Reader Steven Kopits, in response to a posting of alternative indicators, writes:

I am pretty comfortable with both my H1 2022 call and with the role of gasoline/diesel consumption and VMT as indicators of economic stress or comfort, as the case may be.

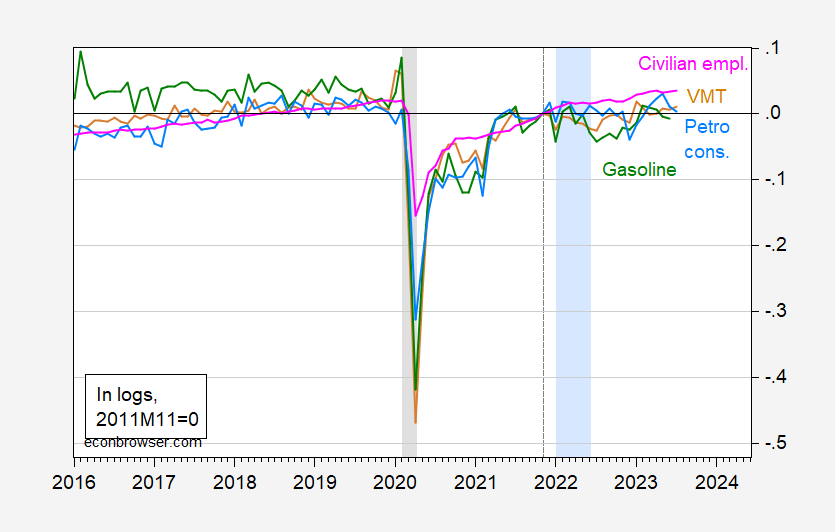

Here is a longer span of alternative indicators, to highlight the fact that using VMT, gasoline consumption or petroleum use, would suggest we have been and remain in a recession.

Figure 1: Civilian employment from CPS (pink, right log scale), Vehicle Miles Traveled (tan, right log scale), Petroleum Consumption seasonally adjusted by author using Census X13/X11 ARIMA (light blue, right log scale), and Gasoline Supplied s.a. by author (green, right log scale), all 2021M11=0. NBER defined peak-to-trough recession dates shaded gray. Hypothetical 2022H1 recession dates shaded light blue. Source: NHTSA, EIA via FRED, EIA STEO, NBER and author’s calculations.

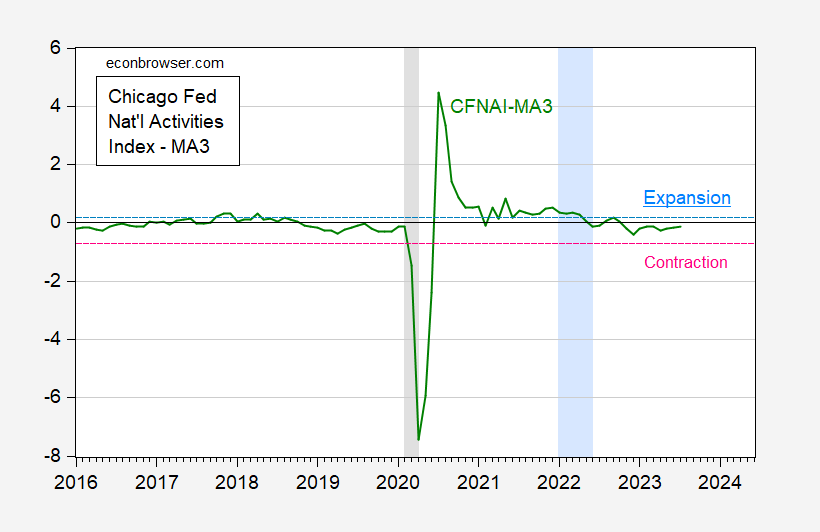

This is in contrast to other conventional indicators, such as the Chicago Fed National Activity Index. I plot CFNAI MA3 over the same time period as Figure 1 below, to show the contrasting evolution. Note that the CFNAI MA3 did not breach the contraction threshold in the hypothetical 2022H1 period.

Figure 2: CFNAI-MA3. If in expansion, coming from above and falling below pink line, then entering recession. If in recession and coming from below and rising above light blue line, then entering expansion. NBER defined peak-to-trough recession dates shaded gray. Hypothetical 2022H1 recession dates shaded light blue. Source: Chicago Fed via FRED, NBER.

