Steven Kopits writes:

On the other hand, interest payments have risen from 9.5% of GDP in 2020 to 13.6% of GDP in 2023. That is a whopping 4% of GDP in just increased interest payments. Further, as the incumbent debt is rolling off and has to be refinanced, interest payments will continue to rise, and fall with considerable delay even when inflation and interest rates return to lower levels.

I do not understand how these numbers were calculated. It must be that “new math” they are teaching in schools these days.

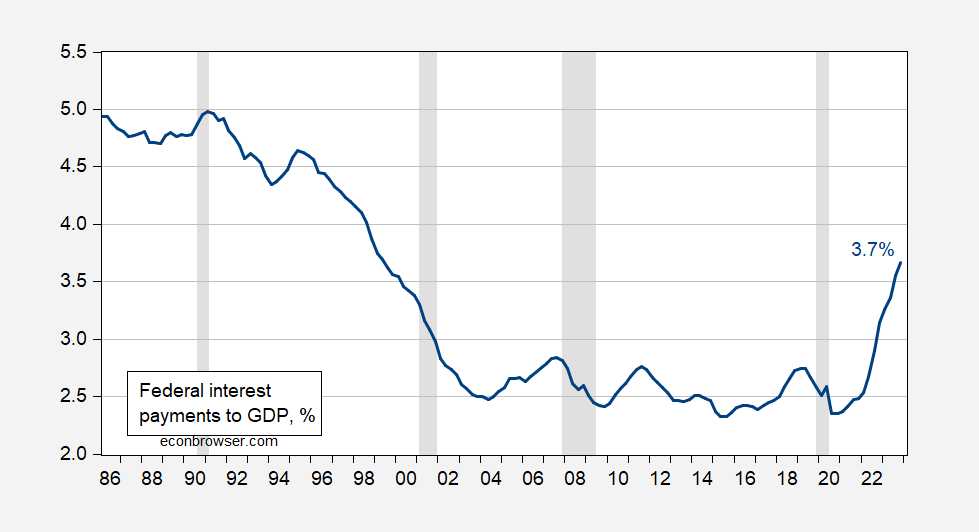

I download FRED series A091RC1Q027SBEA, divide by FRED series GDP, divide the first by the second, multiply by 100 to obtain:

Figure 1: Federal interest payments divided by GDP, in % (blue). NBER defined peak-to-trough recession dates shaded gray. Treasury, BEA via FRED, NBER, and author’s calculations.

I do not see 13.6% in these calculations. If one were to accidentally multiply the Federal interest payments at annual rate by 4 for FY2023, and divide by FY2023 GDP at annual rate, I do then get 13.3%. But this calculation would be nonsensical.

Lovely takedown. Same guy getting facts wrong, over and over, and always in the same ideological direction. How could that happen?

Speaking of math…

Economists at the NY Fed have developed an indicator of wage trends which seems to lead minimal wage changes by a few months:

https://libertystreeteconomics.newyorkfed.org/2024/03/will-the-moderation-in-wage-growth-continue/

The Trend Wage Indicator (TWin) has just been through an inflection from a downward trend to a stable trend at around 5%. The Fed guys conclude that the moderation in wage gains is done, for now, a conclusion which they see as consistent with the current tightness of the labor market.

Combining the Cleveland Fed nowcasts for headline PCE inflation for February and March, which average 3.0%, the TWin estimate gives annualized real wage growth estimate of around 2%. That’s an improvement over the November to January average of around 1.2% y/y.

Of course, you could always look at surveys of companies’ salary increase budgets: “U.S. organizations are planning an average increase of 4.0% in 2024. Though this number is down from 4.4% in 2023, it is well above 3.1% in 2021 and 3.0% in 2020. The 4.2% in 2022 already represented the highest rate since 2008.”

https://www.wtwco.com/en-vn/insights/2024/01/2024-employee-pay-trends

Far from just reporting data, reports like this are important in telling a company what others are planning to do–tacit, indirect monopsony.

“One of the biggest predictors of future salary budget increases is, in fact, prior increases. Historical data has shown that organizations often are reluctant to make dramatic changes to their budgets. As a result, budgets tend to be more inelastic, often lagging economic trends by 6 to 12 months.” In other words, wages are sticky both the downside and the upside.

So how does the notion that wages increase in response to workers’ DEMANDS fit in? It’s pretty clear that in terms of setting wages Corporate America is firmly in control.

