratio (suggested by Borio-Drehmann-Xia). Slides from presentation in June here.

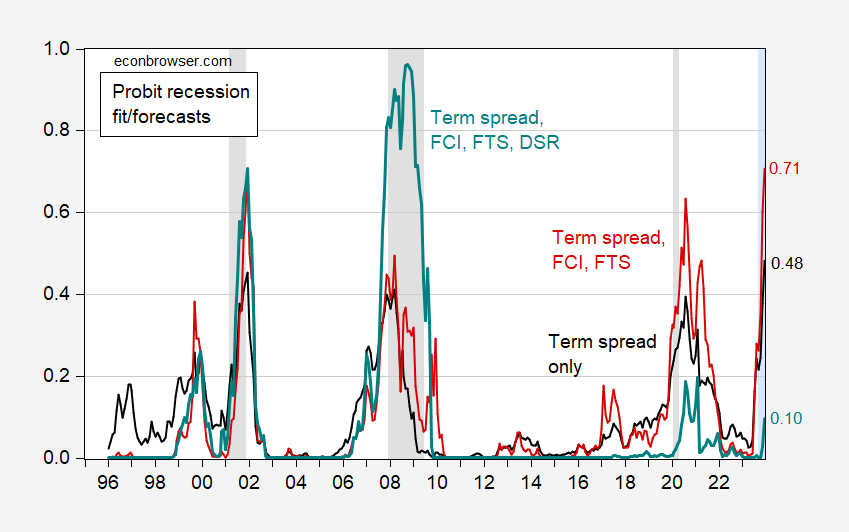

Figure 1: Implied recession probabilities from probit regressions on term spread (black), term spread, FCI, foreign term spread (red), and term spread, FCI, foreign term spread and debt-service ratio (teal). Estimation over 1985-2023M09 (assumes no recession in US as of September 2023). NBER defined peak-to-trough recession dates shaded gray. Light blue shading denotes out-of-sample period. Source: NBER, and author’s calculations.

Of key interest is that the estimates based on term spread and/or FCI and foreign term spread yield pretty high probabilities of recession for December 2023. They are not as high as some other estimates I have presented previously, as the sample period differs. The most important difference is the debt-service ratio of the private nonfinancial sector, which as Borio et al. report has roughly the same predictive power as they financial cycle variable. This variable — available only through end-2022 at the moment — reduces the implied probability to a mere 10%.

The pseudo-R2 of the debt-service ratio alone is higher than that of the term spread alone (or term spread, FCI and foreign term spread).

It’s too early to take too much solace from these results: the debt-service ratio is rising rapidly.

(These results are different relative to June’s in that we now have more up to date FCI data. Note that one would not necessarily want to apply the same sample period to euro area countries or the UK as we do not have the same level of confidence that a recession has not begun in these economies.)

An interesting analysis that goes against the chirping from little Jonny boy. Now we know little Jonny boy will get all emotionally out of shape over this but come on – he gets mad whenever a Queen song is on the air.

https://www.federalreserve.gov/econres/notes/feds-notes/corporate-profits-in-the-aftermath-of-covid-19-20230908.html

September 08, 2023

Corporate Profits in the aftermath of COVID-19

Berardino Palazzo

Overview

This note documents the behavior of corporate profit margins during and in the aftermath of the pandemic. As the traditional measure of corporate profit margin is heavily affected by fiscal support and its withdrawal, it also proposes an alternative measure. The note also provides insights on the dynamics of profit margin at firm level.

In the aftermath of COVID-19, inflation increased to levels that the U.S. economy has not witnessed for more than 40 years. This phenomenon has spurred a large quantity of policy commentary and academic research discussing its causes.2 One popular narrative goes as follows: in the aftermath of the COVID-19 pandemic, and amid a surge in demand and contemporaneous supply chain bottlenecks, corporate businesses increased the price of their final goods and services above and beyond what was justified by changes in labor costs and input prices. The outcome was a marked increase in profit margins that has contributed to overall inflation.3

But were corporate profit margins abnormally high in the aftermath of the COVID-19 pandemic? The answer depends on measurement. Using a measure of nonfinancial corporate profits from the national income accounts–before tax profits with capital consumption adjustment–we find that nonfinancial corporate profit margins, or profits over gross value added, increased sharply to about 19% in 2021q2 and slipped back to 15% in 2022q4, compared to about 13% in 2019q4. This contrasts sharply with the steep dive in margins that normally occurs during a severe economic contraction.

Our analysis shows that much of the increase in aggregate profit margins following the COVID-19 pandemic can be attributed to (i) the unprecedented large and direct government intervention to support U.S. small and medium sized businesses and (ii) a large reduction in net interest expenses due to accommodative monetary policy. Once we adjust for fiscal and monetary interventions, the behavior of aggregate profit margins appears much less notable, and by the end of 2022 they are essentially back at their pre-pandemic levels.

Given the non-negligible effect of government intervention on the overall corporate profit margin, we highlight a different measure of corporate profitability. Specifically, we calculate the nonfinancial corporate net capital share, that is, the amount that remains for debt as well as equity holders after paying labor costs and the cost associated with the wear and tear of installed capital. This profitability measure tells quite a different story. First, the net capital share plummeted at the onset of the COVID-19 pandemic, as one would expect in a recession. Second, the net capital share rebounded to a value only 2.5 percentage points higher than its pre-pandemic level (while the aggregate profit margin rebounded to a value 6 percentage points higher than its pre-pandemic level) and then declined to its 2019q4 level by the end of 2022.