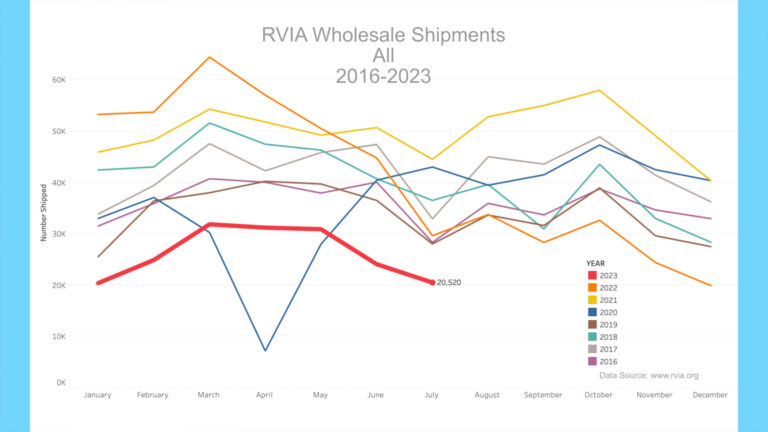

While I haven’t found SPAM sales numbers over time, I did find monthly RV sales. Note that the first half of 2022 (actually through May) was a bumper year in sales, exceed record amounts in 2021 – for obvious reasons.

Source: Marucci (2023). Data through July 2023.

Now, if one wanted to infer incipient recession from the rapidly declining RV sales, one could make a reasonable argument (see my 2019 post on using RV sales to predict recessions). However, I would say that the distortions associated with the pandemic make that a dangerous proposition.

In sum: If you still think the 2022H1 recession call was reasonable, then I have a bridge in NY to sell you.

“If you still think the 2022H1 recession call was reasonable, then I have a bridge in NY to sell you.”

Speaking of NYC, Met fans who follow Steve’s blog are looking for their appearance in the 2023 World Series.

We are constantly being told about how bad things are getting in China: “A Perfect Storm: Does China’s EV Dominance Threaten European Auto Makers on their Home Turf?” https://www.juancole.com/2023/09/dominance-threaten-european.html Oops…maybe that storm is really good news for China…

But what’s curious is that there is little attention given here to how bad things are in Europe!

“French consumers forced to cut back on essentials, Carrefour CEO warns” https://www.reuters.com/business/retail-consumer/french-consumers-massively-cutting-essential-purchases-carrefour-ceo-warns-2023-08-29/

“Germany’s economy hasn’t looked this weak since the start of the pandemic”

https://www.cnn.com/2023/08/23/economy/germany-economy-recession-pmi/index.html

“The UK economy is set to flatline for the next six months, but it will ‘feel a lot’ like a full-blown recession for millions.”

https://www.cnn.com/2023/08/23/economy/germany-economy-recession-pmi/index.html

I noticed years ago that the esteemed mainstream media used to love to cover stories about how bad things were in Cuba, but conveniently ignored how bad things were in capitalist paradises in Central America and the Caribbean!

Well, it may just be coincidence, but there does seem to be a pattern of hyping the travails of countries that Uncle Sam doesn’t like while overlooking those of its allies.

It’s really entertaining to watch Johnny try to make a point. Here, for instance, Johnny claims “But what’s curious is that there is little attention given here to how bad things are in Europe!”

Then he goes on to disprove his own claim by citing Reuters and CNN about how bad things are in Europe. Very clever, little Johnny.

Incoherence is nothing new from Johnny, but let’s have a look, anyhow. So, his comment starts with how bad things are in China, then veers into China’s aspirations in Europe’s electric vehicle market. Do those aspirations tell us anythingabputhowbad things are in China. No, they do not. Score one for incoherence.

“But what’s curious is that there is little attention given here to how bad things are in Europe!” Anything to do with China or EVs? No. Score two for incoherence.

This is where Johnny disproves his own assertion that there is little attention to Europe’s troubles. Scorethree for incoherence.

