Today, we’re fortunate to have Willem Thorbecke, Senior Fellow at Japan’s Research Institute of Economy, Trade and Industry (RIETI) as a guest contributor. The views expressed represent those of the author himself, and do not necessarily represent those of RIETI, or any other institutions the author is affiliated with.

Large Exchange Rate Appreciations

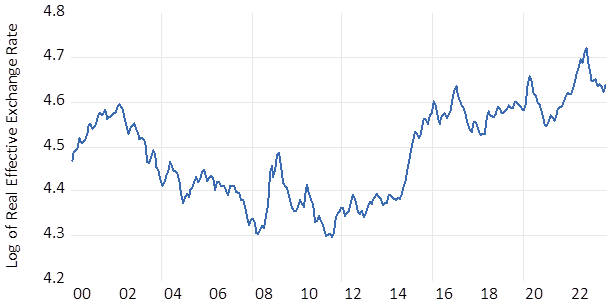

Exchange rates can appreciate substantially. The U.S. real effective exchange rate (REER) appreciated 34% between July 2011 and September 2023 (see Figure 1).[1] The Swiss REER appreciated 36% between October 2007 and September 2011. The Japanese REER appreciated 38% between July 2007 and January 2012. The British REER appreciated 27% between January 2009 and August 2015.

Figure 1: U.S. Real Effective Exchange Rate. Source: Bank for International Settlements.

Large appreciations erode the price competitiveness of exports and cause dislocation. The Swiss National Bank responded to the appreciation in September 2011 by setting a floor for the Swiss franc relative to the euro. The yen appreciation decimated the Japanese electronics industry. The pound appreciation crowded out the British manufacturing sector (see Krugman, 2016 and Mody, 2016).

Exchange Rate Elasticities and Product Complexity

How can countries protect themselves from the harmful effects of appreciations on exports? One way would be to produce goods that are less sensitive to exchange rates. Abiad et al. (2018) and Asia Development Bank (2018) noted that sophisticated goods are harder to produce. There will thus be fewer substitutes for these goods and customers will need to spend more time and effort to find replacements. When there are fewer substitutes, microeconomic theory teaches us that price elasticities will be lower. Thus exports of complex products may be less sensitive to exchange rates.

Abiad et al.(2018) and Asia Development Bank (2018) recommended measuring product complexity using the methods of Hidalgo and Hausmann (2009). Hidalgo and Hausmann employed the method of reflections to calculate a product’s complexity. This approach takes account of how ubiquitous a good is, as measured by the number of countries that have a revealed comparative advantage in exporting the good. This method also takes account of how diversified an economy is, as measured by the number of goods that the economy exports with revealed comparative advantage. Hidalgo and Hausmann used an iterative process involving product ubiquity and economy diversification to derive a product complexity index (PCI) for more than 1,200 products disaggregated at the Harmonized System (HS) 4-digit level.

Arbatli and Hong (2016) employed Hidalgo and Hausmann’s (2009) PCI to investigate whether more sophisticated exports from Singapore have lower exchange rate elasticities. They used annual data disaggregated at the HS 4-digit level over the 1989 to 2013 period. They also used a mean group estimator and found that products that are more complex are less responsive to exchange rates.

Sauré (2015) investigated how exchange rates impact Switzerland’s trade in pharmaceutical and non-pharmaceutical goods. Pharmaceutical goods are sophisticated and require extensive research and development. He employed annual panel data on Switzerland’s trade with 24 partners over the 1988–2007 period. He used Arellano-Bond estimation and reported that an appreciation of the Swiss franc had no impact on Switzerland’s trade balance in pharmaceutical goods but lowered Switzerland’s trade balance in non-pharmaceutical goods.