So, the first thing Johnny does is ask that we look away from data which doesn’t support his view – same old Johnny. Then, he pretends that other sources of information support his view when thet don’t. What he claims is “clear” isn’t clear at all.

Persistence of wage increases is not evidence that firms are in control. You pretend that it supports your position, but it could just as easily reflect persistence of employee leverage. Here’s what Johnny’s source actually says about the determinants of wage increases:

“Tight labor markets, inflationary pressures and employee retention concerns have fueled salary increases to rates not seen in nearly two decades.” See? No claim about which side has power in determining wage gains, but two of the three factors named – tight labor markets and inflation – are entirely beyond the control of employers.

Finally, notice that Johnny is raising the issue of who’s in control, only to fail in his argument. Johnny is a polemicist – a bullshit artist. He doesn’t care if his arguments make sense, he just wants to trick a few people into believing them. It’s all part of his “America BAD! Russia GOOD!” propaganda campaign.

Minimal? I gotta proofread better. The Indicator leadscy/y changes.

Stevie flunked preK reading too

Menzie Chinn,

But so is meaningful analysis. Which your original post wasn’t. Sophomoric at best. Lacking any insight or meaningful application. What’s your excuse (aside from partisanship)?

Econned: To correct somebody’s incorrect math is partisan?

2 plus 2 is a communist plot

You’d be proud of me Menzie. I got a Precalculus book at Goodwill the other day. It’s a circa 2004 book, cost me $3.09. Only it didn’t cost me $3.09. I gotta old B-movie horror DVD for $3. Only it didn’t cost me $3. I only got charged for 3 shirts I got for $6 each and for some reason this kind young Hispanic lady only charged me for the shirts and didn’t ring up the Precalculus book or the DVD. Good Karma for letting her “round-up” to the next dollar for Goodwill cause??

Anyways, I am working on that book along with an internet link on “Simplifying algebraic equations” I think if I can learn the most common simplifying techniques on equations it will help me get past a huge math hump I have had since I only could half manage it in my college years.

I am not as bad at math as some folks here (Kopits being one, we could go down the list) but I am trying to IMPROVE myself on the math. I think some people here could take notes on that, instead of muddying the waters for other readers.

I also got an aged “R” book, and I was “THIS close” to getting an archaic MATLABS book, I think it was version 6, but decided not since it’s not freeware.

Without getting into positive racial stereotypes on Asians and math Menzie, you have always been a personal inspiration to me on your abilities with math and how you use it to enlighten and educate. I wish some more readers appreciated that you do this all for FREE in addition to your very demanding “day job”.

Software like matlab, maple and mathematica have symbolic tools that eliminate your need to do the algebra. Somewhat of a learning curve to them, but well worth the effort to let the computer do the tasks you are prone to make mistakes on. You should look into them a bit.

Menzie Chinn,

Why didn’t you read my comment before replying? Your original post is partisan. I’ll copy it here for you to understand:

“But so is meaningful analysis. Which your original post wasn’t. Sophomoric at best. Lacking any insight or meaningful application. What’s your excuse (aside from partisanship)?”

Here’s the breakdown for the uninitiated:

Meaningful analysis is hard and your original post wasn’t a meaningful analysis. It was sophomoric at best. It lacked any insight or meaningful application. What is your excuse, aside from partisanship, for the sophomoric work that lacked any insight of meaningful application?

If you’re uninterested in actually reading plain English, we can’t expect much out of you.

Econned: Original post? If you want to criticize a given post, you should attach the comment to that post. My first post was in 2005.

By the way, there are five (5) intervening posts between the one I *think* you are referring to and the one your comment is attached to.

Menzie Chinn,

In this blog title you proclaim “Math Is Hard!”. And I responded “But so is meaningful analysis. Which your original post wasn’t.” Here’s the English for beginners version: “meaningful analysis is hard. And the original post that this blog entry is referencing was not meaningful analysis.” Which post? The exact one that this blog entry is referencing. As such, I’m criticizing this post and the post this blogpost is referring to. To remind you of your own blog entries, this post explicitly references another. Are you able to keep up?

