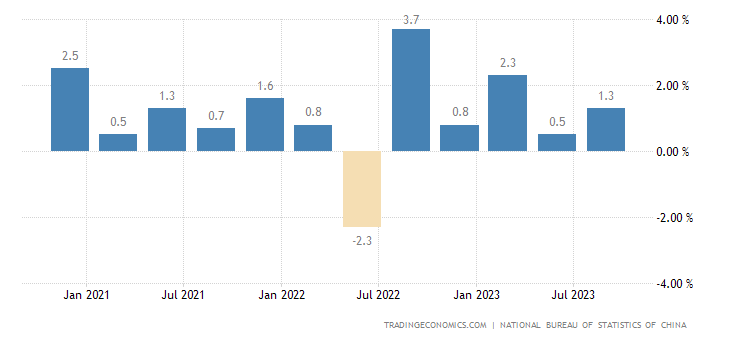

Q/Q was 1.3% vs. consensus 1%.

Source: TradingEconomics.

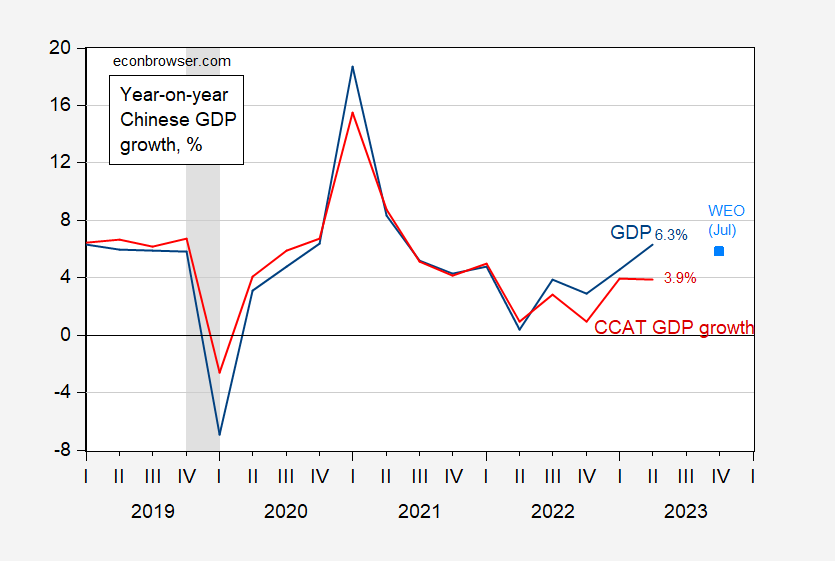

Some skepticism is warranted, given CCAT’s implied numbers for Q2 (on a year-on-year basis), discussed in this post:

Figure 2: Year-on-Year Chinese GDP growth (blue), and growth implied by China CAT (red), IMF WEO July forecast (sky blue square). ECRI defined peak-to-trough recession dates shaded gray. Source: NBS, personal communication, IMF WEO July update, ECRI and author’s calculations.

Natixis wrote yesterday:

Despite the encouraging momentum, three concerning factors are still at play. First, fixed asset investment in real estate continued to edge downward to -9.1% in September from -7.9% in June, posing concerns about the potential spillover effect on the sector, including local governments’ finances. Second, the CPI remains hovering around 0%, which signals stagnant demand. Third, China’s geopolitical relationship with the West remains a concern, especially after the US’ decision to tighten export controls on China.

Watching “Shoestring Hobo” on the YT, after taking 3 Melatonin to get a good sleep before a pain in the A day tomorrow. Shoestring evens me out. I’m probably going to have to wait to Monday to have some G-damned adult beverages. That puts Uncle Moses in a bad mood and the steam relief valve is about to pop. Getting tired of businesses don’t know how to act with customers. If Lowe’s don’t have it fixed by Saturday night I won’t buy so much as-uh spare Christmas light from these F-ers to the day I die, much less a new MIcrowave, which I was thinking about before they broke their word. They can have “Pro accounts” and make guys like me wait on hold half an hour all they like, they’re gonna lose out they treat the common man like chopped liver. They think they know what they’re doing by creating two tiers of customers and then shitting on the B-team. I got news for them. “Economist” magazine threatened my credit rating after I took a TRIAL subscription from them and cancelled it before the trial ended about 15 years ago. I still hate them and squat on them every chance I get. Economist magazine are like Kublai Khan and Marilyn Monroe to me now—-DEAD.

