CROWE and Young America’s Foundation are bringing Arthur Laffer to speak at UW Madison today (Grainger Hall, Plenary Room, 5:30-6:30 CT). The timing is fortuitous, as the state Senate is moving forward on passing AB386, which would exempt some portion of retiree income from taxes (up to 100K for single filers, 150K for married filing jointly), and drop the tax rate.

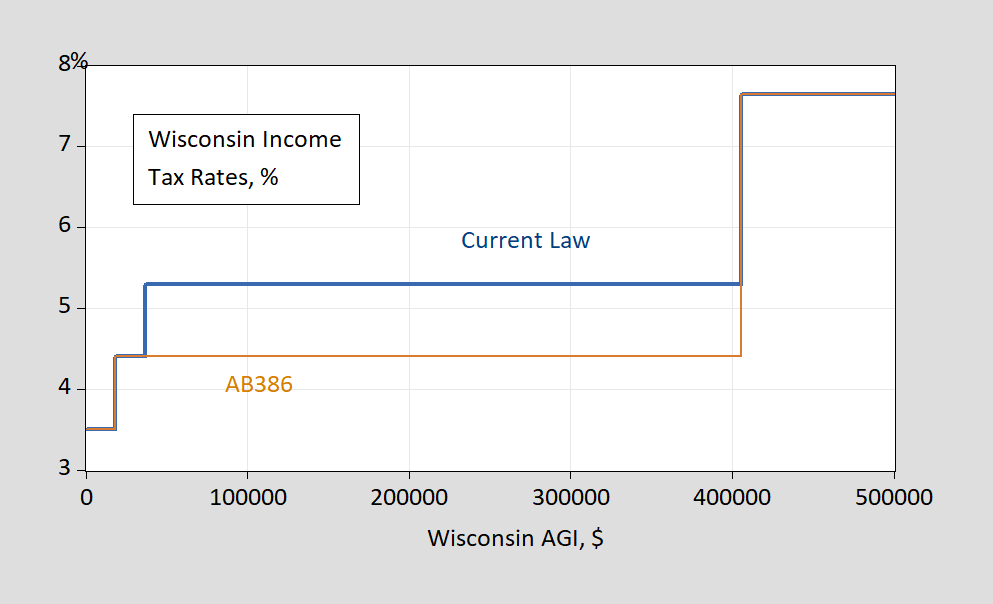

Figure 1: Wisconsin marginal income tax rates, current law (blue), and under AB386 (tan), for married, filing jointly.

I’m sure some people are saying this would jump start the economy and increase tax revenue. The Wisconsin Legislative Fiscal Bureau (the state level counterpart to CBO on this issue) says no to the latter (see page 4 of this document).

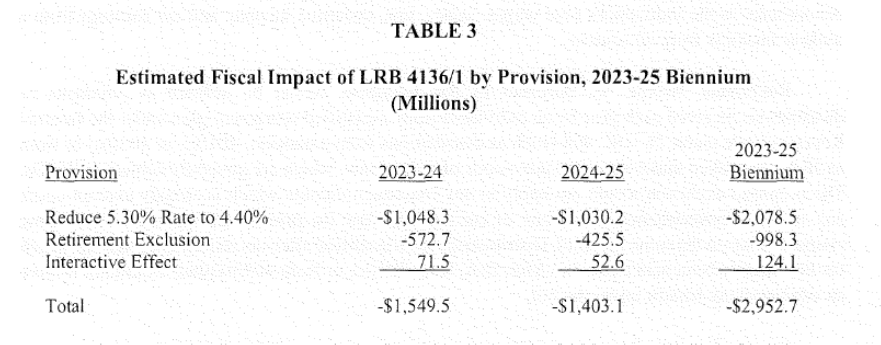

The bill is estimated to reduce individual income tax collections by $1,549.5 million in 2023-24 and $1,403.1 million in 2024-25. This estimate, and the attached distributional tables, are based on a simulation by DOR.

Table 3 displays the fiscal estimate of the bill for each year of the 2023-25 biennium. As shown, the estimates include an interactive effect, which may occur when multiple tax law changes impact an individual’s tax liability. The estimates for 2023-24 also include one-time revenue impacts, which result from differences in timing between the state fiscal year and the tax year.

Two thirds of the cost would be due to the tax rate reductions.

Source: LFB via Joint Finance Committee.

Guo, Ruhl and Seshadri (2023) of CROWE present estimates of gains from select tax rate reductions. Output, employment, capital stock all increase, but overall tax revenue (corporate, sales, income) decreases in their analysis (none of their scenarios match the proposal in AB386, though).

For point of comparison, in the same scenario (2% rate on lowest two tax brackets, 4.5% on highest two), Guo et al. (2023), using a general equilibrium model, find a 13.53% reduction in overall tax revenue in the long run. This compares to a 23.5% reduction in the LFB analysis which does not include long run responses.

“I’m sure some people are saying this would jump start the economy and increase tax revenue.”

Well some of old farts may have to return to the work force if President Nikki Haley raises the retirement age to 70. MAGA.

