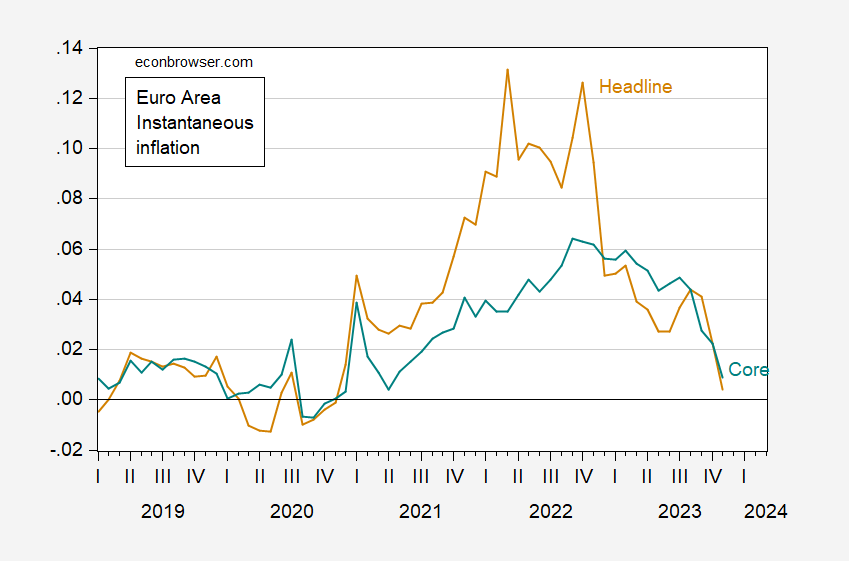

Headlines indicate 2.4% y/y HICP inflation in the euro area hitting consensus. Instantaneous inflation per Eeckhout (T=12,a=4) is 0.4%.

Figure 1: Euro area instantaneous inflation headline (tan), core (teal). Seasonally adjusted using X13 (log transform; X11 ARIMA), calculated using Eeckhout (2023) definition, T=12, a=4. Source: Eurostat via FRED, author’s calculation.

The wide gap between headline and core indicates the role of energy in Euro area inflation. A comparison of core inflation series suggests a larger possible role for demand side factors in the US vs. Euro area, through August 2022. But it could also suggest a role for supply side factors to the extent that nonenergy nonfood prices could be driven by labor market tightness, or nonfood nonfuel import prices (i.e., supply chain disruptions).

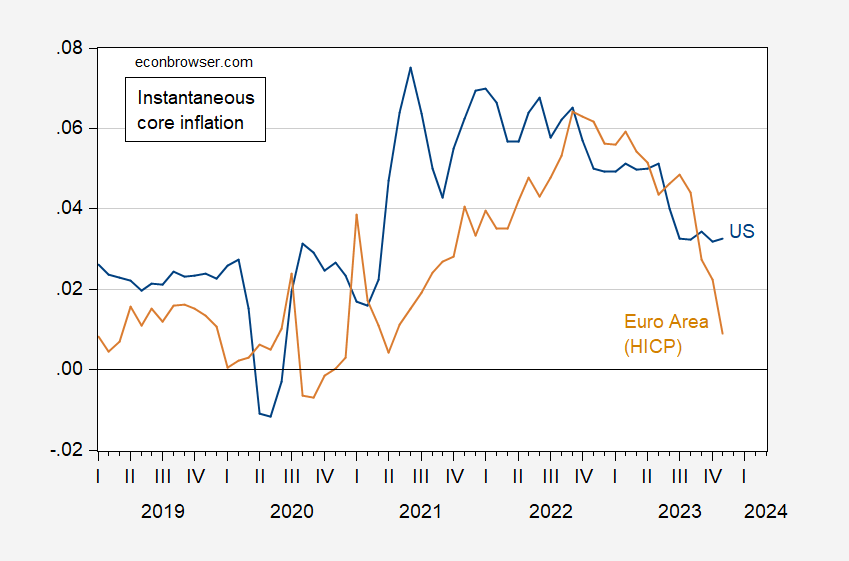

Figure 2: Euro area instantaneous core inflation headline (tan), US CPI core inflation (blue). Seasonally adjusted using X13 (log transform; X11 ARIMA), calculated using Eeckhout (2023) definition, T=12, a=4. Source: Eurostat via FRED, author’s calculation.