Then, Johnny tells us he noticed something. Well howdy do! That must mean Johnny is very, very clever and has discovered something very, very important, yes? Like when he discovered that there is no official U.S. government series in median real weekly income. Like when he discovered that econo.ists don’t care about income distribution. Like when he discovered that Ukraine dragged Russia kicking and screaming into invading Ukraine, murdering, torturing and raping civilians, kidnapping children and interfering with global food supplies.

So maybe that’s the point of all this incoherence. If Johnny put any effort into making sense, he’d be unable to defend Putin’s war in Ukraine.

It’s always good, as much as time allows, to keep your reading habits, over as broad a spectrum of quality sources as you can manage. And JohnH, as tempting as it is to take swings at you, I DO think, you can manage that:

https://www.ft.com/content/74361917-ae03-436d-9d1f-87fa2e239f47

“We are constantly being told about how bad things are getting in China”

By whom? Oh yea – everyone of Paul Krugman’s NYTimes opeds. Dude – when you open a comment with such an absurd sentence, we know the rest of it is your usual waste of time.

CNN, Reuters, and a Middle East religious Historian walk into a bar.

Which one has a clue about China?

Which one was cited as the China authority, above?

(The concerns about China may, or may not, be valid. The source does nothing to aid in determining validity.)

JohnH I’m a little confused. On the one hand you said that no one is talking about how bad things are in France, Germany and Britain; but then you seemed to contradict that very claim by posting links from Reuters and CNN that were all about the weaknesses of those three economies. In any event, my sense is that most mainstream economists have been wary of the French, German and (especially) British economic policies. Brexit is a good example of how Britain ignored sound macroeconomics and fell for media jingoism. Murdoch media outlets never lost money underestimating the intelligence of its readers and viewers.

JH’s babblings are easily condensed:

Ukraine Bad

Russia Good

China Good

Europe Bad NATO BAaaaaD

USA BadGovernment REALLY BAD

EV. Goooood (But only those made in China….USA EV Bad)

Economists BAD…..Oooo Really SUPER BAD

Median Wage Badddd (see data on GDPNIWEEKLY FACTORRIP last week)

Mainstream Media Bad (this week anyway)

War Bad , Costly, Pointless, Futile (but not in Ukraine since Russia Good and only protecting its borders)

Biden You need to ask?

Putin Beloved peace seeker who wants nothing more than restoration of Soviet empire

Nuclear Weapons BAAAD (except for Russia’s necessary to maintain world peace)

JohnH Charismatic blogger without whom there would no knowledge of real economics, history, geopolitics

“JohnH Charismatic blogger without whom there would no” – opportunity to debunk a huge number of idiotic right wing narratives – and having a little fun while doing it. I know there are others here, but JohnH takes the crown for right wing babbling.

best summary i have seen in quite a while. johnny usually goes quiet when he gets so directly taken down.

Menzie, as I have stated here ad nauseam, as my Dad had his Master’s in Education, and hit my sister and me with a sledgehammer up the side of the head for 20+ years on the importance of a good education (which I think for the most part in my Dad’s mind meant “institutional” education, “higher education”, choose your descriptor) he had a big influence on my thinking (sometimes I think he effects my thoughts more so after he died than when he was living, as his voice/thoughts/statements seem to “invade” my head.

This is the long way to say my Dad was funny in some aspects, in that he also enjoyed things such as “The Old Farmer’s Almanac” and other things which might be referred to as “quaint”. Every year I go to the supermarket newsstand to pick up The Old Farmer’s Almanac and pretty much read it cover to cover, because I think if my Dad was still alive, he would read through the greater portion of it. And I realize some people will think it’s dorky that I say this, but I greatly enjoyed the RV portion of this post—correlated to recessions or not, it’s fun to read and think about. Just like pretzels and beer is fun in Economics hypotheticals. It’s just fun because it’s just fun.

