In a recent SF Fed Economic Letter, Sylvain Leduc, Huiyu Li, and Zheng Liu answered the question: “Are Markups Driving the Ups and Downs of Inflation?” If one defines inflation as a broad, economy-wide increase in prices, the answer is mostly “no”.

From the Letter’s conclusion:

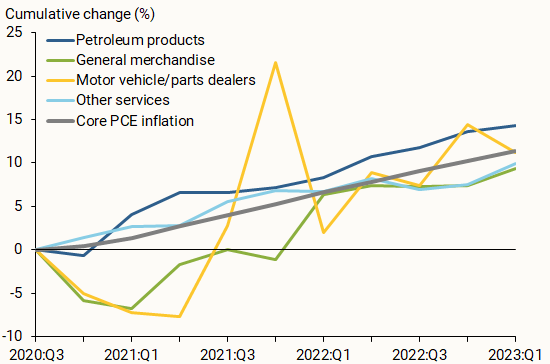

Using industry-level data, we show that markups did rise substantially in a few important sectors, such as motor vehicles and petroleum products. However, aggregate markups—the more relevant measure for overall inflation—have stayed essentially flat since the start of the recovery. As such, rising markups have not been a main driver of the recent surge and subsequent decline in inflation during the current recovery.

Two graphs are essential to seeing the difference between sector/industry specific prices and the general:

Note that a decomposition used in this post refers to the nonfarm corporate sector, and normalizes to nearly a year earlier than in Leduc-Li-Liu.

“we consider another factor that might drive inflation fluctuations: changes in firms’ pricing power and markups.”

We were told literally thousands of times by some now banned (thankfully) troll that economists never study this issue. These economists did. And their empirical results do not support this troll’s incessantly made claim. Oh well!

Let’s remember what that earlier paper noted:

Corporate Profits Contributed a Lot to Inflation in 2021 but Little in 2022—A Pattern Seen in Past Economic Recoveries

By Andrew Glover, José Mustre-del-Río, and Jalen Nichols

Corporate profits rose quickly in 2021 along with inflation, raising concerns about corporations driving up prices to increase profits. Although corporate profits indeed contributed to inflation in 2021, their contribution fell in 2022. This pattern is not unusual: in previous economic recoveries, corporate profits were the main contributor to inflation in the first year and displaced by costs in the second year.

More high quality research that had been grossly misrepresented by certain trolls.

There is another sector, closely related to “home owners’ equivalent rent”, which has been reporting very high margins of late. Y’all know which one I mean:

https://www.attomdata.com/news/most-recent/q1-2024-home-sales-report/

“ATTOM… today released its first-quarter 2024 U.S. Home Sales Report, which shows that profit margins on median-priced single-family home and condo sales in the United States decreased to 55.3 percent in the first quarter – the smallest level in more than two years.”

A profit margin of 55.3% is the lowest in 2 years? Yikes! The margin in Q4 of 2023 was 57.1%, and a year ago in Q1 it was 56.5%. How out of whack are these margins? In 2015, the comparable median profit margin was 12%; in 2019, it was 31%.

By the way, the dollar amount of the median profit in Q2 of this year was $120,500.

There’s yer problem, right there.

I’m drinking now, (OK, OK) but, this is one of my pet peeves with Menzie (one that kind of makes me angry towards Menzie)

Dearest Menzie. Not everything can be caught in……. standard deviations….. Equations…. “R”…… R squared……. correlations (false or otherwise)……

There are places where consumers are being……….. rap_ed……….. “taken advantage of”………………….

Grow up man, Grow up Menzie!!!

Moses Herzog: Well, those might be in those sectors where in fact price cost margins *did* constitute a large share of price increase (petroleum? cars?)

I often just “wonder” if “PAID dept Chairs” (which will have their mating call repeated whenever and however in the media) aren’t driving profs thoughts?? They already have Prof Hamilton licking the Hoover Institute’s balls. Now we are seeing Menzie “follow suit”?? You decide kids./

“Nope, Nope. no greedflation” Are we all that dumb?? Show us the equation Menzie. OH OH OH please, show us the equation that makes you repeat their VERY EXACT words/thoughts.

Moses Herzog: I’m not sure I understand.

MEnzie, YOu know,</b. I have alot of affection/respect to you, or as the kids say, you would have "clapped back" at me. I know it, I know it well. Don't you think it afffects (probably NOT you.) some of your colleagues?? George Mason UNiversity ?? “GMU?? Yes??

Doesn’t it just ever make you sick?? I don’t think Prof Hamilton is in this “group”. I apologize to Prof HAmilton and you. But don’t just act like you don’t know greedflation exists. Please don’t do that, don’t make me lose my faith in you on that ONE score/

‘i tooka survey, ALL economists said ‘above us the sky is blue’ ” ‘if anyone told you (outside our survey/poll) space is dark/black with little twinkling lights, they are liars, I saw it at 1400 time today, it’s blue”

This is what passes for doctorate degrees now.