Figure 2 suggests that core inflation is more persistent in the US than in the Euro area. That can be taken as bad news; or it could be taken as indicating that the Euro area is more rapidly moving to recession.

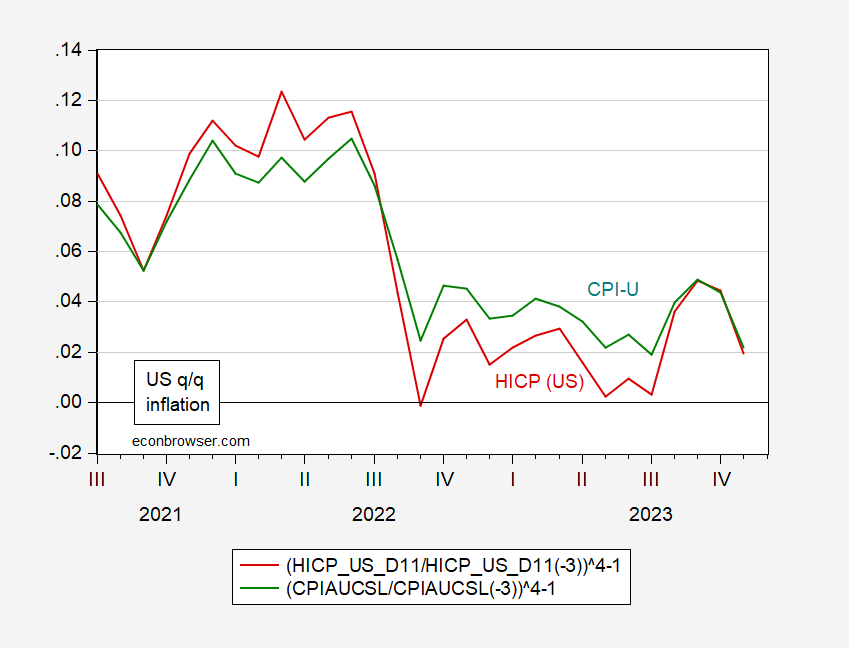

Note that HICP and CPI for the US move in somewhat different ways, but not completely different. To show this, I graph q/q CPI and HICP inflation rates in Figure 3.

Figure 3: US HICP q/q inflation (red). Seasonally adjusted using X13 (log transform; X11 ARIMA), and US CPI q/q inflation, both at annual rates. Source: Eurostat via FRED, author’s calculation.

Mary Daly’s comments in Tuesday’s hardcopy WSJ were interesting.

https://www.reuters.com/markets/rates-bonds/feds-daly-rate-cuts-may-be-needed-next-year-prevent-overtightening-wsj-2023-12-18/

Very late, but interesting. It’s almost like she’s saying the FOMC F*cked up. It seems Mary strongly disagrees with another Fed Res blowhard, also named Mary, running their mouth about 4 weeks ago:

https://www.ft.com/content/ce61eb61-dc4b-4ae4-be5d-a78a1384737b

Both Marys go way past their quota of yearly carbon dioxide exhale quota.

San Francisco Federal Reserve Bank President Mary Daly said Monday that cuts to the U.S. central bank’s benchmark rate are likely be appropriate next year because of an improvement in inflation this year, the Wall Street Journal reported. The Fed must make sure “we don’t give people price stability but take away jobs,” Daly told the Journal in an interview. The Fed aims to bring inflation down to its 2% goal, she said, but wants to “continue to do this gently, with as few disruptions to the labor market as possible.” Daly said her outlook for interest rates and inflation was similar to the median of projections from all 19 Fed policymakers released last week, which showed a majority are penciling in a 75 basis-point reduction from the current 5.25%-5.50% target range for the policy rate, with inflation falling to about 2.4% by year end.

As you know – some of us have been asking for rate cuts for a while. Daly is making a lot of sense.

If spitting into the wind and then looking down 30 days later and saying “I think I got a loogie on my shirt” makes a lot sense, she’s a Gawddamned genius.