In the second part of this note, we explore the profit margins of a large pool of publicly traded nonfinancial U.S. firms. The benefit of focusing on these firms is twofold. First, the large majority of firms did not directly benefit from the large fiscal intervention and, as a consequence, their profit margins dynamics are more in line with what happened line during past recessionary episodes. Second, having firm-level profit margins allows us to explore differences in corporate profit margins dynamics across firms. We find that for the largest firms (as measured by their total revenues) profit margins have not deviated significantly from their pre-COVID-19 trend, while for middle- sized firms, profit margins have remained significantly lower in the aftermath of the COVID-19 pandemic. Overall, the firm-level analysis supports the view that nonfinancial corporate profits margins were not abnormally high in the aftermath of COVID-19.

Two things:

1) Very happy to see the debt service ratio reappear as a recession-predicting tool here. The point about the rising ratio seems pretty important. The Fed needs to be watching its influence on recession risks through the lens of this new information on the predictive power of the debt service ratio.

2) I’m late to the party on the hand-wringimg over the deficit in comments to to the prior post. To refresh memories, a member of the troll choir dutifully repeated stories about the horrors of the budget deficit from right wing members of Congress, from the Peterson Institute and from the Center for a sustainable whatchamacallit, all with an ax to grind over the budget. Remember, kiddos, there’s a big budget fight about to go into the final rounds in Washington, and partisans are feeding self-serving stories to gullible reporters left and right.

Here’s the picture:

https://fred.stlouisfed.org/graph/?g=18KaM

Notice how receipts peaked in 2000 and have run below the prior trend pretty much every year but 2022 since then? Shrub took office un 2001, cut taxes andstarted a war in Iraq. Now, un 2022, capital gains tax revenues boosted overall revenues, but that went away in 2023 because of widespread losses on financial assets. Got that?

On the outlays side, two giant recessions have clearly been a problem? One of those recession began under Shrub, the other under Trump. Are Shrub and Trump to blame for those recessions? Partly in Shrub’s case, no in Trumps. But to the extent that those two weren’t to blame for the recessions, their successors aren’t either. They are instead responsible for preventing far worse economic outcomes.

Look forward to more scary “deficits are scary” stories from the troll choir and their ideological masters, ’cause the Freaky Caucus wants to scare people as an excuse shut down parts of the federal government.

Thanks for linking to that graph. It’s nice to have some perspective on the disastrous history of Federal spending and revenue policies. Alexander Hamilton was a criminal for ever proposing that lunatics in Washington D.C. could borrow money. Our nation could be on the brink of default for the next two hundred years, or even longer, if we continue to indulge in this profligacy. We had a chance for salvation during the Reagan era when tax cuts for the wealthy promised to raise all tides, lift all yachts, and destroy communism–what went wrong? I also remember the “pivot to the deficit” of the Obama years.

I thought Alexander Hamilton only suggested we honor the debt obligations others had built up. Which is why we started with high tariffs and lately decided to actually tax domestically produced whiskey.

The restart of college loan debt repayment will kick DSR up quite a bit. That alone will be enough to kick up the odds of a recession.

In fact, CBO spent a good bit of unk in its most recent budget assessment discussing the student debt issue. Timing of payments under various presidential student debt plans (which are treated as “current law” unless stopped by the courts) have jerked the deficit figures around a good bit lately.

There are three debt sectors – business, government and household. Biden’s intention was to shift debt from households to government. Didn’t happen. There is the same amount of debt, but as you and the authors suggest, the debt burden for households can impose a bigger drag on spending than the same burden for government.

I think Menzie has written a lot of great scholarly papers–related to currency etc. But I view this paper, certainly in the top 5% of the papers Menzie has done. Which is ironic in some aspects as I disagree with the paper’s findings on recession on 2023. But I still think there is a lot of meaning and value in this paper. And the societal value this paper gives, will increase in the general academic community’s view over time. Just like maybe people didn’t quite realize Eugene Fama’s work in his early efforts. There was a “lag” there in people seeing Fama’s works’ greatness. I see this paper in that way, that society will see its great value, but only after a kind of “cognitive lag”, if that makes any sense.

Or maybe I just had too much lime flavored 8% Smirnoff just now. You make the call. Why do I always “tell on myself”??~~Mental problem

Menzie, I love this conversation between Professor Lo and Eugen Fama so much, I could watch this for 48 hours straight. This is so incredible these two guys talking. I just love it so much.

https://www.youtube.com/watch?v=dj-RO4mh-wA

You will find stuff that works, but don’t expect it to hold up.

Ritholz called attention to this NBER paper:

https://www.nber.org/papers/w31376

Turns out that if er want to reduce the deficit there is a 12 fold return on investment in giving IRS money to audit the top 10%. So I am sure all those right wing law-and-order deficit-hawks are calling for an increase in IRS to better enforce our tax laws – right?

“We find an additional $1 spent auditing taxpayers above the 90th income percentile yields more than $12 in revenue, while audits of below-median income taxpayers yield $5.”

Those right wingers are all too happy to have the IRS pursue the little guy but put all sorts of road blocks to going after the rich. Penny wise pound foolish?

what is the “deterrence effect”?