Off topic, fiscal dominance in exchange rate determination –

When credibility is not enough: Fiscal dominance, monetary policy, and exchange rates in early modern Venice

Donato Masciandaro Davide Romelli Stefano Ugolini / 11 Sep 2023

“While many studies have been devoted to the impact of fiscal dominance on inflation, much less attention has been dedicated to its impact on exchange rates. This column focuses on an early and unique experiment of freely floating state-issued money, conducted in Venice from 1619 to 1666. It shows that the monetisation of fiscal deficits had a notable impact on the external value of the domestic currency even if the government had a well-established reputation for maintaining a Ricardian behaviour in the long run. This suggests that institutional design does matter in determining the international credibility of a currency.”

https://cepr.org/voxeu/columns/when-credibility-not-enough-fiscal-dominance-monetary-policy-and-exchange-rates-early

One lesson I take from studies such as this one is the importance of short-term factors. I remember hearing pretty relentlessly the idea that borrowing is the bridge between short and long-run outcomes. In a frictionless, full-information world, that’s a pretty good point. In a world in which agents are unreliable, liquidity is unreliable and rules change, borrowing is an unreliable bridge to the long run. So long-run Ricardian behavior is not enough to protect exchange rates from short-term fiscal wobbles.

I’d note, Menzie, that the US budget deficit looks to come in at $2 trn for FY 2023, up $1 trn from FY 22, representing an incremental stimulus of about 3%+ of GDP, and a deficit of 7.6% of GDP. Eye-popping numbers.

https://www.yahoo.com/news/federal-budget-deficit-set-double-030000373.html

https://thehill.com/business/4186670-us-deficit-is-projected-to-roughly-double-this-year-watchdog/

https://www.npr.org/2023/07/13/1187540763/budget-federal-deficit-nationa-debt-ceiling

https://countrycassette.com/united-states-gdp/#:~:text=The%20Gross%20Domestic%20Product%20%28GDP%29%20in%20the%20United,%2426.695%20trillion%20a%20%241.34%20trillion%20increase%20from%202022.

GDP subtracting government deficit may be an interesting parameter – but how would it be meaningful.

U.S. Sen. Mike Lee called the jump “unprecedented,” in a statement to Deseret News.

Was Mike Lee asleep the entire Trump’s Presidency or what? Like he’s not as stupid as Princeton Steve but damn!

This never seemed to phase you during donald trump’s tax cuts. I don’t suppose you remember who was the President of the United Sates in Q2 of 2020??

https://fred.stlouisfed.org/series/GFDEBTN

“Eye-popping numbers.”

what did you expect after the trump tax cuts? this is self inflicted. that deficit probably would have been even bigger if trump had been reelected. do you really believe he would have cut spending more?

I am no Trump fan.

that did not answer the question. if trump had been reelected, what would you have expected that deficit to be? do you really believe he would have cut spending more than Biden? do you really believe trump had a plan to reduce the deficit? surely you joke.

But you are a fanboy of Hungary’s version of Trump.

If federal budget deficits are a concern for you – you should never vote GOP – because since Reagan every Republican admin has increased the deficit enormously – while every Dem admin has practiced responsible governance and worked to reduce the deficit. Remember the famous GOP motto “deficits don’t matter” when the GOP is in charge. Also if Trump gets back in WH prepare yourself for a massive deficit increase https://www.washingtonpost.com/business/2023/09/11/trump-tax-cuts-2024/ Along with the GOP plans to ensure the IRS has no oversight of their wealthy donors https://news.yahoo.com/heres-why-the-house-gop-made-defunding-the-irs-its-first-priority-123223299.html

Dude we have been over this before. The change in the deficit is not fiscal stimulus if it comes from a weakening of aggregate demand. You keep telling us that we are in a recession so in your little world this has to be a possibility.

Look we get you never learned basic macroeconomics. We have asked you to read E. Cary Brown’s 1954 AER paper.

Until you do so – SHUT UP! Your stupidity has become beyond annoying.

Oil is now approaching $90/barrel. If it continues to rise, we should reasonably expect gasoline prices to follow suit. That should reduce vehicle miles traveled. But isn’t there the possibility that it will have an impact on other prices and increase the rate of inflation? Perhaps we won’t see enough of an impact to move the US into a full blown recession, but it could keep economic growth tepid.

https://finance.yahoo.com/quote/CL%3DF?p=CL%3DF

https://www.bloomberg.com/news/newsletters/2023-09-12/oil-rally-stokes-inflation-risk-sowing-doubt-on-when-fed-can-stop-hikes

Kelly Anne Conway must have called you recently. Hey Bruce – when was the last time inflation exceeded your 13%?

??? My 13%. Please advise where I can purchase some of what you are using.

Oh, wait, that was an intentional non sequitur from you. Got it.