Biden is visiting Wisconsin. it’s interesting to see how the state economy is doing, and what the Evers administration is forecasting (based primarily on national macro developments).

First employment:

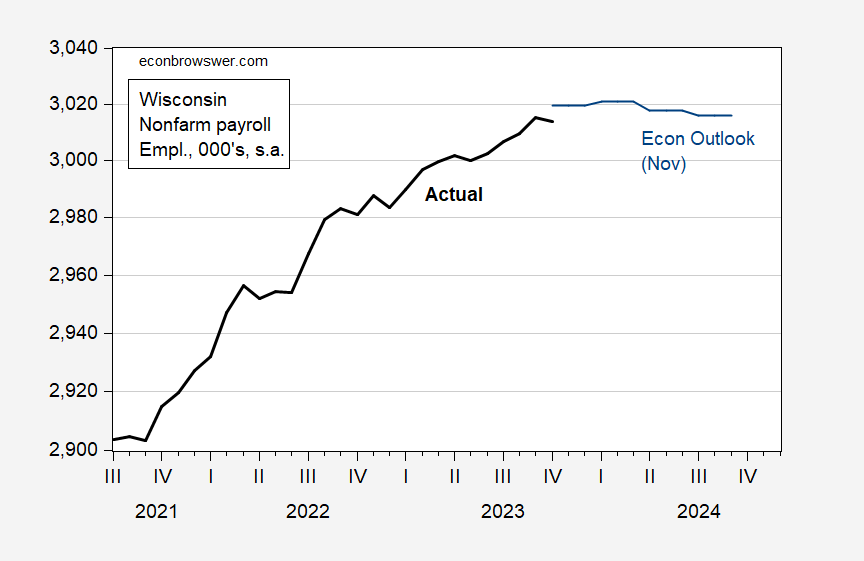

Figure 1: Wisconsin nonfarm payroll employment (bold black), and Wisconsin Economic Forecast (blue), both in 000’s, s.a. Source: BLS and Wisconsin Dept of Revenue Nov. Forecast.

Nonfarm payroll employment growth is forecasted to stall out in the later part of 2024, likely due to a slowing national economy marked into the SP Global (formerly IHS Markit) forecast. The slowdown is

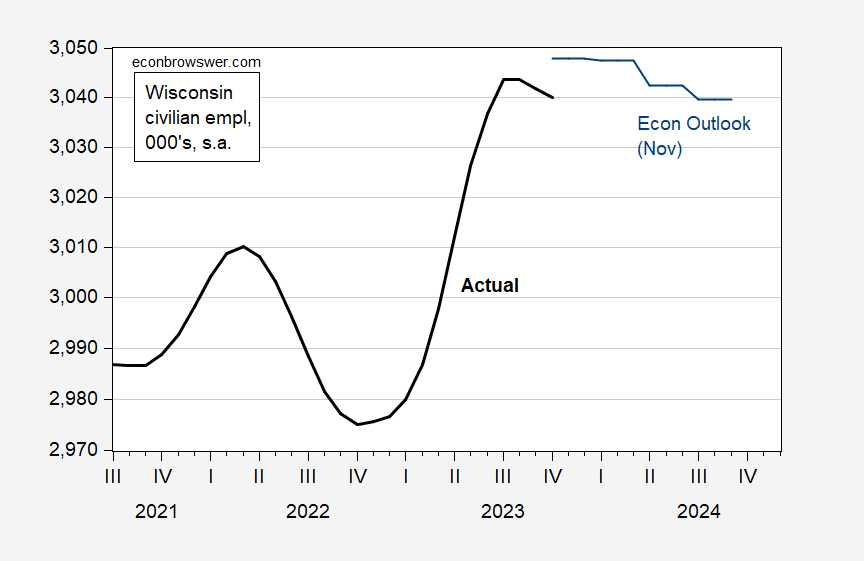

Figure 2: Wisconsin civilian employment (bold black), and Wisconsin Economic Forecast (blue), both in 000’s, s.a. Source: BLS and Wisconsin Dept of Revenue Nov. Forecast.