Do not overdose on Melatonin it can induce mental instability. The combination of anger and mental instability can led to environmental damage (damage in your immediate environment). Just take a deep breath and then another and then another, until you pass out.

Hahahaha, I hope this is friendly joking. 15 mg IS actually overdoing it. But mostly I do 5–10 mg, (maybe once very two weeks) when I want to make sure I’m well rested or doing “catch-up sleep”. The mental instability I was born with and I only knew two cures: alcohol and a Chinese chick who broke up with me in 2004 (?? hell if I know the year). Oh well. Alcohol never breaks up with you, that’s why I love it. It’s just me and Rebekah Rotgut from here on out.

Lowe’s FINALLY made things right. Loony 15 year tirade from Uncle Moses avoided. I was actually amazed at the last guy they sent to the house to make things right. Above and beyond the call. Although I have to state I think it probably had to do with that individual’s individual positive characteristics as a person than anything Lowe’s trained him.

Uncle Moses’ refrigerator worries have ended. Now he can go back to being the occasional drinking degenerate. His true happy space.

Fantastic – now no more popping those melatonins at triple doses (5 mg is already a little too high). You can google “melatonin side effects” its OK to pop a pill for a short period but don’t get addicted.

“fixed asset investment in real estate continued to edge downward to -9.1% in September from -7.9% in June”

Macroduck and Moses have been noting this concern. We have also seen a modest decline in fixed asset investment in real estate in the US even if JohnH keeps denying this were even possible.

http://www.worldgovernmentbonds.com/bond-historical-data/china/10-years/

I guess the good news is that China has been lowering its long term government bond rate. Not sure what is going on with mortgage rates in China.

@ pgl

I suppose a story from 2 months ago in China might well be argued to be the same as one from 10 years ago, but on shorthand check this is the best I could find:

https://www.ft.com/content/423ad0aa-9a47-4a02-a383-15f57e8bf3c4

If the paywall blocks you let me know and I’ll try to put a small snippet up here.

Cursed fire wall. The title says the text must be important.

@ pgl

More up-to-date data on China’s loan prime rates. They don’t want to lower the LPR at this particular juncture, and if they do, it would be by very small incremental amounts, such as 5 bps, vs America’s liking for quarter point pp moves.

https://www.reuters.com/markets/rates-bonds/china-expected-leave-benchmark-loan-rates-unchanged-monthly-fix-poll-2023-10-19/

Here’s an interesting little report from Marketplace:

https://www.marketplace.org/2023/10/19/unemployment-just-hit-an-even-lower-low/

New jobless claims down, existing claims up. So if you look only at the headline new claims number, and think oh-so simplistically, you might declare “rate hikes aren’t slowing hiring”. But that would be wrong. A tight labor market is discouraging layoffs, but the lengthening period of unemoyment for those already laid off suggests slower hiring.

JOLTS hires data show the same thing:

https://fred.stlouisfed.org/series/JTSHIL

In case anyone was inclined to declare that high interest rates don’t affect the labor market. Especially if that person was in the habit of declaring that economists don’t care about labor market issues.

Continued claims are not up by very much and are still lower than even back in April 2023. Things may be slowing, but it’s hard to get that from continued claims.

https://fred.stlouisfed.org/series/CCSA

If you remove the distortion from the Covid recession, it’s actually quite obvious that continuing clai.s are rising:

https://fred.stlouisfed.org/graph/?g=1aqdZ

Tricky Ducky trying to snooker you again. Claims were running about 1.9 million before the COVID recession. Today they’re running about 1.7 million, about the same as 1Q23. Contrary to Ducky’s specious claim, it’s not obvious at all that continuing claims are rising.