Baiardi et al. (2015) examined price elasticities for clothing. Clothing is a low-technology good produced by many countries. They used annual data over the 1992-2011 period on clothing exports from 12 countries disaggregated into 4-digit Standard Industrial Trade Classification categories. They measured relative prices as the ratio of the country’s export unit value for each 4-digit clothing category to the average export unit value for the other 11 exporters of the same good. They employed system generalized method of moments techniques and found that price increases decreased exports for 11 of the 12 countries. On average, a 10% increase in relative prices for these countries would reduce clothing exports by 7.5%.

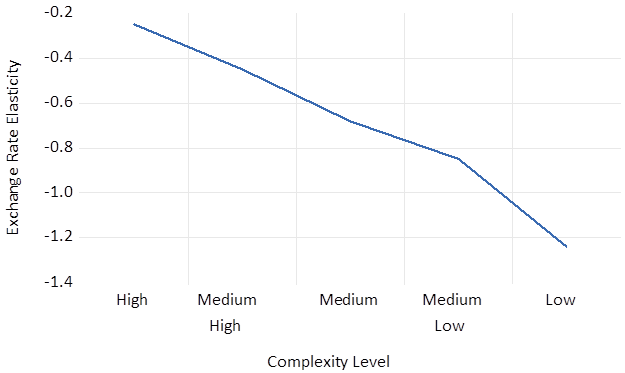

Previous research thus indicates that sophisticated exports such as pharmaceuticals are not affected by exchange rates and while basic products such as clothing are. In recent work (Thorbecke et al., 2021 and Chen et al., 2023), we investigated the relationship between product complexity as measured by Hidalgo and Hausmann’s (2009) method and exchange rate elasticities for China, the world’s leading exporter. We used Bénassy-Quéré et al.’s (2021) approach to estimate exchange rate elasticities. Thorbecke et al. examined China’s exports of 960 manufactured goods disaggregated at the HS 4-digit level to 190 partners over the 1995-2018 period. They reported that a 10% appreciation of the Chinese yuan causes a fall in exports of 2.5% for the most sophisticated exports, 4.5% for medium-high sophisticated exports, 6.8% for medium sophisticated exports, 8.5% for medium-low sophisticated exports, and 12.4% for the least sophisticated exports (see Figure 2). Chen et al. examined China’s exports of 1,242 goods disaggregated at the HS 4-digit level to 190 partners over the 1995-2018 period. They found that appreciations significantly reduced exports during the 1990s and early 2000s. However, as China has upgraded its production capabilities and exported more technologically advanced products, its exchange rate elasticities have fallen.

Figure 2: The Relationship between Exchange Rate Elasticities and Product Complexity for China’s Exports. Notes: Real exchange rate elasticities are estimated for China’s exports of 960 manufacturing goods disaggregated at the Harmonized System 4-digit level to 190 countries over the 1995-2018 period. The 960 categories are sorted into five levels of complexity using the methodology of Hidalgo and Hausmann (2009). The exchange rate is interacted with dummy variables for complexity levels. The regressors also include real GDP in the importing countries and importer-product and time fixed effects. Source: Calculations by the authors.

Lessons for the U.S.

For the appreciations mentioned in the opening paragraph, exchange rates subsequently depreciated for Switzerland, Japan, and Britain. The U.S. REER, however, remains strong. Recent estimates suggest that a strong U.S. dollar keeps steady state U.S. exports lower and the steady state U.S. trade deficit higher.

The Atlas of Economic Complexity reported that the ranking of the U.S. economy in terms of complexity has fallen eight places between 2000 and 2021 while the ranking of the Chinese economy has risen 21 places over this period. According to the Atlas, Japan, South Korea, and Singapore ranked among the top five most complex economies in the world in 2021. Historically the success of East Asian economies at climbing the technology ladder and producing sophisticated goods was driven by factors such as entrepreneurs who face appropriate incentives, workers who are hardworking and well-educated, fiscal policy that is disciplined, national saving rates that are high, infrastructure that is world class, and exchange rates that are not too strong. The U.S., to increase the complexity of its exports and to better weather periods of strong exchange rates, should take a page out of Asia’s playbook. It should also avoid policy mixes such as expansionary fiscal policy and contractionary monetary policy that produce large dollar appreciations.