Notice that the civilian employment series exhibits a lot more variability. It’s important to recall that the state level civilian employment estimates are calculated using a model that differs from the approach used at the national level. This is necessitated by the smaller samples associated with states. In other words, I‘d be very wary of using state level employment series based on the household survey.

That being said, the forecast indicates essentially zero employment growth in 2024Q1.

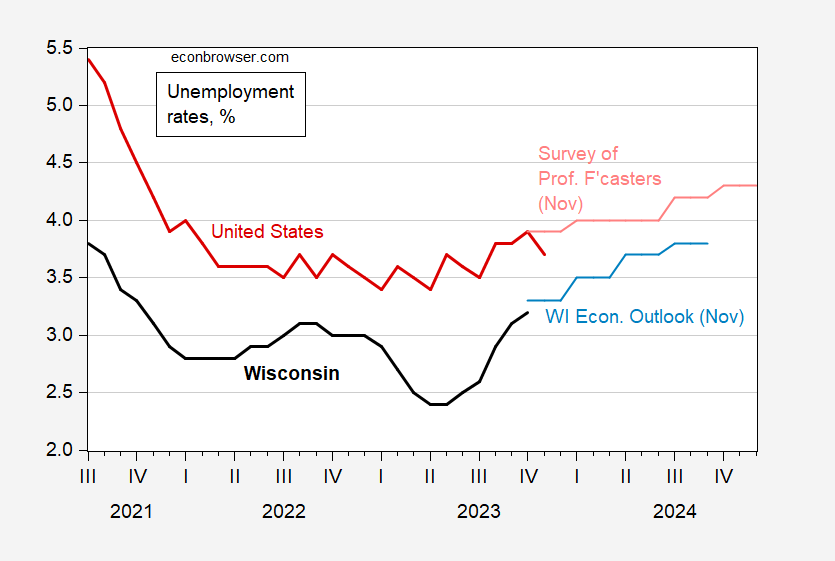

The employment and labor force errors are probably correlated in a way that the unemployment rates are less volatile. Here’s a comparison of Wisconsin and national unemployment rates. On average Wisconsin has 0.9 percentage point lower unemployment than the national average (consider that a state level fixed effect). Nonetheless, the Department of Revenue’s forecast shows faster increase in unemployment than the Survey of Professional Forecasters’ national rate (in principle, to see how the Wisconsin rate is being driven, one should look at the S&P Global (formerly IHS-Markit) forecast).

Figure 3: Wisconsin unemployment rate (bold black), and Wisconsin Economic Forecast (blue), national unemployment rate (bold red), and Survey of Professional Forecaster’s forecast, both in %, s.a. Source: BLS and Wisconsin Dept of Revenue Nov. Forecast. Philadelphia Fed (November)

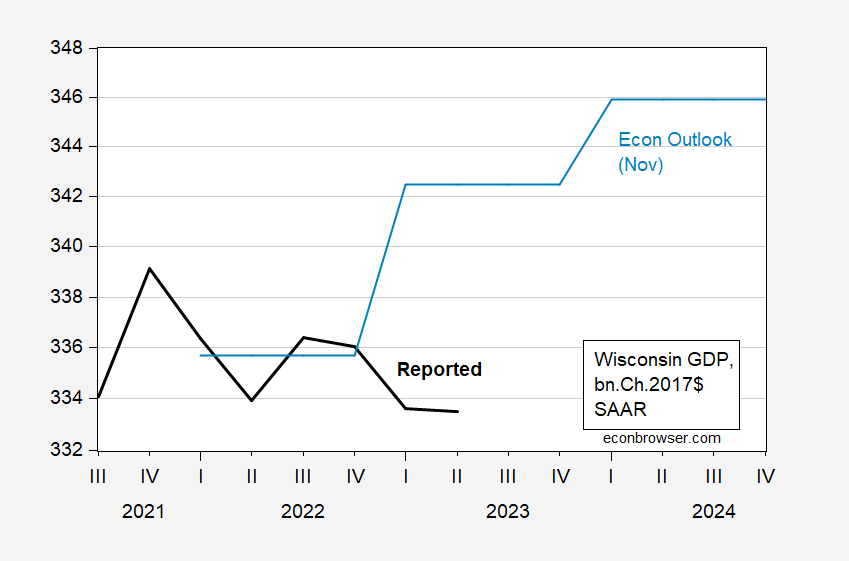

As for non-labor market indicators, GDP is forecasted to rise, mirroring the national level forecasts of continued growth.