Thoughtful and enlightening. Thank you Menzie. (BTW – I’ve been reading a lot about AI. I first I was dubious – but now I am developing simple applications like collecting potential client contact information and sending a summary of background information. Next will be developing a chatbot to take initial calls with appropriate “color” – “oh you live in beautiful Monroe WI – the cheese factory there is great – they have an award-winning Emmentaler.” I wonder how trans-formative it will be – also pretty funny that you can not copyright AI generated content – I am sure Disney will figure out a way to claim copyright – https://www.scmp.com/news/china/science/article/3245725/chinese-professor-used-ai-write-science-fiction-novel-then-it-won-national-award )

There’s a joke here related to mainland Chinese culture, rote learning, and copying every good idea seen overseas. Starts off “China state-sponsored hacker walks into a bar……” Sorry, these are “woke” “social justice” years, you’ll have to finish the joke on your own.

James,

Sample of one? I would hate being chatted up by a chatbot.

Service. That’s what I want.

A UK court has ruled that an AI cannot be named as a patent inventor. The court concluded that an inventor must be a human person to apply for a patent.

So it seems, a mother is a necessity for invention.

Nice.

“The court concluded that an inventor must be a human person to apply for a patent.”

Does this mean donald trump can’t get a patent??

Trump strikes me as artificial but the word intelligence has never been associated with him.

Inflation in the U.S. and the Eurozone are trending down. China is short-term deflationary.

Are we sure inflation trends are healthy?

https://tradingeconomics.com/china/inflation-cpi

China does have a really low inflation rate. Maybe this is why their 10-year government bond yield is only 2.63%.

Of personal interest, and way off topic, a murderous former dictator of a tiny South American country has been brought to justice:

https://www.reuters.com/world/americas/suriname-court-set-rule-ex-presidents-murder-appeal-2023-12-20/

About time. Now, about that torture…

Art Laffer is BAAAACK and dumber than ever!

Top US economist warns implementing new tax ‘will kill the economy’ amid row over net-zero

https://www.msn.com/en-us/money/markets/top-us-economist-warns-implementing-new-tax-will-kill-the-economy-amid-row-over-net-zero/ar-AA1lMOom?ocid=msedgdhp&pc=U531&cvid=1b157611a84b48a5bbf660933a3457d0&ei=19

A US economist has warned that implementing a carbon tax will “kill the economy.” A carbon tax is a fee imposed on businesses and individuals that works as “pollution tax.” In theory the carbon tax would only affect big companies that burn carbon-based fuels, including coal, oil, gasoline, and natural gas. Country’s such as South Korea, China and Thailand have implemented this as a way of cutting down on their use of fossil fuels. However, US Economist Dr Arthur B. Laffer explained that using this in America could have disastrous effects on the economy.

First of all calling Laffer a top economist is an insult to actual economists. Of course no one is proposing massive fiscal austerity as most member of the Pigou Club including Greg Mankiw suggest that the revenues from a carbon tax should be used to offset other taxes. Oh wait:

He told Jacob Rees-Mogg on GBNews America: “Al Gore and I did a paper long ago together which was just put on a carbon tax. “The problem with the carbon tax, of course, is it will kill the economy. “So what Al Gore and I agreed upon was we have a carbon tax put on and then have it offset 100% by an income tax rate reduction. “Or as Al wanted, he wanted a payroll tax rate reduction dollar for dollar so that there will be no net effect on the economy.

Does anyone have a copy of this alleged paper? Yes – use the carbon tax to pay for Social Security and Medicare benefits!

Found a Greg Mankiw paper from roughly 2009, not with Al Gore. Laffer wrote a “blurb” for one of Al Gore’s books. Perhaps he jumbled the book blurb up in his mind as being a “paper” he co-wrote with Gore??

Here is a more recent paper on the topic:

https://www.nber.org/system/files/working_papers/w26146/w26146.pdf

Surveys show majority U.S. support for a carbon tax. Yet none has been adopted. Why? We study two failed carbon tax initiatives in Washington State in 2016 and 2018. Using a difference in differences approach, we show that Washington’s real-world campaigns reduced support by 20 percentage points. Resistance to higher energy prices explains opposition to these policies in the average precinct, while ideology explains 90% of the variation in votes across precincts. Conservatives preferred the 2016 revenue-neutral policy, while liberals preferred the 2018 green spending policy. Yet we forecast both initiatives would fail in other states, demonstrating that surveys are overly optimistic.

Thanks for this paper. I remember the Washington State debates. I did not follow enough to realize these interesting results.

It seems the UK has had some good news on inflation and the benefit is that UK 10 year government bond rates have declined from around 4.5% to 3.5%.

https://www.worldgovernmentbonds.com/bond-historical-data/united-kingdom/10-years/