Johnny has chosen an end-point convenient to his rotting corpse of an argument that interest rates aren’t much of an influence on the economy. He is also arguing levels levels, not changes. My point was about changes; continuing claims are rising. All you have to do is click the link I provided to see that. Johnny says they aren’t. He’s lying.

https://fred.stlouisfed.org/graph/?g=1aqdZ#:~:text=Continued%20claims%2C%20also%20referred%20to%20as%20insured%20unemployment%2C,to%20claim%20benefits%20for%20that%20week%20of%20unemployment.

Once again Jonny boy fails to provide a link. I did. And guess what – there was a COVID distortion. Now what Jonny boy’s little point again?

Dude – they were less than 1.3 million a year ago. Yea after rising a lot, they fell a little. And Jonny boy thinks he has something on Macroduck? Dude – you are the most worthless moron ever so relax.

Macroduck notes Continued claims has risen lately and Jonny boy moves the goal posts to the Tennessee River to assert Macroduck is wrong.

Then Jonny boy cites a post by New Deal Democrat which I suspect Jonny boy did not read carefully. You see NDD noted that from 9/2022 to 9/2033 Continued claims rose by 29% which confirms what Macroduck said.

Oh my New Deal Democrat moved the goal posts back to where they belong and Jonny boy is so stupid he still thinks there are in the river.

New Deal Democrat takes a more in depth look than Ducky’s flippant remark. https://angrybearblog.com/2023/10/initial-claims-on-the-cusp-of-turning-lower-yoy#more-117932

How much lag time are people willing to grant the dictum that “interest rates rise, ergo unemployment skyrockets?”

Are mainstream economists hearting the impending plight of the labor market or really decrying the existing plight of the stock market, which has indeed been hurt by higher interest rates? When labor gets attention, any concern expressed actually just provides cover for criticism of policies that are actually hurting the 1%.

Here is what NDD wrote:

I had surmised that there was unresolved seasonality in the similar decline this year in September as last year. But last year claims started rising steadily in October. Not so this year! If so, it could mean that the strengthening in the short leading data we saw this spring and summer has fed into more coincident data, as perhaps suggested by the big September increase over 300,000 in employment. We’ll see. For forecasting purposes, the YoY% changes are more important, and here, for the first time in over half a year, one measure was not higher. Weekly claims are exactly even with where they were one year ago. The more important four week average is up 5.0%. Only continuing claims continue in very negative territory, up 28.8%:

I guess NDD was talking way above Jonny boy’s little brain. But continuing claims up 28.8% yr/yr sounds like what Macroduck said. Hey Jonny boy – nice try but you still are an utter moron.

I have asked that person how many papers has he published in either the Journal of Labor Economics or the Journal of Labor Research. Apparently zero. Then again the papers there are way over his little head.

Then continuing claims are revised down……whoops.

Kevin McCarthy is nominating Jim Jordan calling him an effective legislator and someone who is willing to compromise. And the Democrats are laughing out loud. Look I get McCarthy is nominating a total jerk but does he have to act like a total jerk to do so?

After the 3’rd failed vote the NYT reported that “The eight Republicans led by Matt Gaetz of Florida, left, who voted to oust Kevin McCarthy as speaker have sent a letter to their colleagues saying they are willing to accept some form of punishment if that will move holdouts to vote in favor of Jim Jordan”. If we get to see Gaetz baring it for a public spanking – that may be worth it.

As I understand it, Jordan has never authored a piece of legislation which has become U.S. law. In fact, he has never authored a piece of legislation which has passed the House.

This is whaylt McCarthy calls “effective”. Uh huh.

China’s statistical authorities announced that the economy grew 4.9% YoY in the third quarter, down from 6.3% in Q-1 and 4.5% in the first period of the year.

In an indication of data reliability, inflation has averaged just 0.4% YoY this year (9 mo) whereas the money supply (M2) rose 11.6%.

The renminbi has fallen 6.1% against the greenback this year, and 8.9% on a real broad effective exchange rate basis. In the first nine months of the year exports are off 5.7%, imports are down by 7.5%, and the trade balance is flat, at US$630.4 billion

Word around the campfire is, Mr. Rear and Stevie Kopits are going to start a think tank on China.