Figure 4: Wisconsin GDP (bold black), and Wisconsin Economic Forecast (blue), both in bn.Ch.2017$ SAAR. Source: BEA, and Wisconsin Dept of Revenue Nov. Forecast.

The latest released Wisconsin GDP (advance, first time in 2017$) is down, and 2023Q1 was revised downward in direction vs. previous vintage. Definitely revisions can change the trajectory of state level GDP.

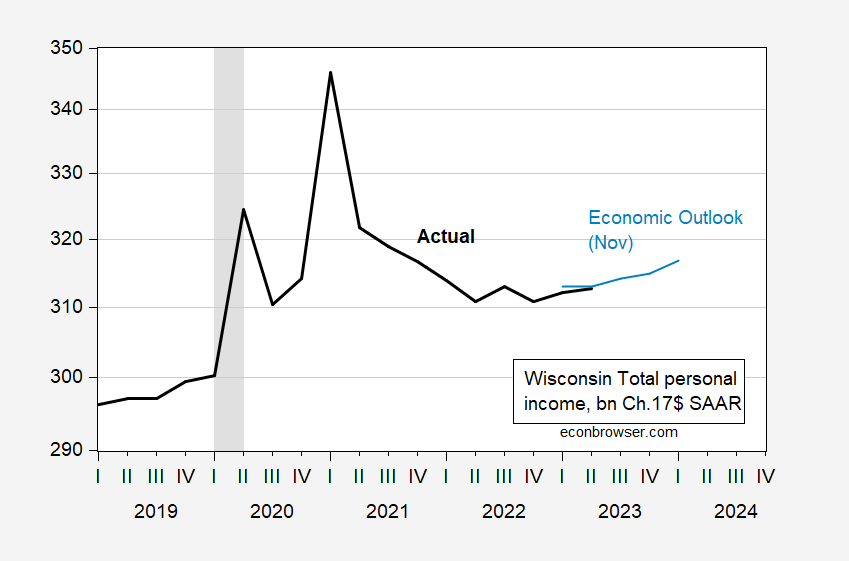

Inflation adjusted total personal income did rise in Q1-Q2, in contrast to GDP.

Figure 5: Wisconsin total personal income (bold black), and Wisconsin Economic Forecast (blue), both in bn.Ch.2017$ SAAR, 2019-2024. Deflated using nationwide PCE deflator, and Survey of Professional Forecasters forecasted nationwaide PCE deflator. NBER defined peak-to-trough recession dates shaded gray. Source: BEA, Wisconsin Dept of Revenue Nov. Forecast, Philadelphia Fed, NBER, and author’s calculations.

It’s important to note that this is total personal income (not disposable), or the NBER BCDC target series personal income ex-current transfers.

