Coming tomorrow morning – the revisions to GDP over the last five years incorporating lots of new source data may change substantially our understanding of the evolution of economic activity (discussion by Claudia Sahm) (in contrast, last year’s annual revisions didn’t really change the outlook).

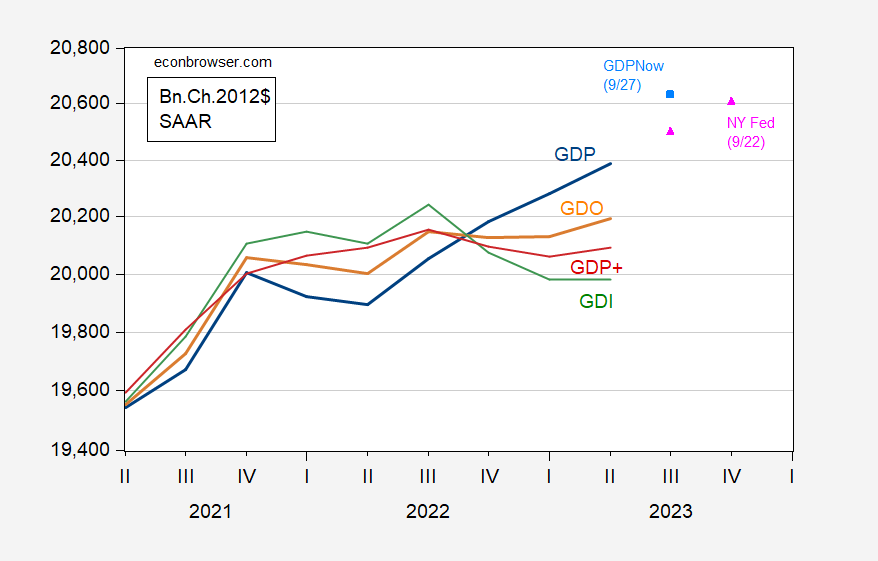

Here’s what we know about GDP, GDO, GDI and GDP+, as well as nowcasts of GDP.

Figure 1: GDP (blue), GDI (green), GDO (orange), GDP+ (red), GDPNow (sky blue square), NY Fed nowcast (pink triangle), all in billions Ch.2012$ SAAR. Level of GDP+ based upon 2019Q4 GDP level. Source: BEA 2023Q2 2nd release, Philadelphia Fed, Atlanta Fed (9/27), and NY Fed (9/22), and author’s calculations.

If GDP is revised down, the nowcasts can be thought of being pulled down (while the growth rate from 2023Q2 to 2023Q3 is unchanged, as the GDP nowcasts are couched in growth rates).

Will GDP likely be revised down? As documented by CEA (2015) and Nalewaik and Braun (BPEA, 2011), this is a likely outcome, with GDP reverting more to GDO than otherwise. For the most recent quarters, GDI growth is more apt to be growth rate of GDP post-revision.

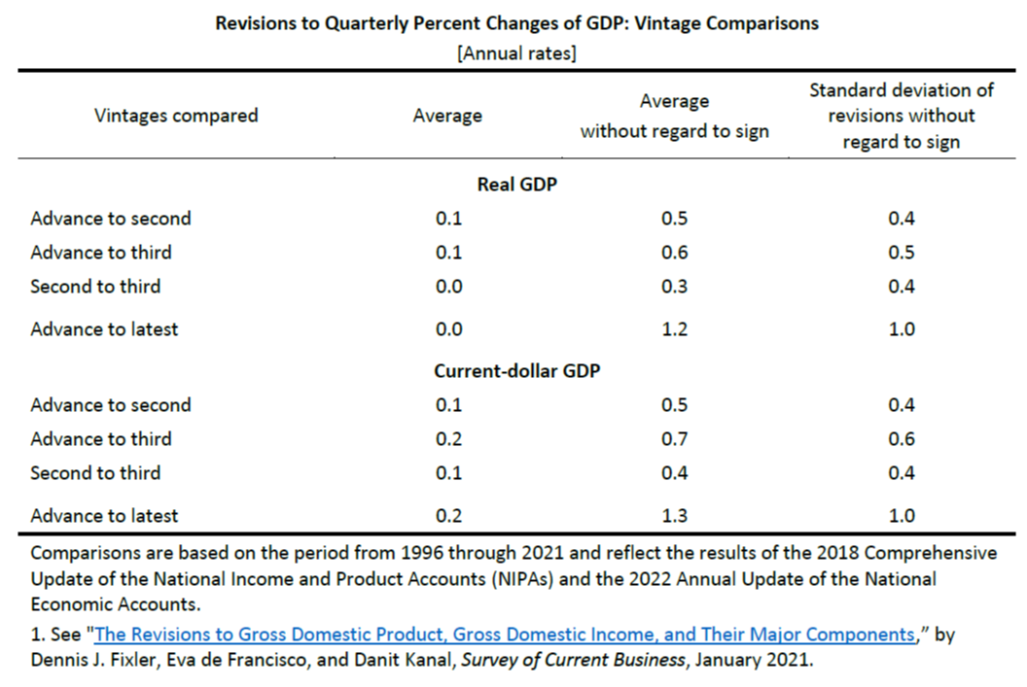

BEA (2022) reports the size of revisions from advance to final vintages.

Source: BEA (2022).

Interestingly, pre-revision growth rates do not appear to be biased, relative to final estimates. However, the RMSE is 1% (MAE is 1.2%). So, even without taking a stand on direction, one can say big changes are not unlikely (which is why the NBER Business Cycle Dating Committee does not put primary reliance on GDP — see 2001 recession).

So the statistical discrepancy is still large. Not as large, but large. So yeah, changes weren’t big enough to clear up the discrepancy.

Very entertaining after the Sahm melodrama:

https://www.bea.gov/news/2023/gross-domestic-product-third-estimate-corporate-profits-revised-estimate-second-quarter

It turns out, after checking from a different satellite angle, the Earth is still round. Now…… [ snicker snicker ] if Claudia Sahm might like to explain other, less dithering reasons raising interest rates didn’t lessen inflation as much as her Fed frat brothers and Larry Summers have wet dreams about every night, I’d love a second round of Sahm comedy.

“Profits of domestic financial corporations decreased $54.2 billion in the second quarter, a downward revision of $6.3 billion from the previous estimate. Profits of domestic nonfinancial corporations increased $39.0 billion, an upward revision of $21.9 billion. Rest-of-the-world profits increased $22.1 billion, an upward revision of $1.9 billion. In the second quarter, receipts increased $25.8 billion, and payments increased $3.7 billion.”

So the collapse of profits in the 2nd quarter (that little Jonny boy never noticed) was not as bad as previously reported but those damn banks got hit hard.

Here is the best summary of the BEA GDP updates I have found so far. Maybe Sahm had mentioned this in her rundown, I don’t remember. Certainly helpful in the acronyms dept. if nothing else:

https://apps.bea.gov/scb/issues/2023/06-june/0623-nea-preview.htm