[ insert canned laughter from brainless poorly written half-hour comedy show (examples: “Friends”, “Big Bang Theory”) here ]

Sorry for the double post; the first one ran into a troll of biblical proportions.

I don’t care what anyone says, you and “ltr” are not trolls for China. You would never say flattering things about Chinese authorities in the name of careerism. I mean that. Who said that anyway??

Halfway through Speaker vote #3 and already 18 Republicans have voted for someone other than the Jerk of the House (Jim Jordan).

Jordan 194 (fewest votes for the majority nominee since the House expanded to 435)

Other Republicans 25

Jeffries 210 (2 Dems were not there)

Strike 3 and you’re out Jimmy boy.

“Biggest Circle Jerk in the History of Circles! Or Jerks!” – Conservative Commentator On House Republicans

I love how some people commenting on YT and other websites were certain that the 2 Democrats had voted for someone else than Jeffries and weren’t simply absentee. You know you have a newbie when the idiot talking doesn’t know these bastards work on a continual bankers’ holiday schedule.

Another quote from the NYT blow-by-blow column:

“Representative Matt Gaetz of Florida says Jordan was “knifed by secret ballot, anonymously, in a closed-door meeting in the bowels of the Capitol.” Gaetz says, “This was truly swamp tactics on display.”

That was truly rich coming from Matt Gaetz.

1 in 5 wayward 17 year old girls say that Gaetz is the perfect gentleman, and always pays tips for happy endings.

Kenneth Chesebro pleads guilty. 2 down in Georgia 17 to go!

When feeling prosecutors’ steamy breath on the back of their neck, even the loonies like Giuliani and Sidney Powell wander off of Smith’s Grove Sanitarium for a few minutes. New version of shock therapy.

Third Jim Jordan vote. FAIL

right now the republican party is a sh!tshow. I no longer consider them one party, but two separate parties. maga and the rest. so America is currently in a three party system, with no one single party in the majority. the rest should begin talks with some democrats to get a moderate into power. this may be the last chance for the republican party to divorce itself from the maga hatters. but since nearly 200 voted for speaker a man who was an enabler of a sexual molester, I am not holding my breath that the party will do what is necessary. my guess is their next move will be even dumber than Jordan…

In order for democracy to work, everybody have to accept that they cannot get all of what they want, but have to give or get proportionally to how large a coalition they can build. Unfortunately in many countries there is a tendency to build really narrow legislative majorities – which gives those who refuse to play by the unspoken rules of democracy, a disproportionate amount of influence. A razor thin majority can be held hostage to a small minority who are aware of their power to block everything and oblivious or impervious to the damage such an action can do to their party and country.

In their conference, Jordan polled his fellow House Republicans asking them whether they wanted him to continue seeking Speakership:

86 yes

112 no

Jordan is out by popular demand among the House Republicans!

And to think, I was really starting to get a fetish for Boebert with yellow ties around her throat.

…….. The heart loves what it loves.

https://www.taxnotes.com/featured-analysis/microsofts-cost-sharing-arrangement-frankenstein-strikes-again/2023/03/03/7fyck

Microsoft’s Cost-Sharing Arrangement: Frankenstein Strikes Again

If one wants to get into all the details of the fight between Microsoft and the IRS, these two authors have written a detailed analysis including a lot of legalesse. One would hope the IRS team hires these two as expert witnesses!

God help me, I think you are one of the best at amalgamating this tax haven/evasion type stuff. The best I know of anyway. You might start getting me to read these articles. I never seem to have enough reasons to hate Bill Gates. More!!!! More!!!!

The best at this are David Cay Johnston and Martin Sullivan but I do what I can. So much tax evasion so little time.

Thanks Menzie – very informative amid China’s touting of the economic benefits of the Belt and Road Initiative – 10th year anniversary. What I wonder about is inflation in the rest of the world if the Chinese “manufacturing floor to the world” CPI remains hovering around 0%, which signals stagnant demand at home.

Also – I’ve seen a storm of hippie economist bashing among the usual suspects (Fox News, NY Post) of Krugman’s most recent take on inflation/odds of a recession: https://www.nytimes.com/2023/10/17/opinion/economy-recession-inflation.html