While I do understand the very low level of discourse on this blog as presented by your fanboys, note that I do not follow the tradition here of referencing irrelevant info. Why would I refer to “five (5) intervening posts”? You claim above to *think* but any internet dimwit in their mother’s basement (or ivory tower) would know what “original post” means when it’s a reply to a blog entry that is explicitly referring to an earlier blog entry – that’s the “original post”. Heck, it’s linked!!!! While it is an incredibly uncommon practice on this particular blog site, I personally try to keep my comments germane to the post I’m commenting on (what a concept!!!). Given the bookkeeping and obsession you have of logging commentary, I’m surprised you haven’t noticed that about me yet.

For note, “original post”, or “OP” ” is common lexicon online. And I don’t believe for a second that you’re nearly as obtuse as your online persona presents itself to be. Your hope/goal is to obfuscate during the back-and-forths.

You failed.

Again.

(Let’s note that if your ego wasn’t so concerned with petty call-outs, this embarrassing confusion that you created for yourself would’ve been avoid. It’s far too easy to reply to replies in the reply section. Novel concept it isn’t.)

Now go wipe that egg off your face and we shall do this again in some future blogpost.

More professional jealousy from the douchebag called econned.

@ Stalker

You can’t even be successful at being court jester. At least CoRev, PeakTrader, and Kopits can give us all the giggles here and comedy relief. You can’t even do that because you’re the resentful sourpuss that just brings the general mood down. Don’t you have some illiterate MAGA friends you can go depress on the playground jungle gym??

Educating people about mistakes they’ve made is something some of us do – even when not being paid! (See this blog, Stackexchange, and many others.) Don’t really need an excuse for altruistic behavior, unless you’re a Republican I suppose.

WTF? You said you agree with something Furman said on this issue but as usual you could not be bothered with noting what paper you were referring to. I did. And yea – the interest expense to GDP ratio was mentioned. Stevie calculates this all wrong for a couple of reasons – the obvious preK arithmetic mistake. Oh wait – little Econned never pass basic arithmetic. Never mind. And I keep asking you and others why use nominal interest expenses when Furman makes the case for the use of real interest expenses. To date – Econned has not addressed this either. Maybe because Econned is as clueless as Stevie boy.

And the professional jealousy surfaces from econned, yet AGAIN.

Or you can just use Fred series FYOIGDA188S directly which displays Interest as Percent of Gross Domestic Product. It only goes through 1/1/23 but I assume it is due to be updated soon for 1/1/24 when 2024 GDP is finalized.

https://fred.stlouisfed.org/series/FYOIGDA188S

Yes, and FRED allows one to avoid the risk of math errors. Or to check our math.

Bu FRED is a buzz-kill, ya know? Heck, realiy is a buzz-kill, for that matter. It feels so good to claim that interest costs are HUGE and Biden is to blame.

I think he did:

interest payments / federal spending

instead of:

interest payments / GDP

Federal spending is almost 25% of GDP, which gives you the 4x factor you’re looking for.

Maybe. But his links were interest expenses (annualized basis) $1.025 trillion

GDP (annual) just shy of $27 trillion.

Now if 1.025/27 is over 13%, then Stevie is a genius.

From FRED, I am using:

FYGFDPUN (Federal Debt Held by the Public, Millions of Dollars, Quarterly, Not Seasonally Adjusted)

GDP (Gross Domestic Product, Billions of Dollars, Quarterly, Seasonally Adjusted Annual Rate)

A091RC1Q027SBEA (Federal government current expenditures: Interest payments, Billions of Dollars, Quarterly, Seasonally Adjusted Annual Rate)

I made my mistake with this latter data set, thinking it was quarterly rather than ‘annual rate’. (Actually, what is ‘annual rate’ for interest payments? Quarterly x 4? TTM? Cash basis? Accrual basis? Not really sure. I was expected simply cash outlays by quarter. My fault.)

So, it’s not ‘Math is Hard’. It’s “Reading is Hard”.

Steven Kopits: Hint: Almost all NIPA series reported SAAR or AR.

You’re forgetting Matthew 7: 6-7 again. Come on Menzie, this is that 1 in 1,000 times something I told you could actually prove useful.

i fail to see why paying interest on Treasuries should be treated differently than any other kind of fiscal outlay…does someone think they shouldn’t pay interest? or maybe that we shouldn’t issue Treasuries at all? then explain how the US & global financial system would work without Treasuries, or without similar instruments in other currencies that function a store of value..

Some debt is ok, but an argument can be made that above a certain percentage of GDP, it can be troublesome, and if nothing else, the debt payments can become a burden.

how do debt payments “become a burden”, Moses? have we ever had trouble issuing new treasuries to cover principal and interest on the old ones?