References

Abiad, A., Baris, K., Bertulfo, D., Camingue-Romance, S., Feliciano, P., Mariasingham, J., Mercer-Blackman, V., and Bernabe, J. 2018. The Impact of Trade Conflict on Developing Asia. (Working Paper No. 566). Manila: Asian Development Bank.

Arbatli, E., and Hong, G. H. 2016. Singapore’s Export Elasticities: A Disaggregated Look into the Role of Global Value Chains and Economic Complexity (Working Paper No. 16–52). Washington, DC: International Monetary Fund.

Asian Development Bank. 2018. Asian Development Outlook Update: Maintaining Stability Amid Heightened Uncertainty. Manila: Asian Development Bank.

Baiardi, D., Bianchi, C., and Lorenzini, E.. 2015. The Price and Income Elasticities of the Top Clothing Exporters: Evidence from a Panel Data Analysis. Journal of Asian Economics 38: 14–30.

Bénassy-Quéré, A., Bussière, M., and Wibaux, P. 2021. Trade and Currency Weapons. Review of International Economics, 29: 487-510.

Chen, C., Salike, N., and Thorbecke, W. 2023. Exchange Rate Effects on China’s Exports: Product Sophistication and Exchange Rate Elasticity. Forthcoming in the Asian Economic Journal,

Hidalgo, C.A,and Hausmann, R. 2009. The Building Blocks of Economic Complexity. Proceedings of the National Academy of Sciences of the United States of America 106 (26): 10570–75.

Krugman, P. 2016. Notes on Brexit and the Pound. The Conscience of a Liberal Weblog, 11 October.

Mody, A. 2016. Don’t Believe What You’ve Read: The Plummeting Pound Sterling is Good News for Britain. Independent, 10 October.

Sauré, P. 2015. The Resilient Trade Surplus, the Pharmaceutical Sector, and Exchange Rate Assessments in Switzerland. (Working Papers No. 15-11). Washington DC: Peterson Institute for International Economics.

Thorbecke, W., Chen, C., and Salike, N. 2021. The Relationship between Product Complexity and Exchange Rate Elasticities: Evidence from the People’s Republic of China’s Manufacturing Industries. Asian Development Review, 38: 189-212.

[1] REER data come from the Bank for International Settlements.

This post written byby Willem Thorbecke.

“Abiad et al. (2018) and Asia Development Bank (2018) noted that sophisticated goods are harder to produce. There will thus be fewer substitutes for these goods and customers will need to spend more time and effort to find replacements. When there are fewer substitutes, microeconomic theory teaches us that price elasticities will be lower. Thus exports of complex products may be less sensitive to exchange rates.”

Makes sense. It takes a page from Joan Robinson and her work on monopolistic competition.

“It should also avoid policy mixes such as expansionary fiscal policy and contractionary monetary policy that produce large dollar appreciations.”

Yes – let’s avoid the early 1980’s toxic mix of Reagan fiscal stimulus and Volcker tight money. Oh wait – we had done that of late. Now I know Princeton Steve thinks this is “secular stagnation” but give me a break – Stevie is a moron.

“They reported that a 10% appreciation of the Chinese yuan causes a fall in exports of 2.5% for the most sophisticated exports, 4.5% for medium-high sophisticated exports, 6.8% for medium sophisticated exports, 8.5% for medium-low sophisticated exports, and 12.4% for the least sophisticated exports”

Takes me back to those 2018 Trump tariffs on Chinese exports. Not that Team Trump was sophisticated but I was wondering if this distinction sheds any light on the dumbest trade war ever.

Hi Menzie, Figure 1 and 2 are the same. Probably a typo.

Jamel: Thanks! Fixed now.

Bow, bow bow bow, bow bow, bow bow…… bow, bow bow bow, bow bow, bow bow

Will the Real EER please stand up, please stand up, please stand up.

Yup, that’s about as sophisticated as I get folks. I apologize.

