From BIS Quarterly Review, article by G. Benigno, B. Hoffmann, G. Nuno Barrau, and D. Sandri:

Source: BIS Quarterly Review (March 2024).

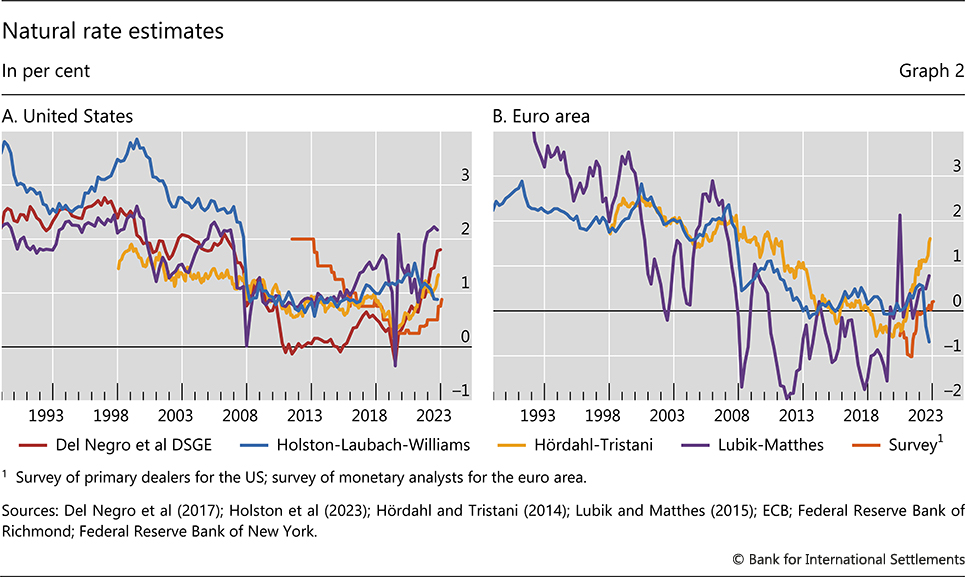

Note: Here, r* is the real natural rate of interest. Following the convention adopted in this NY Fed piece, I’ll call nominal r* what Summers recently termed the neutral rate, r* plus expected inflation:

For other estimates, see this post.

Lubik-Matthes, at the high end of estimates for the US, indicates about a 4.5% neutral rate, if 2.5% CPI inflation is consistent with 2% PCE inflation, still below the 5-6% range (what Summers called a “5-handle”).

I would be remiss if I were not to remind all of Jim’s paper (with Harris, Hatzius and West) on the natural rate (published in IMF Economic Review).

The authors mention a rise in estimates and perceptions of r*. The rise in perceptions, pretty clearly, come from the good performance of the U.S. economy in the face of the Fed-umposed rate shock. That’s a bit too much guess work for my liking. Livelihoods are at stake.

That’s not a criticism of the authors. It is, however, a criticism of Summers.

Menzie, may I ask a question which is only loosely related to my strong dislike/hate of Mr. Summers?? We often criticize (mostly rightly) ignorant people attaching their own definitions to technical terms in economics (or yeah, fabricating entirely new and meaningless lexicon, see: Cape Cod Consultant). How does Larry Summers get away with attaching his own definition of r* in a public policy debate??

Moses Herzog: The “neutral rate” as used by Summers is consistent with Wicksell’s use of the term, as the sum of r* and expected inflation. So he’s on solid grounds to define it as such. Whether the “neutral rate” (as r* plus target inflation) is now around 5% is subject to debate, as indicated in the post.

Thanks.

“The “neutral rate” as used by Summers is consistent with Wicksell’s use of the term, as the sum of r* and expected inflation.”

With expected inflation near 2.3%, anyone saying the “neutral rate” = 5% so telling us r* = 2.7%. Of course as you indicate some researchers think it is a bit lower. Either way anyone trying to justify nominal rates above 5% cannot tell real v. nominal which is of course pathetic. But that would be our little Jonny boy.

Here is the recent (28 and 29 Feb, for last qtr 2023) release from NY Fed for r star. They refer to it as natural rate.

https://www.newyorkfed.org/research/policy/rstar

Yes, the natural rate: “Their approach defines r-star as the real short-term interest rate expected to prevail when an economy is at full strength and inflation is stable.” Real, as in “without inflation”.

