Follow up to Is Velocity Stable? Part MXXVI. With data up to 2023Q4, the answer remains “no”.

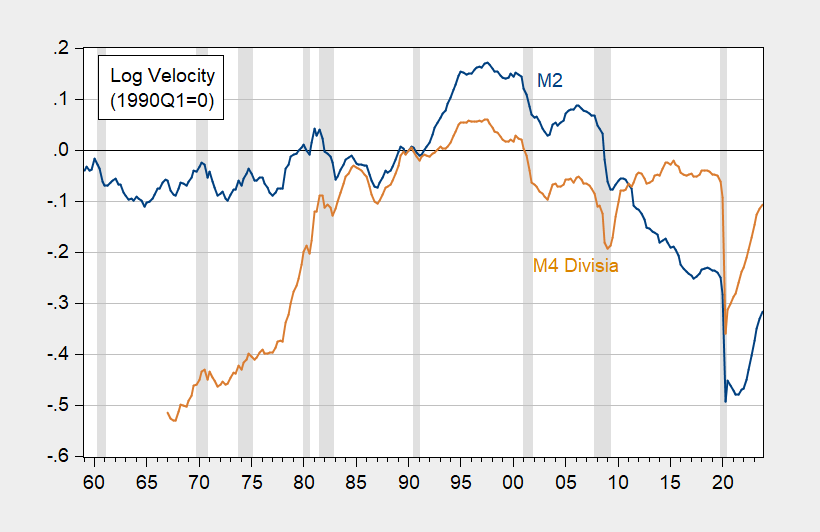

Figure 1: M2 velocity calculated using GDP (blue), M4 divisia velocity (tan), both in logs, 1990Q1=0. NBER defined peak-to-trough recession dates shaded gray. Source: Federal Reserve, BEA, via FRED, CFS, NBER, and author’s calculations.

One would think that a glance at the data would suffice, but some readers have (well, one has) averred that experts consider velocity stable when using divisia measures of money. In order to accommodate those views, I add in M4 Divisia velocity.

An ADF test applied to both velocity series (in logs) fails to reject unit root null, while a KPSS test applied to both series rejects at 5% msl the trend stationary null.

Addendum, 3/15/2024:

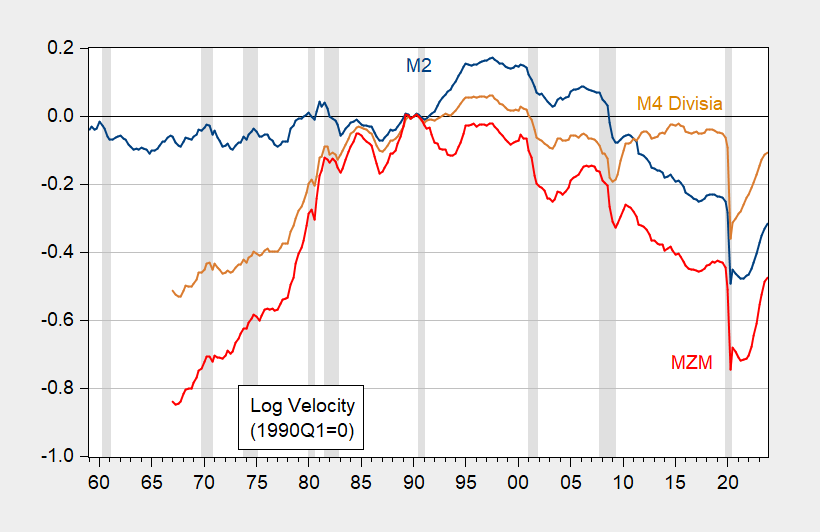

My former colleague and authority on monetary policy notes that broad measures of money are not transactions related, and hence not relevant to the efficacy of monetary growth targeting when taking into account the effective lower bound (Billi, Soderstrom, Walsh, JMCB 2023). Here’s a picture of MZM velocity (compared to other measures).

Figure 2: M2 velocity calculated using GDP (blue), M4 divisia velocity (tan), MZM divisia velocity, all in logs, 1990Q1=0. NBER defined peak-to-trough recession dates shaded gray. Source: Federal Reserve, BEA, via FRED, CFS, NBER, and author’s calculations.

I almost got velocity mixed up with volatility. Nevermind V recessions. Oh, Uncle Moses’ mind just isn’t as agile as it used to be [ sigh ] Variance…. Hicks’ compensating variation…… blaaa

I’m still ahead of Stalker though. Always good to have the LCD there for mental self-esteem.

Off-topic

This is more like “weekend reading”, but anyone looking for a couple chuckles, I highly recommend you read this link. I don’t agree with the criticisms of Gensler, but it’s still good for some laughs:

https://www.ft.com/content/9bd61cca-50a7-4cd3-9d3a-a9dabb7a0bea

As much of an arrogant moron Econned is – Steven Kopits is far worse. Bank assets are not part of the money supply. Bank liabilities maybe. But the world’s worst consultant flunked accounting 101.

I’m not clever enough to think of a connection between the destabilization of velocity and the stabilization in the rate of inflation the began in the early 1990s:

https://fred.stlouisfed.org/graph/?g=1ih4P

But it does seem obvious that continued attention to money supply as a cause of inflation was worse than just an intellectual error. It was also a distraction from the profound structural changes behind the stabilization of the inflation rate.. The increase in the industrial labor force through expanded trade, the declining share of oil as an economic input, the decline of unions, are all under-emphasized when money supply is the focus of analysis and policy.

So called “modern monetary theory” seems to me to suffer the same problem; it’s a distraction from real causes.

Off topic, but just wanted to leave this here.

The Q3 preliminary seasonally adjusted benchmark forecast for the QCEW was published by the Philadelphia Fed today. As I anticipated, it indicated that the nonfarm payrolls reports for Q3 last year were far too optimistic. Nonfarm payrolls as reported grew at a 1.7% annualized rate, but the Philly Fed forecasts that after benchmarking to the QCEW, they actually only grew at a 0.5% rate annualized. It looks like they believe that the jobs number last August was actually negative.

The Philly Fed estimates state-level QCEW employment, which can be added up to estimate national-level employment. As of 2022, however, the Philly Fed raised some doubt about the reliability of its preliminary estimate as a guide to nationwide employment revisions:

“For the U.S. CES methodology, the BLS introduced quarterly updates to the net birth-death model beginning in 2011. This change may have significantly reduced the subsequent revisions to U.S. CES employment growth trends. However, state updates remain less frequent, so the signal remains intact.”

(Click the “Interpret” link here: https://www.philadelphiafed.org/surveys-and-data/regional-economic-analysis/early-benchmark-revisions)

We’ll find out whether the birth-death model is tossing out bad estimates of job growth when the official QCEW data are released. Till then, we’re guessing, but with somewhat improved data on which to base our guess.

As to the high number of jobs added by the birth-death model since the Covid recession, keep in mind the new firms have been popping up at an elevated rate since the recession:

https://fred.stlouisfed.org/graph/?g=1ihty