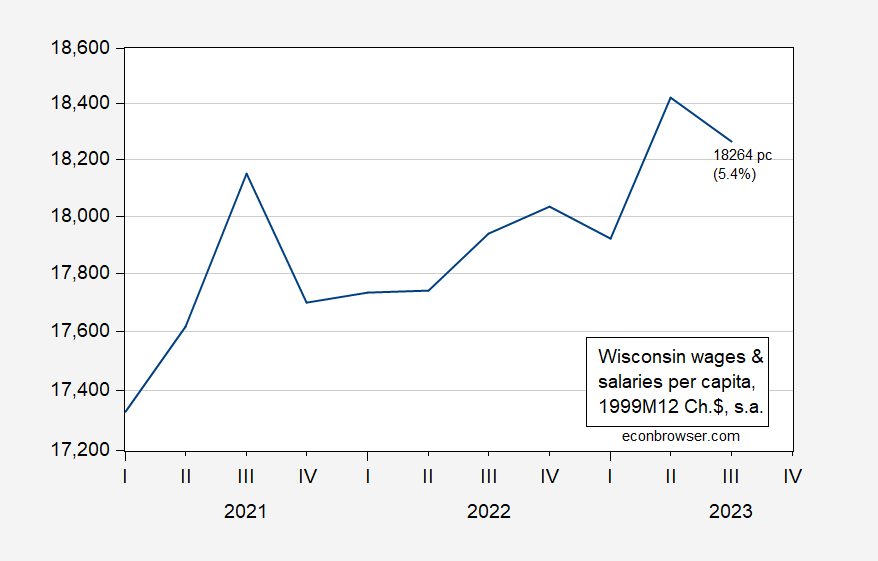

Note that recently, the Joint Economic Committee (Republicans) have been tabulating the dollar increase in living costs per consumer unit (kind of a household) since January 2021, in their “state inflation tracker”, which I take as an attempt to connect with the average person (but ends up being totally confusing). I prefer to tabulate these sort of things on a per capita basis, in percent. Here’s my take – total wages and salaries per capita adjusted by the chained CPI.

Figure 6: Wisconsin total wages and salaries per capita, deflated by national CPI chained, in 1999M12$ SAAR. Total wages and salaries (FRED series WIWTOT) divided by Wisconsin resident population in July (FRED series WIPOP) via quadratic interpolation. Source: BEA, Census via FRED, BLS, and author’s calculations.

Real total compensation (not income) has outpaced living costs by 5.4% cumulative, since 2021Q1 in Wisconsin.

More information on November employment tomorrow from DWD, from BLS on Friday.

Updated, 12/20:

additional links:

Chief Economist John Koskinen, October 23, 2023.

Biden wants to impose higher tariffs on imports of EVs from China? Kevin Drum brings the snark!

Why do we need higher tariffs on Chinese EVs when no Chinese EVs are sold in America?

https://jabberwocking.com/why-do-we-need-higher-tariffs-on-chinese-evs-when-no-chinese-evs-are-sold-in-america/

What’s the point of this? We already have 25% tariffs on Chinese EVs, which means that no Chinese EVs are sold in the US and thus no tariffs are collected. We could raise tariffs to 50%, but 50% of zero is still zero, so why bother?

Yeah, I know, gotta get tough on China. It’s an election-year evergreen.

Of course, car folks say that Chinese EVs are getting so cheap and efficient that they might be able to crash the US market even with a 25% headwind. If that’s the case, I say we should just take their money. If American and Japanese and Korean carmakers can’t compete even with a 25% headstart then something is wrong that no amount of tariffs can fix.

Anyway, you know what Biden should really do? Bring back Cash 4 Clunkers. That was a great program! As policy it was pointless, but it was fairly cheap and did no real harm—and boy, did people love it. That’s the kind of thing you need in an election year. There must be some way to do it via an executive order so that Republicans are stuck screaming about how lawless this super popular program is.

It’s worse than just a 25% tariff. EVs from China are also not eligible for the $7,500 tax credit that domestic EVs get. So effectively it is already almost a 50% tax burden on Chinese EVs to compete with domestic EVs. You will never see lower cost EVs from China under these circumstances.

If Biden wants to achieve his goal of 50% EV sales by 2030, he’s going to have to let cheaper EVs from China into the U.S. Otherwise EVs will remain toys for high income households.

And by the way, California, Colorado and Vermont already have Cash 4 Clunker subsidies for replacing older gasoline cars with EVs.

I wonder how much Wisconsin’s rapidly plateauing population growth impacts these forecasts. IMO Wisconsin needs international migration of workers -ASAP.

And, WIGOP stop wasting millions in taxpayer $ trying to attract hipsters in Chicago to move to Wisconsin for your non-existent boondoggle Foxconn jobs (WIGOP wasted $100s of millions for Foxconn that Gov Evers is now having to clean up.) . https://www.fox6now.com/news/gov-scott-walker-announces-national-ad-campaign-to-attract-workers

WIGOP the best thing you could do for Wisconsin workers/WI children is take the Medicaid expansion money that the Biden administration is pleading with you to take: https://www.politico.com/news/2023/12/18/biden-administration-pleads-with-states-after-millions-of-kids-lose-medicaid-coverage-00132282