As a review of literature, this is fine. The switch to policy prescription is a bit embarrassing. This is the “page out of Asia’s playbook” which is recommended:

“…such as entrepreneurs who face appropriate incentives, workers who are hardworking and well-educated, fiscal policy that is disciplined, national saving rates that are high, infrastructure that is world class, and exchange rates that are not too strong.”

The U.S. ought to just “have” a particular set of workers and a high saving rate and ought to adopt an undefined “appropriate” set of incentives. It ought to subordinate other monetary and fiscal policy objectives to moderating it’s exchange rate. And world-class infrastructure would be nice.

We’ll get right on that.

Nice to know State still has people like Josh Paul:

https://www.politico.com/news/magazine/2023/10/20/josh-paul-israel-civilians-00122716

Had. Had people like Josh Paul.

Paul is part of an honorable, though sad, tradition. I knew John Kiesling in the days before he resigned from State in opposition to the second Iraq war.

It’s in the culture of civil servants, including diplomats, to carry out the policies of the government they serve, even when they don’t agree with the policy – until they no longer can.

When resignations begin, it should set off alarm bells. It means professionals who have dedicated themselves to service of country cannot see their way clear to support a policy, because they believe that policy does not serve their country. This country came to realize that John Kiesling was right about the second Iraq war, even though most don’t know or remember who John is. It seems to me very likely that we will look back and realize that Josh Paul is also right.

A horrible thing is happening in Gaza, and is about to get worse. I cannot see how any good will come of it. I fear we in the U.S. will look back and realize our part in it was a terrible mistake. There are other means than war and death to secure Israel’s safety.

I am going to read this Josh Paul thing, even if I do it next week. But when someone says they knew someone (not “knew of” but knew) in State Dept, then I become very curious who they are. And I should tell on myself , and say, I think my “EQ” is very low for someone my age, but my IQ is slightly above average. And I figured out who pgl is. And I don’t think anyone but possibly Menzie knew, and possibly Rosser (but I don’t think they told Rosser who they are either) And didn’t “tell on” pgl (nor would I ever) out of respect of their anonymity. And if I “figured out” who you are I wouldn’t tell on you either. But now I am getting very curious.

I’m nobody.

https://poets.org/poem/im-nobody-who-are-you-260

Modestly always scores high with me, but I’m going to take that statement with a healthy dose of skepticism on the accuracy.

I did enjoy the old school poetry though. Old poetry and old words are kinda like those old books in the library with the glorious smell to them. Hard to put into words but kind of a good musky smell.

I think for quiet awhile now, the Israel strategy has been “If we make Palestinians death count many multiples larger than our death count, then that will act as a deterrent. But what happens when guys like Netanyahu do that, is, you destroy Palestinian families that have very little to do with the terrorism. And those families have children whose lives are decimated by random Israeli strikes. So the murder of regular Palestinian citizens verifies (in Palestinian children’s minds) what they have been told about Israelis by some adult Palestinians. And if your parents are indiscriminately murdered by “race X” or “cultural group X” is the typical person going to be “neutral” towards them?? i.e. Could maybe the typical educated German person maybe understand why some older Jews hate Germans?? I would say—yes, it is “understandable” older Jews would hate Germans. What do the Israelis think they are baking into the cake (decades from now) when they just bomb the hell out of regular citizen Palestinians?? Guys like Netanyahu love it being baked into the cake, because he gets on the podium and says all donald trump puffed out chest “I….. I…. am the ONLY leader who can save Jews from these ‘animals’!!!!!” But if you are an Israeli living in Israel 20–30 years from now, what has creating an ENTIRE generation/generationS of Palestinians who hate you because Netanyahu murdered large segments of their family~~what has that done to help Israelis safety???

I would propose to Israelis that Netanyahu has made your safety vacant among his list of personal goals.