From Politico, some time back:

https://www.politico.com/news/magazine/2023/03/01/social-security-cut-401ks-00084730

Those who can afford to save for retirement already have tax advantaged schemes. Wisconsin is arguing over whether they should get even more advantages. Why not use the money that AB386 would give to the alreadybetter off and give it to the not better off. I’m sure we could make a “good for the economy” argument.

this is quite accurate. anybody who is making $150k as a retiree in the future, is doing so through a significant 401k bankroll. pensions are a small part going forward. and some folks, like myself, in the future will be sitting on large Roth accounts that will further distort this tax issue. if you drop the limits a bit, the argument may be better economically. but at $150k, this is really meant to be a tax break for the wealthy. and the poor will suffer, not because of a tax break, but because social services will be gutted to handle the shortfall in tax revenue.

Off topic, Deutsche Bank is down in overnight trade –

I don’t know if DB is still heavily exposed to Trump. It does seem likely that anyone who has lent money to Trump may not get it all back after his NY tax bill is settled. The timing of the DB slide doesn’t match very well with the court announcement. Anyone know anything?

Great catch and interesting question. And the DB–trump link is not too “X-files-ie” in nature (seriously). You got my curiosity up. I’m a night owl, I’ll do some pecking online. Not apt to be fruitful as this is apt to be buried deep, but you never know. I’ll give it “the old college try”.

This AXIOS story is the first one seemed to possibly answer the question:

“At least one of the Deutsche Bank loans—a $125 million credit for the Doral property—was refinanced by Axos Bank, a San Diego-based lender, in May 2022. Since the Trump Organization paid $295 million of what it owes to Deutsche, the German bank now only holds $45 million in Trump associated debt, according to the NYAG’s filing. NYAG estimates that Trump saved between $85 million and $150 million in interest rate savings because of the misleading statements.”

If we can trust the accuracy of the numbers quoted (I have 75%–80% confidence the numbers are right) $45 million wouldn’t be enough to really hit the DB stock that hard I don’t think. Then the next question to pop into mind would be, what about others in the trump orbit that might be affected by the court ruling?? Could Kushner be hit hard and he might still have money parked at DB or loans?? It seems DB would have probably washed their hands of Kushner at the same time they washed their hands of donald trump

https://www.nytimes.com/2021/02/03/business/rosemary-vrablic-trump-kushner-deutsche.html

Many thanks. That answers my question. Well, my DB question.

Axos Bank?

Axos shares roughly $48 dollars a share late July to 37 now. Seems like a significant drop to me. But if the two are connected I do not know. The charges were announced much earlier than late July, so I would think the damage had already been done. When I was active in the markets I used to try and do these things by book value type principles, but that doesn’t seem to hold water with “Mr. Market” anymore.

Maybe Axos has first “dibs” on the liquidation of the New York State properties when trump defaults on the loans, and the damage to Axos would be minimized. If they knew DB was giving trump the bottom of their boot, it’s a good bet that had strong covenants in the loan papers. Those bankers are not like the MAGA folks sending away for their red dunce caps. But then again, if donald trump has taxes in arrears on fraudulently attained income I can’t imagine New York State letting Axos run off with the goodies either.

All of that above is just guesses from a guy who only managed to get his bachelor’s. So……

A government so small “I can drag it into the bathroom and drown it in the bathtub”.

This could be your real chance to finally brush up against economic celebrity Menzie!!!!

[ I think you must know by now how much I hate the man, probably hate him more than you do, maybe you just dislike him (??), but mine is pure hate. So you should know I mean the above as ironic humor, a bro shoulder punch there Menzie ]

Moses Herzog: Already met him. In 1982.

Interview in Harvard International Review

I see it was so “eventful” for you you even remembered the year. You made me sardonically chuckle anyway. “Showoff!!!” Hahahaha. You were the little prodigy weren’t you?? Should have known when Frankel took an interest in you aye?? Great Profs always perceive the standouts.

Did you need extra Pepto Bismol that fateful 1982 day?? ‘Cuz I sure as heck would have if the police didn’t cart me off after trying to ring his neck.

“ART LAFFER: It’s just plain economics, whenever you redistribute income you reduce total income and that is what he’s doing and I am very afraid that if he were elected we would have an enormous crash in the market. Now, that crash would come in anticipation of his election, but it’s much like Obama, who I believe was the reason why we had the Great Recession. As he got closer and closer to winning the markets collapsed.”

Is that Uber Rational Expectations or what? Now the statement that redistributing income necessarily lowers it is a bit odd from someone who pushed for Reagan’s massive tax cut for the rich in 1981. Yea income in that case did fall but Laffer had told us it would create the greatest economic miracle ever.

A chart of the S&P 500 would be interesting in light of what Laffer said about Obama causing the Great Recession. His “logic” went something like Obama would lead to a stock market crash. Correct me if I’m wrong but the S&P 500 started tanking in the fall of 2007 but started recovering a few weeks after Obama became President.

The actual bottom was Feb. 2009, so yes. The drop started in Oct. 2007.

It’s interesting how GOP spin works. Reagan blamed the 1982 on Jimmy Carter. The Great Recession started late 2007 which of course was Obama’s doing!