So “natural” is “real” – that is, r* without expected inflation added in – while “neutral” is r* plus expected inflation. Not the happiest choice of terms, but clear enough if we put in the effort.

Then again Irving Fisher made a lot of these distinctions back in 1907. But 117 years later our troll choir (JohnH and Princeton Steve) have not figured out the basics.

Question is, would anyone recognize the neutral rate if it stared them right in the face? And if it could be identified, would it be wearing its real face, a nominal one, or a “natural” one?

In any case, it allows economists to divert attention to something besides the corporate role in inflation and rising inequality!

Jonny boy would not recognize a bus if it ran o er him. Hey Jonny boy stop making incredibly STUPID comments

Jonny boy tries to pretend he gets this topic. Jonny boy makes a fool out of himself. so Jonny boy pretends Summers agrees with Jonny boy only to realize Summers has read a lot of papers on this topic which Jonny boy never read.

So what does stupid little Jonny boy do? Whine to mommy and declare that this foundational concept is not important. Oh yes – Jonny boy needs to focus on learning to tie his own shoe laces. Poor little ignorant Jonny boy.

Foundational concepts are nice…documented reality is better. Where’s the beef?

ponzi johnny, your comments do not make any sense. time to circle back around and espouse your economic theory on high rates of return on low risk assets. and you have the audacity to challenge somebody about reality?

“JohnH

March 14, 2024 at 4:11 pm

Foundational concepts are nice…documented reality is better. Where’s the beef?”

Just have effing STUPID can little Jonny boy be? Hey Jonny boy – what is your source for the “documented reality” of potential GDP?

Yea – Jonny boy is dumber than a retarded rock as evidenced by comments like this.

“The Laubach-Williams and Holston-Laubach-Williams models provide estimates of the natural rate of interest, or r-star, and related variables. Their approach defines r-star as the real short-term interest rate expected to prevail when an economy is at full strength and inflation is stable.”

It seems their estimates of r-star are near 1%. Which means monetary policy should be eased just a bit. Oh well – Larry Summers strikes out again.

“The concept of the natural rate of interest traces back at least to Wicksell (1898), who described it as the rate of interest that would equate saving and investment and be consistent with stable prices. In this vein, the natural rate is generally defined as the level of the short-term real interest rate that would prevail in the absence of business cycle fluctuations, with output at potential, saving equating investment and stable inflation (Borio (2021)).”

Most economists would see Wicksell’s paper from over 125 years ago as a central matter in any discussion of macroeconomics. This paper does a nice job of noting its importance and the important research of late.

But wait – it is real economics and it is so far over little Jonny boy’s little excuse of a brain that he decided this research is of no importance. Yea- that’s our Jonny boy!

In other words, totally hypothetical: “the natural rate is generally defined as the level of the short-term real interest rate that would prevail in the absence of business cycle fluctuations, with output at potential, saving equating investment and stable inflation.” But pgl wants us to believe that there is something real about it…his personal “right answer” about which no one can disagree!!! You have to love the hubris!

the fact that you cannot accept a simple concept like the natural rate indicates you have no clue about economics and have no interest in actually understanding the field. explains why you are foolish and shallow enough to support a murderer like putin.

you have to give Jonny boy’s mom a break. The poor boy can’t tie his own shoe laces. Too theoretical. Using the toilet – toll theoretical for little Jonny boy which is why he still wears stinky diapers.

“But pgl wants us to believe that there is something real about it…his personal “right answer” about which no one can disagree!!! You have to love the hubris!”

Me hubris? The latest pathetically juvenile comment has zero foundation. Sure I cited research that suggests r* = 1%. I also cite the latest Summers claim that r* has risen to more than 3%. Then I again I have noted research from Summers back in 2019 where he estimated r* at the time was more like negative 3%. Then again Summers is smart enough to note why r* may have fallen in the 2010’s but is higher now?

Of course Jonny boy is too stupid to get this economics. So Jonny boy just spews his “personal right answer” which is dumber than a retarded rock. AND THEN this worthless two faced worthless POS accusing others of the same dumb and dishonest behavior. Yea – he is THAT PATHETIC.