There’s this:

https://www.politico.eu/article/benjamin-netanyahu-israel-survivors-of-kibbutz-attack-turn-their-ire/

Bibi, by dividing Israeli society through a naked grab for power over the courts and a naked land grab in the West Bank, by busying Israeli intelligence resources with domestic political opposition, improved the odds of success for an attack by Hamas. By bringing anti-Palestinian activists into his cabinet, he invited attack.

All so Bibi could avoid prosecution? Nah. He really does hate Palestinians. Avoiding prosecution may have been his primary motive, but the way he chose to do it is pure war-mongering dumb-assery.

https://time.com/6322410/how-netanyahu-undermined-israel-security/

How Netanyahu Undermined Israel’s Security

Benjamin Netanyahu, the longest serving Israeli Prime Minister, has made sidelining and ignoring Palestinian demands for freedom and dignity his mantra and legacy. He has repeatedly formulated his policies around the idea that Israel can resolve the Arab-Israeli conflict and proceed to normalize relations with Arab countries without engaging with the Palestinians.

Turns out, Biden agrees that the Saudi/Israeli normalization effort was among the causes of the Hamas attack on Israel:

https://thehill.com/policy/international/4268454-biden-suggests-hamas-attack-related-increased-diplomacy-israel-saudi-arabia/

“Israel and Saudi Arabia have been coming closer to normalization in recent times, and Biden has been working to foster a relationship between the two.”

Is this the Abraham Accords devised by Trump and his son-in-law? The way Team Trump devised this – Palestinians would be left out in the cold. What could go wrong?

https://www.motherjones.com/politics/2023/10/gaza-israel-war-donald-trump-jared-kushner-abraham-accords/

Mother Jones has this so right.

“I Want Trump in Prison for the Rest of His Miserable Life”: Kenneth Chesebro Takes Plea Deal

https://www.msn.com/en-us/news/politics/i-want-trump-in-prison-for-the-rest-of-his-miserable-life-kenneth-chesebro-takes-plea-deal/ss-AA1iC9kJ?ocid=msedgdhp&pc=U531&cvid=6daf71cc26a74cf19614d91469a91378&ei=6

Now that is turning on the mob boss.

pgl: “Yes – let’s avoid the early 1980’s toxic mix of Reagan fiscal stimulus and Volcker tight money.”

I wonder why they never try the opposite, taxing the bejeebers out of the rich and lowering interest rates.

Other nations have done that but then they are not ruled by Mitch McConnell.

@pgl You’ve got an underrated sense of humor. You know why I “never ratted you out” on your real name?? I could do that, outside this blog, (would Menzie let it through?? ) I could let your name out on other economic blogs. You said really pretty mean things and cruel things about me (1/2 below what Rosser said) I let it go, probably because your humor. You’ve got a tinge of letterman sarcasm. That’s why I won’t rat you out. You should feel confident about that. I’m kinda a “bum” but I hold personal things as sacred.

Indeed, crediting austerity for sparking Canada’s 1990s growth ignores several factors: first, Canada benefited from strong US expansion, especially given the strength of export growth; greater integration through NAFTA only solidified how closely Canada followed the US boom of the mid- to late ’90s. Second, fiscal austerity was accompanied by an aggressive monetary loosening that resulted in low interest rates and a depreciation of the exchange rate; alongside more flexible labor policies, these improved profits, investment, and growth. Resource booms also played a role in driving wage growth and reducing unemployment in some regions.

https://jacobin.com/2015/04/canada-austerity-stephen-harper-conservatives/

@Menzie

Can you please tell us, how Professor Learner or Professor Leamer is doing now at UCLA?? Can you tell your dumbest commenter ever on Econbrowser if your colleague at UCLA is OK and healthy now?? Because we love Edward E. Leamer as a kind man and great teacher?? Thanks…… your favorite back of the room slacker student, by Prof Rosser’s reckoning~~ “Uncle Moze”

http://personal.anderson.ucla.edu/edward.leamer/

I trust he is doing well. He indeed kind and a great teacher.

“Let’s Take the Con Out of Econometrics,” American Economics Review, 73 (March 1983).

A true classic!